[Updated on February 4, 2026 with updated screenshots from H&R Block software for the 2025 tax year. These steps don’t change much from year to year.]

When mutual funds and/or ETFs that invest in foreign countries receive dividends or interest, they have to pay taxes to those countries. These mutual funds and/or ETFs report to your broker after the end of the year how much they paid in foreign taxes on your behalf.

When you invest in these mutual funds and/or ETFs outside a tax-advantaged account, your broker will report to you the total foreign taxes you paid through all your funds and/or ETFs. The IRS allows a tax credit for taxes paid indirectly to foreign countries.

Form 1116

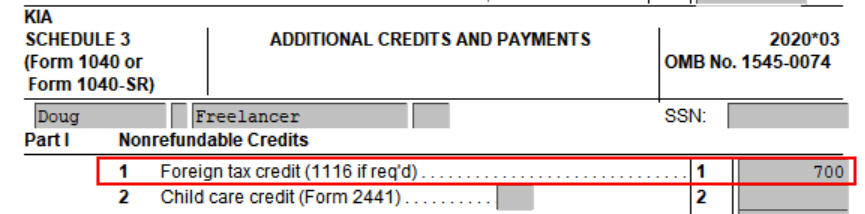

The foreign taxes paid are reported in Box 7 on the 1099-DIV form from your broker. It’s easy to handle when the total foreign taxes paid from all your 1099-DIV forms is no more than a certain amount — $300 for single filers and $600 for married filing jointly. You enter the 1099-DIV forms into your tax software, and the software will automatically put the total on your tax form (Schedule 3, Line 1).

When your total foreign taxes paid from all your 1099-DIV forms exceed the $300/$600 threshold, you’ll need to include Form 1116 in your tax return. I’ll show you how to do this in H&R Block software.

If you use TurboTax, please read:

Use H&R Block Desktop Software

The following screenshots came from H&R Block Deluxe desktop software. The desktop software is both more powerful and less expensive than H&R Block’s online software.

If you haven’t paid for your H&R Block Online filing yet, consider buying H&R Block desktop software from Amazon, Newegg, Walmart, etc. If you’re already too far in entering your data into H&R Block Online, make this your last year using H&R Block Online. Switch over to H&R Block desktop software next year.

I’ll use this simple example:

You received a 1099-DIV from your broker. Box 7 “Foreign Tax Paid” on the 1099-DIV shows $700. 100% of this $700 came from a mutual fund or ETF. You only have this one 1099-DIV that has a number in Box 7.

1099-DIV Entries

If you import your 1099-DIV forms, double-check the import to make sure all the numbers match your downloaded copies. If you’re entering the 1099-DIV forms manually, type the numbers as shown on your forms.

H&R Block doesn’t say anything about the foreign tax paid or that you need a Form 1116 after you enter the 1099-DIV forms. Just continue with your other entries.

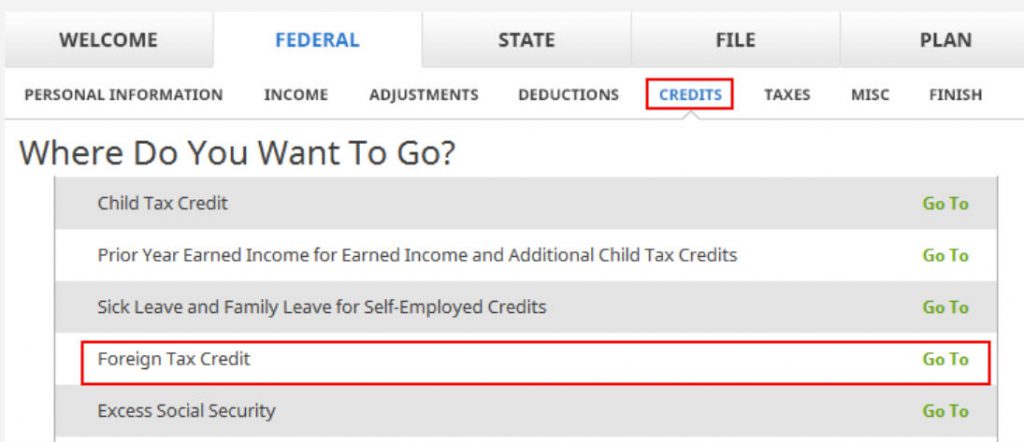

Foreign Tax Credit

Foreign Tax Credit comes up much later in the Credits section under Foreign Tax Credit.

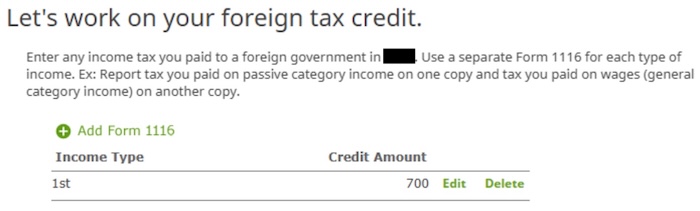

Click on “Add Form 1116.”

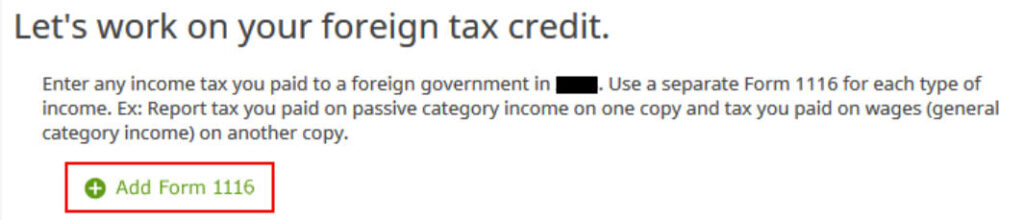

AMT Simplified Election

If this is the first year you’re claiming the Foreign Tax Credit, H&R Block software asks upfront about the simplified election. Select “Yes” for the simplified election. You won’t see this question if H&R Block knows that you already elected the simplified method in a previous year.

