I don’t know who started it. Suze Orman certainly helped spread it. She says that you shouldn’t borrow from your 401k (or 403b) plan because you will be double-taxed. I did a Google search and I found this by Suze Orman:

“Also, never ever borrow against your 401k plan because you will pay double taxation on the money you borrow. Because you don’t pay taxes on the money you put into a 401k, when you pay back the loan (which you must do within five years, or 15 years if used to buy a home), you pay it back with money you have paid taxes on. Then, when you retire and take the money out again, you end up paying taxes on it a second time.”

This allegation is all over the place. It is a myth because there is NO double taxation. It’s a mind trick similar to that well-known “where’s the missing dollar” puzzle.

“Three men went into a hotel. The manager said the room was $30 so each man paid $10. A while later the manager realized the room was only $25 so he sent the bellboy to the 3 guys’ room with $5. The bellboy only gave each man $1 back and kept the other $2 for himself. Now 3 men paid $9 each for the room, which is $27. Add the $2 that the bellboy kept, and that’s $29. But the 3 men paid $30 originally. Where is the other dollar?”

I was able to find a good explanation for this puzzle. The $30 number is irrelevant. The correct math is $27 – $2 = $25. It makes no sense to add $2 to the $27 because it’s already a part of the $27. The $2 should be subtracted from the $27.

Now, back to our 401k double taxation myth. The fact that the loan has to be repaid with after-tax dollars is irrelevant, just like the $30 number in the hotel puzzle. If you didn’t borrow from the 401k plan but you borrowed from a bank, you’d have to pay the bank back with after-tax dollars as well. If you didn’t borrow from your 401k plan but you dipped into your own savings, you have to replace those savings with after-tax dollars too.

What it really means is that a 401k loan isn’t tax-deductible, just like any other consumer loan except a mortgage or a HELOC. Instead of saying you will be double taxed, they should just say that a 401k loan is not tax-deductible, plain and simple.

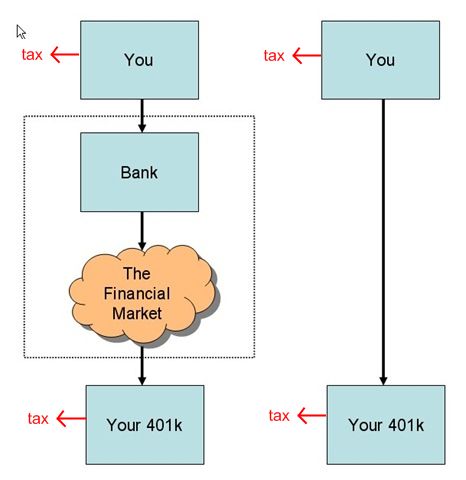

I have had this post in draft for a long time but Jonathan at My Money Blog beat me to it recently with two posts trying to debunk this myth (post 1, post 2). After so much discussion some folks are still not convinced. I think this issue is best illustrated by the chart below:

The left-hand side represents a typical consumer loan, like a car loan. The arrows represent “borrows from” and “pays back to.” You borrow from a bank. The bank borrows from the financial market. Your 401k invests in the financial market. I think we all agree there is no double taxation in this case. You pay after-tax dollars to the bank for both principal and interest. Your 401k earns from the financial market but the earnings are taxed when you withdraw from your 401k.

The right-hand side represents a 401k loan. Now, if you put an imaginary box in the middle on the right-hand side, it becomes exactly the same as the left-hand side. You borrow from an imaginary middleman and pay after-tax dollars for both principal and interest. This imaginary middleman then borrows from your 401k and passes the same dollars it receives from you to your 401k.

All of a sudden you are not double taxed anymore because it looks exactly the same as a car loan on the left-hand side. Because this middleman is only imaginary, it follows that you are not double taxed with a 401k loan, whether for the principal repayments or for the interest.

