[Originally written in 2008. Updated in 2022. The case is still valid after all these years.]

To Roth or not to Roth, that is the question.

Many employers offer both a Traditional and a Roth contribution option in their 401(k) plan. If you choose the Traditional option, your contributions go in pre-tax but you pay tax when you withdraw after you retire. If you choose the Roth option, you pay tax first before you contribute but your withdrawals are tax-free after you retire. You can mix and match between Traditional and Roth but your total contributions between the two can’t exceed the annual limit.

| Traditional | Roth | |

|---|---|---|

| Contributions | pre-tax | post-tax |

| Earnings | tax-deferred | tax-free |

| Withdrawals | taxable | tax-free |

This question of whether one is better off with contributing to the Traditional 401k or contributing to the Roth 401k has been the subject of a lot of debate. Although there is no one-size-fits-all answer, I think for most people the majority, if not 100%, of the contribution should go to a Traditional 401(k). I will state my case against the Roth 401(k) in this article.

The basic premise of a Roth 401(k), and to some extent a Roth IRA, is that of prepayment. You are prepaying taxes now so you don’t have to pay tax later. This prepayment concept is not uncommon. For example, buying a season ticket is prepaying for the individual events. Buying a timeshare is prepaying for vacation accommodation.

Whenever we deal with a prepayment scheme, we have to assess whether prepaying is “worth it.” The same paradigm also applies to Traditional versus Roth 401(k). There are several factors that make prepaying the taxes now not worth it.

Fill In Lower Tax Brackets In Retirement

I showed in a previous post The Commutative Law of Multiplication that if the marginal tax rate at retirement is the same as it is now, the Traditional and Roth 401(k)’s are equivalent. If the marginal tax rate is higher now than in retirement, one is better off contributing to a Traditional 401k. If the current marginal tax rate is lower, one is better off contributing to a Roth 401k.

But that applies only to the marginal dollar, which is the last dollar you can shift between Traditional and Roth 401(k). It is not necessarily the case for the entire contribution or the average dollar.

The tax system in the United States is progressive and it will probably stay that way. It means that income is taxed at increasing rates as it goes higher. Even if you think the marginal tax rate in the future will be higher, there will still be lower brackets and these lower brackets should be filled with money from a Traditional 401(k).

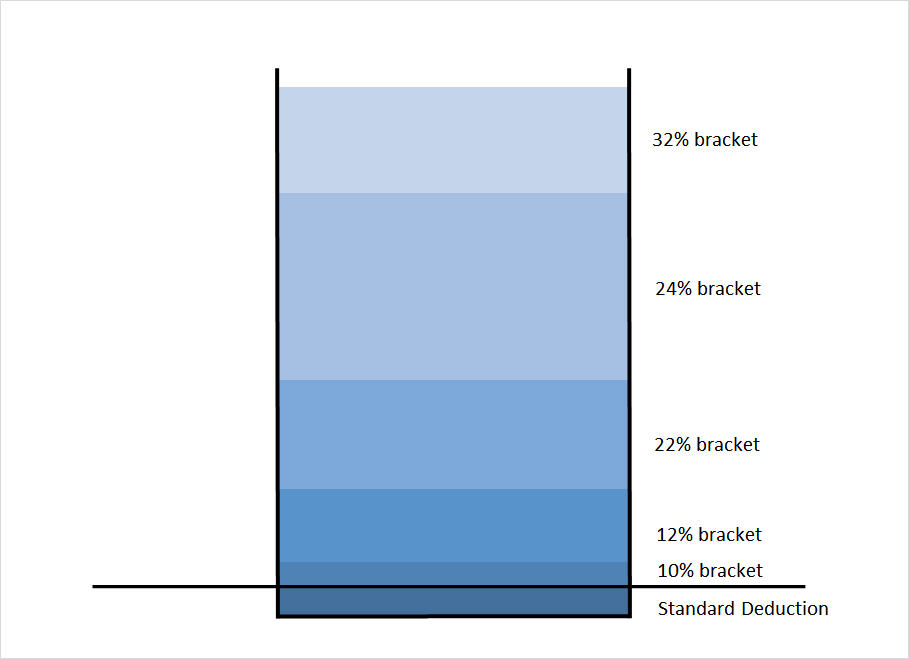

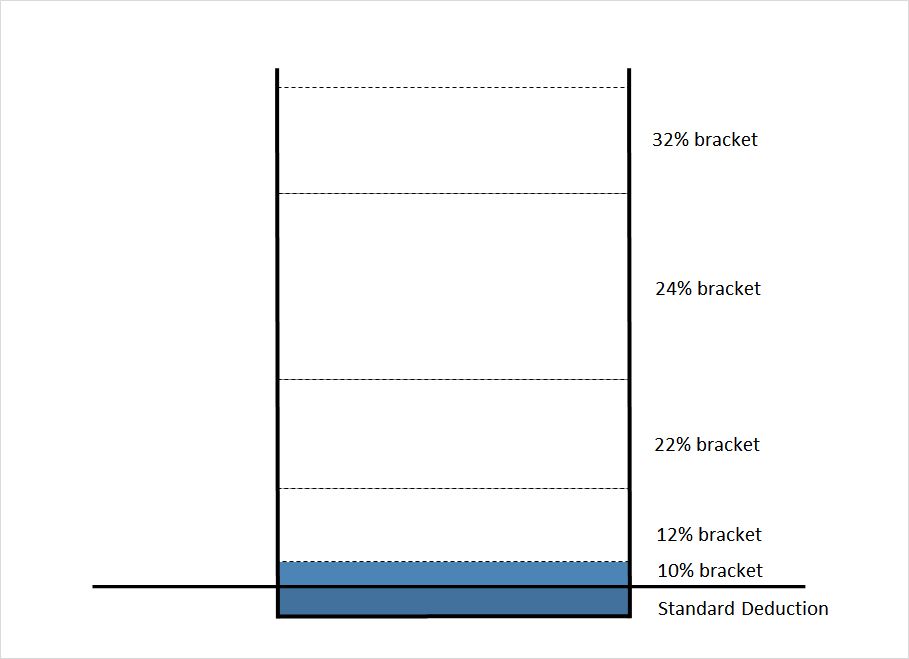

The chart below illustrates how the tax brackets work:

Picture a bucket with markings on the side. As you pour water into the bucket, the water goes up and crosses the marked lines. This represents how your income is taxed. The first chunk of your income absorbed by your tax deduction isn’t taxable. The next chunk of your income is taxed at 10%. The next chunks after that are taxed at 12%, 22%, etc.

When you contribute to a Traditional 401(k), you are scooping up income from the top of this bucket. The dollars you contribute come from the highest tax bracket for your income.

After you retire, you’re staring at an empty or shallow bucket before you pour in money from your 401(k). The money first goes through the lower brackets before it reaches the top.

Even if you assume your marginal tax bracket in retirement will be higher due to tax increases, a large portion of the 401(k) withdrawal may still be taxed at a lower rate than what it was when you contributed the money.

Until you know you can generate from your Traditional 401(k) enough income to fill the lower brackets, it doesn’t make sense to contribute to a Roth 401(k). For people without a pension, it means the majority of the retirement savings should go to a Traditional 401(k), not Roth.

If you have a pension and/or you expect to have a huge balance in Traditional 401(k)/IRA, large enough to fill the lower brackets every year, then contributing some money to Roth makes sense.

