Most people go by the default tax treatment on I Bonds and defer taxes on the interest until they sell (see I Bonds Tax Treatment During Your Lifetime and After You Die). By default, TreasuryDirect doesn’t withhold any taxes from the proceeds because the IRS doesn’t require tax withholding on interest payments. Banks typically don’t withhold taxes when they pay interest in savings accounts or CDs either. You download a 1099 from TreasuryDirect next year and report the interest income on your tax return.

Some people prefer to have taxes withheld even when tax withholding isn’t required. Taxes paid through withholding are assumed to have been paid throughout the year. It helps with some timing issues.

If you’d like to have TreasuryDirect withhold taxes when you sell I Bonds, here’s how to do it.

Log in to your TreasuryDirect account and click on “ManageDirect” on the top.

Click on “Update my personal information” under the heading “Manage My Account.”

Answer a security question. Scroll to the bottom. Change the “Withholding Rate” from the default 0% to your desired rate (up to 50%). This new withholding rate will be used on all future sales. If you buy regular Treasuries at TreasuryDirect, it affects payments from those regular Treasuries as well.

The withholding rate applies only when you sell I Bonds. It doesn’t reduce the interest credited to your I Bonds while you still hold them.

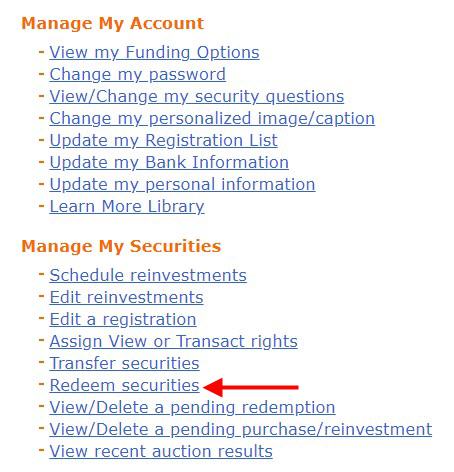

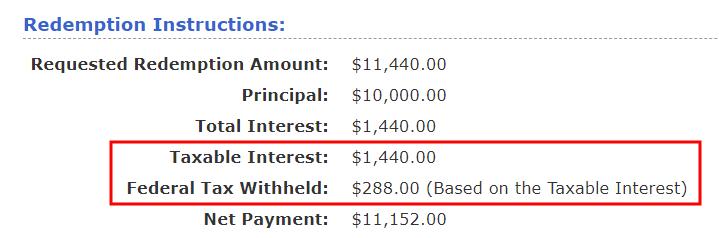

To sell (cash out) your I Bonds, go back to ManageDirect and click on “Redeem securities.” You will see this on the review page after you select the I Bonds to cash out:

I set the withholding rate to 20% for this test. TreasuryDirect knows how much interest is included in the sale. The withholding rate only applies to the interest portion, not to the gross amount. TreasuryDirect does not withhold state taxes because I Bonds are exempt from state taxes.

If you choose to have TreasuryDirect withhold taxes, the amount withheld for federal income tax will be in Box 4 of Form 1099-INT together with the interest amount in Box 3. See Report I Bonds Interest in TurboTax, H&R Block, FreeTaxUSA for how to enter these in tax software. Make sure you download the 1099 form from TreasuryDirect next year. TreasuryDirect will send an email when the form is ready but you should set a calendar reminder in case you miss the email.

Having TreasuryDirect withhold taxes from the sale is completely optional. I choose not to do that because I prefer to pay quarterly estimated taxes myself, but it works perfectly well if you prefer withholding.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Ann says

This is great. Thank you!

GG says

Hi Harry,

You noted that “The fixed rate on new I Bonds to be announced on November 1 may potentially go higher, possibly to 1.5%.” It sounds like you are confident that the fixed rate will increase from the current .9%. I have 20K of iBonds from Dec 21(0% fixed) which I was going to “exchange” for 20K of the current .9% fixed, but I’m thinking I will roll the dice and wait for the new fixed rate info on Nov. 1. My original 2021 purchase was just for short term but I’m becoming more interested in the long term value due to the recently rising fixed rates.

Harry Sit says

That’s my guess but Treasury sets the new fixed rate at its sole discretion.

ammerzy says

Hi Harry,

Long-time reader. On the above comment, how confident are you in the guess? IIRC, you are batting 1.000 on the inflation/variable rate for I Bonds before the Treasury announces them. Understanding, of course, that the Treasury will not be picking up the phone for your counsel (though they should!), do you have similar confidence in fixed rate predictions or is it murkier from your point of view? Trying to make a similar decision as GG myself (take the 0.9% or roll the dice).

Harry Sit says

The variable rate goes by a known formula using published data inputs. It’s just math after October 12th when the last inflation number comes out. The fixed rate doesn’t go by any formula. Everyone can only guess. I hope my guess is right but I can’t have confidence.

calwatch says

Interesting to note that IRS considers withholding differently compared to estimated tax purposes for calculating the “penalty” for not paying through the year (which is really is the interest which should have been paid on the underpayment). So if a taxpayer didn’t pay estimated tax through the year for their business, they could redeem an I Bond in December and ask for 50% of the interest to be withheld to help satisfy their obligation.

ammerzy says

Thanks Harry!

Gina says

I prefer withholding taxes just to keep life simple and to avoid tax time shocks. This is great info that I came back to before I redeemed my zero percent I-Bonds recently. Simple and clear instructions. Just perfect! Thanks as always for all you do.