[Updated in November 2018 after Fidelity Investments started offering HSA to the general public.]

An Health Savings Account (HSA) has triple tax benefits: tax deductible contributions going into the account, tax free growth within the account, and tax free distributions coming out the account if used for eligible medical expenses. In addition, the required High Deductible Health Plan (HDHP) usually has a lower premium. For most people who are healthy, HDHP + HSA is the best combination. See Do The Math: HMO/PPO vs High Deductible Plan With HSA.

The money contributed to the HSA can be invested for long-term growth. However, until recently, it wasn’t easy to find a no-fee HSA provider with good investment options. Most HSA providers usually require any combination of:

- A monthly or annual maintenance fee

- A minimum amount that must be held in cash

- Transfers between one entity holding cash and another entity holding investments

- A limited investment menu, sometimes with additional expenses on top of normal fund expenses

Now an industry giant entered the room. Fidelity Investments started offering HSA to the general public on November 15, 2018. Fidelity used to offer HSA only to people whose employer chose Fidelity as the HSA provider. Now individuals can open HSA on their own directly with Fidelity. When you have an HSA directly with Fidelity, not through an employer or an insurance company, you will have:

- No minimum amount to open the account

- No monthly or annual maintenance fee

- No minimum balance that must be held in cash

- Just one integrated account; no transfers back and forth between different entities

- All the investment options available in a regular Fidelity brokerage account, including commission-free low-cost index funds, ETFs, Treasuries, CDs, and more. See also: Best Index Funds and ETFs at Fidelity.

No other HSA provider comes close to what Fidelity offers. Compare with some other popular HSA providers that offer investments:

Lively: transfer between Lively and TD Ameritrade for investments.

HSA Bank: monthly fee if not holding a minimum amount in cash; transfer between HSA Bank and TD Ameritrade for investments.

HSA Authority: annual fee; fixed menu of investments.

Further: monthly fee; fixed menu of investments or transfer between Further and Charles Schwab.

Saturna Brokerage: higher-expense mutual funds or commission on each investment purchase and sale.

Bank of America: monthly fee (waived for highest tier in Preferred Rewards); fixed menu of investments.

Through Your Employer AND On Your Own

If you have a High Deductible Health Plan (HDHP) through your employer, your employer may already set up a linked HSA for you at a chosen provider. Your employer may be contributing an amount on your behalf there. Your payroll contributions also go into that account. Your employer may be paying the fees for you on that HSA. You save Social Security and Medicare taxes when you contribute to the HSA through payroll.

That doesn’t stop you from having another HSA on your own. You can have two HSAs at the same time. The investment options in the HSA chosen by your employer may not be as good as those in a Fidelity HSA. After the contributions are made to the HSA chosen by your employer, you can move the money to your own HSA for better investment options. You can keep the existing HSA open to accept additional contributions. When you leave the employer or when you no longer have an HDHP, you can close the existing HSA and consolidate into your own HSA.

If you get health insurance outside an employer, you are on your own. The insurance company may offer an HSA but you are free to choose your own provider. You get the tax deduction on your tax return.

Transfer From an Existing HSA

If you’d like to move money an existing HSA to a new HSA, you can do it either as a transfer or as a rollover.

A transfer doesn’t pass through you. There is no frequency limit on transfers. You don’t receive any 1099 forms for transfers. You don’t have to report transfers on your tax return. However, your HSA provider may charge you a fee for the outgoing transfer (some banks and credit unions don’t charge).

You start the transfer by filling out a transfer request from the new HSA provider. A transfer can be full or partial. You send the completed transfer request with any required documents to the new HSA provider. They will take it from there and request the transfer from your current HSA provider. Your current provider may charge you a fee for the outgoing transfer or account closure. If the account will still receive payroll contributions, you can tell the current HSA provider to keep the existing account open when you do the transfer.

To request a transfer into your Fidelity HSA, you can do it online:

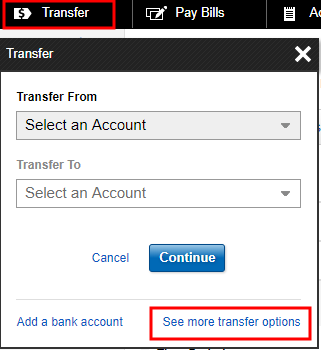

Click on Transfer and then See more transfer options.

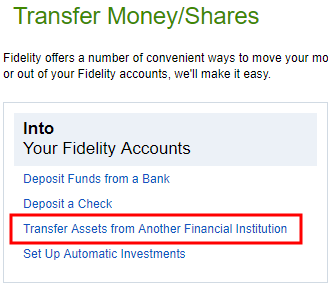

Click on Transfer Assets from Anther Financial Institution in the next screen and follow the steps from there. You will be asked for a recent account statement from your other HSA.

Some HSA providers can transfer investments out without selling them. Some HSA providers can only transfer out cash, in which case you will have to sell the investments in your existing HSA to cash first before you request the transfer. Selling investments inside the HSA is not taxable at the federal level. It’s not taxable in most states either, except in California and New Jersey, where selling investments inside an HSA is treated as a taxable event at state income tax level.

Rollover

If your existing HSA provider charges a fee for the outgoing transfer and you’d like to avoid the fee, you can do a rollover yourself, but you can only do it once per rolling one-year period (not calendar year). A rollover can only be done in cash. You request a distribution from your current HSA provider as you normally would when you reimburse yourself for eligible medical expenses. The distribution is deposited into a personal checking account. Then you send a check within 60 days to the new HSA provider as a rollover contribution.

