Back in March, Congress created two loan programs to help small businesses and the self-employed mitigate the economic impact of the COVID-19 pandemic: the Economic Injury Disaster Loan (EIDL) and the Paycheck Protection Program (PPP). Because we were not sure whether we were able to get either loan, we applied for both (see previous post COVID-19 Loans for Self-Employed: Where to Apply). We ended up getting both loans after a long application process — the EIDL loan directly through the SBA, and the PPP loan through a bank.

Our business stabilized somewhat in recent months. Revenue was down 65% in April compared to April of last year. It was down only 47% in June. It’s still bad but the trend is upward. So we decided to pay off the EIDL loan early.

EIDL Loan Is Not Forgivable

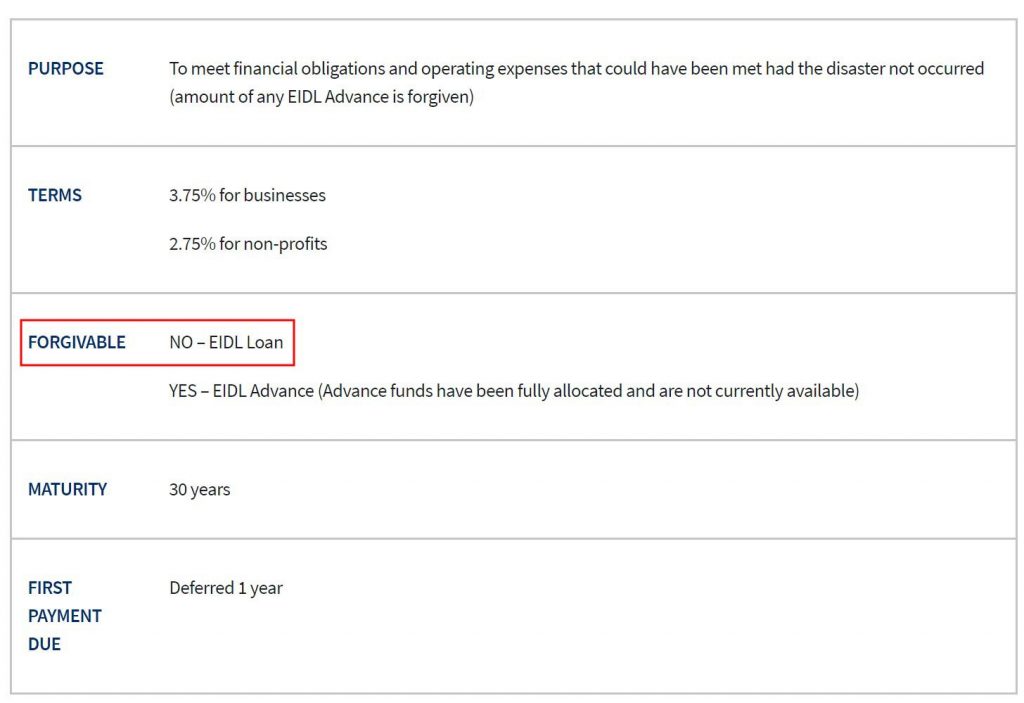

The EIDL loan is a 30-year loan at a 3.75% interest rate. No payments are required during the first year but interest still accrues. Except for the EIDL grant ($1,000 per employee up to $10,000), the EIDL loan is not forgivable.

Therefore if you no longer need the cash, it’s better to pay it back early to stop the interest. There’s no prepayment penalty. When no payments are due yet, the SBA isn’t sending any statement or payment stub. If you’d like to pay the loan off, it’s not obvious how much you need to pay or where to send the payment. I’m showing you what to do if you received the EIDL loan and you’d like to pay it off early or pay back a part of the loan to lower your interest charge.

SBA Loan Number

First, you need the SBA loan number for your EIDL loan. This 10-digit number is in the Loan Authorization and Agreement (LA&A) you electronically signed with the SBA. It’s at the beginning of page 2 and also on the upper left of all pages in that document.