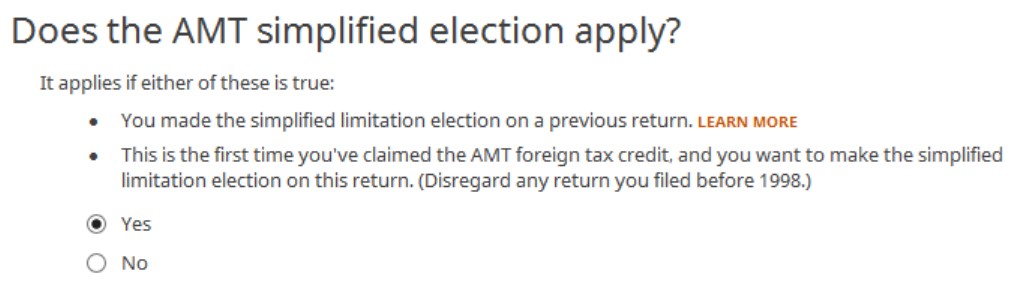

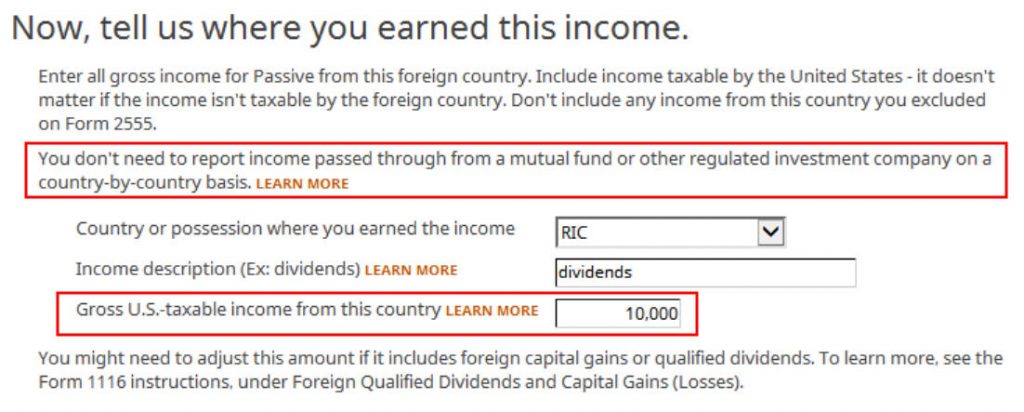

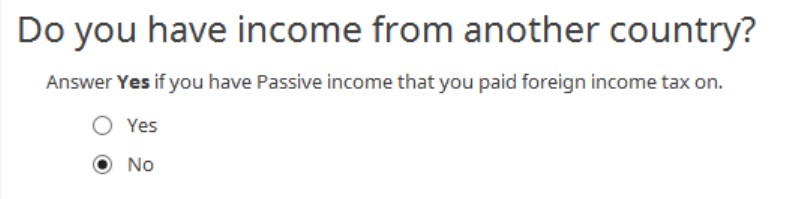

Foreign-Source Income

Dividend income falls under “passive income.”

The “learn more” pop-up says you should choose “RIC” as the country when your foreign income came through mutual funds and/or ETFs. “RIC” is the last item in the country dropdown.

You get the foreign income from the supplemental information in your 1099 package from your broker. If you have multiple 1099-DIV forms that reported foreign tax paid in Box 7, you must add up the foreign income numbers from the respective supplemental information.

Don’t overlook the small note under the gross income input. It says you might need to adjust the amount if it includes foreign capital gains or qualified dividends. When you’re reporting foreign taxes paid from mutual funds and ETFs, the income often does include qualified dividends. H&R Block doesn’t do the adjustment for you. It asks you to read the IRS instructions, learn how to adjust, and report the adjusted income here. That’s lazy.

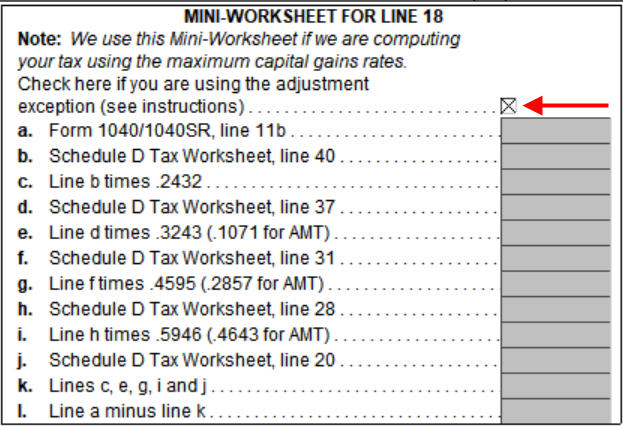

Adjustment Exception

Fortunately, many people qualify for an adjustment exception. From the IRS Form 1116 Instructions (page 9):

You qualify for the adjustment exception if you meet both of the following requirements.

1. Line 5 of the Qualified Dividends and Capital Gain Tax Worksheet doesn’t exceed:

a. $394,600 if married filing jointly or qualifying widow(er),

b. $197,300 if married filing separately,

c. $197,300 if single, or

d. $197,300 if head of household.2. The amount of your foreign source capital gain distributions, plus the amount of your foreign source qualified dividends, is less than $20,000.

The dollar amounts in the first requirement correspond to the top of the 24% bracket. You are spared from figuring out how to adjust if your taxable income minus your qualified dividends and long-term capital gains isn’t in the 32% tax bracket or above, AND your foreign source capital gain distributions and qualified dividends aren’t $20,000 or more.

