[Originally written in 2008. Updated in 2022. The case is still valid after all these years.]

To Roth or not to Roth, that is the question.

Many employers offer both a Traditional and a Roth contribution option in their 401(k) plan. If you choose the Traditional option, your contributions go in pre-tax but you pay tax when you withdraw after you retire. If you choose the Roth option, you pay tax first before you contribute but your withdrawals are tax-free after you retire. You can mix and match between Traditional and Roth but your total contributions between the two can’t exceed the annual limit.

| Traditional | Roth | |

|---|---|---|

| Contributions | pre-tax | post-tax |

| Earnings | tax-deferred | tax-free |

| Withdrawals | taxable | tax-free |

This question of whether one is better off with contributing to the Traditional 401k or contributing to the Roth 401k has been the subject of a lot of debate. Although there is no one-size-fits-all answer, I think for most people the majority, if not 100%, of the contribution should go to a Traditional 401(k). I will state my case against the Roth 401(k) in this article.

The basic premise of a Roth 401(k), and to some extent a Roth IRA, is that of prepayment. You are prepaying taxes now so you don’t have to pay tax later. This prepayment concept is not uncommon. For example, buying a season ticket is prepaying for the individual events. Buying a timeshare is prepaying for vacation accommodation.

Whenever we deal with a prepayment scheme, we have to assess whether prepaying is “worth it.” The same paradigm also applies to Traditional versus Roth 401(k). There are several factors that make prepaying the taxes now not worth it.

Fill In Lower Tax Brackets In Retirement

I showed in a previous post The Commutative Law of Multiplication that if the marginal tax rate at retirement is the same as it is now, the Traditional and Roth 401(k)’s are equivalent. If the marginal tax rate is higher now than in retirement, one is better off contributing to a Traditional 401k. If the current marginal tax rate is lower, one is better off contributing to a Roth 401k.

But that applies only to the marginal dollar, which is the last dollar you can shift between Traditional and Roth 401(k). It is not necessarily the case for the entire contribution or the average dollar.

The tax system in the United States is progressive and it will probably stay that way. It means that income is taxed at increasing rates as it goes higher. Even if you think the marginal tax rate in the future will be higher, there will still be lower brackets and these lower brackets should be filled with money from a Traditional 401(k).

