Updated on January 29, 2024 with screenshots from TurboTax Deluxe downloaded software for 2023 tax filing. If you use H&R Block tax software, please read:

Many self-employed business owners buy health insurance through the ACA healthcare marketplace (healthcare.gov or a state-specific exchange). If your estimated income qualifies for a subsidy, the marketplace will pay part of the premium directly to the insurance company.

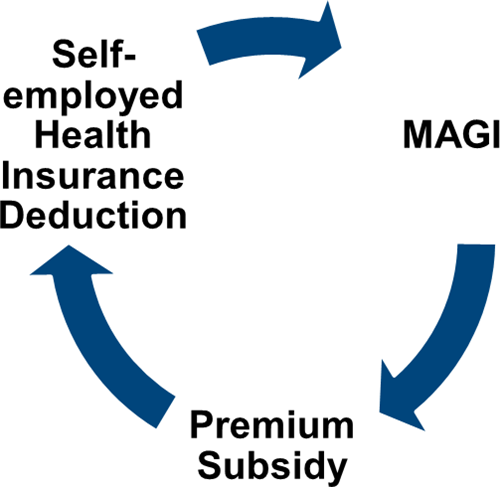

Circular Relationship

However, the advance subsidy is only an estimate based on the income estimate you provided when you signed up. As self-employed people know full well, the actual income from self-employment can vary greatly from year to year.

After the year is over, you have to square up and calculate the actual subsidy you qualify for. If your business didn’t do as well as you anticipated, you may qualify for a higher subsidy. If you had a great year, you may have to pay back some of it.

If you’re self-employed, you also qualify for a tax deduction for the health insurance premium. If you qualify for both a subsidy and a deduction, they form a circular relationship.

The IRS prescribed a method to calculate the split between the subsidy and the deduction. It’s difficult to calculate by hand but tax software will take care of it for most people.

Use TurboTax Download

The screenshots below are from TurboTax Deluxe downloaded software. The downloaded software is way better than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax download from Amazon, Costco, Walmart, and many other places and switch from TurboTax Online to TurboTax download (see instructions for how to make the switch from TurboTax).

We will use this scenario as an example:

Self-Employment Income

You should enter all your self-employment income and expenses into TurboTax before you start doing health insurance related to your self-employment.

TurboTax offers you to upgrade to the Home & Business edition but the Deluxe edition of TurboTax download software works just fine for a simple service business.

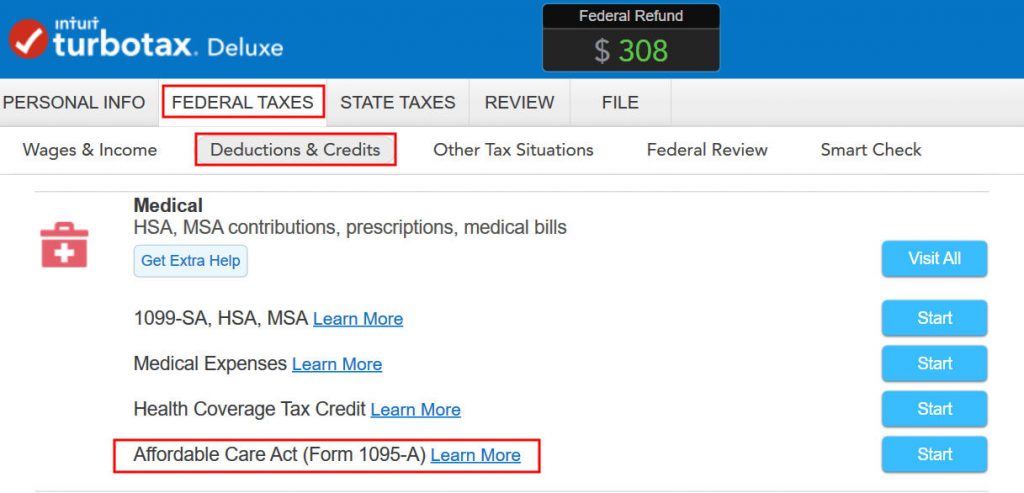

Enter 1095-A

Go to Federal Taxes -> Deductions & Credits. Scroll down and find Affordable Care Act (Form 1095-A) under Medical.

