I mentioned in the previous post When to Claim Social Security: How Much Does It Matter, Anyway? that a common recommendation for a married couple is for the lower-earning spouse to claim Social Security early at 62, and for the higher-earning spouse to delay claiming until age 70. Several readers raised a concern that claiming Social Security at 62 may raise the ACA health insurance premiums. The same concern also applies to a single person considering claiming at 62.

We’re assuming that you’re not working when you’re considering claiming Social Security at 62. Otherwise, the Social Security earnings test may apply, which defeats the purpose of claiming at 62. When you’re not eligible for Medicare yet, you’ll most likely buy health insurance from the ACA marketplace unless you have retiree health insurance or you’re covered through your spouse.

ACA Premium Subsidy, Cliff or Ramp?

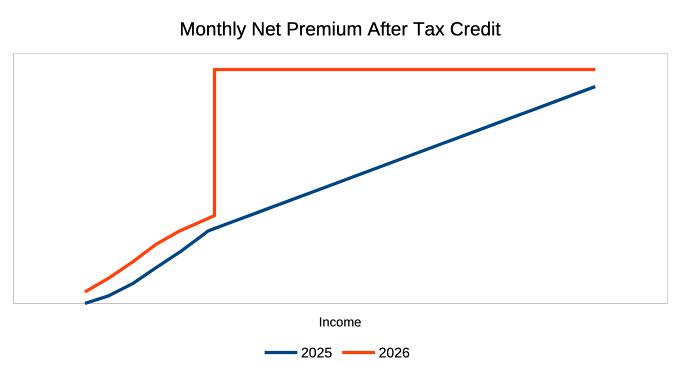

How does claiming Social Security affect the ACA health insurance premiums? It depends on your household income. I had this chart in my post The ACA Premium Subsidy Cliff After the 2025 Trump Tax Law:

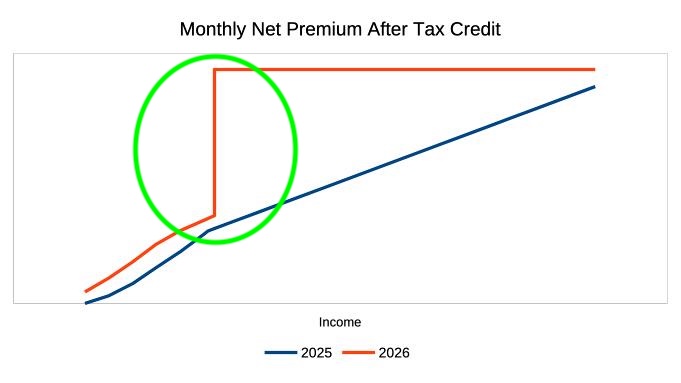

The federal government shut down due to disagreements in how ACA health insurance premiums will be structured in 2026 and beyond. The blue line in the chart represents the law in effect in 2025. As your household income increases, your ACA health insurance premiums also increase on a ramp. The orange line represents what will happen in 2026 and beyond if Congress doesn’t pass a new law to stop it. The ACA health insurance premiums will be higher at all income levels, and then suddenly jump up a cliff when your household income exceeds 400% of the Federal Poverty Level (FPL), which is $62,600 for a single-person household, and $84,600 for a two-person household, in 2026.

The first question is whether there will be a cliff.

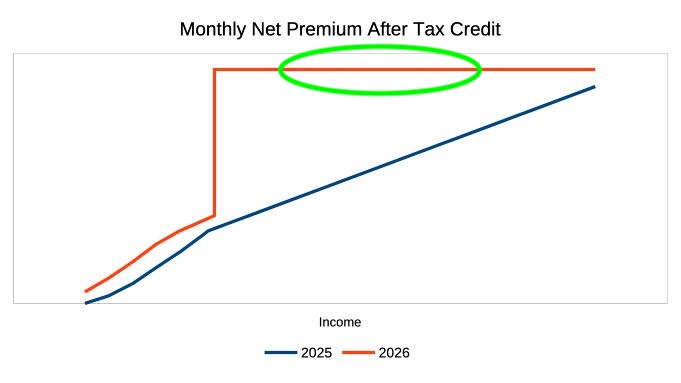

Suppose there is a cliff (the orange line), and your household income is already over the cliff before claiming Social Security (the flat part of the orange line). In that case, you’re already paying the full price without any premium tax credit. Receiving additional income from Social Security won’t affect your ACA health insurance premiums.

