[Originally written in 2008. Updated in 2022. The case is still valid after all these years.]

To Roth or not to Roth, that is the question.

Many employers offer both a Traditional and a Roth contribution option in their 401(k) plan. If you choose the Traditional option, your contributions go in pre-tax but you pay tax when you withdraw after you retire. If you choose the Roth option, you pay tax first before you contribute but your withdrawals are tax-free after you retire. You can mix and match between Traditional and Roth but your total contributions between the two can’t exceed the annual limit.

| Traditional | Roth | |

|---|---|---|

| Contributions | pre-tax | post-tax |

| Earnings | tax-deferred | tax-free |

| Withdrawals | taxable | tax-free |

This question of whether one is better off with contributing to the Traditional 401k or contributing to the Roth 401k has been the subject of a lot of debate. Although there is no one-size-fits-all answer, I think for most people the majority, if not 100%, of the contribution should go to a Traditional 401(k). I will state my case against the Roth 401(k) in this article.

The basic premise of a Roth 401(k), and to some extent a Roth IRA, is that of prepayment. You are prepaying taxes now so you don’t have to pay tax later. This prepayment concept is not uncommon. For example, buying a season ticket is prepaying for the individual events. Buying a timeshare is prepaying for vacation accommodation.

Whenever we deal with a prepayment scheme, we have to assess whether prepaying is “worth it.” The same paradigm also applies to Traditional versus Roth 401(k). There are several factors that make prepaying the taxes now not worth it.

Fill In Lower Tax Brackets In Retirement

I showed in a previous post The Commutative Law of Multiplication that if the marginal tax rate at retirement is the same as it is now, the Traditional and Roth 401(k)’s are equivalent. If the marginal tax rate is higher now than in retirement, one is better off contributing to a Traditional 401k. If the current marginal tax rate is lower, one is better off contributing to a Roth 401k.

But that applies only to the marginal dollar, which is the last dollar you can shift between Traditional and Roth 401(k). It is not necessarily the case for the entire contribution or the average dollar.

The tax system in the United States is progressive and it will probably stay that way. It means that income is taxed at increasing rates as it goes higher. Even if you think the marginal tax rate in the future will be higher, there will still be lower brackets and these lower brackets should be filled with money from a Traditional 401(k).