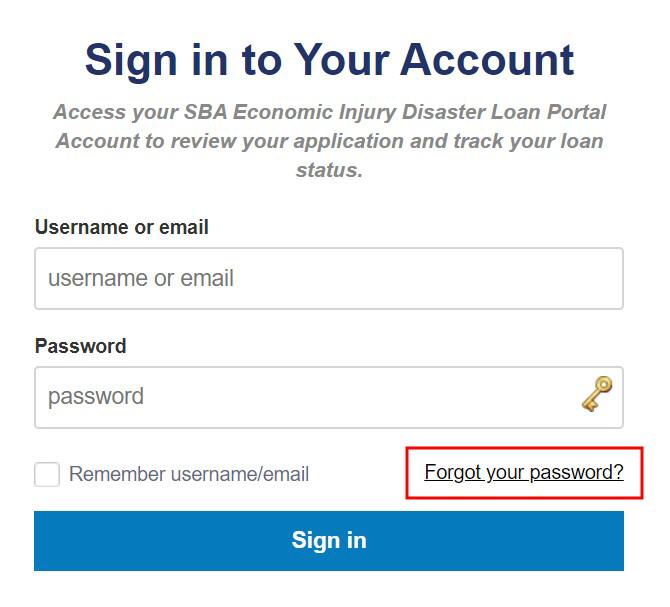

If you didn’t save the document you electronically signed with the SBA, you can go back to the EIDL loan portal at https://covid19relief1.sba.gov and sign in with the email and password you created. If you forgot the password, there’s a “forgot your password” link on the login page.

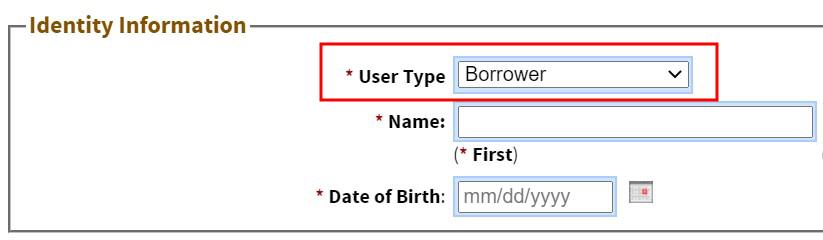

After you log in, you can re-download the signed loan document.

If you still can’t get into the loan portal, please call the SBA EIDL customer service center at 800-659-2955 or email [email protected].

SBA CAFS

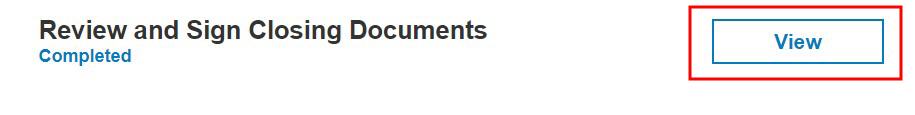

Next, you need to register with the SBA’s Capital Access Financial System (CAFS). This is similar to the online banking site when you have a loan with a bank. If you have problems registering for online access, please scroll down for how to contact SBA’s Disaster Loan Servicing Center by phone.

Click on the “Not Enrolled?” link above the login fields.

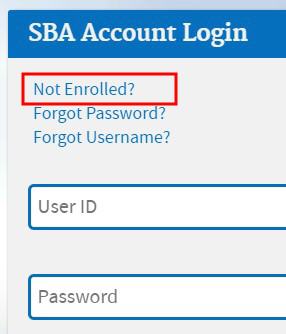

Choose “Borrower” under User Type.

After entering your zip code, click on the Lookup Zip button.

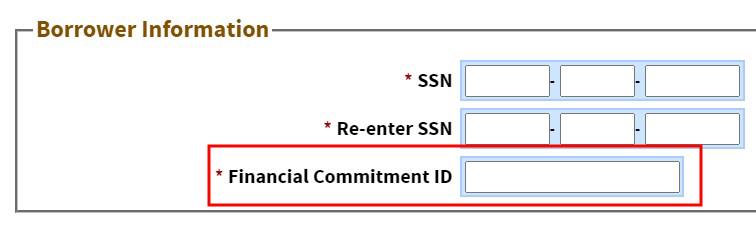

Enter your SBA loan number in the “Financial Commitment ID” field.

Payoff Amount

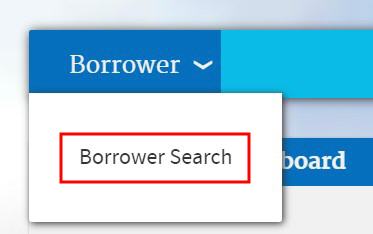

After you successfully register for access, you log in to CAFS with the user ID and password you created. The system will send a one-time PIN to your email address or mobile phone for two-factor authentication. After you get in, at the light blue bar at the top, click on Borrower, and then Borrower Search.