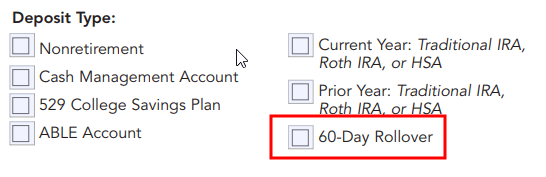

Rollover and normal contributions are reported differently by the receiving HSA provider to the IRS. While there’s an annual dollar limit for normal contributions, there is no dollar limit for a rollover. When you send the rollover to your new HSA provider, be sure to indicate the money is a rollover, not a normal contribution. That way it doesn’t use up the annual limit for your normal contributions. For rolling over into a Fidelity HSA, attach your check to a completed Deposit Slip and mark the box for “60-Day Rollover.”

After the end of the year, the HSA provider that distributed the money will send you a Form 1099-SA showing the distribution. You will report on IRS Form 8889 line 14b how much of the distribution was rolled over. The amount rolled over isn’t taxable. In May each year, the receiving HSA provider will send you a Form 5498-SA, which confirms the normal contributions and the rollover received in the previous year. Save the 1099-SA and the 5498-SA in your tax files to show that you did a rollover if you are ever asked for proof.

See also: How To Rollover an HSA On Your Own and Avoid Trustee Transfer Fee

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

David says

I’ve changed employers and HDHPlans. I’ve never been concerned with which bank is used til now. My impression has been that the insurance company (Aetna) dictates what bank (Chase) is to be used for HSA funds…Is this true ? or can i choose any bank offering HSA accounts?

I make my own post – tax contributions, as the pretax payroll option is not available.

Can someone provide some links to the FICA deduction losses “nickel” refers to….

D in NY.

Harry Sit says

If you contribute through payroll, the money is deducted pre-FICA and usually you don’t have a choice in which bank to use. Since you don’t have the payroll option, it’s moot. You contribute on your own, post-FICA, to the bank of your choice, and you take the deduction yourself on your tax return.

Nicholas says

Hi TFB – Question for you. I had just started contributing to a HSA with my previous employer and probably have ~2000 dollars in it.

Now I have left that employer and my new employer doesn’t offer a HSA. Since I left my old employer I have been paying a ~$10/quarter or similar fee on the HSA since I am no longer an employee. I absolutely hate that….especially since there’s minuscule return in terms of interest.

What are my options here?

Harry Sit says

If you just want a savings account and draw it down for current medical expenses, Alliant Credit Union, no monthly fee, 0.65% interest rate.

Thooda says

One option is to transfer your HSA balance to another custodian like a credit union. Example – open a savings and HSA account with Alliant Credit Union and do custodian to custodian transfer. Alliant HSA pays 0.64% apy as now today on HSA balance over $100. You can become a member by joining foster care to success with $10 donation and that’ll make eligible to gain alliant CU membership.

This just one example. I’m sure there are other credit unions or financial institutions out there where you can do similar custodian to custodian transfer. But, not many have low minimum balance and no fee for HSA

Brendan says

There are plenty of no fee options. Most are like checking accounts. I used to have a no fee HSA from TD Bank. It paid no meaningful rate of return. Check out the HSA from Saturna Capital. It is one of the few that will easily allow you to invest in mutual funds. You could park that $2,000 in a growth fund and not touch it until you retire. You could also Google “no fee HSA” and should be able to find something.

Mike says

I’m not sure if they have recently upgraded their HSA accounts, but Wells Fargo seems to have a pretty good offering going for their HSA program. You can start to invest in a decent number of funds starting once you have $2,000 in the account. You don’t pay any monthly fees once you have a combined $5,000 in your investment / savings HSA account with them. And they offer at least one lower cost expense ratio fund WFIOX (.25% expense ratio). While it’s not Vanguard low, its better than average. This along with being able to avoid monthly fees and transaction load fees, and the convenience of a debit card, checks, and online banking seems to make this one of the best available for the public. What are your thoughts / recommendations on this one?

Brian says

It appears that Elements HSA accounts are now earning just .598%, as of June 30. 🙁

Harry Sit says

Thanks for the heads-up. They stay true to what they promised: “Rates subject to change without notice.” $10 less per year on $2,500 balance. Annoying. I will move to Saturna next year.

Answer is 42 says

Lake Michigan Credit Union (LMCU) lmcu.org has basic HSA with APY of 2.0% for balanced over 5K (1.5% for less than 5K).

Anyone can join with donation to ALS Association ($5 min. donation).

Also, need to open a basic share acct, with minimum of $5.

No additional fees.

If one wants to let money sit in an account without investing, this is the best rate I have found so far.

Cheers.

Edward says

LMCU has changed this sometime in the past month.

Base Rate Annual Percentage Yield (APY)

$0 – $4,999.99 0.50%

$5,000+ 1.00%

Kevin says

Why don’t more brokerages offer HSAs? Every brokerage and bank out there offers IRAs. A few years ago, I figured it was just because the accounts were still new. But they’ve existed for over 10 years now. It seems like almost all institutions offering them have the mindset that a consumer has only one HSA, and that they must require some minimum cash balance to make sure the consumer has money for health expenses. But these days, HSA balances can be pretty hefty, and consumers are definitely looking for long-term investment options beyond the short-term savings account. It looks Saturna is is one of the few (if not only) brokerages to understand this and go after the market. If only there were some competition!

Linda says

Hi, Harry:

Would you please so kind as to give us an update on the best HSA provider?

Have you already moved to Saturna?

Thanks

Dave M says

I’m also curious to know if the HSA recommendations have changed for 2016, and if Harry moved to Saturna. I see Wells Fargo offers an HSA and it looks pretty attractive except for their high-expense investment choices.

jim says

For 2017, what is the minimum amount to hold in the HSA account to avoid a fee? For 2016 it was $5050. I can’t find that info on their website.

Erik says

I contacted HSA Bank asking about 2017, and they responded saying, “There is no minimum balance requirement to keep in your HSA. However, you would need to maintain a $5,000 or greater balance in the HSA part of the account in order to avoid the monthly maintenance fee of $2.50 and the monthly investment fee of $3.00 each month.”

