During the summer when food inflation was high, there were a lot of news reports about package shrinking. Instead of raising the price, companies just give you less and sell for the same price. That makes it easier for them to hide the price increase. This is still going on even though the inflation pressure […]

Latest Blog Posts

Old Money Versus New Money

If you make a change to your portfolio, say you add some more money into a fund, do you check the price the next day and see if your move made money? I do, and it doesn’t make much sense. If I have some money in a fund, I don’t check the prices every day […]

Too Many Banks

Do you think we have too many banks in the United States? There were 8,451 FDIC-insured banks as of June 30, 2008. Canada, on the other hand, with 1/10th of the population as the U.S., only has 81 banks, which can be listed on one page. On a per capita basis, we have 10 times […]

Solo 401k For Part-Time Self-Employment

Calculate how much you and the business can contribute to your solo 401k plan when you also contribute to a 401k plan at a different employer.

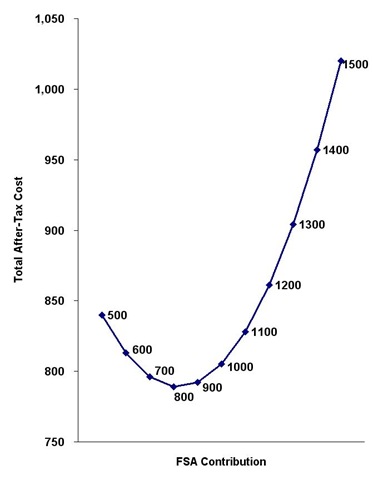

How Much Should You Put Into Flexible Spending Account (FSA)?

My company is doing open enrollment again for next year (for more info on what to choose in open enrollment, see previous posts). I’m not going to make any changes except I have to re-enroll for flexible spending account (FSA). If you use flexible spending account, you should be familiar with the use-it-or-lose-it rule. If […]

Bond Proposals on Ballot

I have quite a few bond proposals on my November 4th ballot. I voted (by mail) for one measure for public transportation, another for public schools and against the others. What’s interesting to me is that the proposals all say there is no tax increase because the bond repayments will be paid out of the […]

Tax Loss Harvesting and Missing the Best Days

When news about the $700 billion bailout plan first came out last month, the U.S. stock market staged a big rally on September 18 and 19. The S&P 500 index rose 8.5% in two days. Respected author Larry Swedroe posted this on the Bogleheads forum on Sunday, September 21: “It is often discussed about TLH […]

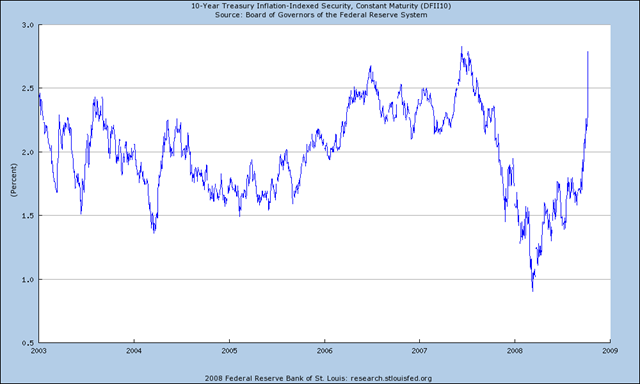

TIPS During Deflation

[Updated on Oct. 28, 2008. All yields are real yields, after inflation/deflation adjustments.] While the stock market was in turmoil, the real yields on Treasury Inflation Protected Securities (TIPS) rose to an attractive level. The real yield on 10-year TIPS broke the magic 3% number, a level that hasn’t been reached for many years. Many […]

Overbalancing Continues

The stock market crashed last week. I continued with overbalancing although I slowed down the pace from my original plan because it’s hard to keep up with the speed the market was dropping. Both the U.S. and international broad market indexes crossed the 40%-off mark. My target stocks/bonds ratio is 70/30, up from 65/35 when […]

Refinanced to Foreclosure

I heard this on the radio on my way home last week. A lady called a talk show program about her foreclosure story. I’m paraphrasing here: The bank foreclosed my home recently. It was my family home of 35 years. I raised my kids in it. I love it. The bank was WaMu. I begged […]