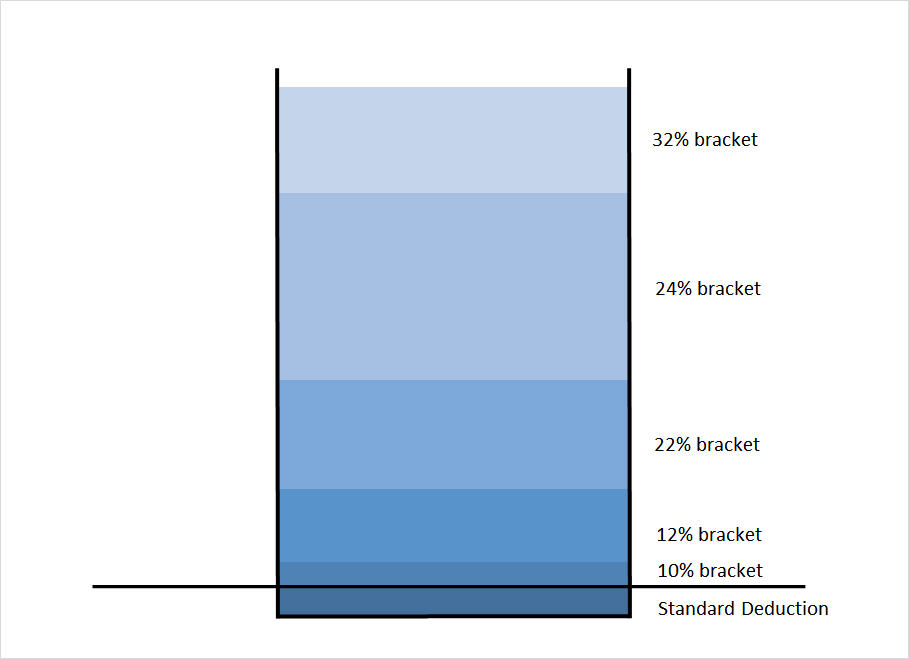

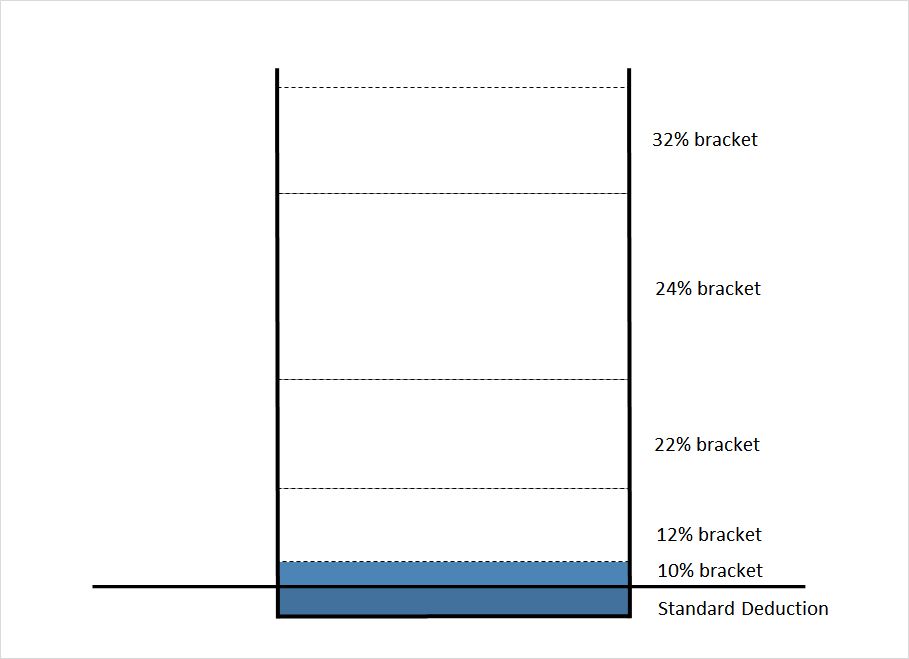

The chart below illustrates how the tax brackets work:

Picture a bucket with markings on the side. As you pour water into the bucket, the water goes up and crosses the marked lines. This represents how your income is taxed. The first chunk of your income absorbed by your tax deduction isn’t taxable. The next chunk of your income is taxed at 10%. The next chunks after that are taxed at 12%, 22%, etc.

When you contribute to a Traditional 401(k), you are scooping up income from the top of this bucket. The dollars you contribute come from the highest tax bracket for your income.

After you retire, you’re staring at an empty or shallow bucket before you pour in money from your 401(k). The money first goes through the lower brackets before it reaches the top.

Even if you assume your marginal tax bracket in retirement will be higher due to tax increases, a large portion of the 401(k) withdrawal may still be taxed at a lower rate than what it was when you contributed the money.

Until you know you can generate from your Traditional 401(k) enough income to fill the lower brackets, it doesn’t make sense to contribute to a Roth 401(k). For people without a pension, it means the majority of the retirement savings should go to a Traditional 401(k), not Roth.

If you have a pension and/or you expect to have a huge balance in Traditional 401(k)/IRA, large enough to fill the lower brackets every year, then contributing some money to Roth makes sense.

Avoid High State Income Tax

Many people work in high-tax states like California and New York today. They work there because there are a lot of good-paying jobs in those states. They won’t necessarily retire there because taxes and the cost of living are high in those states.

States popular with retirees like Florida and Texas have no state income tax. If you’re working in a high-tax state today but there’s a good chance you will retire in a no-tax or low-tax state, contributing to a Traditional 401(k) lets you avoid paying the high state income tax on the contributions. Prepaying the high state income tax now is a dead loss.

Leave the Option Open for Future Roth Conversions

When you leave your employer, you can roll over the Traditional 401(k) to a Traditional IRA, which then can be converted to a Roth IRA at a later time when it is advantageous to you. A Roth 401k or IRA on the other hand can never be converted back to Traditional.

With a Traditional 401k, you hold the option, which has value. If you contribute to a Roth, you give up that valuable option. You can decide to convert and pay the tax whenever you are in a lower tax bracket than where you are now. Good times for conversion include:

- Going back to school for a career change.

- Becoming unemployed due to layoffs or burn-out.

- Starting a business (not as much income in the first few years).

- A two-income couple having one parent stay at home or work part-time for a few years after they have kids.

- A high-income single person marrying a lower-income spouse.

- Taking early retirement.

- Moving from a high-tax state to a no-tax or low-tax state.