This doesn’t sound right, since we know 2016 was $5,050. I may contact their Customer Contact Center at 1-800-357-6246 later.

Erik says

I called HSA Bank and was told the same thing that I pasted from my earlier email conversation… maintain at least $5,000 in your savings to waive fees. The gal I spoke with actually said that it had stayed the same at $5,000 and didn’t really know where I was getting the $5,050 value from for 2016. I wasn’t equipped to point to my source for the 2016 amount, so I just left it at that.

Googling around gives me PDFs like this one where it says, “Adjustments to the Balance Waiver Amount will be effective on January 1st of each year. 2015 Balance Waiver amount is $5,000 and 2016 Balance Waiver amount is $5,050.” I can’t find anything that talks about the “2017 Balance Waiver amount.” https://www.scanafamily.com/docs/librariesprovider16/default-document-library/health/hsa-bank-fliers_2016_combined.pdf

Erik says

Alright, here’s the deal as I understand it from my second call to HSA Bank this afternoon. Each account has its own minimum required balance to wave maintenance and investing fees. I started with a $5,000 minimum, and I’m told that has never changed. It sounds like the $5,050 minimum in 2016 would have only applied to accounts opened that year (or maybe some other criteria that we don’t know). In short, your account is given a minimum required balance value and it sounds like that doesn’t change. To determine what your individual minimum is, I think you just have to contact them: https://myaccounts.hsabank.com/ToolsAndSupport/ToolsAndSupport.aspx

Side note: HSA Bank should really disable auto-complete for the “Social Security Number (last four digits)” field you have to fill out when transferring money to TDA. Chrome, at least, remembers that value and offers it up as an option each time I’m presented with the field.

Eddie says

From HSA bank website, click Standard HSA Rates and Fee Schedules. I have been with HSA bank for a long time, back when minimum balance was single contribution limit, and has slowly increased to $5k and has remained here several years.

If your employer has a plan through them, they can negotiate a lower fee, mine has it down to $2 instead of $3 but I would bet you can assume the amounts on the schedule are the max (note they haven’t changed since 2014 according to the effective date of the documents.

jim says

To Erik. Thanks for checking. You’re right, 2016 it was 5050 so I’m expecting it to go up a little bit. I honestly wish there would working customer service. It is such torture dealing with these people and when you do something wrong they will pounce on you with fees but they can’t even be straight up.

John says

Make complaint to BBB, I had lots of fees reversed from them from playing these little games with the minimum amount when their disclosures aren’t clear. They respond very fast and are better than dealing with the people that respond to the Better Business Burea then the ones you get when you call in.

Mark says

What about SelectAccount? If I’m reading it correctly, you can open the HSA as a “thrift saver” which costs $1 per month for the HSA. After that, you can invest in a fairly wide amount of mutual funds for $18 per year. That’s $30 total with a minimum requirement of $1000 in the HSA. Has anyone tried this provider?

Nancy says

This looks useful:

http://corporate1.morningstar.com/ResearchLibrary/article/813893/2017-health-savings-account-landscape/

Mitch says

For residents of southwest and central Ohio, Universal 1 Credit Union offers 2.5% with no fees for HSA accounts: https://www.u1cu.org/HSA

The HSA dollars are invested in a 90-day CD to earn the 2.5% interest that can be set to automatically rollover.

John says

My ELFCU HSA account has zero balance and the Maintenance Service Charge of $4 is levied every month and waived. I want to move my account since I fear that at some point they will enforce the fees.

Has anyone in this situation been able to move their investments from TD Ameritrade to Saturna? I assume the account needs to be funded to at least cover outgoing transfer fees

scs says

what!? I can pick my own account administrator from what my employer provides?

all of it or just the investment side? external account gets linked back to the cash account which pays the medical bills? or all of it can be new. looks like i have some reading to do.

Gus says

SelectAccount also has Vanguard High-Yield Corporate Admiral VWEAX. Also you just need to leave $1000 cash each time you are buying investments. You can then withdraw the cash for medical expenses if you want. Also, I paid no fee to transfer funds from (employer-chosen) HealthEquity to SelectAccount.

SF Giants Fan says

Saturna may have a $10 surcharge for open-end mutual funds other than Fidelity and Vanguard. When I recently tried to buy a Schwab index fund, the order was cancelled because my order didn’t factor in the $10 fee. The confusing part is that Schwab is listed as a fund family without surcharges on their website.

Here is their response:

“It appears that our list is a little out of date. Recently, a lot of the Schwab and Fidelity funds have change(d) their agreements with how they pay brokerage firms to be on the platform. To lower their expense ratios, they don’t cover some of the regulatory requirements for delivery of documents. That being said, our clearing firm, Pershing, has to cover those cost by charging the surcharge and this is something that Saturna passes through to the end customer.”

So, if you plan on buying an index fund, you may want to check with them first to see if you’ll get the surcharge or not.

msf says

Of the three HSA providers currently highlighted, ISTM that each works best for a different user profile.

If you’re satisfied working with a limited set of funds (as one typically does with a 401(k)), the HSA Authority seems best. It has a wide variety of Vanguard funds (many with Admiral share class), both active and passive, it has low cost international funds (DODFX and the R5 share class of Am. Funds EuroPacific), and generally lower cost share classes than the other two providers. For example, PIMIX (PIMCO Income Fund, class I) vs. PONDX (class D). In contrast with Select Account, you don’t have to tie up $1K in a low interest bank account. In contrast with Saturna, you have very low cost Vanguard funds that Saturna doesn’t offer NTF. The ER savings more than compensates for its $36 fee.

If you’re interested in a buy and hold brokerage account, Saturna seems better (as noted in the column). Higher cost to trade than Schwab (Select Account), but one trade a year still comes out cheaper than paying $30/year to Select. If you don’t trade at all with Saturna, you’ll get charged a fee, but still less than $30.