You should have a Form 1095-A from the ACA healthcare marketplace. If you didn’t get it in the mail, log in to your online account and look for a document download.

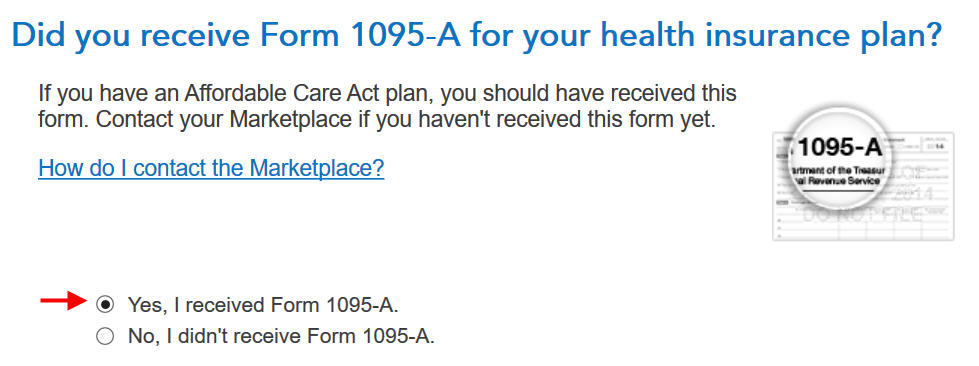

Enter the premium numbers from your Form 1095-A. If the numbers are the same for all months, enter the row for January and click on the Copy button next to it. It will put the same numbers for all other months.

The first column is the full unsubsidized monthly premium for your plan. The middle column is the full unsubsidized premium of the second lowest-cost Silver plan, which is used to calculate your subsidy. The last column is the advance subsidy the ACA marketplace already paid on your behalf to the insurance company.

Link to Self-Employment

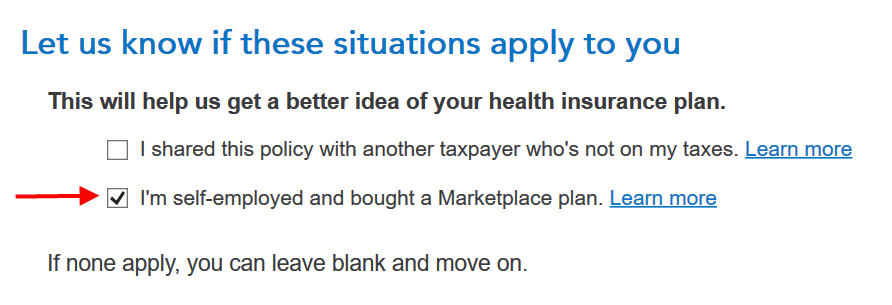

You get a tax deduction only when the insurance is linked to self-employment. TurboTax doesn’t know it only from the 1095-A form. You have to tell TurboTax it’s linked to your self-employment.

This is important but easy to miss. Even though TurboTax knows you’re self-employed and you have the 1095-A form from the ACA healthcare marketplace, you still must check this box.

