I don’t know who started it. Suze Orman certainly helped spread it. She says that you shouldn’t borrow from your 401k (or 403b) plan because you will be double-taxed. I did a Google search and I found this by Suze Orman:

“Also, never ever borrow against your 401k plan because you will pay double taxation on the money you borrow. Because you don’t pay taxes on the money you put into a 401k, when you pay back the loan (which you must do within five years, or 15 years if used to buy a home), you pay it back with money you have paid taxes on. Then, when you retire and take the money out again, you end up paying taxes on it a second time.”

This allegation is all over the place. It is a myth because there is NO double taxation. It’s a mind trick similar to that well-known “where’s the missing dollar” puzzle.

“Three men went into a hotel. The manager said the room was $30 so each man paid $10. A while later the manager realized the room was only $25 so he sent the bellboy to the 3 guys’ room with $5. The bellboy only gave each man $1 back and kept the other $2 for himself. Now 3 men paid $9 each for the room, which is $27. Add the $2 that the bellboy kept, and that’s $29. But the 3 men paid $30 originally. Where is the other dollar?”

I was able to find a good explanation for this puzzle. The $30 number is irrelevant. The correct math is $27 – $2 = $25. It makes no sense to add $2 to the $27 because it’s already a part of the $27. The $2 should be subtracted from the $27.

Now, back to our 401k double taxation myth. The fact that the loan has to be repaid with after-tax dollars is irrelevant, just like the $30 number in the hotel puzzle. If you didn’t borrow from the 401k plan but you borrowed from a bank, you’d have to pay the bank back with after-tax dollars as well. If you didn’t borrow from your 401k plan but you dipped into your own savings, you have to replace those savings with after-tax dollars too.

What it really means is that a 401k loan isn’t tax-deductible, just like any other consumer loan except a mortgage or a HELOC. Instead of saying you will be double taxed, they should just say that a 401k loan is not tax-deductible, plain and simple.

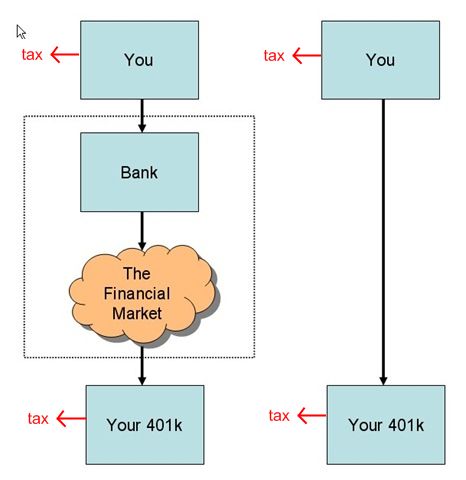

I have had this post in draft for a long time but Jonathan at My Money Blog beat me to it recently with two posts trying to debunk this myth (post 1, post 2). After so much discussion some folks are still not convinced. I think this issue is best illustrated by the chart below:

The left-hand side represents a typical consumer loan, like a car loan. The arrows represent “borrows from” and “pays back to.” You borrow from a bank. The bank borrows from the financial market. Your 401k invests in the financial market. I think we all agree there is no double taxation in this case. You pay after-tax dollars to the bank for both principal and interest. Your 401k earns from the financial market but the earnings are taxed when you withdraw from your 401k.

The right-hand side represents a 401k loan. Now, if you put an imaginary box in the middle on the right-hand side, it becomes exactly the same as the left-hand side. You borrow from an imaginary middleman and pay after-tax dollars for both principal and interest. This imaginary middleman then borrows from your 401k and passes the same dollars it receives from you to your 401k.

All of a sudden you are not double taxed anymore because it looks exactly the same as a car loan on the left-hand side. Because this middleman is only imaginary, it follows that you are not double taxed with a 401k loan, whether for the principal repayments or for the interest.

Whether or not you are mathematically better off with a 401k loan depends on how these three rates play out:

- Your alternative after-tax interest rate from a bank loan

- What bond funds in your 401k are expected to earn from the market

- The interest rate on your 401k loan

Suppose your alternative after-tax interest rate from a bank loan is 7% and the interest rate on your 401k loan is 5%. If you borrow from your 401k, you save 2% in interest cost in after-tax dollars. But also suppose the bond funds in your 401k are expected to earn 8%. If you borrow from it, your 401k plan can only earn 5% from you. So your 401k plan account is 3% worse off in before-tax dollars. Between 2% better off after tax and 3% worse off before tax, it can become a wash.

The reason you have to compare it with what bond funds can earn is that the 401k loan payments are not subject to market fluctuation. If you do borrow from your 401k, increase your allocation to stocks for what’s left in the plan.

While there is no double taxation on a 401k loan, there are other negatives in borrowing from your 401k plan. The biggest negative is that if you change jobs (voluntarily or involuntarily), you sometimes have to repay the outstanding balance of the loan within a short period of time, like 60 days. Some plans actually allow you to continue the loan repayment even after you terminate employment, but not all plans do that.

If you really need cash and you don’t have any other source except your 401k, taking out a 401k loan is at least better than taking a hardship withdrawal from the plan. Just be absolutely sure you will be able to repay the loan and you won’t change jobs before paying off the loan. And don’t reduce your regular 401k contributions while you are paying off the loan.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Frank T says

Anyone believing 401(k) loans are double taxed is forgetting that they get to use the NON-TAXED proceeds to, for example, buy a car. This is immensely important because when you pay back the loan, you are simply paying the income taxes on the amount you used to buy the car. Therefore, we do not have double taxation.

Assume you want to buy an $8,000 car and are in a 20% tax bracket.

Assume you have a 401(k) with exactly $8,000 in it and you can borrow all of it.

If you pay cash for the car, you would have earned $10,000 to do so since you would only receive $8,000 after taxes.

