Updated on January 29, 2024, with updated screenshots from H&R Block software for tax year 2023. If you use TurboTax, see:

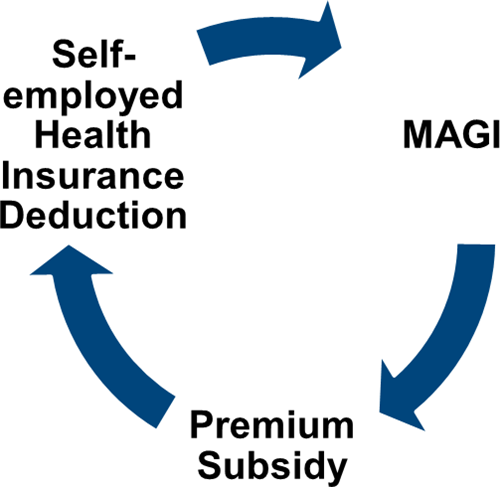

Many self-employed business owners buy health insurance from the Affordable Care Act (ACA) healthcare marketplace. Self-employed health insurance premiums are tax-deductible. When your income is low enough, you can also receive a subsidy in the form of a premium tax credit. The tax deduction and the subsidy form a circular relationship. The math is difficult to do by hand but tax software easily handles it for most people.

Use H&R Block Downloaded Software

The screenshots below are taken from H&R Block downloaded software. The downloaded software is way better than online software. If you haven’t paid for your H&R Block Online filing yet, consider buying H&R Block download software from Amazon, Walmart, Newegg, and many other places. If you’re already too far in entering your data into H&R Block Online, make this your last year of using H&R Block Online. Switch over to H&R Block download software next year.

Self-Employment Income

You should enter all your self-employment income and expenses into the software before you start doing health insurance related to your self-employment.

Self-Employed Health Insurance

I’m using this scenario as an example:

You are single, self-employed, with no dependent. You had health insurance from the ACA healthcare marketplace for all 12 months in the year. The second lowest cost Silver plan was $600/month. The full unsubsidized premium for the plan you chose was $500/month. Based on your estimated income, you got a $150/month advance credit. You paid net $350/month out of pocket.

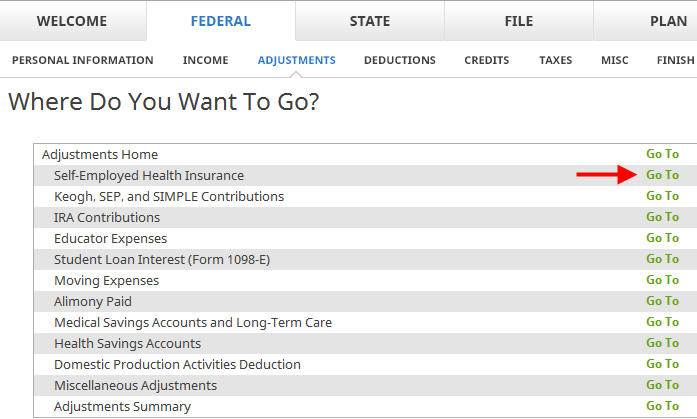

Go to Federal -> Adjustments -> Self-Employed Health Insurance.

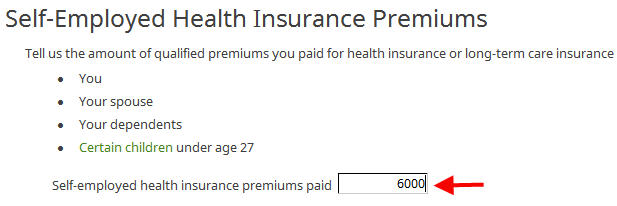

Enter the full unsubsidized premiums for your health insurance in the year. You find this number on the 1095-A form you receive from the ACA healthcare marketplace (line 33, column A). If you know exactly how much insurance premium you paid after the subsidy, you can also use that number plus the advance premium credit paid by the healthcare marketplace in Form 1095-A Line 33 column C. Sometimes the number in Form 1095-A Line 33 column A is off from the sum of what you paid plus the subsidy in Form 1095-A Line 33 column C.

If you also paid premiums for dental and vision insurance, add those as well. We don’t have dental and vision premiums in our example.

Right now it says 100% of your premium is deductible. It’ll change after you enter more information from your 1095-A form.