Avoid High State Income Tax

Many people work in high-tax states like California and New York today. They work there because there are a lot of good-paying jobs in those states. They won’t necessarily retire there because taxes and the cost of living are high in those states.

States popular with retirees like Florida and Texas have no state income tax. If you’re working in a high-tax state today but there’s a good chance you will retire in a no-tax or low-tax state, contributing to a Traditional 401(k) lets you avoid paying the high state income tax on the contributions. Prepaying the high state income tax now is a dead loss.

Leave the Option Open for Future Roth Conversions

When you leave your employer, you can roll over the Traditional 401(k) to a Traditional IRA, which then can be converted to a Roth IRA at a later time when it is advantageous to you. A Roth 401k or IRA on the other hand can never be converted back to Traditional.

With a Traditional 401k, you hold the option, which has value. If you contribute to a Roth, you give up that valuable option. You can decide to convert and pay the tax whenever you are in a lower tax bracket than where you are now. Good times for conversion include:

- Going back to school for a career change.

- Becoming unemployed due to layoffs or burn-out.

- Starting a business (not as much income in the first few years).

- A two-income couple having one parent stay at home or work part-time for a few years after they have kids.

- A high-income single person marrying a lower-income spouse.

- Taking early retirement.

- Moving from a high-tax state to a no-tax or low-tax state.

Unless you’re sure that your marginal tax bracket will never be lower throughout your lifetime, you should leave the option open by putting money in a Traditional 401(k) and waiting to convert to Roth when an opportunity comes.

Avoid Triggering Phase-outs

Because contributing to a Roth 401k does not reduce your gross income, you appear to have a higher income than if you contributed to a Traditional 401k.

There are all kinds of income-based eligibility cutoffs and phase-outs in the tax code. When you exceed the income threshold, your tax benefits from those programs are either reduced or eliminated. Some of these tax breaks include:

- Child Tax Credit

- Child and Dependent Care Credit

- American Opportunity tax credit

- Lifetime Learning credit

- Eligibility to contribute to a Roth IRA

- Student loan interest tax deduction

Think of the stimulus payments during the COVID pandemic. If a single person earned $80,000 but contributed $10,000 to a Roth 401k, he/she wasn’t eligible for the payment. If he/she contributed $12,000 to a Traditional 401(k) instead, he/she was eligible.

Easier to Get the Full Employer Match

Some people think if you contribute to Roth 401k, the employer’s match will also go there, which will effectively increase your employer match. That’s not true. The employer match always goes to the pre-tax account whether you contribute to the Traditional 401k or the Roth 401k.

When money is tight, it’s easier to qualify for the full employer match when you contribute to the Traditional 401k with pre-tax dollars.

Who Should Use a Roth 401(k)?

With so many disadvantages, then, for whom does a Roth 401(k) make sense?

A Roth 401(k) is good for people in low-paying jobs now but expect to have high-paying jobs later. Doctors in resident programs fit that description very well. They are paid very little while they are in residency but their income is expected to rise substantially higher when they finish the program. Their income will stay high in their career and they will receive a high income after they retire. Prepaying tax now makes sense because they are prepaying at a low rate and they will avoid paying a higher rate later.

College students working part-time jobs or recent graduates working in entry-level jobs are also good examples for taking advantage of a Roth 401(k) while their income (and their tax rate) is low.

A Roth 401(k) is also good for people who are already in the top tax bracket and expect to be there forever. If they don’t see any chance of being in a lower tax bracket, prepaying tax now will lock in the tax rate so they won’t have to worry about future tax increases. On the other hand, people who are in the top tax bracket are in a good position to retire early, with many years of lower tax brackets to fill. So don’t be too sure of staying in the top tax bracket forever.

Tax Diversification?

What about the idea of tax diversification? Some advocate both a Roth 401k and a Traditional 401k because the tax rates in the future are uncertain.

Diversification is good in general but it doesn’t mean automatic 50:50. Just like investing in emerging markets provides diversification, it doesn’t mean you should invest 50% of your money in emerging markets. You still have to decide how much you should allocate your retirement savings between Traditional and Roth just like you allocate a portfolio between developed markets and emerging markets.

Tax diversification also doesn’t mean you have to do it right now if you are in your peak earning years. There might be better times coming up in the future.

As for me, I had contributed 100% to a Traditional 401(k) every year when I worked full-time. Prepaying taxes just wasn’t worth it.

Higher Effective Contributions

Some say the Roth 401(k) is better because you can fool yourself into contributing more when you’re using after-tax money. Contributing 10% of your salary post-tax effectively puts more money into your 401k than contributing 10% of your salary pre-tax. It’s true but you should adjust your contribution to 12% or 15% to equalize the net paycheck when you contribute to a Traditional 401k.

A Roth 401k has a higher effective contribution limit because the annual contribution limit is the same when you max out your 401k. There is some truth to it. See follow-up post, Roth 401(k) for People Who Contribute the Max, which includes an online spreadsheet that calculates the value of having a higher effective contribution limit in a Roth 401k.

What About Roth IRA?

All arguments for and against the Roth 401k also apply to the Roth IRA when you are not yet contributing the maximum to your Traditional 401k. Instead of contributing to the Roth IRA, you can just increase the contribution to your Traditional 401k.

An additional argument in favor of the Roth IRA is that some 401k plans have higher fees. Even then the Traditional 401k can still be better when you don’t expect to work there for many years. You can roll over to your own IRA for lower fees when you change jobs. See Alternatives to a High Cost 401k Or 403b Plan.

If you are already contributing the maximum to your Traditional 401k, you may still be able to take a deduction for contributing to a Traditional IRA. See The Forgotten Deductible Traditional IRA. A Roth IRA is better when you already contribute the maximum to your Traditional 401k and you don’t get a deduction for contributing to a Traditional IRA anyway.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Mitch says

Great job TFB.

I finally came to this realization within the last year. Starting a new job that put me in the 28% bracket, and where I’ve historically contributed to a Roth IRA after contributing enough to get the full 401K match from my past employer, I started contemplating a Roth 401K.

I then had some fun with excel…

I realized in order to pay an average tax rate of 28%, which is what I can deduct each marginal 401K dollar at, in today’s terms, I’d be earning over $300,000!!!!! Sounds like a great problem to have…

If you don’t believe me, head over to dinkytown:

http://www.dinkytown.net/java/Tax1040.html

So as you highlighted, that marginal 28% benefit I’m getting now with a trad401K overwhelmingly supersedes the roth option. With that said, I’m doing 17K to a trad401k now.

The other nice benefit is it lowers my AGI, which allows me (although I’m phasing out) a better chance to do a Roth IRA as well!

And to the people that still don’t understand why 10K pretax is not the same as 10K after tax (when contributing), you really need to re-visit 6th grade math!

Alex says

Excellently written. Your analysis was complete and provided several points that I have yet to hear from any other author on the subject.

apple says

what is best for me with the Roth is I get to pick the investments!!!

I have always complainted that my investment choices are limited to the 20 picks my company offers.

Honestly, my 401K consist of 5 different mutual funds. Some I like others I would never buy on my own.

I have 5 mutual funds that are basically the least of the 20 evils..LOL.

The ROTH is with sharebuilder and I have a wide assorment of stocks, bonds, CEF and EFTs.

I am able to create greater diversity and a much higher yield.

I think this freedom of choice will be the only way I retire comfortably.

I know people in my company that have over a million dollars invested in….well they don’t really know????

Further, this article fails to mention the lifetime hidden fees you pay from 401K mutual funds!

