I don’t know who started it. Suze Orman certainly helped spread it. She says that you shouldn’t borrow from your 401k (or 403b) plan because you will be double-taxed. I did a Google search and I found this by Suze Orman:

“Also, never ever borrow against your 401k plan because you will pay double taxation on the money you borrow. Because you don’t pay taxes on the money you put into a 401k, when you pay back the loan (which you must do within five years, or 15 years if used to buy a home), you pay it back with money you have paid taxes on. Then, when you retire and take the money out again, you end up paying taxes on it a second time.”

This allegation is all over the place. It is a myth because there is NO double taxation. It’s a mind trick similar to that well-known “where’s the missing dollar” puzzle.

“Three men went into a hotel. The manager said the room was $30 so each man paid $10. A while later the manager realized the room was only $25 so he sent the bellboy to the 3 guys’ room with $5. The bellboy only gave each man $1 back and kept the other $2 for himself. Now 3 men paid $9 each for the room, which is $27. Add the $2 that the bellboy kept, and that’s $29. But the 3 men paid $30 originally. Where is the other dollar?”

I was able to find a good explanation for this puzzle. The $30 number is irrelevant. The correct math is $27 – $2 = $25. It makes no sense to add $2 to the $27 because it’s already a part of the $27. The $2 should be subtracted from the $27.

Now, back to our 401k double taxation myth. The fact that the loan has to be repaid with after-tax dollars is irrelevant, just like the $30 number in the hotel puzzle. If you didn’t borrow from the 401k plan but you borrowed from a bank, you’d have to pay the bank back with after-tax dollars as well. If you didn’t borrow from your 401k plan but you dipped into your own savings, you have to replace those savings with after-tax dollars too.

What it really means is that a 401k loan isn’t tax-deductible, just like any other consumer loan except a mortgage or a HELOC. Instead of saying you will be double taxed, they should just say that a 401k loan is not tax-deductible, plain and simple.

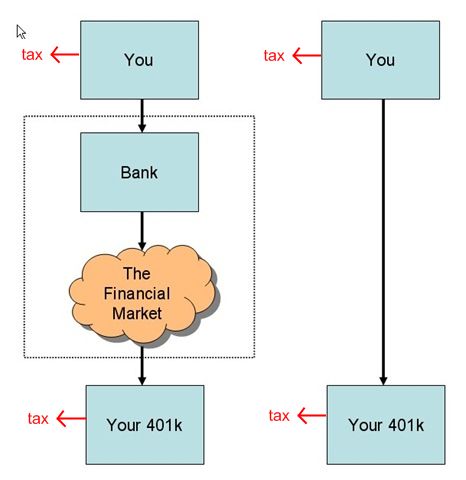

I have had this post in draft for a long time but Jonathan at My Money Blog beat me to it recently with two posts trying to debunk this myth (post 1, post 2). After so much discussion some folks are still not convinced. I think this issue is best illustrated by the chart below:

The left-hand side represents a typical consumer loan, like a car loan. The arrows represent “borrows from” and “pays back to.” You borrow from a bank. The bank borrows from the financial market. Your 401k invests in the financial market. I think we all agree there is no double taxation in this case. You pay after-tax dollars to the bank for both principal and interest. Your 401k earns from the financial market but the earnings are taxed when you withdraw from your 401k.

The right-hand side represents a 401k loan. Now, if you put an imaginary box in the middle on the right-hand side, it becomes exactly the same as the left-hand side. You borrow from an imaginary middleman and pay after-tax dollars for both principal and interest. This imaginary middleman then borrows from your 401k and passes the same dollars it receives from you to your 401k.

All of a sudden you are not double taxed anymore because it looks exactly the same as a car loan on the left-hand side. Because this middleman is only imaginary, it follows that you are not double taxed with a 401k loan, whether for the principal repayments or for the interest.

Whether or not you are mathematically better off with a 401k loan depends on how these three rates play out:

- Your alternative after-tax interest rate from a bank loan

- What bond funds in your 401k are expected to earn from the market

- The interest rate on your 401k loan

Suppose your alternative after-tax interest rate from a bank loan is 7% and the interest rate on your 401k loan is 5%. If you borrow from your 401k, you save 2% in interest cost in after-tax dollars. But also suppose the bond funds in your 401k are expected to earn 8%. If you borrow from it, your 401k plan can only earn 5% from you. So your 401k plan account is 3% worse off in before-tax dollars. Between 2% better off after tax and 3% worse off before tax, it can become a wash.

The reason you have to compare it with what bond funds can earn is that the 401k loan payments are not subject to market fluctuation. If you do borrow from your 401k, increase your allocation to stocks for what’s left in the plan.

While there is no double taxation on a 401k loan, there are other negatives in borrowing from your 401k plan. The biggest negative is that if you change jobs (voluntarily or involuntarily), you sometimes have to repay the outstanding balance of the loan within a short period of time, like 60 days. Some plans actually allow you to continue the loan repayment even after you terminate employment, but not all plans do that.

If you really need cash and you don’t have any other source except your 401k, taking out a 401k loan is at least better than taking a hardship withdrawal from the plan. Just be absolutely sure you will be able to repay the loan and you won’t change jobs before paying off the loan. And don’t reduce your regular 401k contributions while you are paying off the loan.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Pinyo says

Excellent discussion of double taxation and 401k. I also like how you threw in the bell boy puzzle, that threw me off too.

Anyway, I thought Jonathan made a valid point after I read his article and in fact there is NO double taxation. However, there are still plenty negative associated with taking a 401k loan. Another potential pitfall is that some employers do not allow contribution while you have an active loan. This essentially wipe out your ability to get the matching contribution.

Lastly, you pay interest to yourself when borrowing from 401k so the comparison is not relevant.

CapinWinky says

The point about not being able to take the employer match is the biggest negative I can see, A standard employer match is 50% match up to 6% of your salary, which effectively increases your salary by 3%. You could be missing out on thousands of dollars if your plan doesn’t allow the match if you have an outstanding loan.

Rob says

I have yet to see a 401k plan that stopped allowing contributions with a loan outstanding despite being talked about on all the “Don’t borrow from your 401k! articles” but I’m sure they are out there somewhere.

