The age of majority is 18 in most states in the U.S. Kids under 18 are allowed to work for pay but they aren’t allowed to open an account with a financial institution unless an adult is either a joint owner or a custodian. This is because kids under 18 can’t legally sign a contract and agree to the terms.

When a kid works for pay, the kid is eligible to contribute to a Roth IRA based on their earnings, up to the kid’s income from their job or the annual Roth IRA contribution limit, whichever is less.

The money doesn’t have to literally come from the kid. If the kid spent their money on something else, a parent can open a Roth IRA for the kid and fund the Roth IRA with the parent’s money. It’ll be the same as the kid contributed their income to the Roth IRA and the parent gave the kid money to spend on something else.

However, an IRA by definition has only one owner; there’s no joint IRA. Because the kid under 18 can’t open the account themselves, an adult has to do it as the custodian. This type of account is called a custodial Roth IRA. The kid is the owner. The adult is the custodian. When the kid becomes an adult, the account turns into a regular Roth IRA.

A custodial Roth IRA is different from a UGMA/UTMA account. Earnings in a custodial Roth IRA are tax free. Earnings in a UGMA/UTMA account are still taxable. But funding a custodial IRA has an upper limit up to lesser of the kid’s work income or the annual contribution limit. If the kid doesn’t work for pay, you can’t fund a custodial Roth IRA. A UGMA/UTMA account doesn’t have such limit.

Vanguard, Fidelity, and Schwab all offer custodial Roth IRAs.

Vanguard

[Hat tip to reader always_gone in comment #14 for how to do it online.]

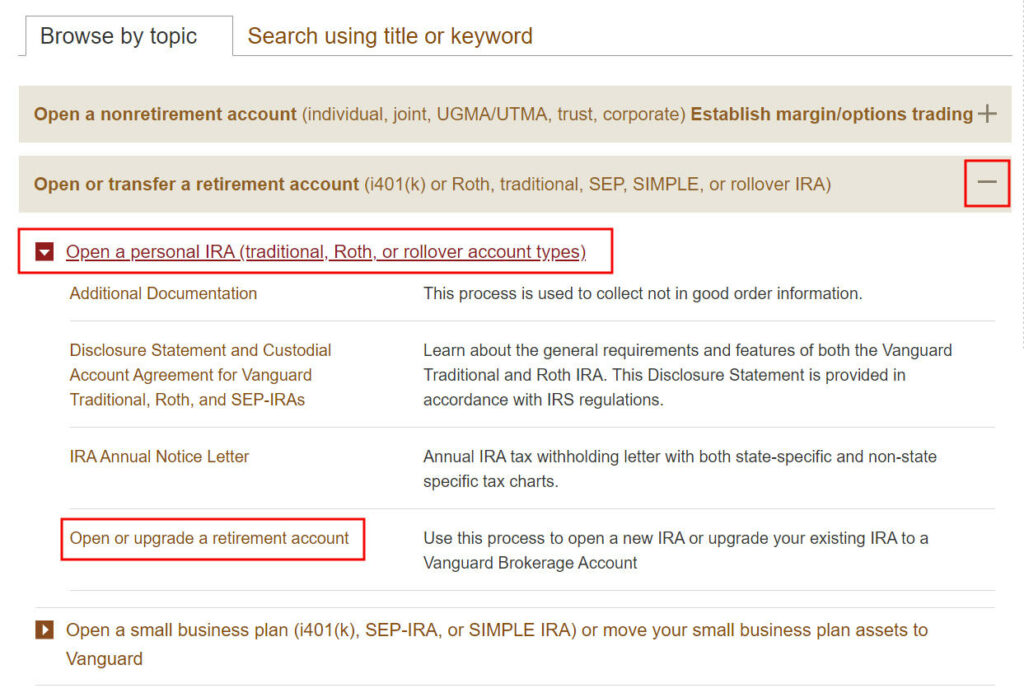

With Vanguard, after you log in, click on Forms in the top menu. The more intuitive “Open an Account” menu item doesn’t work for custodial IRAs.