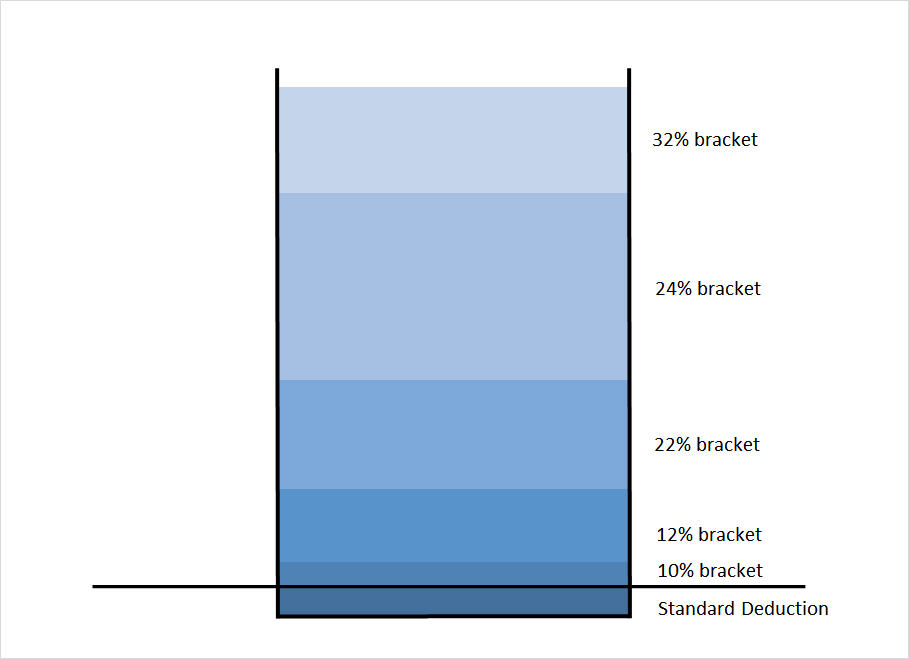

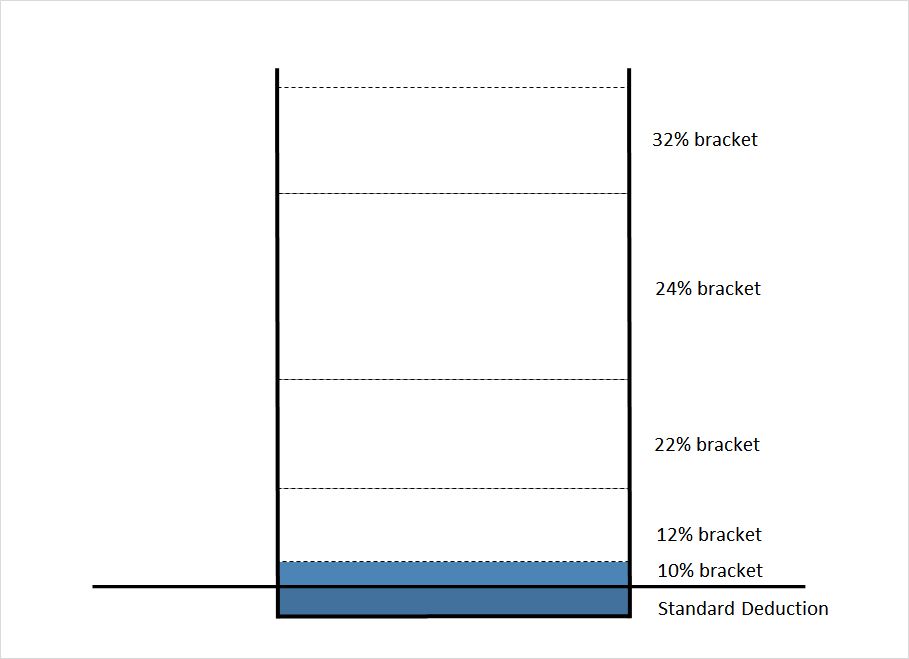

The chart below illustrates how the tax brackets work:

Picture a bucket with markings on the side. As you pour water into the bucket, the water goes up and crosses the marked lines. This represents how your income is taxed. The first chunk of your income absorbed by your tax deduction isn’t taxable. The next chunk of your income is taxed at 10%. The next chunks after that are taxed at 12%, 22%, etc.

When you contribute to a Traditional 401(k), you are scooping up income from the top of this bucket. The dollars you contribute come from the highest tax bracket for your income.

After you retire, you’re staring at an empty or shallow bucket before you pour in money from your 401(k). The money first goes through the lower brackets before it reaches the top.

Even if you assume your marginal tax bracket in retirement will be higher due to tax increases, a large portion of the 401(k) withdrawal may still be taxed at a lower rate than what it was when you contributed the money.

Until you know you can generate from your Traditional 401(k) enough income to fill the lower brackets, it doesn’t make sense to contribute to a Roth 401(k). For people without a pension, it means the majority of the retirement savings should go to a Traditional 401(k), not Roth.

If you have a pension and/or you expect to have a huge balance in Traditional 401(k)/IRA, large enough to fill the lower brackets every year, then contributing some money to Roth makes sense.

Avoid High State Income Tax

Many people work in high-tax states like California and New York today. They work there because there are a lot of good-paying jobs in those states. They won’t necessarily retire there because taxes and the cost of living are high in those states.

States popular with retirees like Florida and Texas have no state income tax. If you’re working in a high-tax state today but there’s a good chance you will retire in a no-tax or low-tax state, contributing to a Traditional 401(k) lets you avoid paying the high state income tax on the contributions. Prepaying the high state income tax now is a dead loss.

Leave the Option Open for Future Roth Conversions

When you leave your employer, you can roll over the Traditional 401(k) to a Traditional IRA, which then can be converted to a Roth IRA at a later time when it is advantageous to you. A Roth 401k or IRA on the other hand can never be converted back to Traditional.

With a Traditional 401k, you hold the option, which has value. If you contribute to a Roth, you give up that valuable option. You can decide to convert and pay the tax whenever you are in a lower tax bracket than where you are now. Good times for conversion include:

- Going back to school for a career change.

- Becoming unemployed due to layoffs or burn-out.

- Starting a business (not as much income in the first few years).

- A two-income couple having one parent stay at home or work part-time for a few years after they have kids.

- A high-income single person marrying a lower-income spouse.

- Taking early retirement.

- Moving from a high-tax state to a no-tax or low-tax state.

Unless you’re sure that your marginal tax bracket will never be lower throughout your lifetime, you should leave the option open by putting money in a Traditional 401(k) and waiting to convert to Roth when an opportunity comes.

Avoid Triggering Phase-outs

Because contributing to a Roth 401k does not reduce your gross income, you appear to have a higher income than if you contributed to a Traditional 401k.

There are all kinds of income-based eligibility cutoffs and phase-outs in the tax code. When you exceed the income threshold, your tax benefits from those programs are either reduced or eliminated. Some of these tax breaks include:

- Child Tax Credit

- Child and Dependent Care Credit

- American Opportunity tax credit

- Lifetime Learning credit

- Eligibility to contribute to a Roth IRA

- Student loan interest tax deduction

Think of the stimulus payments during the COVID pandemic. If a single person earned $80,000 but contributed $10,000 to a Roth 401k, he/she wasn’t eligible for the payment. If he/she contributed $12,000 to a Traditional 401(k) instead, he/she was eligible.

Easier to Get the Full Employer Match

Some people think if you contribute to Roth 401k, the employer’s match will also go there, which will effectively increase your employer match. That’s not true. The employer match always goes to the pre-tax account whether you contribute to the Traditional 401k or the Roth 401k.

When money is tight, it’s easier to qualify for the full employer match when you contribute to the Traditional 401k with pre-tax dollars.

Who Should Use a Roth 401(k)?

With so many disadvantages, then, for whom does a Roth 401(k) make sense?

A Roth 401(k) is good for people in low-paying jobs now but expect to have high-paying jobs later. Doctors in resident programs fit that description very well. They are paid very little while they are in residency but their income is expected to rise substantially higher when they finish the program. Their income will stay high in their career and they will receive a high income after they retire. Prepaying tax now makes sense because they are prepaying at a low rate and they will avoid paying a higher rate later.

College students working part-time jobs or recent graduates working in entry-level jobs are also good examples for taking advantage of a Roth 401(k) while their income (and their tax rate) is low.