If you do a moderate amount of trading (or like the Schwab index funds), the Select Account may be better. But it’s costing you not only $30/mo, but the use of $1K that is stuck in the bank account. Figuring even 4% return lost, that can cost you $40/year. So you’ll need more than a couple of trades a year to justify this account.

NTF fund lists:

Select Account – https://hsainvestments.com/fundperformance/?p=HSA

HSA Authority – https://hsainvestments.com/fundperformance/?p=TBH

Saturna: https://www.saturna.com/saturna-brokerage-services/fundvest-focus-fund-list

Ob says

SF Giants Fan – In that case, would buying the closest ETF equivalent of the mutual fund work to avoid the surcharge?

SF Giants Fan says

Ob, It’s kind of hard to navigate through all the Saturna fees, especially when they say their website is out of date. My understanding is, yes, you could avoid the surcharge by purchasing an ETF, but they charge a $1 fee per event for dividend reinvestment on equities and the inactivity fee is doubled to $25 for equities vs. $12.50 for mutual funds. So, ultimately, it depends on what you do with dividends and whether or not you are going to stay enrolled in an HSA eligible health plan.

Erik says

When I asked Saturna about parking an HSA investment that I cannot invest in right now, because I’m no longer on a HDHP and got this response (in case this helps)…

A few items to note:

1. There is no fee from Saturna for transferring your account to us

2. The trades you place will each incur a commission of $14.95 (online) or $24.95 (broker-assisted) plus a $10 surcharge at the time of the trade

3. There is no fee for dividend reinvestment in mutual funds only; most Vanguard funds will allow reinvestment though occasionally we run into funds that do not

4. Any account that does not have one trade settle within the calendar year will be subject to an Inactivity Fee ($12.50 if only mutual fund positions are held, $25 if more than mutual funds are held)

a. This can fee can be paid for by depositing funds (will not count toward contribution limit so you do not have to eligible to make contributions), by selling securities to raise cash, or maintaining a cash balance

Ob says

SF Giants Fan – Good points you mentioned there. I didn’t even think of the dividend reinvestment cost, since my original plan was to buy no dividend stocks. Staying enrolled in an HSA plan is no guarantee too, because the employer decides on the plans that are offered.

I don’t remember IRAs having this much fees compared to HSAs. Is there much of a difference in costs for regulations/record keeping/compliance between an IRA and an HSA that justify all of these fees? I also never see ‘cash’ promotions for HSAs, unlike in the IRA universe (“Open a Roth, Traditional IRA, rollover account with us and we give you free trades and $$$”)

Harry Sit says

Because contributing to an HSA requires having an HDHP, fewer people are eligible to begin with. Among those who contribute, most use it for reimbursing expenses, whereas IRAs are mostly one way incoming flows from most who contribute, and they receive large sums from 401k rollovers. As a result, the average balance in HSAs is much lower than the average balance in IRAs. To the provider, once you get a customer to open an IRA with you, you have a good chance of getting more money coming in year after year and a large sum coming in from 401k rollovers. With an HSA, not so much. The money gets spent. New money stops coming when the customer stops being eligible.

msf says

Harry makes a good point. You may not remember it, but IRA contributions used to be limited to $1500, and it was common to see a $10/yr charge for each fund in the IRA. That was just as onerous.

While the HSA reporting requirements seem similar to those of IRAs, it seems that brokerages are loathe to serve as HSA providers. (When they do, they usually offer them only through employers where they can manage lots of accounts together; see Fidelity).

So individuals are usually dealing with two entities, the provider bank and the investment brokerage. That adds to the cost of offering the HSA with investments. (Many banks offer free HSAs if you don’t want to invest.)

scott w says

Probably time to update this article for other investment options.

Gus says

I agree with the 3 listed for using HSA for investing: HSA Authority, SelectAccount, Saturna (at this time Oct 2017 — things can and do change). You want to minimize fees/costs/expenses. You really only need one or a few good funds to choose, since an HSA is typically a small part of one’s portfolio.

Do you have any other suggestions?

Matt says

Has anyone rolled over their Elements + TD Ameritrade account yet? How did it go?

I have been rolling over from my employer’s HSA once a year to take advantage of lower FICA tax, so I have 2 HSA accounts currently. Will have to check if I can transfer my stock holdings or if I need to liquidate. I also will be rolling over 2 HSA’s into a new one this year. Still worth it, market was killing it this year.

msf says

We’ve been trying to do this. Our plan was to liquidate the TDAmeritrade account, move it to the Elements side, then have the new HSA send a transfer request. So far, lots of glitches.

It seems that Elements won’t let you move cash from the TDA account until three days after it shows up as cash at TDA. We’re not talking about T+3 settlement (where the cash shows up in TDA three days after you liquidate a holding), but three days for the cash balance info to be transmitted to Elements.

Right now 11/25/2017, we’re sitting with cash in TDA, accruing pennies of interest. If we go to the Elements transfer page, it shows: “Current TD AMERITRADE Cash Position Balance $XXX.XX 11/20/17” It doesn’t show the true current cash position that is a few pennies higher.

This is not a matter of Elements failing to recognize accrued interest (which TDA will allow you to withdraw). Elements shows the amount ticking upward as interest accrues; it just lags by three business days!

I tried calling Elements to ask if they couldn’t just move the money that TDA says is available for withdrawal. They first claimed that we wouldn’t be accruing interest in TDA, which was wrong. Then they said that we could move all the money except for what accrued in the last three days. However, we could send them email to move that small amount and close the account after we moved the rest. We were told there was no way to do move all the money from TDA in a single transaction.

It gets worse. Because we had both ETFs (T+2 settlement) and mutual funds (1 day settlement), we tried to put a transfer order in for each part as it became available for transfer (settlement day plus three business day lag). Elements executed the second transfer, but not the first, even though their system shows enough money available (this was without adding in any interest accrued).

