The best investment strategy is to take risks that the market decides to reward. Somebody, somewhere, is always saying something about how much the market will reward which risks. Knowing who to listen to and when makes a big difference.

Gold

A reader asked me back in February whether I was against investing in gold. I said I didn’t have gold in my portfolio, but I wasn’t against it. My problem with gold is that it tends to get people’s attention only after a sharp price run-up. Then it goes quiet for a long time before the idea of investing in gold comes up again.

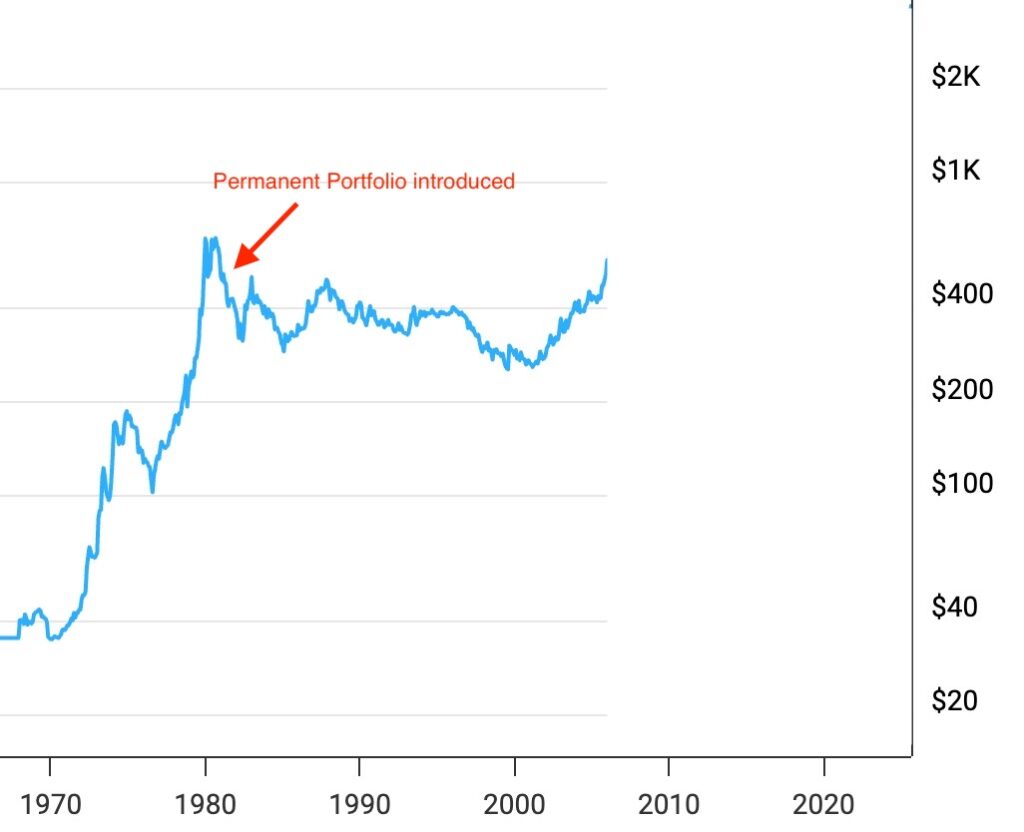

Harry Browne introduced the Permanent Portfolio in 1981. It invests 25% in U.S. stocks, 25% in long-term Treasuries, 25% in short-term Treasuries, and 25% in gold. The stand-out feature of Harry Browne’s Permanent Portfolio is its 25% allocation to gold. The rationale is that gold provides a hedge against inflation and currency crises, scenarios in which both stocks and bonds can suffer simultaneously.

Gold was $400 to $500 per ounce in 1981. It stayed below that range for the next 24 years until 2005. I don’t know how many people had the patience to stay with such a big drag for so long.