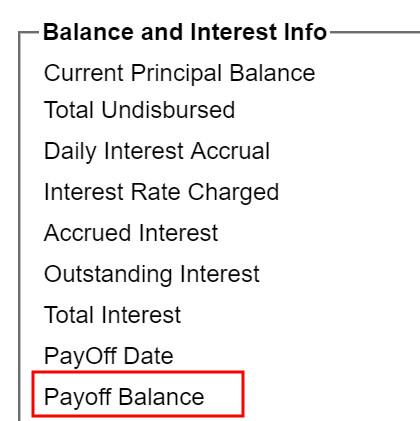

You will see a list of your loans. If you received both the EIDL loan and the PPP loan, you can identify your EIDL loan by the loan number, the loan amount, or the loan type (“DCI”). Click on the EIDL loan. You will see your loan details. If you are trying to pay the loan off, read the Payoff Balance during working hours Monday through Thursday.

Further down the page, you will see a link that says “Go to pay.gov to make a payment.” So you go there next.

Pay.gov

The link just sends you to the home page of pay.gov. This is a multi-purpose website for making many different kinds of payments to the U.S. government. You will see this in the middle of the home page:

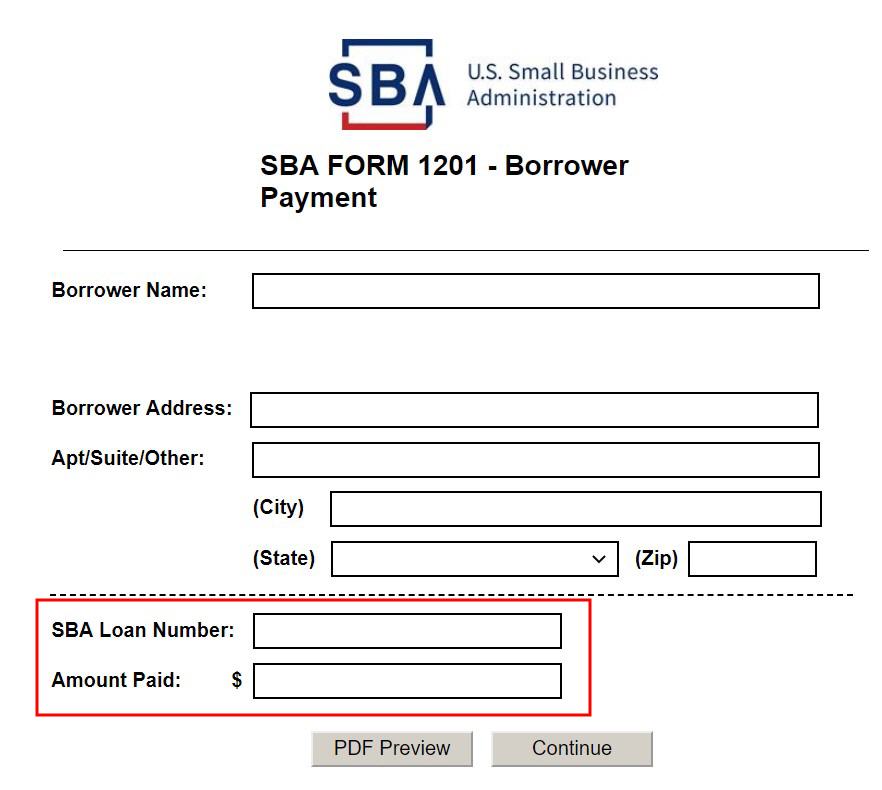

You follow that link even though you don’t really have a payment notice (Form 1201) from the SBA. When you follow along, the crucial information you need are your SBA loan number and the payment amount.

If you are trying to pay the loan off, enter the payoff amount you got from SBA CAFS (you can also make a partial payment). The soonest payment date is the next business day. That’s why if you are trying to pay it off, you need the latest payoff amount during the working hours Monday through Thursday. If you get the payoff amount in the evening or on a Friday, by the time the payment arrives, additional interest may have accrued and your payment will be short.

You will give the routing number and account number of a bank account for the payoff. Pay.gov will debit your account and send the payment to the SBA. You can go back to SBA CAFS after a few days to verify the payment and the loan status.

You are done when you see the loan status says “Paid in Full.”

SBA Disaster Loan Servicing Center

If you have problems enrolling in CAFS to view your payoff balance and loan status, you can also try calling SBA’s Disaster Loan Servicing Center. I haven’t called them myself because I was able to get into CAFS. I only found the information on SBA’s website.