A Roth 401(k) is also good for people who are already in the top tax bracket and expect to be there forever. If they don’t see any chance of being in a lower tax bracket, prepaying tax now will lock in the tax rate so they won’t have to worry about future tax increases. On the other hand, people who are in the top tax bracket are in a good position to retire early, with many years of lower tax brackets to fill. So don’t be too sure of staying in the top tax bracket forever.

Tax Diversification?

What about the idea of tax diversification? Some advocate both a Roth 401k and a Traditional 401k because the tax rates in the future are uncertain.

Diversification is good in general but it doesn’t mean automatic 50:50. Just like investing in emerging markets provides diversification, it doesn’t mean you should invest 50% of your money in emerging markets. You still have to decide how much you should allocate your retirement savings between Traditional and Roth just like you allocate a portfolio between developed markets and emerging markets.

Tax diversification also doesn’t mean you have to do it right now if you are in your peak earning years. There might be better times coming up in the future.

As for me, I had contributed 100% to a Traditional 401(k) every year when I worked full-time. Prepaying taxes just wasn’t worth it.

Higher Effective Contributions

Some say the Roth 401(k) is better because you can fool yourself into contributing more when you’re using after-tax money. Contributing 10% of your salary post-tax effectively puts more money into your 401k than contributing 10% of your salary pre-tax. It’s true but you should adjust your contribution to 12% or 15% to equalize the net paycheck when you contribute to a Traditional 401k.

A Roth 401k has a higher effective contribution limit because the annual contribution limit is the same when you max out your 401k. There is some truth to it. See follow-up post, Roth 401(k) for People Who Contribute the Max, which includes an online spreadsheet that calculates the value of having a higher effective contribution limit in a Roth 401k.

What About Roth IRA?

All arguments for and against the Roth 401k also apply to the Roth IRA when you are not yet contributing the maximum to your Traditional 401k. Instead of contributing to the Roth IRA, you can just increase the contribution to your Traditional 401k.

An additional argument in favor of the Roth IRA is that some 401k plans have higher fees. Even then the Traditional 401k can still be better when you don’t expect to work there for many years. You can roll over to your own IRA for lower fees when you change jobs. See Alternatives to a High Cost 401k Or 403b Plan.

If you are already contributing the maximum to your Traditional 401k, you may still be able to take a deduction for contributing to a Traditional IRA. See The Forgotten Deductible Traditional IRA. A Roth IRA is better when you already contribute the maximum to your Traditional 401k and you don’t get a deduction for contributing to a Traditional IRA anyway.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Debbie M says

Interesting. I love the Roths, but I seem I am one of your exceptions. I have a very good pension plan, I’m in the 15% tax bracket, I now live in a state with no state income tax, and I expect my tax rate to go nowhere but up in the future, mostly because I think tax rates will climb, but I also kind of hope to get big raises one day! (See what the tax rates were in the 1970s, and you’ll see what I’m afraid of.)

Nice analysis.

metalate says

> I’m in the 15% tax bracket\

What do you mean? There is no federal 15% bracket for earned income.

Richard says

there was in 2008 when Debbie M originally posted:

https://www.google.com/search?client=firefox-b-1-d&q=tax+brackets+in+2008

there isn’t currently in 2022 but that changed upon the Tax Cuts and Jobs Act of 2017

onthehomefront says

My company began offering the Roth 401(k) in addition to the traditional 401(k) this year. I stuck with traditional even though I’m just starting out in my career and hope that my income will only go up from here. The deciding factor for me was that the company would not be matching anything in the Roth plan, but would continue it’s current match structure on the Traditional.

No sense in giving away free money!

Ryan Marquette says

I’d check that with HR. They may still match your Roth contribution but put their bit in as traditional. This can make rollovers a nightmare in the future but I think you still would get your money

Anonymous says

This is one of the best posts I’ve read in a long time. I *totally* agree.

I’m paying federal + state marginal rates of about 43%. I fully expect to have less taxable income in retirement, and to live in a lower-tax state. I can see no benefit to putting money into a Roth 401k in this situation.

It amazes me that alleged financial experts refuse to recognize that for those of us whose retirement income will come entirely from 401k accounts, using a tax-deferred account can result in a tremendous tax savings.

Harry Sit says

@Debbie – I agree that Roth is perfect for you.

@onthehomefront – Usually employers don’t penalize you for using Roth. If you contribute to Roth 401k, they will still do the match. It’s just the match is placed in a Traditional 401k account. You will have your money on the Roth side and their match on the Traditional side. If you are just starting your career and you expect higher income (and higher tax rate) down the road, Roth is still good for you.

@anonymous – Thank you for the compliments. I’m glad you agree with me.

Anonymous says

I don’t agree with this. Kaye Thomas lays out an extensive comparison between Roth vs Traditional accounts. The bottom line is this:

http://www.fairmark.com/rothira/roth401k/wealth.htm

The Roth 401(k) is _bigger_ than the traditional 401k. While the nominal contribution limit is the same for both ($15,500), the Roth limit applies to after-tax dollars. This “quirk” of the rules means that while the nominal limits are the same, the Roth is effectively bigger.

Harry Sit says

With all due respect to Kaye Thomas, the first part of his analysis is not valid because it does not take into account the impact on take-home pay. “Saving in a Roth account can make you as much as 53% wealthier in retirement!” Yeah, right, but you also pay 53% more when you contribute. Until the heading “So the traditional account always loses?” it then starts to make sense.