The system is insane. They’ve got three different logins you have to use: one for the Elements side, one for the TDA side, and a third one to access a third party site (pilothsa.com) that deals with the transfers. That third site double counts our balance, because it shows the Elements side as of 11/24/17 (after one of the transfers went through), but the TDA balance as of 11/20/17. It then adds the two together to get our “HSA Total”.

We had been using this system as invest and hold. For that it worked okay (aside from the “wire” fee to get money to TDA). Getting money out, how much you want, when you want, is, shall we say, challenging.

linda says

msf, what a hassle to deal with Elements/TD !

What new HSA you choose?

Thanks

msf says

A quick rest of the story. We finally moved our money from TDA to Elements. Elements apparently realized that there was trailing interest (from leaving the cash sitting in TDA) and did a followup transfer from TDA. But in the meantime, that interest itself earned a penny of interest.

We now have closed the Elements account, gotten the money transferred, but there’s still an orphan TDA account with a penny in it.

We decided to go with the HSA Authority. I explained (in a post above) how that can work well if one is willing to live with a limited set of funds. We had considered Select Account (at least for an HSA with over $10K, so that we could use Schwab), but I didn’t like having to leave cash on the bank side.

I also seriously entertained the idea of using Lively (thanks, Patrick for suggesting it). I decided against it for a few reasons: I had pretty much committed to HSA Authority by the time I became aware of Lively (that partners with TDA), I’m still not thrilled with TDA’s changes (we had used Vanguard ETFs there), and it’s a startup.

On that last point, I actually like startups. I’ve worked at half a dozen, and I think startups should support each other with their business. But I also thoroughly investigate any startup before I decide to use its services – its funding (Lively has $4.2M in VC/private funding), its business plan (which often changes as as a startup gains experience), its staffing, burn rate, technology, etc. As I was already in the process of liquidating holdings, I didn’t want to take a lot of time doing research.

Since then, Lively has gotten a very positive writeup at The HSA Report Card.

dcguy says

People seem to treat the HSA like the IRA accounts because they both allow you to funnel funds for future use and they both operate in a similar fashion. Companies now offer for you to invest those funds into the stock market or other areas. While that makes them good long term investments (especially with a rising market), in a prolonged bear market, those funds can be wiped out overnight. Unlike IRAs, HSAs are meant to be used for medical expenses. Usually for IRAs, the owner can control the withdrawal timing over the years. For HSAs, you may not have that control, especially if an unforeseen medical emergency occurs. And if a bear market happens just before the medical emergency, your balance can take a nosedive. Remember, that what goes up can come down. And trying to time the market often is a loser’s game.

Gus says

*If* possible, you can pay your bills from other sources, and withdraw (years?) later from the HSA when you choose.

However, if your HSA really is your medical emergency fund that you need for medical bills as they arise, then you are right and it should be in safe short term investments or cash.

East Coast says

Can someone remind me what the issues are with Elements Financial? I think there’s now a small fee at Elements when purchasing shares of VTI thru TD Ameritrade? But if I only move money from my HSA in a local bank (paycheck deposited) to my Elements HSA and then buy VTI once a year, is it really such a problem? And I guess there would be a small charge when I want to access the Elements HSA VTI shares, but if that is also done rarely…….? I think the hassle of setting up a different HSA somewhere else isn’t worth my time, but perhaps I don’t understand the recent changes and future cost increases. Thanks.

msf says

Their little fees add up:

– $48/year, unless you keep $2500 in the credit union (earning 1%)

– $25/transfer from CU to TDA

– $6.95/trade of VTI

In contrast, at the HSA Authority, for $36/year you can invest 100% of your money in VTSAX, a different share class of VTI Vanguard Total Stock Market with the same 0.04% ER. Less than half the cost annually if you want to put all your money to work.

linda says

msf:

I want to rollover from Elements as well. Did Elements charge the closing fee? Will it allow Trustee to Trustee transfer? Will it charge for TtoT transfer? or one better ask for distribution entire balance at Elements to rollover oneself?

Thanks

msf says

On the banking side of Elements, things went smoothly.

After we’d sold our TDA holdings and transferred money into the Elements side, we had the new trustee send a transfer request. Same as one does with an IRA transfer.

When Elements got the transfer request, it pulled any remaining cash from TDA (except for a penny). That was on a Friday. On Monday it sent a check to the new HSA. On Thursday the money was in the new account. No close out fee charged (and I don’t see one on Elements’ fee schedule).

Can’t complain about this part. If we didn’t have the TDA account attached, Elements would have been a pleasure to work with.

linda says

msf:

Thanks for quick reply.

what a shame, if it’s not for its ridiculous ACH fee to TD and holding Cash, I’d stay with Elements.

So I take it that Elements has no Trustee to Trustee transfer as well.

because my employer’s HSA has both closing fee $25 and $ Trustee to Trustee transfer fee $25.

Thanks again.

Cleotus says

I posted to this thread back in 2011, how time flies!

Every January I look into the HSA landscape again and every January I decide to just pay the $66 to HSA Bank and transfer the rest to TDA. I don’t think it is a bad deal for people who are not planning to use the money for decades.

Personally I value the ability to own asset classes that are not available at most other HSA custodians. As these are funds that are certain not to be touched for 20+ years (as certain one can be anyway), it frees one up to take additional risk and hopefully reap the historical reward of doing so.

I mean, where else can I hold Emerging Markets Value (FNDE) or Int Developed Small Cap Value (FNDC) along with the usual Vanguard market cap funds .. in an HSA? Sure it’s $7 a trade, perhaps one or rarely two trades every January. Over the long haul, these are trivial expenses.

Btw, we have until January 19th to trade the old batch of 100 no-commission ETFs at TDA without a commission I believe.

Thanks for many years of great content Harry!

Bob says

SelectAccount is changing its name to Further https://www.hellofurther.com/. Being a dyed in the wool conservative, all change makes me nervous. So far all they say is marketing-speak but they do make noises about great new features etc. Gulp.