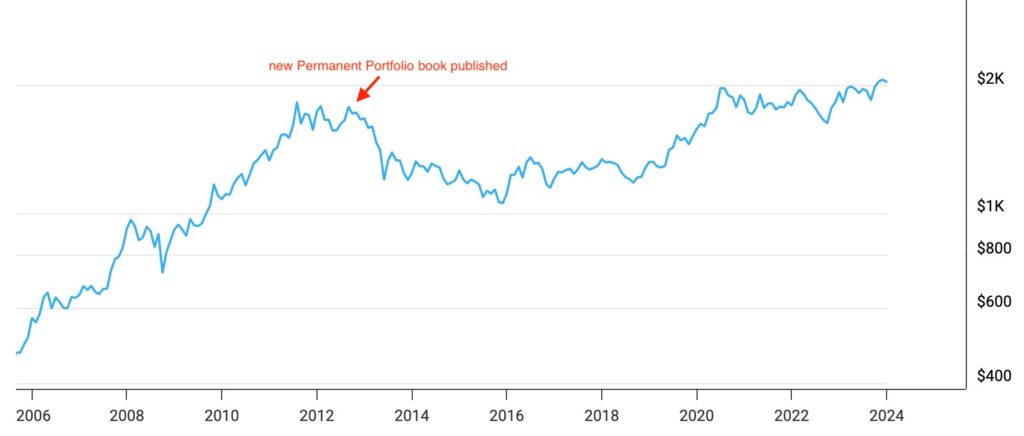

The Permanent Portfolio popped up on the radar again after the 2008 financial crisis. A book, The Permanent Portfolio: Harry Browne’s Long-Term Investment Strategy, was published in 2012 to reintroduce the strategy. The price of gold was about $1,700 per ounce at that time. It rose to $2,050 per ounce by the end of 2023. That was an average annual return of 1.7%, which was lower than inflation for 11 years, before a switch was turned on in 2024.

When the reader asked me about gold in February 2025, it was after the price of gold had increased nearly 40% in one year. Gold handily beat the S&P 500, which performed quite well during the same period, if only not compared to gold.

Adding gold after the price had gone up 40% in one year is chasing performance, right? Doing so when gold was hot in 1981 and 2012 did poorly. What about this time?

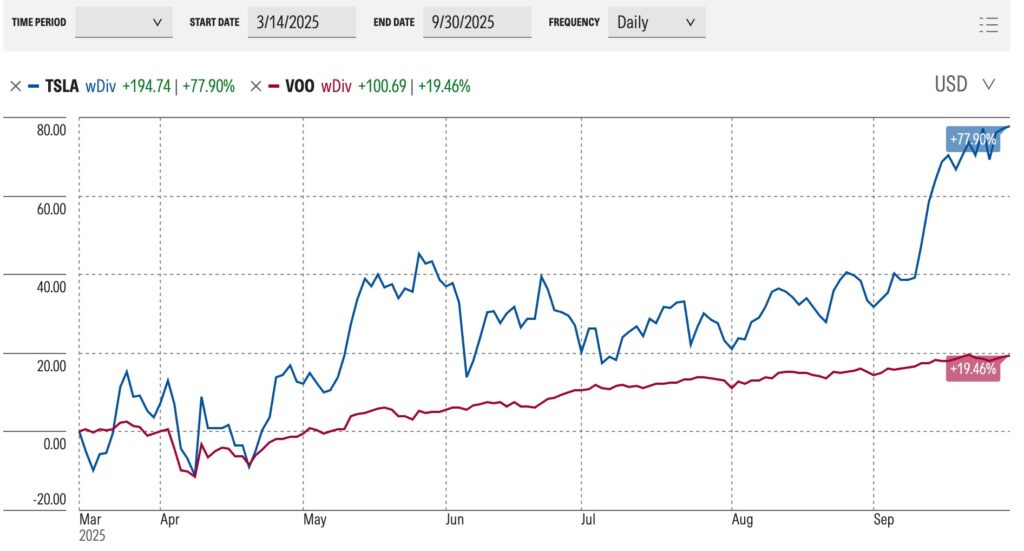

Although I thought it was late, it wasn’t too late. Gold continued to do well. The price went up another 35% in seven months. Investing in the SPDR Gold ETF (GLD) since March 2025 would’ve beaten the S&P 500 by a wide margin, even after the stock market shrugged off the tariff jitters and reached record highs with rich valuations fueled by tech and AI.

People chase performance because sometimes the market decides to reward performance chasing. Knowing when to chase and when not to chase makes all the difference.

