Today we look at how dividends and capital gains will be taxed after the fiscal cliff deal, officially known as the American Taxpayer Relief Act of 2012. Don’t be surprised it gets a little more complicated.

First of all when I say dividends and capital gains, I’m referring to qualified dividends and long-term capital gains. Non-qualified dividends and short-term capital gains are taxed as ordinary income. Collectibles and odd-ball 1250 gains still have their own quirks.

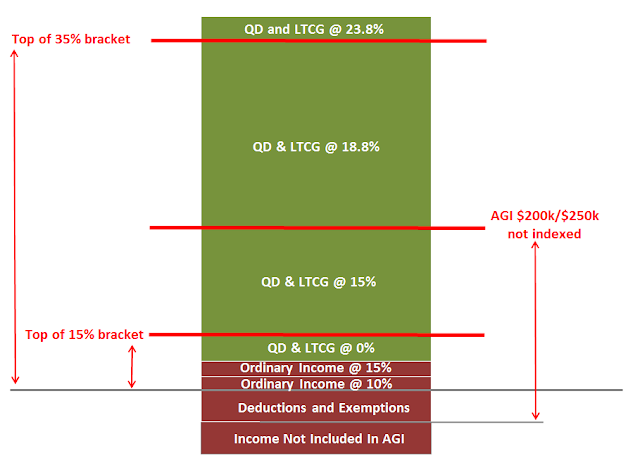

I did my best in this chart below to represent the rate(s) at which the qualified dividends (QD) and long-term capital gains (LTCG) are taxed. Even my best effort doesn’t capture the complications brought by AMT and many other phaseouts.

The chart should be read from the bottom up. Picture pouring your income into an empty bucket.

At the bottom sits your income not included in the Adjust Gross Income (AGI). These include your tax exempt income from muni bonds, and your pre-tax 401k/403b/457 contributions, health care premiums, and FSA/HSA contributions deducted from your paychecks if you are working. For retirees, they include your untaxed Social Security benefits, Roth IRA withdrawals, and withdrawals from your own savings. They also include your above-the-line deductions: deductible IRA contributions, contributions to self-employment retirement plans, student loan interest, moving expenses, etc.

Next comes your personal exemptions and your standard or itemized deductions. These are in the AGI but they are deducted before you apply the tax schedule.

As additional income is poured into the bucket, you go up the income tax brackets: 10%, 15%, 25%, 28%, 33%, 35%, and the new 39.6%.

Qualified Dividends (QD) and Long-Term Capital Gains (LTCG) sit on top of ordinary income. If your ordinary income is low enough, the first batch of QD and LTCG is taxed at 0%. Yay! The next chunk is taxed at 15%, followed by a larger chunk taxed at 18.8% due to the 3.8% additional Medicare tax on unearned income. Finally any additional QD and LTCG are taxed at 23.8%.

As your ordinary income (the red block) goes up, it’s going to push up the QD and LTCG (the green block) to higher rates. If your red block is already above the first red line, then your QD and LTCG will be taxed at a minimum 15%, and possibly some at 18.8% and some at 23.8%.

Similarly once your ordinary income breaches the second red line, your QD and LTCG will be taxed at a minimum 18.8%, and possibly some at 23.8%. Going above the third red line will see all your QD and LTCG taxed at 23.8%.

Add another 6.5-7% if you are in the AMT phaseout zone. You fall into the AMT phaseout zone when you are subject to the AMT and your AGI minus mortgage interest and charitable donations is roughly $150k to $450k for married filing jointly or $115k to $300k for single.

Add another 1-2% if you are in the new exemption and deduction phaseout zone (AGI above $300k for married filing jointly and $250k for single; the upper bounds are difficult to calculate).

Add an unknown percentage if your QD and LTCG puts you in one of many AGI-based phaseouts. For example if an extra $100 of QD or LTCG taxed at 15% causes you to lose another $25 in a tax credit, that $100 is really taxed at 40%. The exact percentage to add depends on which phaseout(s) you land in.

If you just want to know at what rates your qualified dividends and long-term capital gains will be taxed, it’s not that easy to figure out because of all those phaseouts. The chart in this post gives you the minimum rates. Your actual rates could be higher, and possibly much higher.