Jim says

There is one thing I’m not sure about. The interest you pay back is after-tax money ($10,000.00 loan, total payback $13,750.00). You’ve never paid any income tax on the $10,000.00, but you already paid tax on the $3,750.00. Is the $3,750.00 considered after-tax funds? If it isn’t, then work the interest money be taxed again when I make my withdrawal?

Harry Sit says

Jim – The interest you pay on any other loan (car, credit card) is with after-tax dollars. The earnings your traditional 401k make from any other sources will be taxable at the time of withdrawal. The two taxes are unrelated. You have to pay these two taxes anyway if you didn’t borrow from your 401k.

Kim says

The interest you pay is still taxed twice. If I repay a car loan, for example, I am never taxed again on the car. But if I repay a 401k loan to buy stock I am taxed on that stock at withdrawl time (and not just on the earnings of that stock but on the original interest I used to buy the stock). That is why people talk about double taxation. It is the double taxation of the interest. Of course you are not double taxed on the principal of the loan because you didn’t originally pay tax on that.

Kim says

There is double taxation on the interest. Do not get confused by the argument above which only applies to the loan principal! Even the blog post cited above admits that there is double taxation on the interest.

Harry Sit says

Kim – If you repay a car loan, you still pay tax on the “interest” earned by the money that stayed in the 401k. By not removing the money from the 401k, it earns extra interest. You still pay two taxes: once on the interest you paid to the car loan, again on the interest the money that otherwise would’ve been removed earned in the 401k plan. Either way you are going to pay two taxes.

Testing Grounds says

Ok, no double taxation except on the interest earned on your loan to yourself, which to me is better than paying the bank interest. MOOOOOOOOOSSSSTTTT IMPORTANT!!!!! SELL HIGH!!!!

Take out a loan right before a crash like now. The highest market has ever been. Then as you contribute back as long as you are buying a lower share price than you sold to get the loan. You will end up with more shares than if you wouldn’t have taken the loan. Thereby increasing your 401K shares by selling high and buying back in low. YOU CAN’T TIME THE MARKET–blah blah blah You can learn from historical data and use it to your advantage. Also, save up so you can lump sum pay off loan when the market is 20 to 30 percent in the hole. Simple sell high buy low

jim s says

Agreed….I just retired and borrowed from my 401k several times over the last 30 years. No matter where I borrowed money (except home equity), it was always paid with after tax dollars. I always found it easy to think its better to pay myself the interest, rather than any other third party. Only caveat….never reduced my 401k contribution while paying back the loan. Otherwise, means, I could not afford the loan.

JOHN CURTIS says

The explanation here is far too complicated. To make it simple think of it this way:

Borrow $50,000 from your 401k, and put this tax free money in a back pocket. Now think of that money and repeat, “This money has never been taxed as income, and it never will be”.

When you repay the loan with after tax dollars through payroll deduction is where that advantage is cancelled out.

If you repay the loan directly from the tax free money you borrowed, it’s taxed once at withdrawal just as before, and the money you earn is taxed as income, just as always.

No tax difference.

If you repay the loan with money you’re earned it’s taxed as income, just as always. And the money you borrowed is never taxed.

There is no tax advantage.

John says

You’re all just wrong. You repay the loan and interest with after-tax dollars. You are taxed again when those same dollars are distributed via a withdrawal. 20 years in the 401k business, I know what I’m doing. Couple the double taxation with the opportunity cost and 401k loans are one of the worst financial decisions you can make.

Kerry says

John, you are missing the point. Sure, repayments are double taxed. But you are ignoring that the original loan out of the plan was NEVER TAXED. So you just went and collected a bunch of TAX FREE money! If you had earned this money at your job it would have been taxed, but instead you sheltered it in the retirement account and then got it out without ever paying a dime in taxes.

You then even out this gain when you repay it (after tax, cancelling out the incredible tax free event you just had). So now you are back to where you were in the first place. Then when you withdrawal in retirement it is taxed, as it always was supposed to be.

Essentially your “tax scorecard” goes +1, -1, -1. You are only considering the last two -1 entries when you say you are being double taxed. Don’t forget about the original +1 where you got a lump sum cash payment with no taxes.

Danimal says

401k loan principal isn’t double taxed. A T Chart shows that. The interest is. Interest is paid back with after tax dollars and introduces new money into the account. The interest paid back was taxed before paid back and taxed when withdrawn.

indexfundfan says

Good explanation. I always had trouble trying to convince people of this, especially when they say “Suze said this”. Sigh.

Patty says

This still makes no sense! The money in the 401k is my money. Went in untaxed…I borrow it and pay it with already taxed money that I earned.. they should not tax that amount again in the future! What a crock !

Harry Sit says

If it’s not taxed everybody would take their 401k balance out as a loan and then immediately pay it back. Boom, taxes in the future are eliminated!

Harry Sit says

@Pinyo – “Another potential pitfall is that some employers do not allow contribution while you have an active loan. This essentially wipe out your ability to get the matching contribution.” I’ve never heard of that although it has been several years since I last worked in the employee benefits field. When you take a hardship withdrawal, you are required to suspend the contribution for 12 months. There is no such requirement for taking a loan. Making the loan payments while actively contributing to a 401k is allowed. I don’t see why some employers wouldn’t allow it. Do you know for sure some employers don’t allow it or did you confuse it with hardship withdrawals? Some employees voluntarily suspend or reduce their 401k contributions while they are paying off the loan (bad idea). But that’s not the fault of a 401k loan. If they borrowed from a bank, they may find it hard on the cash flow and suspend or reduce the 401k contributions too.

JoeTaxpayer says

401(k) loans can go either way. I agree that most companies do not stop new deposits while loans are paid off. Recent Kiplinger article cites how much the loan ‘costs you’ but assumed no deposits. The risk in case of job loss is well noted. But the ‘double taxation’ issue is simply wrong as you state. A 401(k) loan can be good or bad but usually it’s clear only in hindsite. Spouse is out of work, bills (CC) got racked up a bit, now spouse is back to work. Using that loan to knock off the high interest CC debt, while the spouse also starts their own 401 account and are both spending responsibly…… you get the idea. There are just too many stories of 401(k) loans gone bad, cards charged up again, etc, in the press.

