Reader KD’s guest post about looking at the big financial picture really put many of my posts to shame. I post many small tips and tricks here and there but they often fall on the trees side rather than the forest. Most of them aren’t even trees, but twigs and leaves.

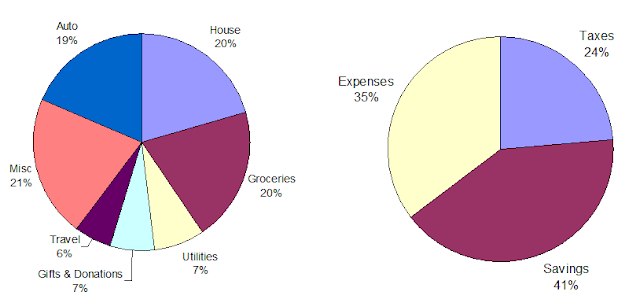

Getting an extra $5,000 in I Bonds via tax refund is cute and all, but how much difference does it really make? Suppose I Bonds pay 3% more than the alternative, which is really generous, getting extra $5,000 in I Bonds means getting an extra $150 interest a year. Does the extra $150 even register on these two pie charts KD shared with us?

How does KD get to save 41% of his income? Not by earning an extra $150 interest, that’s for sure. I don’t know if you noticed his housing expenses are only 7% of his gross income (35% * 20% = 7%) or 9% of his net income after taxes. Isn’t the mortgage payment guideline something like 28% of gross? When you spend 7% of your gross income on housing while others spend 28%, your savings rate can be 21 percentage points higher. It’s that simple.

How does KD keep housing expenses that low? I asked him via email.

TFB: Are your housing expenses low because you paid off your home already?

KD: No, I haven’t paid off my mortgage yet.

TFB: Did you only count mortgage interest but not principal repayments or taxes and insurance?

KD: No. It includes principal, interest, tax, insurance, plus condo fees.

TFB: Do you live in a 300 sq. ft. studio?

KD: No. It is a 1,000 sq. ft. 2-bedroom, 2-full-bath condo with a wood burning fireplace, a balcony, a walk-in closet, a washer and a dryer, a dishwasher and all that you need to make yourself comfortable and at home.

So what’s the secret? Housing in some parts of the country is less expensive, sometimes much less expensive. Within the same area there is still a wide variation in housing. It’s all about what you choose. You choose which part of the country you live in. You choose between consuming housing and having a high savings rate.

When you don’t have to spend that much on housing, you free up so much cash for savings. From some earlier comments I learned KD’s mortgage was less than $50k when he bought his home a few years ago. Now it’s down to $30k. Compare that to other people having a mortgage of $300k or more.

People in more expensive areas do get paid more. Does it make up the difference? I don’t think so. Having a higher income also means you pay more taxes because the government doesn’t consider cost of living when it comes to taxes. Unless your line of work is really tied to a specific area, choosing where you live makes a huge difference.

It’s even more so for retirees. I keep hearing people have inadequate retirement savings. Moving to an inexpensive area (not Florida) will make the savings last much longer.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

xyz says

I totally agree on the housing expense issue. My wife and I have put a lot of focus on this issue. While many of our colleagues continually upgraded to nicer homes as their earning power increased, we’re still in the same house we bought when we first entered the workforce.

At the time it felt like a minor stretch (though was still well within the ‘28%’ guideline), but by avoiding the upgrade cycle, as our careers have progressed and mortgage rates have dropped, our house costs have become almost ‘in the noise’, and our savings rate has increased to consume the difference.

@TFB, I also wanted to mention that I really liked the concept behind the ‘Big Picture’ article — the idea of giving a peak into an anonymous person’s finances is a great one. I think you should consider making it a regular feature! I do think it would be nice, given the anonymity, to encourage the authors to provide a little more personal financial information. Obviously comparisons are not possible nor desirable, but it’s easier to learn from people in a similar situation. Thanks!

Sam says

House is key, wife and I live in a 900 sq ft condo, that is what it takes for us to have a high savings rate.

Lynne says

Where do you people live that decent housing can be so cheap? My job is in expensive New York City, and I work long hours that often include evening events, so my home can’t be too far away. I live in a modest 2-bedroom apartment in a safe but not trendy neighborhood. My monthly mortgage + co-op maintenance payment equal 27% of my pre-tax income. That seems to be within guidelines, but in this high-tax state, housing costs eat up just over half of my after-tax income. That’s after other payroll deductions like 401K contributions in addition to taxes, but even so doesn’t leave much money after other bills like food and utilities are paid. My 401K contribution is 11% of my salary, but it’s hard to save any more than that toward retirement.

Harry Sit says

Lynne – I would say almost anywhere else is cheaper than New York City. Here’s a heat map of home prices from Trulia:

http://www.trulia.com/home_prices/

KD says

One thing that the pie charts do not tell is the time line (history and expected future) of the behavior. There will some years of low pay, low expenses, low savings; some years of high pay, high expenses, low savings, and some years of high pay, low expenses, high savings. Hopefully, none or few of low pay, high expenses, no savings as that would eventually result in bankruptcy at some point.