If you take a 401(k) loan for $8,000 you must only earn $8,000 to do so since it is not taxed. Since you must pay income taxes on money used to buy cars, you use taxed dollars to pay it back, meaning you have to earn (you guessed it) $10,000 to pay back your $8,000 loan, which is the same thing as the cash price. The only difference is that you get your car sooner.

In the end, both options (A, paying cash or B, taking the loan) require you pay exactly $2,000 in taxes and leave you with $8,000 in your 401(k), and a car. If buying a car with cash is not double taxation, then neither is using a 401(k) loan.

fooBar says

Interest is double taxed. I see your reply below about salary, which is used to pay the interest of 401k, is still taxed. But the point is that if you wouldn’t have to use that part of the salary to pay the interest on 401k loan then that salary will not have the second tax.

Check point 3) https://www.morningstar.com/retirement/401k-loans-mythbusters-edition

Viennes says

No one seems to get this. It’s very simple,

Step 1.

You take a 50K loan from 401k, you are taxed at 25%, you end up netting 37.5k CASH.

Step2.

You immediately use that SAME 35.5K(already taxed) CASH and repayed that SAME LOAN and you would still owe 15K CASH. That 15k (already taxed) would also come from net earnings. No problem so far right? Right.

Step3.

You just withdrew 50k , of which the govt earned 15k, and you earned 35k.

You paid YOURSELF back that 50k in the form of 401k repayment, and you now decide that you want to take that SAME 50k loan again. See step1 for the breakdown of earnings.

Here’s the kicker you borrowed 50k twice from YOUR 401k totaling 100k. Note that it’s the SAME 50k, however, it’s been taxed twice so the govt has earned 30k off or your 50k.

You say, “who borrows” from their 401k twice in a lifetime. Well, that’s essentially what you’re doing when you borrow once, and take a final distribution at retirement. 50k-15k(loan)-15k(retirement dispersal)=20k(in your pocket) and 30k to uncle sam.

Peter Krieger says

Some important details – many contributory retirement plans permit loans totaling half of the balance. So, if a 401K plan has a $50K balance, the maximum loan is $25K.

The loan proceeds are not taxed. So a $25K loan is free-and-clear of any taxes, provided you remain with your employer for the duration of the loan. Any unpaid loan is considered a distribution subject to taxes.

The money to pay it back will be after-tax dollars, and those after tax dollars will be taxed again when withdrawn in retirement.

Another fold – some 401K plans permit ROTH contributions, so withdrawals in retirement are tax-free (but the contribution dollars are taxed).

If a person takes out a loan, that loan is paid back in after-tax dollars.

The most important point is that a 401K is a SAVINGS plan, and not an account that can be ‘raided’ in the event someone wants to drive away in a brand-new sports car; the consequences of non-payment are quite costly.

Any debt will impede future cash flow; savings increases future cash flow. Any 401K loans are going to reduce your cash flow by the principal and interest payments; if the proceeds are used to reduce high-interest borrowing, then you are arbitraging cash flows (this can work to your advantage). A 401K plan loan is a tool to be used wisely; particularly if your employer is prone to bouts of corporate anorexia (layoffs).

Frank says

Viennes, your scenario assumes you are taxed when you take a 401(k) loan. That is not the case. You are taxed when you take a distribution, which is very different than a loan. Thus, you are not taxed twice, just the once when you take a distribution (hopefully when you retire).

The fact that loan repayments are taxed is making up for the fact that you used non-taxed money to purchase goods/services with the loan proceeds. So there is still no double taxation.

Viennes says

Peter: The statement “if a 401K plan has a $50K balance, the maximum loan is $25K. The loan proceeds are not taxed.” is inaccurate. It is considered as income and must be filed as such. I know because I just went this exact scenario in 2012 in taking out 25k of a 50k balance in my 401k plan.

I HAD to declare that 25k as income on my 1040.

Harry says

Who HAD you declare that $25k as income on your 1040? Sounds like you overpaid your 2012 taxes. Amend your return and get that money back. You are welcome.

Peter Krieger says

It sounds like we are discussing two different concepts here (please correct me if I am wrong).

Your situation is that you WITHDREW money from your 401K plan, and, according to my understanding of tax law, that is considered a taxable event.

The circumstances that I am describing are a formal loan, administered by the plan’s record keeper, taken from my assets in the plan, and paid back via paycheck deduction.

The payment amount consists of both principal and interest; due to the nature of tax law, interest MUST be charged for it to be considered a loan; even if you pay yourself back the interest.

These are two different concepts; I have taken some loans from the 401K plan over the years, and paid them back in full; at no point did I ever have to declare the loans as income when I filed taxes. I even asked my CPA.

I do believe that if you take out a mortgage loan to make an IRA contribution or any kind of investment there are tax consequences. Perhaps that extends to using a mortgage loan proceeds to pay back a 401K plan loan. I am not certain on that one.

But, if the withdrawal is structured as a loan, it is not a taxable event. Loan provisions exist because fewer people would participate in defined-contribution plans if they could not access their money.

Viennes says

It was declarable because of the 10% tax penalty for early withdrawal.

Harry says

Maybe you left your employer and you didn’t pay back. Just a plain loan isn’t a withdrawal; no 10% penalty either.

Viennes says

There’s no guarantee that the loan will be repaid, hence the taxation, correct?

Harry says

Not correct. If you are still with the same employer, paying it back through payroll deduction, the loan is not a withdrawal, not taxed, no 10% penalty. Even if you terminate, some employers’ plan allows you to continue the payments on your own. In that case it’s still not a withdrawal, not taxed, no 10% penalty.

Viennes says

I see your point now. The mis-understanding may have been in that the tax advisers interpreted the withdrawal as a ‘hard-ship withdrawal’ whereas it was actually only a loan taken out against my 401k balance. I’ll check with my tax advisers again.