Whether or not you are mathematically better off with a 401k loan depends on how these three rates play out:

- Your alternative after-tax interest rate from a bank loan

- What bond funds in your 401k are expected to earn from the market

- The interest rate on your 401k loan

Suppose your alternative after-tax interest rate from a bank loan is 7% and the interest rate on your 401k loan is 5%. If you borrow from your 401k, you save 2% in interest cost in after-tax dollars. But also suppose the bond funds in your 401k are expected to earn 8%. If you borrow from it, your 401k plan can only earn 5% from you. So your 401k plan account is 3% worse off in before-tax dollars. Between 2% better off after tax and 3% worse off before tax, it can become a wash.

The reason you have to compare it with what bond funds can earn is that the 401k loan payments are not subject to market fluctuation. If you do borrow from your 401k, increase your allocation to stocks for what’s left in the plan.

While there is no double taxation on a 401k loan, there are other negatives in borrowing from your 401k plan. The biggest negative is that if you change jobs (voluntarily or involuntarily), you sometimes have to repay the outstanding balance of the loan within a short period of time, like 60 days. Some plans actually allow you to continue the loan repayment even after you terminate employment, but not all plans do that.

If you really need cash and you don’t have any other source except your 401k, taking out a 401k loan is at least better than taking a hardship withdrawal from the plan. Just be absolutely sure you will be able to repay the loan and you won’t change jobs before paying off the loan. And don’t reduce your regular 401k contributions while you are paying off the loan.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Wilson says

very interesting discussion here. After reading most of the post, I think most people here agree that the principal paid back to the 401k loan is not “double taxed”. The real tricky situation is only on the additional interest paid to the 401k account. One thing to keep in mind is that any interest earned within your regular 401k account will be taxed anyway whether the interest is paid by you or your 401k account earns the interest by itself.

To simplify the problem, let’s forget about the principal payment and just focus on the interest payment. When you pay interest payment(after income tax dollar) to your 401k and that interest payment is taxed when you withdraw at retirement, you certainly “feel” that it is double taxed.

However, if you pay that same amount of interest payment to a bank(just like any other you loan you have), then that bank deposits that same interest payment to your 401k(assuming your 401k account lend the principal to that bank as an investment), then your 401k will earn the same amount of interest you pay to the bank. Remember again, any interest earned within 401k will be taxable, so you will need to pay tax on that interest payment earned by the 401k. Comparing to paying interest directly to your 401k yourself, you are now in exact same financial situation. However, do you still “feel” being double taxed?

Harry Sit says

@Wilson – You got it! That’s exactly what I tried to show with the picture. There are two taxes. Some say it’s double tax. I say it’s two taxes, unrelated to each other. The bottom line is exactly the same though.

dd says

Agree with this analysis, as one is paying any mortgage or loan back with post-tax money. But this should not be so, as pre and post-tax contributions can be made to a traditional 401K (depends on employer). When the 401K money is distributed, taxes are not paid on the post-tax portion of money and distributions are taxed proportionally. Earnings on both pre and post-tax earnings are taxed. Paying back a 401K loan is in reality exchanging pre-tax contributions with post-tax contributions.

Harry Sit says

@dd – It should be so. The loan payments are merely replacing the money taken out of the plan account. If the loan money came from the pre-tax bucket, the repayments have to go back to the pre-tax bucket. Otherwise I would just take a loan, immediately repay it and shift money from pre-tax to post-tax. Same goes for the loan interest. Since the earnings in plan account will be taxed without the loan, the interest it earns from the loan has to be taxed as well.

Josh B says

@TFB – Perfect simple explanation for the non-interest part. I don’t see why there’s so much confusion on this.

Strictly speaking, i would say the interest is double taxed from the perspective of the 401k owner. You call the interest payments earnings of the 401k plan, but someone else could just as validly argue they are non-standard contributions. I think the interpretation is arbitrary in that the law could have been written either way. It’s not a surprise that it’s written to maximize government revenue.

dd says

Josh B, I agree with you that this area could have a number of interpretations: this is probably why there is so much confusion. Somehow the current interpretation does not seem intuitive, but does maximize government revenue.

I am not a fan of Suzy Orman and prefer the Jane Bryant Quinn. Although Suzy Orman’s recommendations are not always 100%, most of her recommendations follow generally accepted financial concepts. She has simplified and popularized financial literacy to the benefit of many.