Unless you’re sure that your marginal tax bracket will never be lower throughout your lifetime, you should leave the option open by putting money in a Traditional 401(k) and waiting to convert to Roth when an opportunity comes.

Avoid Triggering Phase-outs

Because contributing to a Roth 401k does not reduce your gross income, you appear to have a higher income than if you contributed to a Traditional 401k.

There are all kinds of income-based eligibility cutoffs and phase-outs in the tax code. When you exceed the income threshold, your tax benefits from those programs are either reduced or eliminated. Some of these tax breaks include:

- Child Tax Credit

- Child and Dependent Care Credit

- American Opportunity tax credit

- Lifetime Learning credit

- Eligibility to contribute to a Roth IRA

- Student loan interest tax deduction

Think of the stimulus payments during the COVID pandemic. If a single person earned $80,000 but contributed $10,000 to a Roth 401k, he/she wasn’t eligible for the payment. If he/she contributed $12,000 to a Traditional 401(k) instead, he/she was eligible.

Easier to Get the Full Employer Match

Some people think if you contribute to Roth 401k, the employer’s match will also go there, which will effectively increase your employer match. That’s not true. The employer match always goes to the pre-tax account whether you contribute to the Traditional 401k or the Roth 401k.

When money is tight, it’s easier to qualify for the full employer match when you contribute to the Traditional 401k with pre-tax dollars.

Who Should Use a Roth 401(k)?

With so many disadvantages, then, for whom does a Roth 401(k) make sense?

A Roth 401(k) is good for people in low-paying jobs now but expect to have high-paying jobs later. Doctors in resident programs fit that description very well. They are paid very little while they are in residency but their income is expected to rise substantially higher when they finish the program. Their income will stay high in their career and they will receive a high income after they retire. Prepaying tax now makes sense because they are prepaying at a low rate and they will avoid paying a higher rate later.

College students working part-time jobs or recent graduates working in entry-level jobs are also good examples for taking advantage of a Roth 401(k) while their income (and their tax rate) is low.

A Roth 401(k) is also good for people who are already in the top tax bracket and expect to be there forever. If they don’t see any chance of being in a lower tax bracket, prepaying tax now will lock in the tax rate so they won’t have to worry about future tax increases. On the other hand, people who are in the top tax bracket are in a good position to retire early, with many years of lower tax brackets to fill. So don’t be too sure of staying in the top tax bracket forever.

Tax Diversification?

What about the idea of tax diversification? Some advocate both a Roth 401k and a Traditional 401k because the tax rates in the future are uncertain.

Diversification is good in general but it doesn’t mean automatic 50:50. Just like investing in emerging markets provides diversification, it doesn’t mean you should invest 50% of your money in emerging markets. You still have to decide how much you should allocate your retirement savings between Traditional and Roth just like you allocate a portfolio between developed markets and emerging markets.

Tax diversification also doesn’t mean you have to do it right now if you are in your peak earning years. There might be better times coming up in the future.

As for me, I had contributed 100% to a Traditional 401(k) every year when I worked full-time. Prepaying taxes just wasn’t worth it.

Higher Effective Contributions

Some say the Roth 401(k) is better because you can fool yourself into contributing more when you’re using after-tax money. Contributing 10% of your salary post-tax effectively puts more money into your 401k than contributing 10% of your salary pre-tax. It’s true but you should adjust your contribution to 12% or 15% to equalize the net paycheck when you contribute to a Traditional 401k.

A Roth 401k has a higher effective contribution limit because the annual contribution limit is the same when you max out your 401k. There is some truth to it. See follow-up post, Roth 401(k) for People Who Contribute the Max, which includes an online spreadsheet that calculates the value of having a higher effective contribution limit in a Roth 401k.

What About Roth IRA?

All arguments for and against the Roth 401k also apply to the Roth IRA when you are not yet contributing the maximum to your Traditional 401k. Instead of contributing to the Roth IRA, you can just increase the contribution to your Traditional 401k.

An additional argument in favor of the Roth IRA is that some 401k plans have higher fees. Even then the Traditional 401k can still be better when you don’t expect to work there for many years. You can roll over to your own IRA for lower fees when you change jobs. See Alternatives to a High Cost 401k Or 403b Plan.

