There’s a saying — “A little knowledge is a dangerous thing.” When you don’t know much about a subject, you stay with the tried-and-true because there’s safety in the mainstream. As you learn more about the subject, you start to explore off the beaten path. That’s when the danger starts. You think you know what to do but you don’t know what to avoid. If you only know enough to get into trouble, you’re better off not knowing it.

We have an example of this in using TreasuryDirect.

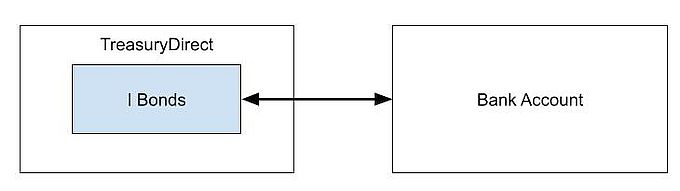

Many people bought I Bonds last year at TreasuryDirect. You link a bank account and put in an order to buy. TreasuryDirect debits the bank account and gives you I Bonds in the account. Many readers of this blog have done that. It works in reverse when you sell. TreasuryDirect credits the linked bank account. These are all routine transactions.

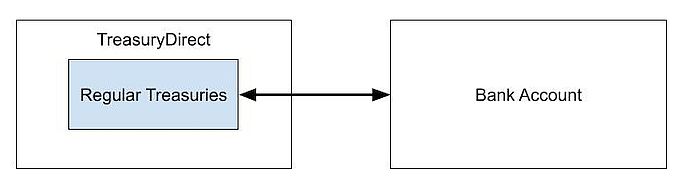

Some people discover that you can also buy regular Treasuries in the TreasuryDirect account. You can buy in $100 increments as opposed to in $1,000 increments in a brokerage account. You can place the order more days in advance versus having to wait for the official announcement. TreasuryDirect supports “auto roll” whereas not all brokers support it. TreasuryDirect debits the same linked bank account for purchases and credits it when the Treasuries mature. These are all routine too.

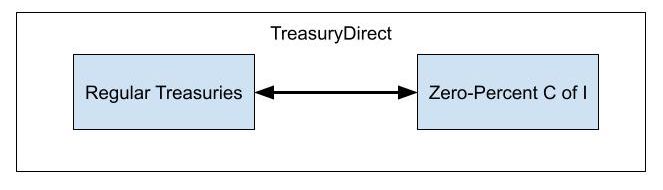

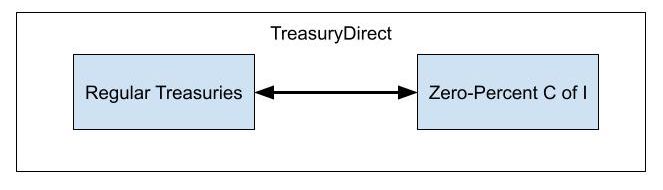

Then some people notice this peculiar thing called a “Zero-Percent Certificate of Indebtedness” or in short “Zero-Percent C of I” or simply “C of I.” It’s basically TreasuryDirect’s version of uninvested cash in a brokerage account. It doesn’t pay any interest, hence “Zero-Percent.” Zero-Percent C of I can be designated as the destination of the credits from matured Treasuries, to be used as the source of your debits for the next purchase.

You would think this Zero-Percent C of I is useless because drawing from and sending to the bank account works just fine and you can at least earn some interest while the money is in your bank account, but some people decide to use Zero-Percent C of I to hold cash in TreasuryDirect.

That’s when the trouble starts. I read this report on the Bogleheads investment forum (I edited it slightly for brevity):

Well, I moved all of my savings into the US Treasury, in the form of four-week T-Bills that redeeem to C of I.

Normally, that’s not an issue, works every time.

Until two days ago when I got an email saying my account was flagged as having some concerns and Risk Management had placed a hard lock on the account as a precautionary measure.

I was asked to fill out a FS Form 5444. I mailed the notarized form but the processing time for this form is “20 weeks minimum.”

I called the Treasury and got transferred to the hardlock department. They said they received my form but couldn’t act on it.

They also said, the reason for the hard lock was because I bought a $1,000 C of I with my bank account, intending to use it to buy a T-Bill, and this was a fraud risk.

So I will not be able to log into my account to recover any of my money, nor will I be able to reinvest it.

Over the next 20 weeks I’m going to lose out on perhaps about $5,000 worth of interest, yikes.