John Monahan says

dd’s point stated extremely well, and I have to agree. While both Suzy O. AND Dave Ramsey have brought some semblance of basic understanding to the masses, one has to recognize that their aim is exactly that – ease of understanding to the masses.

One example of this point: both laud the benefits of using the Roth IRA. Having been in financial services myself, I have a basic disagreement about the Roth products, but for the general public – especially those who are currently not saving at all – the Roth is a an easily understandable way to save money with expected tax saving benefits. Is the traditional IRA, 401(k) or 403(b) a better choice? In my estimation, yes, but probably a discussion for another forum. However educating a less-than-sophisticated group of new savers (particularly en masse and by popular media) can be a long process which can and does eat up precious saving time. Here the time honored, “Time is money” is precise and to the point. Get ’em saving is paramount.

Harry Sit says

@Josh B, @dd – Loan interest and contributions are different concepts. Loan interest comes from time value of money. If you are replacing $100 pretax money a year from now, you have to replace it with $105 because of time value of money. The extra $5 isn’t a contribution.

Suppose both you and your co-worker are borrowing the same amount on the same terms but you are borrowing from her account and she’s borrowing from yours. The cash flows from your pockets and to your accounts are identical with a regular 401k loan. Your accounts don’t care where the money comes from and you don’t really care to whose account you are repaying. You got a loan. You are paying interest. That’s all. You are not making a non-standard contribution to her account. You are paying interest to compensate her for the time value of money. Of course she should be taxed for that. It’s the same when you and she are the same person.

The public wants a simple, black-and-white solution for their money questions. Suze Orman fills that need. A consultant to financial planners lamented that all the CFPs in the country added together don’t have as much reach as three mass marketing gurus: Suze Orman, David Bach, and Dave Ramsey. It’s the same as McDonald’s. It’s fast, cheap, and it serves far more customers than white-table-cloth restaurants. If you are hungry, McD’s will do. Just don’t eat there every day.

dd says

Ok, I am convinced now, the last example was good.

SMW says

@John Monahan – I agree on your point concerning Roth IRAs, especially when anyone proclaims: “everyone should have one” or “the only account you need is…” And to the other comments: maybe we should apply the 80/20 rule to financial planning talking heads – take 80 percent at face value, and view the rest with raised eyebrow.

@dd – If I’m understanding your complaint correctly, you wish that it would be allowed for your interest paid to be allocated to the pre-tax portion of your retirement account. I think you’re spot on. TFB, I get your point that the interest is replacing what would otherwise be earned in the markets (at least that was Congress’ intent when they allowed plan loans), but its future value, and potential, is the same as contributions, so even those of us in the plan administration field do view it as similar to another type of contributions – earnings. They are contributed by the markets. The account balance and it’s taxable value are the concerns. This is one of those social policy issues, where Congress’ other intent was to mildly discourage borrowing from retirement plans: to tax those post-tax, out-of-pocket loan interest payments. But again, the effect of that tax is so minor, really percents of percents, that, as we’ve agreed in this “forum” in the past, should not be a deterrent to borrowing against your retirement plan funds if you have greater investment/savings opportunities elsewhere (doesn’t stop me, and I’ve designed plans!). @TFB – while I don’t agree with you on everything, I think your website and the discussions it engenders are great. You attract people online who really are interested in becoming financially educated.

John Monahan says

@ SMW – In some cases, there should be a 99/1 rule – I worked under one of those…

I have many reasons to dislike the Roth. As I said earlier, I would only use it as a position of last resort. I believe in filling up the bucket no matter what bucket the client prefers. I may take my best shot at educating them, but quite frankly (and I’ve run into this several times) they want a Roth no matter what, usually because their ‘investment guru’ (translation – the guy in the office or a friend talks like he knows what he’s doing financially…) told them the Roth is the best thing since chewing tobacco. Sigh – ok – at least they’re saving/filling the bucket.