If you are already contributing the maximum to your Traditional 401k, you may still be able to take a deduction for contributing to a Traditional IRA. See The Forgotten Deductible Traditional IRA. A Roth IRA is better when you already contribute the maximum to your Traditional 401k and you don’t get a deduction for contributing to a Traditional IRA anyway.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

PhrugalPhan says

Very interesting and good article, but as the saying goes “your mileage may vary – YMMV”. As others have said, if you have a pension, this can push you towards using the Roth option, and certainly has in my case.

For me I have a 457 plan with good moderate to low cost fund choices. We get no match as we get a defined benefit as well (pension). If I retire ASAP at 60 (I’m 56 now), I will be getting for my pension near $55k/year to age 67, then $40k/year thereafter. Add in SS payments and it won’t take much for me to get to a higher tax rate. With a large 457 plan balance, RMDs at 70.5 y.o. will easily push me into very high tax rates than I have now. My 457 balance is well over $600k now, so I figure my RMDs should be in the $40k+/year range in my 70’s, and only increase over time. Add together that estimated RMD, my pension, and SS payments, I will be getting more than I get today (I currently earn $100k/year), and won’t have the ability to shelter income with a 401k style plan.

Thankfully I started using the Roth option when it became available and now 1/4 of my 457 is the Roth option. I still put some contributions in as pre-tax, and I also use an HSA to cut my taxable salary too, so to keep myself in a lower tax rate (currently 22%). For many people I can see why traditional pre-tax will work best, but for me I can only see the same to higher marginal tax rates going forward (except for possibly a few years in my late 60s if I hold off SS payments until 70).

One thing I have not seen mentioned is the IRMAA in retirement. This should be included Roth/not Roth discussion. As it currently stands, Roth withdrawals do not count towards determining IRMAA fees for Medicare. I figure IRMAA could add an extra 1% “tax” if I have to pay the maximum fee, and by using Roths I think I will be able to avoid all of this tax.

FinancialDave says

Harry,

One point about this article, is that being 10 years old, a few things have changed with tax rates and standard deductions.

I think the referenced Vanguard article in todays link has it about right when they point out only about 12% utilize the Roth. Most everyone needs some Roth just for tax diversity sake.

I do disagree with your definition of “marginal rate” and tend to agree with the Boglehead definition of “marginal rate” as it applies to the Roth / Traditional decision. Marginal does not apply only to the “last dollar” it applies to all dollars saved or spent in the “referenced decision.” In other words in retirement it is quite easy to see that this can cross tax bracket boundaries and you have to take that into consideration, you can’t just compare your marginal rate of the last dollar saved and the last dollar spent. The word marginal means “incremental” and incremental can be “many” dollars wide depending on the comparison you are making.

https://www.bogleheads.org/wiki/Marginal_tax_rate

Dave

Jon says

Thanks to you TFB for a great article and your patience! I agree with your main premise in the article: You should consider the Marginal rate of Roth contributions when made to the ‘Effective Tax Rate’ under which you’ll pull that money out in retirement.

Regarding the ‘Commutative Law of Multiplication’, I have seen many here make the mistake of not understanding it…and also have a smart engineering friend that did not understand it either. He has been aggressive at converting funds to Roth and had been planning to convert all funds quickly during early retirement.

I do believe that having some split between Roth and Traditional makes sense- mainly because I always expect to have taxable income from other investments.

My wife and I are very heavily weight towards Traditional. Since she is now a SAHM, we are looking for an opportunity to convert some income.

A suggested addition for ‘A good time to convert’ is: In a down market.

Eric Gold says

The appropriate comparison is between the marginal rate for the Roth contribution Vs the *marginal rate* for the withdrawal in retirement. The reasons the IRA usually win out for the middle class are two fold:

1. Deductions drop the retiree into a lower bracket

2. Annual income during the working years is usually higher than retirement

The so-called effective tax rate is total-tax / AGI. Not what you want.

My case is something of a poster child for avoiding Roth: Instead of paying marginal rates of 20% to the IRS and 5% to my state for a Roth, I pull the money during retirement at a rate of ~ $25k a year to supplement my SS of ~ $30k a year. My federal tax after a standard deduction for two people on the $25k of IRA money is $500 or about 2%

John Endicott says

” I pull the money during retirement at a rate of ~ $25k a year to supplement my SS of ~ $30k a year”

The one thing that might trip you up is RMDs. If your accounts are large enough when RMDs kick in the government could be forcing you to take a much larger withdraw than your projected 25k. With the new RMD tables, at age 72* , you are looking at an approx. $36k per million rate of withdraw. In other words, your account(s) would need to be no higher than about $700k in total in order to not be forced to withdraw more than your target of $25k.