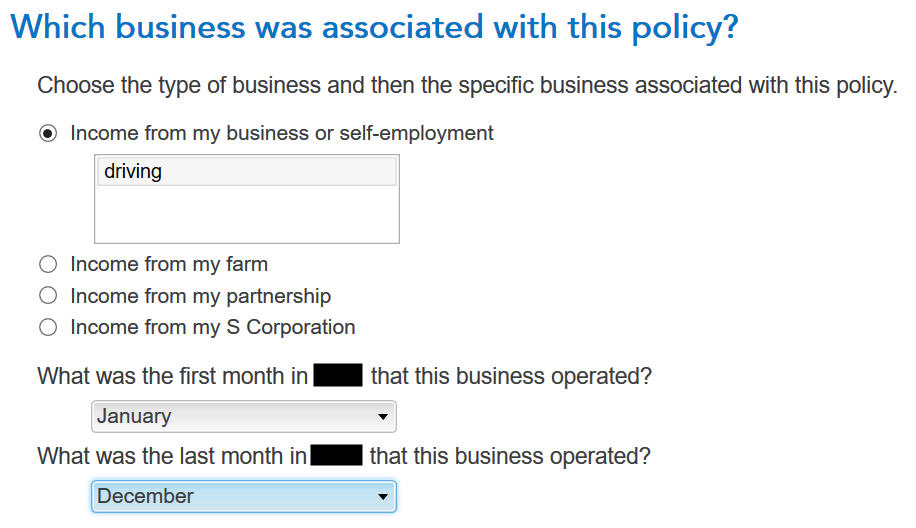

Associate the health insurance with your self-employment. Choose the partnership or the S-Corp option if your business income is from a partnership or an S-Corp. Say during which months you had business income.

If you have more than one Form 1095-A, repeat and add them all. We only have one in our example.

Calculation Result

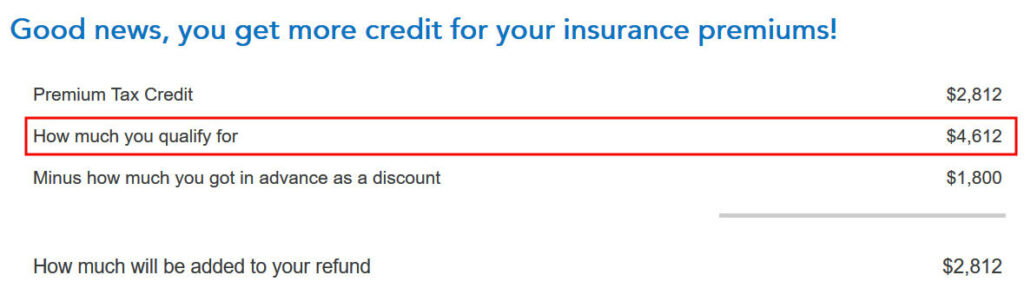

TurboTax crunches the numbers in a split second. It says we’re eligible for more tax credit than the ACA healthcare marketplace already paid directly to the insurance company. We’ll get the difference in our tax refund.

If you qualify for less subsidy than the advance already paid, you’ll pay back the difference, subject to a cap (see Cap On Paying Back ACA Health Insurance Subsidy Premium Tax Credit).

Self-Employed Health Insurance Deduction

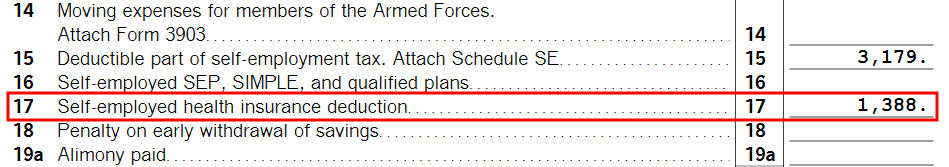

We’re also eligible for a tax deduction for the portion not covered by the premium tax credit.

To see your self-employed health insurance deduction, click on Forms on the top right. Find Schedule 1 in the left navigation pane. Look at Line 17. It shows we’re getting a $1,388 tax deduction for self-employed health insurance.