Bob says

Harry

IIRC you opened a SelectAccount account and transferred your HSA to it. If so, I am curious your experiences. I have been trying to transfer from HSABank to SelectAccount since January and it has been a bad experience. I want to set up a Schwab account for my HSA and am nearly there but it has been an experience. Every step seems to involve a multiple business day wait. Their software is buggy and one of the application web pages did not work on my Firefox browser. I finally opened a Schwab account but am now in another hold before I can transfer funds to it.

Anyway, I am curious how it went with you?

Harry Sit says

Bob – I didn’t open an account with SelectAccount. I moved my HSA to Saturna a few years ago.

Bob says

I live in a Federal HSA law non-compliant state so any investment income in my HSA gets taxed by the state. To keep things simple, I want to invest only in US Treasury securities in the HSA. Schwab does not charge a commission for buying Treasuries at auction so that is a good option for me. I will have to persist with SelectAccount. It is strange that their process to open a Schwab account is so poorly implemented. I would think it would be common but few of the Reps knew much about it. And no wonder since it is really complex involving transferring money to their basic investment account, from there opening a Schwab account, and then transferring from the basic account to Schwab. Each of those steps involves a multiple business day wait. Sigh.

BTW, my impression is that you live in California. If so, how do you handle the tax reporting on HSA investment income for your state income tax form?

Harry Sit says

I just add up the dividends, interest, and distributions from my account and report the total as an extra entry on my state income tax return. I only invest once a year in one fund. The fund only distributes twice a year. So it’s not too difficult for me.

TenBlinkers says

Lake Michigan Credit Union – which anyone in the country can join – has the same investment options as Further, but with NO MONTHLY FEES for investing. Furthermore (pun intended), they have better interest rates and NO MONTHLY FEES on cash balances.

https://hsainvestments.com/fundperformance/?p=LMC

https://www.lmcu.org/personal/banking/savings-accounts/health-savings-account/

If you want both good rates on cash and a solid list of funds for investment – all with NO MONTHLY FEES – then I defy anyone to find a better choice.

/gauntlet thrown

SF Giants Fan says

Straight from Lake Michigan’s HSA Faq:

Who is Devenir and what is their role?

Devenir LLC, is a registered investment adviser that was chosen to research and select the HSA investment account mutual fund investment options.

What fee does Devenir pull from my HSA investment account?

$30/year

How does Devenir pull the fee from my HSA investment account?

A $30 annual fee is deducted from the investment account at account opening (initial deposit) on the first business day of the following month, and then on the anniversary month thereafter.

Saturna’s choices are better and they have lower fees. Per Harry’s article above, “If you contribute the maximum once a year and you do one purchase, you only pay $15 or $25 per year. Saturna Brokerage Services is the best HSA provider for investing HSA money if you can limit yourself to one purchase per year.”

/gauntlet picked up

Rick Van Ness says

Just talked to Fidelity to see if I could move my HSA account there. He said that 4th quarter of this year (2018) they will begin offering Standalone HSA accounts for those of us that cannot enroll through an employer. This sounds great for me, and no maintenance fees if have more than $250,000 at Fidelity.

Harry Sit says

Nice! Hope that will also prod Vanguard and Schwab to do the same. I’m very happy with my Fidelity HSA. The only thing is they accept incoming transfers only in cash. If you have investments in your other HSA you will have to sell to cash before you transfer.

Cleotus says

Great news! It’s important to consider that in states like California, New Hampshire & Tennessee where an HSA is not tax free – when the account is liquidated to cash in preparation for transfer there will be capital gains to pay (for many, given the last nine years of market gains). It’s too bad Fidelity doesn’t allow in-kind transfers, at least for non-mutual fund securities as many of us have ETFs in our HSA accounts.

msf says

Spoke with a Fidelity rep today – I said that there was a rumor about Fidelity offering retail HSAs. The immediate response was that this is real, and that it should happen early next year. Though he added that sometimes these launches get delayed for a month or two.

Still, sounds legit, with the target date not getting further away (just not getting too much closer, either).

Almeta says

Is that 250,000 figure correct? I thought the HSA was free?

Harry Sit says

It is correct for employer-chosen HSA. Retail HSA is free.

TJ says

@Harry – did you know that Bank of America has an HSA for individuals? I noticed Vanguard listed them on their HSA page as having Vanguard funds in addition to HealthEquity and Health Savings Administrators.

The fee’s,if any, are not easy to find and I am curious if having BofA/Merrill Edge status would have effect on any fees….

Harry Sit says

I heard the fee is waived for at least the Platinum Honor tier, but you will have to call them and request it after you open the account. I’m still hoping the mention by the customer service rep that Fidelity will open up HSA to the general public in Q4 will materialize.

Harry Sit says

Fee is $4.50/month if not waived. https://healthaccounts.bankofamerica.com/current-hsa-fees.shtml

Investment options: https://healthaccounts.bankofamerica.com/assets/pdf/investment_menu_core_consumer.pdf

Harry Sit says

Fidelity came through. Now everyone can open a Fidelity HSA, with no monthly fee, and the same investment options and fee schedule as in any normal Fidelity brokerage account. Post is updated.

John says

Awesome. I still was using ELFCU. Time to close that account. My current employer uses Health equity which provides decent vanguard funds but need 1,000 in cash (not invested). Might bear with it for now till I terminate employment.

Steve says

Harry, what is the best way to move my Saturna money to Fidelity? I have an employer who uses Chemical Bank for my HSA, so I front load at the beginning of each year to save on FICA. I then call Saturna in February to do a Rollover from Chemical Bank (I wait 365+ days) and invest 100% in VTI. Heading into 2019, I am hoping to get everything moved over to Fidelity FZROX. Since I am hoping to avoid the $75 Saturna closing fee, and because I can only do 1 rollover per 365 days, what do you think is the proper procedure to get this done? Thanks!