* Using the Uniform Lifetime table, if, on the other hand there is a > 10 year age gap between you and the younger is the sole designated beneficiary of the olders retirement account(s), you would use the the Joint Life and Last Survivor Expectancy table instead which will give you lower RMD numbers, how much lower depends on the differences in your ages.

Chad says

Has anyone ever read the article titled “Roth a Wolf in Sheep Clothing” written by a CFP from Certified Financial Group out of Orlando. Google it. Its a very eye opening article. A must read for sure. Details to facts regarding tax brackets and how they actually work and the fact that you are paying tax up front on the Roth contributions and people may over look that only looking ahead at possible tax free withdrawals under the current tax law.

Roth Fan says

Back in the days when had some extra money, I opened a Roth. Fast forward a few years later, and I am going back to school. Withdrawing the Roth sort of sucked, because I had paid that 15% or so income tax on it, whereas now I would have paid close to zero.

On the other hand, lacking true income qualified me for free Masshealth (Medicare). If I had to buy subsidized healthcare, I would have been some 6K / year poorer. Not to mention I would have had to withdraw 6K more, which would have lowered the subsidy and increased the tax bill.

John Endicott says

That is indeed one of the benefits of a Roth: withdraws aren’t counted as “income” which helps you stay under income thresholds that would cost you more when your income is above them (Medicare premiums are a good example where Roth withdraws won’t hurt you with higher costs but a traditional IRA or 401K could – moving up just one bracket will cost you close to a thousand dollars in premiums for the year, move up multiple brackets and you are looking at a loss of a few thousand dollar for the year.)

Mike says

I am confused by this whole post and it seems to contradict a section on the Bogleheads wiki, which says the following:

“With IRAs, the eligibility of traditional vs. Roth is affected by income. There is an income limit for deducting contributions to a traditional IRA. Above that limit, and below the Roth IRA contribution income limit, a Roth IRA is best.”

It’s why I’ve been contributing to Roth 401k and Roth IRA. Does the above only apply for Roth IRA and not Roth 401k? Is the entry incorrect/flawed in reasoning? Also my current employer put me into a Roth 401k by default. I don’t recall even having an option for a regular 401k, but perhaps I’ll look into it and see if it can be changed.

Harry Sit says

The sentence immediately before what you quoted in the Bogleheads Wiki, says “Within employer-sponsored accounts (401k, 403b, 457) the eligibility of traditional vs. Roth is unaffected by income.” And a little further before that,

“If one does not believe a reasonable estimate is possible (see estimating future marginal tax rate for suggestions), consider

– Using 100% traditional because, for most people, traditional will be better”

sarabayo says

FYI, the chart illustrating 2008 MFJ tax brackets appears to have disappeared from the article, and now only shows a warning symbol.

Harry Sit says

Thanks! It’s telling me I should redo it after all these years. 🙂

D says

This analysis does not consider the impact that higher taxable income during retirement may have on Medicare premiums and medicaid eligibility.

Brad says

How does a company match factor in to the discussion? Let’s say you company will match 100% up to $12k per year, shouldn’t you use the Roth option so the matched dollars are post tax dollars? It is essentially increasing your company’s effective match by your marginal tax rate at withdrawal.

Harry Sit says

The match is always pre-tax. It’s easier to qualify for the full match when you contribute to Traditional.

Andrew says

Harry, isn’t this another case in which a self-employed person might be better off with Roth 401(k) contributions?

“How The New QBI Deduction-Reduction Ruins The Value Of Pre-Tax Retirement Plans For Small Business Owners”

https://www.kitces.com/blog/199a-qbi-deduction-reduction-small-business-owner-retirement-plan-contributions-roth/

Harry Sit says

It’s a factor but it’s not automatic. For example a self-employed person in California pays up to 7.x% lower federal income tax with a Roth 401k contribution but it adds up to 12.3% in state income tax.

Andrew says

I see, thanks. How about for someone with no state taxes?

John Endicott says

“After you retire, you’re staring at an empty or shallow bucket before you pour in money from your 401(k). ”

Only true if your only other income is pretty much just Social Security. If you have other income (pension, interest from bank accounts and various types of taxable bonds, dividends and capital gains from a taxable brokerage account, royalties, income from side hustles, real estate rentals, etc) your bucket may already be filling in those lower brackets long before you include withdraws from your 401k or Traditional IRA.