Expand the second item in the list – “Open or Transfer a Retirement Account.” Click on “Open personal IRA” and then “Open or upgrade a retirement account.”

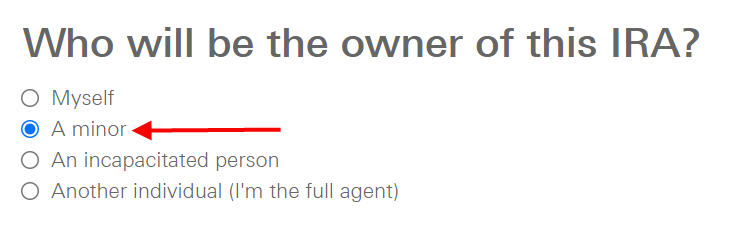

You will answer a series of questions from there. The critical part is in Step 3, where you choose to have a minor as the owner of the new Roth IRA.

You will DocuSign a form after you answer all the questions.

Buying an all-in-one Vanguard Target Retirement Fund requires a $1,000 minimum investment. You can buy ETFs with less money but because you can buy only whole shares, it’s not as easy to invest small amounts. Vanguard charges a $20 annual maintenance fee for small accounts but it can be waived if you sign up for e-delivery of statements and documents.

Fidelity

You can open a custodial Roth IRA at Fidelity online with no minimum balance and no annual maintenance fee. A Fidelity Freedom Index Fund would be a good all-in-one option. It doesn’t require any minimum investment. See Fidelity Freedom Index Funds: Hidden Gems For Your IRA and 401k.

Charles Schwab

Charles Schwab also offers a custodial Roth IRA with no minimum balance and no annual maintenance fee. They ask you to download a paper application and mail it in. A Schwab Target Index Fund would be a good all-in-one option there. The minimum investment into a Schwab Target Index Fund is only $1. See Schwab Target Index Funds: Hidden Gems For Your IRA and 401k.

***

If your kids work, seize the opportunity to open a custodial Roth IRA for them. Among these three brokers, I would choose Fidelity, because they make it easy to open an account online and you can invest in an all-in-one fund with no minimum investment and no annual maintenance fee.

Say No To Management Fees

If you are paying an advisor a percentage of your assets, you are paying 5-10x too much. Learn how to find an independent advisor, pay for advice, and only the advice.

Doug Nordman ("Nords") says

I’m glad to see that this is getting easier for parents. A teen’s IRA is one of the most powerful forms of compounding that an investor can find.

Back in early 2007, the only place we could find that welcomed custodial IRAs with a low minimum was T. Rowe Price. Even their funds were expensive. As soon as our daughter turned 18, we moved on over to Fidelity.

I think the fund companies are short-sighted and putting a higher priority on 401(k)s instead of IRAs. They’re not willing to subsidize a young investor through high school and college, when the majority of them will finally have enough income to resume funding their IRAs. Yet if the companies snagged them during their susceptible teen years, their customers would likely stay loyal for decades…

Peter Baldwin says

I have two great grand sons; both under age of five years. Would like to establish education funds whereby my initial contributions and subsequent earnings will eventually be available tax free. Should this be in the boys natural parents names?

Also could parents control funds distribution when boys reach college age?

Any comments will be appreciated.

Thanks, peter baldwin

Harry Sit says

Peter – The subject of this article — a custodial IRA — is for employment income earned by the child, such as from a summer job. It’s not for money you contribute for their education. You can look into a 529 plan, in your name or the parent’s name, with the child as the beneficiary.