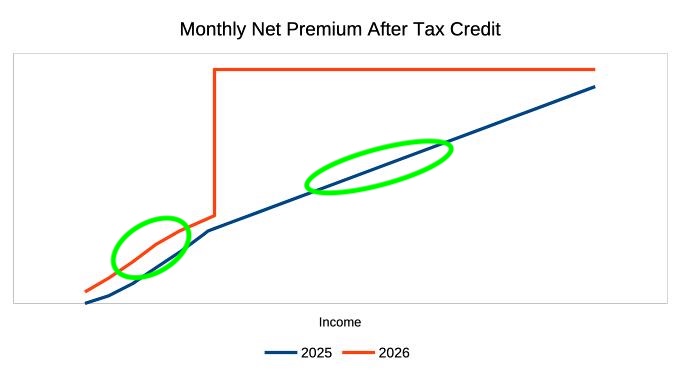

Suppose there’s no cliff (the blue line), or suppose there’s a cliff, but your household income will still be below 400% of FPL after claiming Social Security (the left part of the orange line). In that case, every $100 of incremental income from Social Security will increase your ACA health insurance premiums by $10 – $20.

If there’s a cliff (the orange line), and claiming Social Security will push your household income from below the 400% of FPL cliff to above it, your ACA health insurance premiums will jump a lot. That’ll make it not worth claiming Social Security at 62.

| Household Income | Cliff | No Cliff |

|---|---|---|

| > 400% FPL before SS | No Effect | Increase by 10% of the incremental income |

| < 400% FPL after SS | Increase by 10-20% of the incremental income | Increase by 15-20% of the incremental income |

| Cross 400% FPL with SS | Huge Jump | Increase by 10-20% of the incremental income |

Replacing or Increasing Income?

Note that the table above says “incremental income.” Incremental income is the difference in income between not claiming Social Security and claiming Social Security, on an apples-to-apples basis. What would you do otherwise if you don’t claim Social Security? The incremental income isn’t necessarily 100% of the Social Security benefits you’ll receive. The incremental income can be zero or negative if receiving Social Security will only replace other income.

Where does your household income come from if you don’t claim Social Security?

Case 1. Suppose you would withdraw from a pre-tax account, such as a Traditional IRA, to cover living expenses if you don’t claim Social Security. A $20,000 withdrawal counts as $20,000 of income for ACA health insurance. You don’t need to withdraw as much to cover living expenses if you claim Social Security. $20,000 in Social Security benefits also counts as $20,000 of income for ACA health insurance. Your income stays the same when you replace the same amount of withdrawals from a pre-tax account with Social Security.

The IRS taxes at most 85% of Social Security benefits, while many states don’t tax Social Security. In contrast, pre-tax account withdrawals are fully taxable by the IRS and most states. When you receive $20,000 in Social Security benefits, it can replace maybe $22,000 in pre-tax account withdrawals to cover the same amount of living expenses.

Your incremental income will be negative, and your ACA health insurance premiums will decrease if you replace a larger amount in pre-tax withdrawals with Social Security benefits.

Case 2. Suppose you would sell appreciated investments in a taxable account to cover living expenses if you don’t claim Social Security. Only the capital gains portion counts as income for ACA health insurance. Suppose your investments comprise 30% as cost basis and 70% as capital gains. $14,000 from selling $20,000 worth of investments counts as your income for ACA health insurance.

You don’t need to sell much to cover living expenses if you claim Social Security. $20,000 in Social Security benefits counts as $20,000 in your income for ACA health insurance. Replacing investment sales with Social Security will increase your income for ACA health insurance, but by only 30% of the Social Security benefits in this example.

Case 3. Suppose your current household income comes from a pension, rental income, interest and dividends, and other income that can’t be stopped after claiming Social Security. In this case, 100% of the Social Security benefits will be incremental income.

| Source of Income Before SS | Incremental Income |

|---|---|

| Pre-tax account withdrawals | Zero or negative, after reducing withdrawals |

| Selling investments in a taxable account | Partial, after reducing investment sales |

| Unstoppable income | Full |

Cost-Sharing Reductions

At the low end of the income spectrum, ACA health insurance also includes something called Cost-Sharing Reductions (CSR). CSR lowers the deductible, co-pays, and the out-of-pocket maximum only when you buy a Silver plan.