SBA has two Disaster Loan Servicing Centers, one in Birmingham, AL, the other in El Paso, TX. Your loan may be assigned to one of the two centers. Or maybe either center will be able to tell you the payoff balance and verify that your loan is paid in full. The Loan Servicing Center also takes payments by phone.

Birmingham Loan Servicing Center

Phone: 800-736-6048

Hours of Operation: Monday – Friday 8:00 a.m. to 4:30 p.m. (CST)

Email: birminghamdlsc at sba dot gov

El Paso Loan Servicing Center

Phone: 800-487-6019

Hours of Operation: Monday – Friday 8:00 a.m. to 4:30 p.m. (MST)

Email: elpasodlsc at sba dot gov

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

John says

I never got a SBA loan number for my EIDL loan nor a Loan Authorization and Agreement (LA&A). All I got was an application # and money in the bank. Any idea how to find it? I did e-mail SBA? Thank you.

Harry Sit says

You don’t have a loan number if you only received the EIDL grant of $1,000 per employee, up to $10,000. The EIDL grant is not required to be repaid (but it reduces the amount to be forgiven from your PPP loan if you also received that).

Laura Cottril says

I can’t find a loan number, just the application number.

I received both the loan and the grant.

This post is VERY helpful!

Thanks.

Harry Sit says

You can re-download the loan document from the EIDL loan portal and find your loan number in the document. I added the link to the loan portal and some screenshots.

Laura Cottril says

THANK YOU! I got it!

I will forward your tutorial on to my national photography association to help other photographers. I so appreciate your support.

Laura

Laura Cottril says

Do you also have information about the PPP loan? Specifically, what is forgiveable for a sole proprietor? I am a portrait photographer.

Thank you!

Harry Sit says

Here are the simplified PPP loan forgiveness application form and its instructions. You can try filling out the application and see. For most sole proprietors with no other employees, if the original loan amount was calculated correctly and you use the loan to pay yourself, 100% of the loan will be forgiven under the new 24-week Covered Period. Most lenders haven’t started accepting loan forgiveness applications yet. There’s also talk about allowing automatic forgiveness for small loans, to save the paperwork burden for everyone, but it hasn’t become law yet.

Hollie Oh says

What happens if you get SBA Loan and your business don’t survive COVID pandemic and needs to be closed down. Does the SBA Loan become your personal loan?

Harry Sit says

It depends on the loan amount. An EIDL loan over $25,000 requires the assets of the business as collateral. A loan over $200,000 requires a personal guarantee.

Phebe Mansur says

Is there a way to set up recurring payments on an EIDL loan?

Where can we find details on expenses that are forgiveable? Are rents and utilities forgiveable on an EIDL loan?

Your article is so valuable. The loan doc has no details on how to make payments. I’ve spent several days contacting various SBA offices, congress reps, SBA reps – – no one has an answer: Except You! TY

Harry Sit says

I found this address for accepting bill pay through your bank, which you can schedule as recurring payments:

https://www.sba.gov/offices/disaster/blsc/resources/29931

Please call the phone number on that page to verify it’s still current.

Except the EIDL grant ($1,000 per employee, up to $10,000), the EIDL loan is not forgivable. If you received both the EIDL grant and the PPP loan, the EIDL grant reduces the amount of the PPP loan that can be forgiven.

Harry Sit says

Pay.gov also allows scheduling automatic recurring payments, but you need to create a Pay.gov account first. Go to Pay.gov and click on “Create an Account” on the top right.

https://www.pay.gov/WebHelp/HTML/payments_automatic_scheduling.html

Kyle Dabe says

Can any part of the EIDL loan not the grant be forgiven? I spoke with SBA Disaster Assistance Customer Service Center at 1-800-659-2955 today asking some questions on how to avoid interest if we pay it off before the 1 year maturity date, I did not get an answer but she said may be part of the EIDL loan used for business expenses such as payroll, utilities, etc could also be forgiven??? Is this true?

Harry Sit says

Except the EIDL grant, the EIDL loan is not forgivable. I added a screenshot and the link to a page on the SBA’s website. It clearly shows the EIDL loan is not forgivable.

Serena Tate says

They told me interest starts immediately including the entire year deferment and some reps told me wrong info saying it was at much lower rate 1st year

Does anyone Have a clue what formulate they figure use to figure out the EIDL loan? Anyone stroke a and can give me some details I just don’t feel comfortable having no idea what I’m getting myself into and don’t understand why they can’t give you a ballpark range like PPP I’m also not a normal business I’m 1099 freelance I don’t have a ton of gross I just want to know the ballpark amount and if it’s anything similar to PPP range thank you guys

Harry Sit says

Interest starts immediately at the same 3.75% rate. That’s why some of us paid it off or started paying early.

