[Updated on February 22, 2022 with a different example.]

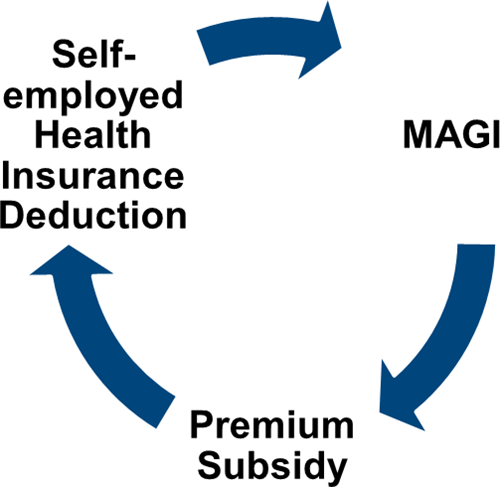

When you’re self-employed, you can deduct your health insurance premium on your tax return. When you buy health insurance through the ACA healthcare marketplace, you can also get a premium subsidy when your income qualifies. The circular relationship between the self-employed health insurance deduction and the premium tax credit creates an interesting math problem.

Tax Software

After the IRS provided an iterative method for this math problem (see IRS Guidance On Circular Reference in ACA Premium Subsidy and Deduction), tax software vendors such as TurboTax and H&R Block implemented the calculation in their software. It solved the problem for most people. For a step-by-step walkthrough of how to make the software calculate the subsidy and the deduction, please see Self-Employed ACA Health Insurance Subsidy and Deduction In TurboTax and Self-Employed ACA Health Insurance Subsidy and Deduction In H&R Block Tax Software.

However, the calculation in the software still doesn’t work for everyone. Sometimes your specific numbers throw the software out of whack when the same software works perfectly fine with other numbers for other people. Worse yet, the software doesn’t warn you that its calculation is wrong. If you don’t know it’s wrong, you may miss out on large tax credits and deductions!

Here’s a simple example for which TurboTax and H&R Block tax software gives the wrong calculation:

Diane, single, earned $45,000 in self-employment income after all business expenses. She didn’t have any other income or deductions. After subtracting one-half of the self-employment tax, Diane’s MAGI before health insurance was $41,821. As a Texas resident, Diane paid $498/month for a health plan from the ACA healthcare marketplace ($5,976 total). The Second Lowest Cost Silver Plan in her zip code cost $600/month ($7,200 total). Diane received no advance subsidy from the ACA healthcare marketplace.

TurboTax calculated $810 in self-employed health insurance deduction (Schedule 1, Line 17) and $4,522 in premium tax credit (Form 8962, Line 24). We know this result makes no sense because Diane should be able to deduct the full amount not covered by the premium tax credit. Diane paid $5,976. If she receives $4,522 in premium tax credit, she should be able to deduct $5,976 – $4,522 = $1,454, not just $810.

In other words, this equation should hold true:

Self-Employed Health Insurance Deduction + Premium Tax Credit = Unsubsidized Health Insurance Premium (including any dental and vision premiums)

You know the tax software is giving you wrong numbers when the numbers fail the equation (except for a small difference due to rounding).

H&R Block tax software does better than TurboTax in this case. It calculates $1,378 in self-employed health insurance deduction (Schedule 1, Line 17) and $4,612 in premium tax credit (Form 8962, Line 24). This is a little too generous. Diane only paid $5,976 for her health policy but she’s getting $1,378 + $4,612 = $5,990 in tax deduction and tax credit.

A Better Calculator

Mathematician Sam Ferguson first heard of this problem from a self-employed Uber driver when he was a Ph.D. student at NYU. He studied the math angles and found out why the calculation didn’t work in all cases. He wrote an alternative method in his paper Obamacare and a Fix for the IRS Iteration. When he spoke to the person in charge at the IRS, the IRS personnel acknowledged the problem but they didn’t treat it as a high priority when the existing method already worked for most people, just not for the edge cases.