Enter 1095-A

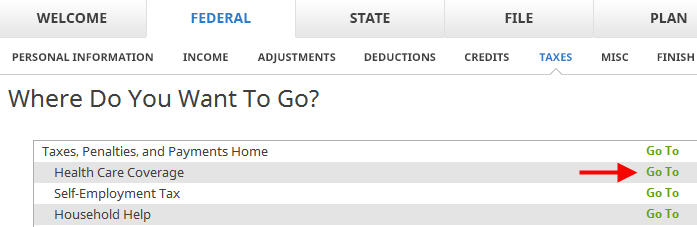

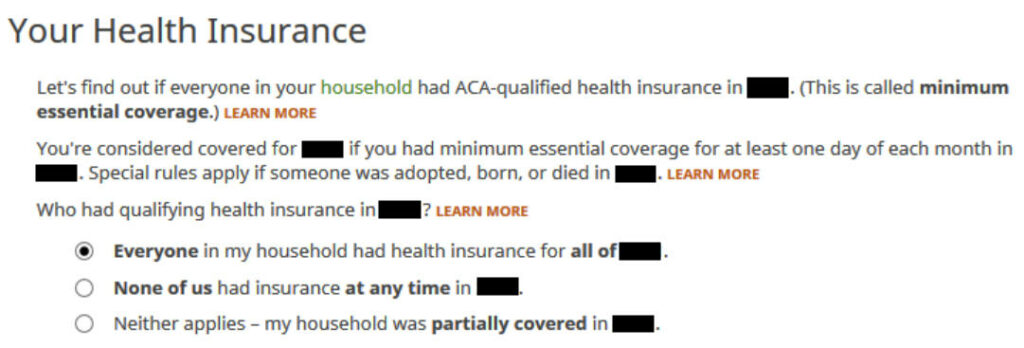

Go to Federal -> Taxes -> Health Care Coverage.

Everyone had insurance in our example.

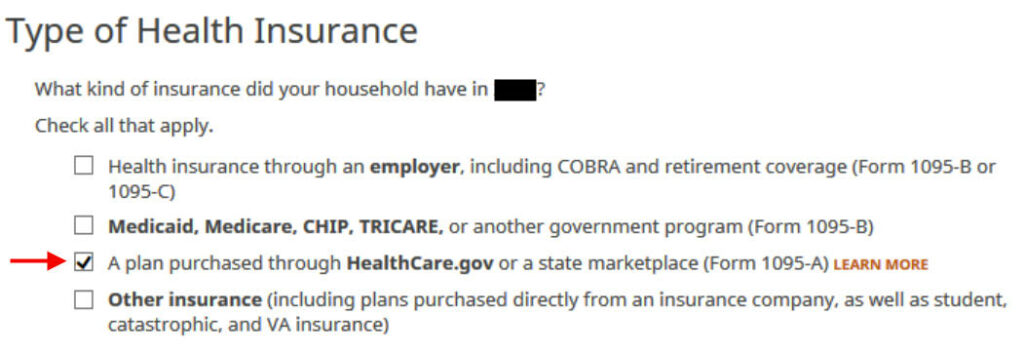

Check the box for a plan from the ACA healthcare marketplace.