David C says

@apple

This article is for comparing Traditional 401(k) vs. Roth 401(k) contributions, not 401(k)s vs. Roth IRAs. As TFB has mentioned elsewhere (http://www.bogleheads.org/forum/viewtopic.php?f=10&t=100155&p=1448691#p1448691) most workers are better off rolling over their 401(k)s into IRAs for the reasons you cited and more.

Bundy says

Would this year be a good year to max out on the 401k Roth? My take is that PAYROLL taxes are cut this year, hence in reality you are paying 2% LESS taxes. Next year the cuts are going to expire, the taxes are going to roll back in. I am in the lower bracket – 25% and was wondering if it was a wise move…

I am not planning to save my Roth IRA for retirement…I am actually saving it for a first-home purchase. the first 10,000$ in earnings are TAX FREE. So thus, it might be strategic move where I save 30%( federal,state,city, etc) in taxes, or $3000.

Thanks in advance for your suggestions!!!

Harry says

Bundy – Payroll tax has nothing to do with this. You get the same reduction in payroll tax whether you contribute to traditional 401k, Roth 401k, or you don’t contribute anything at all. And the same reduction will go away next year no matter what.

Victor The Cleaner says

Hi Harry: that is true, but I took advantage of the 2% payroll tax reduction/credit and shifted it towards my 401(k). I am pretty much at the contribution limit now, which was my personal goal.

Jane says

Well TFB, after reading some strong augments on “the OP missed some critical points” and your repeated explanation on the communicative property of multiplication, I feel for you. Dear TFB, you have summarized this topic better than almost any other articles, and you deserve a pat on the back. Good job! Leave those guys to their spreadsheets…I think they will realize the mistake eventually one day.

kathy says

I just finished listening to a webinar about the benefits of the Roth 401K vs traditional 401K IRA. I understand the communicative properties of multipication but is there a benefit to opening a roth 401k and then rolling it over to a regular roth 401 in order to avoid the RMD? I guess in my mind the beauty of a Roth 401 is to never have to take the RMD if you do not need to.

Thanks

Harry says

Kathy – Yes Roth 401k rolled over to a Roth IRA will avoid the RMD but “at what cost” is the question. I’m not exactly sure why RMD is such a bad thing if it means you pay a higher tax rate in order to avoid it.

Steve says

I’m starting a career at age 22 and am putting away 20% of my salary into a company 401k. This means I am hitting the limit and then some, with the rest going into an after-tax account within that savings plan (which I will convert to a Roth IRA until I am ineligible for it due to income limits). I live in Alaska, with no state income tax. I will be in the 25% tax bracket for the next few years. I get a 9% company match, and and a 6% company pension on top of that. Both of those are pre-tax. I’m of the mind that my tax rates will be higher when I retire, either due to living somewhere with a state income tax or tax rates in general going up. As such, I feel it makes sense to make all of MY contributions to a Roth 401k, with the other 15% from the company going into a pre-tax account. Does anyone here see a flaw in this thinking? Thanks!

Joel L. Frank says

You are right on! Now get your employer to give you the opportunity to rollover each year your Roth 401(k) balance to your favorite Roth IRA.

Joe says

The biggest thing most people here are ignoring are the benefits of tax-free growth in the Roth if you satisfy the requirements of 5 year aging (you’ve had roth assets for at least 5 years) and you’ve bypassed age 59 1/2. Take a very extreme and simple example (obviously returns will vary depending on investments and many other factors): If you invest $5k into a Roth 401k or IRA and never put anything else into it at all, but made outstanding investment selections and turned that $5k into $500k, you may withdrawal that entire $495k from the account without paying a single nickle in taxes, as long as you satisfy the above rules. That is an enormous advantage, especially when you have a long period of time to allow for these gains to come into fruition by compounding your earnings.

The second huge benefit of the roth is that, unlike traditional 401k’s and IRA’s, you may withdrawal the principal amount at any time without paying anything in taxes or penalties. You may do this because you’ve already paid the tax on it – the only part you can’t touch early without tax and penalty is the growth of your principal (as described above). This allows for Roth to potentially act as an emergency fund of sorts.

After stumbling across this forum, I felt compelled to add this as I was shocked to see almost no mention of it.

Source: Certified Financial Planner professional and 10 years of financial advisory

Ben says

Great post, I am with you TFB. For people who don’t get it (commutative property of multiplication), I guess they forget paying tax upfront is actually lowering how much money they really invest. I saw several people try to provide simple example of one time investment and grow tax free, and argue that they will save a lot (tax) at retirement. I think that is wrong because the basis is different.

Let me try my way if I can convince them:

If you put one time investment $10000 @ 25% bracket into Roth 401K, you only contribute $7500 ($10000-$2500 on tax upfront). Now you grow tax free. Compare traditional 401K, you really put whole $10,000 (pre-tax) into your IRA.

If same investment strategy applies, both grow 10 times more, Roth 401K turns $7,500 into $75,000 (tax free). Traditional IRA grows from $10,000 to $100,000. If the tax bracket remains the same at retirement, you will get same amount $75,000 ($100,000 – $25,000 tax).

People who favored Roth 401K due to growing tax free forget that when they compare same amount money in Roth and Traditional account, that is different basis. In order to contribute $7500 into Roth IRA, you need $10000, which can be totally invested in traditional IRA. If you only put $7500 into traditional IRA, you will have additional fund available $2500 x (1-0.25) that can be invested as well.

Matthew says

Look you can spin your numbers any way you like and you can try to justify your decision till your blue in the face, but you cannot escape the RMDs that are imposed on 401K and traditional IRA accounts at age 70. If your investments do really well, which we all want, then you will be faced with the Required Minimum Distribution imposed on all but the Roth IRA accounts. The minimum is calculated base upon life expectancy tables at the IRS. This means that for most of us some where along the lines we will be forced to take out more than we want in a given year. In 50% of those case it will bump us into a higher tax bracket.

Since most of us here are not in the highest tax bracket and since we don’t have a crystal ball to see what taxes will be like when we retire, it makes sense to treat this subject with some respect. Both account types have something to offer. If you really look at the numbers you will begin to see that which investment avenue you take is going to be determined by what your company is offering as a match and what you can afford in your monthly budget. If your company match is not as high as your tax bracket, then you should take a serious look at the Roth option.

My rule of thumb is max out your company match (assuming my rule matching rule from above) and then max out your Roth options.

Adam says

Since this post goes into the Roth and traditional 401ks so well, I thought I’d ask question that also fits into choosing strategically.

Are the Roth 401k contributions, once converted into a Roth IRA, tax and penalty free immediately like the normal Roth IRA contributions are? Again, the contributions, not the earnings. I ask because I have for several years maxed out my Roth IRA, and am now in the position to max out my 401k (either traditional or Roth). However, I have a strategic decision to make. I am applying to go back to school for a PhD and even with the possibility of grants, scholarships and stipends, there may (likely) still be expenses. If the need arises, and I can use the Roth 401k contributions made this year tax and penalty free, then that is a nice safety net. However, if the whole conversion from Roth 401k to Roth IRA is subject to the 5 year wait, then I don’t see a benefit (for this year) for Roth vs traditional 401k contributions.

Harry says

Adam – The five-year rule affects earnings and money converted from a traditional account. Neither applies in your case when you are only talking about withdrawing your own contributions, not earnings, not converted money. A rollover from Roth 401k to Roth IRA is not a conversion.