My main concern with the Roth (and frankly in today’s political climate a lot of other things) is the ability for the govt. to change directions at any point they see fit. You only need point to a social program, started in the 1930’s with no taxation on benefits, that 40 years later began taxing those same benefits. You know the one I’m referring to – SSI. So is it far fetched to think the Roth proceeds could be taxed? Maybe. Is it possible? You betcha.

Lastly – your encapsulation of the miniscuilty (is that a word?) of the tax consequenses should be in a text book somewhere. Excellent summarization. I have accessed funds from 403(B) accounts for my wife and I and we’ve saved thousands and maybe tens of thousands of dollars in interest payments. May have cost me a couple of hundred in taxes, but I’ll do that all day every day. Thanks for the concise description.

Dean in NY says

You are misleading people with this article. Yes you are not getting double taxed when comparing it to a credit card or non-tax deductible loan. But 401k loans in general are NOT tax deductible. So those of you borrowing from it to invest in something else (IRA) are losing doubly because they cannot deduct the interest they are paying. Even credit card interest is deductible when used for business or investment purposes. 401k interest is not deductible under these conditions. If you do not believe me, try to do this. It will take about 3-5 years for the IRS to catch it and catch up to you, and when they do.. look out!

Steve says

Question

Lets say someone contributes 5k yearly to their 401k. December rolls around and they want to add 5K to their IRa. Being that the 5k in the 401k is pretax, if they take a loan out for 5k can they now deduct 10k from their taxes? It would be a win win.. they are really only placing 5k yearly into their retirement acct, yet they are deducting 10k for tax reporting purposes. Also they are giving themselves guaranteed return on their 401k.

Thoughts on this.. im sure there is no way this would work but curious to see what others think.

SMW says

@Steve: You can do this, but it might be counter-productive, or at least unproductive. This might be a good idea in a bear market, and you have no better use for that money, but since it is a year after you could have been contributing, the opportunity cost is a little high, IMHO. You could have been contributing regularly to the IRA all during the past year, using the concepts of dollar cost averaging (DCA) and compounding. These concepts don’t always work in our favor, however, with 2011 as a good example: when a market ends the year at roughly the same point it began, with values increasing during the year then reverting back to the mean, you can actually lose money on a DCA basis. I find it hard to time markets with loans, and the risk, mentioned below, is a little uncomfortable for me. I think there might be better places to invest, but at only $5K, that risk is relatively low.

You also bear the risk of leaving the job of the 401(k) sponsor, and not being able to pay back the loan immediately, triggering both the 72(t) early distribution (10%) penalty and income taxes on the amount not repaid to the 401(k). If your plan charges fees for loans, that may be a detractor as well: remember, once you start doing this, you might keep investing like this on an annual basis. If it’s a one-time deal, it’s probably relatively harmless. If it becomes a long term pattern, you could be eroding your investment basis through fees, and paying yourself a minimal return in many bull markets over your career.

I’d say instead, start investing habitually.

Billy M. says

Here’s a brain tickler:

Joe puts 1000$ into traditional 401k back in 2009. Company matches the 1000$. His current tax bracket is at 15%. He has 2000$ in the account.

Joe takes a 401k loan for 1000$ in January 1, 2011 at 5% and pays back the loan, 1050$, later on in the year Dec 31, 2011 at the current tax bracket 25%. The 50$ is now taxed at 25%.

The way I see it, the 401k loan will eventually force you to lock more money into the traditional 401k, that will not get matched and is taxed at a higher rate. If you have to do it, do the smallest amount you need to. If you start playing in the 10,000$ loan, you’ll end up having to put 500$ at 25%. Money that can be better spent elsewhere.

The way I was taught is the following: put $ into 401k up till match contributions. Max out ira because of versatility and availability of funds/stocks. After you max out roth, put more money into 401k or another vehicle providing better yields.

I was also taught to put money into Roth versus traditional, mainly because when you start making distributions, you’d most likely be in the late 60’s early 70’s. At that time, most of your deduction capabilities will be gone, and you will still need to survive on some level of revenue… and if it’s traditional, it will be taxed.

Right now many who are contributing to their 401k is probably around the 25% tax rate. Many plans enforce an income tax rate of 20%. So regardless, that 25% tax above for the 50$ is working against you.