Viennes says

Harry.

Spoke with my tax adviser. Got my answer. Here’s the deal….

401k loans CAN be taxed IF they do not satisfy all of the below conditions.

This he said is clearly documented on the 1099-R forms.

1. The loan is evidenced by an enforceable

agreement,

2. The agreement specifies that the loan must be

repaid within 5 years, except for a principal residence,

3. The loan must be repaid in substantially level

installments (at least quarterly), and

4. The loan amount does not exceed the limits in

section 72(p)(2)(A) (maximum limit is equal to the lesser

of 50% of the vested account balance or $50,000).

Certain exceptions, cure periods, and suspension of

the repayment schedule may apply.

The loan agreement must specify the amount of the

loan, the term of the loan, and the repayment schedule.

The agreement may include more than one document.

If a loan fails to satisfy 1, 2, or 3, the balance of the loan

is a deemed distribution. The distribution may occur at the

time the loan is made or later if the loan is not repaid in

accordance with the repayment schedule.

If a loan fails to satisfy 4 at the time the loan is made,

the amount that exceeds the amount permitted to be

loaned is a deemed distribution.

Note that if a loan is treated as a deemed

distribution, it is REPORTABLE on Form 1099-R using the

normal taxation rules.

That’s the bottom line. Hence, double taxation.

Harry says

You are still not getting the straight answer. Yes it can be taxed if those conditions are not met but the 401k provider will make sure your loan meets the requirements: it has a written agreement, the term is within 5 years except for principal residence, the amount is 50% or less of your balance, etc. So who botched your loan and turned it into a withdrawal and made you pay tax and penalty? Are you still working for the same employer? Are you still paying back the loan through payroll deduction? If yes, ask your 401k provider why they issued a 1099-R for your loan.

A normal 401k loan is not taxed. No double taxation.

karthik says

Good article, but what about the taxes that you pay on the interest payments when you contribute and withdraw?

Harry says

You would pay them anyway even if you don’t borrow. You pay tax when you earn your salary. You pay tax when you withdraw from your 401k. Same two taxes, whether you borrow or not.

Rob says

Harry,

Isn’t it amazing how much confusion can be caused by irresponsible statements by so-called financial experts? I have had this loan debate with numerous colleagues who were convinced otherwise until I could ” ‘splain things ” to them. Just heard another talking head on CNBC last week crowing the same double tax garbage.

My simplest example is to pretend you take the loan and immediately pay it back because you found you didn’t really need the money. Were you then double taxed? It usually shuts them up. My second point is to ask; okay, so let’s say you get to repay it with pre-tax deductions again – isn’t that a double tax benefit? Wouldn’t that be sweet?

Loved the Bellboy story too. My father sprung that one on me when I was a teen over 40 years ago. He made me figure it out!

Good stuff here! Care to tackle the Roth vs Regular IRA next? LOL.

$iddhartha says

Sorry, but I can’t resist attempting to clarify because I believe that 401k loans can be very useful for certain people.

Scenarios

1) You borrow money from JoeBlowBank. You pay interest with after-tax money. JoeBlowBank is taxed on the interest earned.

2) You borrow money from your 401k. You pay interest to your 401k with after-tax money. You are taxed on the interest earned (even though you paid the interest to yourself).

3) You don’t borrow from your 401k. That money remains in the 401k, and its earnings are taxed (assuming the investments go up).

Explanations

#1 Two different entities are paying the two taxes.

#2 The same entity (you) is paying the the two taxes… Which is why many term this “double tax.”

#3 You would have paid taxes on any earnings from money not borrowed from 401k anyway. Which is why some say the “double tax” is irrelevant.

$iddhartha says

Personally, I am okay with the term “double taxation” because I strongly believe that the IRS should not be allowed to tax interest paid to oneself. However, I also agree that this double taxation is almost completely negligible in a decision to take a 401k loan.

Keep in mind, this 401k loan double taxation is ONLY referring to the INTEREST portion paid to yourself and not the principal.

Don says

******** This article is so ridiculous it’s laughable. ************ Many “experts” agree with Orman’s statement but then again experts are not always right. Neither is this author here.

Yea, technically it’s taxed twice but it will always be taxed once anyway. 401k withdrawal the money is taxable when it comes out whether you paid back a loan or not.

The negatives on a 401k loan are many but with regard to the tax issue it’s simple .

You’re taking pretax dollars paying it off with post tax dollars so you lost the pretax dollar contribution benefit. Period- end of story. This is what they are referring to as the “2nd tax”.

Don’t listen to one “expert” 1/2 of them are idiots.

$iddhartha says

“You’re taking pretax dollars paying it off with post tax dollars so you lost the pretax dollar contribution benefit. Period- end of story. This is what they are referring to as the “2nd tax”.”

This is precisely the misconception being referred to actually.

The fact that you pay back the principal portion of the loan with after-tax money is irrelevant because you still received the tax deduction on your initial contributions. However, you also pay the interest portion of the loan with after-tax money. This interest portion is additional money above and beyond your original contributions and the full amount will be taxed when it is taken out of the account. Therefore, the interest portion is the only part that is “double-taxed.” Since the interest on such a loan is relatively insignificant, many–including myself–say the double taxation is largely a non-factor.

TFB is simply arguing that if you don’t take a loan then your balance would be taxed on the growth of the money that remains in the account anyway… so either way you look at it you are still paying a tax.

Gaurav Kumar says

I think there is a double taxation and let me explain how, albeit in special circumstance like mine.

You took a loan of $100 from 401K. Lets say you had $200 in your account. Now since those 100 you took would have costed you 130 dollars had you took it from some other source, assuming 30% tax bracket.