Wikada says

I just paid off via http://www.pay.gov after 1 day received the loan and got confirmation email . Do I need to do anything to make sure it got paid off or any document?

Harry Sit says

Check CAFS after a few days to verify the payment has been credited correctly and the loan status now says paid in full.

Kyle Dabe says

Is the SBA EIDL loan still giving away $1000 grant per employee, I completed the application and there was no mention of the grant accept entering the number of empolyees. The SBA website said funds ran out of grants.

Harry Sit says

Only if you applied before they ran out of grant funds in early July.

Donna says

Can I transfer the remaining balance I owe on my EIDL loan to a 0% credit card?

Harry Sit says

If the credit card gives you a balance transfer check (sometimes also called a convenience check), which you can deposit to your bank account, you can use the money to pay off your EIDL loan. If you have to pay a balance transfer fee, and the 0% is only for a limited time, maybe it isn’t worth the trouble, and you may end up paying more if you’re not careful.

Sue says

I tried 12 times to fill out this form and can’t get it to go through. How do you do it when the loan is on behalf of an LLC? Are you the borrower or the partner? Is the loan number the application number? What is a Headquarters Location ID? How does the “Lender’s Authorizing Official (Lookup)” section work?

Harry Sit says

Follow the steps in this post exactly. Print it out if that helps you cross out the steps as you go along. Choose “Borrower” in the User Type field, as shown in the screenshot. When you choose “Borrower” it won’t ask for the Headquarters Location ID or Lender’s Authorizing Official.

Sue says

I followed the steps exactly and it said it wasn’t a match. I went though it 12 times. So if Borrower is correct for an LLC then I am stumped.

Jorge says

I do have a similar problem as Sue does. My EDIL loan is on behalf of an LLC (partnership). I have the Loan number from my documents but when I put either my personal SSN or the LLC’s TaxID, I get an error that the combination does not match the information on the database.

Is there a different enrollment form for LLCs?

Harry Sit says

My EIDL loan is also on behalf of an LLC (partnership with its own tax ID). I had no problem enrolling in CAFS with my SSN. Because they get your personal credit score before they issue the loan, I would think they have your correct SSN. The error message on that enrollment page can be confusing. Maybe it’s referring to something else? You can also call SBA customer service to confirm that they have your correct SSN associated with your loan. If all else fails, maybe call the Loan Servicing Center to get your payoff balance.

https://www.sba.gov/offices/disaster/blsc/resources/29931

Harry Sit says

I added information about the two Loan Servicing Centers to the post.

UGH! says

I, too, am stumped for an LLC. It says it doesn’t match. Tried both with my own name and business name. Gone through the captcha and security questions about 15 times already because that doesn’t save when you do this.

Jorge says

Thanks I’ll keep on trying

Frank Agrusa says

Thank you so much for the step by step. This was a great help, greatly appreciated.

Jorge says

Hi Henry I was finally able to enroll and access the information. Thank you very much for the step-by-step instructions. I do have a question, do you know if there’s a possibility of getting a formal payoff letter on the capital systems website? So far what I can access is a statement but my bank is asking me for a formal payoff letter.

Thanks again

Harry Sit says

Great! In case others run into the same problem, what wasn’t matching before?

I don’t know about the payoff letter. I haven’t received anything in the mail since I paid off my loan. If printing out the loan details page from CAFS and highlighting the “Paid in Full” loan status doesn’t satisfy your bank, maybe call the Loan Servicing Center and see if they issue any formal letter.

Jorge says

Thank you!

surinder pal singh says

Hello,

This is surinder singh, i like to return my loan now.

please help me , who to contact and how i can pay back

surinder singh

Dominique says

Thank you so much for posting this. What a great help!

TJ says

I got the loan as a precautionary measure but have not needed to tap into the funds, meaning my account has not gone below the actual loan amount. It is my understanding, that just taking the EIDL loan, self-employed persons were only allowed to use the funds for salary, rent, etc and NOT allowed to take dividends/bonus distributions. Can I just raise my salary and pay the respective taxes, et al? Also, after paying the loan off, will I be able to pay myself dividends without any of the “threatened” contract penalties i.e. double the loan amount.

Harry Sit says

Sorry, I don’t know. After you pay the loan off, I would think any restrictions you agreed to would end. It doesn’t make sense to stop you from doing something forever only because you took a loan in the past but paid it off already.