Harry Sit says

Steve – When you need to move out of two places at the same time, one of them has to be a transfer because you can only do one rollover. So if Chemical Bank charges less for the transfer (some banks don’t charge), request a transfer out of there and do the rollover out of Saturna: sell VTI, ask for a check and close the account, deposit to Fidelity as a rollover contribution.

Cleotus says

Great to hear! I’ll be moving over and taking advantage of their low-cost mutual funds. Now to unwind from HSA Bank and TDA..

https://www.fidelity.com/go/hsa/why-hsa

https://www.fidelity.com/mutual-funds/investing-ideas/index-funds

Only 0.03% ER for treasury funds.

Thanks for the update Harry.

linda says

I already invest some at TDAmeritrade keeping minimum at ELFCU. Do I have to liquidate shares at TDAmeritrade to move money to ELFCU, before transfer to Fidelity, Or I can do in-kind-transfer from TDAmeritrade to Fidelity directly?

Thanks

Cleotus says

The rumor up to now is that Fidelity will only take cash, so no in-kind transfers. Most likely you will liquidate your TDA to ELF CU, then initiate the move from ELF to Fidelity.

Definitely do your research on this and talk with the institutions so it gets done right.

East Coast says

I looked at the Fidelity HSA link above briefly but didn’t see many details. I don’t have a Fidelity account of any kind. Most everything is with Vanguard and my HSA is invested at TDA thru Elements Financial (formerly ELFCU). Would I need to have some minimum amount of money at Fidelity to have an HSA there? How do the fees to move money in and out, buy shares, etc in the Fidelity HSA compare with Elements Financial? Thanks.

Harry Sit says

Fidelity gives people little excuse for having HSA elsewhere. No minimum to open, no maintenance fee or minimum amount in cash, no separate entities for cash and investments, more no-commission low-cost index funds and ETFs than TD Ameritrade. I can’t think of anything that Elements does better.

msf says

Here’s a pdf with all the Fidelity HSA information, including the custodial agreement, the HSA account agreement, brokerage commissions and fees schedule (including a fee if the HSA is held through a third party), and more:

Fidelity Health Savings Account

While I agree with you that I don’t see anything that Elements does better, I wouldn’t go so far as to say that Fidelity does everything at least as well as other places.

For example, though The HSA Authority has a $36/year fee, if I want to buy Dodge and Cox funds (DODGX, DODFX), I can do that without a transaction fee. If I want to buy PIMCO funds, I can get the cheaper institutional class shares (PIMIX, PTTRX, PSCSX) there. At Fidelity, they’ve now got a $1M min, even in an IRA. On a $15K account, these come out cheaper even after paying the $36 annual fee. Same idea with a couple of American Funds – a cheaper R6 class vs. F1 shares at Fidelity.

Sure it’s not an overwhelming assortment of funds, but if there’s a particular fund you’ve got your heart set on, you might do better outside of Fidelity.

The HSA Authority investment options

John says

Does anyone know if one needs to move the funds from TDA to ELFCU before moving to Fidelity or it can be done directly?

Harry Sit says

You do need to move the money from TDA to Elements before moving to Fidelity.

Joe says

I have an Elements HSA account now. There is cash in the TDA account. I’ve tried contacting both TDA and Elements to ask how to move the cash into Elements, and both said I needed to contact the other! How to move the cash from TDA to Elements? By the way, Elements apparently stopped using the separate pilothsa login accordingn to their customer service, so that’s not the way it appears.

Joe says

Oh and by the way, Elements had notified me several months ago that they were going to “escheat” my assets to the state due to lack of account activity unless I mailed them a form confirming that I was the owner of the account. I sent the form. Then last month they escheated the funds. Thankfully, two days later, they reversed the transaction. But that’s enough reason for me to get the funds out of Elements.

Joe says

I think I figured it out: Elements.org -> My HSA tab ->I Investment Account -> Transfer Money

John says

Joe, did you liquidate your TDA and then use the above option to move to Elements? And once it is in Elements is there an easy way to move to Fidelity?

Joe says

I did submit the Sell order on my non-cash at TDA today. Due to the Thanksgiving holiday and the additional business day that Elements needs to register a transfer from TDA, TDA customer service told me that the funds will not appear at Elements until Monday. From there it seems from some of the above comments that the process of submitting a transfer request to Fidelity in this blog post does work and Elements customer service told me that they would not charge a fee for cooperating with it. I have retirement/investment accounts at Fidelity but not an HSA there, and I assume you also need to open the HSA account there before requesting the transfer.

Eric says

Harry said “In order to save FICA taxes, the employer has to establish a Section 125 flex plan and include contibuting to HSA as part of it. Probably not worth it for a very small employer.”

Please tell me more ! I have found an internet shop called coredocuments.com that offers the plan as a boiler-plate for $99. Is this any more complicated than offering a set amount each year and letting the employee (me) direct it to an HSA ?

Harry Sit says

Having a document is just one small part of it. Please consult a CPA knowledgeable of small business benefits to see if it’s worthwhile to your business.

Dan says

Harry – Which is best MSA provider for investing MSA money?

Harry Sit says

Just roll over to an HSA and use the best HSA provider?

Dan says

Are you sure Medicare MSA can be rolled over to HSA? Distributions from Medicare MSA requires filing of Form 8853 Section B.

John says

I’m rolling over to Fidelity from Saturna before year end. Once the Saturna account balance is at zero, what did you to close the Saturna account, they have no forms at Saturna. I’d like it closed by year end also so there are no “necessary annual transaction issues” etc Thanks

Harry Sit says

Just call them. They have excellent customer service reps.

Kelly says

My employer’s payroll system just asks for a routing number and account number for my HSA payroll deductions. My employer contributions will go to HSA Bank but I’d like my payroll deductions to go to Fidelity. As long as my employer is OK with doing that, I’ll avoid FICA taxes? There’s no rule that it has to go to my employer’s plan? Thanks.