Now lets say you are going to now pay the money back to 401K. There can be two scenarios:

1. You are still employed with the same company and your 401K account is active. In this case, you can continue to pay the loan with pre-tax dollars. So basically, you will again only use your $105 dollars (adding some interest) to your own 401K account. This is a good case, you are not overpaying. They will levy the ongoing rate of tax when you withdraw this $100 on your retirement.

2. You have changed jobs, and your 401K account is not active. In this case, the only option to pay the loan back is using your taxed dollars. So you will be paying them the same $105, but note, this would be coming from your taxed money, which means you need to earn around $142 dollars to really put $105 dollars in the 401K account. Now you have paid already tax on it. Now move forward to the time you want to withdraw money on your retirement. Now again, IRS will levy the ongoing tax rate on this money, which means they will put another 30% tax on $105 and any growth you would have made. So in nut shell, you will get around $70 from $142.00 dollars you actually earned.

This is how it is double taxed. Hope it explains.

Barbara Passarge says

My husband took out a $3,000 loan from his 401K plan. His deductions from his paycheck for the principle plus interest is reinvested into his 401K, is this correct?

The problem I have is that he was fired so his company deducted the remaining balance of $2500 and sent the remaining balance of his 401K plan to him. If the original funds source was the sell off of his stock then where does the $2500 sold stock to pay the loan off, who gets to keep the cash from those stocks that were sold?

Harry Sit says

The remaining loan balance is part of the 401k balance. Suppose he had $10,000 at the time he got the loan, $3,000 worth of investments was sold off to give him the loan. The 401k balance was still $10,000: $7,000 in investments, $3,000 on loan to him. Fast forward to today, suppose the 401k balance is now $10,500: $8,000 in investments, $2,500 in loan balance not yet paid. When the 401k account liquidates, he gets only the $8,000 in investments. If he paid the 2,500 off before it liquidated he would get the whole $10,500.

If you don’t want to pay tax on the $2,500 loan balance and on the distribution, add $2,500 to the distribution and roll it over to an IRA.

CP says

This is a bad analogy – the difference is the money you borrow from a “bank” is not your money, the money in your 401K is indeed your money! come on. bottom line you do pay taxes twice on the money you borrow. you are better off taking an earlier withdraw than a loan. why doesn’t the gov. allow 401k loans to be paid back with pre-tax money just as you put in to begin with? NM I know the answer to that question.

Ross says

CP-

Here is a real world example, without hypotheticals. Back in Dec. 2006, we bought a new home. I took the max 401k loan amount, $50k without any fees or special conditions. My 401k plan sold $50k in assets and gave me a check to do with as I please. The check I received was not claimed as income, so no tax owed and the $50k in assets sold came from pre-tax money. So there was no tax hit from the loan transaction.

The terms of the loan were 10yrs. (home purchase), 8.25%. Before people admonish me for the rate, think back to late ’06/early ’07. A 30yr conventional mortgage was 6.25% and second mortgage rates were around 8.25%. So my up-front cost for a 401k loan would be the same as a home equity loan (not HELOC). The idea that home equity interest could be a tax deduction is not relevant to the point I’m making.

I’ll save you the details of the amortization schedule, so trust me when I tell you the total repayment amount is $73.5k (P+I). This would be exactly the same repayment amount for a home equity bank loan or a private loan from a pawn shop. To repay either my 401k loan, or a bank loan, or a pawn shop loan, I would need to generate about $100,800 in wages. From those wages, the IRS takes $25k, my state takes $4k, FICA takes $6k, & Medicare takes $1500. The point is that no matter where the loan proceeds come from, you need to generate taxable income to pay back any of them. So yes, your source of income for repaying the loan is taxed but it’s taxed no matter what. Another way to think about it is, let’s say you got a gift from a rich uncle to repay your loan. Your uncle was taxed on the gift money before you got it. So even though it’s not YOUR tax burden, taxes were paid.

So in a literal sense, yes the source of income to repay the 401k loan is taxed twice. But by the same line of reasoning you could argue that your brokerage account is taxed twice. You put after tax money in the account and then get taxed on the gains. However, no one ever seems to debate that point and people are actually thankful that capital gains tax is less than wage income tax. 401k loan repayment is no different. You never paid tax when you contributed to the account, you got a personal benefit from tax free money (e.g. $50k check), you are paying back to your account with after tax funds (be they yours or your uncle’s) and, at withdrawal, you pay tax on income from your 401k account. Keep in mind that the 401k plan is NOT a tax-free shelter, it is a tax-deferred savings plan….eventually the IRS will get theirs.

Dan says

I’ve recently decided to go back to school, and I’m looking to borrow against my 401k to make my tuition payment. Upon completion of the semester, my employer will reimburse me, in full, for my tuition and related expenses. Because I will be reimbursed in full (up to $5250 yearly) in a lump sum untaxed payment, are there any foreseeable negatives to taking this loan? Also, should I set a greater loan length than is needed, say 60 months, to minimize the amount withdrawn from my paycheck to repay the loan, and then satisfy it once I receive the tuition reimbursement?

Harry Sit says

Ask your plan administrator whether you can pay off the loan early with a lump sum deduction from your paycheck or a separate check you write. Also ask whether you can continue the loan payments even if your employment terminates. One possible downside is if there is a change in employment, you won’t get the reimbursement and you have to pay off the loan right away.

Mike says

I am a CPA and a 401k plan administrator. The deduction for 401k loans is after taxes. Those funds are reinvested into your account and are taxed again when you withdraw from them. To say that a 401k is equivelvent to a commercial bank loan is not accurate, yes they are both paid back with after tax dollars, but with a 401k loan you are the bank and if you withdraw you pay taxes.

If you are in the 25% tax bracket and take out a 30,000 loan you will effectively pay 50% in taxes, once when you pay the loan back and again when you withdraw the funds.

