[Originally written in 2008. Updated in 2022. The case is still valid after all these years.]

To Roth or not to Roth, that is the question.

Many employers offer both a Traditional and a Roth contribution option in their 401(k) plan. If you choose the Traditional option, your contributions go in pre-tax but you pay tax when you withdraw after you retire. If you choose the Roth option, you pay tax first before you contribute but your withdrawals are tax-free after you retire. You can mix and match between Traditional and Roth but your total contributions between the two can’t exceed the annual limit.

| Traditional | Roth | |

|---|---|---|

| Contributions | pre-tax | post-tax |

| Earnings | tax-deferred | tax-free |

| Withdrawals | taxable | tax-free |

This question of whether one is better off with contributing to the Traditional 401k or contributing to the Roth 401k has been the subject of a lot of debate. Although there is no one-size-fits-all answer, I think for most people the majority, if not 100%, of the contribution should go to a Traditional 401(k). I will state my case against the Roth 401(k) in this article.

The basic premise of a Roth 401(k), and to some extent a Roth IRA, is that of prepayment. You are prepaying taxes now so you don’t have to pay tax later. This prepayment concept is not uncommon. For example, buying a season ticket is prepaying for the individual events. Buying a timeshare is prepaying for vacation accommodation.

Whenever we deal with a prepayment scheme, we have to assess whether prepaying is “worth it.” The same paradigm also applies to Traditional versus Roth 401(k). There are several factors that make prepaying the taxes now not worth it.

Fill In Lower Tax Brackets In Retirement

I showed in a previous post The Commutative Law of Multiplication that if the marginal tax rate at retirement is the same as it is now, the Traditional and Roth 401(k)’s are equivalent. If the marginal tax rate is higher now than in retirement, one is better off contributing to a Traditional 401k. If the current marginal tax rate is lower, one is better off contributing to a Roth 401k.

But that applies only to the marginal dollar, which is the last dollar you can shift between Traditional and Roth 401(k). It is not necessarily the case for the entire contribution or the average dollar.

The tax system in the United States is progressive and it will probably stay that way. It means that income is taxed at increasing rates as it goes higher. Even if you think the marginal tax rate in the future will be higher, there will still be lower brackets and these lower brackets should be filled with money from a Traditional 401(k).