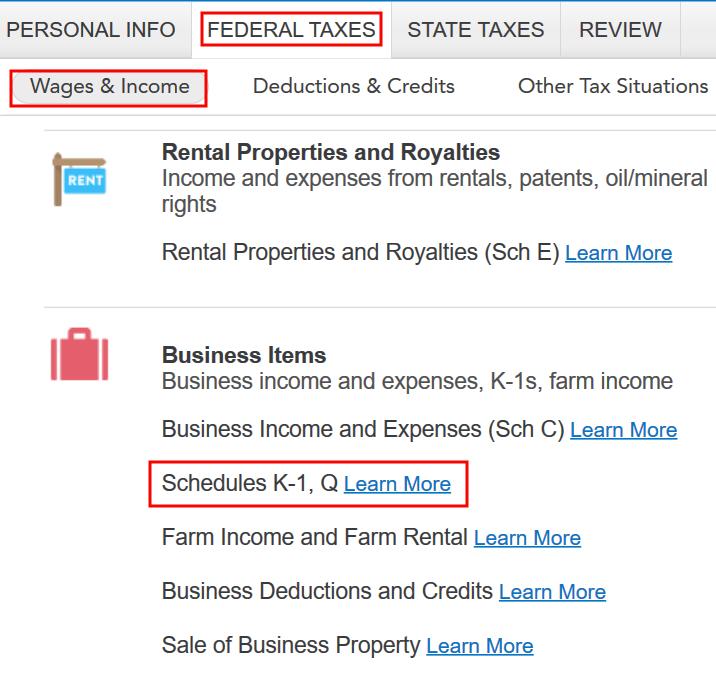

S-Corp Shareholder

Go to the Schedule K-1 from the S-Corp. Create a dummy K-1 even if you didn’t take any distribution from the S-Corp.

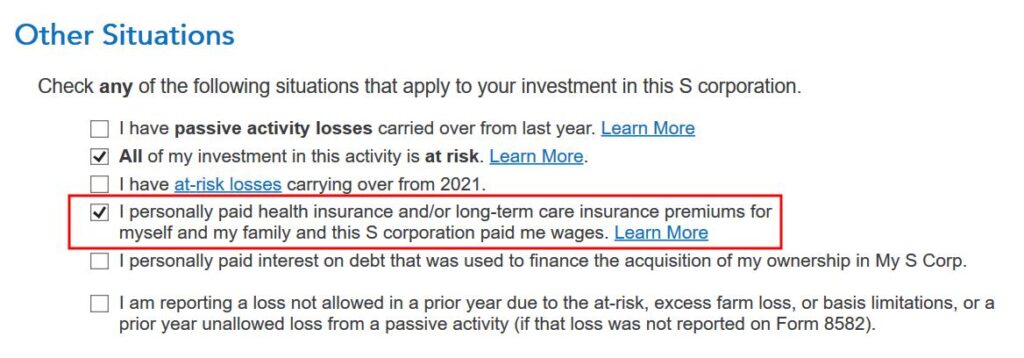

Be sure to check the box “I personally paid health insurance …” even if the S-Corp paid it directly.

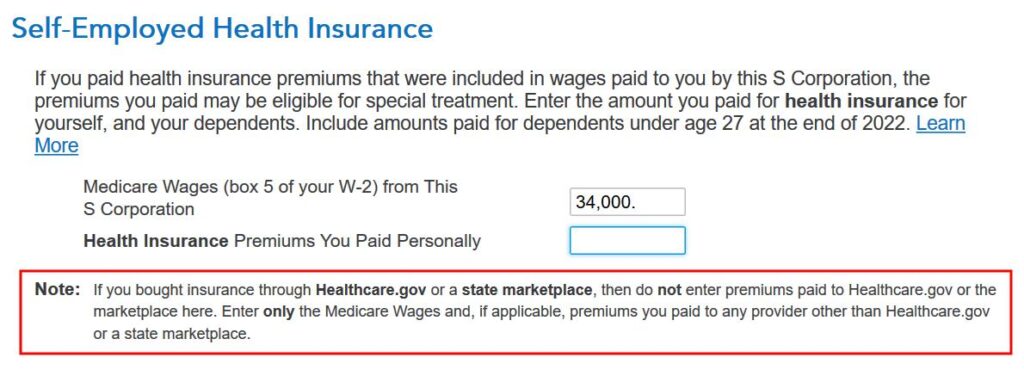

Enter the Medicare Wages from Box 5 of your W-2 from the S-Corp. Read the note carefully. Leave the second box blank if the S-Corp only paid for an ACA marketplace health insurance policy. Enter a number for any policy paid outside the ACA marketplace, such as any dental or vision premiums.