The fact is when you put money in to a traditional IRA, you are scooping from the top of the bucket and when you are taking money out of it, you are adding it to the top of the bucket. The only question is how fill is the non-IRA/401k marked money in those buckets relative to each other. And there is no one size fits all answer for that.

Harry Sit says

That’s why people with a pension are called out as an exception. If someone expects to have pensions, royalties, rental income, dividends and capital gains that fill the bucket fuller than when they are working, they’re a good candidate to retire early.

John Endicott says

The point is that you aren’t scoping from the top and filling from the bottom. You are really looking at taking from (when contributing) or adding to (when withdrawing) the top, so it’s best to consider where that top is and will be (IE how full is that bucket now vs later).

John Endicott says

and another point. Even at your $25k withdraw, you will be paying more tax than just on the 25k as you seem to think. SS gets taxed at 50% when you have provisional income greater than $25k single or $32k married. The provisional income calculation *includes* half of your SS income, thus the income that would be counted in your scenario is approx. $40k (25k + 30k/2) which is greater than $32k – resulting in half your SS benefits being taxed in addition to the 25k in IRA/401k withdraws.

John Endicott says

This was in reply to Jon #203, not sure why it got posted here at the bottom.

Tom P says

I retired in mid-2020 and left my 401(k) balance with my former employer. Over the last few years of employment I only put about $10K into the Roth option, but it’s now been in there for 5 years and is fully qualified. When I recently took my RMD for this year a small part was therefore paid as not taxable.

I’m trying to decide if it would be worth doing an in-plan conversion to convert some of my existing 401(k) balance to Roth, say $40K this year, and maybe the same next year. For me, the main reason I’m considering this option is to ultimately protect the surviving spouse from having to withdraw too much taxable money in any given year that may shift them into a higher tax bracket and/or needing to pay IRMAA.

However, reading through this article and the responses it seems Roth funds might not be such a great deal? I would be interested in any opinions. Thanks.

Harry Sit says

This post is about contributing to a Traditional 401k or a Roth 401k. You are in a different stage now. Whether you should convert some money to Roth depends on how full your bucket is. If it’s still relatively shallow, maybe you should convert. If it’s already quite full, maybe you shouldn’t. Tax advisors and software run numbers to figure that out. By the way, if you roll over your Roth 401k to a Roth IRA, you won’t have to do RMD from the Roth IRA. That’ll keep more of your money in a Roth account.

Tom P says

Thanks Harry. Our retirement income is 100% a combo of SS and withdrawals from my 401(k) and my wife’s Rollover IRA. Currently those withdrawals put us in the middle of the 22% bracket and I expect to be in that bracket for the foreseeable future.

Rolling over some or all of my 401(k) Roth to a Roth Rollover IRA sounds like it may be a good idea to avoid any future RMD withdrawals. Any future in-plan conversions can then be rolled into the IRA and should immediately be fully qualified.

Anonymous says

Interesting article. Don’t disagree persay but do think there are a couple good points to consider in favor of Roth: 1) Don’t under sell the tricking into saving more bit, somethings are great in theory but I don’t know how many people truly reinvest their tax savings from a traditional 401k versus ending up just spending it and short changing their future and 2) people need to ensure they’re looking at their Effective tax rate now vs projected rate later. I’m a divorced mom of 3 and even though I make enough to be in a marginal tax bracket of 22% my effective tax rate after deductions is much lower, hence after divorce I chose to switch all contributions to Roth 401k.

Harry Sit says

If your effective tax rate is low because you get refundable tax credits, you’re going to get those anyway. Your effective tax rate can go negative when you contribute to traditional. The marginal tax rate you’re paying for contributing to the Roth 401k may still be 22%. It can be even higher if you hit some phaseouts. You’ll know when you calculate your taxes both ways.

anonymous says

Oh, I understand contributing to Roth 401K vs traditional doesn’t impact my other refundable tax credits and deductions, what I mean is because I’m in a stage of life with tax credits and deductions I won’t have in retirement (dependents, mortgage interest, etc.) its important to consider my effective tax rate to determine if its better to pay taxes on the savings now or in the future. At surface level I’m likely to have the same marginal tax rate in retirement as now, but once you consider my effective tax rate I have a much lower tax rate now than I’m likely to have in retirement. Just pointing out the importance of considering effective tax rate and not just marginal tax rate. Thanks for your response!