Billy M. says

To clarify, I understand that you will end up having to pay the 25% on the 50$, but instead of wanting to, you are now obligated to.

In terms of loans, this is a good type compared to any of the other private bank loans.

Matt B says

This is absolute crap…. There is absolutely double taxation on loan payments back to a 401k.

True, it’s not tax deductible…but you’re making the payments with after-tax dollars. When you withdraw the funds at retirement – the entire balance is taxed, including those after-tax loan payment dollars.

The author threw in a bunch of pointless examples of other types of loans you pay back with after-tax dollars, but it all comes down to the above.

Double taxation on 401k loan PAYMENTS is not a myth.

Billy M. says

No. You are incorrect. Only interest incurrs DOUBLE TAXATION if and only if you have traditional (pre-tax) 401k. This will include, company matching, and any pre-tax contributions.

If you have a traditional 401k and you borrow (not withdraw) let’s say 1000$. At that moment you get 1000$. That 1000$ has never been taxed, ever. When you put the money back in, you are putting that 1000$ back in + interest. It’s relative. The interest however is paid with after tax money at your current tax bracket. When you finally retire and start distribution, the interest is then taxed again upon distribution.

However, if you have a Roth 401k, it is not taxed again upon distribution.

Like I mentioned above, you are forced to pay tax at your current tax bracket for the interest. This could mean you are at 25%, or maybe even 35%.

Unless you can get a 0% loan indefinitely, a 401k is the best choice unless it’s for a house, which in that case, I’d prefer you take up their mortgage loan.

Case: Let’s say your account has 60% roth 401k and 40% matching (pretax) contribution by your company.

You still have to pay back the principal + interest for both, but when you retire, 60% is not double taxed, the other 40% is.

John says

I think the best way to explain the missing dollar problem.

30 (10 dollars by each man) = 25 (amount kept by hotel) + 3 (1 dollar for each man) + 2 (kept by the bellboy)

Still trying to wrap my head around the above posts.

dave says

I’ve always thought the same thing, Suze is theorizing and not being mathematical. Another basic case is if you have some 20 percent credit card and carry a balance of lets say $5000, so you’re paying $1000 a year (ballpark) in interest…instead you take a $5K loan from your 401K, you pay yourself back 4-5% interest and you pay off your CCard. You’ve just saved $1000 a year in interest and while you did have to pay the interest to yourself ($250), you did not lose that money, it’s back in your account. Now multiply this time some number of years (considering the ccard balance is going down) and you find that you have likely saved at least a couple thousand bucks. And if you didn’t pay off the ccard with the 401k loan, well you’d be paying the credit card off with AFTER TAX DOLLARS. You’re always paying stuff off with after tax dollars, so it is a moot point. Not to mention that she and others are always saying, oh but you won’t be realizing those 401k gains…they never say …losses. You can just as well have saved yourself some more $$$ by taking $$$ out from your account before the market went down.You just don’t know. Bottom line: taking out a 401k loan is a great idea as long as you use it for a specific purpose and don’t get too used to it. and of course be sure you have the fund to pay it back either in bulk (if you get fired and the plan doesn’t allow monthly payments anymore) if you have to cuz you dont want to get swatted with a withdrawl tax + 10%.

dave says

Matt:

best way to look at this is this:

you put $1000 pre-tax money in a 401K

..eventually you are going to pay a tax when you make a withdrawl

you take out a $500 401k loan….you will be paying yourself some interest (like 4-5%_

3 months later you pay off the $500 loan ..yes you are using ‘after tax money’ to pay if off

but you’re using after tax money to pay off any loan

you pay off the $500 401K

when you take out the $500 401Kk money, you pay taxes..just like you were gonna pay taxes on it if you didn’t take out a loan at all.

…so in theory you paid off your ccard with ‘before tax money’

there is no double tax… you are paying tax on the 401K loan with some dollars, the fact that the dollars you have in your pocket that you were already paid tax on means nothing.

Vinod Sindhu says

OK,

All of you are missing one part.