Dr. Ferguson developed an online calculator with a software engineer. He authorized me to host it and keep it updated. Here’s the link:

You get these results when you run the same numbers using the better calculator:

Appropriate subsidy amount: 4,601

With this subsidy, your net health insurance cost to be deducted on your tax return is: 5,976 – 4,601 = 1,375

With this net health insurance cost, your modified adjusted gross income is: 41,821 -1,375 = 40,446

| Calculator | TurboTax | H&R Block | |

|---|---|---|---|

| Tax Deduction | $1,375 | $810 | $1,378 |

| Subsidy | $4,601 | $4,522 | $4,612 |

If Diane simply goes with the wrong numbers from TurboTax, she will miss $79 in tax credit plus another $565 in tax deduction.

Overriding Tax Software

After getting the correct numbers from the calculator, you still need to find a way to have your tax software use those numbers. I couldn’t figure out how to override the wrong numbers in TurboTax Deluxe downloaded software. I’m not sure whether a different edition allows manual entries. I was able to figure out how to override in H&R Block software. If you use TurboTax and you run into this problem, consider switching to H&R Block software.

Although the H&R Block software is close enough for our example that it doesn’t need overriding, I’m showing you how to override H&R Block software in case its calculation is off by a larger amount for a different set of numbers. Overriding may prevent you from e-filing, but the inconvenience of having to file your return by mail sure beats missing out on a large deduction or tax credit.

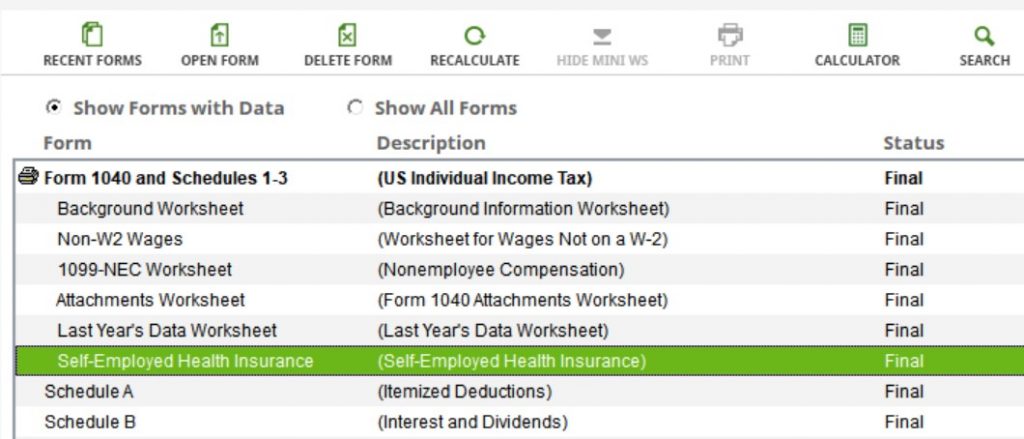

In H&R Block downloaded software, click on Forms on the top, and then find “Self-Employed Health Insurance” in the forms list.

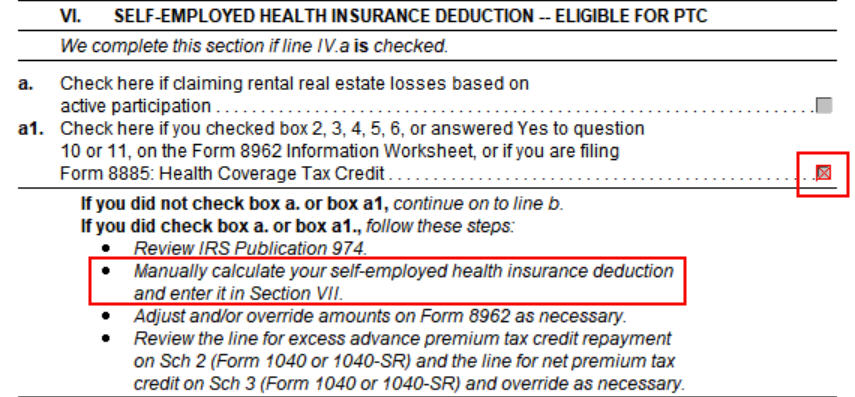

Double-click to open that form. Scroll down to Part VI. Right-click on Box a1 and click on Override. This will allow you to enter your manually calculated deduction.