John McDonnell says

Let me see if I have this right, I max out my Traditional 401(k) today get a 6% match and also max out the Catch-Up contributions. I can not do a Roth IRA due to income limits. I am considering the Roth 401 (k), but I live in Illinois where they completely exempts 401(k) income from tax. The State income tax is 4.95%. I should continue to max out my traditional 401(k) vs switching over to a Roth 401(k), correct? If I still can contribute more should I add that into a Roth 401(k) or taxable investment account?

Harry Sit says

That’s correct. If you contribute to Roth 401k you’ll pay the 4.95% state income tax unnecessarily. You can still do a Roth IRA indirectly when your income is above the limit. It’s called a backdoor Roth. Many employers also allow non-Roth after-tax contributions to the 401k plan, which can be converted to Roth. That makes it a mega backdoor Roth. I would add to taxable investment account after maxing out the backdoor Roth and mega backdoor Roth.

John McDonnell says

Thanks. Also been looking at iBonds especially with inflation and current rates at 7+%. Where would you slot this strategy into the above comments (401k, Backdoor, Mega, Investment Account)? I live in Illinois with a 4.95% state tax. Before a backdoor Roth or mega backdoor Roth or after? Seems to me the things to consider are no state taxes on iBonds, known return of iBonds which currently pretty high, liquidity of Roth …

Harry Sit says

After backdoor Roth and mega backdoor Roth.

Maria says

Example of someone for whom Roth 401k is no-brainer: a (mostly) retired person with $7K (or less) of earned income from a very small part-time job. If they contribute their full earnings to a Roth 401K, they can ADDITIONALLY contribute their full earnings to an IRA (traditional or Roth, as they please), for up to $14K in tax-advantaged savings. This kind of double-contribution is not possible with a traditional tax-deferred 401k plan, since every dollar contributed to their tax-deferred 401k reduces their box 1 W-2 earnings and therefore also reduces the amount of IRA contribution allowed.

Joel says

Harry;

What is your opinion on Ed Slott’s position on Roth investing?

Joel

Harry Sit says

Which is? If he says everyone should make Roth contributions when they’re eligible for a traditional deductible contribution, I disagree. If he says everyone should convert all their pre-tax money to Roth, I disagree. I made 100% traditional pre-tax contributions to my 401k when I worked full-time. I haven’t made any Roth conversion so far.

Joel L. Frank says

Harry;

You make no mention of those that have a pension and 401(k)/(457(b)/403(b) savings which are all government workers on the federal and state and local levels and those private industry workers that have pensions.

Example: Retiree has a taxable an employer financed pension + an 85% taxable SS annuity + taxable RMDs on his $500,000 401(k) balance + other taxable income.

Such retirees are clearly placed in a higher tax bracket after age 72 than prior to age 72. Moreover, pre-tax savings are clearly hurtful to them and their significant other because the survivor will have to file as a single tax payer at yet higher rates.

I look forward to your learned reply.

Respectfully yours;

JOEL L. FRANK

Harry Sit says

I did mention pension twice in the body of this post and several more times in the comments. The word “pension” appears more than 40 times altogether on this page. For federal government employees participating in the TSP, see Most TSP Participants Should Switch To the Roth TSP.

Jon W. says

When I started working the only option available was traditional 401k. Four years ago we had the option to use Roth contributions so we switched. I do miss the tax break currently but believe it will be better down the road. Plus i wanted to start the Roth contributions to earn time towards the 5 year limit on withdrawing. As our kids get older and we lose those tax benefits, i’ll likely go back to traditional contributions for the tax savings now. We do have traditional pensions as well and may use the time before drawing pensions/SS to roll over some. Keeping tax brackets in mind. I still love the Roth, but also really miss the benefit of the tax savings while working. SS and pensions would replace about 80% of what we currently earn.

FrugalMD says

I’m currently a resident and my SO is a non-physician who is making 120-130k. We live in California right but plan on moving to a state like Texas, Florida, etc. in about 4 years. We are not married. My income potential is 500k-600k plus. My question is, does it make sense for her to contribute to a Roth 401(k) given that when we are married our combined income will tip her into a higher tax bracket or do you think that a traditional 401(k) makes more sense to her given that she is getting heavily taxes due to the nature of living in California? Thank you.