There are three tiers in CSR. The income to qualify for the three tiers caps out at 150%, 200%, and 250% of FPL. Here are the maximum incomes that qualify for CSR in 2026:

| 1-Person Household | 2-Person Household | |

|---|---|---|

| CSR tier 1 (150% of FPL) | $23,475 | $31,725 |

| CSR tier 2 (200% of FPL) | $31,300 | $42,300 |

| CSR tier 3 (250% of FPL) | $39,125 | $52,875 |

Many people choose to forego CSR even when their income qualifies, because they’re healthy and a Bronze plan is less expensive than a Silver plan.

How claiming Social Security at 62 affects your eligibility for CSR again depends on the “incremental income” from claiming Social Security. If the incremental income is zero or negative, it will have no effect, or it will make it easier for you to qualify for CSR or a better tier of CSR. If the incremental income is positive, and you qualify for CSR before claiming Social Security, it can disqualify you from CSR or drop you to a worse tier.

How Many Years on ACA Health Insurance?

Claiming Social Security at 62 versus claiming at 65 when you qualify for Medicare will potentially affect your ACA health insurance premiums for 3 years. If you have a younger spouse who’s also on ACA health insurance, claiming early could affect your ACA health insurance premiums until the younger spouse is also 65. The more years you’ll use ACA health insurance, the more impact there may be from claiming Social Security at 62.

Compare with Delaying Social Security

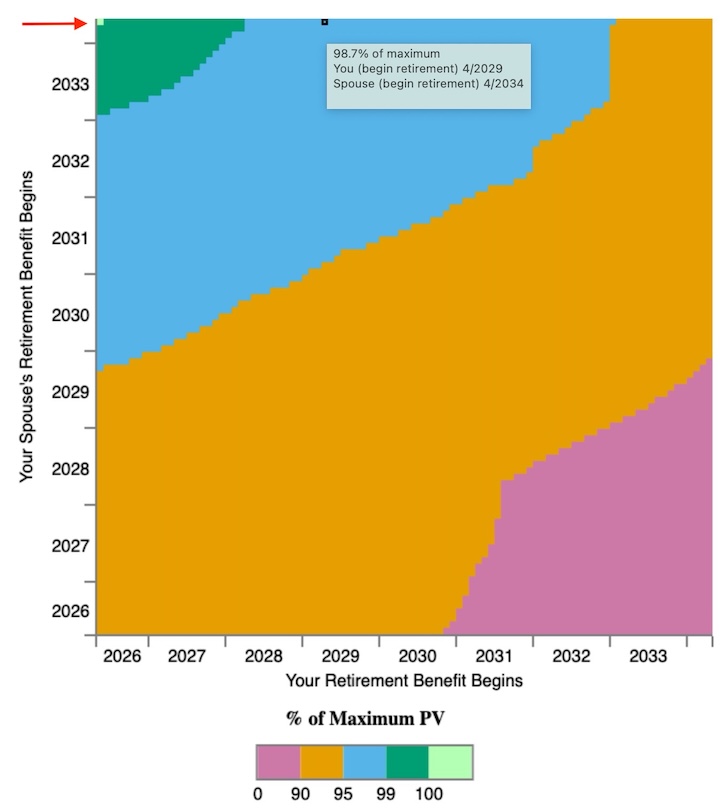

I ran a test case in Open Social Security for a married couple, both born in 1964 (will be 62 in 2026). One spouse has a Primary Insurance Amount of $2,000 per month, and the other has $3,000 per month. The recommendation from Open Social Security is for the lower-earning spouse to claim at 62 and for the higher-earning spouse to wait until 70.

If the lower-earning spouse waits until 65, this couple would still receive 98.7% of the maximum present value from Social Security. The difference in the total present value is $9,470 over their lifetime. See more on how to use Open Social Security in When to Claim Social Security: How Much Does It Matter, Anyway?

Suppose their incremental income from claiming Social Security falls into the “partial” category, and the effect on their ACA health insurance premium isn’t a big jump, but 10-20% of the incremental income. Then they need to balance the increase in ACA health insurance premiums against the loss in the present value of Social Security benefits if the lower-earning spouse waits until age 65.