Jeff says

Adam – just a quick tip, if you don’t plan on working while you’re going back for your PhD, take that time to convert some of you’re traditional 401k holdings over to Roth holdings (i.e. rollover your 401k, then convert 20k or so a year over to your Roth IRA — it’s usually just a matter of asking your broker to journal the funds between accounts). If you won’t be taking a salary, and you don’t have a large source of income from some other source, you can effectively convert the funds tax free (or for a very low rate).

In some cases like yours, it can even be worth taking the 10% penalty to withdraw the funds (if you have no other options). Imagine you’re currently paying 28% tax on every extra dollar earned (you’re AGI is above 87k), then contributing to a traditional this year saves you 28% in taxes. Suppose you have no income at all for the tax year of 2015 (I’m assuming there would be a year in between where you worked part of the year so had some income), you could 10k tax free (standard deduction + personal exemption) and another 9k at the 10% tax rate, pay another 10% penalty on the whole thing and you’d still only be paying an average of 15% on that 19k of income as opposed to the 28% you’d be paying this year if you don’t contribute it to a traditional 401k plan (including if you did contribute it to a Roth 401k plan).

The better option is to not withdraw the funds, but simply convert them from traditional to Roth funds 20k at a time. That way you take full advantage of your personal exemption, deduction and 10% tax bracket. You’ll need a thousand dollars in savings to pay the 10% tax on the second half of the conversion, but that’s much less than the $5,600 you’d be paying if you put it into a Roth 401k plan today.

I live an alternative lifestyle, which involves taking lots of mini “pretirements”. When I work, I save most of what I make and max out my 401k contributions. Then during my “pretirements” I take advantage of my temporarily low tax bracket to convert the money over to roth accounts with minimal tax payments. The trick most people can’t seem to stomach is living on 20% of your income when you have one. I’ve never understood normal people…

Adam says

@Harry Thank you. I figured that was the case, I just couldn’t find a specific example of doing so.

@Jeff That idea makes a lot of sense. Since I have other sources of liquid funds I can tap for some expenses and taxes, I think that I’ll make full use of my lower tax bracket to convert some of my traditional holdings to Roth. And, since I’m going that route, to just make traditional 401k contributions this year and save the several thousand in taxes and only pay taxes/penalties if I need to later.

William says

It strikes me that the question is really one of effective tax rates, not marginal tax rates. So, if you assume the tax code remains unchanged (which though certainly unlikely to be true, is probably the most conservative approach), a Roth 401(k) is better than a traditional 401(k) if you effective tax rate is lower while investing than in retirement.

Marginal tax rates are irrelevant. They are just an input into the calculation and the entire discussion of high marginal rates going in and low marginal rates coming out is misleading.

If this is incorrect, I would really like to hear why.

Harry says

William – It’s still about the marginal rate, but not necessarily the marginal rate for the very last dollar. We can call it “effective marginal rate” if you’d like to put it that way.

At the time of contributing, the money comes off from the top. If it spans multiple marginal rate brackets, then you get a weighted average marginal rate for your contributions. If you are contributing as Roth 401k, that weighted average marginal rate is the rate of tax savings you are giving up. It’s not your effective tax rate taking into account your entire income, just the portion you are contributing into the 401k.

After you retire, if you have other income (pension, Social Security, etc.), your withdrawal from a traditional 401k goes on top of those. If it spans multiple marginal rate brackets, then you get a weighted average marginal rate for your withdrawal. If you contributed as traditional 401k, that weighted average marginal rate is the rate you will pay. It’s not your effective tax rate taking into account all your retirement income, just the portion you are withdrawing from the 401k.

If you have no other income in retirement, the “effective marginal rate” is the same as your effective rate. You do have other income when you are contributing. The “effective marginal rate” when you are contributing certainly isn’t the same as your effective rate.

Andrew says

Harry- I am a 34 year old cardiologist in California, just beginning my career. my salary puts me in the 33% tax bracket and I can expect only a modest increase through my career, possibly into the 35% bracket (but not by much) I work for a large healthcare organization with excellent benefits including a pension which gives me 2% a year x 20 years and 1% thereafter, and a set contribution from my organization into a 401(k) of about $20K per year (this is not a “matching” contribution). I can choose to contribute on my own to a traditional or Roth 401(k). I do not plan to retire outside of California (but who knows) and I don’t care much about my “estate.”

– Given my company already contributes to a traditional 401(k) for me, should I contribute on my own to the Roth to achieve better tax diversification?

– Given I have a pension plan which will likely give me at least $100k/year in retirement which would boost me into a higher tax bracket than someone without this benefit, should this push me more towards the Roth?

– The ability to convert a traditional to a Roth (but not vice versa) is appealing. Why don’t more people take a job at Starbucks for a year before retirement and convert while they’re in a lower tax bracket?

Harry says

Yes having a pension and employer contributions to the traditional 401k favor Roth contributions, but if there are chances you will retire early before the pension kicks in, you will still have years to convert those traditional balances to Roth when you have little income. Working at Starbucks isn’t necessary. Just going fishing (or hiking, bicycling, volunteering, …) will do.

FinancialDave says

I admit I did not read all 171 comments to this thread, but the theme is pretty clear. There are seemingly a lot of people, some of which are probably advising others that just don’t get the fact that given identical tax situations for the money going into the account as coming out later in retirement there is NO mathematical advantage to one plan over the other. The author uses many terms such as the Commutative Law of Multiplication and marginal tax rates that just tend to confuse people, but let’s just reword it to say if the average tax rate going in is the same as the average tax rate going out, there is no advantage.

AND let’s be fair if we could predict our future tax rates with any degree of accuracy we could make the right decision, but despite what anyone thinks, Congress CAN totally mess you up in just a few short years, so give up trying to guess one way or the other and just split the allocation in some reasonable way — 40/60, 50/50, or 60/40. I believe you will have a much nicer retirement.

fd

FinancialDave says

I also agree with the author that by contributing to the 401k you do lower your income and “possibly” become available for some tax credits, but you must also remember the other end of the spectrum in retirement — A large non-Roth 401k or IRA is going to create higher taxes when the forced RMD’s kick-in and on this end of timeline you could be looking at going from paying no tax on your SS to being taxed on 85% of it.

fd

JJackson says

Fd…can you elaborate on your point of no mathematical advantage to Roth money versus Traditional money? There very clearly is an advantage, and it has nothing to do with estimating future tax rates, which is near-impossible.

Let’s assume you make $100k and are in the 25% bracket today. You decide to contribute $10k to a traditional 401k. Thus, only $90k of your income gets taxed (not taking into consideration any other deductions or credits). Since the $10k contribution is saved tax-free today, you are effectively saving $2500 in taxes (otherwise would have paid 25% tax on that $10k in income.

Or, you could contribute $10k to the Roth. You would pay your tax rate of 25% today on this contribution, as it would be included with the rest of your income.

So, Traditional 401k saves you $2500 today versus a Roth.

Now, let’s just assume for illustration purposes tax rates do not change at all (if you know for sure which way they are heading and what your tax rate will be upon retirement, there are additional benefits in going with either Roth vs Traditional). So, upon retirement, you are still at the 25% rate.

Then let’s assume you invested your $10k well and over 30 years you turned it into $100k. (This is not unreasonable, and would take an 8% annualized return to achieve.) If we compare both options, Traditional versus Roth, you’ll see a dramatically different outcome. If we withdraw our $100k out of the Traditional plan, it is ALL considered income. So, now your tax bill is $25,000 (25% tax rate and $100,000 of income) at time of retirement. Contrarily, if we withdraw our $100k out of the Roth plan, it is ALL withdrawn tax-free. Meaning at time of withdrawal, you pay nothing at all in taxes.