I used such a loan as part of my home refinance plan, reducing the interest and term of the mortgage, dropping from a jumbo to a conforming loan. The payback for that exercise was huge, despite all the warnings.

Joe

federal plus loan says

When we start out work for the first time, we believe that we would stay with the same company until retirement and have a comfortable retirement life with all the money we have saved in our 401k account. Unfortunately this does not happen.

Peter C, Krieger says

Here’s a thought:

it is late March, you are filing your taxes and your preparer asks if you have made any IRA contributions, as doing so would reduce your tax liability.

You respond ‘No, and I don’t have any spare cash!’

I am certain this has happened to many people more than once.

Now if one has the ability to borrow from their 401K plan, why not do so and deposit the loan proceeds into an IRA (either Traditional or Roth)?

You get the tax deduction, and you pay yourself the interest.

At the end of the day, if you use BOTH and IRA and a 401K to prepare for retirement, your overall retirement stash is unaffected.

If a worker has $25,000 in an IRA, and $30,000 in a 401K, borrowing $5000 from the IRA reduces the amount in the account to $25,000.

However, the IRA grows from $25,000 to $30,000 leaving you no better off than when you started. Of course there is the question of how those assets will grow in the IRA, versus the 401K, but this model assumes (roughly) equivalent choices.

There are definite drawbacks, such as loan payments reducing your paycheck (thus further reducing your ability to contribute to the IRA) and the possibility of needing to pay back the loan in a hurry (in case your job disappears).

Furthermore, my own perspective on 401K borrowing is that one should take into account the ‘replenishment rate’ or the time it would take principal, interest, new contributions and net gains to restore your account to where it was before the loan.

But 401K borrowing needn’t be demonized, as long as the money is used productively.

Bill says

i know it is 8 years after the original post, but here goes…

You wouldnt get a tax deduction with a roth IRA.

and with a trad IRA you save taxes now, maybe 25%, and perhaps pay 15% in retirment when you collect it. a net saving of 10%. which is why I beleive there is a 10% early withdrawl penalty so you cannot cheat the government, you have to wait until 59.5 y.o.

i borrowed from my 401k to refi into a 15 year mortgage at an interest rate under 3%, saving an estimated $50k. with the loan modeling i did i estimated the 35k loan @4.5% interest paid back to me, would cost about $12k on losing out on market capitolization. so, it was a good investment for me. netting $38k.

borrowing from your 401k can be a wise thing to do if you understand all the factors. i should also mention that the earlier you borrow in your working career, the worse idea it may be. im middle aged basically.

ajk says

Here is my version:

Put money into 401(k) – not taxed; take money out as loan – not taxed; put the same money back into 401(k) to repay loan – not taxed; take money out at retirement – taxed once and only once.

If you use other money to pay back the loan, it is only slightly more complicated.

Put money into 401(k) – not taxed – and also put money into savings – taxed; take money out of 401(k) as loan – not taxed; pay back loan with savings – not taxed; take money out at retirement – savings taxed for second time. However, the money taken out of the 401(k) was never taxed. There were two sets of money; one was taxed twice and the other was never taxed.

Now here is the real trick. Given that I put money into the 401(k), took it out as a loan, and paid it back, can you tell if I used method one or method two? Does it matter if I used the borrowed money or after tax money to pay it back? No, there is no difference. Each set of money , 401(k) and savings, is effectively taxed once.

GB says

But wouldn’t it be better to take full withdrawal rather than a loan for 1st time home purchase? the 10% penalty is waived by the IRS. As your equity grows in the first home it can be transferred into the next home without paying the gain on sale (unless you made a ridiculously great gain). Plus, if the expectation is that by the time you retire, you’re making more money, you’re probably in a higher tax bracket at 59 1/2 compared to lets say 35. So you’re taking home less at retirement.

These comments are just in consideration of using the funds to buy a home rather than to pay down debt.

Harry Sit says

GB – Actually that’s not true. Your house does not know how much down payment you put in. It will increase in value according to real estate market and generate the same amount of tax free capital gains no matter how much down payment you put in. The extra down payment only reduces your mortgage loan interest cost. In essence you are earning only the loan interest rate. Because a 401k invested in mutual funds is expected to earn a higher return than the loan interest rate, it’s not a good idea to take a full withdrawal from the 401k plan for first time home purchase.

Jan says

This is not necessarily right. The extra down payment from 401k loan will reduce your interest more than the amount you calculated based on an annual loan interest. The earlier the extra payment is made to the principal, the more you save on the mortgage interest. This is because you pay a lot more interest at the beginning of the mortgage than toward the end of the mortgage. Plus, you’d have to pay tax too when you withdraw from 401k.

SMW says

“Also, never ever borrow against your 401k plan because you will pay double taxation on the money you borrow. Because you don’t pay taxes on the money you put into a 401k, when you pay back the loan (which you must do within five years, or 15 years if used to buy a home), you pay it back with money you have paid taxes on. Then, when you retire and take the money out again, you end up paying taxes on it a second time.”

This statement, as posted, is inaccurate. Suze Orman is confusing people with a broad statement that doesn’t portray the whole picture. The loan is borrowed at the same [tax] rate it is re-contributed. The part that is actually double taxed is the interest. This amount does act as a contribution, and rebuild the account with more asset than was removed, but does so after tax, and builds no basis. If $1,000 is borrowed, $1,060 is re-contributed (re-paid). The $60 “interest” grows tax-deferred, and is taxed upon withdrawal. This is such a small effect over time as to be negligible. If the IRS allowed that $60 to become basis in the qualified retirement account, then this would not be double taxed. However, since there are plans out there (401(k)s, etc.) that allow after tax money to be contributed, and to be counted as basis so as not to be double taxed, the IRS is, through tax policy, discouraging people to draw on their retirement accounts early. People who borrow are being forced to add a little more to their accounts through this interest “contribution.”