If you have questions about your 401k, CALL THE PLAN ADMINISTRATOR. You pay a fee for these people to manage the plan, use them. Do NOT take advice from the internet!

These loans are a BAD deal, they only entity to make out is the IRS.

Frank says

Mike, if you take a $1,000 loan from 401(k) and literally send that same $1,000 back, how could double taxation occur? It is obvious in this scenario that double taxation cannot occur.

Now imagine you placed the $1,000 proceeds from a 401k loan into a jar full of cash and pulled out a different $1,000 and sent that back. That is clearly mathematically equivalent as the to the first scenario, as the $1,000 proceeds were simply an equivalent substitute and thus no double taxation could have occurred.

Now imagine you buy a car with the $1,000 and use $1,000 from your next paycheck. Still mathematically equivalent. Even though your paycheck was taxed, the loan (think of it as an advance) was not. So it is proper to repay with taxed dollars.

You may be a CPA, but that does not mean you understand this concept. Please have an open mind.

Now, imagine a world where you could take a loan from the 401k and repay it with pretax dollars. In your mind, presumably, this would be single-taxed and ok. But in that world, you would get to take a tax free loan, buy an item with tax free dollars, then give back tax free dollars to repay the loan. You would have essentially never been taxed on the money used to purchase that item. After distribution in retirement you will receive the money again, pay taxes and buy a second item, this time taxed, once. If this was legal it would be an advisable strategy to take as many 401k loans as possible to churn tax free purchases.

Harry Sit says

You don’t even have to buy anything. If you can repay with pre-tax dollars, just keep borrowing and repaying to exhaust your pre-tax income. You reduce your income tax to zero every year. If you use after-tax dollars to repay but the money you pay back won’t be taxed again when you retire, just keep borrowing and repaying to eliminate taxes on your future withdrawals.

frugalnacho says

Harry I believe you are wrong about the double taxation of the interest portion of the loan. You are absolutely correct about the principal not being double taxed (this myth is a big pet peeve of mine). A couple other people have already brought it up in the comments and you have dismissed them telling them they are wrong. However, the interest you pay back for a 401k loan is absolutely double taxed. I also believe most of the examples you use are unnecessarily complicated and confusing so I have what I believe to be a much better example which will demonstrably show you do in fact get double taxed on the interest portion of the loan.

Say you have $5 in cash. You also have $100 in your 401k (totaling $105 in net worth). You keep your 401k invested in cash, so no interest or growth. You also have earned no money this year, and never will for the rest of this example.

Scenario A:

You withdraw $100 from your 401k. You now have $100 in taxable income. You also have $5 in “post-tax” money that you already had. You end up with $105 in cash, $100 of which tax is owed on.

Scenario B:

You borrow $100 from your 401k. You pay back your loan within the same year at a cost of $105. You withdraw $105 from your 401k. You now have $105, all of which is taxable income.

You have not earned or spent any money in either scenario, just shuffled the money around, but scenario B gives you a higher tax liability. You are being double taxed on the interest you paid back into the loan.

The amount of tax is likely small, and other factors (how bad you need money, the opportunity cost of borrowing the money, the risk of being fired and having the loan recalled immediately, etc) should be the driving factors of whether you ultimately decide to take the loan, but the double taxation of the interest is absolutely real.

I think the example should stand on it’s own merit and convince everyone that the interest portion is double taxed, but here is another finance blog from vanguard that confirms what I’ve already stated:

https://vanguardblog.com/2009/07/24/401k-loans-are-you-really-taxed-twice/

Harry Sit says

You only showed that you pay tax on the money that your 401k earns, which everyone knows to be true. In your Scenario A your 401k money earned nothing. Therefore you pay tax only on $100. In your Scenario B your 401k money earned $5. Therefore you pay tax on the $100 plus the $5 earnings. That $5 happened to be from you is beside the point. Your 401k money doesn’t care where it gets its earnings. It wants to earn something. If you keep your 401k money invested in Scenario A, it can earn $0.01, $3 or $7, and you’d still pay tax on it. If it happened to earn exactly $5, your taxes will be the exactly the same in two scenarios.

Either way there are two taxes, one on your salary and one on your 401k earnings. The two taxes are unrelated, just like when you buy a hamburger you will pay tax on your salary and you will pay sales tax on your purchase. If you call two taxes “double taxed” so be it. I don’t call it double taxed because you are not disadvantaged in any way. You would pay two taxes anyway. It’s not an extra tax. I call it double taxed only when it’s an extra tax you otherwise would be able to avoid if you didn’t borrow.

Joel says

Correct me if I’m wrong. I’ve only read a few comments in here because there are so many.

But if there is no such thing as double tax on a 401k loan, why do you need to pay taxes on that amount loaned when it comes to retirement. If I’m not mistaken, a Roth IRA is after tax dollars and when you retire it is tax free because they are after tax deductions???

Ross Lomazov says

Joel,

I’m not 100% sure what you’re asking, but if you’re asking about reporting your 401k loan proceeds on your IRS-1040, then the answer is in MOST cases the 401k load is tax exempt. I think people aren’t familiar with tax law and assume that the 401k loan money will be taxed as income…NOT TRUE.

If you’re asking “why you pay an EXTRA tax on the amount borrowed”…you DON’T. I know there is a lot of jabber about the “double tax” but there is no such thing as paying an extra amount when you withdraw in retirement. There is no “penalty” tax for borrowing 401k money…assuming you pay it all back 🙂

What some people call a “double” tax is the idea that you pay back the 401k loan with after-tax money and then you pay income tax on that same money when you take withdrawals in retirement. So I guess that [after-tax + income tax = double tax]??

In this case, I think people lose sight of the fact that the money they borrowed from their 401k was never taxed originally. So people say, “well, I got a tax benefit once, why can’t I have it again?” The reason you can’t have it again is that you would be double-dipping.