So, with the Traditional 401k you pay $25,000 in total taxes (taxed at time of withdrawal). With the Roth 401k, you pay $2500 in total taxes (taxed at time of contribution). Very big difference. In this particular example, you pay ten times as much to Uncle Sam if you go with the Traditional approach.

If you have time on your side or reasonable expectation of performing well in the market and actually growing your money, Roth is VERY attractive. With the above example, you can see this clearly. It’s amazing how often people don’t consider the power of compounding returns when they think about Traditional versus Roth. Don’t make this mistake.

William says

Just to point out a mistake in the math. At a 25% tax rate, it would take $13,333 of taxable income to put $10,000 in a Roth. So the present tax hit is not $2,500, it’s $3,333. Still, I’ll grant you that the last I checked $25,000 is a bigger number than $3,333.

Steve says

Just to point out something you’re missing while comparing the two: You have to assume that the extra $3,333 it would take to invest 10k in a Roth vs traditional would also be invested and getting the same returns. You then can compare the value of $10k in a Roth versus $13,333 in a taxable account after 30 years or whatever. If you do this, you will see that (assuming a 25% tax bracket at both ends) the difference is negligible (~$30).

JJackson says

You’re absolutely right – elementary math mistake on my part that I’ll blame on distraction by responding via iPhone on a train on the way home from work. ; ) Thanks for the correction.

But yes, the argument still stands. Point is, saving for the future is all about earnings, and if it isn’t in your eyes then you’re making an enormously costly mistake whether you consider taxes or not. When you do consider taxes, and earnings from each type of retirement account are considered, there is a clear, after-tax winner. Roth.

FinancialDave says

I can link you to my website where I explain it in the simplest terms I know how with a very simple example:

http://financialdave.wordpress.com/retirement/investing-101-how-to-invest/lesson-five-roth-account-vs-traditional-account-401k-403b-457-etc/

The shorter answer to your question is that you have to consider the amount of money you earn, not only the amount that goes in the Roth — in the case of the Roth the taxman is compounding your money for 30 years and keeping the gains, while in the case of an IRA you are compounding the gains and then giving the taxman his cut at the end of the period. The taxman’s cut is the same in either case and the amount of money you have at the end exactly the same.

fd

JJackson says

I see your point and the approach you’re taking. I suppose I’m coming from the angle of not wanting to give the IRS the benefit of my (hopefully) strong investment performance. Just like you said in the example on your link, you’re really doing the taxman a big favor if you delay the tax until AFTER you’ve made all your money. You’re effectively passing on your strong investment management skills to the IRS for free. The government is likely not making investments that yield 8%+ per year, as you may be able to obtain, as they won’t take the inherent short-term risks of doing this. Therefore, if you go with a Traditional/tax-deferred retirement plan, they are capitalizing on you taking risk on their behalf and giving them much more money after all is said and done than they would have had had you paid the 25% up front in a Roth option.

The rate is the same either way – either way you’re paying the IRS the same share, the same 25%, whether now or 50 years from now – but, if we are looking at it from an actual dollars standpoint, which is what really matters when it comes down to it, I’d much rather give someone 25% of a smaller sum rather than a larger sum. For example, going to the extreme just to illustrate, would you rather give someone 25% of $1 today, or 25% of $1,000,000 a year from now?

KildareBill says

Financial Dave-

I think you are missing an important point in your comparison between ROTH and non-ROTH accounts. If you choose and can afford to contribute the maximum amount to your account, the ROTH has a significant advantage. In order to compare to your example, let’s assume that $7,500 is the maximum allowable contribution.

With the ROTH, to contribute $7,500 you start with $10,000 income and pay $2,500 in taxes up front. After 20 years, the ROTH will be worth $50,456, as your example showed.

With the non-ROTH, you contribute $7,500 and you save $1,875 (25%) in taxes. To compare with the $10,000 income from the ROTH, you end up with $625 ($10,000 – $7,500 -$1,875 = $625) of taxable income. Paying 25% taxes ($156) leaves you with another $469 to invest. Of the $10,000 income, $7,500 went to non-ROTH, $156 went to taxes and $2,344 is left to be invested outside of tax-deferred account.

This $2,344 can be invested at an after tax rate of 7.5% (10% return less 25% taxes). After 20 years this will be worth $9,957. After 20 years the non-ROTH will be worth the same $50,456 as the ROTH. However, you must pay $12,614 (25%) in taxes leaving $37,842. Adding this to the $9,957 gives you a total balance of $47,799 for the non-ROTH.

In this example the ROTH enjoys a $2,657 or 5.6% advantage over the non-ROTH.

Also note that if you extend this to 30 rather than 20 years, the ROTH advantage exceeds 10%. Also note that if your tax rate is 30% (including state) rather than 25% and extends over 30 years, the ROTH advantage is 15%.

The ROTH advantage when you contribute the maximum amount is real and significant.

FinancialDave says

Kildare,

I understand your point, but it only compares apples to oranges and does not compare the Roth / non-Roth investments on equal footing. You are comparing a $10,000 investment in the Roth to a $7500 investment in the non-Roth, with a $2500 adder in a taxable account. Of course the $10,000 tax-free investment wins over a $7500 tax-deferred plus $2500 taxable investment.

By your logic then if the tax limit on the Roth is $20,000 and the tax limit on the IRA is only $10,000 if you earn $26,667, then you should invest the total after tax $20,000 into the Roth account because that will give you more money in retirement.

This is just bad tax planning and a waste of your money, for reasons I point out on my website.

What if by investing equal amounts in both accounts you could take not only the tax-free money and gains on the $10,000 Roth investment, but you could take completely tax-free money and gains on the non-Roth money as well — for which the taxman got ZERO taxes (none going in and none going out).

The result is your scheme cost you $26,667 to get the same gain that I got for $23,333, because I was able to actually adjust my tax rate to a lower level (zero in this case) which thus made the IRA funds much more valuable.

This is not some dream as I see evidence every year when I do taxes for retirees and they have all kinds of tax-free income, that had to have cost them dearly while they were working, but now don’t have enough taxable income to even equal their deductions and exemptions, which for a married couple can amount to $30k of tax-free income. If they had something like a tax-deferred IRA or even a taxable account they could be pulling money out on a tax free basis. This is the flexibility that having both Roth and non-Roth funds gives you, so stop trying to compare apples to oranges and realize that the money streams are equal given the same earnings and taxes on both ends and realize you need both types for your best chance at lowering your lifelong taxes.

fd

Joel Berry says

In this example you can make all the predictions, assumptions, and proposals you want, but that has more value as confetti than anything. There are TWO facts that should make this simple for nearly everyone.

1st. 90% of the population will not have saved enough when they retire, therefore most people (90%) need to use the tax savings from a traditional IRA or 401K to increase their contribution. “A bird in the hand is better than two in the bush.” IF YOU DO NOT UNDERSTAND WHAT THIS MEANS HAVE SOMEONE EXPLAIN IT TO YOU.

2nd. No one knows the future! If you can tell me what Tax rates will be in 20 years, what your income will be, what investment will turn out the best, then this is the least of your concerns. AGAIN “A BIRD IN THE HAND…”.