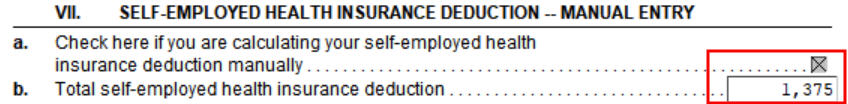

Scroll further down to Part VII. Right-click on Box a and click on Override. Enter the deduction from the online calculator in the box below (in our example, $1,375).

Close this form. Find Form 8962 in the forms list.

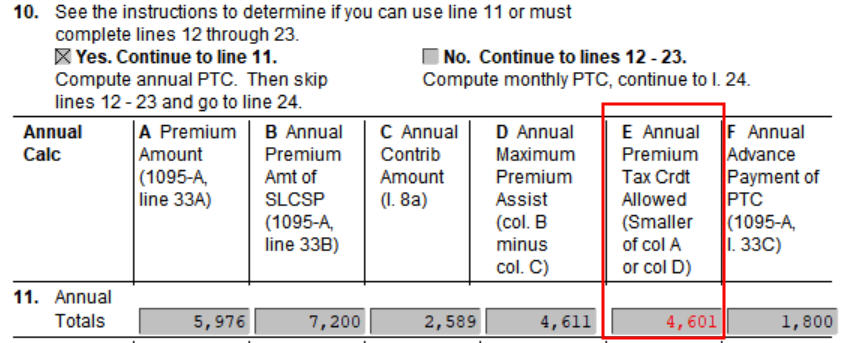

Double-click to open Form 8962. Scroll down to Line 11. If the number in column E is different than the number from the online calculator, right-click on Line 11 column E and click on Override. Enter your manually calculated subsidy (in our example, $1,398). If you must use monthly numbers in Lines 12-23 as opposed to the annual totals in Line 11, do the override in Lines 12-23 column E.

That’ll do it. You should double-check that your Schedule 1 Line 17 shows the correct deduction and your Form 8962 Line 24 shows the correct subsidy.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

LA says

Have you heard any issues with FreetaxUSA?

Thanks.

Harry Sit says

It’s worse. FreeTaxUSA can’t calculate for the most cases TurboTax and H&R Block already do correctly.

LA says

oh noooo.

Karin says

Any info about TaxAct? Do they get it right? Thanks!

Harry Sit says

Tax software can only follow the IRS method. When the IRS method fails, it fails everywhere. The wrong numbers aren’t the tax software’s fault. TaxAct was able to calculate for most cases when the IRS method works.

Susan A says

My Federal tax returned filed on 4/13/21 with Turbotax was rejected today due to this problem. Turbotax has advised that it is a bug in their software and that it will be fixed on or by 4/30/21. It is delaying my refund, however, my bigger concern is what happens if Turbotax does not get it fixed/worked out by 4/30/21. To be honest, I am not a tax guro; thus, I count on Turbotax to make these calculations correctly. I am not fully following how you are showing to fix it. If Turbotax does not fix this issue by 4/30/21, what would you do if you are me?

Harry Sit says

Susan – First you want to double-check what’s really causing your issue. What was the message from the rejection? After you follow the steps in Self-Employed ACA Health Insurance Subsidy and Deduction In TurboTax, what is the tax deduction on Schedule 1 Line 16, and what is the premium tax credit on Form 8962 Line 24? What are the numbers on your Form 1095-A Line 33 (all 3 columns)? Your issue may or may not be the same as the one in this post. If it’s indeed the same, and TurboTax doesn’t make it possible to override the software, I would consider switching to the H&R Block downloaded software. The fix in the second part of the post only applies to the H&R Block software.