MWS says

Question. I have a 403b loan that I am paying off over 5 years. The plan still allows me to make contributions which I am doing, and the interest rate of the loan is variable averaging about 6% over the past 2.5 years. These interest payments go back into my 403b plan as well, basically paying myself. The value of the loan ($10,000) was not removed from my account, but rather placed in a Money Market fund as collateral in case of default or leaving the company. I still earn interest in the 403b on this $10,000 balance, the average being about 2.5% over the last 2.5 years. The money I am using to pay back this loan is in an online savings account that has averaged about 4% over the last 2.5 years.

Am I missing something here, or is this $10,000 403b loan earning me the combined interest detailed above, 6% + 2.5% + 4% (minus taxes on this one) = approx 10%?

In the bad market of the last year, the MM fund has been nice on its own compared to my various stock funds.

SMW says

Money recontributed, and paid back with “interest,” into a qualified retirement account can actually provide much greater investment valuation potential when the overall market is depressed. Repurchasing shares, or units, at a lower value will net you an incredible increase in the retirement account valuation once the market rebounds. Not to mention you did not cease regular pre-tax deferrals. (Using rounded numbers for simplicity) Your $100 repayment after tax plus your $100 pre-tax deferral are buying shares back at a 10-20% discount, or more. This is the favorable side of dollar cost averaging. Interest was placed in quotes because retirement funds are not allowed, by law, to call it contributions, but that’s what it really is. Your amount set aside that is still earning interest is not only performing better than the market right now, but (case 1) your fund does not distribute the money to you like mine (case 2) does, so that’s another benefit to you. Some will argue that the fund in case 2 is actually lending money from their general pool, and purchasing bonds or other securities to hedge against default, but the effect is the same to the company, so this argument overcomplicates the issue. Put another way: most companies that send you a loan check do not allow you earn the interest on the money placed in a money market account. How much you’re earning, in terms of interest, is not able to be easily estimated, because increased retirement fund valuation is not technically interest. If the market (your aggregate investment allocation)after one year skyrockets to 20% above the previous year – you earned 3% on $10,000 (out of market) plus the amount of shares repurchased during that one year multiplied by 1.06, plus the increased valuation of whatever funds were not removed from the fund.

(Sorry, the paste didn’t work perfectly)

Account value, Jan 1, 2009 $ 20,000

Dollars per share $ 5.00

Number of shares 4,000

Loan $ 10,000

Dollars per share $ 5.00

Shares converted to MM 2,000

Original # of shares 4,000

Shares remaining in acct 2,000

Dollars per share $ 5.00

Value in 403(b) market-linked acct $10,000.00

Acct performance w/loan Value Jan 1, 2009

Amt in 403(b) Money Market $10,000

End of year balance (subtract pmts) $7,692

Average daily balance (ADB) $ 24.24

Average monthly balance $ 737.15

$ 265.37

Value in 403(b) MM acct Jan 1, 2009 $7,956.98

Dollars per share Dec. 31

$ 5.00

Market increase, Dec. 31, 2008 20%

Dollars per share, Jan. 1, 2009 $ 6.00

Payroll deferrals for the year $ 1,200

Shares purchased by deferral @$5 240

Loan repayment amount $192.37

One year’s payments (192.37×12) $2,308.39

Shares repurchased @ $5 461.68

Shares in 403(b) market-linked acct 2,000

Total shares 2,701.68

Value in 403(b) market-linked acct $ 16,210

Total $24,167

Acct performance w/o loan

Value in 403(b) market-linked acct $ 20,000

Dollars per share Dec. 31 $ 5.00

Number of shares 4,000

Payroll deferrals for the year $ 1,200

Shares purchased by deferral @$5 240

Total shares 4,240

Market increase, Dec. 31, 2008 20%

Dollars per share, Jan. 1, 2009 $ 6.00

Total value $ 25,440

A few assumptions were made: 1) The 403(b) is originally a market-linked mutual/institutional fund/account; 2) Interest was posted from the MM acct to the 403(b) as average month accrual; 3) Excel’s PMT function was used to calculate an end-of-period payment schedule; 4) the market fluctuated evenly and consistently enough to yield no increase or decrease (flat) until the last day of the year’s huge increase – not likely, but useful for demonstration purposes; 5) no fees were included – which there always are, so be cautious of these.

Barring any errors in actual calculation on my part, the example above isn’t exactly ahead at the end of the year. But what’s being done with the other $10K in your pocket? Living expenses so that you can defer more annually? Funding business ventures or other investment opportunities? Paying off 28% interest rate credit cards? Really, all of these discussions boil down to “What does your opportunity cost analysis tell you?” These are very individual decisions.

Lastly, to answer the question about taking the money from another investment to pay for this is a wash, unless you consider the reduced balance in that account with interest earning potential. What financial planners will say is that the retirement fund repayment usually comes from your paycheck, so you end up tightening the belt a little – it’s money that once in the bank would’ve been spent anyways. Some will use this as a strategy to keep their paychecks lower, so that themselves or their spouse will not have as much cash to burn through. Kind of a wild and risky sheltering plan, though. SMW

Frank Rizzo says

Suze is wrong, but you’re wrong too when you say “there is NO double taxation.” The accurate statement is that principal is single-taxed and interest is double-taxed.

Now you can make the argument that a 401(k) loan is better than other loans because double-taxed interest that you get to keep is better than single-taxed interest that you have to give to someone else, but that doesn’t change the fact that it is in fact taxed twice.

Harry Sit says

Frank – Read the post and look at the picture again. If the interest rate is the same, a 401k plan loan is *identical* to a non-deductible consumer loan like a car loan or a credit card. If you say the interest on a 401k loan is double-taxed, then the interest on a car loan is also double-taxed. If you say the interest on a car loan is not double-taxed, then the interest on a 401k loan is also not double-taxed. I’ve never heard anybody saying the interest on a car loan is double-taxed.

