Hi, I’m Harry. I’ll show you the nuts and bolts of managing your money.

401k, IRA, investing, insurance, taxes, … I lived, breathed, and wrote about these for so many years. No fluff, just concrete first-hand learning and sharing.

Explore Topics

Recent Posts

How I Bought a Home Without an Agent After the NAR Settlement

You can buy a home without a buyer’s agent and save a lot of money when you’re prepared. Here’s how I did it.

Real Life Experience with a Deferred Fixed Annuity (MYGA)

A deferred fixed annuity, aka MYGA, is like a CD issued by an insurance company. It worked as advertised but I’m not renewing or buying more.

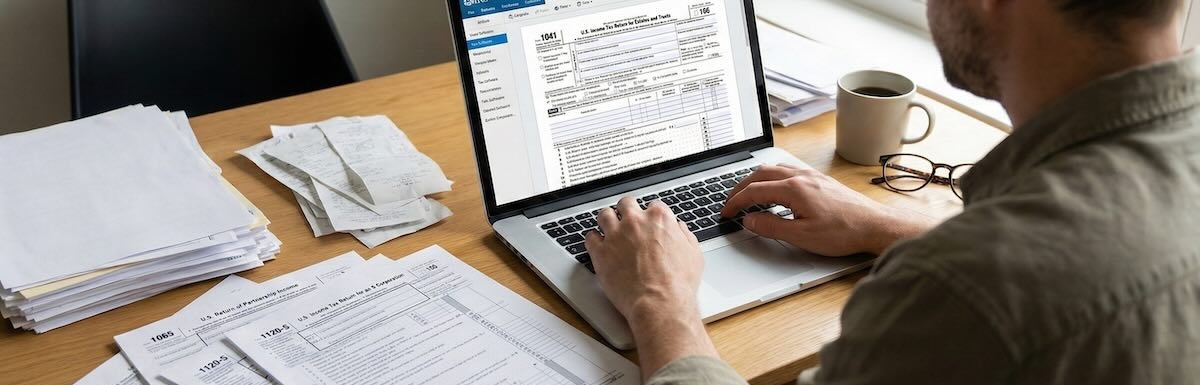

Software for Business and Trust Tax Returns: 1041, 1065, 1120-S

H&R Block Business is inexpensive tax software for filing business and trust tax returns. Try it if you need to file a Form 1041, 1065, or 1120-S.

Building a Bond Ladder with Individual Bonds and ETFs

A bond ladder is helpful psychologically and for predictable cash flow. You can build one with individual Treasuries and TIPS and with ETFs.

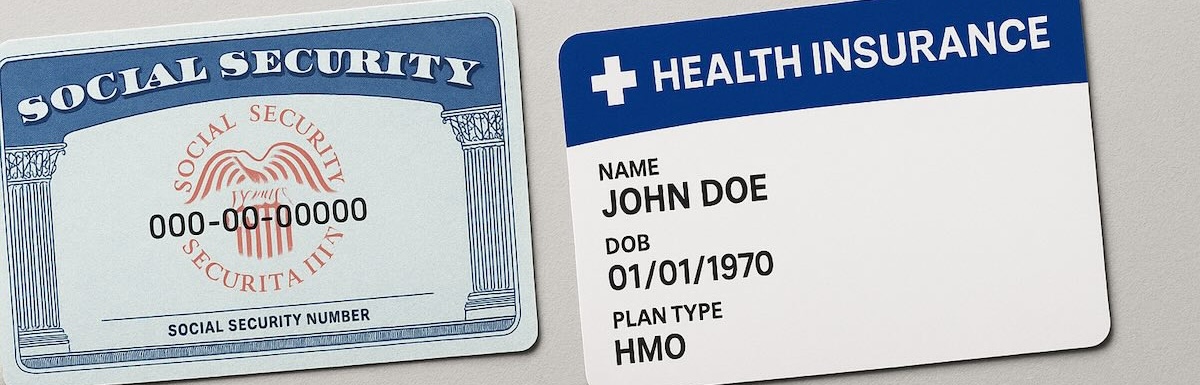

ACA Health Plan Premiums When One Spouse Starts Medicare

The ACA health plan premiums may decrease, stay the same, or even increase when one spouse starts Medicare. Here’s why.

How Does Claiming Social Security Affect ACA Health Insurance?

How claiming Social Security affects ACA health insurance depends on if there’s a cliff, and your household income before and after Social Security.