Mario says

The CAFS website (https://caweb.sba.gov/cls/dsp_login.cfm) seems to be down for 2days now. Any idea whats going on?

Jennifer Davis says

Seeing the same issue on my side (website wouldn’t load yesterday and today). I emailed [email protected] but haven’t gotten a reply. I also called the Customer Service Center @ 1-800-659-2955 but can’t seem to get anyone on the line.

I did get someone on the line at the Birmingham Disaster Loan Servicing Center and she was very helpful. She informed me that all of their systems are down right now but they are expecting they may be up this afternoon.

Disaster Loan Servicing Center

2 North 20th Street Suite 320

Birmingham, AL 35203

Phone: 800-736-6048

Fax: 205-290-7765

I am also going to try to go to pay.gov to see if I they have the payoff information there.

Jennifer Davis says

Website is still not up (https://caweb.sba.gov/cls/dsp_login.cfm) as of 2 pm EST.

They advised I could go to Pay.gov and from the homepage choose “Make a SBA 1201 Borrower Payment” and it will ask for the loan #, and you can make a payment from this screen.

In my case I am wanting to pay in full, so I need to find out the “full payoff amount” which is in the system that is down. Good luck!

Rob says

I never comment on blogs, but I had to THANK YOU for this awesome write up!

Besides obviously saving the pay off confirmation screenshot and email is there anything I need to send to my state to remove the lien from my business? I’m not entirely sure how all of that works since I was in a rush back when I applied.

Harry Sit says

I borrowed only $25k because I didn’t want a lien. Since the SBA charged you $100 to file the lien through their contractor, I would think they’re responsible for removing the lien when the loan is paid off. Please ask the Loan Servicing Center whether it’s automatic (and the timing) or you need to make a request.

T Ally says

I received $13,300… For SBA disaster loan I did sign the contract 3.75% $65 a month for 30 years. I am a sole proprietor. I have a girl that was working with me but she ended up applying for unemployment. She’s a contractor can I just cut her a check for what’s owed to her the last four months? And pay back the money that I didn’t use?

Graham says

I just applied for eidl for 24k. If I don’t use it in 6 months , and I want to pay it back in full, how much would the interest be that I have to pay along with the 24k?

Steve says

24 k times 3.75%/2 (6 months) will get you close. Review your account after payment is made and depending on if the 3.75% was APR it should be paid off. Plus the 24k

Sue says

I’ve now tried this 10 more times and still can’t get through. This is literally the worse online web form ever! Always one little thing kicks it out, they want a dash here, they want another digit there. And each time you have to re-fill out the password and 3 security questions and the captcha.

What the heck does this mean? City/State on one line. I have tried every combination I can think of, a / between like they show, a space between. I have a masters in engineer and I absolutely cannot get this form completed. Could you please post an example filled out with dummy information?

Sue says

OK, the state thing if fixed with the lookup. But ow I get the same dreaded thing I originally got, the ss# doesn’t match. So something is obviously supposed to be done differently for an LLC. Unfortunately the phone number for help at the SBA doesn’t work either; instead of routing you to CAP registration help, it sends you to info for PPP.

Jennifer says

Hi Sue – Hope I can help. I had the same issues since I was trying to get logged in with my company.

Can you see my reply above? Scroll up and see if that info helps you out. The Birmingham center was hugely helpful for me. I ended up not making a CAFS account and just doing my payment over the phone with the Birmingham center. Gave them my routing # and account #.

Disaster Loan Servicing Center

2 North 20th Street Suite 320

Birmingham, AL 35203

Phone: 800-736-6048

Fax: 205-290-7765

Sue says

Thanks Jennifer! I called that number and they said you CANNOT MAKE payments through CAPS. So this entire article seems incorrect. You have to make payments through pay.gov or by calling that number you provided. Easy as pie.

Jennifer says

I think CAFS was just to login and get the full loan amount so you know how much to pay to pay in full. You still have to make the payment over the phone or on pay.gov.

It’s all quite confusing, but I’m hopeful they were able to help you solve your problem!

Sherry says

I just followed the steps and completed the payment. Thanks so much. FYI when I called the Phone: 800-736-6048. The agent said you can NOT make payment over the phone, but have to go through pay.gov. So I follow the article to get the payoff amount and completed the payment. Thanks a lot for sharing.

Roy says

I recently got approved for 30k. Docs are signed and sent, and funds are now in the funding stage. Is there anyway to request for a lower loan amount since I’m probably going to use half of it. That way my monthly payments and interest would be lower.