Looking at the big picture also includes looking at such a timeline. Hopefully, that would help us understand ebb and flow that happens in our personal careers and lives, help us gain a more balanced perspective on things and help us focus on things that we can control rather than on things that we cannot.

DaveLev says

I work in NYC, Boston, Chicago, LA, Seattle, and SF. I travel to my clients often. I learned from a peer 5 years ago that she lived in a rural part of Idaho, about 45 minutes from the airport. She said she flies into Los Angeles on Monday, and flies home on Thursday night or Friday afternoon. I thought she was nuts. Her husband lost his job, and she made more money than he did working for a major defense contractor.

The airfare is a business travel expense. The company provides lodging and per diem, but not airfare. It still sounded nuts.

Fast forward 5 years. I left the big city and a 500K mortgage and moved my whole family out to the sticks in Idaho. I pay rent at 1,200 a month now. Cost of living is VERY cheap compared to the big cities. My employer pays for all travel, hotel, and lodging, however, some of my clients don’t re-imburse. I cover those, and deduct this travel at year end on my taxes. I have W-2 and 1099-Misc income.

What does this mean? I put away thousands of dollars a year into savings, investing, and retirement. We have a great lifestyle. Our kids go to the best schools in the state. The airport is 30 minutes away, and flights go to all major markets.

I thought my co-worker was nuts, but she has a paid-for house and a non-working spouse (stay at home dad) in just 5 years.

Because we sold our house in the big city and live pretty lean (budget, forecasted income, etc.), in just 9 months we have enough cash saved to buy a mansion in this town (the fastest growing in Idaho). Crime is low. Schools are safe. Cul-de-sacs, tons of outdoor activities, etc.

After 18 years of working in the big metro areas, I’m done with owning, renting, or living in the big city. I think everyone should seriously consider moving out to the sticks. Do your homework as far as schools, cost of living, state income tax rate, etc.

My wife and I have NEVER been happier in our marriage (15+ years). We are debt free and sleep good at night. We have a great life, tons of friends, and lots to do.

Give it a try, people – you might like it.

Financial Advice for Young Professionals says

I’ve been spoiled living in SoCal for my first 25 years of life. I’ve been very lucky to never live more than 10 minutes from the beach, but boy have I paid for it! I paid 280k for a 2bed/2bath somewhat dated condo in San Diego. I could have bought a mansion in Alabama and gotten paid the same amount, but then I’d be living in Alabama.

Not that I have anything against other areas, but I think most people are more comfortable with the areas they grew up in. It would be a lot easier to move somewhere cheaper, but all my friends, family, etc are here. Hard to quantify how much that is worth to someone..

babar says

Best pie chart I have seen in a long time.

My numbers:

Income (W2 + interest + dividend + realized capital gain in taxable accounts) = 100%

Taxes (Federal + state (none for me) + payroll + Sales tax (estimate) + property tax + vehicle tax = 24%

Savings (401k, IRA, 529, ESA, addition to bank/investment accounts) = 32%

Expenses (everything else) = 44%

I hadn’t realized we spent so much in a year. Our housing expense (mortgage + insurance + prop tax) is about 12% of the income; i.e. 26% of all our expenses.

nick says

Generally speaking, keeping your housing expenses low so you can invest more is a good plan because stocks return more than home equity over the long term.

BUT NOT NOW! We have what is probably once-in-a-lifetime low home prices combined with equally exceptional low mortgage rates. This is the time to buy MORE house than you might otherwise purchase.

anie says

This is something that keeps me up at night! We bought our home in Northern California 3 years ago as a MAJOR fixer, had to the FHA and what not so we’re slow to get equity but the price is going up. What we’ve realized is that, despite the mortgage interest deduction (which if taken away will completely negate any reason for us to own a home), we are paying an enormous life insurance policy for my husband (high home price and not perfect family tree health as the cause, neither of which we can do anything about), we are paying a high price for car fix its because even though we live in a very urban area, the public schools are rotten so we carpool. In addition, I try to carve out extra income and so have to find a schedule that works around the kids and therefore end up driving to get to my various jobs. Shall I go on?

I have us on a 3 year plan to get out of dodge! I feel that even though we’d still want to be near an urban area, we are paying *way* too much money and lifestyle happiness to do it here. We stay because my husband loves his job, but meantime many other factors degrade our quality of life. We both grew up in the sticks and I am pulled there constantly. The good news is we have a plan!

Sam Seattle says

I, too, live in a 1000 sq-feet house. When I told people that it is one-bedroom too big for hubby and I, they usually didn’t believe me. People thought, by living in a 1000 sq-feet house, we were depriving ourselves! No, no, we’re not. More square footage means more time, labor and cost to do the upkeep, maintenace, insurance … time and cost that we’d rather spent on many other more enjoyable pursuits (like reading your blog, Harry 🙂 and connecting with friends), than doing housekeeping or paying for housekeeping.

Oh, by the way, our housing expense is also only 2.5% of income.

They don’t believe that, either.

Oh, well.