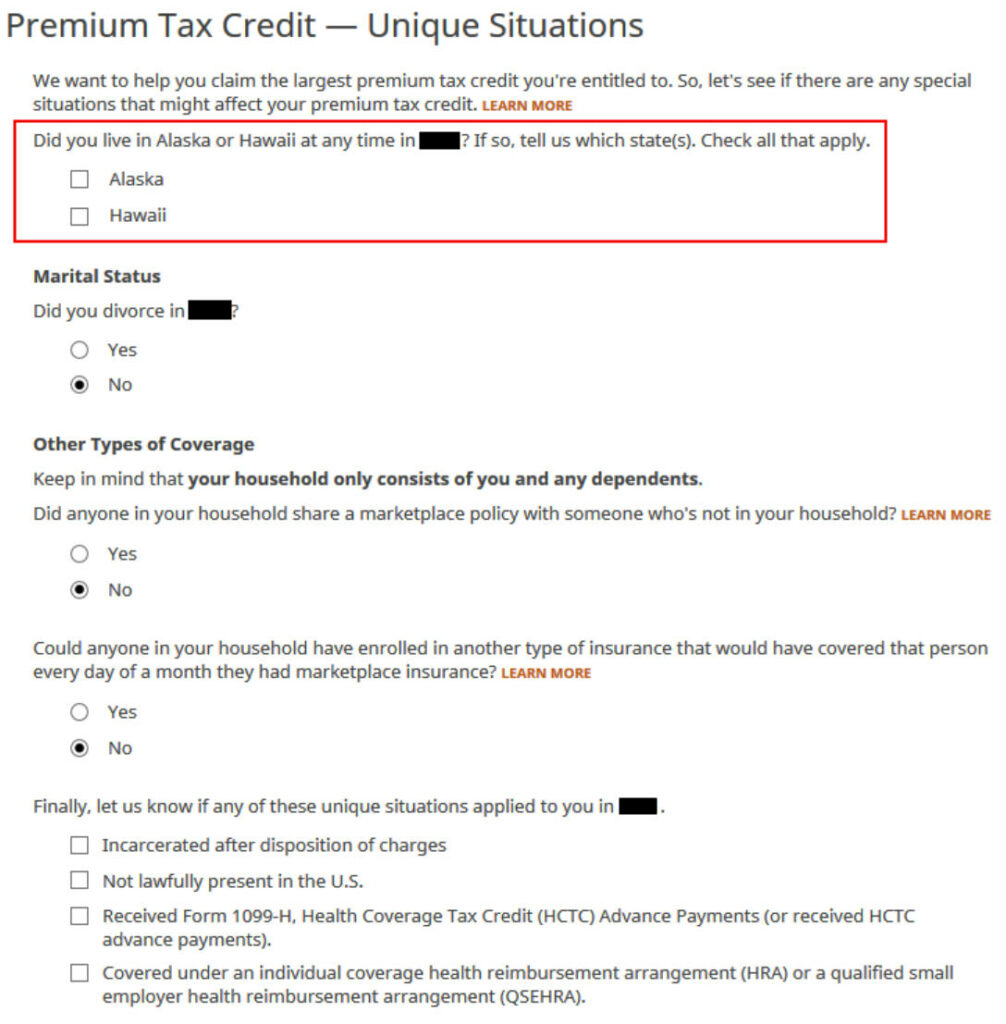

We don’t have any of these unique situations here. Check the box for Alaska or Hawaii if you lived there.

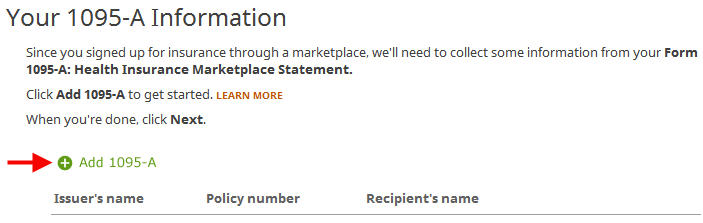

We need to add the 1095-A from the ACA healthcare marketplace.

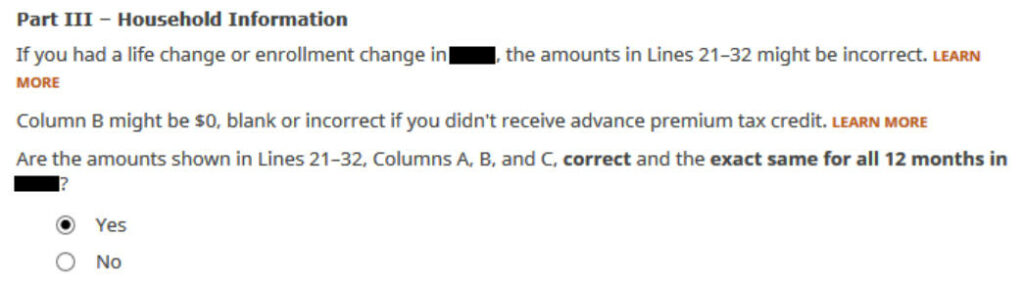

Enter the information as requested. Scroll down to Part III. The numbers on our 1095-A are the same for all 12 months and correct in our example. If you have different numbers for some months, choose ‘No’ and enter the month-by-month numbers from your Form 1095-A.