Tesla

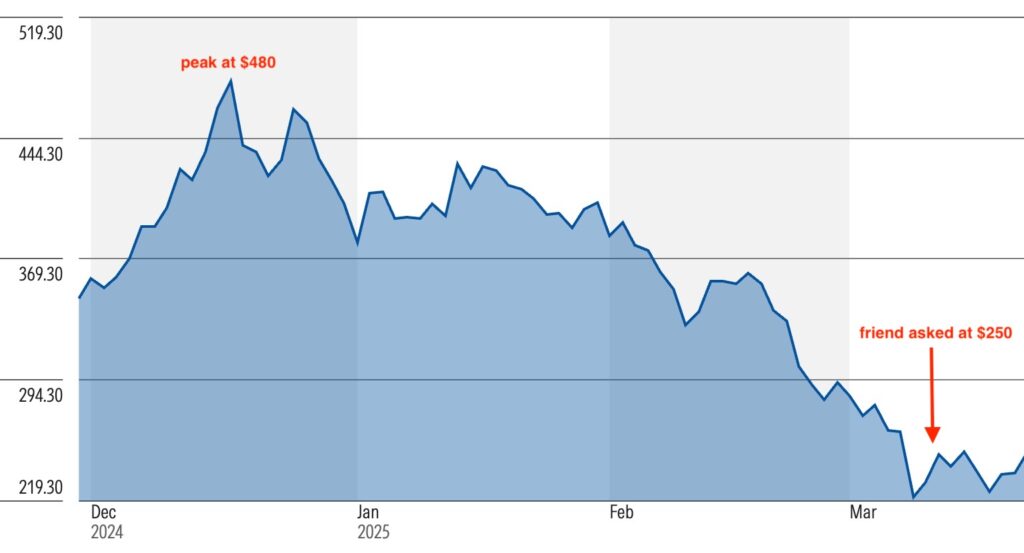

A friend asked me about the Tesla stock in mid-March this year. There was a big backlash against Elon Musk at that time for his role with DOGE. The price of the Tesla stock had dropped nearly 50% in four months. My friend thought it was a good buying opportunity.

I of course said I didn’t know where the stock was going. It could drop more, or it could rebound. Tesla’s price-to-earnings ratio was still astronomically high after the stock had dropped nearly in half.

My friend was right. Tesla’s stock price is up 78% since March, which beats the S&P 500 by 4x.

Is buying a stock with a high P/E ratio only because its price is 50% off a recent peak pure speculation or taking a calculated risk? Either way, the market decided to reward it. A high P/E ratio can go higher still in six months.

Apple

This happens in a longer timeframe, too. I listened to a podcast by Boldin (formerly NewRetirement) some time ago. The guest, David, was laid off by his former employer in 2013, which allowed him to roll over his 401k to an IRA. Once the money was in an IRA, he had more investment options than only the ones offered in the 401k plan’s menu.

Apple was coming out with iPhone 4 at the time, and David was a big Apple fan. He saw that all the Apple stores were always busy. So he put 100% of his IRA into Apple stock and stayed in it through several splits. That one decision helped him retire 7 years later at age 53.

You can say David got lucky, and he wouldn’t have been on the podcast if it didn’t work out, but you can’t argue with success. It’s better to be lucky than good. Investing everything in one stock looked “wrong,” but David’s conviction helped him retire sooner.

Bitcoin

When did you first hear about Bitcoin? I remember that some co-workers were getting into it in late 2017 when the price of Bitcoin was going from $10,000 to $20,000.