Harry Sit says

Roy – You had an opportunity to ask for less than the amount approved before you signed the docs. I don’t know how to reduce the loan amount after docs are already signed. If you’d like to pursue it, call the SBA customer service line to see if it’s still not too late to halt the processing.

It’s certainly much easier to let them go through their normal process and pay back half immediately after you receive the funds. Interest on the amount you pay back will stop. Your monthly payments starting a year from now will still be calculated off the original amount. Because the payments are stretched over 29 years, the difference in monthly payments on a $30k loan versus a $15k loan will be something like $150/month versus $75/month, which isn’t that much in absolute dollars. If you pay $150/month toward the remaining $15k balance, your loan will be paid off much sooner (10 years versus 29 years) and you actually pay much less in total interest.

alan c Martin says

I called SBA Disaster help line and they told me to pay via Pay.gov . Is that another way of paying back the EIDL ?

Harry Sit says

It’s the same way described here. Please read it through again.

chris says

If you take the EIDL and you use it for something that is not approved, lets say CC debt, but you pay the loan back before the 12 month due date, are you still at risk for getting audited later, even if you are paid in full before the monthly payments begin?

Harry Sit says

Yes, you should still follow the permitted use of funds. It isn’t related to the payment start date or the loan status.

Seeven says

Hi Harry,

I applied for the loan back in July. I asked sba to lower the amount because the function didn’t work on the site. They didn’t lower it and it was SO hard to speak to anyone about the loan. I just recently (october) approved the loan for 60k. They deposited the amount and right after, I received a response from their account support about not being able to lower the amount because I received the loan (i know, funny timing, right?). As far as amortization goes, If i pay the full loan back after 2 1/2 years, will I be stuck with an early payment penalty? I’ve scoured through the Loan agreement forms and found nothing. Thanks for reading Harry!

Harry Sit says

There’s no early payment penalty. Since you didn’t want this much loan to begin with, you can pay back part of it now. The amount you pay back will stop accruing interest.

Bill says

Harry,

In this case if you paid back a large amount, but not the whole loan would your required monthly payment drop or would you still have to pay the same monthly? IE: loan amount is $150,000 & payment is $720. If you paid $40,000 would the new payment be around $550 or would you still be paying the $720 and just pay it off in fewer years?

Harry Sit says

It won’t change your monthly payment but you’ll pay it off sooner and pay less interest.

Dwight W Mattmuller says

Like some I signed up for the PPP and the EIDL 30 year loan and both were granted. The EIDL loan eliminates the PPP forgiveness program from what I have read. The virus has not been as bad as I thought and can pay back the EIDL loan now. Would that make the PPP forgivable? Since the EIDL loan was under 200k and the only assets tied to the loan are the LLC (No personal guarantee) what happens if the LLC goes under?

There are a few tricks getting signed into the CAFS site. You must enter your zip code for the state to come up and your loan number and your application number are different.

Harry Sit says

The EIDL loan does not eliminate the PPP forgiveness. Only the EIDL grant ($1,000 per employee, up to $10,000), which doesn’t have to be repaid, reduces the forgivable amount of the PPP loan.

Blooms says

Can I apply for the EIDL a second time, after paying off the first loan?

Deborah says

Great site! I applied for EIDL grant for $10,000 before it was restricted to $1,000/employee. I am sole employee of my LLC and received $10,000 grant.

I also applied for PPP and received funds there ($12,500). That should be forgiven in total (I met guidelines).

My question is: since I received a grant of $10,000 and am only eligible for $1,000, am I going to have to repay $9000 of PPP loan, PLUS $9000 of the EIDL too since I have to declare any EIDL grant received on my PPP loan forgiveness? I would like to return the grant, but of course not possible. I bet I am not the only person wondering and of course now I regret applying for EIDL first, as was suggested. thanks much

Don says

Do you happen to know how long it takes for the SBA to credit your account with the payment. I paid off two days ago and it’s still showing the same balance with accruing interest.

Harry Sit says

I don’t remember exactly whether it was two days or three days. If money already left your bank account, you’ll probably see it reflected in CAFS on Monday or Tuesday.

Billchan says

I am planning on selling my company and have already found a prospective buyer, however, I’m unclear on how my outstanding SBA loan affects my situation.

Am I permitted to sell my company with an outstanding SBA Economic Injury Disaster Loan?

If I am, then is it possible to transfer the outstanding loan balance to my company’s buyer?