Yes Roth lets you effectively save beyond the $15,500 cap on Traditional 401k but people who can afford to do so are also in the high tax brackets. So it comes at a higher cost. Can a single person earning $50,000 gross afford to save $15,500 after tax money in a Roth? Not likely. You need perhaps $100k gross income before you hit the cap. When you are at $100k though, your marginal tax bracket is already pretty high. Read what the 3rd comment said. Is it worth it to pay 43% tax in order to save in a Roth 401k?

Anonymous says

Roth 401K’s were not available when I was working, so all my deferred dollars are in TIRA/401K’s. My pension puts me just inside the 25% bracket. I ran a projection on what my RMD’s would be starting in 10 years or so and was alarmed at what I’d have to take out by the time I reached 80.

Over the next 10 years, I am going to convert TIRA $$ to Roth up to the top of the 25% bracket. That will help reduce the RMD problem, but it will still be there.

I encourage folks to watch this aspect. A mix of TIRA/Roth seems best; unfortunately, I don’t have time to reach the mix I want without forcing myself into the 28% bracket now.

Paul

Anonymous says

Your commutative math law is wrong becuase it doesn’t account for the growth which is taxed on the traditional but not on the Roth. Assume a 40% marginal tax and $100 contribution and 10% growth for 1 year. In the Roth you have $110. In the Traditional you have $110 + 44 (you invested the extra take home pay) = $154. Tax is $44 on the 401(k) and $1.60 on the $4 which leaves you with a net $108.40. Roth wins.

Harry Sit says

Trust me the math law isn’t wrong. You assumed the tax savings must be invested outside the 401k. Actually you can gross up your 401k contributions to $166.67 and still get the same take home pay (166.67 * 60% = 100). So grow it by 10% you get $183.33. Tax is $183.33 * 40% = $73.33. After paying the tax, you get the same $110.

Anonymous says

Interesting post, TFB.

My wife is a teacher and will have a decent pension. I was a federal employee and will have a small pension. The Roth seems to make sense for us, but we are also making contributions to traditional IRA/401ks so that we can take advantage of opportunistic Roth conversions. My wife wants to stay home with our kids for awhile, eventually wants to take a sabbatical. These income-depressing events will be perfect to make Roth conversions more cost-effective.

Anonymous says

quote: Trust me the math law isn’t wrong. You assumed the tax savings must be invested outside the 401k.

Well, I’m assuming you are maxing out your 401(k) in either case. I just used $100 to make the math easier.

Anonymous says

One valuable benefit of the Roth 401(k) is the ability to convert it to a Roth IRA without any tax orcost (once you leave employment). At that point, you can take penalty free withdrawals up to your contributions for any reason at anytime.

Harry Sit says

@anonymous re: being able to rollover to Roth IRA and do penalty-free withdrawals. It’s true, although not all will agree that being able to raid your retirement account so easily is a valuable benefit. If one really needs money, I think a 401k loan is a better option than taking penalty-free withdrawals because once the money is withdrawn, there is no way to put it back.

Anonymous says

Are you locked into a one size fits all mentality? It isn’t raiding your retirement account if you are retiring before the government says you are of retirement age.

Don says

I’m so glad someone else has come to this conclusion. I got a bit of flak over at AllFinancialMatters over a similar analysis.

I agree with you. There is a lot of jumping on the Roth bandwagon, and there might be good reason to consider the old-fashioned Traditional savings.

mcfnord says

i track my tax situation very closely. i should hit the 25% rate in September. And that’s when I’ll push every penny to the traditional self-401k. In a future year where I don’t hit the 25% rate, I might convert the traditional funds in to Roth. So traditional acts as a “buffer” to keep me out of the 25% rate, but also soaking up the 15% rate as long as it’s attainable. and there’s an exit strategy, too: i converted $11k a few years ago. after five years I can withdraw it without penalty, such as in a low rate scenario where i can pay down mortgage that’s at a higher rate.

so traditional wins as an interim to roth when the tax rate is favorable.

2million 401k says

Nice piece of work. I didn’t do the math, but decided to stick to the traditional 401k until our tax bracket was lower. The tax deduction was just too significant to miss out on ;-).

Lee says

Nice analysis, but I’ve spent some time thinking about this and want to call your attention to 2 issues.

1.) If your tax rate at retirement and now is exactly the same, and you max out your 401K, then Roth vs. Traditional are not equal… you are actually better off with a Roth.

I know WHY you think they are the same. You are saying that (Tax_rate)*(1+r)^years is the same as (1+r)^years*(Tax rate). On that point I agree, but the two are still not the same.

The main reason is that both Roth and traditional have the same NOMINAL cap in dollars… $15,500 for 2008. Now which one has the highest cap in POST-TAX dollars? That would be the Roth. You can put $15,500 pretax into a traditional 401K, or, if your tax rate is 50%, then you can put $31,000 of pretax into a Roth. Of course, in a traditional case, you’d still have $15,500 leftover to invest in taxable accounts, but do the math and you won’t come out ahead if your tax is the same.

2.) On tax diversification, most people have employer matching, and the matching part is always in pretax dollars (so even if you put money in a Roth, your employer matching will look like it is going into a traditional). Therefore, Roth is actually a nice diversification.

I concede that the prepayment option is the most compelling case for Traditional. I personally could picture myself going unemployed one year in my 40s, moving to Vegas with no state income tax, and converting the whole thing in a fell swoop.

