Questions from some readers on my post about PenFed CDs versus bond funds in the next five years reminded me something I’d like to bring to the attention of all readers, not just those who follow the comments.

Back in February I wrote Invest In Long Term Bonds Now? At that time I was pondering whether I should move my muni bond investment from intermediate-term to long-term, especially when the average maturity of Vanguard’s long-term muni bond fund didn’t appear that long.

Back then Vanguard reported these numbers for its intermediate-term and long-term muni bond funds:

| Fund | Average Duration | SEC Yield |

|---|---|---|

| Vanguard Intermediate-Term Tax-Exempt Fund (VWITX) | 5.1 years | 1.7% |

| Vanguard Long-Term Tax-Exempt Fund (VWLTX) | 6.1 years | 2.2% |

* Source: post by Riprap on Bogleheads forum on 2/18/2013

For one extra year in average duration, the SEC yield on the long-term fund was 30% higher.

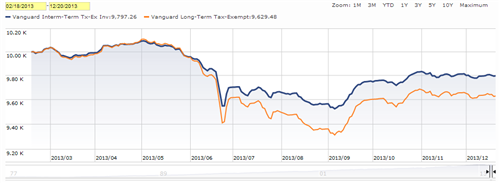

Because the average duration was similar, you would think the performance would be similar too, but that’s not the case. The two funds were close until June. Then they started to diverge when the Fed started talking about tapering. The gap is still not closed as of late December 2013.

The chart shows growth of $10k, i.e. the total return between February and December. The blue line is the intermediate-term muni fund. The orange line is the long-term muni fund.

The gap can’t be explained just by one extra year in average duration. I will spare you the math but I can tell you that’s not it. 6.1 years versus 5.1 years doesn’t make one fund nearly double the loss of the other, especially when you also have a higher yield coming in dampening the effect of principal loss.

It appears that the average duration reported by Vanguard is not a reliable indicator for how a muni bond fund would behave in response to interest rate changes.

Here’s what Vanguard reported on the two muni bond funds as of 11/30/2013:

| Fund | Average Duration | SEC Yield |

|---|---|---|

| Vanguard Intermediate-Term Tax-Exempt Fund (VWITX) | 5.5 years | 2.32% |

| Vanguard Long-Term Tax-Exempt Fund (VWLTX) | 7.6 years | 3.40% |

The gap in average duration between the two funds grew from one year in February to two years in December. The gap in SEC yield also grew to one full percentage point. Did Vanguard managers decide to make big changes to the funds?

I doubt it. I suspect the “call” feature in many muni bonds was messing it up, making the average maturity and the average duration of the long-term muni fund appear artificially low. Vanguard’s fine print for average maturity says this (emphasis added by me):

For Vanguard municipal bond funds, actively managed taxable bond funds, and non-Vanguard bond funds, average maturity is the average effective maturity of holdings, defined as the average length of time until fixed income securities held by a fund reach maturity and are repaid, taking into consideration that an action such as a call or refunding may cause some bonds to be repaid before they mature.

A call means the issuer can choose to repay the bond sooner than the stated maturity date. Many, if not most, muni bonds can be called. When interest rates are low, a bond with 30 years to go and a call date coming up in 2 years is considered as likely to be called in 2 years. If interest rates go up, the probability of it being called goes down. The issuer may decide to stick with it longer, maybe all the way to the end, making the bond a true 30-year bond.

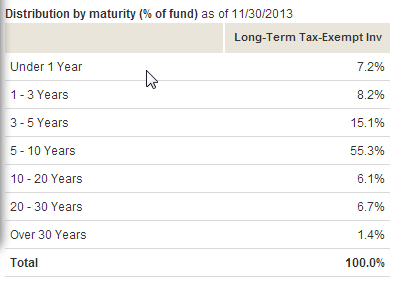

You see this effect if you look at the actual holdings of the bond fund. Vanguard reports the maturity breakdown for the long-term muni bond fund like this:

According to this table, only 14% of the portfolio mature beyond 10 years. If you click on the portfolio holdings link though, you will see many holdings mature way beyond 10 years. I only tallied the top 50 holdings on the first page. 66% by market value mature beyond 10 years. If you are interested you can go through all 1,000+ holdings. I bet it’s way above 14%.

Which is right? 14% or 66%? Probably neither. Some bonds will be called before the official maturity date. Some bonds are estimated to be called as of now but probably won’t be if interest rates go up; or they will be called later than the current estimate.

I would suggest taking the reported average duration of long-term muni funds with a grain of salt. Even though the number is technically correct as of now, you may be investing in bonds with a longer term than you thought.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Kevin says

Very interesting. I was wondering about this discrepancy myself since I own both funds (and have for some years), and noticed the recent more-than-expected divergence in price.

So, your hypothesis is that before the recent increase in rates, the maturity and duration numbers included the assumption that more longer-term bonds would be called, thus lowering the effective duration, and that after rates increased fewer longer-term bonds are likely to be called, thus increasing the effective duration?

Thanks,

Kevin

Harry says

Yes, and that’s still the case now. If rates go up some more, the duration will go up again. A 5% coupon bond is very likely to be called when the going rate is 3%, not as likely when it’s 4%, and not worth the bother if the going rate is also 5%.

robert uphaus says

Very timely and precise post. Thanks much. Bob

JD says

So is this same situation also impacting the Intermediate term fund as well since call-able bonds to take advantage of lower rates should also be impacted (but I assume to a lesser degree than the Long Term)?

Harry says

Probably so to a much less extent. Note the duration changed from 5.1 years to 5.5 years from February to December for the intermediate-term fund while the same changed quite more for the long-term bond. A casual inspection of the top 50 holdings (of 3,800 holdings) shows 31% of them have a stated maturity date longer than 10 years whereas Vanguard reports only 5% mature beyond 10 years.

RobK says

It is interesting to compare the distributions of maturities on Vanguard’s web site with those on Morningstar’s. The latter are much longer.

Harry says

Good point, Rob. I imagine Morningstar doesn’t get or use the call date. Morningstar reports as of 9/30/2013, 80% of the holdings in the Vanguard Long-Term Tax-Exempt Fund have maturity longer than 10 years. 40%+ have maturity over 20 years.

finametrics says

the guy that posted this is right.

next step is to look at convexity. the 2nd order derivative in the price / yield relationship. willing to bet its pretty curvy (vs a flat linear duration line).

which means (just as the poster says) duration increases with rising rates for precisely the reason state.

the funds have the ability to calculate their convexity. but they wont share it with schmucks like you and i. dont believe me? call vanguard and ask em.

#pizzagate

that is all.