Back in 2020, I bought a 5-year deferred fixed annuity, also known as a Multi-Year Guaranteed Annuity (MYGA). A MYGA, in essence, is like a CD issued by an insurance company. The insurance company guarantees a fixed rate for a fixed period. I spoke about MYGAs in my April 2021 presentation, Fixed Income Alternatives in a Low-Yield Environment.

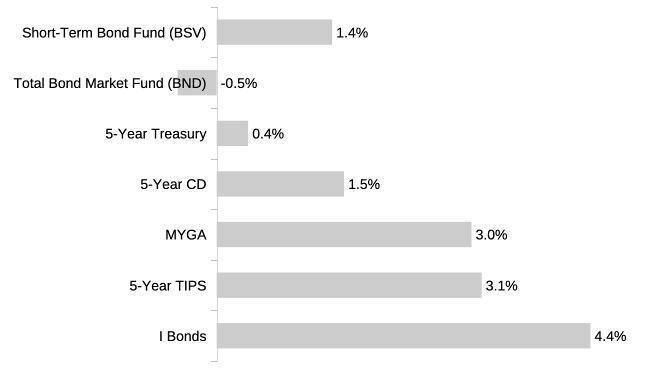

I bought the 5-year MYGA because it was paying significantly more than a 5-year CD from a bank or credit union at that time. The MYGA paid 3% a year. The best 5-year CD was paying 1.5%. This MYGA had reached its 5-year guarantee period last month. I ended it and pulled the money back to my Fidelity account.

The insurance company kept all its promises. Everything worked exactly as advertised. The MYGA was illiquid, with a prohibitive penalty if you withdraw more than 10% of the balance each year, but I knew that going in. The insurance company was a little slow in processing paperwork, but it was nothing compared to the slow manual processing at TreausryDirect, which can take from six weeks to ten months.

In terms of investment returns, the MYGA did better in these five years than a short-term bond fund, a total bond market fund, a 5-year Treasury, and the best 5-year CD. It trailed a 5-year TIPS by only a hair. I Bonds did better, but they had low purchase limits.

However, I would put my experience with MYGA in the “winning the battle but losing the war” category. That’s why I’m not renewing it or buying another MYGA.

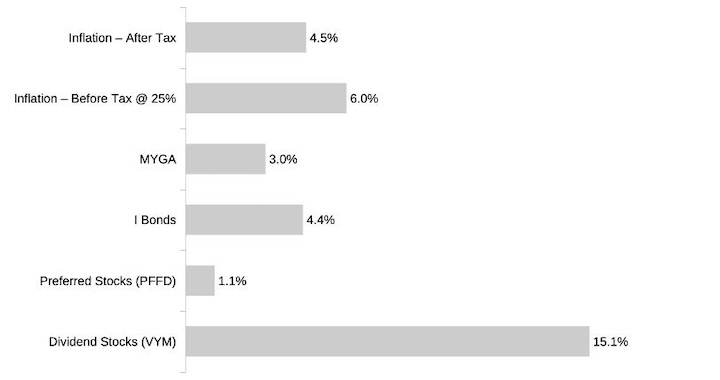

The war is against inflation. Inflation averaged 4.5% a year in the last five years. Because you pay taxes on the gross return, if your tax rate is 25%, you’d have to earn 6% a year to keep pace with inflation. Viewed through this lens, all bond investments lost to inflation in the last five years. The Vanguard Total Bond Market Index Fund had a negative 5-year return before inflation.

Bond Substitutes

Burton Malkiel is the author of the famous book A Random Walk Down Wall Street. He was making rounds in the podcast circle in the summer of 2020 to promote the 12th edition of that book. Mr. Malkiel called the low-interest-rate environment at that time “financial repression.” He suggested lowering the allocation to bonds and investing in preferred stocks and high-dividend stocks as “bond substitutes.”

Burton Malkiel’s suggestion for investing in “bond substitutes” was controversial at that time. Some commentators went so far as to say it was stupid. Now we see the results after five years.

Preferred stocks didn’t do well, but high-dividend stocks did. Investing 50:50 in preferred stocks and high-dividend stocks outpaced inflation both before tax and after tax. Bond substitutes won the war.

The Forest and The Trees

My excursion to MYGA shows that we tend to pay more attention to things that can be analyzed with greater certainty, while neglecting things that are more uncertain but have a more significant impact. I often see people asking questions along these lines:

Which money market fund should I use?

Buy I Bonds in April or May?

Should I invest in Fidelity’s S&P 500 fund (FXAIX) or Vanguard’s S&P 500 ETF (VOO). What about Fidelity’s Zero fund?

TIPS ladder or TIPS fund?

Each question is complicated in its own way if you look at it under a microscope. There’s a powerful spreadsheet that sends you an email alert when it’s time to switch from one money market fund to another. These decisions make a difference, but they easily fall into the “winning the battle but losing the war” category. Before diving into the best place to park your cash, consider whether you should park that much cash in the first place. Then you will avoid a dilemma like this:

Saved up 1 million for a house we are no longer buying, now investing it into the market

The big-picture decisions don’t have an easy answer, but they make a much larger difference when you get them right.

How much to invest in stocks, bonds, cash, real estate, Bitcoin, or gold?

U.S stocks versus international?

Value stocks or growth stocks?

Developed international countries or emerging markets?