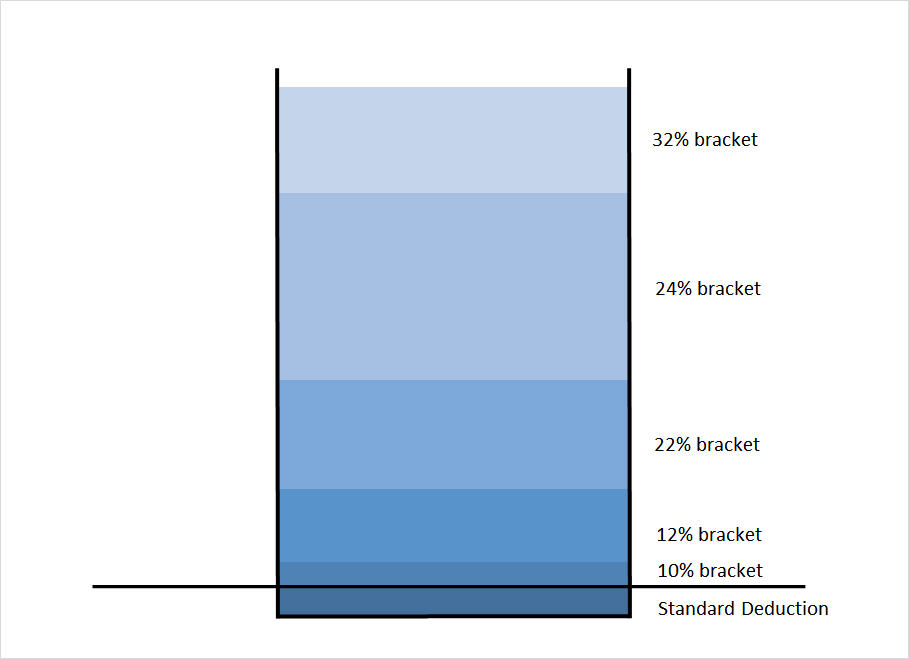

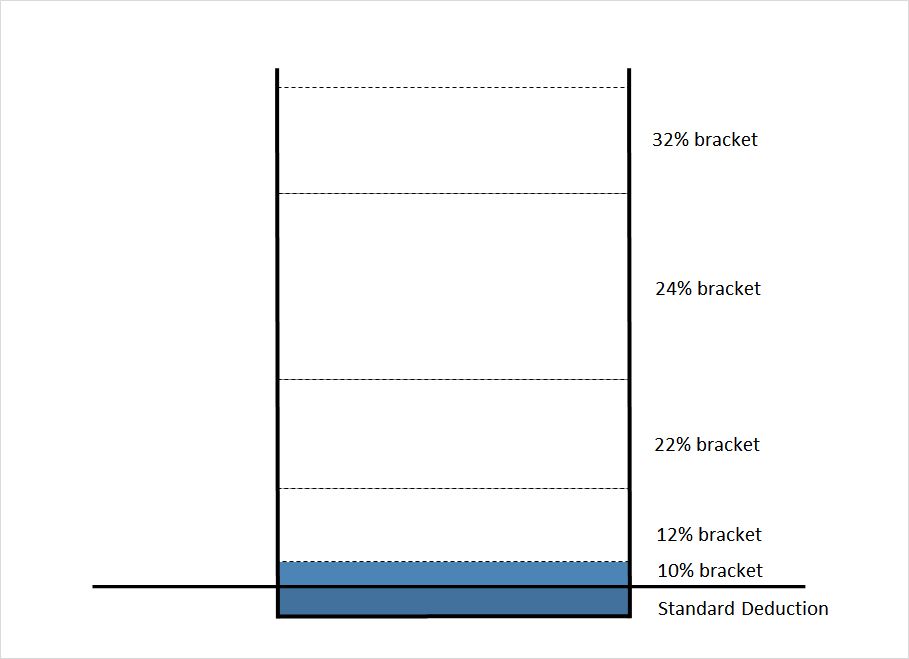

The chart below illustrates how the tax brackets work:

Picture a bucket with markings on the side. As you pour water into the bucket, the water goes up and crosses the marked lines. This represents how your income is taxed. The first chunk of your income absorbed by your tax deduction isn’t taxable. The next chunk of your income is taxed at 10%. The next chunks after that are taxed at 12%, 22%, etc.

When you contribute to a Traditional 401(k), you are scooping up income from the top of this bucket. The dollars you contribute come from the highest tax bracket for your income.

After you retire, you’re staring at an empty or shallow bucket before you pour in money from your 401(k). The money first goes through the lower brackets before it reaches the top.

Even if you assume your marginal tax bracket in retirement will be higher due to tax increases, a large portion of the 401(k) withdrawal may still be taxed at a lower rate than what it was when you contributed the money.

Until you know you can generate from your Traditional 401(k) enough income to fill the lower brackets, it doesn’t make sense to contribute to a Roth 401(k). For people without a pension, it means the majority of the retirement savings should go to a Traditional 401(k), not Roth.

If you have a pension and/or you expect to have a huge balance in Traditional 401(k)/IRA, large enough to fill the lower brackets every year, then contributing some money to Roth makes sense.

Avoid High State Income Tax

Many people work in high-tax states like California and New York today. They work there because there are a lot of good-paying jobs in those states. They won’t necessarily retire there because taxes and the cost of living are high in those states.

States popular with retirees like Florida and Texas have no state income tax. If you’re working in a high-tax state today but there’s a good chance you will retire in a no-tax or low-tax state, contributing to a Traditional 401(k) lets you avoid paying the high state income tax on the contributions. Prepaying the high state income tax now is a dead loss.

Leave the Option Open for Future Roth Conversions

When you leave your employer, you can roll over the Traditional 401(k) to a Traditional IRA, which then can be converted to a Roth IRA at a later time when it is advantageous to you. A Roth 401k or IRA on the other hand can never be converted back to Traditional.

With a Traditional 401k, you hold the option, which has value. If you contribute to a Roth, you give up that valuable option. You can decide to convert and pay the tax whenever you are in a lower tax bracket than where you are now. Good times for conversion include:

- Going back to school for a career change.

- Becoming unemployed due to layoffs or burn-out.

- Starting a business (not as much income in the first few years).

- A two-income couple having one parent stay at home or work part-time for a few years after they have kids.

- A high-income single person marrying a lower-income spouse.

- Taking early retirement.

- Moving from a high-tax state to a no-tax or low-tax state.