Lets say you borrowed 500 from 401K and paid back 550, here $50 is the interest on which you have already paid taxes. Now when you will withdraw this $50 after retirement again you will be paying taxes on it. That means you are taxed twice on the interest you pay on the loan from 401K.

Harry Sit says

Vinod – If you didn’t borrow from the 401k account, you would still pay tax on your salary (tax #1), the money in your 401k account would still earn something from somewhere and you would still pay tax on that earning (tax #2). You are taxed twice regardless. Double taxed implies you pay an extra tax if you borrow. That’s not the case.

Dana says

As far as doule-taxation, I may be dense but I don’t understand these arguments. Suppose I take a $10,000 loan for 4 years and payback $50 a week.

That’s $2600 a year x 4 years = $10,400 – after taxes. When I retire and withdraw that $10,400 I’ll have to pay taxes on it. How is that not double-taxation? If I put that same $50 a week in without taking a loan that $50 only gets taxed when I withdraw it.

To say that I have to pay back any other loan with after-tax dollars or the money wasn’t taxed when I originally put it in are not valid arguments and doesn’t even pertain to the situation.

Joe says

Dana:

Take your 10,000 (from the tax-free 401k loan) to pay back the 10,400.

Your “first” tax on the 10K never occurred because it’s from a non-taxed source.

If the 400 is from a taxed source, then it will be double-taxed on removal.

It’s a silly loan to make but illustrates that you have (temporary) access to tax free money when you take a loan from a 401k.

Mark says

Agree that payments made to any loan are from already taxed income. That puts all loans on a level playing field for the “first” tax. The principal amount I pay back can be counted as if it was originally drawn out of the 401K trom originally tax free contributions so there is technically no “second” tax on those amounts.

However, there is a “second” tax on the interest that I pay into the 401K because when I withdraw that money later I pay taxes on it. The interest I pay back was not withdrawn from the 401K which means they are being paid from previously taxed funds..This counts as a “first tax” on those payments. This is the big difference that is being ignored in the “no double tax” argument – that you will later draw the payment funds back out of the loan source and pay taxes on them. You cannot do this with a regular loan so there is no possibility for a second tax event.

So the double tax statement is not completely wrong nor is it completely right. The weighting depends on the ration of interest to principal paid.

Harry Sit says

Mark – “You cannot do this with a regular loan so there is no possibility for a second tax event.” With a regular loan your 401k assets are untouched and therefore it will grow a little more. You will pay tax on the extra earnings. That’s your second tax event.

Joe says

This blog seems to argue that in some indirect way, there is ultimately a detrimental tax-like effect on you from a bank loan because a bank would have to pay taxes on a loan to you and this eats away at how much the bank can invest in the financial markets that your 401(k) is based on, or something like that. I think that in reality, the direct tax on your interest on lending yourself money from your 401(k) is more likely to have an actual economic effect on you than some indirect detrimental economic effect on your 401(k) from borrowing from a bank, whether or not you want to call it double-taxation.

rob says

OK, I have a 20,000 loan for 10 years at 6 %. I have a goverment 457(b) which I understand means I am not subject to the 10 penelty for early distribution.

Why not default on the loan (my money) and pay the tax now. Use the emaining funds to pay off CC debt and take the money I would have been paying back to the loan and put it in a Roth?

I have a pension, and with our debt, I do not see tax bracket change when I retire dut to taxable pension.

I must missing something as I see no discussion of this anywere

Paul says

Isn’t it better to over-contribute to a 401K and take a loan if needed rather than over-contribute to a savings account and just spend the money from savings if needed? If nothing happens (car repair, appliance replacement, etc.) then I get the added benefit of a larger 401K right?

So if I would normally contribute 5% to my 401K and 5% to my rainy day fund (savings account), why not contribute all 10% to the 401K and then borrow within that extra 5% for unexpected big ticket items?

Harry says

Paul – A 401k loan usually has a setup fee to the tune of $100. It also takes a week or two to get. If you use 401k as an emergency fund, it has to be for something major, not just replacing a dishwasher costing $500. After you have a few thousand dollars in a rainy day fund, the 401k loan can certainly serve as a 2nd tier as you described.