It might be good to consider though that right now, Bush has cut taxes to near lows in recent history, and you have to wonder whether we foresee income taxes actually being lower in the future. Also, you are a smart person financially, so I suspect you will be quite rich when you reach 59.5, flush with stocks, bonds, real estate, and lots of other sources of passive and portfolio income. You may very well be forced into the top bracket by your retirement, so if you aren’t there now, go ahead and prepay 🙂

$iddhartha says

With your assumption in #1 you are not accounting for the opportunity cost of losing the traditional deduction. The $5,000 or so you save on taxes can be invested.

Also, assuming you have a high yearly income, you can pretty easily get the tax rate down considerably in retirement.

Harry Sit says

Lee – Thank you for your detailed comments. On the first issue of Roth allowing you to shelter more, it’s true, although it only matters if you are hitting the maximum. According to this study by Vanguard, only 10% of people max out their 401k. If you are one of the 10%, then yes, Roth 401k means you can contribute more. For the other 90%, instead of contributing to Roth 401k, they can also increase their Traditional 401k contributions. If you have enough income to contribute $15,500 after tax money to a Roth 401k, it also means your tax rate is high and therefore you are paying high cost for doing so.

On your second point of having the match in Traditional as tax diversification, I think the match alone is not going to fill in the lower brackets in the future. Like most people in my generation who don’t have a pension, the majority of my retirement income will come from my 401k and IRAs. For a married couple, the combined 401k and IRA contribution limit is $41k a year. Unless their income is really high, how many people still have money for investing in taxable accounts after putting in $41k a year toward their retirement accounts? The marginal tax rate might be higher, but there will still be lower brackets that need to be filled.

Scott says

I think I am one of those exceptions too,I have a very good pension plan-I’m in the 25% tax bracket-I currently in NJ.I also think rates have no where but to go in the future.

JoeTaxpayer says

What a great analysis! Glad I found your page. I’ve come to the same conclusion, and been writing about this as well. The defined benefit pension is important to note (which you did). A great plan can replace 75-80% of one’s income at retirement, and could make the Roth more favorable, although with a plan so great, one isn’t likely to save much else.

Only other issue I need to study further, is the impact of Social Security taxation. I wrote an article on that at http://www.joetaxpayer.com/ss.html

and need to work to tie it in to the Roth IRA decision. Many variables to consider.

Disappointed in Kaye at Fairmard, although I think the site is great.

Joe

J says

Even if you were going to go 100% Traditional, it still might be a good idea to make a small one-time contribution to your Roth 401k account as soon as you can. That year will be the start of the 5-year requirement for qualified distribution eligibility for that Roth 401k account (this is helpful, should you change your mind and elect to fund it in the future).

RK says

Thank you for writing this. The government is pushing Roth 401(k)’s so that they can receive your tax dollars today instead of tomorrow! The regular 401(k) makes the majority of investors.

steve says

I need written info stating that a roth ira withdrawl does not factor in to the req min distribution calculations for my traditional ira in the same tax year. These withdrawals will be after the age of 70 1/2. I’ve searched for hours. Thanks

Harry Sit says

Steve – This article is about Roth 401k, which is still subject to Required Minimum Distributions (RMD). You are asking about Roth IRA. Here are the FAQs on RMD from the IRS. You will see that (a) the RMD rules do not apply to Roth IRAs while the owner is alive; and (b) the RMD from your traditional IRA can only be satisfied by following the rules, i.e. taking the distribution from your traditional IRA. Taking money from elsewhere won’t cut it.

ChimRichalds says

I think one person addressed this above but you are all forgetting about the GROWTH of the principal over the years. I am 23 and if the funds I contribute to a Roth 401k are in the market for the next 37 years, I am not going to have to pay tax on either the principal OR earnings. If I contribute $2k this year to the Roth 401k, and I’m in the 15% marg. bracket, I am forgoing $300 in tax savings now. GLADLY! Say the $2k invested today is $10k when I’m 59.5, I have only paid $300 in taxes total, whereas a traditional 401k person would be paying taxes on both the contributions and earnings when he/she is 59.5 which is, no matter how you take distributions, way more tax overall than for a Roth 401k.

Also a great point was raised that the marginal tax rates today are some of the lowest we will ever see! Pay the tax now, max out to ROTH.

Harry Sit says

Chim – I said “Roth 401(k) is good for people in low paying jobs now but expect to have high paying jobs later.” If you fit that profile, Roth 401(k) is good for you. No I did not forget about the GROWTH. If you are going to stay in 15% tax bracket forever, your $300 tax paid today, if allowed to stay in a traditional 401(k) will grow to a size which will exactly pay for the tax on distribution.

Shawn says

Excellent article. My employer just added a Roth 401, so I’ve been thinking about this issue over the last several weeks. I’ve been trying to quantify various options under multiple scenarios. For me, the Roth is the likely winner. One cannot overlook the advantage a Roth has for those who maximize their 401 contributions and have defined benefit pensions. This includes higher income people. I calculate that my tax rate in retirement would need to be about 5% lower than my working years to make the traditional 401 a better choice (since I maximize contributions – a very significant effect). My current marginal tax rate is 34.7% (28% federal + 9.3% state – 2.6% federal deduction for state taxes). If I don’t move, under current tax laws and planned retirement dates, my marginal tax rate will be 32% when I retire (25% federal + 9.3% state – 2.3% federal deduction for state taxes). Admittedly, I need to closely monitor my income (close to 33% federal rate, AMT, etc) and weigh the likelihood that I will retire to a low tax state, but for now I’m betting on the Roth.