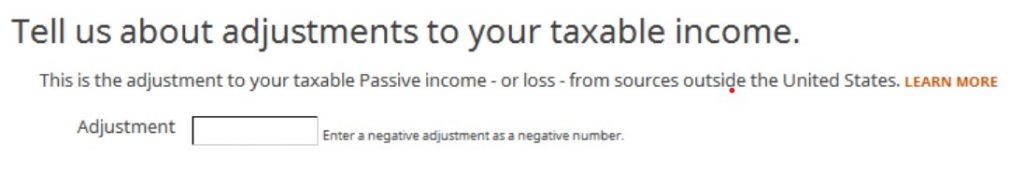

If you’re eligible for the adjustment exception and you decide to take the easy route of not adjusting your foreign-source income, you need to claim a corresponding adjustment exception on your total income.

Click on Forms on the top right. Open Form 1116. Scroll down and find Mini-Worksheet for Line 18 just above Line 18. Check the box for using the adjustment exception.

Close the form and return to the interview.

If you don’t qualify for the adjustment exception, good luck learning how to adjust from the Form 1116 instructions. You’re better off switching to TurboTax, which does the adjustment for you when you need it. See How to Enter Foreign Tax Credit Form 1116 in TurboTax.

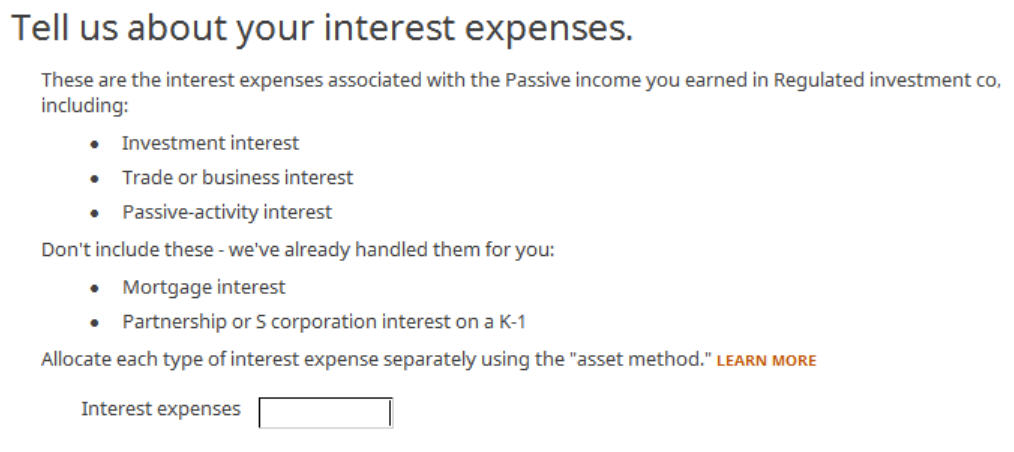

We leave this blank because we don’t have any interest expenses.

If you have any above-the-line deductions, such as an early withdrawal penalty from breaking a CD or an HSA contribution made outside payroll, enter the total here. We leave this blank in our simple example because we don’t have those deductions.

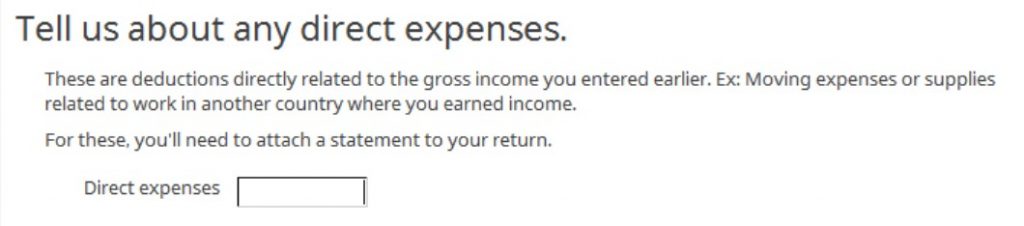

We don’t have any direct expenses either.

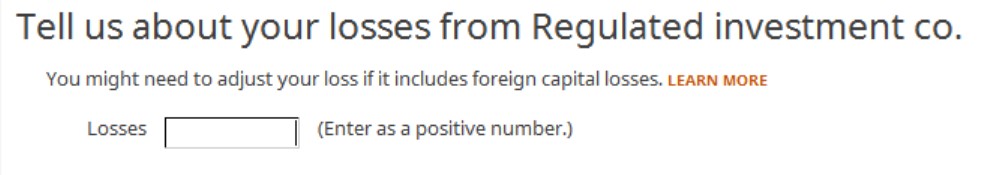

We have no losses to adjust.

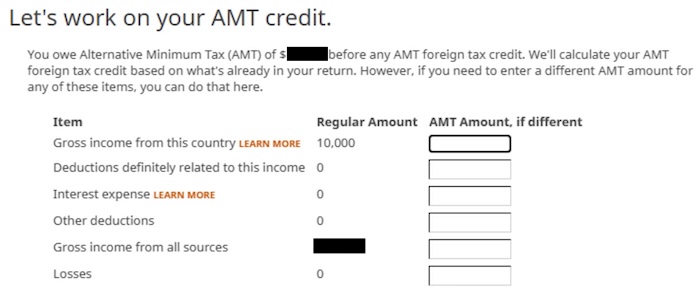

We don’t need to enter a different AMT amount for anything.

Yes, our 1099-DIV was reported in U.S. dollars.