Holly says

I want to make sure I have this write. I have a 401K loan. My contribution are taken out pre-tax, however my loan payment is being taxed (according to the federal taxable wages section).

I called the IRS to find out if the payment was supposed to be taxed and they told me that my employer should be consistent, meaning that since the 401K contribution is being deducted pre-tax then the payment should be pre-tax also.

Harry says

The IRS agent you spoke to was mistaken or misunderstood your question. The loan payments are after tax, just like your loan payments to any other consumer loan, like a car loan or credit card loan.

Holly says

Thanks Harry. I believe the agent thought I was referring to a one time distribution vs. a loan that was not assigned a penalty.

Phil says

But the interest you pay on the 401k loan is actually a contribution to the account, and should be pre-tax. Under my payroll, it is not. This is a very small amount of money, but technically it is a new contribution and not a repayment of the loan. Right?

Harry says

Phil – The interest is not a contribution. It’s your money’s earnings, just like the earnings your money gets from mutual funds, except this time it’s getting the earnings from you.

Holly says

this is where I get a bit confused. The concept of the loan repayment, whether it be a normal consumer loan or a 401K I understand, if the payments were solely being applied to the loan but if the loan payment is increasing my 401K balance isn’t that a contribution back to the 401K? I went back to the loan documents and it doesn’t state either way if it would be considered strictly a payment to the loan or a contribution to the plan.

Harry says

See previous comment about the difference between earnings and contributions. Not everything that increases your 401k balance is a contribution.

holly says

Thanks Harry…that was very helpful.

Holly says

who governs these rules? Is it the IRS or the plan administrator? My issue now is that my employer wants to provide me with an amended W2 for 2010 and 2011 and I would be responsible for amending my taxes, but if there was not a clause in the loan documents about how the loan payment should be/have been applied should I have to file an amendment?

SMW says

@Holly: a 401(k) loan repayment does not alter contributions credited to your account each year. Ex: your $1,000 in loan payments in a year does not impact your ability to contribute up to $17,500, regardless of how much of that payment is principal or interest. Unless some portion of what you borrowed is being considered a withdrawal, or is deemed, I do not understand why your plan administrator is trying to amend W-2s. Except in case of errors, I’ve not seen amendments in W-2s regarding plan loans. BTW – it is the IRS, not the administrator who governs plan loans, and here’s a link (scroll down to the bottom): http://www.irs.gov/Retirement-Plans/Plan-Sponsor/401(k)-Resource-Guide—Plan-Sponsors—General-Distribution-Rules – Sean

Harry says

Holly – The IRS sets the rules. If your employer mistakenly took the loan payments pre-tax in previous years, then they should give you amended W-2’s showing more income and you should amend your tax return and pay the tax that you should’ve paid back then.

Josh says

You are double taxed on the interest you pay. First when you earn it and put it in, later when you take it out. That’s double tax plain and simple.

Claire says

What are you all talking about????? 401 K loan repayment is double taxed, period. It’s does not matter who contributed to your 401K: you, your employer or John Smith, it’s your pre-tax earnings and you will pay taxes when you get retired. If you borrowed loan from your 401K it’s not tax deducted, so you should pay it back not tax deducted; otherwise you repaying your loan by already tax deducted funds, and later, when you’ll retire you will pay taxes again. Does not matter what interest or no interest your plan will make, it’s your plan earnings(that is what 401K plan for…) and you will pay taxes on all that money upon retirement. Don’t compare it with car loans, mortgages and other…that is the different things… 401K is simple math: you borrowed loan from 401K and repaid it back with your money where taxes already taken, and upon retirement you will pay taxes on all 401K money again: SO YOUR LOAN AMOUNT TAXES WOULD BE PAID TWICE.

Vince Wagner says

Helo,

I appreciate your article but you leave out one major detail. You ARE double taxed on a 401k early withdrawal because UNLIKE a bank loan, inwhich you DO NOT have to claim it as adjusted gross income, you DO have to claim a 401k loan as adjusted gross income. Because of this I was put into a higher tax bracket, and subsequently paid a much higher tax rate.