Premium Tax Credit

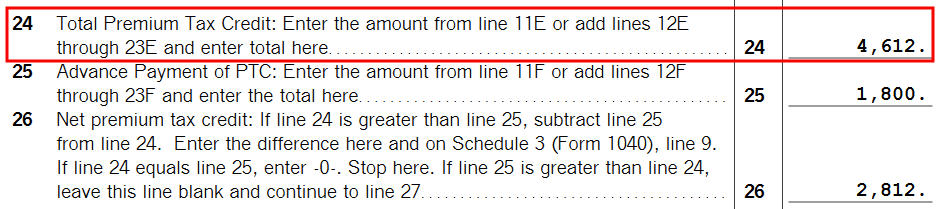

To see the subsidy you qualify for based on your actual income, find Form 8962 in the forms list navigation pane. Scroll down and look at Line 24. When you’re done looking for the form, click on Step-by-Step on the top right to get back to the interview.

$1,388 in self-employed health insurance tax deduction plus $4,612 in premium tax credit equals $6,000 ($500/month), which is the full unsubsidized premium for our health plan (plus any dental and vision insurance premium, which we didn’t have in our example). The numbers add up!

TurboTax figured out the split between the tax deduction and the tax credit. It also matched the result from H&R Block software for the same example.

Edge Cases

TurboTax works for most cases but it doesn’t work for everyone. You know you’re running into one of the edge cases for which the software doesn’t work when the numbers from the software fail this equation (except for a small difference due to rounding):

When this happens, you need a better calculator. See When TurboTax and H&R Block Give Self-Employed Wrong ACA Subsidy.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Sam Ferguson says

There is an issue with TurboTax Self-Employed: in many cases it gives a premium tax credit for self-employed individuals which is too small. Sometimes thousands of dollars too small.

For an example, read the comments under the question

https://ttlc.intuit.com/questions/4213136-what-ptc-amount-for-56-085-on-line-12-and-5-478-it-s-slcsp-on-1040-s-line-29-tt-says-0-but-this-is-wrong-expected-contribution-is-5-478-what-is-right-se-single?jump_to=comment_6549891

where the responder explains that the issue has been known to Turbo Tax for three years and has not been resolved.

Recently, I solved the math problem associated with this, and created a free online calculator for people to use. The IRS says that it gives the appropriate premium tax credits, which in many cases are higher than the amount given by the Turbo Tax software. My website was made with help from a Google engineer, and is hosted by NYU at https://cims.nyu.edu/~ferguson/Calculator%20SE%20ACA.html

Morgan says

Sam,

FWIW, I run my numbers long hand and they were within a few dollars of your webpage, and also with a few dollars of turbo tax. All to the good. The one I can’t get to jibe up this year is HR Block. Same numbers come out to a total disagreement of about 500 dollars. While both TT and yourself suggest 4010 is the area to be in, HRB gives another 300 or so in credits, throwing everything else off. Frustrating as heck! It seems like everyone should get basically the same answer, doesn’t it?

Harry Sit says

Sam – Any chance to update the nice calculator for 2019 and 2020? The applicable percentage tables are here: https://thefinancebuff.com/aca-premium-tax-credit-percentages.html

Sam Ferguson says

Harry, a college student in NYC is helping me make a new calculator site. It will incorporate the the numbers you’re pointing out for 2019 and 2020. As I’ve graduated from NYU, I won’t be updating the old calculator going forward.

Harry Sit says

That’s great. Thank you Sam. I look forward to the new site.

Sam Ferguson says

Interesting. Yes, normally they should all be close. Do all three give a similar Line 29 deduction on the front page of your 1040? Or is HRB also giving you a larger deduction there than TT and the ACA calculator website? Also, could you provide the numbers you are plugging in on the website so I can try myself? And finally: are there any deductions on the front of your 1040 below line 29?