FinancialDave says

Joel,

You are very close to getting it yet you contradict yourself, when you say you can’t predict future taxes yet you suggest a strategy that is based on one particular tax scenario.

If 90% of the population is under saving their one hope of having more than the next person over their lifetime, given the same investments, is that they give less to the taxman over their lifetime.

It would be sad indeed (except for the taxman) if someone followed your strategy and then found out in retirement because of RMD’s and other factors that they had to pay twice the tax rate on their money than was expected.

fd

KildareBill says

Dave-

I believe you misread my post. I did compare apples to apples with $7,500 invested in ROTH and non-ROTH.

Let’s face it, the vast majority of the people following this are not the 90% who won’t have enough to retire. They are the 10% who will be adequately funded and will likely not be in a low tax bracket in retirement. They are reading this to determine the best place to put their retirement dollars.

For the majority of people who will not fully fund their retirement and won’t have significant income during retirement, your recommendations make sense. But for those of us who try to max out our retirement contributions and anticipate being in a higher tax bracket in retirement, the ROTH is a clear winner under most scenarios.

John Navarre says

Would these same arguments apply to the discussion of Traditional Deductable IRA vs Roth IRA? If not, why not?

Harry Sit says

They would if you qualify for a deduction for contributing to a Traditional IRA, or if you just increase the contribution to a traditional 401k instead of contributing to a Roth IRA. See The Forgotten Deductible Traditional IRA.

EL @ Moneywatch101 says

I always wondered why people jump into financial fads before doing any real tax research. Once you contribute the full match on the traditional 401K, is this case against ROTH 401K, also in conjunction with not contributing to a regular Roth IRA? I know it varies on the person, but for diversification of investable assets do you feel it will benefit people to do 6% in traditional 401Ks, and then if they have enough to max out the regular Roth IRA?

Harry Sit says

See reply right above yours. All arguments against the Roth 401k also apply to the Roth IRA when you are not yet contributing the maximum to your traditional 401k. An argument in favor of the Roth IRA is that some 401k plans have higher fees. Even then the traditional 401k can still be better when you don’t expect to work there for many years. You can roll over to your own traditional IRA when you change jobs.

David Heinrich says

I think it is worth noting that one point in favor of a Roth IRA is that they don’t have RMDs during the lifetime of the account holder and can thus be quite valuable to the heirs. This is where the benefits of these accounts become huge.

Harry Sit says

If you don’t want RMD, you can convert to Roth at any time. Picking a time to convert to Roth on your own schedule gives you more flexibility than contributing to Roth up front. I listed some of those opportune times under #3.

David Heinrich says

Right, you can convert on your own schedule, but that’s more likely to possibly bump you up a tax bracket, depending on how far apart you can stretch the conversions.

Also, people are unlikely to take those big tax hits and do conversions. It is a psychological road-block.

The real issue is whether it makes sense to contribute steadily to a Roth year after year, versus contributing to a traditional year-after-year, then converting large amounts of money and paying the taxes on those conversions over 1, 3, 5, 10 years.

Also, if you think tax rates are likely to go up when you may have an opportune time to convert, those opportune times become less opportune.

David Heinrich says

On the other hand, an advantage of Traditional IRAs for those who can afford to donate to charity is the possibility of the Qualified Charitable Distribution and IRA Charitable Rollover. However, looking ahead 10, 20, 30 years, that’s an enormous “if”, as it seems like this expires every year and is then reinstated (not yet in 2014).

Mitch says

Wow… I actually read all the responses to this great article… and even discovered I had posted one a few years ago (#151).

I’m still flabbergasted how people continually aren’t comparing apples to apples… but let’s move beyond that…

In the end, I think the die-hard analysts and tax planners that are browsing this thread shall not have much to worry about in retirement. “Do I have a side salad or an order of broccoli tonight?” Both are healthy options… just don’t get the fried chicken…

While I had initially understood the Roth to be a great vehicle upon graduating college, especially in lower tax situations, I think there’s definitely something to be said for “delaying taxes”. For instance, I live in VA. If I move to say Florida or Texas or Nevada to retire, avoiding that 5.75% VA income tax with a traditional 401k may prove to be worthwhile.

Conversely, if I were already living in a no-income-tax-state today, I’d be more inclined to do a roth…

As has been widely debated, who knows what Congress may decide to do. Yea, perhaps brackets change and marginal rates go up… but what if Congress decides to start taxing Roth vehicles? Please don’t be so naive to say “they can’t do that!” Look at the health care bill that was passed… It’s anyone’s guess what the future may bring…

And going back to my original post where I was calculating what current day income would put me in an “average rate” of my current 28% marginal bracket… that was well over $300,000… For those of you that aren’t understanding the math… Because I’m not having to pay taxes at roth levels while I’m earning today (28%), in order to have a cost of said 28% when I retire and withdraw from my traditional-401 (assume I’m already retired today), I’d need to be withdrawing over $300K+ for income… and I can tell you that is _well_ above what I make. 🙂 Sounds like a good problem to worry about… and as someone that is only 31, I have a few decades to ponder it and find a good tax guy to pay to help me do that if need be…

Keep the thread running!

-Mitch

ken says

You make a formidable argument until the subject of the”company match” comes into play. If a company is willing to match 4,5,6 %, that is free money of which will NEVER be taxed within a Roth 401k. This match would however be taxed in a traditional upon withdrawl. End of story. Makes no sense at any income bracket if any significant match is in play.

Ken-Morgan Stanley

Harry Sit says

You say you work at Morgan Stanley but you don’t know that the match goes into Traditional 401k regardless? Check with your training department.

brendon says

Thank you for the thread. I know deferred taxation topics well, but recently my company began offering a Roth 401(k) in additional to the Traditional. As I have a fairly large traditional 401(k) balance after 20 years on the job, I began worrying about the RMDs and if I should diversify.

This original article – and many of the comments – have helped me think through that problem, and decide to take my tax break now (in a high income tax state).

DD says

I have an S corp with me and my spouse as the only employees. Due to a good business year, personally we’ll likely be in the highest tax bracket this year. I want to save on taxes and put away a lot to retirement. For each of us, we can take a salary of $140K which allows us to put $18K deferred in a 401K (or a Roth 401K) and the other $35K as profit sharing (25% of $140K) for a total of $53K each or a total of $106K to the 401K’s for both of us. That’s all a tax write-off. I’m trying to decide whether it makes sense to do this, or if I should just pay myself more thru profit distributions and possibly wages (and my spouse nothing) to save the social security taxes on her wages (12.4% up to $118,500 =$14,694 in 2015). I think it does make sense to pay her and pay the social security taxes given the tax savings on that $53K of her income we’re deferring by putting it in the 401K , but my other dilemna is whether it makes sense to pay her that $140K and then choose the Roth IRA option for her $18K “deferral” which isn’t really a deferral since it’s taxed. Seems like I’m paying the extra 12.4% this year and not getting any tax benefit on that $18K going to the Roth this year. I like the idea of the Roth but I can’t figure out the math. And I’m of the opinion that taxes will likely be higher in 30 years when I retire due to government spending and lack of retirement savings by the average person.

Harry Sit says

I think it’s better to keep your salaries in line with comparable jobs as the IRS requires. If the increase in income is only temporary, it makes more sense to use the traditional 401k.

Luke says

This articles a little old now, but I found it very refreshing compared to other Traditional 401(k) vs Roth 401(k) articles out there.

I’ve read most of the back and forth comments and I’m pretty convinced of TFB’s arguments.

