When you buy real estate or apply for a loan or a visa, you may be asked to present proof of sufficient funds. You can submit an account statement, but a statement contains much more information than they need to know. You only need to show that you have more than a certain amount. You don’t want to give them your account number, exact balance, or transaction details.

The party you’re disclosing the information to may not have good security. Who knows what will happen to your document after you submit it? The less information you disclose, the better. For instance, the account number is a key piece of information for transferring a brokerage account. You should treat it as a secret (see Protect Your Brokerage Accounts From ACATS Transfer Fraud).

Some financial institutions make it easy to create a proof of funds or balance confirmation. They only include minimal information without oversharing. Because I ditched banks and only use a Fidelity account for day-to-day cash flow, here’s how I generated a proof of funds or balance confirmation for a Fidelity account.

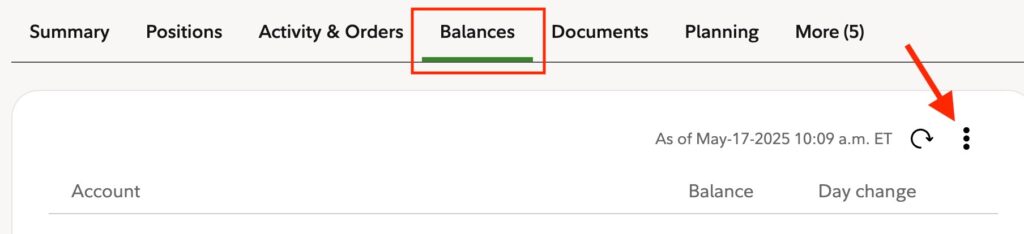

Log in to Fidelity’s website. Select an account on the left. Click on the Balances tab, and then the three dots on the right.

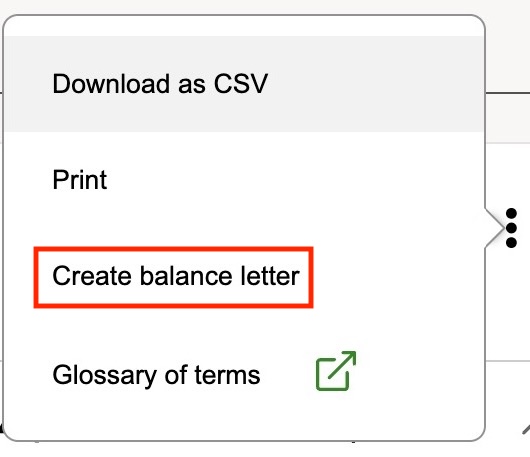

Click on “Create balance letter” in the pop-up.

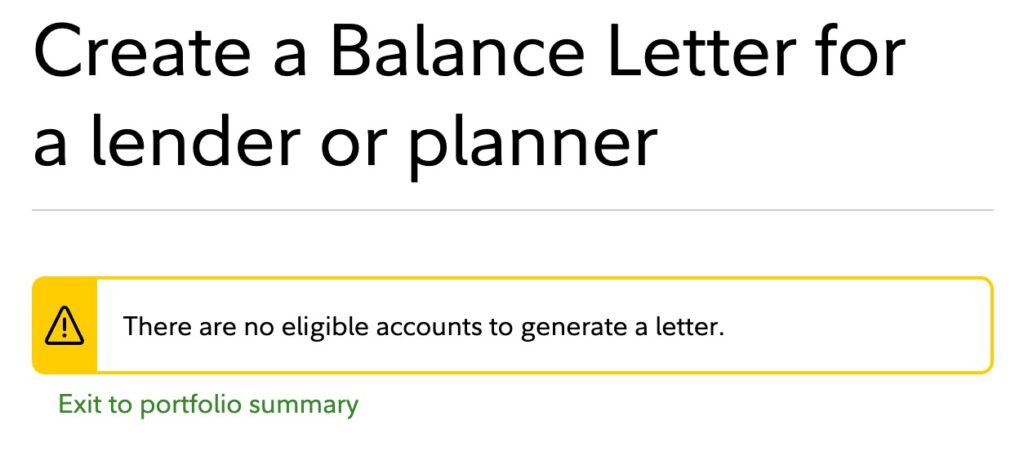

If you enabled Fidelity’s Money Transfer Lockdown for your accounts, you’ll see an error saying “There are no eligible accounts to generate a letter.” Turn off Money Transfer Lockdown and try again. Select one or more accounts you need for the balance confirmation.

