I can’t say I invented the Backdoor Roth but I was an early proponent of it. If you are not familiar with this concept, a Backdoor Roth means contributing to a non-deductible Traditional IRA before converting it to a Roth IRA.

Before the move was ever possible for those who earn "too much," I prepared for its arrival. I contributed to a non-deductible IRA for several years. I moved pre-tax money in my Traditional IRAs to a qualified plan in 2009. As soon as it was possible to convert the Traditional IRA to Roth in January 2010, I jumped on it. I took advantage of the same opportunity in 2011 and 2012.

Recently Michael Kitces at Pinnacle Advisory Group raised some concerns that the move could be ruled illegal under the step transaction doctrine.

The step transaction doctrine says if a series of transactions are parts of one transaction, they should be viewed as just one transaction. Michael Kitces theorizes that because the contribution and conversion end up putting money from your pocket into a Roth IRA, under the step transaction doctrine they could be viewed as just one move: a contribution to the Roth IRA. If your income is too high for contributing to a Roth IRA, doing so will make your contribution an excess contribution, which is subject to a 6% excise tax every year.

Are the concerns valid or just FUD? I have plenty of reasons to disagree with that theory. I Googled step transaction doctrine and I studied it carefully.

First there have to be transactions, which usually involve two or more parties. A single entity moving its own money around is not a transaction.

Next there are specific tests: binding commitment test, mutual interdependence test, and end result test. Backdoor Roth clearly fails the mutual interdependence test. Just contributing to a non-deductible IRA is meaningful by itself without converting it to Roth.

I’m not a lawyer. Neither is Michael Kitces. Without an outright announcement from the IRS or a tax court ruling saying one way or the other, I imagine even lawyers will have different opinions. So whom should you believe?

Although I disagree with Michael Kitces, my disagreement means nothing. Nor does his allegation. Only what the IRS and the tax courts say counts. We can argue till our faces turn blue and we still won’t get anywhere because nobody knows how the IRS or the tax courts will rule or whether they will ever rule on this.

However, there are things I can do today to reduce the risk. These things don’t cost that much. They don’t detract from the great value of Backdoor Roth either.

Here’s what I will do:

(1) I will recharacterize my 2011 and 2012 Roth IRA conversions. Recharacterizing them will move the money back to my Traditional IRA as if I never converted. I have until October 2012 to recharacterize my 2011 conversion. I’m well within the deadline.

My 2010 conversion is perfectly legal even under the step transaction doctrine. That conversion included money from 2010, 2009, 2008, and several years before.

(2) I’m allowed to reconvert my 2011 conversion after 30 days but I will wait. I’m allowed to reconvert my 2012 conversion after January 1, 2013. I will convert the entire account consisting of two years of contributions plus earnings to Roth in January 2013.

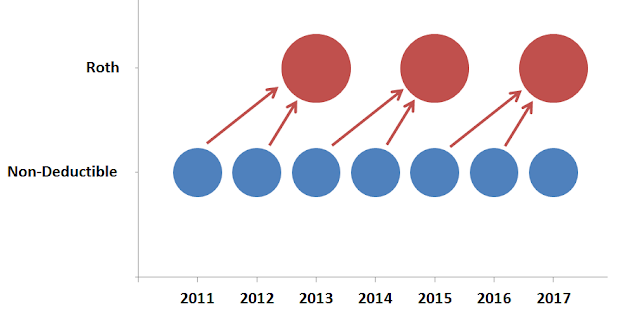

(3) Going forward, I will still contribute to my non-deductible Traditional IRA every year. Instead of immediately converting it to Roth, I will convert every two years. 2011 and 2012 contributions will be converted in 2013. 2013 and 2014 contributions will be converted in 2015, and so on.

Leaving the money in the Traditional IRA for a year or two is not a big deal. At the time of conversion, I only pay tax on the earnings, which won’t be much for a year or two. I won’t even bother moving the earnings to a qualified plan. After the conversion, the money will still enjoy tax free growth for many more years.

Converting two years worth of contributions plus earnings can’t possibly be argued as a step transaction to contribute to a Roth IRA. Otherwise all conversions to Roth would be.

Are these changes to the Backdoor Roth strategy necessary? Probably not, but they are easy to do. I just want to stay conservative and remove any doubt. The revised strategy will still maintain 99% of the value in Backdoor Roth. I’m willing to pay a small price for being conservative. Some experts quoted by Michael Kitces said waiting a few days, six months, or until the next year would be enough. Pick whatever you are comfortable with.