Srini says

Hi

I love this article about why not to invest in Roth 401K. It covered every topic exactly it should. Excellent article!!! Thanks a lot. I agree 100% with every thing you mentioned and its good to read it in formal writing..

I contributed 15K in Roth 401K on the pretext of tax diversification. But I am not too comfortable with that logic.. (For all the reasons you listed against Roth). I mean Marginal tax rate vs Effective tax rate even in taxes go high in 20 years form now..

Any way, I was hit by AMT (lost $1000) because of stupid Roth 401K. Then I Google –> 401K “Roth 401K” AMT

The first hit I got was your article and its excellent.

I immediately changed my 2009 contributions from Roth 401K to traditional 401K

J says

TFB: your work is great, both here and on the bogleheads site.

I’m in the 28% bracket now and use 401k contributions to bring myself down almost to the 15% bracket. I expect to straddle the 15 and 25% brackets when I retire. So for me, a traditional 401k makes much sense.

However, I haven’t factored in the social security taxation that Joe Taxpayer talks about in the earlier comments. Granted, tax changes will occur between now and 25+ years from now when I retire. But have you considered a post on your SS tax thoughts?

Harry Sit says

J – To be honest I haven’t looked into issues related to SS taxation because I’m so far away from receiving SS. I’m not familiar with the rules. I vaguely know there is a 50% zone, a 85% zone, and some offsets for earnings while receiving SS — I’m not sure if those are still the current rules. Too complicated. Guessing future tax rates is hard enough. Congress can always invent new rules. For example they can count Roth withdrawal when determining SS payouts or taxation. Roth withdrawal itself is not taxed, but it can be part of means-testing for offsetting other benefits. Too many variations, beyond what my brain cells can handle.

JG says

TFB, Excellent article! It gets to the real meat of the issue as opposed to many other articles that only cover the shallow points of this ROTH vs. Traditional issue.

I just wanted to add that another advantage of the Traditional IRA/401k over ROTH exists for those of us applying for finantial aid for school for our children. The Traditional IRA/401k option makes one more aid-eligible by lowering your taxable income.

sls says

Great article

I have a related question re Roth conversion. If you have both a deductible and a nondeductible IRA and want to avoid having to convert the deductible portion, can you roll the deductible IRA into a traditional 401(k)? Then you could convert the nondeductible IRA alone.

Harry Sit says

@sls – Yes, you can roll it into a traditional 401(k). Make sure you complete the rollover before the end of 2009.

JBA says

I know that the issue is traditional 401K vs. Roth 401K… but what I was wondering what if you max your traditional and then additionally (assuming you meet income limitations) open an Roth IRA.

Just to try to maintain some tax diversification…

Harry Sit says

JBA – Roth IRA is totally fine because it doesn’t take away the contribution limit for traditional 401k.

BR says

Great, insightful article. I have pondered this since my employer made Roth 401k available in 2007. Living in NY, my marginal tax rate is ~36%. Totally doesn’t make sense doing Roth because from a financial standpoint a) it could trigger a higher current marginal tax rate +AMT, b) at retirement, moving out of NY to a tax-free state provides around a 6% tax hedge, which when combined with a potentially lower bracket at withdrawal time provides a good cushion against overall higher tax rates in the future.

Admittedly, I am late to this article, but thanks TFB for the good work and your conviction in the responses.

Scott says

The problem now is I think this whole “Great recession” has changed things,uncle Sam had HUGE bills coming due in terms of it’s debt, but now with hundreds & hundreds of billions in bailout money on top of that,added to the debt..it’s now ENORMOUS future debt levels.

You can say well they will raise the taxes on the rich only( those families making more than 200K if you wanna call them rich)but I think this whole big thing about raising taxes on the over 200K is just to get use use to it.There is just not enough rich people to make serious dent in the HUGE debt,taxes will have to be raised on everyone at some point…and I think it will be not so far in the distant future.

Uncle Sam has some serious debt issues 5,10,15 and years beyond down the line,and defered taxes..401ks retirement money etc.adds up to trillions still owed to the goverment,one quick swipe of the pen by the goverment raising income taxes on everyone and the goverment just gave themselves an extra $500 billion

from defered 401ks and IRAs.

I have to think this whole recession changed the game..How many zero’s can you add to a debt in short period and not have it choke you at some point..Medicare will be first HUGE debt in 10 years that will come due when it runs out of money,thats just the beginning though..

Wes says

“The Roth 401(k) is _bigger_ than the traditional 401k. While the nominal contribution limit is the same for both ($15,500), the Roth limit applies to after-tax dollars. This “quirk” of the rules means that while the nominal limits are the same, the Roth is effectively bigger.”

Could someone explain this to me?? I’m just a novice, sorry!

J says

Wes – It’s another way of saying that you pay for taxes in a Roth up front.

If you put 15.5k in a Roth you take 15.5k out later. With a traditional 401k, you put 15.5k in, you get 15.5k minus the taxes at your income future tax rate.

I think what Scott is missing is that new taxes could come in many forms. They could come from reduced services (you have to pay for stuff yourself), pay-for-service (billing for trash service), to outside an income tax like a VAT tax.

Or it could be that future revenue will bring taxes down. I remember the cries that Reagan’s crazy budget deficits and tax cuts would result in higher taxes for the next generation. Taxes were generally lower 10 years later. Politics aside, as TFB says above it is impossible to judge future income tax rates.