Susan Ahern says

Follow up on your questions:

Description of error:

Your federal return was rejected due to an issue with Self-Employed Health Insurance Deduction on Schedule 1: Additional Income and Adjustments to Income

What needs to be done:

ACTION NEEDED: Important Information About Your Federal Tax Return Updates to the Self-Employed Health and Long-Term Care Insurance Deduction Worksheet are estimated to be completed by 4/30/21. What do I do now? If you’re using a CD or downloaded version of TurboTax: When these updates are completed, update TurboTax (visit our Support Site if you need help updating) Please review your answers under the topic of the Affordable Care Act under Medical in Deduction and Credits. Make any corrections if prompted E-file your return (you won’t be charged for e-filing) If you’re using the online version: When these updates are completed, log into your TurboTax Online account Please review your answers under the topic of the Affordable Care Act under Medical in Deduction and Credits. Make any corrections if prompted E-file your return (you won’t be charged) We apologize for any inconvenience. Thank you for using TurboTax!”

After you follow the steps in Self-Employed ACA Health Insurance Subsidy and Deduction In TurboTax, what is the tax deduction on:

“Schedule 1 Line 16, $3,206”

“and what is the premium tax credit on Form 8962 Line 24: blank”

“Form 8962 Line 25: $5,478”

“What are the numbers on your Form 1095-A Line 33 (all 3 columns):

33 A = $5,474.81

33B = $8,229.87

33C = $5,474.81”

Per the Calculator in your post:

Appropriate subsidy amount: 0. You aren’t eligible for a subsidy if (a) your modified adjusted gross income exceeds 400% of the federal poverty line; or (b) it falls below 100% of the federal poverty line but the ACA exchange didn’t pay any advance subsidy to the insurance company during the year.

With this subsidy, your net health insurance cost to be deducted on your tax return is: 5,475 – 0 = 5,475

With this net health insurance cost, your modified adjusted gross income is: 66,782 – 5,475 = 61,307

Your expected contribution toward a benchmark plan is: 82,230

Your subsidy can’t exceed 0

You are encouraged to check that your modified adjusted gross income gives the expected contribution indicated. Your net health insurance cost, though, can exceed your expected contribution. This occurs when you have more expensive health insurance than the benchmark plan, and when a subsidy cliff at 133% or 400% of the federal poverty line prevents a higher subsidy.

Any assistance is appreciated. If you wish to assist privately and charge a fee, please email me.

Harry Sit says

Susan – The error appeared to have come from TurboTax, not the IRS. They know a change is coming and they just stop you from e-filing until you get the software update. Chances are the error will go away when the software is updated. It appears when you enrolled you estimated your income low and you got a Bronze plan for free, and now it turns out your income in 2020 was much higher. The good news is, by a special provision in the new law, you will get to keep the subsidy in 2020 even though the calculator says your subsidy should be zero (this only applies to 2020). For now, just wait for the software update. File an extension if it isn’t resolved by May 17. You don’t have to rush.

Ciggy says

Dear Mr.Sit.

Thank you so much for this article and your “Self-Employed ACA Health Insurance Subsidy In H&R Block Tax Software” article. I have been banging my head for too many hours trying to figure out the self-employed health care deduction specifically in H&R Block. I really appreciate your post – I was missing the “FULL unsubsidized” part of the numbers. No one from H&R Block could help me (local H&R Block as well as online H&R Block); their support for the desktop version is less than acceptable.

I plan to add catastrophic health care premiums (purchased only in 2020 in fear of covid) as well as my long term care insurance through MetLife to the “full unsubsidized premiums”. Do you agree this should be acceptable?

Thank you again for these posts.