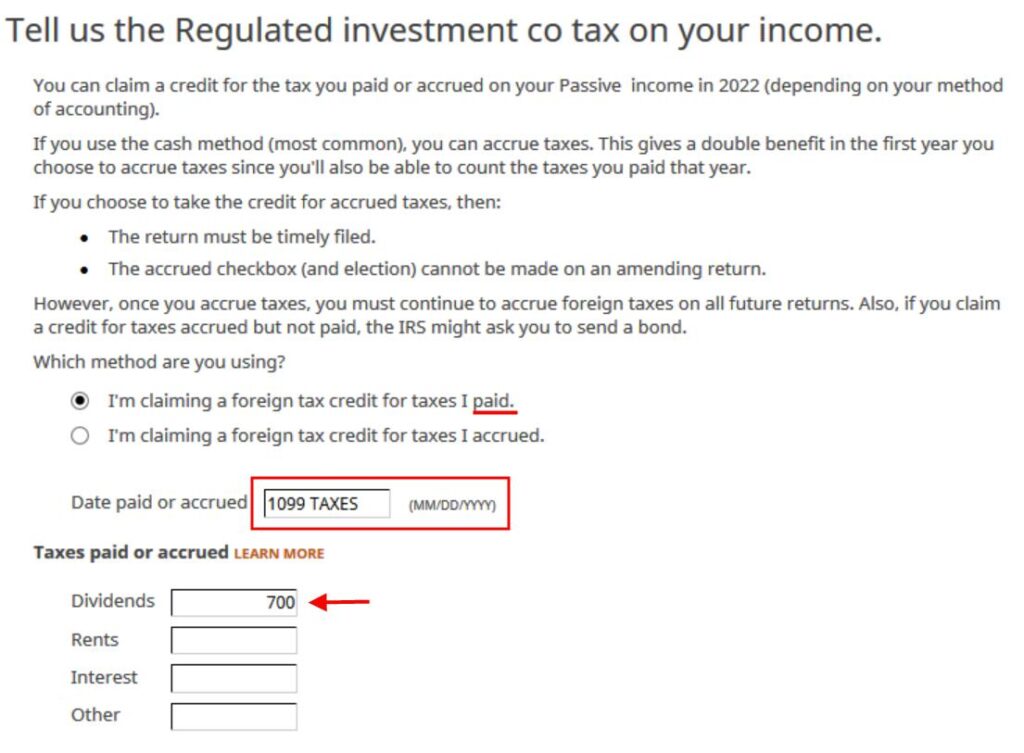

Foreign Taxes

I chose the simpler “paid” method. Although the “Date paid or accrued” asks for a date in “MM/DD/YYYY” format, you can type “1099 TAXES” to indicate that the foreign taxes were paid on various dates through the 1099 forms. Enter the total foreign tax paid into the Dividends box.

If you have multiple 1099-DIV forms that report foreign tax paid in Box 7, you must sum up those numbers yourself. I wish the software could do the math and auto-populate this field.

All our foreign taxes paid were through mutual funds and ETFs. RIC is the only country to use. We don’t have foreign income from any other countries.

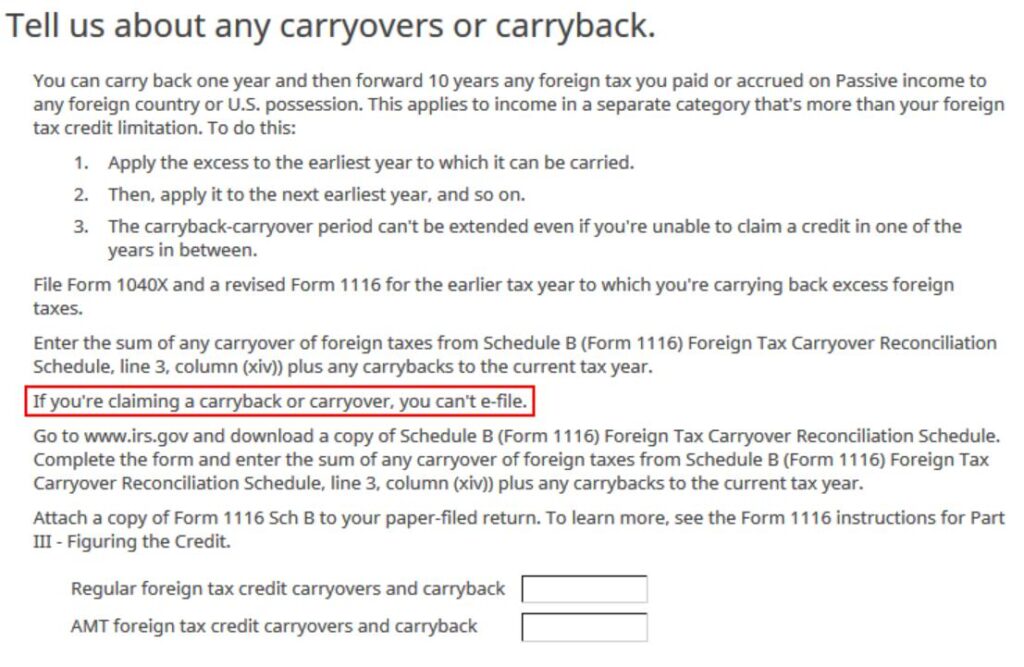

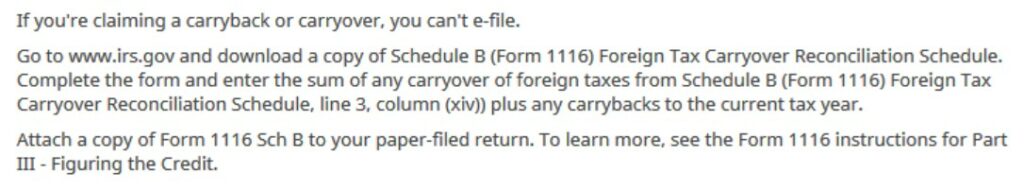

Carryover and carryback happen when the allowed foreign tax credit is less than 100% of the foreign taxes paid. Fortunately, we don’t have any carryover or carryback. If we can’t get 100% credit for the foreign taxes paid this year, we’ll have to create a carryback or carryover, which means we can’t e-file with H&R Block.