As an example, IF I borrowed 50k form the bank, I WOULD NOT have to claim this as AGI, however, I actually borrowed this same amount from my 401k in 2012 and had to pay an additional 10k on 50k additional taxable income. Now ( in taking the repayment with post-tax dollars discussion off of the table entirely ) that SAME 50k ‘taxable income’ will also be ‘taxed again’ when I withdraw at retirement.

SMW says

@Vince – since I am a tax pro, I am in the “double-taxed” camp, and have posted to this forum several times, but must encourage you to make sure your taxes were filed properly, since loans from 401(k)s are not taxable. It is just borrowing from the account, and is not reported to the IRS, unless it changes to a taxable event, such as you quit or retire from your job. Then, and only then, would the retirement plan administrator send you a 1099-R showing your taxable distribution, reported also to the IRS, unless they have a continuing loan repayment provision for those who’ve separated service. If this was a mistake, amend and get your money back!

Michele says

There is an exception for loans

If a loan qualifies for this exception, you must treat it as

a nonperiodic distribution only to the extent that the loan,

when added to the outstanding balances of all your loans

from all plans of your employer (and certain related employers, defined later) exceeds the lesser of:

$50,000, or

Half the present value (but not less than $10,000) of

your nonforfeitable accrued benefit under the plan,

determined without regard to any accumulated deductible employee contributions.

You must reduce the $50,000 amount if you already

had an outstanding loan from the plan during the 1-year

period ending the day before you took out the loan. The

amount of the reduction is your highest outstanding loan

balance during that period minus the outstanding balance

on the date you took out the new loan. If this amount is

zero or less, ignore it.

Finance Whiz says

Good point. But it looks everybody is missing a point.

yes, the double taxation on 401k loan is a myth. You take out the loan, take money out (no tax), and then put it back within <5 years. No "double taxation" there – author and everybody out there gets it.

The point we are missing is the fact that the INTEREST on the 401k loan (which is paid back to the borrower) is put back into the 401k account. This in turn will become taxable on withdrawal*. Since this interest is paid with after-tax dollars, so there is a little bit of double-taxation (both at payment and at withdrawal.

*my understanding based on research. No tax advice is offered based on the above.

Harry says

I explained in previous comments #58 and #73. Double-taxed suggests you are worse off or penalized for taking a loan from the 401k account. In fact you always pay two taxes whether you borrow from your 401k account or not. Whether the two taxes are levied on “the same money” doesn’t make any difference when the amounts you pay are the same.

Ernest Nova says

Geez. This is still going on? 🙂

Part of the issue is people inherently assume that calling it double-taxed must mean it is a bad overall outcome. As the author has patiently explained, whether you took a loan and paid it back or left the money in the 401K and took a loan from somewhere else, your net financial outcome at the end is the SAME from a tax perspective.

This is because if you do not take a loan from your 401K the money left in your 401K is also growing every year (lets call it interest) and that accumulated interest will ALSO be taxed when you withdraw the money.

Contrast this to say a 10K loan you took out from a bank. Now you are making interest payments with after tax amounts. Taxed once. Fine. But wait, the 10K money you did not take out from the 401K is still there in the 401K and also still earning interest. That interest the 10K is making in the 401K WILL be taxed in the end. So the same 10K is being taxed in two places even in the case of the bank loan. See how that works?

So call it double-taxation, or two taxes, or whatever causes you to sleep at night – but if you are taking a loan you are not being penalized if you take a loan from a 401K.

If anything, for reasons outlined earlier, you may get a better interest rate than the bank, so you would be better off.

Vienes says

Bank loans are not taxed.

Ernest Nova says

I would like to know if there is a way to #hack the 401K loan process for a better outcome.

If my employer has a 4% match, so I do contribute to the 401K, but the 401K investment choices are limited and are returning around 5% per year, and I can take a loan of $50K out at 4.25% currently, what rate of return would I need on an alternate vehicle where I could reinvest that $50K for a better overall outcome.

Has someone created a spreadsheet to model this based on marginal tax rates etc.