Harry Sit says

The deductible long-term care insurance premium has age-based caps. When you include your long-term care insurance premium please be sure to adjust your premium down according to the caps if your premium is higher. Click on the “learn more” link and read the maximum you can include for your age.

Ciggy says

I am new to your website and now a huge fan. This is a question for my partner but related to this very topic. Let’s say that you are NOT self employed but employed by a small company who does not offer health care insurance (they are not required to do this legally based upon their size). You purchase health care through ACA and receive PTC. You are similar to the scenario above as you are paying for your health care premiums with non pre-taxed money. Inside TurboTax, can you deduct your premiums similar to the above scenario – how? Thank you again.

Harry Sit says

For someone not self-employed, health insurance premiums can only count as medical expenses. The first 7.5% of AGI in medical expenses can’t be deducted. The amount above 7.5% of AGI can be included as an itemized deduction. All itemized deductions added together must compete with the standard deduction. In the end, very little, if any, of the health insurance premium can be deducted for someone not self-employed.

Mike says

My god thank you. I knew the numbers were wrong and eventually calculated a better one through trial and error but felt like I might still be doing something out of bounds. Thank you for the validation that it is an issue and a cross check on numbers I came up with.

My understanding is the self employed tax credit impacts the MAGI which also impacts the IRA deduction in pretty close to the same income range. This in turn impacts the MAGI used in PTC. It would be great if that were included in that calculator as well, or at least discussed.

Susan Ahern says

Dear Mr. Sit:

Wow to your words, “The good news is, by a special provision in the new law, you will get to keep the subsidy in 2020 even though the calculator says your subsidy should be zero (this only applies to 2020).” Is this provision the “American Rescue Plan Act?”

What a gift. I am a self-employed caregiver who takes care of the elderly (mostly Alzheimer’s Disease or dementia) and caught Covid-19 for 40 days and was in the hospital for a week last year. Thus, lost my two job (worked 72 to 102 a week to get by as this is a low paying field). In 2018, I left a business job to be a caregiver as it is both ministry and a work of love to me and really integrated my spiritual and work life. However, the cons are the pay is low with no benefits. You would never know looking at me, however, I am immunocompromised and was out of work for six months. Since I was not paid any sick time, I did fill in a new section on my taxes “Self-employed sick leave credit” to get a $630 credit. Between this credit and the subsidy, I can put some emergency money away. Very grateful as I lost a lot last year.

Thank you so much for the good news on not paying back the subsidy. Blessings.

Harry Sit says

Yes, it’s the American Rescue Plan Act.

Nana says

Hi Susan and Harry,

I experienced exactly the same issue as Susan.

I’m self employed and bought the health insurance from the marketplace.

I e-filed on April 11 and it was rejected on April 14 for an issue of self employed health insurance deduction.

TurboTax displayed the same message as Susan listed above.

Google search took me here and I’m glad I’m not only one!

Thank you for sharing the information.

This is annoying and I hope TurboTax releases the bug fix soon.

Nana

Karen Manelis says

I’ve run into a problem with TurboTax where it ends up putting a negative number on Sch 1, Line 16 for the SEHI. Looking at the returns, this appears to mean that the PTC exceeds any deduction for SEHI. Only way I’ve found to “fix it” is to enter a positive number = negative number provided to zero out the deduction. Is there a better way this should be done?

MDM says

Re: “…how to override the wrong numbers in TurboTax Deluxe downloaded software. I’m not sure whether a different edition allows manual entries.”

For TY2021, downloaded TT Premium allows a manual entry if one does NOT check the “I’m self-employed and bought a Marketplace plan” box (see https://thefinancebuff.com/self-employed-health-insurance-aca-taxes.html for a screenshot of that page).

When that box is not checked, the SEHI deduction may be entered in the Self-Employed Health Insurance Premiums box on the Enter Your Business Expenses page (the page where one enters Advertising, Supply Expense, etc.).