I hedge my bets and use traditional until I hit the 15% bracket, then I use Roth.

Harry Sit says

@Donald – Strictly between a traditional 401(k) and a Roth 401(k), asset allocation has nothing to do with them, because the lower capital gains tax rate only applies to taxable accounts. Between a traditional 401(k) and a taxable account, giving up the tax deduction in order to invest in stocks in a taxable account almost never pays. You can play with the spreadsheet in Alternatives to a High Cost 401k Or 403b Plan and see for yourself.

Whether to contribute to a 401k, which version you use, and what you put into the account after you contribute are totally separate issues.

Kudos to you for your high savings rate. If only all Americans save as much you do!

Donald says

What I have not seen, and perhaps I just missed it, is a discussion regarding the effect one’s asset allocation has on the decision. If one is investing in mostly bonds then I think one can consider the points raised in this article when comparing the two. Equity investments raise other tax issues. Withdrawals from a traditional 401K are taxed as ordinary income. For someone with a large equity stake it makes little since to invest that money in a traditional 401K when you can invest it outside of the 401K and be subject to the much lower capital gains rate upon sale. (Of course this assumes a tax efficient stock investment like a total market index fund). A Roth 401K is even better because you are paying no tax on the withdrawal of an asset class that historically performed better than fixed income investments. Unless you are going to be in a significantly lower tax bracket (like dropping from 35% to 15%) I fail to see why it is ever good to put tax efficient equities in a traditional 401K. Leave that room for inefficient investment vehicles like bonds and REITs.

Just as an aside, I have noticed that several people have advanced the opinion that one can’t max out their 401(k) unless they are already in a high tax bracket making over a 100K a year. This is simply false. I max out my TSP (the government and military version of a 401(k)) and max out my Roth IRA- all on an enlisted military members salary.

Donald says

I guess an assumption I missed was that you are assuming if you are saving in a Roth vehicle you are reducing your contribution by whatever tax saving you are losing. I guess I never think like that. I’ll set a goal of saving, for example $20,000 a year, and allocate based on what I think will give me the best tax treatment in the end. I save that amount no matter whether I paid taxes or not, effectively giving me a higher savings rate if I save in a Roth.

Of course, I am in that small majority that a Roth makes since for because I will end up in a much I higher tax bracket (active duty Navy in medical school.)

PatentGuy says

TFB,

I am pleased to have found your blog and in particular this post. Although it is 1.5 years old, there are recent comments, so I am hoping you and/or others will respond to mine. The Roth conversion hype in the WSJ, etc, had me assuming it must be a no-brainer, but upon reading your post and this thread of comments, maybe it is a “brainer”?

We make a good living and taxes are by far our biggest expense. I agree with you that it is impossible to predict future tax rates, but easy to be assume that the federal and state governments will not be any less “broke” and thus likely will be doing everything they can to take wealth from anyone, anywhere they can find it in order to continue to hand out benefits and (most important) pay interest on the staggering debt, assuming we don’t pull an Argentina on China.

I would love to get your opinion on whether we are the “exception” to your rule, and should pay the taxes in 2010 to convert an IRA to Roth.

I am 48; wife is 50. I have a traditional (pre-tax) IRA that has a current balance of around $500K. The IRA was funded entirely from rollovers from former 401k plans, plus a rollover from a cash balance (defined benefits) pension plan from a previous partnership. Since all three rollovers were entirely “before tax” money, we will get hit for income tax on the entire IRA, when distributed. I also have a current “traditional” (before tax) 401k that receives my personal contributions ($16.5K this year), plus my partnership profit sharing plan contributions (about $30K this year). We also have a cash balance (i.e., defined benefits) pension plan into which I contribute approx $50K a year into, all before tax. My wife (school teacher) has both a 403(b) plan and a 457 plan, and we max them out each year ($22K per plan, because she turned 50), again all before tax. We have no IRAs funded by after tax contributions. We have no Roth IRAs and no Roth 401ks.

For better and worse, we live in California. Since I am self-employed in a partnership, excluding unlimited SE taxes (Medicare), my incremental net tax rate is over 42% (we pay the extra 1% “Rob Reiner” tax at the margin). I don’t know how long we will keep working, but presumably at least another 10 years, and I am more likely to have a transitional retirement over many years, than an abrupt one. We will likely have enough pre-tax 401K and CB plan distributions (if we live long enough) to stay in a relatively high incremental tax bracket at the time the IRA distributions commence. This being the case, I presume that our eventual IRA distributions will be taxed at the highest marginal fed and state rates at the time. Tax rates always matter at the margins, and the “other brackets” you remind people about will already filled by our other income sources. It is possible (likely) we will move out of California to a low or no income tax state before any distributions are made from the IRA (and everything else), but I don’t know with any certainty whether this will happen.

If I understand correctly, we can “convert” the entire IRA to a Roth IRA by paying tax on the full $500K in 2010 (or split between 2010 and 2011). Assuming tax rates are the same for 2010 as they are for 2009, the conversion would cost us about $210K, and we would use existing (already-taxed) savings to pay the tax.

So, the question we are faced with is whether to pay the fed/CA state $210K next year to convert the IRA to Roth, or invest the $210k in something else. For simplification, I assume we would make identically-faring investments with the $210K as we do in the IRA account, and the exact same investments in the IRA account, regardless of whether we convert to Roth. To make the math easy, I assume we will withdraw all funds from the IRA at a point in the future when its value has exactly tripled (and that there are no age or other penalties involved by then). Same with the $210K alternative investment.