Harry Sit says

If there’s a window between moving to a no-tax state and having a very high income (moved but not married yet or moved and married but not earning $600k yet), she can still contribute to Traditional and convert to Roth in that window. If there’s no such window and the two of you will marry and have a high income forever, she may be better off contributing to Roth. Either way, it’s only for a few years. It won’t make that much difference in the grand scheme.

James says

Sorry but you’re wrong. Over time, Roth IRAs yield superior net returns due to tax-free compounding. The marginal tax rate argument gets stomped out easily as the time invested increases assuming average investment returns. You forgot to factor in many years of investment returns that compound and are tax-free when using a Roth. Also, you are assuming your marginal tax rate is lower in retirement which is not necessarily true. Most people have more than one source of retirement funds which, when combined will push your marginal tax bracket up.

You were just as wrong back in 2008 (article link not working by the way) as you are today.

One of us is an experienced financial professional while the other is an author. Big difference.

Pat says

I had maxed out my contributions to my Traditional IRA/401K while I was working, reinvesting dividends, so it grew substantially. I used a modeling tool to determine what my RMD would be when I reach 73. To my surprise, it is significantly (about 50-60%) higher than what my salary was when I retired. So the race is on to convert as much as possible to a Roth, without impacting Medicare premiums for myself & my spouse. I am sorry I didn’t invest in the Roth while I was working (it didn’t exist when I started working).

Joel Frank says

Deceased Senator William Roth of Delaware is credited with the after-tax version of investing for retirement. All too many retirees never had this opportunity. They were born too early. Convert or Remain with the pre-tax concept……that is the question!

RH says

Does the removal of RMD for Roth 401(k) starting in 2024 change your thinking on this, or still Traditional all the way?

Harry Sit says

No, it doesn’t change my thinking. Previously Roth 401(k) balance is usually rolled over to a Roth IRA, which doesn’t have RMD. Removing RMD from Roth 401(k) only saves some administrative work if someone prefers to keep the balance in the Roth 401(k). Most people will probably still roll over to Roth IRA anyway.

GD says

The biggest issue with this article is you’re not factoring in growth of the pre-tax assets and how much of a bite that takes when you’re getting 2x+ growth over time.

Example: for simplicity say you contribute 100k to a trad vs. roth at time zero at a 37% tax bracket and put it in an S&P 500 index fund. Let’s assume you will get average annual 10% growth over time. You’ll pay 37k in taxes on the roth up front (although not out of the roth account so the principal balance is unaffected) and nothing on the trad. After 40 years of growth you’ll have approximately $4.5 million in both accounts. The roth will be entirely tax free but you’ll have to pay taxes on the trad which is now 45 times larger than it was when you made the contribution. Even if you paid taxes at the lowest possible federal rate of 10% (which won’t happen for a lot of reasons) that’s still 450k which… is a lot more than 37k.

Harry Sit says

What if you have more left in your pocket after paying $450k? 45 times of $37k taxes that you didn’t have to pay up front is $1.67 million. That’s more than enough to pay the $450k.

Mark says

Wow!

$100k PLUS $37k in taxes invested in a Roth is worth more than $100k alone invested in a traditional 401k?

So $137k is worth more than $100k?

Jess says

Hi Harry, thanks for this helpful post! I’m currently working, maxing out my 401(k) and IRA contributions, and continuing to build my retirement savings. A Fidelity advisor recently recommended shifting to Roth 401(k) contributions instead of traditional 401(k) to reduce the impact of future RMDs. I mentioned that I plan to slowly convert pre-tax 401(k) funds to Roth over time, and taking advantage of lower tax brackets in retirement—but he still highlighted RMDs as a reason to contribute to Roth now.

I’d love to better understand when RMDs become a deciding factor while still working for folks under 50 years of age. Is there a general threshold or rule of thumb to help determine when contributing to a Roth 401(k) is more advantageous than traditional 401(k), specifically from an RMD planning perspective? Thank you for your insight.

Harry Sit says

RMD is a percentage of your Traditional account balance. Having large RMDs after you’re 75 means that you still have a large balance in your Traditional accounts at that time after converting to Roth over the years. That’s a success. Your investments did well. You’ve made it. Paying tax on large RMDs will be the least of your worries.

On the other hand, if your investments do poorly or you have prolonged unemployment, illness, or other misfortunes, you won’t have huge RMDs anyway.

I would much rather have large RMDs than not.