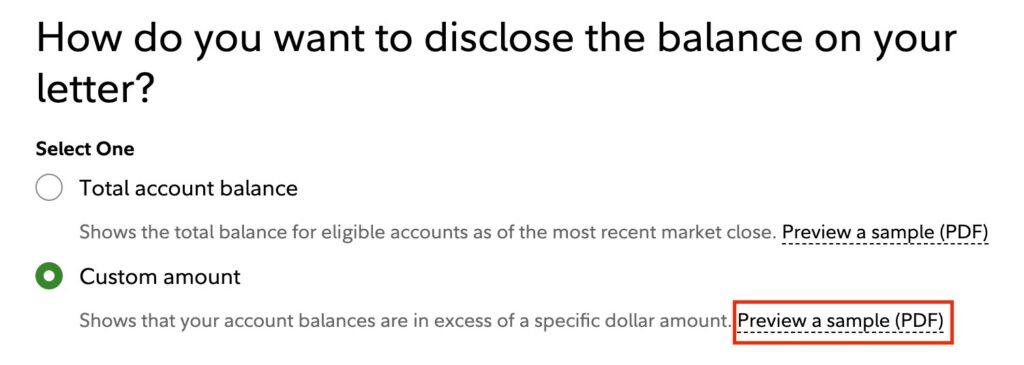

You have the option to show the total balance or a specific balance. The custom amount is a better option for privacy. When you give the minimum amount you need, the letter will say this:

Please accept this letter as confirmation that as of market close on [date], you held a balance in excess of $[amount] in cash and securities in your portfolio at Fidelity Brokerage Services.

The proof of funds letter bears the Fidelity letterhead, includes your name and address, and is signed by a Fidelity officer. It doesn’t have your account number, the exact balance, holdings, or any transaction details.

Remember to re-enable Money Transfer Lockdown if you turned it off to generate the letter.

Vanguard and Schwab may also have a similar process to do this. I don’t know how because I don’t have accounts there. Call customer service if you don’t see it on their website.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

PB says

Hi Harry. You never cease to amaze me with the wealth of information you share with your readers. I have been with Fidelity for years now and I’m very happy I made the switch from Vanguard brokerage, but I’m still learning all the ways of Fidelity since they have such a busy website. I never even would’ve known something like this exists. Thank you for sharing, plus all you do for the industry.

Sharon says

Thanks, Harry, for alerting me to this feature. I didn’t know that Fidelity gives this option to create a balance letter.

Jim says

Good information; thank you.

After reading your post, I checked the Vanguard web site and they also offer the ability to print a balance letter.

Unfortunately, the banks I’ve contacted all require 2 month’s of statement history for their mortgage loan pre-approval process – a balance letter is not accepted/sufficient.

Mark says

Can someone who has done this in Vanguard, explain the steps needed to obtain the balance letter? I am unable to find where I can obtain this in my account.

Jim says

Mark,

The steps I followed to create a balance verification letter on Vanguard were:

1. Sign on to the Vanguard web site (I used a PC and web browser, not the mobile app)

2. Click on the Vanguard search icon (magnifying glass icon) and type “balance verification letter” (without the quotes) in the search field

3. Click on the first link in the search results, titled “Request a balance verification letter”

4. The Balance verification letter interface is displayed. Click the radio button for Balance verification letter and then click Continue.

5. The remaining interface panels allow you to select what amounts you want to be included in the letter, which accounts/stocks/mutual funds to include in the total, whether you want the account type and/or account numbers to be included in the letter, etc.

6. Click Review to review your selections. If they are as you wish, click the Generate pdf button and your letter will be created. You can then download or print the letter.

Balance verification letters are available for 18 months. Once you have created a balance verification letter, the The Balance verification letter interface (step 4 above) will have a link at the top – “Access previous letters” – that allows you to display/print previously generated letters.

Mark says

Thanks Jim, I did not even think to use the search function on Vanguard’s website.

I did find where Vanguard placed the balance letter link in their online interface but the “Search” method is faster and it actually works.

For reference, here’s where Vanguard has the link on their interface without clicking the search icon:

1. Log into the Vanguard account.

2. Click on “Balances” tab.

3. Then click the “Balances by Date” link located near the bottom.

4. Scroll down to the bottom and their is the link to obtain the balance verification letter.

This link is pretty hidden on their interface and currently does not even work as the link appears broken. So, everyone should still use Jim’s search method until Vanguard updates the link on their interface.

g says

This will not include 401ks, even the BrokergeLink portions, that you have with Fidelity – FYI.