Here’s a real scenario using the 401k pre-tax limit of $18,500 for 2018. In February, you contribute a lump-sum of $18,500 tax-free to your 401k. In July, you take a $10k loan. In August, you start paying back $2k per month (ignoring interest to make the math easy). By the end of the year, you have paid back the loan. If both your lump sum contribution and your loan payments were pre-tax, you have effectively sheltered $28,500 in income from the IRS. The limit is $18,500, need I say more?

Regards,

Ross L.

eelllee says

I think the biggest part to consider besides three rates would be tax savings on the interest. Interest on 401(K) loan is usually non-deductible, however, interest on a home equity loan used to build an addition to an existing home is typically deductible even under the new tax law (https://www.irs.gov/newsroom/interest-on-home-equity-loans-often-still-deductible-under-new-law).

Ross Lomazov says

April,

The tax savings on the interest paid to a bank will not offset the fact that you are still paying to the bank.

The interest you pay back to the 401k is money that you get to reinvest and then draw upon.

The interest you pay to a bank is never recouped.

You can see my example using real numbers in my comment to Ron C., below.

Ron C says

I believe this will clear up this string.

401K contribution $10,000 payroll deducted from income.

401K loan $10,000 no tax event

Loan repayment principal $10,000 no tax event.

Loan interest @5% = $500 net (after tax) e.g. 25% I had to earn $666 to pay $500 net. (NOT DEDUCTIBLE)

Distribution in retirement $10,500 taxable @25%.

Because I couldn’t deduct the $500 interest, I paid an extra $166 which could be more than double considering I would typically be in a lower tax bracket in retirement. e.g. 15%. I left it at 25% in retirement for easy comparison and it could be 25%.

So…

$10,000 Payroll ded. -$2,500 tax relief

$10,000 Loan $0

$10,000 repaid $0

$500 net interest +$166 tax paid

$10,500 distribution +$2625 tax paid

That $666 that I earned to pay the $500 cost me a total of $291/44% tax.

Growth in the account is irrelevant. We can assume a 0% interest MM account if you prefer.

The interest should be deducted to be fair, but a 401K cannot allow for tax deductible contributions outside of EE payroll deductions and ER matching. The only difference is an IK but you still can’t deduct repaid after tax interest. 401K loans should be taken only as a last resort. Cheers!

Ross Lomazov says

Ron C.,

I don’t think you are painting the whole picture. To say that, “401K loans should be taken only as a last resort.”, assumes you have better options. I would love to know what you have in mind as a better option. If you assume that a home equity loan (HEL) is a better option, then here is one scenario below.

As of today, 1/22/19, a HEL (not HELOC) has fixed rate of 6.2% with $125 in fees (source: bankrate.com). For me, a 401k loan would cost 5% with no fees.

I’m going to use $50,000 as the loan amount since that’s the max allowed under 401k tax law.

The personal income cost to repay a 5 yr., $50,000 @ 5% 401k loan would be $56,614.

The net cost of a 5 yr., $50,000 @ 6.2% HEL would be:

$58,260 (total repayment amount)

– $1,982 (tax savings in 24% bracket…there is no 25% bracket for 2018)

+ $125 (fees)

= $56,402

The difference is only $200.

However, the interest that I pay back to my 401k account versus a 3rd party lender is a net gain of:

$8,260 (HEL interest)

– $1,982 (discount for no tax deduction)

– $1,587 (24% tax on 401k interest at withdrawal)

= $4,690!

So even if I repay my 401k with after-tax dollars and then pay tax on the proceeds, I am still way ahead. Even if you get a HEL rate as low as 4.2%, the net proceeds from paying yourself interest will be $2,805.

Bottom line, you cannot say that a 401k loan is a last resort unless you have a better option…such as an interest-free loan from a rich uncle…which we would all jump at! 🙂

chris says

It is a myth. Lots of complicated arguments and [kind of] math here. This is not hard to figure out on a spreadsheet. Annual 401 return matters a little if you expect it to average more than 6% over the 5 years of the max loan term. Double taxation is irrelevant. Here’s why.

* 50,000 in 401 over 5 years at 6% average annual return = $66,911

* 50,000 401 loan over 5 years at 6.5% loan rate and 6% average investment return = $66,178

* At the end of 5 years you end up with about the same 401K balance because you pay yourself $8,698 in interest and gain $7,479 at 6% invest rate.

* 50,000 bank loan at 12% over 5yrs is $66,733. Costs you $16,733 interest. 401 is still $66,911 since you didn’t use it BUT you gave $16,733 to the bank instead of accruing $16,178 in your 401.

* You would have to achieve 13% average annual return on your 401 to do better with a bank loan.

I’m an engineer, not an accountant. Take that for whatever it’s worth.

Ross Lomazov says

Chris,

All the numbers aside, the best part of your example is the idea that the borrower NEEDS the money. Therefore, if they don’t use a 401k loan, they would have to borrow from another source. Most people who support the “double tax” argument lose sight of the fact that another source of funding carries with it a borrowing cost. As you illustrated, the borrowing cost for any 3rd party loan will often be more than the borrowing cost for a 401k loan. This has to do primarily with the fact that the interest is paid to a 3rd party instead of to themselves. Even in the case of a home equity loan, the borrowing cost will be more than a 401k loan.

chris says

Good point Ross. I also need to have a job, open the 401 account, put money in it, select investments that will grow, etc., etc. Just a bunch of other things that are presumed to have happened before you have the discussion!

Cheers!

TBwoods says

I was double taxed! The 401k Administrator above is correct! I took out a $40k 401k loan from my pretax account. Up to that point, no taxes had been paid on that money. But when I paid it back, it was with “after tax” money at my tax rate at that time. So, in a 20% tax rate (round number to make the math easy), It took $48k of income to generate the $40k for repayment. (let’s keep it simple by assuming 0% loan repayment interest). But here is the real kicker. All that money I repaid back WAS PUT BACK INTO MY PRE-TAX 401K account. So that means that it will be taxed again when I withdraw it at retirement. All of you people guessing what is going on should look a real live example and not pretend what is going on.

