I wrote on Monday about 0% APR, Same As Cash, and No Interest No Payments. Upon closer reading of the final rules adopted by the federal regulators in December, I realized that deferred interest payment plans like “same as cash” or “no interest no payments” are actually banned after July 1, 2010. Good riddance! I […]

Latest Blog Posts

I Received a Parking Ticket That’s Not Mine

Right before Christmas I received an overdue parking ticket in the mail. It has my name and license plate but it’s really not mine. I have never been to the location noted on the ticket. The vehicle description has the right make but the wrong color. Why did they think it was my car? I’m […]

Bought HP 12C Platinum Calculator

A generous reader gave me a good tip for answering some questions. I used the money and bought myself an HP 12C Platinum calculator. This is a financial calculator. It has financial functions like loan payments and bond prices. What really makes it different from all other calculators is that it uses a different input […]

2008 Personal Rate of Return

Everybody knows 2008 was a bad year for investing. It may seem odd to some people that I never bothered to calculate my rate of return during the year. That information just isn’t so useful to me. I have no control over what the market does. Most of my investments are already in index funds […]

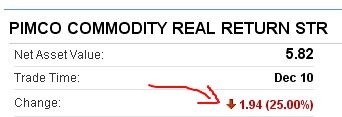

3 Reminders About Year-End Mutual Fund Distributions

I wrote on Tuesday that I bought PIMCO CommodityRealReturn Strategy Fund D (PCRDX) on Dec. 5, 2008. It’s a good segue to today’s post. As luck had it, only a few days later, my jaw dropped when I saw the price of the fund dropped 25% in one day. It turned out it was just […]

Ratings in Magazines Versus Actual Customer Experience

Good customer service is worth paying for. I think everybody understands that. But in this age of easy price comparison, we sometimes forget. Fellow blogger indexfundfan is having trouble with TradeKing, an online discount broker. TradeKing is holding his money hostage for 60 days. According to TradeKing, it was rated #1 in customer service by […]

Diversifying Portfolio with Commodities Futures Fund

I first heard about commodities futures in the last bear market. In 2002, commodities futures returned something like +25-30% while the S&P lost 22%. People were saying back then commodities futures were a great investment because they had “equity-like” returns while being uncorrelated with the stock market. This characteristic would add diversification to one’s portfolio […]

Reforming the 401k: Good Ideas and Bad Ideas

When stock market crashed, people’s 401(k) accounts crashed with it. Needless to say people are not happy. They are saying 401k’s don’t work. Wall Street Journal published an article How to Fix 401(k)s by Anne Tergesen. It listed many proposals for changing the 401k’s (and 403(b)s and 457’s). I think some of the proposals are […]

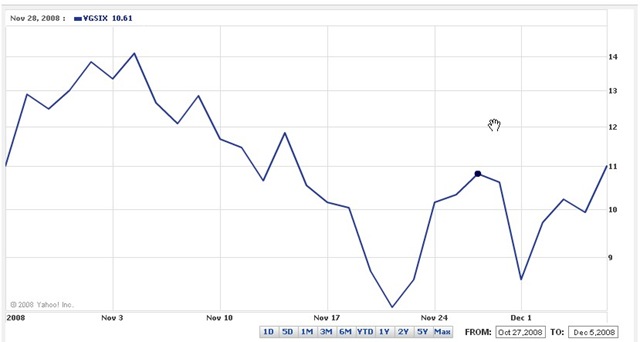

Catch a Wild Ride with REIT

If the Vanguard REIT Index Fund (VGSIX, or its EFT share class VNQ) were a person, I’d say he must have bipolar. In the past few weeks, its prices changed from one end to another in rapid cycles. It could not make up its mind whether it wanted to go up or go down. One […]

Risk Tolerance Metric: Loss to Income Ratio

A common asset allocation advice is by the age of the investor. There is that rule of thumb “age in bonds” which says a 30-year-old should have 70% in stocks and 30% in bonds and so on. That of course does not take into consideration the investor’s risk tolerance. However, risk tolerance is somewhat vague […]