SMW says

The reason you’ve not heard people say that a car loan is double-taxed is because it’s not. Double-taxation is the instance in which the same individual is taxed twice on the same money in the same asset pool. This most often occurs in “C” corporation dividend disbursements and when the C corp is sold. I would actually argue that double-taxation does not occur in 100% of the dividend situations either, because the tax rates on corporate net incomes (EBIT) and individual dividends are often much lower than individual marginal rates. I would also argue that double-taxation on recontributions to a retirement account loans is the single most pure form of the imposition of two or more taxes on the same money that most people will experience. Double-taxation is often not referenced concerning retirement accounts, except for debates such as this. Some of the scenarios I’ve debated are that if someone is a shareholder in a bank, and also has a loan with that bank, that car loan interest is double- or triple-taxed. The ownership interests are segregated in instances such as these, however, so double-taxation has not occurred. Also, all members in a credit union are shareholders, so wouldn’t this constitute higher taxation to the individual equity owner? One is a debt collateralized by an asset, the other is a diluted ownership pool only somewhat affected by the member’s loan. Again, two separate interests, two separate investments, whereas the retirement account is solely distributing and receiving borrowed and repaid monies. If anyone could offer a compelling argument that a car loan’s, or similar lending situation, interest is double-taxed, I’d like to hear it. While this is a fun debate, one of the points I’d like to make is that the opportunity costs are more important if all things are considered equal (or close to it). We’ve run simulations that show the comparisons between taking a bank loan versus a 401(k) loan, and came to the conclusions that: 1) even considering double-taxation, if the interest rates of both loans are identical, the net cash available ends up being identical, because the interest recontributed to the 401(k) grows tax-deferred; 2)although I said these debates are fun, the serious component to the discussion is that disinformation such as Suze Orman’s, along with highly publicized blanket statements that are possibly detrimental to a certain percentage of the viewership, needs to be combated by those of us who are most interested in promulgating information that is accurate per situation. Personal financial planning is better individualized rather than oversimplified for mass consumption.

“The accurate statement is that principal is single-taxed and interest is double-taxed.”

Frank is correct, and much more concise than I. – SMW

Harry Sit says

SMW – Thank you for the detailed comments. I think by this time we all agree that the cash flow for a 401(k) loan is identical to that of a car loan. In either case there will be two taxes: (1) tax on income earned from employment, which provides the source for loan repayments; (2) tax on income earned by the 401(k) regardless whether it’s earned from the financial market or from loan repayments. Like you said “the net cash available ends up being identical.” So there are these two taxes. If you link them directly with no middleman in between, you call it double-taxed. If you separate them and put a bank in the middle, you call it two taxes, but not double-taxed. It goes down to the definition of double-taxation. To me, double-taxation implies a disadvantage. As long as there are going to be the same two taxes anyway, I don’t really mind what you call them, double-taxed, or two taxes.

SMW says

I believe TFB is signaling that this dead horse has received quite the thrashing. Many sites are not nearly as professional, so I appreciate that from everyone. Good discussion, all. – SMW

Joe says

Good diagram.

Negating the taxes… Separating the loan from the interest…

Assume you can take a 15k 401K loan out for 0%.

Break the loan into 24 chunks and use it to pay the loan back.

All done.

Easy way to see no double tax.

Use your paycheck to pay that back. Now you start feeling you’re using after tax money to pay it back. It’s a mind game.

double tax on the interest? yes. you’re putting (non borrowed) money into you’re 401k on top of your borrowed amount which will get taxed again when you take it out.

Although interested compounded as a result of that interest payment again falls into the single tax bucket.

Still, take that double taxed interest % and put it into you CC interest instead, you’ll see none of it.

Living the numbers… I took a 2 year loan out in Jan, when news about the recession hit. Used it to pay off all CC. Not necessary, but seemed like the right thing to do.

Now, I just quickly buy back in 401K stock over the next 2 years (401K repayment + Continued contribution) when stocks are lowest.

First year is done. Ride out the bear market next year with more contributions. (Maybe I should have taken out a 3 year loan)

Works for me. I’ll live with the double taxes on the interest (10K @ 6% @ 2yr = ~1200).

Consider middle class family with 2+ kids and a house, after tax income really isn’t after tax. After your deductions, rebates and stimulus, you’re income is practically tax free anyways.

When the market is heading in the other direction, most of Suze’s estimates and projections about how much you could have gotten goes down the drain.

Had I (instead) pop that loan in a reverse index fund back in Jan, that would have been prime. Another shoulda-coulda.

kevin says

I will not go into a long discussion on the double taxation issue but the interest rate comparisons are somewhat irrelevant because you are paying the interest to yourself. The interest that is applied to the 401K loan is paid back to you so it is not really a loan in the traditional sense because you are both borrower and loaner. Borrowing against your 401K makes more sense than borrowing from a bank because principal and interest all go back to you so you are actually able to put more money into the 401K than when you opened it. The Ideal scenario is to use the 401K “loan” (for lack of better terminology) to pay off debt (e.g., high interest credit cards, etc.) — you save yourself money, pay yourself back at a lower rate and you end up with more money for your retirement (at least that was the hope in a stable market) while minimizing your present expenses. How can that be imprudent or wrong? Keep in mind that Suze Orman’s views are biased as she receives monies from many of the same insitutions that created our present financial crisis for which she should receive some of the credit.

SageGriot says

This so-called “interest” being paid on 401k “loans” is also a misnomer, IMO. If paying interest to oneself is good, wouldn’t a higher interest rate be better? I believe the true cost of a 401k loan has nothing to do with the interest rate and everything to do with the oppourtunity cost. It is important to remember the loan proceeds come from liquidation of assets in the plan (so it really NOT a loan). If the plan sells stock that doubles in value while you are paying back the loan, your true cost is the difference between the stock which would have doubled in value if it had not been liquidated and whatever avererge cost you pay as payments are applied to the account. This is why I always take 401k loans from the cash allocation in my 401k which fixes my oppourtunity cost at whatever fixed rate that account is earning (usually under 5%)

The Real Buff says

Sage,

I agree with your assessment of the lost opportunity cost. Also, remember that 401k’s are limited, and only about 1/3 of the plans even offer a fixed income option (and equity index funds don’t count as fixed income). The mutual fund industry is going to fight hard to keep it that way, but hopefully there will be some changes. By the way, is Dave Ramsey still assuring everyone they can get 12% in a “good” mutual fund? There is another piker conveniently neglecting to talk about ACTUAL instead of AVERAGE. I digress…

The 401k should never be used as a borrowing tool. Although, really what you are doing is saying, “Uncle Sam, I need some of that money back that I gave to you to hold, and I understand that I will have to pay you back plus interest out of the money that is left after I pay you those taxes.” Many of you are focusing on this whole “double taxation” debate, and you are missing the point. Taking money from your 401k is just plain dumb, with very few exceptions (i.e. you have no options left). It could be argued that just having and contributing to a 401k is just plain dumb, unless you have good match and contribute up to it but no more. You are not really borrowing anything.