Ian Marshall says

Peter, the accounts, if they were Roths, would have to be in the kids names. 529’s are in the name of whomever set them up. That person then designates beneficiaries. Also, with Roth’s, those kids would have to earn taxable income in order for you to gift them the equivalent into each of their Roths. Harry is correct that the 529 is designed for what you’re inquiring about. But in many ways the Roth is a far more versatile avenue for saving. You can contribute more, and at a younger age, in a 529, but the money is earmarked solely for educational use… and computer technologies. The Roth can be used as either educational savings, or a down payment for a home without penalty… or retirement for which it was intended. You’re just limited to 5,500 per child, and that’s provided they earned 5,500 or more that year… challenging for a 7 year old. Think 14 or 15 year olds. If you could find a way to create taxable income for 10 year olds, you could create a great avenue for saving for college and generating long term compounding tax-free wealth. And despite Roth’s traditionally not being pretax dollars, they would be in this scenario because the kids most likely aren’t earning enough income to pay taxes. Another thing, FAFSA looks at 529’s when deciding the student/parent contributions for college. They don’t look at Roth’s. So it is a shelter for lack of a better term, and the children would possibly qualify for more grants, loans… Etc. I understand that the goal is to avoid loans. Roth’s just give you choices… Take the loan keep the tax-free wealth machine, or liquidate the Roth and avoid the loan… Choice.

Andrea says

If a child’s income is paid in cash, how do you determine the amount allowed to contribute? Does it affect the requirement for the child to file a tax return, even if under the amount where they would have to file a return?

Harry Sit says

Andrea – Income is income regardless how it’s paid. If you end up filing a return even when it’s not strictly required, it’s not necessarily a bad thing. A simple return is simple.

linda says

hi, Harry:

Can you let me know a bit more detail about filing kid’s income return? at what amount kid has to file a return?

thanks

Harry Sit says

In 2017, (a) earned income more than $6,350 or (b) unearned income more than $1,050 or (c) total earned and unearned income greater than the larger of earned income plus $350 or $1,050. See IRS Publication 929 for more info.

John Kelly says

So… in 2019, maximum contribution to kid Roth IRA is $6,000… if my kid makes $1,000 in 2019, could I then as his parent contribute $5,000 to max his Roth IRA contribution in 2019?

Harry Sit says

No. The maximum is the compensation earned or $6,000, whichever is lower.

Jim says

You can as a parent make up the difference.

However, you have to pay the 15.3% self employment tax. The self-employment tax rate is 15.3% of net earnings. That rate is the sum of a 12.4% Social Security tax and a 2.9% Medicare tax.

Your child would have a cash job, so you would be responsible for the 15.3%. A small price to pay for tax free growth.

Danielle says

My 9 year old wants us to start this. He would be contributing 1/2 of of his chore money into this. Clearly we don’t file a tax return on that and this would be appox $500 a year I’m guessing. Would this be ok or would we run into tax issues?

Norma says

I am curious to know the answer to your question. I have a 10 year old that does jobs for our neighbors. Would setting up a Venmo account to keep track of work done suffice. Up to how much can he earn so he doesn’t have to file taxes?

Randy says

First, I’m not a expert in this area, but I believe that you need to file a tax return to be eligible. No tax return, no roth is my read on this.

always_gone says

Vanguard *will* let you open a Custodial IRA online.

Log in ->

Go to Forms ->

Open or Transfer a Retirement Account ->

Open Personal IRA ->

Open or Upgrade Retirement Account ->

Fill in the Wizard questions and Docusign paperwork ->

Wait.

Carol says

Do you have any advice whether it makes sense to open a UGMA/UTMA account for newborns?

Harry Sit says

After maxing out your own retirement accounts, and after funding a 529 plan for the kid’s college education, maybe.

Carol says

What are the downsides? Saves us taxes from dividends and can harvest gains tax free (up to 2,100 per year).

Perhaps material for a future article?

Linden says

Vanguard now allows ETF purchases by dollar amount, not just whole shares, so this could be a good way to build up enough to move over to funds with a higher minimum. Our son got his first paycheck and we opened his custodial Roth this week. Thanks for the tips!

aravinda says

How about E-Trade? Any reason they’re not mentioned here?