What if Congress changes the laws to make Backdoor Roth no longer available? It’s not a big deal either. I just convert what I have then. Even if in the worst case I have some money stuck in a non-deductible Traditional IRA, it’s still not the end of the world. When the tax on dividends and capital gains is seen as being too low, a non-deductible Traditional IRA can still beat a regular taxable account.

Converting to Roth on the very next day is not a core part of the Backdoor Roth strategy. Don’t let the uncertainty scare you away from doing the Backdoor Roth.

I also updated my previous post Backdoor Roth: A Complete How-To.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

JeffB says

TFB,

I’d like to compliment you on your well written blog! I stumbled upon it recently while googling Roth vs Traditional 401[k]’s*. For some time I’ve been extremely hamstrung in saving for retirement. I was considered an HCE at work and so was limited to just 6% there. I made too much for a Roth leaving me to be content with making non-deductible contributions to a traditional IRA.

I have a fair balance in my traditional IRA – the result of years of contributing when I could deduct and a rollover from a previous employer. I had given some thought to converting this when the conversion income limitation was removed but just couldn’t see myself emptying my emergency fund to pay the taxes due.

So I found your article on the Backdoor Roth approach most welcome. First and foremost because I didn’t realize that one could rollover the pre-tax portion into an employers qualified plan. I’ve checked with our HR department and I can do so. Both my IRA and 401[k] are with Vanguard and I have plenty of good investing options inside the plan so I’m not worried about any loss of investment flexibility.

I too had read the legal concerns regarding with the backdoor approach. I took them seriously enough to begin questioning whether I should do this or not. I thank you for your revised approach posted here today. Time for me to consider it a little more!

* P.S. – on the Roth vs Traditional 401[k] I decided to go with the Roth. Reason being is that I am turing 50 this year and was just notified by my employer that I am no longer an HCE (that’s what years of no raises will do for you 🙁 ). So I’m making the maximum contribution ($17,000 + $5,500 catch up) and I intend to put another $6000 into an IRA ($5000 + $1000 catchup).

I *think* I can be classified as one of the few who should contribute to a Roth. I will have a pension and have a fair amount of pre-tax savings already. So for me a Roth is about tax diversification.

Cheers!

Leigh says

Out of curiosity – do you invest your non-deductible Traditional IRA funds according to your asset allocation in the meantime before you finally convert the funds into your Roth IRA?

Harry says

Yes I invest them. Paying taxes on gains is better than not having the gains to begin with.

Hastibe says

TFB, I was wondering, are you still doing the conversions only every two years? Do you think that the IRS applying the step transaction doctrine to the backdoor Roth IRA is still a concern? I’m planning on (at least) starting the process of a backdoor Roth IRA for the first time this year, and I posted on the Bogleheads forum (http://www.bogleheads.org/forum/viewtopic.php?f=1&t=143801) about how I was thinking of delaying the conversion step like you laid out here, to avoid any concern about the step transaction doctrine. I was advised that there really isn’t much concern about the IRS making an issue of the backdoor Roth IRA any more. I’d be curious to know what you’re doing (as of 2014, now) and your thoughts on this!

Harry Sit says

I still wait some time, at least a month. It’s really not necessary to do it on the next day.

Hastibe says

Thanks for your response, Harry–despite there being less of concern that the IRS will make an issue of the backdoor Roth, I think I’ll follow your practice and wait at least a month, too.

NP says

Harry, what do you think about this strategy: every 2 years, between Jan 1 and Apr 15,

– contribute for prior year to Trad IRA

– contribute for current year to Trad IRA

– convert whole amount to Roth

This differs from your article’s strategy only in that first step is done at the same time as second. Or this would not be as “safe”?

Harry Sit says

Since I wrote this I switched to a routine of contributing in the early part of the year and converting in the later part of the year, but still all within the same calendar year. It makes tax reporting easier. See Make Backdoor Roth Easy On Your Tax Return.

Ron says

When you recharacterize a Roth conversion, how do you report that on your tax return? I know it goes on the Form 8606, but what does it look like? I have a 1099R showing a fully taxable distribution from the IRA due to the conversion. Will the financial firm issue a new 1099R for the recharacterization?

Harry Sit says

If you use tax software, just answer the questions and say you recharacterized. If you do it by hand, you don’t report the part you recharacterized on Form 8606 (“Do not include amounts you later recharacterized …”). See Form 8606 Instructions (page 4, #3) for what you need to include on the 1040 form and in an attached statement.