Ross Lomazov says

TB, you said yourself that you used tax free money for a personal benefit. Let’s say you borrowed money from your rich uncle, interest free. The loan is money given to you as a source of income without any taxes taken out on your end. However, the money you got from your uncle was already taxed once. Then you repaid your uncle from your after tax income. Would you consider that a “double tax”, since the source of funding and the repayment were taxed separately? The only difference between borrowing from your rich uncle and from your 401k is that you are both the lender and borrower. When a bank loans you money, you don’t pay tax on the loan amount. However, the bank funds you got were taxed at a corporate income rate. You paid them with after tax dollars. So since the loan funds and the repayment were taxed separately, is that “double tax”?

The point is that folks use the word “double tax” to mean some kind of penalty. When in reality both the source of funds and the repayment money are taxed separately. With a 401k loan, the source of funding is tax-deferred…but still taxed at some point. The repayment to yourself is from taxed income. This is no different that any other borrowing scenario except that, in most cases, the borrower is not impacted by the lender’s tax burden.

chris says

The example is real math although not live :). At the risk of beating what is clearly a dead horse in this thread, if one is purely intent on not getting ‘taxed twice’, then 401K borrowing should not be considered. If the objective is to build net worth, it’s just fine! Another thing to consider is that listening to talk show hosts for financial advice is probably not a good idea!

tbwoods says

Just curious how you feel borrowing from you 401k (and getting double taxes) helps build net worth. In my case, I used my 401k loan for a down payment on an apartment building. So in my case, it did help build net worth. But if not used for an investment like this, I don’t see how it can have any positive effect on your net worth.

chris says

Because you’re retaining the interest you would have lost (paid) to a 3rd party (e.g., bank) which will then also continue to gain investment value in your 401. See math above (post 121).

tbwoods says

Good point on the interest. However the negative effect of the double taxation far wipes out the interest benefit.

chris says

In your example above you are saying it cost you 8K to replace the 40K borrowed (ignoring interest). At retirement, you’d get taxed on the 40K and at 20% you’d pay 8K. You’ve now paid 16K on the 40K…the dreaded “double tax”. If you had not borrowed the money in the first place, you would still have paid the 8K in retirement so really you’re down 8K. If you instead borrowed from the bank (or other 3rd party) it would still cost you the 8K to repay the loan PLUS interest which could range from say 2K (home equity loan rate) to 6K (bank personal loan rate) so let’s use the average 4K. In that case your paying 12K (total out of pocket), still more than using 401K. If you add in the reality of losing investment income on the 401K interest you paid, the difference is even larger (in 401K favor). I use math. I like math. Always liked math. Maybe like math too much! 🙂

Tijuana Clark says

I took out a 401k loan in 2016 for $3800. The money was coming out of my check every payroll. In Jan 2018, I received a 1099R for $3884.32 because nothing was paid on the loan. It was my statements. So I filed it with my taxed and spoke with my employer and he stated that he filed bankruptcy and he has now made all of the past due payments. I told him that Im not understanding since I had already received the 1099R and filed it with my taxes. In Jan 2019, I received another 1099R for the same loan but the lesser amount of the money the employer put in the 401K for $2787. I didnt default on the 401K loan he did by taking the money out of my check and not applying it to the loan until after I received the 1099R form. If this is not double taxation, why am I being penalized twice? I spoke to Transamerica and told them that they cant tax me twice on the same loan. Their response was, Yes we can because you have up to 5 years to pay it off. My thoughts are that the contract was breached when I received the first 1099R because my payroll shows where the money was coming out. I dont plan on taking another loan out due to the employer not making payroll on time and not applying my funds to my 401k loan or my 401k fund.

Ross Lomazov says

Tijuana, a 401k loan does NOT trigger a 1099. Your employer, most likely, processed the loan as a withdrawal, which is incorrect. You should never have received a 1099 for the original loan amount. The “double tax” that people are discussing here assumes that the 401k loan is paid as a loan and never converts to a withdrawal. In certain cases, such as a person leaving a job, the loan must be repaid in full or it will convert to a withdrawal and trigger a tax event. Since your employer declared bankruptcy, the remaining balance of the loan, $2787, may have been converted to a withdrawal and triggered a 1099. I don’t know bankruptcy laws, nor do I know what type of bankruptcy your employer declared. However, even under bankruptcy laws, you should have been given a chance to repay the loan before it was converted to a withdrawal.

All that being said, your employer is the one to blame for your tax burden. This is not the same situation that is being discussed here about the “double tax”.

Kevin says

I always found Suze Orman’s double taxation claim absolutely ridiculous. Obviously she does not understand basic math. It’s totally irrelevant how one pays a 401k loan back, it’s the same amount of money you got that you are replacing back. You got $1000 you put back $1000, which pocket it came from is totally irrelevant. common sense.

MRD says

If I make $1,000 a week and I put $500 into a 401k I am only taxed the remaining $500 that doesn’t go into my 401k. Lets say my tax rate is 35% so I end up paying $175 in tax so I take home $325 per week ($1000 – $500 401k contribution – $175 tax). Now lets say I take out a $10,000 401k loan and STOP my 401k contributions. I pay back my loan at a rate of $500 a week (same amount I was originally contributing to my 401k pre-tax). My new paycheck now looks like this: $1,000 a week, taxed at 35% ($350) which leaves me with $650 of which $500 goes to pay my 401k loan. My take home is now $150 per week ($1000 – $350 tax – $500 401k repayment). Now when it comes time to retire, I have to pay tax on the $10,000 in my 401k that was used to pay back that original loan. How is this not considered double taxed? Honestly not sure what I am missing here.