Going through the actual Form 8962 calculations (i.e., with no overriding), it seems the best one can do with the $5976 premium is

SEHI deduction = $1371 and Total PTC = $4599 (for a total of $5970)

If one tries another $1 of SEHI, one gets

SEHI deduction = $1372 and Total PTC = $4611 (for a total of $5983)

Harry Sit says

Thanks! I’ll add the steps with screenshots for TurboTax shortly.

Heather says

I filed with H&R Block. Guess what I got in the mail? A large bill from the IRS!

I wish I had found this article before filing. H&R Block is no help whatsoever. Their accuracy guarantee is also a joke. I even paid “extra” for their support should I need it.

The inaccurate calculation on the Self-Employed ACA cost me the amount I should have paid, plus penalty & interest.

If this was a known issue – I really feel like I should have been notified by the software.

Ann J says

I’m very late to this party. I’ve always hand-done our taxes but have never taken any deduction for our health care because I just couldn’t figure it out. Now that I’ve found this article and read some of the linked articles, here is my question; my husband and I are each self-employed but share an ACA health plan. Are there any tax programs (even if I have to pay) that will figure the ACA mess correctly?

MDM says

If there is one business (either yours or your husband’s) that has enough income to cover the entire ACA premium, that simplifies things. Is that the case, or are your ACA premiums larger than the net income from any single business?

From Pub. 974 you are OK “as long as the sum of the [SEHI] deduction claimed…and the PTC computed [(Form 8962 line 24)], taking the deduction into account, is less than or equal to the enrollment premiums [(Form 8962 box 11a or the sum of 12a-23a)].”

In other words, if your Premium Tax Credit (PTC) pays your entire ACA premium, you can’t take any SEHI. But if the PTC doesn’t cover the whole premium, then you can use some of that difference for SEHI.

You could try Harry’s calculator for previous years and, if you could take a large enough SEHI to make it worthwhile, file amended returns to get refunds.

Harry Sit says

This article talks about some corner cases. Either TurboTax or H&R Block works for most “normal” scenarios. Of course you don’t know whether yours is “normal” until you try it.

Larry says

I encountered something unusual when doing my 2024 taxes on TT this year. I was on ACA for all of 2024. When I enrolled in Dec 2023 my estimate of 2024 income was low enough that the subsidy would cover our entire premium so monthly payments would not be required. Our income rose unexpectedly in late 2024 but we were still under 400% FPL. As a result, we are required to pay back the excess in PTC, but it will be limited to the $3150 repayment cap.

The TT program correctly determined the amount of subsidy repayment due but it also assigned the $3150 to my schedule A as an allowable 1095A medical premium. I will not be making the repayment until April 15th of this year so it’s my expectation that I will claim it on my 2025 taxes. I do not understand why the program would consider it as an allowable 2024 deduction.

For a comparison check I also did our return using H&R Block software and it also determined that we would need to repay the $3150 PTC, but it (correctly) did not allocate the amount to schedule A.

I reviewed my data entry on the TT program multiple times trying to determine if the misapply was my error but could not find a thing. Any thoughts on why the discrepancy?

Harry Sit says

Think of the $3,150 as an interest-free loan you received in 2024 and now you’re paying it back. The insurance expenses were still incurred in 2024 when you paid them with money from the loan. The medical expenses deduction on Schedule A requires clearing a 7.5% of AGI floor. Then you also have to itemize your deductions. H&R Block doesn’t bother showing it on Schedule A when the medical expenses are lower than 7.5% of your AGI or your itemized deductions are lower than the standard deduction.

Larry says

Thanks Harry, I understand your explanation as to why TT included the subsidy repayment but even without the $3,150 I still had sufficient schedule A expenses to itemize this year. That’s how I noticed the discrepancy between the two programs.

While the H&R program did not have a separate line item specifically for taxpayer 1095A premiums like TT has, the line item in the worksheet for Total Medical & dental expenses was still $3,150 less than what TT displayed.

My takeaway from this is that for H&R users the entry for subsidy repayment needs to be manually done.