Morgan says

Sorry about the delay, I’m happy to share. I’ve been trying to figure out the issue for about 3 weeks! To add to the conversation, Esmarttax gets a different number yet again but because their software allows you to see the forms I can look at them and at least form the opinion that they are not properly deducting/crediting the circular health fee/credit. They appear to be deducting the health costs to get the MAGI, calculating the credit and then giving that without going the next step to reduce the health insurance deduction. But at least I can figure that out!

TT gives a 4018 subsidy, my excel gives 4015, yours says 4007. HR Block says 4260. (side note, hrb also give a notice when you reach this point that since you did the health deduction as well as IRAs, that you need to have one of their accountants review… who knows what those two things have to do with each other). That 260 pushes against everything else and amounts to about 500? less in taxes since it lowers my AGI in a way that inflates my savers credit beyond the 800 I am barely making now.

Easiest first (what I am plugging into your website)

2017

7256.76

5634.84

16020.00

41446.26

The others are harder to answer because neither of those programs will allow me to look at the forms they are using so it’s really hard to compare. This is what I believe I have entered into both and what I have on the excel spreadsheet (and that TT matches within about 4 dollars)

(22) Total Income: 113,217

(25) HSA: 6750

(27) SEmpTax: 6021

(28) Retirement: 48,000

(29) Health Insurance: 4018

(32) IRA 11,000

AGI: 39,829.42

I’ve used HRB for years and I won’t rule out user error… but something weird is going on!

M.

MDM says

The TY2021 calculations look good – nice work as usual!

If instead of costing $500/mo the chosen plan costs $498/mo, TT seems wildly inaccurate.

At least, I went from matching your results exactly with the $500/mo amount:

SEHI deduction = $1388 and Total PTC = $4612 (for a total of $6000)

then (AFAIK…) changing only to $498/mo (= $5976/yr), at which point TT returned:

SEHI deduction = $810 and Total PTC = $4522 (for a total of $5332)

I think the best one can do with the $5976 premium is

SEHI deduction = $1371 and Total PTC = $4599 (for a total of $5970)

If one tries another $1 of SEHI, one gets

SEHI deduction = $1372 and Total PTC = $4611 (for a total of $5983)

That jump of $13 for a $1 change in SEHI appears to throw TT’s numerical solver further out of whack than one might expect….

Fortunately it appears such problems might occur in fewer than 1% of returns, because the jump from one integer value to the next on line 5 of form 8962 occurs only $1/(Federal Poverty Limit (FPL) * 1%) of the time. Because the FPL is always > $10,000 that fraction will always be <1%.

Harry Sit says

That’s bad. I’ll update the edge case calculator shortly. With $498/month as opposed to $500/month as the actual cost of the policy:

TurboTax: $810 deduction + $4,522 credit

H&R Block: $1,378 deduction + $4,612 credit

Calculator: $1,375 deduction + $4,601 credit

The H&R Block software is closer to the correct result.

Mike says

This is a bit off topic but this seems like the most informed group on this general issue. I’m having an issue with TurboTax not allowing the self employed insurance credit for a 100% owner of an S-Corp – or at least that is what it looks like.

– a 100% owner of an s-corp

– insurance purchase through the WA health plan marketplace

– premiums in 2022 were $9746.88

– TurboTax calculates a PTC of $7763 and no self employed insurance deduction.

My understanding is I should be able to claim the difference $1983.88 as self employed insurance. Or are there other factors I’m missing?

Harry Sit says

You get the self-employed health insurance deduction only when your insurance is linked to self-employment income. TurboTax doesn’t know they are linked unless you tell it. See the “Link to Self-Employment” section.

The total credit plus deduction also can’t exceed your self-employment income after deducting 1/2 of the self-employment tax and pre-tax retirement contributions. Your health insurance deduction will be limited if you only have a small amount of self-employment income left after deducting all those.

Mike says

I did complete the link to self-employment. But the link is to an S-corp not a sole-proprietor. I’m very sure S-corp owners with greater than 2% ownership qualify for the self-employed insurance deduction. And in the TurboTax link to the schedule K you specify your percent ownership, mine is 100%. But it hasn’t put any amount as a self-employed health insurance deduction.