$2,000 per month at Full Retirement Age translates to $16,900 per year when the benefits are claimed early at age 62. Suppose receiving $16,900 in Social Security benefits brings 30% of the benefits as incremental income, and it increases their ACA health insurance premiums by 15% of the incremental income. The increase in the ACA health insurance premiums for 3 years is:

$16,900 * 30% * 15% * 3 = $2,282

That’s much less than the $9,470 loss of total present value from delaying claiming until age 65. The lower-earning spouse should claim at 62 despite the increase in ACA health insurance premiums.

On the other hand, if 100% of the $16,900 in Social Security benefits will be incremental income, and it’ll push their income over a cliff, which will increase their ACA health insurance premiums by $2,000 a month, then clearly they should hold off claiming Social Security until they no longer use ACA health insurance.

It All Depends

Claiming Social Security at 62 doesn’t necessarily increase your income for ACA health insurance. In some cases, it can decrease your income and lower your premiums. If it does increase your income, the incremental income isn’t necessarily 100% of the Social Security benefits. It can be only a small percentage of the benefits. The premium increase from the incremental income can be less than the loss in the total present value of Social Security benefits if you choose to delay claiming until 65. Don’t be afraid to claim Social Security at 62 only because it may raise your ACA health insurance premiums.

In some other cases, claiming Social Security at 62 will increase your income by a large percentage of the benefits, which will push it over a cliff and raise your ACA health insurance premiums by a huge amount, possibly more than the Social Security benefits received.

It all depends on whether there’s a cliff, and if so, where your household income is relative to the cliff before and after claiming Social Security. A ramp is much easier to deal with than a cliff.

You should calculate your incremental income based on the income composition before claiming Social Security. Wait to see how the cliff situation will be resolved. Then calculate the effect on your ACA health insurance premiums and compare with delaying Social Security.

Manage Risk

Finally, laws can change, and your financial situation can change. If you think it’s too risky and you want to avoid any complications, it’s OK to delay claiming Social Security until you no longer use ACA health insurance.

It comes down to “What if I’m wrong?” What if you think you’ll go over a cliff, but you don’t? You delay claiming and unnecessarily lose 1.3% of your Social Security benefits in my example. What if you think you’re safely under the cliff, and you’re suddenly over? You pay a huge amount in ACA health insurance premiums. Losing 1.3% of the lifetime Social Security benefits may be a small price to pay for the peace of mind that your ACA health insurance premiums won’t blow up in your face. See Use Pascal’s Wager When You’re Not Sure About Tax Rules.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

KD says

This is such a am important topic that Harry has answered so well. Many professional planning experts, YouTubers you have millions of followers and so called bogleheads forum folks all butcher this topic to no end and provide excruciatingly bad advice. Kudos to Harry for elucidating this so well. Thank you.

Pete says

Claiming early might also reduce or eliminate cost sharing reductions so this, along with premium tax credits, should be another part of the calculation.

Harry Sit says

That’s a good point, Pete. Thank you for bringing it up. I added a new section for Cost-Sharing Reductions. How claiming early affects it again depends on the incremental income, which may be zero or negative. Claiming early can help someone qualify for CSR in some cases.

Meril Amdursky says

What does making a full $8000 Ira contribution (or $16000 for two) do to lower income for ACA credit?

Harry Sit says

Making a deductible contribution to a Traditional IRA requires earned income from a W-2 job or self-employment, and the total income must be under a limit to take the deduction. Many retirees considering claiming Social Security aren’t eligible. If you’re eligible, the deductible contribution lowers the income for ACA health insurance dollar for dollar.

erik says

Hi Harry, When the tax software is released for tax year filing for 2025 I will go through these examples on my own with my personal financial picture and get back to you with a comment to this post at that future point in time. I suspect you will do so likewise.

Dan Wick says

Does anyone know the cost difference for the ACA with a cliff and the ACA without a cliff to the national budget and should that even be a consideration?

Harry Sit says

I haven’t looked into it myself. For what it’s worth, according to AI, extending the enhanced subsidies (the blue line) costs 1/12th to 1/10th as much as extending the 2017 tax cuts. That includes pushing down the ramp part of the line. Only removing the cliff would cost less than that.