Rostik Lomazov says

@MRD

No one ever said that your 401(k) loan is tax-free. The fact is you get “double-taxed” no matter where you take your loan. Let’s say you take a bank loan and leave your 401k money alone. You will repay the bank with after-tax dollars and then you will pay tax on your 401k when you withdraw. Let’s say you want to borrow from your own savings. You initially funded the savings account with after-tax dollars. Then you replaced your savings with after tax dollars. You will still pay tax on your 401(k) withdrawal in retirement.

So the point is, even though your initial deposit to your 401(k) was tax-deferred, you don’t get that same tax break for a 401(k) loan. People use the word “double-taxed” like it’s some kind of penalty fee. But it’s not any different than any other loan scenario. Financial “professionals” should NOT use double-tax as a negative for a 401(k) loan…which is what usually gets said. Financial “professional” should NOT differentiate a 401(k) loan from other loans because of “double-taxation”…which is what they usually do.

If you consider a 401(k) loan to be double-taxed, then all loans should be considered double-taxed and not just single out the 401(k).

Tbwoods says

Mrd, plain and simple. It is double taxed.

Duderino says

There is another simpler way to look at it. When you use a 401k loan to pay for something (for example, a down payment), you are using pretax money to pay for something for which you would usually use posttax money. Then, you pay it back with posttax money, which is the effectively the same as having used posttax money for that purpose (the down payment) in the first place. It is technically double-taxed, but in essence it is only to make up for the fact that the money wasn’t taxed when it was used (which it typically would be). Only the interest is double taxed.

Duderino says

On second thought, even the interest is not truly 100% double taxed. You are taking the pretax money from the loan and paying down the mortgage principal. This is an investment that appreciates. Furthermore, you avoid the mortgage interest. The net return is probably at least 6-7% depending on the real estate market. This offsets part of the first round of taxes.

$iddhartha says

That’s my analysis as well. Only the interest is double-taxed. Interest is paid into your account with after-tax money then taxed again when you take it out in retirement. (As an aside, if you borrowed from a bank you’d pay for the interest with after-tax money and the bank would pay the tax on the interest earned.)

However, the amount is so small that the “double taxation” of the interest is a minor consideration in taking a 401k loan in my opinion.

LJ says

I didn’t read through all of the comments so forgive me if I’m just repeating what someone else said previously.

The Missing Dollar Problem. This puzzle tries to get our brains to group the wrong numbers together. Some of our minds (mine included) will grasp onto two equations: $30 – $2 = $28 and $25 + $3 = $28, that have no business being involved in the solution. The first equation is the brain saying, “They paid a total of $30 and only didn’t get $2 back so $28 is the answer.” And the second one is “They paid $25 in the end for the room plus got back $3 from the hotel, so the answer is $28.” Silly brain; you’re grouping the wrong things together!…and Trix are for kids! (Sorry, I had to.) My theory is that throwing in the 3rd party of the bell boy messes things up for many minds, and as I stated previously, mine included. If one slows down the brain (for some of us this is needed anyway) and groups things together that belong together, for example in the category of What Money Permanently Left the Guest’s Wallets, then we see the accurate solution more clearly. $30 initially left the guest’s wallets…but not all of it left permanently, so let’s be careful about using this figure as it doesn’t belong in this category. $25 was the final cost of the hotel room. No further discounts or rebates or lower prices were offered beyond this figure. Thus, $25 permanently left the guest’s wallets. (Put that under our category.) $3 is another figure given. It is an amount RETURNED to the guest’s wallets, so it can’t be added to the category What Money Permanently Left the Guest’s Wallets. (But it can be taken from the non-permanent amount of $30. More on that later.) $5 is mentioned. We know that it is split between the $3 we just discussed that was returned to the guests and the final puzzle figure of $2 that is taken by the bell boy. The $2 permanently left the guest’s wallets because we know the bell boy is not returning the money to them. (Put that under our category.) We’ve now taken into account every figure mentioned in the puzzle. Which figures were in the category of What Money Permanently Left the Guest’s Wallets? $25 + $2 = $27. $27 permanently left our guest’s wallets. And that makes sense because the maximum dollar amount that ever left the guest’s wallets was $30. Some of the $30 was returned to them, $3, providing a second accurate equation to double-check our solution: $30 – $3 = $27. No dollar is missing like the puzzle states because we’ve asked our brains to stop a.) grouping together numbers like $30 (maximum amount that left the guests wallets though not all permanently) with $2 (an amount that did permanently leave the guest’s wallets) which is also PART of the initial $30 but isn’t returned with the $3 so we can’t just subtract it from the $30. Instead it is simply reallocated. It starts as part of the higher hotel room cost (as we just mentioned) and then changes to being part of what was intended by the hotel manager as being refunded to the guests ($5) but then changed again to being the bell boy’s self-gratifying tip. And b.) we’re no longer combining the final, lower hotel cost of $25 (permanently left the pockets) with the $3 that was RETURNED to their pockets. Those two categories are not to be combined. By this point we already know that because our brains are already thinking more clearly. I always try to explain things to myself as if I were a child or Denzel Washington’s character in the movie Philadelphia where he says, “Explain this to me like I’m a 6 year old.” For me anyway, this always helps. Now I’ll play with the 401k problem.

Natalie says

Terrible article. Sorry I wanted to believe.

I’ve known for years the principal wasn’t double taxed but the interest is double taxed. I came across this article a while back posted on a forum and I didn’t understand it and felt stupid but the author seemed smart so I said okay there’s no double taxation on it. Now with CARES act I want to take a 100k loan from my solo 401k and revisited it.

Of course the interest is double taxed, I wasted 20 minutes trying to wrap my head around riddles and diagrams here.