I just generally stay away from any vehicle that has an Internal Revenue Code. The government has clearly demonstrated its inability to manage anything to do with money and anything that has an IRC number was probably not created with MY best interest in mind. If anything, I’d be putting money into a ROTH 401 (before they take it away), but even that is questionable and not too many companies offer it anyway. Does anyone here actually believe they will be in a lower tax bracket at retirement? And who do you think is going to be enlisted to help save Social Security, Medicare, and pay for all this money being created to “save” the economy? I worry about the baby boomers, but also my generation.

Ask yourself this question… “Do you think that the government would ever pass legislation that would cap the tax rate someone would pay on the distribution of their 401k? For instance, you are in a 25% bracket now, but you would know you would never be paying more than 30% on the distribution? Why do you think the government would or would not do this?

*And just a disclaimer here, I think Bush was a puppet and Obama is realizing he is a puppet too. I am not talking about left vs right here.

kc says

ajk is right except for one point. You do not just pay back the money into your 401K interest free so really the scenario is:

Put money into 401(k) – not taxed; take money out as loan – not taxed; put the same money back into 401(k) to repay loan – not taxed; take money out at retirement – taxed once and only once PLUS put the interest owed on the loan back into 401K from your savings which has already been taxed and will be taxed again when you eventually withdrawl it from your 401K. Hence the double taxation.

Shawn says

It’s true that you are not double taxed on the principal repaid (you take it out and you put it back in with no tax impact on either end). To possibly clarify and agree with kc above, there is double taxation on the interest you pay yourself back with. That is essentially an additional contribution to your 401k account. It is made with after tax dollars, and it is taxed when taken out. Still, that is only a fraction of the amount borrowed and a relatively small price to pay for the flexibility.

Geoff says

What it comes down to on the double taxed interest is that you are paying taxes on the interest you have paid back on a 401k loan because you have the interest you have paid whereas if you got a loan from a bank, they would have the interest, not you… therefore, really the only problem with a 401k loan is the potential losing of the job or the loss in market gain of the money current invested in the market.

Karen says

If a person is paying 22 to 30% on a credit card and can borrow the money from the 401K at 6%, that is a savings of 16 to 24% . The payments would be from after tax dollars also. On $50,000, that is a savings of approx. $22,954 to 36,304 over 5 years. Which could be used to pay the loan off faster or contribute to the 401k if allowed. This takes a 30 year loan and converts to 5 years. I think that makes 100% sense!

Josh schneider says

I agree on the priciple payments, but aren’t you still being double taxed on the interest? I am paying interest on the loan, in theory to myself. I am paying that interest with post tax dollars, it is applied to my 401k account balance, then when i withdraw it during retirement, i pay taxes on it again. This is not the same with a bank loan. With a bank loan, i never get the interest back therefore i never pay taxes on it after i initially earn the money.

Geoff says

Josh,

Yes you would be double taxed on interest but realize if you are paying the interest to the bank, they will be getting the money (and perhaps have to pay taxes on it) whereas if you are paying the interest to yourself, you will be getting it and of course have to pay taxes on it.

Harry Sit says

Josh and Geoff – As I tried to show with the picture and in the post, if you pay interest to a bank and not take a 401k loan, your 401k money will earn some money from the financial market and you will have to pay tax on such earnings. You are not paying any more tax when you have a 401k loan versus having a non-deductible bank loan.

Reggie says

Good discussion. Clarified it for me. I have read the explanations of the hotel puzzle, but I think my explanation is easier than any I have seen:

Each man pays $25/3 for the room and $2/3 to the bellboy. $27. Its as simple as that.

Nathan says

Re: double-taxation of interest paid on 401(k) loans

According to the plan administrator at my employer, interest payments on 401(k) loans are deducted pre-tax (since they are considered “new” contributions to the account) and principal payments are deducted post-tax. I don’t know if this is based on federal rules or if it is just the policy of my plan administrator. Obviously, YMMV.

In any case, thanks very much to the original poster for this insightful article.

Phil D says

@Nathan

Very, very interesting. I just contacted my Account Rep to see if this is possible.

As for the naysayers – failing some spectacular market fluctuations, I don’t see how a loan from a retirement account can be detrimental. If you have a good use for that money, such as paying down debt or a worthwhile investment, a retirement account appears to be the ideal way to fund those expenses. The drawback here is that the funds you borrow lose the potential to gain value. However, taking out a traditional loan makes it CERTAIN that your money will lose value (i.e. you WILL pay interest on that money).

I’d rather take a chance at forgoing a few hundred dollars in gains instead of having a 100% chance to PAY a few hundred dollars in interest.

Josh B says

I puzzled over this for a while and found it easier to understand if the problem is simplified a bit.

Consider a $5,000 401k loan is taken out at 0%.

The since the interest of the loan is 0%, the loan can be paid off entirely with the principle that was loaned out. The loan is not reported as income (of course). No taxes are paid on principle loan amount.. Taxes are paid on the principle loan amount only when it is withdrawn from the 401k (after retirement).

As others have mentioned, the interest is another story, that is “extra” money that is paid with after tax dollars. The interest is again taxed when it’s withdrawn.

Tim D says

Hmmm… paying myself 5% versus the rest of my 401K losing 1/2 it’s value with the recent market fluctuations? I’ll take the loan from my 401K.

EDV says

Everybody considers the 401k money growing but what happens when the market goes down? I have seen 401k loosing money in the pass couple of years. If you are using the money in some other way and paying it back to you, it is better than loosing it.