Unless you’re sure that your marginal tax bracket will never be lower throughout your lifetime, you should leave the option open by putting money in a Traditional 401(k) and waiting to convert to Roth when an opportunity comes.

Avoid Triggering Phase-outs

Because contributing to a Roth 401k does not reduce your gross income, you appear to have a higher income than if you contributed to a Traditional 401k.

There are all kinds of income-based eligibility cutoffs and phase-outs in the tax code. When you exceed the income threshold, your tax benefits from those programs are either reduced or eliminated. Some of these tax breaks include:

- Child Tax Credit

- Child and Dependent Care Credit

- American Opportunity tax credit

- Lifetime Learning credit

- Eligibility to contribute to a Roth IRA

- Student loan interest tax deduction

Think of the stimulus payments during the COVID pandemic. If a single person earned $80,000 but contributed $10,000 to a Roth 401k, he/she wasn’t eligible for the payment. If he/she contributed $12,000 to a Traditional 401(k) instead, he/she was eligible.

Easier to Get the Full Employer Match

Some people think if you contribute to Roth 401k, the employer’s match will also go there, which will effectively increase your employer match. That’s not true. The employer match always goes to the pre-tax account whether you contribute to the Traditional 401k or the Roth 401k.

When money is tight, it’s easier to qualify for the full employer match when you contribute to the Traditional 401k with pre-tax dollars.

Who Should Use a Roth 401(k)?

With so many disadvantages, then, for whom does a Roth 401(k) make sense?

A Roth 401(k) is good for people in low-paying jobs now but expect to have high-paying jobs later. Doctors in resident programs fit that description very well. They are paid very little while they are in residency but their income is expected to rise substantially higher when they finish the program. Their income will stay high in their career and they will receive a high income after they retire. Prepaying tax now makes sense because they are prepaying at a low rate and they will avoid paying a higher rate later.

College students working part-time jobs or recent graduates working in entry-level jobs are also good examples for taking advantage of a Roth 401(k) while their income (and their tax rate) is low.

A Roth 401(k) is also good for people who are already in the top tax bracket and expect to be there forever. If they don’t see any chance of being in a lower tax bracket, prepaying tax now will lock in the tax rate so they won’t have to worry about future tax increases. On the other hand, people who are in the top tax bracket are in a good position to retire early, with many years of lower tax brackets to fill. So don’t be too sure of staying in the top tax bracket forever.

Tax Diversification?

What about the idea of tax diversification? Some advocate both a Roth 401k and a Traditional 401k because the tax rates in the future are uncertain.

Diversification is good in general but it doesn’t mean automatic 50:50. Just like investing in emerging markets provides diversification, it doesn’t mean you should invest 50% of your money in emerging markets. You still have to decide how much you should allocate your retirement savings between Traditional and Roth just like you allocate a portfolio between developed markets and emerging markets.

Tax diversification also doesn’t mean you have to do it right now if you are in your peak earning years. There might be better times coming up in the future.

As for me, I had contributed 100% to a Traditional 401(k) every year when I worked full-time. Prepaying taxes just wasn’t worth it.

Higher Effective Contributions

Some say the Roth 401(k) is better because you can fool yourself into contributing more when you’re using after-tax money. Contributing 10% of your salary post-tax effectively puts more money into your 401k than contributing 10% of your salary pre-tax. It’s true but you should adjust your contribution to 12% or 15% to equalize the net paycheck when you contribute to a Traditional 401k.

A Roth 401k has a higher effective contribution limit because the annual contribution limit is the same when you max out your 401k. There is some truth to it. See follow-up post, Roth 401(k) for People Who Contribute the Max, which includes an online spreadsheet that calculates the value of having a higher effective contribution limit in a Roth 401k.

What About Roth IRA?

All arguments for and against the Roth 401k also apply to the Roth IRA when you are not yet contributing the maximum to your Traditional 401k. Instead of contributing to the Roth IRA, you can just increase the contribution to your Traditional 401k.

An additional argument in favor of the Roth IRA is that some 401k plans have higher fees. Even then the Traditional 401k can still be better when you don’t expect to work there for many years. You can roll over to your own IRA for lower fees when you change jobs. See Alternatives to a High Cost 401k Or 403b Plan.