Enter the monthly amounts from the 1095-A. The full unsubsidized premium was $500/month. The full unsubsidized premium for the second lowest cost Silver plan was $600/month. The ACA healthcare marketplace paid $150/month in advance subsidy to the insurance company on our behalf.

We only have one 1095-A form in our example. If you have more than one, repeat and add them all.

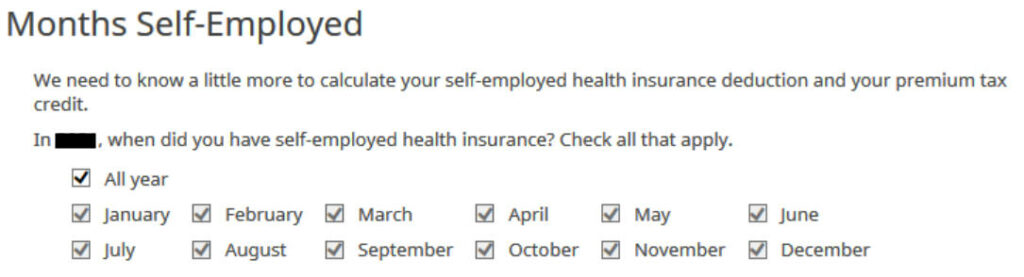

Which months you were self-employed determines how much counts as deductible self-employed health insurance. We were self-employed in all 12 months in our example.

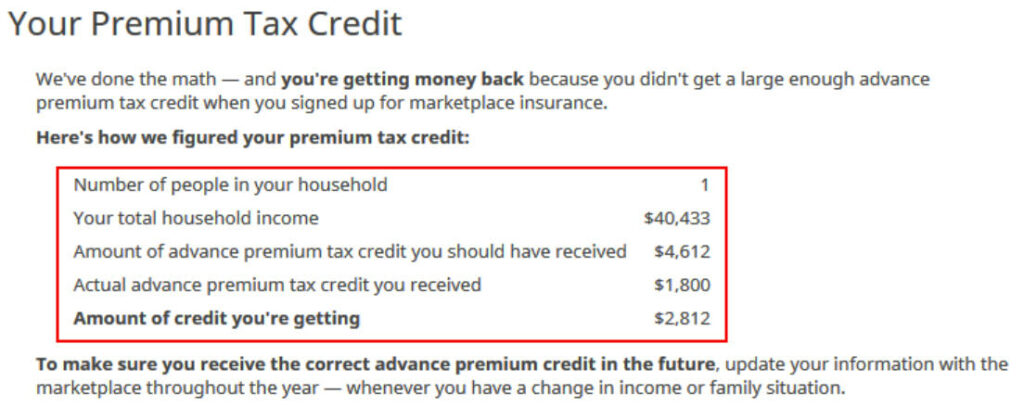

The software crunches the numbers. It says we are eligible for more premium tax credit than the advance subsidy the ACA healthcare marketplace already paid to the insurance company.

Self-Employed Health Insurance Deduction

We’re eligible for a tax deduction on the amount not covered by the re-calculated premium tax credit.

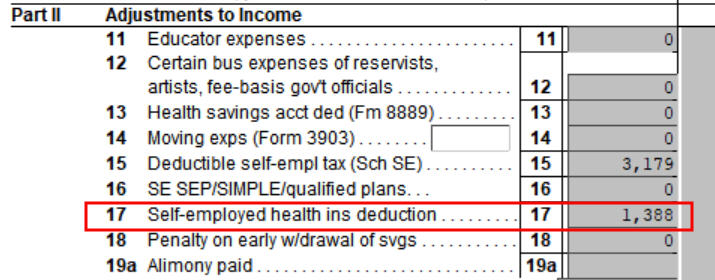

You can verify how much you are receiving a tax deduction. Click on Forms at the top. Double-click on Form 1040 and Schedules 1-3. Scroll down to Schedule 1 and look at line 17. That’s your self-employed health insurance deduction.

Premium Tax Credit

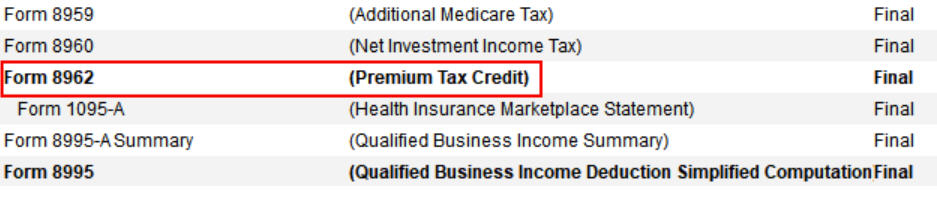

Close Form 1040 and Schedules 1-3 and find Form 8962 in the forms list. Double-click on it.