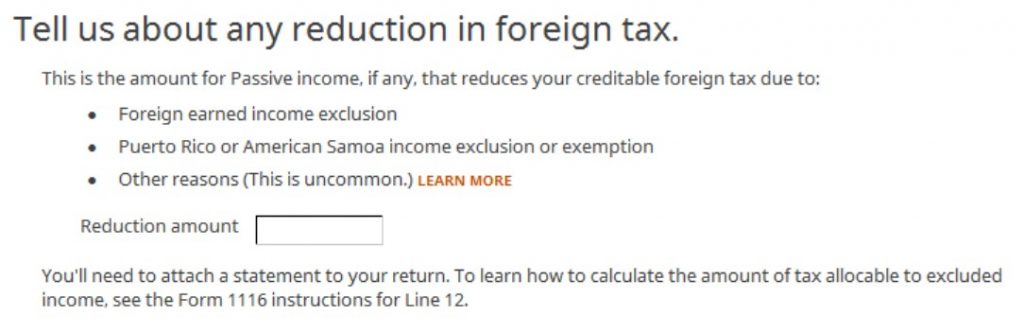

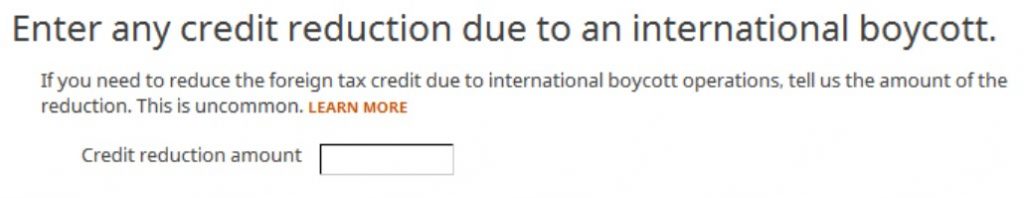

We don’t have any reduction either.

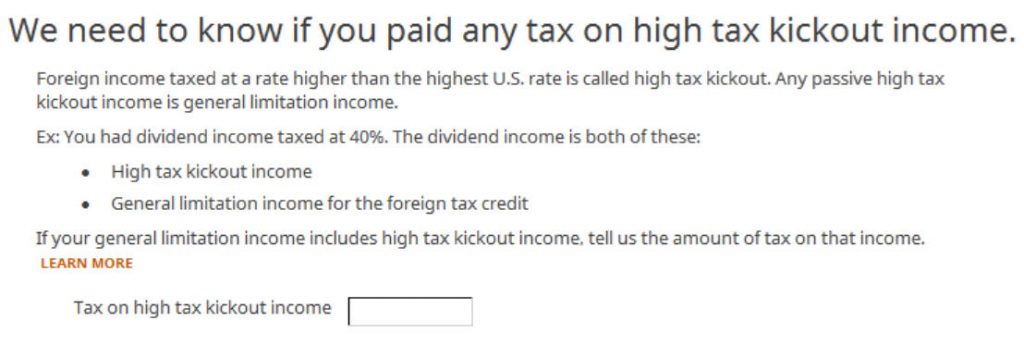

We don’t know what the foreign tax rate was. We’re leaving this blank.

We don’t know how to adjust. We’re leaving it blank again.

This is getting ridiculous. All I want is to get the foreign tax credit!

We’re finally done with Form 1116. Are we getting the credit?

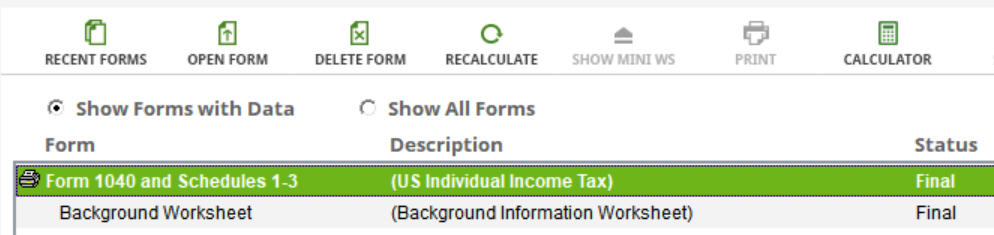

Verify on Schedule 3

Click on Forms on the top. Double-click on Form 1040 and Schedules 1-3.

Scroll down to Schedule 3. Line 1 shows our foreign tax credit. You can also look at Form 1116. It looks awfully complicated.

Excess Foreign Tax Credit

We received 100% of the foreign taxes paid as a tax credit in our example. If you paid higher foreign taxes on a lower US income, you may not be allowed to take 100% of the credit. You’ll have to wait until next year to take the rest of it.

Carrying over part of the credit to the following year requires filing a Form 1116 Schedule B. H&R Block doesn’t include it in the software. They tell you to download the form from the IRS website, complete it yourself, and attach it to your paper return. That’s ridiculous.

Summary

H&R Block software works when you paid more in foreign taxes than the $300/$600 threshold that requires a Form 1116. You’ll have to gather the foreign income and the foreign dividends from the 1099 supplemental information from your brokers. After it’s all said and done, you’re getting some credits for taxes you paid to foreign countries through your mutual funds and/or ETFs.

H&R Block asks you to add up the foreign tax numbers yourself. It asks you to make any necessary adjustments to the foreign-source income, which is quite difficult. The option to activate the adjustment exception is hidden in the Forms mode. You’re on your own when you don’t qualify for the adjustment exception.

If you don’t get to claim 100% of your foreign taxes paid this year, you’ll have a carryover or carryback. H&R Block doesn’t let you e-file if that’s the case. It asks you to handle the carryover yourself on a paper form.

TurboTax does a better job of handling the foreign tax credit than the H&R Block software. See How to Enter Foreign Tax Credit Form 1116 in TurboTax.

It’s better to avoid the complicated Form 1116 altogether next year by putting your international mutual funds and ETFs in a tax-advantaged account. See Too Much Hassle in Claiming Foreign Tax Credit on IRS Form 1116.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Mike says

Thanks – this is really helpful. Since H&R Block seems to make it very very easy to miss this credit, I realized today that I apparently should have been doing this for at least the last two years. I’m really wondering whether it makes sense to file 1040X’s for the last two year to get that money back (prob about $1400 total), or just avoid the risk of further screwing this up and chalk this up as a lesson learned. Also thinking about moving some of my international allocation to tax deferred so that I can fall under the $600 married exception in the future. I agree with you, this seems like too much of a PITA.