Harry Sit says

If you also had to provide a routing number and an account number for the HSA Bank account, I don’t see how replacing those would change the FICA tax calculation. You can always try it for one pay period and see whether your FICA tax withholdings change. Do it after the first pay period in January.

VI says

any advice (step-by-step description) on how to move Elements HSA (with a TD Ameritrade sub-account) to Fidelity?

Danny says

Does Fidelity offer a debit card? Or do you pay out of pocket and reimburse?

Harry Sit says

If I remember correctly they automatically send you a debit card after you open the account. If they don’t do that any more you can certainly request one or more debit cards. I prefer paying out of pocket and reimbursing after insurance pays. Getting a refund if you paid too much up front on the HSA debit card becomes messy.

Bob says

Bend’s HSA looks interesting as well, and says no fees for individuals. Nice Mutual Fund program, with low expense ratio options. Their site says they use artificial intelligence to make HSAs easier. Any thoughts on this? http://www.bendhsa.com

Harry Sit says

Must hold at least $1,000 earning 0.05% interest. Must pay $3/month when you invest.

Dan M. says

Hi Harry, I’m wondering if you received the 6-12-2020 update to available HSA investments available from Fidelity. If so, do you have any insights or takeaways on the new investments fund offered? The expense ratio of .08% on the target date funds looks very attractive. Looking forward to your insights, and perhaps an update.

I don’t know if Fidelity’s rules changed to eliminate the new Zero expense funds for HSA accounts, but I have been (and am) holding Fidelity Zero Total Market Index and Total International Market Index funds (60/40 split). Any thoughts on this would be appreciated, too.

Harry Sit says

The new Fidelity Health Savings Fund (FHLSX) is nothing special. The HSA Funds to Consider list is just a list. A fund being on the list or not doesn’t make any difference. You can still invest in all other funds and ETFs not on the list, including the Fidelity Zero funds. As a single holding, I think the Fidelity Freedom Index funds are great and underrated. They are low cost, broadly diversified, and automatically rebalanced.

Liz says

Hi there,

Thanks for this post and the recent update.

I have a question about contributions. My husband has an HSA provided by work but I don’t know too much about it and I’m just going to assume it has poor investment options and high fees. BUT we do like that we would save on Medicare and SS taxes by contributing directly through his payroll, plus his company puts in a little money each month as well.

But from what I’m understanding from this, my husband could fully fund his HSA through work and do a rollover at the beginning of each year to the Fidelity account and get the best of both worlds?

Thanks!

Harry Sit says

That’s correct. Contribute through payroll, reimburse expenses throughout the year, transfer or rollover, and invest the rest. Rinse and repeat.

Kathy says

Great info, thanks! I want to rollover my HSA from last year to a new HSA. However, the old HSA only lets me withdraw to my bank account $500 each day (for security reasons). Can I withdraw my entire balance over the course of 1-2 weeks, and then after the final withdrawal, prepare to rollover the full amount to the new HSA in one check? Or is there a problem with having several limited daily withdrawals (even if my intention is to rollover the whole HSA)?

Harry Sit says

There is a problem. You can only rollover one withdrawal in a rolling 12-month period. The additional withdrawals aren’t eligible for a rollover. Ask your old HSA whether the limit will be higher if you ask them to send a check to your address on file. Or you will have to do it as a trustee-to-trustee transfer even though your old HSA provider may charge you a processing fee.

Kathy says

Thank you! I can follow up with the old HSA to try to get it done in one withdrawal and avoid having to do a transfer.

Just so I understand, at the end of the day, the old HSA provides their 1099-SA tax form that includes total withdrawals for the year, or is there a breakdown of the number of withdrawals and amounts? Or is that based on the law that would come into play if the IRS wanted to audit the rollover and see the details of how it was conducted? I am just trying to understand the reporting involved if the old HSA gives me the money, and I send my own check to the new HSA afterwards, about the reporting details. Thanks again!

Harry Sit says

The old HSA likely sends only one 1099 for all the withdrawals during the year. When you file your tax return, you’re entering an amount on your tax form saying it’s eligible to be rolled over. When you know some of the withdrawals aren’t eligible, it’s not right to lie on your tax return just for convenience or to save a small fee.

Mikael T. says

Let’s say I do a rollover by withdrawing from HSA1 in January X, and then deposit it as a rollover in February Y. Does the 12-month period restriction until I am allowed to do another rollover begin counting on January X or February Y?

Harry Sit says

When it’s not clear, punt, and make yourself not depend on having the correct answer. Do you withdrawal next year on February Y+10. There’s no way it falls within 12 months of your previous rollover regardless of how the days are counted. Doing a rollover every 13 months or 14 months as opposed to every 12 months still achieves your goal while staying clear of the boundaries.

Mikael T. says

Makes sense, thanks! And I received my 1099 from my HSA for last year’s withdrawal that I did for my first ever rollover, but it does not mention the dates when the transactions happened. Does my tax software program let me put that date information when I say that the money was for a rollover? If not, is that more for my records in case the IRS asks for proof that the rollover was done within 60 days?

And just to make sure I understand, I will use the 1099 (from HSA1) to file with my taxes, and I would indicate that the amount was for a rollover. But the 5498-SA (from HSA2) comes after taxes get filed anyway for my records, but that one serves to confirm that the amount rolled over in my tax filings matches what HSA2 received if needed (I assume that the IRS could at least match the numbers from those two forms in the future, and then if they wanted they could reach out to verify that the right dates were met). Is that right? Thanks again!!

Harry Sit says

That’s correct. Tax software and tax forms don’t ask you to put down dates, but you can keep a journal with account statements or screenshots to show that (a) you deposited within 60 days of your withdrawal; and (b) your rollovers are at least 12 months apart.