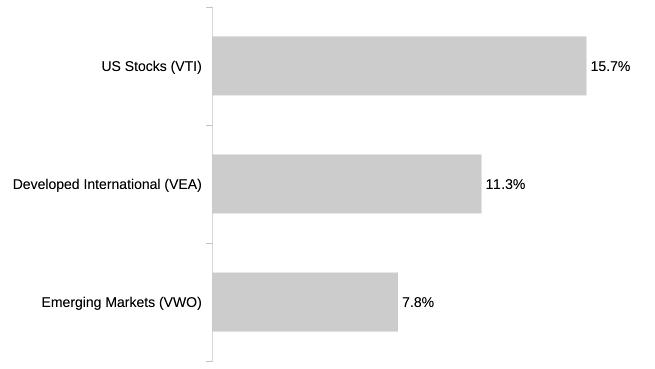

Burton Malkiel got the “bond substitutes” right. However, his other suggestions in the same podcast episode for increasing allocation to international stocks and increasing allocation to emerging market stocks within international stocks didn’t pan out. His arguments sounded convincing, and they still do today, but the markets just didn’t accept them.

U.S. stocks outperformed international stocks, and developed market stocks outperformed emerging market stocks, both by a substantial margin. How much you invested in US stocks versus international stocks, and in developed international countries versus emerging markets, made a huge difference in the last five years. This is why VTSAX-and-chill was an easy sell.

Maybe it will take more time for those other suggestions from Burton Malkiel to have the last laugh. Maybe they won’t ever catch up. Either way, don’t lose sight of the forest when you examine the trees.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Marc says

I am half way through two MYGAs earning 4.75% and 5.2% respectively. I transferred money from my 403(b) earning 3.5% to open these accounts 8 months apart back in 2023 when rates spiked. I kept the 403(b) open in case interest rates drop below 3.5% again (they appear to be heading in that direction). This is the fixed rate part of my portfolio. I have other investments in the stock market which have done better than these MYGAs but I am pleased to have them anyway to balance my portfolio. My only regret is not waiting the 8 months to get the higher rate on the entire amount but that is why I split the money into two MYGAs instead of one, because I saw the trend and hedged against it. I suppose the rate amount is the trees and the balancing of my portfolio is the forest. I also am not planning to renew the MYGAs unless rates rise by 2028 when the MYGAs come due. I am not sure what I will do with those funds at that time, One option is to return them to the 403(b) if 3.5% seems attractive at that time. Otherwise, I will be looking for other bond alternatives. Any suggestions would be appreciated.

BN says

The lower return of MYGA/CDs is the “avoiding risk” premium. No one can predict what the stock market will do over the next 5 years. It could have gone down 5% or stagnated as it has happened many times before. As Marc pointed out, you need to decide how much of a risk you want to avoid in your total portfolio and take a “hit” on the return.

JT says

“Before diving into the best place to park your cash, consider whether you should park that much cash in the first place…”

This reminded me of something my grandfather used to say, “Just because you can, doesnt mean you should. Just because you did, doesnt make it good.”

DavidBBackpacker says

Once again, thank you Harry, for your straightforward approach. You have simplified what so many in the investment world seek to complicate (and perhaps obfuscate), “Either way, don’t lose sight of the forest when you examine the trees.” Here’s a perfect headline example Morningstar posted this morning, “Well, Just About Everything Happened in 2025. Here Are the Top 9 Podcast Episodes That Got Investors Through It.” After reading your articles, I hear myself saying “turn down the noise”, “simplify”, “get outside and enjoy life, after all, that’s what your investments are for.” Thanks Harry! Wishing you and yours a happy and healthy 2026!

Dunmovin says

A bit off target but…If one is required to take RMDs from an IRA consider taking an immediate annuity with a charity. The $ amount goes to the charity tax free and counts toward your RMD (no charitable deduction). Purportedly one can do it but all in one year up to a total of approx $55K (adjusts each year). In 2023 I purchased a SPIA from a college that (depends on age for pay out which is then set for the duration) is joint with spouse that pays up to (then) 9% per year as ordinary income (could be viewed as a return of capital but taxable since it going in funds were pre-tax). There is no residue, i.e. upon final death, the balance of funds, if any, go to charity/college. The “qualification” of the charitable issuer (unlike FDIC and NCUA no insurance for same unless in state of issue) deserves some insight/research…years ago (now?) New York state qualified insurers were believed to be the most responsible/qualified with the resultant payout rate the lowest. I bought from a NY non-qualifier issuer and thus a higher rate. There is also a “rate firm” that (interestingly…to put it mildly) publishes the available rates which is surprising the same or close to it for NY qualified. No right to redemption. Have had no problems.

The “kicker” is that I was also able take more IRA distributions that year to stay within my targeted, for the year, tax bracket/goal since the charity annuity purchase amount was not deemed income upon distribution from the IRA

Win-win for me and charity! Anyone else have some way to do other/similar types of IRA charitable distributions?

PD says

Don’t know why you did not take the 10% withdrawal option each year that you could have gotten more than the 3% guarantee to get a higher rate. Never buy a MYGA without the 10% free withdrawal option in case rates go up. Can get 6% on a 3 year myga with direct buy option Canvas Annuity right now..

Harry Sit says

I did take the 10% withdrawal each year. I didn’t mention it because it was more like winning some skirmishes in the battle.

PM says

Did you consider a tax free exchange into a new MYGA or into a SPIA/annuity?

Harry Sit says

No, because I used IRA money to buy it originally, I just transferred it back to the IRA.

Anthony says

Hi,

I’m curious how you arrived at the performance numbers for VTI, VEA and VWO? It seems like they are much higher 2020-2025 so I must be wrong about something.

Thanks,

Anthony

Harry Sit says

It was 10/1/2020 to 9/30/2025, based on data from Portfolio Visualizer. I wrote this in December 2025. 9/30/20205 was the most recent quarter-end at that time.