Quick question for you. When you check off the “adjustment exception” box in the forms, do you know what specifically this does? I don’t see a corresponding check box on the printed 1116 form. But it does appear that all my values in the bottom half of Form 1116 Part 1 are not adjusted – so is that all this does?

Harry Sit says

Checking the “adjustment exception” box in the form mode allows you to use the foreign dividend number reported by the broker as-is, without having to adjust the foreign income down by multiplying by 0, 0.4054, and 0.5045. Having a higher foreign income gives you more room to claim the foreign tax credit.

Steve says

Currently there is a backlog of millions of prior year amended returns at the IRS. Amended returns must be reviewed by a person. In normal times, processing an amended return takes 6 to 12 months, assuming the reviewer has no need to contact the taxpayer. I’d avoid amending returns right now.

If your foreign tax credit for 2022 is limited, look at whether you would actually benefit by carrying it back. If carrying back excess 2022 credit one year would not benefit you, then carry it forward with a schedule B (on turbotax) and potentially make use of it in the next 10 years.

BN says

I am in the same spot as Mike except the miss is for 2021 and 2022.

I am thinking of filing amended returns for both years but really don’t want to deal

with carryovers since they are small.

Question – Can I just ignore/forego the carryovers for both 2021 and 2022 by not filing Schedule B 1116 in my amended returns ?

Harry Sit says

The carryover credit only affects your tax payment or refund. It doesn’t change anything else. I don’t see a problem if you willingly forego the carryover credit.

BN says

Thanks Harry for the quick reply.

BTW, I have more than 3 countries in form 1116 which means I need two 1116 forms with the same category – passive income. Unfortunately, it looks like H&R block does not seem to support e-filing for multiple 1116 forms of the same category.

Any one know of any workarounds ?

Steve says

Hello BN: I just did a test of foreign taxes in 2023 Block home software. Assumed passive category for 4 countries. Entered the first 3 countries on a Form 1116. Then went back, added a second Form 1116 for the fourth country.

At first glance the return shows the total of foreign tax credits from all four countries. In the view forms section of the software, you can view copy 1 and copy 2 of the Form 1116.

I did not go through and check the calculations for each country, but you may want to try adding a second Form 1116 in Block for countries more than first three and see how it looks.

As with anything related to Form 1116, good luck!

BN says

Hello Steve,

Yes, that is what I am using – two 1116 forms – but the issue is with e-filing with multiple 1116 forms. H&R Block (at least the 2021 version) doesn’t seem to support e-filing in this scenario.

Steve says

BN:

Using 2023 Block home software and test return containing 2 Form 1116s, I was able to go to the Finish Return Electronic Filing tab, clear all the issues that the software said prevented efiling – Nothing listed about 2 forms 1116 on the return, and proceed on to the point that the software prompted me to enter my activation code to pay for efiling.

Based on this, I believe 2023 Block will efile with 2 Forms 1116.

I have no knowledge about using 2021 software to try to efile during calendar year 2024.

Have never tried to efile an older year return in a later year.

BN says

Thanks for confirming that it works with the 2023 version (I have > 3 countries in 2023 as well).

I am amending my 2021 return to get the FTC which H&R conveniently missed and had no alerts or warning popup about (really bad imo). I guess I will file a paper 1040X for 2021. unless anyone has a workaround for e-filing in my situation.

Next up is 2022 amendment 🙂

Steve says

BN:

I have not efiled a federal amended return, but IRS FAQ for 1040X says it can be done.

There are some restrictions. Check the IRS FAQ. I don’t think these comments allow links.

Another IRS page says that amended returns take up 20 weeks for processing.

Good luck.

Steve says

I am using H&R Block 2022 Deluxe (downloaded) software. I want to look at the qualified dividends and capital gains tax worksheet. Block used it to calculate my 1040 line 16 taxes but I cannot find the worksheet anywhere in the software. I cannot find it in Forms, or as a mini-worksheet in Block’s Form 1040 & Sch 1 -3. I am not using Schedule D (which has a tax calculation worksheet) since I only have capital gains distributions and qualified dividends.

What do I have to do to view qualified dividends and cap gains tax worksheet in 2022 Block software?

(I completed the worksheet manually so Block and I are getting the same result.)

Harry Sit says

Even though you’re not using Schedule D, you can still view the worksheet in Schedule D. Click on Forms and find Schedule D. It’s not in bold font in the list of forms when you’re not using it. Open it and scroll down to Line 22.

Steve says

This question applies to 2022 tax returns filed in 2023. I have a carryover of unused foreign tax credit from 2021 tax return (form 1116 and schedule B filed in 2021 using turbotax). Adding all of that carryforwarded amount to my 2022 foreign tax credit meets the allowance limits on my 2022 Form 1116.

Do I need to attach a 2022 Schedule B to my 2022 return if I include the carryforwarded credit? I’m having trouble understanding the Schedule B filing instructions for Line 10, Form 1116.

Harry Sit says

You need to include a 2022 Form 1116 Schedule B if you’ll use the carryover credit from the previous year. Form 1116 Schedule B provides the breakdown of the carryover used. Unlike capital loss that can be carried forward indefinitely, foreign tax carryover expires after 10 years. So they want to see how much credit expired and you’re using only unexpired credits. Unfortunately the H&R Block software can’t e-file when you need to include Form 1116 Schedule B.

George says

FYI – The entry for “Date paid or accrued” can be set to “1099 TAXES” instead of entering the final date of the year like you did in your example. This accounts for the multiple dates that the tax is actually paid in a typical RIC situation, as shown in your 1099

Harry Sit says

Thank you for this. I updated the screenshot to show “1099 TAXES.”