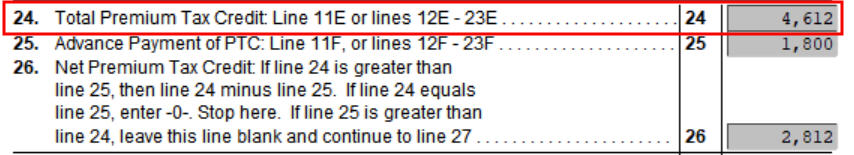

Scroll down to Line 24 on Form 8962. That’s our premium tax credit based on our actual income. Because we received less in advance subsidy, we’re getting the difference in our tax refund. If you received more in advance subsidy, you’ll have to pay back the difference (subject to a cap, see Cap On Paying Back ACA Health Insurance Subsidy Premium Tax Credit).

$1,388 in self-employed health insurance deduction plus $4,612 in premium tax credit equals $6,000. That’s the total unsubsidized premium for our health insurance (plus any dental and vision insurance premium, which we didn’t have in our example). The numbers add up!

The software figured out the split between the tax deduction and the tax credit. It also matched the result from TurboTax for the same example. This is where software does its best. If you take this to a tax professional, they will have to use their software to calculate the split anyway. I bet they aren’t able to do it by hand.

Edge Cases

Tax software works for most cases but it doesn’t work for everyone. You know you’re running into one of the edge cases for which the tax software doesn’t work when the numbers from the software fail this equation (except for a small difference due to rounding):

Self-Employed Health Insurance Deduction + Premium Tax Credit = Unsubsidized Health Insurance Premium (including any dental and vision premiums)

When this happens, you need a better calculator. See When TurboTax and H&R Block Give Self-Employed Wrong ACA Subsidy.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Cindy says

Thank you for this example. I was struggling with how to complete the healthinsurance blanks on the IRS forms to get the accurate deduction for my health insurance. This example worked great! Now I just have to figure out how to deduct my medicare health insurance premiums. We had 9 months of ACA and then 3 of Medicare after that. When I add it to the ACA amount, it makes the subsidy charge go up??

Harry Sit says

Medicare is not ACA. So don’t add it there. Use software. It’s next to impossible to do it by hand.

J Harper says

I used H&R Block Deluxe 2016 to calculate the SE health insurance deduction and the ACA premium tax credit following the procedure you described. It generated the following numbers:

SEHI Deduction = $3,809

Tax Credit = $12,637

Total = $16,446

The total is $13 more than my plan’s total premium, which violated IRS guidance.

Calculation with a spreadsheet (tested with IRS examples) gave the following results:

SEHI Deduction = $3,549

Tax Credit = $12,884

Total = $16,433

The total equals my plans total premium, which meets IRS’ requirement. Plus it results in a $250 higher refund in my case.

If you override H&R’s numbers with the better numbers, the software will not let you file electronically.

Harry Sit says

The $13 difference could be due to rounding from annual to monthly and then adding up to annual. You can print out Form 8962 and see. If the spreadsheet is accurate, the inputs to the software and to the spreadsheet must be different. Was the deduction for 1/2 of the self-employment tax taken into account? H&R Block and TurboTax gave the same numbers on the same inputs. I’m confident the software is calculating correctly.

Jill Snodgrass says

My situation is the same as your example with these figures: 5631.12 in premiums, 5908.80 silver plan and $3948 in advance tax credits. My self employment income was about $15,000. When I put in the numbers into HR software it gives me a $1673 on line 69 but only $10 on line 29. Any ideas why?

Harry Sit says

$3,948 in advance credit plus another $1,673 in tax credit plus $10 equal to the $5,631 premiums. The numbers add up. Congratulations, your health insurance for one full year only cost you $10. Now even that $10 is tax deductible.

Kenny R. says

I live in Virginia which did not expand Medicare. As a result, everything I read said that my 22 year-old daughter, who is independent, filing as Single and earned only $1100 in 2016, would not receive ANY ACA subsidy, since her income falls below the federal poverty line of $11,770.