Option 1: do the Roth conversion and pay $210K tax in 2010. Result: $1500K “tax free” IRA balance at the time of distribution, no matter where we live.

Option 2: leave as “traditional” before tax IRA, and invest the $210K in same investments. Result: $1500K fully taxable IRA at time of distribution + $210K already taxed principle + $420K taxable gain on the investment = $1920K taxable plus $210K “tax free”. So, to break even or do better than the Roth conversion option 1, we would need to net at least [$1500K – $210K =] $1290K after tax from the $1920K taxable amount. This translates to an effective combined fed/state net marginal tax rate of no more than [(1920-1290)/1920] = 32.8% at the time of the distribution.

This may be possible IF we move to a low/no income tax state, but is extremely unlikely if we stay in California. One of your above commentators pointed out that capital gains taxes outside of the IRA are currently lower than income tax rates, it is entirely possible we will pay less than 32.8% on the $420K investment gains in option 2. Again, will depend on what state we live in. Plus, these investment gains are less than 25% of the total taxable amount.

Did I do the math wrong or make a flawed assumption? I believe your counseling that doing a Roth conversion is a bad idea is premised upon an assumption that people will not have any other significant sources of retirement income outside of the IRA/401k distributions in question. Maybe that is what you meant by the “millionaire” exception??

Speak to me, my friend. Is this a brainer or a no brainer? It seems to me the answer may come down to where you will live at the time of the distribution!

Extra credit: Estate planning nuances. Does it help or hurt your heirs if you die with undistributed traditional v. undistributed Roth accounts?

Harry Sit says

PatentGuy – I think you fit the 2nd exception very well. I wrote in the post:

“A Roth 401(k) is also good for people who are already in the top tax bracket and expect to be there forever. If they don’t see any chance of being in a lower tax bracket, prepaying tax now will lock in the tax rate so they won’t have to worry about future tax increases.”

By the way the options for paying the tax on Roth conversion (a) 100% of the conversion income reported as 2010 income OR (b) 50% of the conversion income reported as 2011 income and the other 50% reported as 2012 income. Given that the administration already proposed higher tax rates for your income level in 2011, you probably want to report the whole thing in 2010 and not risk a higher rate in 2011 and 2012.

For the extra credit, Kaye Thomas at Fairmark wrote:

“If you have enough wealth to be concerned about the estate tax, you should consider the benefit of a Roth IRA conversion in this connection. The estate tax applies to your total assets at death, including assets held in a traditional IRA or a Roth IRA. The difference is that the estate tax doesn’t “notice” that the Roth IRA is bigger. So the amount of estate tax on a $500,000 IRA is the same whether it’s a traditional IRA or a Roth IRA.”

Advantages of Conversion

PatentGuy says

Thanks for the sanity check, TFG.

I suppose it is still gambling to pay the taxes next year, because we don’t know for sure we are going to stay in a high tax bracket and/or in a high tax state. But at least one of those two is likely. And, if we pay the tax in 2010 (you are correct, we won’t wait for the higher taxes in 2011 and 2012 to make the payments), but things later go south for us financially, the money we “squandered” (in hindsight) on paying the conversion taxes would likely be toast in any event.

Harry Sit says

PatentGuy – That’s true. If you don’t know whether you will be in a high tax bracket or in a high tax state forever, nobody else knows. Just remember it’s not all or nothing. You can convert only a portion of your traditional IRA as well.

MsTexas says

I have read all of the posts but am still a little confused. I think the Roth 401k is best for me but I wanted to verify this as I just started a new job and get to make the election now.

I live in TX – no state income taxes. I will be in the top income tax bracket (Fed). I will max out my 401K contributions. I will receive some sort of match from my company up to a limit. I know that I won’t retire anywhere with cheaper state tax than now since, as I mentioned, TX doesn’t have state income taxes. So, in the future, my state income tax will either remain the same or go dramatically up. Also, I plan on investing 100% of the 401k in growth funds for most of the life of the 401k – hoping for solid gains.

I don’t know if I will continue to bring in income after retirement. I can easily visualize it going either way…full retirement or self employed.

Did you think the Roth 401k is right for me?

Thank you.

ROTH fan says

Please help me understand if I am missing something here….but there seems to be a huge error in one of the main assumptions in this discussion. If the taxes saved by investing in a non-Roth are allowed to accumulate and compound, they will be significantly inadequate to equal the Roth. Please consider this simplified example:

If you are in a 30% combined tax bracket (now and in the future) and invest $15,000 in a Roth, you’ll pay a $4,500 tax up front. If you successfully invest the $15,000 for 30 years at 10% compounded, you’ll have $261,741.

You would also have the same balance in a non-Roth account but would owe $78,522 (30%) in taxes. The argument has been that you can invest the $4,500 in up-front tax savings to cover the future taxes. Unfortunately, the $4,500 will be invested in taxable investments where your 10% return is reduced to 7% and will accumulate in 30 years to only $34,255 which is $44,267 short of the taxes owed.

I realize that this is simplified example and there are infinite variables, but am I missing something? Thanks.

Harry Sit says

Roth fan – I answered that already in comment #19. The extra $4,500 in your example does not have to be put in a taxable account. It can go to a Roth IRA. Also see follow-up post Roth 401(k) for People Who Contribute the Max.