Mike M. says

I thought I would share my experience and a warning. I worked in Canada for many years and receive a pension from there, 15% of which goes to the Canadian government. I get most of that back as a foreign tax credit. This year I decided to save prep fees and used the H&R Block software. It made a $1500 error in computing my maximum allowable credit resulting in a thousand dollar error in my tax owed. Unacceptable. And of course I had to file paper returns for both federal and state. Next year: TurboTax.

Alex Broadhead says

I gave up on H&R Block last year (2025 for 2024 tax year) – my first real year of needing the Foreign Tax Credit – as it was incredibly buggy, and there was no way to report the bug. I have to assume it is still buggy, so I’ll be trying Turbot Ax for the first time this year.

Here’s my note to myself after numerous experiments trying to figure out what was going on: “H&R Block 2024 can’t handle the Foreign Tax Credit! It doesn’t compute gross income from all sources properly (which can be fixed by adding income). It doesn’t properly handle short/long-term capital gains (which can’t easily be fixed), and it doesn’t end up with the proper limit on the credit.”

Maya says

Do you look at Box 1a for the foreign source income on Form 1099-DIV or do you get this for each Etf and mutual fund that had foreign taxes paid only. For eg if box 1a says 1000 but VTIAX which paid the foreign taxes only gave 500USD in dividends, is this the foreign income ( VTIAX foreign income percentage is 100% of the dividends )

Hope this makes sense?

Harry Sit says

You get it from each fund that had foreign income. For example, Fund A $500 @ 100% foreign income + Fund B $300 @ 70% foreign income = $710.

Maya says

Thank you. That clears up things. Just wanted to check as on my last years taxes the accountant just put whatever was in Box 1A even though only some of the funds had foreign tax.

Appreciate the quick response.

David Obermeyer says

Thanks for these instructions Harry. I spent days using the IRS Form 1116 instructions and the few instructions available on the HRBLOCK web site, but I was not able to complete the HRBLOCK form until I found your instructions. All that trouble because my foreign tax paid for the first time peeked over the limit at $314. I’ve been seeing several fixed limits that don’t change with inflation, so this limit will likely be showing up for more people.

Steve says

Subject: Estimating dividends from mutual funds that pay foreign tax

I have two mutual funds that pay foreign tax and make year-end distributions in December.

From what I can tell from December distributions in prior years, the eventual Form 1099-DIV Box 1a total dividends includes those year-end distributions plus the foreign tax paid by the fund. (For these two funds, foreign tax paid is not included in the year-to-date distribution info available from the broker accounts holding the funds.)

In December, after I see the actual year-end distributions paid by the funds, is there any way to find the foreign tax paid so I can get a good estimate of total dividends for those funds? If I don’t include foreign tax paid, my estimate of total dividends will be low.

I do the income estimate so I can finish tax withholding in December.

Harry Sit says

There’s no way to know the actual foreign tax paid right now. You can only estimate. If the number on the 1099-DIV last year was 110% of what you actually received in distributions last year, gross up this year’s number by 110%.

Steve says

Got it. Thanks.

Steve says

Still waiting for final Form 1099-DIV but at the moment my estimated total foreign tax credit is $540 – $60 under the amount that requires me to file Form 1116. Here’s hoping that estimate holds and I won’t need to relearn how to complete Form 1116. What a hassle.

I wish they would raise the limit requiring Form 1116 above $600.

Barry Emmett says

This year my foreign tax credit is $385. I have a carryover of $1487. When checking the box for using the adjustment exception, the form 1116 line 24 allows a credit of $128. When I uncheck the box, the allowed credit is $190. What am I doing wrong?

Harry Sit says

Your options are:

(a) check the adjustment exception box and use the reported foreign income as-is; or

(b) don’t check the adjustment exception box but adjust your foreign income by following the Form 1116 instructions.

Getting $190 by unchecking the box but still using the same unadjusted foreign income isn’t an option. It won’t be $190 after you adjust the foreign income.

BN says

Also make sure to enter all foreign income even if there was no foreign tax withholding (for e.g. UK dividends) since the available credit is based on the ratio of foreign income to total income.

HTH !

Barry Emmett says

Thanks. This suggestion increased the foreign tax credit. I am still not able to benefit from checking the ‘adjustment exception’ box. The IRS instructions talk about filling out the ‘Qualified Dividends and Capital Gain Tax Worksheet’ if using the ‘adjustment exception’, but I am not seeing how and where to enter worksheet numbers on form 1116. Simply checking the ‘adjustment exception’ box lowers my foreign tax credit from $326 to $219. Both ways do not give me full credit for the $385 that I paid out in foreign taxes in 2023. The carry over, $1487, is ignored by the H & R Block software.

Thank you for your help which has already increased my foreign tax credit.

Harry Sit says

Did you multiply your foreign qualified dividends by 0, 0.4054, and 0.5405 as per Form 1116 instructions (page 9, “How to make adjustments”)? Once you do that, your foreign tax credit won’t be $326. Most likely it’ll go lower than $219. Most people benefit from the adjustment exception. That’s why people with high income or high foreign qualified dividends aren’t allowed to check that box. They must adjust their foreign qualified dividends down and claim a lower foreign tax credit.

The whole purpose of Form 1116 is to limit your foreign tax credit. It’s normal to not get the full credit. Many people keep accumulating more carryover every year and they never have a chance to use the carryover credits before those credits expire.

BN says

In addition to the income ratio, the FTC is also based on your total US tax.

This website below gives a good explanation

https://www.greenbacktaxservices.com/knowledge-center/foreign-tax-credit-carryover

BARRY W EMMETT says

Thanks. Your reply is very helpful

BARRY W EMMETT says

Using H & R Block, filling out form 1116 calculates a foreign tax credit of $326 which is less than the $385 I have paid for 2023. Is it possible to skip form 1116 and enter (somewhere) the $385? The H & R Block software will not permit me to enter an amount directly to Schedule 3 line 1 (or the worksheet) of form 1040. Thanks for all of your help.