What I’m REALLY confused about though, is how some online calculators seem to spit out numbers that make Roth 401(k) almost always better than Traditional 401(k).

Example: http://www.bankrate.com/calculators/retirement/401-k-or-roth-ira-calculator.aspx

The only way I can make that calculator show Traditional 401(k) as better is if the Current Tax Rate is MUCH higher than the Retirement Tax Rate. As in the Current Tax Rate has to be at least 8% higher than the Retirement Tax rate.

So for example, I’m in the 28% tax bracket right now and according to that calculator, a Traditional 401(k) would only make sense if my retirement tax bracket was at 15%. I’d have to take less than 38% of my current income in retirement to get that low!

Is that calculator accurate, or based on some flawed assumptions?

Jim says

I was one of those who invested early and at a high percentage in a 401k/TIRA with little chance to invest in any Roth. I am reaping the benefits of a large TIRA to go along with a nice pension and soon to collect SS at age 70.

RMDs for the most part won’t be needed to fund retirement expenses but will likely push me into a higher tax bracket during a hopefully long retirement. While I loved the tax deduction of my T401k contributions I now wish I had had the opportunity to put say 1/4 of those contributions into a Roth 401k. I know you can’t have it both ways but sometimes a bit of both can make some sense – retirement often lasts as long as your working years.

Joel L. Frank says

Why don’t you effectuate a pre-tax to Roth IRA conversion over multiple years?

Phillip Henry says

I’m young and intelligent enough to see what our economy and debt has exploded to since this original post. Looking at the history of the marginal tax rate, we are in one of the lowest taxable periods ever. I’m not a fortune teller but tax rates will be higher in the future. Why would I want to defer my low taxable amount to pull out during a higher time. Who assumes that you will be in a lower tax bracket in retirement. I hope I’m not in a lower tax bracket, that means I wasn’t successful in life. Plus, look at all the tax credits you lose: children are all grown up, hopefully your mortgage is paid off, you probably sold your business since your retired. Most importantly, yes your money grows tax deferred, but who else is enjoying in that growth…. Uncle Sam. Uncle Sam is your business partner that didn’t contribute anything but will expect his cut. I look to diminish his cut. I have three buckets, taxable, tax deferred, and tax free. By having these 3 buckets, to include ss benefits, I can optimally avoid paying majority of the taxes, that this post will force Americans to do. Keep drinking the Kool-Aid

Eric says

Excellent article, both well reasoned and presented.

Paying marginal rates now vs filling up the tax brackets later pretty much is the crux of why traditional is vastly superior over Roth for just about everybody. NOT everybody, but close.

There is another aspect to this discussion that I don’t see mentioned. The advice to put money in Roth when young and t/IRA when older hinges on the assumption that the young earner will have years of similar if not higher annual disposable income as they age. That might be true but it is not likely. To see why, we can start with 50% of marriages ending in divorce, and continue with out-sourcing, illness, disability, periods of unemployment, college tuitions, children and a gazillion other expenses that present themselves in later years.

We don’t know what the schema of progressive future taxation will look like but the 2016 standard deduction and personal exemptions for a married couple are ~ $20k today and are likely to stay the same in real (2016) terms. Since retirement can easily last 25 years it follows that the first ~ $500,000 of t/IRA savings are tax FREE and the next $500,000 of t/IRA savings are in the 10% tax bracket if no other income streams are present. Roth contributors at a young age are counting their shaved eggs waaay before they hatch. This is not just a case of having to make plans and choices at a young age; Electing Roth is often just a case of not considering the uncertainty in our society and workplace.

Last comment, social security really should be considered. I cooked up a simple spreadsheet to calculate federal taxes for a married couple in retirement with mixed income streams here:

https://docs.google.com/spreadsheets/d/1incT1p9z6rUkyf1FtxP24GfQZZghuc-qiKb0rHZz3DQ/edit?usp=sharing

My prototypical example is $62k of 2016 dollar income from $36k SS and $26K savings results in a federal tax liability of $1130.00. Taxes of the SS would be zero if it was the only income stream so the tax rate on the t/IRA works out to 1130/26000, equal to 4.3%

Tell me again why people are paying marginal tax rates today for a Roth ?

Cheers — Eric

Dads, Dollars and Debts says

Nice post! I had discussed something similar in a recent post. I stuck with the traditional 401K. The cost of that dollar means more to me now then it might later. In the future, if I go down to part time, then I may consider doing a large conversion from traditional to roth, but that is 10 to 15 years from now!

– EJ at Dads Dollars and Debts

Joel L. Frank says

In service rollovers from a Roth 401k to a Roth IRA should be allowed. We should not be forced to wait until attainment of age 59-1/2.

wayne says

I’ve seen this article and most others discussing Traditional 401k vs Roth 401k focus almost exclusively on the tax on the contributions and to take the Roth only if you think your tax rate will be lower in retirement.

The analysis seems to ignore the gain on the investment never being taxed as part of the equation. I wonder if I’m missing something in my own analysis.

I currently have a large six figure balance in a traditional 401k. I have to realize that the govt will eventually force me to withdraw part of it each year and pay taxes on 100% of that part of it.

I’m currently in the 39% tax bracket, age 43, and I hope to remain in that bracket the rest of my working years.

I’m currently funding a Roth 401k the past few years because I figure that with years of investments, it is a no brainer that my investment will eventually gain enough to make up for the taxes I’m paying now just on the contribution. That is, I have let’s say a max $18k to invest in either bucket. Why would I pay the govt later on my entire contribution and the gain in the investment when I could pay them now one time just on the investment and then let the money grow/grow (even well into retirement with no mandatory withdrawal), tax free?

I don’t articles emphasizing this latter point. Am I missing something?

Harry Sit says

The Commutative Law of Multiplication article addresses your question.

John Endicott says

“The Commutative Law of Multiplication article addresses your question.”

Actually it doesn’t as it’s still overlooking Wayne’s point. Let’s take the max contribution of 6k a year for an IRA (the same concept for 401ks, just different numbers). 6k for a Roth actually represents 6k + however much you paid in taxes for that 6k, we’ll call that amount X.

6K post tax = 6k + X pre tax.

in pre-tax dollars what we have is: 6k + X (roth) > 6k (trad)

the Roth and Trad effectively are not starting out with equal amounts of maximum allowed contribution. X is above and beyond the max contribution to the trad, so that’s money that was always destined to be taxed in current year rather than grow in either account and thus can’t be counted in trads favor.

Now the flip side is that the 6k contributed to trad could be used to lower current year taxes the equivalent of X thus cancelling out Roth’s larger effective maximum. But that actually still is to Trad’s detriment because all of Roth’s “profits” are tax free, whereas everything in the Trad still has to pay taxes despite already “paying” for the difference in contribution size between the two via the lowering of current year’s taxes.

wayne says

Appreciate the article, and I freely admit that I must be overlooking something, but I continue to believe I will certainly have more money left over after taxes (the point of the article) by paying a known tax on a known fixed amount ($18k per year) than letting the govt tax all of what I may earn on that $18k in the future at an unknown tax rate.

I see even in the comments folks debating the math and debating the point being made. Being I don’t have mandatory withdrawals on that money, meaning $18k today could say stay there until I’m 90 making money and never be taxed when I take it out, I don’t see how any theory makes sense of me deferring taxes on that $18k plus 100% of the capital gain made over 47 years (my age now until I’m 90) makes sense versus paying a known tax on a fixed amount and I get to keep the capital gain and the $18k tax free.