False positives in risk management and account restrictions happen sometimes. Normally it wouldn’t be a big problem because at worst you can’t place new orders and money from matured T-Bills will still come back to your bank account. In this case, the money goes to Zero-Percent C of I, which earns no interest while it takes 20 weeks to resolve the account restriction.

This investor is clearly better off not knowing that Zero-Percent C of I exists.

He or she is also better off not knowing that you can use TreasuryDirect to buy T-Bills. If he or she bought T-Bills in a commercial brokerage account, at least the settlement fund or core position earns interest and it should be much quicker to resolve the risk management issue than 20 weeks.

To be clear, I don’t blame this investor for using Zero-Percent C of I or using TreasuryDirect to buy T-Bills. It still wouldn’t be a big problem if TreasuryDirect could review the notarized form and remove the restriction in two days as opposed to 20 weeks, but the reality is that TreasuryDirect is understaffed. The computer system runs routine transactions efficiently but things requiring human intervention can take a long time.

Lessons learned: Treat TreasuryDirect as a delicate object. Do as little as possible with it. Stay on the beaten path. Buy your I Bonds. Sell your I Bonds. Use your linked bank account to transact. Don’t use the browser’s back button. Remember your password and your answers to the security questions. Be extra careful not to get your account locked. Use your brokerage account when you buy regular Treasuries. Stay away from Zero-Percent C of I in TreasuryDirect.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

thefinanceBuffReader says

Treasury Direct should consider allowing the purchase of I Bonds from a commercial account so that customers of their I Bonds will never have to use their substandard account for access to the I Bonds.

Ann says

Thanks for the informative story! I’m allergic to zero interest, so would never do this. I’ve heard other horror stories about TreasuryDirect accounts getting locked. So far all my dealings with them have been OK, although I find their website pretty clunky.

Dan says

What a nightmare. Government incompetence on full display.

Deskandchairs says

Well said, Dan

Jim Tooley says

Great article … thanks for your efforts to keep us from stepping in a hole.

One question I could never find clarification for …

If you sign up to purchase a T-Bill but there is not enough money in your bank account when the Treasury tries to grab it … what happens? An NSF incurred and you miss the auction or what?

Harry Sit says

TreasuryDirect answers it in its FAQ:

“What happens if I don’t have enough funds in my bank account or C of I to cover a security purchase?

On the issue date of a Treasury marketable security, TreasuryDirect debits your financial institution or your C of I, depending on which payment source you choose, and the security is issued in your TreasuryDirect account. If your financial institution returns the debit due to insufficient funds (which may take several days), the security will be removed from your account and no further attempt to collect the funds will be made. The Bureau of the Fiscal Service is not responsible for any fees your financial institution may charge relating to returned ACH debits.”

https://www.treasurydirect.gov/indiv/help/treasurydirect-help/faq/#id-what-happens-if-i-don-t-have-enough-funds-in-my-bank-account-or-c-of-i-to-cover-a-security-purchase–592578

Sean O'Gara says

Sadly, Jim, this happened to me.

My timing was off on having funds in my bank account, so Treasury Direct simply did not allow my purchase. My bank, on the other hand, hit me for their NSF fee.

Dennis says

TreasuryDirect locked my account simply for adding a new bank account in my name; no other transactions.

TreasuryDirect confirmed the receipt of the notarized form 4 weeks ago and the confirmation email said it would take 12 weeks to process.

The system initially soft locks an account, until it is reviewed by someone a few days later.

It is clear that the department doing the locking is overwhelming the department in charge of unlocking accounts, hence the 12 week wait time.

I doubt that there is any type of feedback loop to measure the insane amount of false positives they are generating.

If they truly encounter that many fraud attempts that they have a 12 week backlog to clear it, despite requiring 2 factor authentication via phone for every login, then they have much bigger security issues. That 12 week turn around time has been going on for years, and the internet is filled with people getting their accounts locked for no reason.

TreasuryDirect is unusable due to the locking of fear thereof.

Dennis Reyes says

My wife got burned too by the COI, and she did not even use it! Here is how. She sold a business and invested $800,000 of her hard-earned money into 4-week Treasury Bills, via TreasuryDirect. She scheduled twelve 4-week reinvestments inside TreasuryDirect. At the 5% rate, this should yield about $3000 every 4 weeks, and it should all “fly” automatically for twelve 4-week periods. However, for some reasons unclear to us, TreasuryDirect put a hard security lock on her account. We lost all access to the account.