Furthermore, what would be needed from me or the buyer in order to be able to transfer the loan balance?

What can I do to get written consent from SBA.

If I am not, then what do I need to do in order to be permitted to sell my company?

Best regards,

Harry Sit says

Sorry, I don’t know. Please contact the SBA district office near you.

Mike H says

I gave up on the SBA CAFS website. After entering my info 10 times, and having to redo because it didn’t accept my phone number, and then you have to reenter your security info, password again, and again every time when the site did not agree with your format. VERY frustrating! After I finally thought that I overcame all the difficulties, the final error was it did not recognize either my SS or loan number.

I tested my patience for 30 minutes trying to get into this site and ultimately failed.

Be warned ahead of time, you have to enter your Country code in the phone number field, something most Americans do not do or know.

Hubert says

This is truly amazing stuff and I wish you all the best.

M says

Can it be paid back by money order?

Monica says

Thanks so much for this how-to! I appreciate it!

Peg J says

Thanks for the excellent directions. I am an LLC and was able to pay off the loan including the interest owed. The SBA CAFS registration was definitely a challenge, but I finally got through it. My status is now “paid in full”!

Steve says

Anyone know if the loan is paid off does the PPP now forgivable instead of going against amount received of the original loan?

Harry Sit says

The new law signed by the President over the Christmas weekend makes the PPP forgiveness amount not deduct the EIDL grant ($1,000 per employee up to $10,000). This is true regardless of whether the EIDL loan is paid off or not. The EIDL payoff amount does not include the EIDL grant.

Deborah Schilling says

exactly my question. Hope someone can answer this

Steve says

Hopefully the SBA will set a new guideline for the ones who thought (Or actually where) in a worse positions that ones who only applied for the PPP. Not sure how a loan that must be paid off at an interest rate of 3+% takes the place of money that is forgivable? Some of us could not take a chance (Or did not have long term contracts in place) and could not risk coming up cash short and then either lay off people or shut down the business. Anyone from the SBA out there?

Harry Sit says

EIDL has two separate parts: the grant and the loan.

– If you only received EIDL, keep the grant and must pay back the loan (early or over 30 years).

– If you only received PPP, go through the normal PPP forgiveness process.

– If you received both EIDL and PPP, keep the EIDL grant, pay back the EIDL loan (early or over 30 years), and go through the normal PPP forgiveness process.

So if you didn’t apply for EIDL because you didn’t want debt, you’re only missing the EIDL grant ($1,000 per employee up to $10,000). The new law also allocates some more money for EIDL. There may be a second chance to apply for EIDL now if you really want the EIDL grant.

Steve says

SBA on Jan 11, 2021 repealed the requirement for the EIDL loan to be subtracted from the PPP forgiveness loan so now receiving of the EIDL loan does not offset the amount forgiven. Seems SBA does have managers working there that understand SB’s !!!!!!

Jose Mestre says

If an eidl was taken out in Aug, and no ppp was applied for, when taking out a ppp now, must the Eidl that must be repaid be used to offset the ppp?

Steve says

Apparently the SBA has removed the EIDL loan as part of the offset for both PPP 1 and PPP 2.

Gary Newsom says

I put the EIDL loan money in an investment account thinking I might as well draw interest on it while waiting for the need. Turns out I have not needed it. Can I just pay it back in full prior to the one year and be finished with it?

Steve says

Yes you can. This web site describes how to do this. The interest is not bad but higher than you can get in most money market holding accounts.

Gary Newsom says

Well…actually it was in a stock market account…it made more money than the interest. Is this a problem?

David Estuardo says

This was very helpful, thank you very much!!!

Marcelo Castro says

What happens if you get SBA Loan and your business don’t survive COVID pandemic and needs to be closed down. The loan amount is $24,000.

Steve says

I am assuming you are referencing a EIDL Loan. Since the loan was under 200k there was no personal guarantee signed and the SBA will write off the loan. There are going to be tens of thousands of business’s that did not survive and the SBA will not spend much time writing these off, especially if you did not sign a personal guarantee. You will probably not be able to obtain another SBA loan for 7 years and you will have to legally shut down your business. (File bankruptcy)

Marcelo says

Steve, thank you very much for your response. Yes, it is EIDL loan. I shut down my business and terminated my LLC, although I did not file bankruptcy …. do you think this is a must?

Steve says

Probably, the SBA is going to have tens of thousands of cases like your to deal with. If push comes to shove you could file bankruptcy later if pushed.