Not trying to be argumentative but I see nothing in that article that would change my view on that.

Harry Sit says

It addresses your previous question on the small amount now versus a large amount in the future. Not having RMD is a plus in Roth’s favor. The cap being the same dollar amount is another plus. Except for those two factors, the commutative law of multiplication would hold. Now the two plus factors must be weighed against the four negatives in this article: progressive brackets, changes in state income tax, opportunity to convert at a favorable time of your choice, and avoiding phaseouts and AMT. If the negatives don’t apply to you and only the positives apply, then Roth would be right for you. To me it’s the opposite. It just depends on how the factors play out to each person.

Joel L. Frank says

Hi Harry:

I have not gone through this entire thread so I don’t know if anyone mentioned the Harvard study of 2015. It reached the conclusion that the Roth approach is superior in all situations.

JOEL L. FRANK

Pension Columnist

The Chief-Civil Service Leader

277 Broadway

New York, NY 10007

732-536-9472

[email protected]

Harry Sit says

I googled, and I found this:

Does Front-Loading Taxation Increase Savings?: Evidence from Roth 401(k) Introductions

It’s a 43-page paper. It at least warrants a separate blog post as a response. Stay tuned. I will post the link here when it’s available.

$iddhartha says

“the Roth approach is superior in all situations”

That’s an absurd statement.

There’s ways a person’s marginal rate can decrease significantly in retirement. Also, a common fallacy is not accounting for the lost opportunity cost of the traditional 401k deduction.

Jahn Dowe says

Interesting thread here. Has anyone looked at how future value of money plays into all of this? Would it make sense to pay tax now (Roth) since $1 in the future is worth less than today? So every dollar I pay in taxes today would be like paying $2 in taxes say 20-30 years in the future. Since income taxes are based on %’s, then one should expect those %’s to rise to account for future value and inflation. Any thoughts on this?

fyi – I’m looking to switch to a Roth 401k. I’m mid career, 40 years old (will work another 18-20 years). I have a pension plan that has not been frozen yet, and I can max out my 401k and a Roth IRA (just started a Roth IRA last year). So I have roughly 20 years left of full contributions (including catch up starting in 10 years) to two Roth accounts.

M says

Lots of comments on tax implications. Not much discussion on the lost compunding effect from the Roth ( compounding a smaller number over time). Over time the greater compounding baseline will make the tax implications of the Roth not relevant.

Dwight S. says

I haven’t read all the posts but has anyone really looked into what the effective federal marginal income tax rate is when social security taxation is included into the calculations? A good article was written by Dr John Walton in Advisor Prospectives April 16, 2016. As stated in the article “The unique way that SS benefits are taxed dramatically changes the marginal tax on retirement income, particularly for clients with benefits enhanced by delay until age 70.” When the article was written and depending on income level, for a married couple filing jointly the 15% federal marginal bracket would become 27.75% and the 25% bracket would become 46.25% when the effect of the impact of additional taxes on social security was considered! Those brackets have now changed but the way SS becomes increasingly taxable hasn’t. That and the impact of RMDs can make a strong case for a higher tax rate in retirement than someone might think.

Eric Gold says

This is such a good article, and it has not aged with time. I want to add another important benefit to the IRA/401k over the Roth: Unexpected drops in future income

It is way too common for people to retire early (forced or voluntary), have unemployment periods during their working years, be forced to get more schooling, or just be sick for prolonged periods. The Roth guarantees you will pay the highest marginal tax rate every contribution year while the tax deferred vehicles smooth out and average the good and bad years, resulting in an even lower effective tax rate in retirement.

For every person who finds that their retirement nest-egg exceeded their expectations, I’m willing to bet that many more find the opposite. Tax deferred savings are a fantastic hedge against the latter.

Ajay Doshi says

Shall we not consider the potential growth of the taxes saved by contributing to traditional 401K over the same time horizon.

For example for 18000 contributed to traditional 401K, tax savings at 25% bracket would amount to 4500. That savings can grow on the side over your retirement horizon.

Assuming retirement grows at 8% and post-tax savings grow at 6%; I believe the bucket of $$$ from tax savings can be substantial and potentially offset tax liability of withdrawal from traditional 401K.

foo.c says

I contribute the max to my traditional 401k, and max Roth IRA for me and for my wife, and invest money into a taxable account (actually have several accounts).

I think in my case it makes sense to switch to a Roth 401k. Does it not? I’m going to invest the max either way, but the Roth will grow tax free.

Jahn Dowe says

For what it’s worth, I look at it this way…$18,500 contribution * .25 (taxes) = $4625 in taxes paid now for Roth 401k. When I go to withdraw from my 401k in retirement, I expect to withdraw double what I contributed each year (as an example). So if in a traditional 401k I would pay $37,000 x .20 (lower tax bracket in retirement) = $7400 in taxes. Seems like Roth may save taxes in the long run because even though you are paying taxes on the smaller contribution at a higher tax rate, and withdrawing at a lower tax rate, you are paying tax on a bigger dollar amount at withdrawal.

Here’s my real world situation… have switched this year to fully funding a Roth 401k. I have 18 years of tax deferred traditional contributions and continuing company match to help eat up the lower tax brackets in retirement. I also fully contribute to 2 Roth IRAs (me and my spouse) and have an HSA fully funded. Trump’s new tax plan for 2018 will ease the tax shock (loss of deferred taxes from traditional contributions) as compared to last year due to changing of tax brackets. Gross Income is $160,000 per year. I have a pension plan as well that will also eat up the lower tax brackets (including personal deduction/exemption).

My plan in retirement is as follows: After pension and social security, I plan to draw from both the traditional an Roth 401k (in a way that minimizes my income tax burden and keeps both accounts funded for as long as I need) as my primary source of income to pay bills and living expenses. HSA funds will be used to pay medicare premiums and other medical needs in retirement (money is tax deductible going in and earnings and contributions are never taxed coming out if used for medical expenses). Roth IRAs will be used to buy consumer goods, vacations, etc. I don’t want extra income tax burden because I bought a new TV or went on vacation…

Everyone can argue that traditional or Roth is better than the other based on math and future predictions, but I have set forth a plan based on my specific situation and retirement accounts that makes the most sense to me. Therefore, I feel that switching everything to Roth mid career is my best bet, even at my income level. I’m giving up roughly $5,000 in tax deductions per year as a result (roughly $100,000 over the next 18 years, which earning will cover and then some), but my Roth accounts will only continue to earn tax free dollars in retirement. My answer is that I will have a diversified portfolio of different retirement accounts (traditiona and Roth 401k, HSA, Roth IRA, pension, social security, land, personal savings) that will all be assigned a job in retirement.

I would probably not recommend one only contribute to a Roth account as there is the personal exemption/deduction ($12,000 per person as of 2018 of tax free earnings) that you want tax deferred money to eat up before any Roth withdrawals are made.

Hope this helps

FinancialDave says

Jahn Dowe,

I don’t think you understood the article, if your tax rate is less in retirement, you will have more money by putting it in the Traditional and NOT the Roth. Does NOT matter how much your money grows ONLY the comparison of tax rates in vs tax rate out.

In your case if your tax rate is 25% while you are working and 20% when you are retired, you will get more money from a traditional account. Here is an article where I explain it in more detail:

https://seekingalpha.com/instablog/3752451-financialdave/4845086-roth-vs-non-roth-401k-403b-457-etc-and-time-value-money

Dave