Note that with an S-corp there is no self-employment tax as far as form SE, Fica and Medicare are paid as part of the pay roll.

Harry Sit says

I just tried this. Click on Forms -> Open Forms. Search for “K-1 S” and select “Sch K-1 S Corporation Additional Info 1.” Select the existing form. Scroll down to the bottom. Fill in Item 2 “Medicare wages” under “Outside Expenses” from your S-Corp’s W-2 Box 5. Close the form and return to the interview. You entered a W-2 but TurboTax doesn’t know that W-2 is from the S-Corp.

Harry Sit says

I also figured out how to enter the Medicare wages without going into the forms. See the new section for an S-Corp shareholder.

Jimmy says

Thank you for the very relevant article. I started to purchase my health insurance from the marketplace in 2022, so the first time for me to handle 1095-A. However I don’t see the question “I am self-employed and bought a marketplace plan”. I only see questions “I shared this policy with …”, and “I got married in 2022”. Do I need to declare somewhere that I am self-employed so this option will pop up? BTW, I haven’t input my K-1’s as they are not available yet. Hope this is not the cause. Appreciate your help.

Mike says

Thanks to Harry for helping with my problem which is now fixed. Several things need to come together for it to behave.

It keys on Box 14 of the W2. If you don’t have “Health Ins” and the amount in box 14 then it won’t have any self employed insurance deduction.

I’m not sure it uses it, but the percent ownership is input with the schedule K.

When inputting the 1095 from I get the “I am self-employed and bought a Marketplace plan” on the next screen. One the screen after that it asks to associate the insurances with a particular business. So I’m thinking that if the there is no schedule C or K1 then these are not asked.

Jimmy says

Thanks Mike for the hints, I will try later once I have K-1’s.

1095-A QJV Split! says

What’s the best practice for having TurboTax correctly calculate & attribute/populate figures for a Qualified Joint Venture (QJV), 50/50 split, if only one Form 1095-A is issued for a marketplace insurance plan that covers both spouses? That single 1095-A cannot be attached to the sole proprietorship of both spouses to then be split by TurboTax, it must be fully attached to just one or the other. Maybe manually invent a separate Form 1095-A to attach to each spouse’s sole proprietorship within TurboTax (regardless of the fact that only one was issued/reported), then populate each with 50% of the actual figures (enrollmemt premiums, SLCSP premium, advance payment of premium tax credit) from the actual 1095-A, and then let TurboTax add them together again for the Form 8962? Or do you not worry about that level of attribution, and simply choose either sole proprietorship (flip a coin, whatever) to attach the 1095-A, then check the “Spouse is covered by plan” box?

Harry Sit says

I haven’t tried it but I think either way would work. Make a copy of the TurboTax file and do it one way in one copy and the other way in the second copy. Compare the outputs (Form 8962, Schedule 1, the new Form 7206, Form 1040) from the two copies.

1095-A QJV Split! says

Yes, thanks; comparing side-by-side, either way seems to produce the same results on the relevant forms. What’s probably just a program quirk is the only difference I can see between the two approaches: when completing just one 1095-A (owned by taxpayer, spouse covered by plan), for some reason, only on the spouse’s identical Form 7206, the “Lines 9 Smart Worksheet” does not automatically populate the “Total from the Keogh, SEP and SIMPLE Contribution Worksheet….” But that’s easy enough to reference with a manual click. So I guess this is the way to go.

PS: Here’s a link to TurboTax explaining how to do this for an actual partnership rather than a QJV:

https://ttlc.intuit.com/turbotax-support/en-us/help-article/insurance-medical-benefits/self-employed-health-insurance-deduction-partners/L1gYQG7n0_US_en_US

1095-A QJV Split! says

Comparing the two TurboTax test files again today, while each spouse’s QJV figures will appear identical (as noted previously) regardless of method chosen, THERE IS A DIFFERENCE in the total return amounts depending on method chosen.