SMW says

See my comment #2: http://thefinancebuff.com/401k-loan-double-taxation-myth.html#comment-862. You’re right – that is a valid point, one which those on this forum will recognize as opportunity cost. The opportunity that is bypassed as a result of borrowing from a retirement plan in a recession is actually favorable, even if you earned nothing on that money (because it’s not generating income on it’s own – you have, however, gained the right to contribute additional, albeit taxable, money to the plan). The opportunity “missed” of losing money – I know, a double negative – was a beneficial one. A huge caveat here is that if you did not pay that money back, so it could earn interest naturally on the huge upturn in 2009, then that was an opportunity lost, this time detrimentally, so it might have been a zero sum, or close to it, game.

Monjon says

You have to pay tax on any income you use to buy an object. Paying back ‘pre-tax dollars’ with tax dollars simply makes you pay income tax on the object you borrowed the money for. You’d pay it that way if you have a bank loan, a mother-in-law loan, a home equity line of credit, or a 401(k) loan.

Period. End of story.

SMW says

Unfortunately, that argument is nonsensical. The reality is actually that when the income is earned, income tax is paid. What occurs with double taxation of loan interest recontributed to a retirement plan is that money to pay the interest back is coming “out-of-pocket” as we say in the retirement plan industry. It has already been taxed once, to that individual. When that interest is placed inside of the plan, for instance a 401(k), which is money that has not been taxed, it will therefore be taxed at your ordinary tax rate upon withdrawal. Since that small pocket of money (remember it was already taxed once) is indistinguishable from the other plan assets, upon withdrawal it will be taxed, as I said, at your ordinary rate. It would be possible, but unlikely, that a 401(k) could have 10% of its balance comprised of already-taxed loan interest, and 90% from untaxed earnings and contributions, but it’ll work for this example: upon withdrawal, the 10% already taxed and the 90% untaxed will be taxed indiscriminately, at what is often a higher ordinary tax rate than one pays while working because of fewer write-offs at retirement age. Retirement plan loan interest double taxation is a fact, and not a myth. In the tax accounting realm it is known as one of the social economic policies of tax law: the IRS is going to let you use money in your retirement plan prior to retirement age, but they’re going to offer a slight disincentive for you to do so: they get more tax money from you because of it.

Check out Line 15b of your Form 1040 and realize: if any money that has already been taxed (401(k) loan interest) winds up on this line in retirement (which it will if you paid loan interest into a retirement plan), you’re a victim of double taxation. Take it from a tax accountant that this is no myth. By the way, all of the examples of bellboys who can’t count, credit union, bank and mother-in-law loans have nothing to do with taxation, and certainly not double taxation. I realize you’re trying to explain the overall effect of a group of people and companies, but taxation is very individualized to a person, family or business entity, and therefore the aforementioned examples and explanations are irrelevant and misleading. A bank loan does not get taxed again (just once upon repayment, amortized from your paycheck). A mother-in-law loan does not get taxed again. A home equity line of credit does not get taxed again, and in fact is tax advantaged, giving you additional write-offs. Not that that’s a great reason to hyper leverage your potentially largest asset, but these decisions are unique to the individual. Speaking of decisions: I really hope that those of you drawing the useless diagrams, giving inept examples, and claiming to (inaccurately) be experts (“Period. End of Story.”) on subjects like these are not using this misinformation to steer clients, friends and family the wrong way. What has been bandied about has been opinion, but opinion has no place in cut-and-dried matters of tax and retirement law such as these. Not that subjects like these are all that serious, but it can evidence a personality trait of continued misinformed misdirection, which could eventually lead to a cause of action from one or some of those you have advised. Is your Errors & Omissions insurance up to date?

Harry Sit says

@SMW – I thought we settled it two years ago in comments #14-17. With regard to loan interest, you call it double-taxed. I call it two taxes, unrelated to each other. As long as people understand there are these two taxes whether they borrow from a 401k or borrow from a bank for a car loan, I don’t mind what it’s called. After all, double is two, two is double.

SMW says

Sorry, TFB. The comment was actually to Monjon who replied on the same date as my recent post, which was a reply to EDV. Double taxation is the correct technical term, not something I made up, and it is directly related: income taxed once, then taxed again in retirement, and in the same retirement plan. The beating of the dead horse was just for clarification – prob got a little carried away. I hope it wasn’t rude. And just because I can’t help it: you are not taxed two times on loans from banking institutions, and other individuals. Only on retirement plan loans, i.e.: 401(k), 403(b), 457(b) plans. And if you withdraw early from the 401(k) and/or 403(b), there’s not only a double tax on the interest portion, but also a 10% Sec. 72(t) penalty on both the taxed interest and the untaxed funds, but I digress.

Harry Sit says

@SMW – The interest you pay into the plan is replacing the interest the plan account otherwise would earn from the financial market. If you get a loan from a bank, you are also taxed twice: once on the income earned to pay interest on the loan; again on the money the plan account earns from the financial market because the plan account didn’t loan out the money to you. You don’t escape any taxes by borrowing from a bank.

Still Confused says

An employee contributes X amount of money directly from employer’s payroll pre-tax into 401k. The, employee takes out $1,000 (though amount is irrelevant) loan from 401k. The loan is a pre-tax distribution. The employee then, makes after-tax payments on the 401k loan through direct deductions from payroll. Therefore, the employee is paying taxes on the 401k loan repayments contributions into the 401k account.

Employee leaves employer while loan is only 50% paid off. The employee opts to rollover the 401k balance into his new employer’s 401k. The remaing loan balance is deemed, the amount is deducted from the total balance before rollover and the employee receives a 1099 to claim as income on federal tax income, thus paying taxes on it.

Employee retires. Employee takes distribution from 401k. The distributions will be taxable.

My question is: If the employee is making after-tax loan payments into the 401k and then, upon distribution must pay taxes on the amount, then isn’t that double taxation? Or does the 401k institution separate pre-tax and after-tax (loan repayments) contributions when reporting 1099’s?