HOWEVER, H&R Block software is awarding her the full ACA subsidy. I love it, but I’m confused and not sure I can trust it. Her income is 9% of the federal poverty level, she lives in VA, and yet H&R Block says she gets the full $2611 ACA tax credit. Why is this??

Mikael says

This is very helpful, but it seems to work only “retrospectively” for doing previous year taxes.

I am self-employed and trying to figure out whether we would get a subsidy on the ACA, our first time buying insurance that way. Can the tax software help me do that, or do these calculations get done in the sign-up process.

Grateful for any guidance.

Harry Sit says

The cutoff numbers don’t change that much from year to year. Unless you are very close to the borderline, using previous year’s tax software with this year’s income and premium numbers will give you a good idea.

JIm Fulton says

Harry,

I think the 2015 H&R Block software failed to handled the circular calculation of the ACA tax credit and the self-employed health insurance tax deduction.

As a confirmation, did you ever check the 2015 H&R block software?

Harry Sit says

I didn’t check 2015. This community forum post from an H&R Block employee said it handled the most common scenarios. I don’t know how it actually worked.

Karen Cox says

Thank you so much for providing these instructions. I have been very happy with H&R Block Deluxe for many years until I tried to complete my self-employed son’s 2017 return using this software. The software didn’t explain or lead me through the calculations for his self-employed ACA health insurance but thank goodness i found your website. Thank you so much for your clear and illustrated step-by-step instructions.

If I hadn’t found your website, I was just going to enter zero for self-employed health insurance premiums. It was either that or tear out my hair trying to do the calculation manually.

Susan Borsch says

Finally found a good forum for this question — thanks! This is the first time I’m using tax software (TaxAct) and as far as I can tell, they are calculating my self-employment health insurance deduction wrong — in my favor.

I paid $3,072 in premiums (for a bronze insurance plan) but overestimated my income (now $39,330) so am receiving a net premium tax credit. TaxAct calculates my premium tax credit as $1,380 and asks me to fill in $1,384 as an “adjustment required to self-employed health insurance deduction.”

“Of the $3,072 Marketplace premiums you paid, $1,384 were applied toward the premium tax credit. An adjustment is required because these same premiums cannot also be claimed for the self-employed health insurance deduction. Enter $1,384 below.”

I enter $1,384 as requested, and my TaxAct return shows my line 29 self-employed health insurance deduction as $4,760. I also get the $1,380 on line 69 as a net premium tax credit. That can’t be right…right? Line 29 should only show what I actually paid and then I get the credit on line 69?

Happy to receive extra refund but don’t want it if it’s not correct! I’ve checked the1095 insurance subsidy forms I filled in online and I did it correctly. ?????

Harry Sit says

This post is about H&R Block software. You are using TaxACT. Apparently you entered $3,072 twice. $3,072 marketplace premium – $1,384 credit = $1,688 remaining deductible. If you entered $3,072 under self-employment healthcare premium again somewhere, $3,072 + $1,688 = $4,760. So find that duplicate $3,072 and delete it.

Susan Borsch says

I’m sorry, I meant to put this in your article comparing tax software.

Your numbers make sense, but I never actually entered $3,072 at all. The software calculated this amount from my 1095 form data. I had two forms, one for January February payments and one for the rest of the year, since I moved to a different state in Feb. Also, the software says “of the $3,072 marketplace premiums you paid….” so they don’t seem to be indicating I’ve paid in $3,072 twice? I wonder if they could be thrown off by my having two 1095 forms filled out?

Harry Sit says

A non-marketplace dental policy is also deductible but it’s not eligible for the premium tax credit. So if you did spend $3,072 on a dental policy it would be added to the marketplace deductible amount. Look really hard for where the software asks for healthcare expenses other than marketplace policies. If you are sure you didn’t put a number there, contact TaxACT support.