Inputting one Form 1095-A attached only to one spouse’s sole proprietorship is generating a smaller premiuim tax credit, smaller self-employed health insurance deduction, and thus affects adjustments to income, and total amount due or to be refunded.

Manually generating two Forms 1095-A (splitting the original amounts 50/50%) and attaching one to each spouse’s sole proprietorship, per QJV, had a more favorable outcome. This method happens to produce a Schedule 3 premium tax credit, that when added to its Schedule 1 self-employed health insurance deduction (and then subtracting my state subsidy), equals the exact amount of our monthly premiums paid when divided by the number of months covered.

The quick & easy way to see the difference is to enter two Forms 1095-A with the original amounts split 50/50%, then simply toggle (in TurboTax forms view) the “Link Field” to either have both Forms 1095-A attached/linked to only one spouse’s sole proprietorship, or instead attach them one per spousal sole proprietorship. The total figures on the test return differ when I do that, no other changes being made.

Tiffany says

Amazing post! So helpful! Thank you for all of your work on this vexing issue. 🙏🏻 I do have one follow-up question. Although so far TurboTax is satisfying the requirement that SEHI + PTC = our unsubsidized health insurance premium, I’m confused about where that SEHI is showing up on our forms. That is, while it *is* included in the total on Schedule 1, Line 17, it appears no where else. By contrast, the portion of our SEHI from non-specified premiums is included *both* in the total on Schedule 1, Line 17 *and* on a Form 7206. I actually called TurboTax over this, because I thought it was so odd to have the Marketplace-related, specified premiums deductible as SEHI appear nowhere else (e.g., on a Form 7206 or on our Form 8962) but as a hidden component of the total SEHI on Schedule 1, Line 17 and in a comment at the bottom of the in-TurboTax version of Form 7206 (not on the final, “print preview” version of Form 7206 meant for filing). Incidentally and oddly that comment mistakenly refers to Form 7206 as “worksheets,” stating, “A self-employed health insurance adjustment of $xxxxx from premiums paid through an exchange is included as an adjustment to income but does not appear on these worksheets.” The TurboTax employee I spoke with said this issue had been reported by others, reviewed and found to be no problem. Your thoughts?

MDM says

P. 91 of https://www.irs.gov/pub/irs-pdf/i1040gi.pdf directs you to “use Pub. 974 instead of…” 7206 or the worksheet on p. 90 when there is both SEHI and ACA. That may be what TurboTax is following.

Tiffany says

Thanks MDM. Yes, I too thought of that when I first read the instructions for Schedule 1, line 17 that you quoted. However, I believe clarity is a bit lacking as to whether those instructions reference Pub. 974 merely for its details re *how to calculate* the portion of SEHI related to ACA premiums or to also suggest there’s no need to *show* that calculation or its result somewhere in the forms. Pub. 974 doesn’t clarify much on that question either. The most I could find remotely related to the topic was a sentence on p. 48 of Pub. 974, “Use Form 8962 to figure the PTC for specified premiums.” Yet Form 8962 also contains no spot for showing the ACA-related SEHI premiums to be included on Schedule 1, line 17. So, sadly, I remain confused. 😔 Any further insights/thoughts would be most welcome, from either of you (MDM or Harry). Thanks again.

MDM says

You are in the correct neighborhood by finding p. 48 of Pub. 974. Pages 47-63 of that publication (https://www.irs.gov/pub/irs-pdf/p974.pdf) wax eloquent on how to reconcile SEHI and PTC.

See p. 47 under “Using this information, do the following,” where it specifies filing form 7206 in some cases for non-ACA premiums, and p. 54 where it says

“Note. Your self-employed health insurance deduction

is the total of the Step 5 Worksheet, line 7, and Work-

sheet W, line 14. Enter this total on line 17 of Sched-

ule 1 (Form 1040).”

Step 5 Worksheet line 7 is the allowable ACA premium, and Worksheet W line 14 is the non-ACA premium.

Don’t know if TurboTax includes the Pub. 974 worksheets in its backup documentation.