So, when the first 4-week T-bill matured, the TreasuryDirect simply put everything into COI, the entire $800,000. And canceled all reinvestments. It takes 2 months to get the security lock removed, and during that time, you cannot access your money, nor do you get any interest and nor does any interest accrue. Your money just sits locked in this COI account, and is not accruing any interests whatsoever.

The 12 reinvestments of the 4-week bills were already scheduled by my wife before the lock, but they were simply not honored. At least if reinvestments were occurring while the account was locked, she would have gotten all back interests once the account was eventually unlocked. But no. The US government just dumped all of my wife’s money into the non-interest bearing COI and called it a day.

My wife called TreasuryDirect and they could do nothing. They simply said that the policy is that once the lock occurs, all reinvestments are canceled, and all money goes into a non-interest bearing account inside TreasuryDirect called COI. To which you of course have no access until the security lock is removed by a special person called “assessor”.

To remove the lock, you need to first go to a public notary, fill out a form, pay for the certified signature, and then mail your signature to some TreasuryDirect office in Minnesota. Then you wait for weeks and weeks without any info. It takes 2 months but your mileage may vary. No access to your money, no interest. The money just sits there in the COI, locked and without any interests accruing on it.

My wife lost about $6000 because of this. And there is nothing that anyone can do about it. The government is just following the policy, the TreasuryDirect people on the phone are nice, but can’t remove the lock.

We didn’t do anything special that would result in a lock. We are “normal” law-abiding citizens from Los Angeles. We simply opened a TreasuryDirect account. Maybe the lock got triggered because the amount is high. We don’t know. We feel powerless.

So, you don’t need to even use COI to get burned by it.

Harry Sit says

Thank you for sharing your horrible experience and warning others of this possibility.

Curtis-Timothy: says

Dang, I wish I had looked this up last night. I had no idea that C of I would get my account locked. I thought it would just put some funds on the account that I could use later to purchase a bond a two at some point. Then this morning, I got an email that as a security measure, my account was locked.

Very not cool. They have like 16 security features to get into the account, and 4 extra every time you want to change something. You can’t change anything on the site, or over the phone, but they don’t mind taking your money from your account. Seems like it could be much easier than they let it be. Probably because they are getting interest from your money by holding from you. So they keep it in their account, take your interest, and then it sounds like you are lucky to get it back if you do…. 🤦🏼♂️🤷🏼♂️😔🫤

Steve says

It’s even worse if the treasury direct account owner dies. I’ve been told processing a form 5512 will take at least 6 months. It’s costing my mother a minimum of 10K in lost interest with money just sitting in a zero percent CoI. Didn’t matter she was listed as co-owner of the securities. It didn’t matter she had transaction rights on her account. It didn’t matter the securities were set to mature into a joint bank account owned by both of them. Don’t use Treasury Direct ever. Get a brokerage account.

Jim Willis says

I use Treasury Direct to buy T Bills. When a T Bill matures, the money goes into my linked credit union checking account. I immediately transfer the money to my money market account (which pays better interest than my cash account at Fidelity). When I schedule a new T Bill purchase, I look at the auction results to find the cost per $100. I wait until the day before settlement day, and transfer the appropriate amount from the money market account to the checking account. During the few days between the maturity of one bill and the purchase of a new bill, I get at least some interest.

I’ve been doing this for years, and it has worked well.

Harry Sit says

Does the money market account at your credit union not allow linking? Linking the Fidelity cash account doesn’t require transferring back and forth as you do between the checking account and the money market account. The interest rate difference between the Fidelity cash account (currently 3.97%) and the credit union money market account probably doesn’t make that much difference in dollars for the few days between the maturity of one bill and the purchase of a new bill.

Jim Willis says

When I opened my TD account (years ago), I could link only a checking account.

Yes, the interest rate in the Fidelity individual cash account is 3.97%. In Fidelity Roth and Rollover IRA accounts, it’s 2.19%. I agree, the interest for just a few days is insignificant.

I just looked at the interest rate in my credit union money market account. It’s less than at Fidelity!

So now that you’ve got me thinking about this, I’ll probably gradually transfer all of my T Bill transactions to Fidelity.

Thanks for the information about TD Zero-Percent C of I. It never affected me, but it’s good to know.