Steve says

Barry: Look at the Form 1116 generated by the tax software. There are limits on foreign tax credit based on several factors. If the software is not allowing $385, you should be able to review the Form 1116 and see why the form is reducing the allowable credit. It is not unusual for the allowed credit to be less than foreign tax paid.

Good luck!

Vincent says

Harry, thanks for this posting. Back in 2020 I exceeded the $300 limit for the foreign tax credit so I had to explore how to fill out a form 1116. After reading publication 514 and the instructions for form 1116 I decided there was no way I would trust tax software to fill out form 1116 due to the complexity of the form. Reading the statements posted here and on your other articles on form 1116 you have convinced me I made the right decision. It has taken me four years but I am now comfortable filling out the form for my specific tax situation. I have gone back and examined my previous three 1116’s and there are no errors that change the amount of tax I owe.

Earlier in your posting there is a reference to “high tax kickout income”. You made the comment:

“We don’t know what the foreign tax rate was. We’re leaving this blank.” The foreign-tax-rate referred to here is calculated by you. There is a good discussion of HTKO at:

https://www.ryanandwetmore.com/insights/rwblog/foreign-tax-credit-high-tax-kick-out

So far I have not had any hightax kickout but if it occurs it must be dealt with.

You also made the following statement in your response to comment 13 “Did you multiply your foreign qualified dividends by 0, 0.4054, and 0.5405 as per Form 1116 instructions (page 9, “How to make adjustments”)?”

The values given above are based on the maximum tax rate for ordinary income which is 37%.

0.4054 = (0.15)/(0.37); 0.5405 = (0.20)/(0.37); These numbers change when the tax cuts expire.

In a similar manner the adjustments used in “Worksheet for Line 18” are given by:

0.4595 = 1 – (0.20)/(0.37) and 0.5946 = 1 – (0.15)/(0.37).

While reading comments 13-15 I was surprised by the statement that it is rare for a person to be able to claim the full amount of foreign taxes paid. Not only have I received the full credit every year I also have a significant safety margin. This may be a result of the fact that I am retired and taking the standard deduction. If a large enough portion of your deductions are applied to your foreign earned income this could result in lowering your foreign tax credit. Another possibility is that a person is in the region of the tax rate schedule where a significant portion of their qualified dividends are tax free. Is it possible either of these situations is the reason for not receiving full credit for foreign taxes?

Harry Sit says

I only said it’s normal to not get the full credit, not that it’s rare to get the full credit. Suppose half of the people get the full credit and half don’t (I don’t know the percentage breakdown), both cases are normal. Not getting the full credit doesn’t mean you did your taxes wrong. You don’t get the full credit when the average tax rate on your US income is lower than the average tax rate paid on foreign income. The US tax rate is low when a large part of the US income consists of qualified dividends and long-term capital gains taxed at 0%. This is common for retirees before RMD age living on dividends.

Steve says

Looks like I will be joining the “required to file Form 1116” club for 2024. Ugh.

han meng says

Super helpful, Sir!

Steve says

If you are using Block software to create 2024 Form 1116 with foreign income for more than one country, check to ensure the 2nd & 3rd country names are populated before you file your return.

I used H&R Block 2024 Deluxe Federal & State home software to prepare federal taxes.

The Form 1116 has foreign income and credits in 3 columns for 3 countries (Regulated investment company – RIC, country XX, country YY). When I completed my return today and printed return during efile process, Form 1116 did not have entries in Line 1 (country name) for the two countries in columns B & C.

In Block forms view, Form 1116 did show country codes for those two countries.

I had to bring up Form 1116 and manually enter the country names to get the country names included on Form 1116 in the final efiled return.

Last update to my Block software had been posted today prior to completing my return.

BN says

I was wondering if the foreign tax withholding on dividends can be avoided/reduced for countries with taxation treaty. For example, Germany has a tax treaty with the US and yet Fidelity withholds/pays 26% tax on German company dividends for US individual investors.

Anyone have insight on this or is the below website wrong ?

Reference – https://www.simplysafedividends.com/world-of-dividends/posts/31-foreign-dividend-withholding-tax-guide

“As a result, most major countries have deals with the U.S. to apply only a 15% withholding tax to dividends paid to nonresident shareholders. Some examples include Australia, Canada, France, Germany, Ireland, and Switzerland.”

Harry Sit says

If the treaty applies, Fidelity has to do something to get the special treatment. Maybe Fidelity chose not to apply for the treaty benefits because the paperwork is too onerous (identify each beneficial owner for each stock, which changes all the time). Anyway, we can’t control what Fidelity does. Whatever Fidelity reports as tax withheld, we try to get [some of] it back as a foreign tax credit.

Terry says

You say above in the Adjustment Exception section:

“You qualify for the adjustment exception if you meet both of the following requirements.

1. Line 5 of the Qualified Dividends and Capital Gain Tax Worksheet doesn’t exceed: …”

which seems to mean that anyone required to use the Sched D tax worksheet cannot claim the exception.

But when I look at the 2024 instructions for form 1116 it says:

“Line 5 of the Qualified Dividends and Capital Gain Tax Worksheet in the Form 1040 instructions or line 18 of the Schedule D Tax Worksheet in the Schedule D (Form 1040)…”

which appears to say the exception can apply in either case.

Have I missed something?

Harry Sit says

One way to qualify for the exception doesn’t preclude other ways.

BN says

Has H&R improved in handling Form 1116 now ? Thinking of switching back to H&R as Turbotax keeps jacking up their price.

Harry Sit says

I have the 2025 software but I haven’t tried it. I assume it hasn’t changed. I will update this post when I do the walkthrough next year for 2025.