Morgen says

Harry,

I know you said you haven’t checked 2018 but I’d love for you to do so. I always do my taxes long form throughout the year on a spreadsheet, then I compare HR Block and Turbo Tax. This year, TT fails to recognize the Oregon state deduction for federal taxes paid (they agree to this after 3 hours on the phone but note that the downloaded version is not believed to have the same bug) but other than that their numbers are very close to mine. HRB however gives both a higher credit / refund as well as calculating the self employement deduction in a way that doesn’t make sense mathematically. Several hours on the phone with them ended with them saying it was more complicated than Health Ins expenses less credit equals self employment deduction… but couldn’t tell me what. They were sure though that if I just efiled my taxes, I could figure it out after because I’d have access to more forms.

I’d love to know who was right!? HRB would keep a couple THOUSAND dollars in my pocket but I actually think TT is correct this time around. 😀

Harry Sit says

Try this calculator and see which one it agrees with:

https://cims.nyu.edu/~ferguson/Calculator%20SE%20ACA.html

In general the downloaded version works better and is less expensive. This is true for both TurboTax and H&R Block.

Maria says

What about someone who cannot afford insurance? I am getting hung up on the “monthly employee cost” vs the “annual premiums paid through salary reduction arrangement.” Which one is used to determine affordability? What does “monthly employee cost” mean?

H&R Block: Tell us the monthly employee cost of your employer’s health plan. We’ll use this amount to determine if you could afforded your employer’s plan in 2017.

Monthly employee cost

Annual premiums paid through a salary reduction arrangement

Janet Sommerfeld says

Hi Harry

Thank you for the above help. It really helped. Now I have question.

I received a $2000 IRA from my father when he passed in 2017. He had it for years in my name. I rolled it into a new Roth IRA with the same company and have left it alone. Where do I declare this on my 2017 fed and mi state taxes? Will I have to take RMD this year? I am 51 yrs. Thank you

Harry Sit says

What do you mean by “He had it for years in my name.”? Was the IRA itself in your name and you just didn’t know about it? Or did he list you as the beneficiary for the IRA in his name? Was the IRA a traditional IRA or a Roth IRA? If it was a traditional IRA in his name, as a non-spouse beneficiary, you are not allowed to roll it over into a new Roth IRA. If it was a Roth IRA in his name, which became an inherited Roth IRA for you, you must start taking RMD in the year after his death (i.e. 2018). The RMD from an inherited Roth IRA isn’t taxable.

https://www.irs.gov/retirement-plans/required-minimum-distributions-for-ira-beneficiaries

Stacey says

You’ve saved me AGAIN, as you have before! Thank you so much for this clear article, which is still applicable for 2021 H&R Block Desktop. For the past three days, I’ve been banging my head against this problem, trying to figure out why it kept saying my Self-employed Health Ins deduction was 0. It’s because, in your second screenshot, where H&R Block says “Tell us the amount of unqualified premiums YOU paid…,” (emphasis mine) I was entering the amount I actually paid, not including the advance premium credit. Once I changed it as you explained, ta-da!, my deduction is correct.

There have got to be LOTS of people making that same mistake, not realizing it, and simply missing out on this valuable deduction. Seems like the text on H&R Block really ought to clarify, as you did, that we need to enter the total, NOT just what “you paid.”

Bill says

I 100% agree with Stacey above (February 21, 2022 at 11:05 am). I had the same problem (entering the amount I actually paid). I wish the H&R instructions were as clear as yours. Thank you very much for your explanation!

Martin Griffin says

Hello, I’m self employed, do my taxes by hand, and just completed Form 8962. I received an excess advance payment of $3858, but it is limited to $1800 because my line 5 percentage is 298%. On schedule 1 , I have a deduction for the $1800 + my actual out of pocket cost of monthly premiums for the year. Am I finished or do I now have to go back and complete another 8962 using my revised Schedule 1, line 5 number (that is now lower due to the limitation)? Thank you.

Harry Sit says

Yes, you have to go in circles until the numbers stop changing when you’re doing it by hand. The lower deduction on Schedule 1 Line 17 increases your AGI, which increases the percentage of Federal Poverty Line on Form 8962 Line 5, which lowers the premium tax credit you’re eligible for on Form 8962 Line 24, which increases the excess advance payment. Your repayment limitation on Form 8962 Line 28 may also be higher now if your higher percentage on Form 8962 Line 5 crosses into a new range. A higher repayment means you can deduct more on Schedule 1 Line 17, which kicks off another round of going in circles.

Tax software goes in circles faster than doing it by hand. Newegg currently sells H&R Block Deluxe + State for $20 after a promo code.