The new law is very generous to wealthy retirees, especially early retirees. When you manage your income to stay under the top of the 15% bracket (close to six figures for married filing jointly after you include exemptions and deductions), you can harvest capital gains every year. Eventually all your qualified dividends and long-term capital gains will be tax free!

[Photo credit: Flickr user comedy_nose]

Say No To Management Fees

If you are paying an advisor a percentage of your assets, you are paying 5-10x too much. Learn how to find an independent advisor, pay for advice, and only the advice.

KD says

“The new law is very generous to wealthy retirees, especially early retirees. When you manage your income to stay under the top of the 15% bracket (close to six figures for married filing jointly after you include exemptions and deductions), you can harvest capital gains every year. Eventually all your qualified dividends and long-term capital gains will be tax free!”

It is a very interesting conclusion. Combined with ACA’s income-based premium generosity, this would really make it sweeter to quit earlier wouldn’t it?

If possible, please do illustrate this with a separate post. Thanks for this wonderful article!

Harry says

Yes, KD. It’s been brewing for a long time. I have a name for the strategy already: asset rich, income poor. When you build up a large nest egg but you spread it over more years by retiring or semi-retiring early, you look poor on the tax return but you have very good discretionary income, with the the freedom to live in a low cost of living area. If you mange to stay under the 4x poverty line, you also get subsidized health care. I’m working towards it.

Silvio says

We are in the same boat- exactly what I’m doing. I’m trying to find a way to “manage” dividend payment to make sure it doesn’t exceed tax bracket thresholds. In other words, get dividend payments only for what is needed (pay bills) and leave room for tax gains harvesting and (if possible) take advantage of health care subsidies.

random person says

2 questions:

1. If you have no income other than ltcg and dividends does dividend/ltcg over the 15% bracket (+deduction/exemption) amount get taxed at 15% and below at 0% (provided total is under 200/250) or all at 15%

2. “you can harvest capital gains every year. Eventually all your qualified dividends and long-term capital gains will be tax free!”

What do you mean by this? Aren’t dividends & ltcg immediately tax free provided total income stays under 15% bracket (+ exemptions/deductions)? It’s not like you can put that in a roth like account and then gains on that money becomes tax free forever for independent reasons.

Thanks

random person says

I think I understand what you meant now in what I asked about in question 2 above. Please let me know if this is correct.

If I understand correctly, you are talking about the fact that the basis is slowly resetting at 100%. However, I believe unless a large increase in spending is desired in the future vs the present (or the tax law changes) this feature of it wouldn’t matter much (though should still be used in case tax law changes)

For example: Assume basis = 0 in taxable account, so max withdrawal for married is approximately 95K. If only 47.5K is needed 47.5K in addition to what is spent can be sold to reset the basis at 100% on the 2nd 47.5k in that year. While this is pretty cool, unless you start needing more than 95k (or the law changes), AND you previously needed a nice amount less (so you could reset basis in the past), you will never need/be able to take advantage of the fact that you have increased your basis.

Harry says

Yes to the first question. If you chip away your unrealized capital gains, your AGI will be low when Social Security kicks in because return of basis isn’t income. Otherwise even if your capital gains still go into the 0% zone, they add to your AGI making your Social Security 85% taxable.

Rick says

So, it appears that the treatment of Long Term Cap Gains covered under the American Taxpayer Relief Act of 2012 will be the same as it has been for tax years 2011 & 2012. Is that true?

Is the American Taxpayer Relief Act of 2012 for ever ( as long as ever can be) or does it have a sunset date?

Harry says

Rick – For income below the second red line (from the bottom), yes. It doesn’t have a sunset date.

BK says

So, if one can fill the Standard Deduction with Ordinary Income (OI), & fill the 0% Qualified Dividend (QD) bracket, one has a 0% Federal Rate. The next OI dollar is at 10% & pushes the last QD dollar into 15% for a combined federal rate of 25%. If the next OI dollar is $10,000 the marginal OI rate is 12% & pushed $10,000 of QD into 15%, TOTAL NIGHTMARE! What are some countermeasures given that the income is unavoidable?