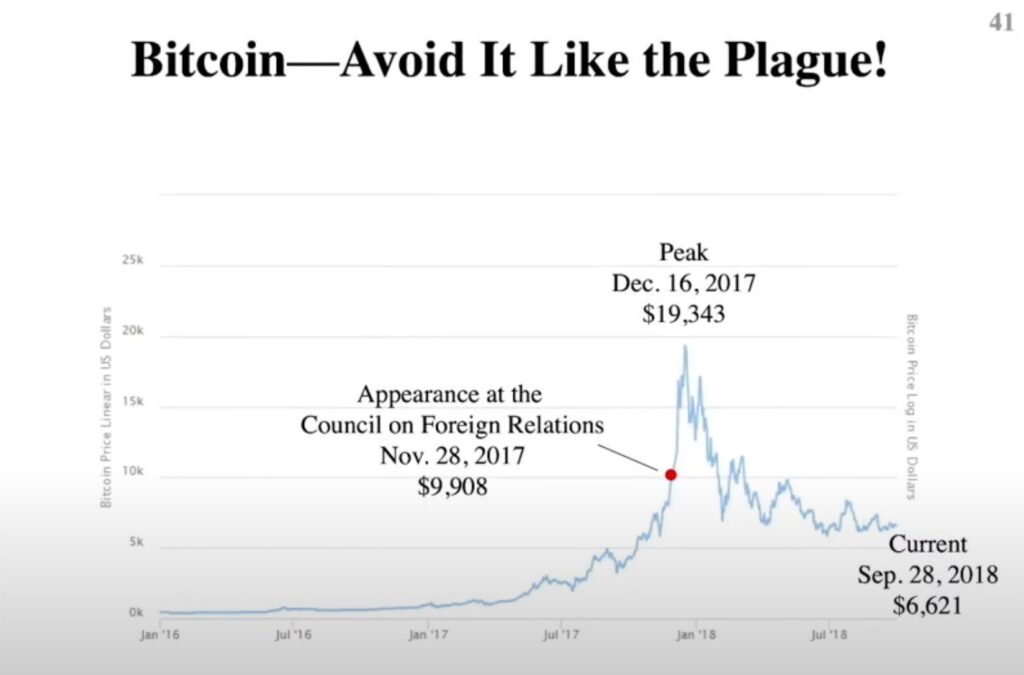

I found a video clip on YouTube of Jack Bogle talking about Bitcoin. It included a chart showing a date of September 28, 2018. I assume the presentation was given around that time.

Mr. Bogle said people should avoid Bitcoin like the plague, and he would tell them what Bitcoin is worth when it gets to $1. What happened since then?

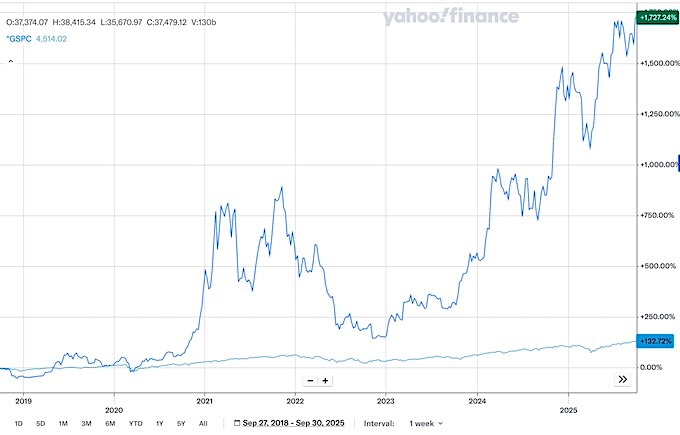

If someone bought Bitcoin after hearing the presentation by Jack Bogle in 2018, it would’ve grown 1,700%, versus 150% in the S&P 500. My co-workers would beat the stock market several times over even if they bought at the previous peak in December 2017. They only had to hang on for the ride, or as someone said on Reddit:

A few years of volatility versus 20 extra years of steady work, with no way to catch up.

Round_Ad_40 in r/Bogleheads

That’s the power of taking risks that the market decides to reward.

VTSAX and Chill

Investing in index funds also benefits from the same phenomenon. Investing 100% in the U.S. stock market (“VTSAX and chill”) is a popular, simple path to wealth in recent years. It beat investing in a target date fund or a globally diversified fund (such as VT) because stocks have outperformed bonds, and U.S. stocks have outperformed international stocks.

The Market Has the Final Say

Investing in gold, Apple, Tesla, Bitcoin, and, to a lesser extent, 100% in U.S. stocks looked “wrong” at the time, but the market disagreed. The thing is, it’s hard to tell ahead of time which risks the market will decide to reward.

A successful strategy looks irrational at the time, but not all irrational strategies will be successful. Somebody, somewhere, is always saying something. All the talks about investing are basically trying to answer this one question:

How much will the market reward this risk?

Some answers will be proven right. Some answers will be proven wrong. If you get into the habit of wanting to hit the right answers, you will invariably also hit some wrong answers. You can only hope that the right answers will outweigh the wrong ones, which is far from a given. Despite such a strong tailwind for Bitcoin and tech stocks, someone still lost $500k chasing crypto and speculative stocks over the last 5 years.

The point of investing in a globally diversified portfolio of both stocks and bonds is to avoid relying on hitting the right answers and to avoid the wrong answers that come along. Getting rewarded by the market for the risks you take can be life-changing, but a diversified portfolio is more reliable, and there’s safety in the mainstream.

[Headline Image Credit: Mohamed Hassan from Pixabay.]

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

erik says

what used to be right is now wrong, and what was once wrong is right. its called the new normal. speculation is rewarded and prudent investment planning is mocked. its like defund the police until criminal gangs ravage your neighborhood. then you get criminal justice 101 like you get investing 101. i can’t tell you when this will happen.