[This is a guest post from long-time reader KD.]

In this day and age of financial blogs, coupon sites, and one-click online shopping, savings are easy to find and easy to replicate. The question I end up asking myself is what difference did these savings have on my bottom line? More often than not, in my case, the actual value is less than a couple of percentage points of the total annual spending. It is easy to forget the forest for the trees.

This is primarily because most often, the largest items in our spending are fixed such as housing payment, insurance payment, grocery shopping including non-food items, auto payment, gas and utilities. I call these necessities. Thanks to the rise in the disposable income of most U.S. households, this chunk has decreased considerably over the past few decades. But it still takes quite a big bite each and every month.

I hear, see and read in various personal finance programs on radio, on TV and on the Internet, about how rich I would get if I forego the latte every day and save the money. Sure, the idea is simple, easy to implement, and with guaranteed results. All you need is discipline! Umm, yeah! That is right, discipline! An exercise of will power, a resistance to frivolous temptation and a few calories you may do without. But we all know we have only so much of this discipline and will power. Wouldn’t you rather use it for something substantial?

I would like to save that special tour-de force of discipline and will power for special occasions – like when I decide to buy a house with that extra bedroom, extra bathroom, extra garage space and extra large yard that I won’t keep up or that new car with all bells and whistles, extra warranty, and a payment protection plan.

The truth is most of us could do better than save some money on lattes. We could ask ourselves some very tough critical questions about our lifestyle design. Which of the possessions is my family really using and how much? How may I rearrange my spending to increase my satisfaction? My goal typically is to have a balance of form and function. The aesthetic is important, but I also try to make an effort that I use at least 80% of the utility value of my home each day. So yes, an extra bathroom may slide in but not much else and the extra bedroom will have to double up as the den.

I started tracking my expenses two years ago which has made it easy to check what I have spent my money on. (No, it didn’t require any discipline on my part, but one time motivation for setup was essential.) Generally, the split is 2/3 on necessities and 1/3 on desires. It may be a different fraction for you but you need to know it. After you know this number, you have to ask yourself if the satisfaction you get is worth the money you are spending on it. Does it help create more financial security for your loved ones and you?

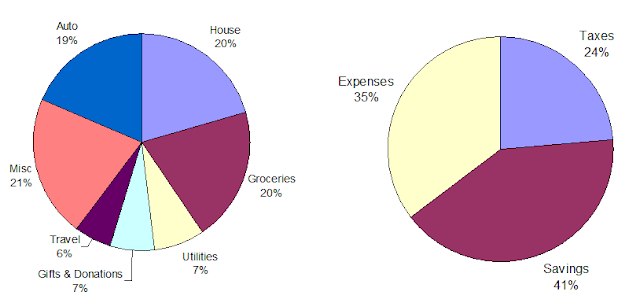

I am reproducing the two pie charts that help me understand the big picture.

I see some positives and some negatives in the above two pies. The high savings rate and the low cost of housing are commendable. But the groceries and the impulse buys hidden under Misc. could use some attention and work. Improving the gifts and donations and reducing taxes would also be welcome.

I hope the reflection and awareness serves you well as it has for me. Go grab yourself a slice of a pie!

[Editor] Follow-up articles on lifestyle design:

- Lifestyle Design: Choose Where You Live

- Lifestyle Design: Choose What You Do

- Lifestyle Design: Choose What You Know

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Leigh says

KD, that is a very good way to look at it! Whenever I attempt to chastise myself for spending too much money, I then look at how much I put into savings/investments in the month and usually feel better (especially since a very large portion of my spending is planned). When that savings part of the pie chart is > 50%, I’m not really concerned about my spending as much.

Bethy @ Credit Karma says

Thanks for sharing from your own experience! I think it’d be interesting to look at my spending without my “necessities.” In other words, what percentage of my discretionary spending is on “things,” what percentage on “experiences,” etc. I think I could better reach my short-term savings goals if I took that approach to analyzing my budget.

KD says

Thank you Leigh and Bethy for your kind words. I appreciate it.

Financial Samurai says

Howdy KD, where do you live?

I’ve saved 55%-70% of my after-tax income savings for the past 13 years, so I can relate. It’s a great feeling to wake up 13 years later with 15-18 years of full living expenses saved up to do whatever one wants!

B says

I liked your post. I think the concept of assessing what you have and whether or not you are using it is a good one. Particularly anything that costs you money in taxes, insurance, subscriptions, maintenance, etc.

White Coat Investor says

You’re so right. It’s all about the big things. It isn’t the lattes making someone go broke, it’s the $500 a month car payment and the house that costs 30% of their income.

KD says

Harry, would you please link other lifestyle design articles at the bottom of this one? Thanks!

Harry Sit says

I added links to three follow-up articles.