MES says

I still don’t get it. My loan is not supposed to be taxed because it is not considered a distribution. BUT I repay it with AFTER tax dollars. THEN when I retire, I pay tax on that same money. I know it’s not a good idea to borrow from a 401k, BUT…it’s done, so…

It kind of reminds me of the rule of paying tax on tuition reimbursement which was then reversed since it was also determined to be double taxation. And it was. Aftertax dollars were spent on tuition and then when reimbursed by the company, the IRS was stating that it was income when it was NOT. Same with the 401k as I see it. If it’s NOT supposed to be taxed, then repayment should be made from pre-tax dollars.

Ancient says

Lets use Roth 401K example and it will become more clear:

You contribute $10 to the roth 401k with after tax money, you take a $10 loan out tax free. You repay back $10 (+ interest) to the account with after tax money, and eventually you’ll take the $10 (+ interest) out tax free when you retire.

No double taxation there, right? By taking the loan you just moved the money around in the cycle two times instead of one.

Now substitute this scenario with a pretax 401k:

You contribute $10 to the 401k with non taxed money, you take a $10 loan out tax free. You repay back $10 (+ interest) to the account with after tax money, and eventually you’ll take the $10 (+ interest) out taxed again when you retire.

A little more complicated, but you can see $10 has never been taxed at all, and $10 (+ interest) has been taxed twice. $10 cancels out and is taxed only once, and (+ interest) is taxed twice.

Should interest be taxed twice? It is not a transaction between two parties, there are no profits being made when you put more money into your own account, I don’t think interest should be taxed again when you retire…..

regor60 says

MES:

The original money you contributed was from income that wasn’t taxed. When you paid back the loan you took, you paid it back from new income that was taxed, as you’ve said. The reason you’re paying taxes on the income to repay the loan is because it is not a “new” contribution. A loan from a 401k is booked as an investment of the 401k and is called a “loan fund”. So your original investment just changed form. As you pay off the loan, the balance of the loan investment of the 401k is reduced dollar for dollar. The net balance of the 401k only changes to reflect the interest on the loan.

Yes you do pay taxes on the original contribution you made, but that is only because you didn’t pay them up front. The loan you took has nothing to do with this.

Amy says

So I liked this part: ” The interest you pay into the plan is replacing the interest the plan account otherwise would earn from the financial market. If you get a loan from a bank, you are also taxed twice: once on the income earned to pay interest on the loan; again on the money the plan account earns from the financial market because the plan account didn’t loan out the money to you. You don’t escape any taxes by borrowing from a bank.”

This says it all.

My scenario: Contribution to 403(b) plan. Money was in various Fidelity plans. Market begins to tank. I move it all into a Savings fund that is still in my 403(b). I accrue interest at about 1% or less.

I have a car loan with a 12% interest.

So… my car loan was a 5 year loan and my monthly payment is over $300 a month. This cuts me short of money every month. Plus, at 12%, my loan will cost about $4k more at the end of the term (or something like that).

So I take out a 403(b) loan. SAME exact 5 year term. My MONTLY payment is literally halved. This means I am more comfortable with my monthly living expenses. This means I can take out MORE pre-tax (not matched) contributions. The cost of my loan at the end of term ends up being a 1/3 of the original loan.

I am paying myself back at 6%.

I would have been a fool to not borrow from myself.

See, there is MUCH more to balancing your life than just an Excel spreadsheet. And it’s clear to me that because there is NO definitive answer on this and many, many interpretations, it’s not black and white.

See, I am earning 6% on my money. If I were to put the same money in a regular savings account today, I would earn. .00000001% or something like that. In other words, my after tax dollars have ZERO ability to earn interest other than an unpredictable stock market.

And for the subjectivity: So maybe the same after tax money could earn more in the market (after tax). A) I would have to know what to do B) where to invest C) have the financial fluidity to risk possibly LOOSING the money.

I am not hugely financially savvy. I cannot take any stock market risks.

So in this scenario, the answer to the question is not just what it looks like in Excel. The answer depends heavily on multiple circumstances and factors.

In My case:

Needed to reduce my monthly after tax bills or risk accruing more debt

Needed to continue to contribute to my 403(b)

Needed the safety of returning my money to a financial management situation that works for me.

Needed for the cost of the loan to be halved.

How, in all of the double taxation talk, can you work this into that language? I don’t think you can.

BP says

Let’s say you have $50,000 in professional student loans at an interest rate of 6%. (I know of no way to get a lower interest rate.)

It then makes sense to borrow $50,000 from your 401(k) assuming the following:

1) You continue making savings contributions while the loan is still outstanding.

2) You feel certain that you will not leave or lose your job for duration of the loan.

3) You consider a fixed return of roughly 6% to be an acceptable investment.

Anything I am missing here?

R Cole says

There is a fundamental flaw in the example used here: In one case the loan comes from a bank (money is not yours), in the other case the loan comes from ones own 401K account, (money is yours). The example is thus an ‘apples and oranges’ comparison.

There is a ‘double taxation’ with a 401K then because the money (your money) used to repay to loan has already been taxed as income. That already-taxed money icommingleded with the before tax money but there is no accounting of that – so when the money is withdrawn at retirement is all subject to income tax. Thus the after-tax dollars that went into the 401K are taxed again. That portion of the disbursement is double taxed.

By the way, the cute story has nothing to do with this situation.

Joe says

Still? You don’t have to use taxed money to pay off the loan. Quit thinking that. You have a pile of untaxed money at your disposal.

You took out un-taxed money. Just imagine you using that money to pay back the loan and it will make more sense.

theoretically, when you pay back what you take out, what’s left, (interest) could be paid with taxed money, which will get taxed (a second time) when taken out.

then again, even that interest doesn’t have to be paid with taxed money. you’re untaxed money taken out can bring in untaxed income if you stick it in a roth and take it out after retirement.

make sense?

jeff says

Can I use funds from an older 401k to pay off a loan in my new 401k. Rolling over the money inside the 60 day grace peiord and pay off the loan at the same time.

David says

SO nice to find a guy that gets that the whole “double taxation” thing is bunk! I try to convince people of this, and they never get it.