Interactive Brokers (IBKR or “IB”) is an online broker used by many active traders. Unlike other typical brokers for retail investors (Fidelity, Schwab, Vanguard, E*Trade, etc.), Interactive Brokers offers more avenues not needed by the typical retail investors, such as trading options, futures, and on international exchanges.

However, one of their features appealing to me as a non-trader is the low margin rates. Using margin means borrowing against your portfolio. While traders use margin to add leverage to their trading, which increases both the risk and the potential payoff, long-term investors can use margin only for short-term cash needs.

Under the “IBKR Pro” pricing plan, the interest rate charged for the first $100k in a margin loan is about SOFR + 1.5%. The rate for borrowing the next $900k is only about SOFR + 1.0%. Say you have some investments in a taxable account with large unrealized capital gains. When you need cash, instead of selling your investments and triggering capital gains, you can borrow at these low rates to bridge a short gap.

You repay the loan with money from other sources at a later time (delayed financing, real estate sale, matured CDs, etc.). If you only borrow a small amount, say less than 10% of your portfolio, and only for a short period, your risk of getting liquidated when the market goes down is very low.

I wanted to move an account to Interactive Brokers to gain access to the low margin rates. Because my source account is under the name of a revocable living trust, I needed to open the new account at Interactive Brokers as a trust account as well. When I tried, I had a hard time figuring out how to open a trust account.

I finally found the way. I’m putting it here in case others run into the same difficulties.

When you go to Interactive Brokers’ website, you see a red “Open Account” button on the top right. Don’t go there when you’re trying to open a trust account.

You also see a prominent link on the homepage. Don’t go there either when you’re trying to open a trust account.

After you click on either button and create an email and password, the account types in the application are limited to only:

- Individual

- Joint

- Retirement

- Custodian

There’s no option to create a trust account.

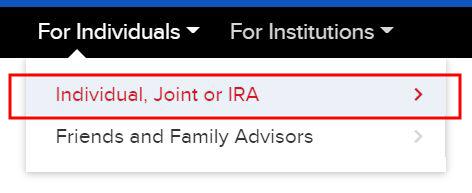

Instead, use the menu on the top left. Click on “For Individuals” and then “Individual, Joint or IRA.”

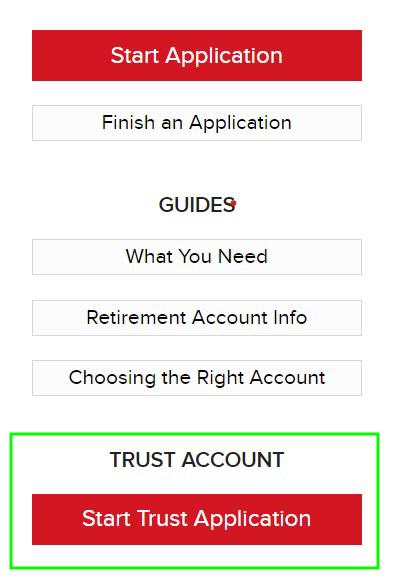

You see a bar of icons in the middle of the next page. Click on the last one “Open Account.”

Now, finally, click on the red button at the bottom instead of the one at the top to open a trust account.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

hikingout says

Harry,

Thanks for this, I’ve been having a heck of a time trying to have my trust as the beneficiary of my individual account. Love the margin rates, but the setup is not intuitive.

Bob says

Harry, Does IBKR put any restrictions on the cash you receive in a margin loan? For example, do you have to leave it invested with IBKR or could you withdraw the money and use it elsewhere?

Harry Sit says

You can withdraw and use the money elsewhere. The maximum amount you can borrow when you leave it in your account and the maximum amount you can borrow when you withdraw may be different. I haven’t figured out how it’s calculated yet.

Mark says

That’s a pretty good rate. Is this rate variable day to day based on the benchmark they use? If it’s fixed this might be a good way to fund a home down payment rather than keeping it ready in a savings account.

Harry Sit says

It’s variable. The current benchmark rate is 0.07%.

Steve says

Thank you for this post and others about securities-based loans. 1. Does having margin privileges at IBKR mean you can you can remove the margin loan proceeds from the account, or do you have to leave the proceeds in your IBKR account to buy securities, etc? I’m interested in borrowing money secured by securities to use for short-term spending. TDAmerica and Schwab offer both margin and “collateral lending” programs. See Schwab online article entitled 3-ways-to-borrow-against-your-assets . 2. Any comments about differences between margin loans and securities-based line of credit products?

Harry Sit says

You can remove the margin loan proceeds but the amount you can borrow and remove is lower than the amount you can borrow and buy securities. If you have $100,000 in the account, you can borrow and remove up to $50,000 under the default program, but you can borrow up to $100,000 if you leave the money in the account to buy securities. The alternative “portfolio margin” program allows you to borrow more.

Of course either way you shouldn’t borrow close to the limit, or else you’ll be subject to liquidation when the values of your securities drop. IBKR doesn’t do margin calls. They will automatically liquidate.

As I understand it, there’s no practical difference if you use the margin loan or a securities-based line of credit as a loan and you stay well below the limit.

Steve says

Harry: Thanks for your reply. The posts you have done about securities-based loans have been useful. I plan to make use of this approach as a short-term line-of-credit option. Did not like the looks of high interest rates for margin privileges at Fidelity. Was not aware of IKBR.

Harry Sit says

Some people reported getting offered a lower rate from Schwab, TD Ameritrade, and E*Trade than the published rates when they called and mentioned the low rate at IBKR. It’s worth a phone call to see what you can get before you transfer an account. I haven’t heard anything about Fidelity though.

KANG CHIANG says

Where can I find the fee schedule for a us taxable trust account on their website? I am looking for simple buy and sell etfs, some us stocks and mutual funds, No option trading, no futuer trading etc.

can you share your experience after opening new account?

Thanks,

KC

Harry Sit says

They have two pricing plans, IBKR Lite and IBKR Pro. The fee schedule for a trust account is the same as that for an individual account. Click on Pricing in the menu on their home page.

I closed my account because it’s too difficult to use. You can buy and sell ETFs, stocks, and mutual funds more easily at Fidelity, Schwab, E*Trade, or Vanguard. If you’re thinking of opening an account for the low margin rates, other brokers can almost match IBKR’s margin rate when you have a large account. See How To Use Securities-Based Lending to Manage Cash Flow. You can also borrow by selling short box spreads. See Short Box Spread Trade vs Margin Loan: How It Works at Fidelity.