If you are already contributing the maximum to your Traditional 401k, you may still be able to take a deduction for contributing to a Traditional IRA. See The Forgotten Deductible Traditional IRA. A Roth IRA is better when you already contribute the maximum to your Traditional 401k and you don’t get a deduction for contributing to a Traditional IRA anyway.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Brian says

The one factor that is not addressed is that taxes will likely be much higher in the future. This is especially true for Baby boomers and younger. Although it may not feel like it, we are actually at a very low relative tax rate presently, (prior to 1987, you need to go back to the depression to see rates this low) and with the baby boomer driven projected insolvency of Medicare and Social Security, and the total lack of a real social security trust fund (Yup, the lock box concept never happened), the issue is becoming critical. Take a look at the recent and very alarming increase to the national debt, now over 14 Trillion and growing daily and it is not much of a stretch to realize that higher tax rates are an inevitability. It is entirely likely tax rates will increase significantly, so a better way of looking at a Roth 401k is like locking in these historically low tax rates. Works for Mortgages, and it works here too.

john says

Income taxes are going to drop in the future. Additional VATs, tolls, sales taxes, and user fees will be added. I am staying with the traditional 401K.

patent guy says

I don’t know what income tax rates will do, but I have seen the future. It’s a place about 70 miles east of here, where it is lighter.

David says

To all of the folks that keep hitting the tax angle, I think that TFB has a very good argument, within that limited context. But, my argument, which takes into account a Monte Carlo scenario, can neutralize any tax scenario. As an example, plus in scenario 2 into a Roth and then plug in scenario 1 into a traditional. It doesn’t matter what your tax bracket is. The Roth wins. Reverse it, and plug in scenario 2 into the traditional and 1 into the Roth. The traditional could win (assuming existing tax rates).

David says

Great article. As a math major and someone who works in the industry, I spend a lot of time trying to counter the hype that has been created regarding the Roth. Folks, the Roth is not better or worse, just different. It simply gives you the option to pay taxes now. A Roth does not grow “tax-free”. Your entire account and all of the growth that it might achieve is fully taxed up front. For many people, the Roth is a trap and they will never know that it hurt them.

Example: You are a farmer. Your fields are flooded, but your neighbor has some extra fields. He offers to “rent” them to you for 30%. Do you give him 30% of your seeds before they grow? Do you give him 30% of the crop after it has grown? Answer: It doesn’t matter. 30% is 30%, before or after growth. If you put your investments in a Roth, you START OUT with less money invested because you pre-pay the taxes on the entire account, including all of the future growth. It “feels” like the Roth is better because we can say “yeah, but you never pay taxes on all that growth”, but the math proves otherwise.

The feds weren’t stupid when they created the Roth. They were looking for sources of income now by allowing you to pre-pay your taxes. They are still getting their cut, and more in some cases. If you stop looking at the caps and compare earned wages invested into both plans, they come out the same if your tax rate is the same for your whole lifetime. Exactly the same.

Most of the people I deal with have a lower income in retirement, and therefore are better off with a tax-deferred (traditional) vehicle.

David says

@David. You’re still missing the point. Your investment returns are not linear unless you invest in a fixed interest account, somehow. Otherwise, it *might* make a difference what you invest in, even if your tax rate and contributions are the same.

Danny says

@David Your math is very flawed when you say that “A Roth does not grow “tax-free”. Your entire account and all of the growth that it might achieve is fully taxed up front.”

If that is the case, then we are double taxed in normal investments. Even if that is the case, the Roth still grows tax free.

If I buy a normal mutual fund with $10,000 and 40 years later it turns into $1,000,000; I’m taxed for that $990,000 of growth on top of the tax I have already paid for that $10,000 of income. However if I instead contribute that $10,000 to my Roth 401k, I’m not taxed on that $990,000 of growth 40 years later. I was only taxed on the original $10,000.

As far as Roth vs. Traditional….In a 401K, people do not specify dollar amounts when telling their company which they want to contribute. They give percentages. This % is of their gross income whether they do a Traditional or a Roth 401K. If someone contributes 10% of their $50,000 yearly salary, $5,000 is going in whether they do the Tradiotional or the Roth. Therefore, doing the Roth forces the average person to save more.

I also don’t understand how the average person is in a lower tax bracket when they retire. The average working person has 2 -3 tax deductable children plus a tax deductable mortgage. A retired person whom has lived life in a responsible manner has neither of these. When I retire, I want to be able to dip into my retirement and make a big purchase (a boat, a car, a vacation house) without the worry of taxes.

I buy invest ONLY in the Roth and will continue to do so.

bob says

@Danny: When you compare your Roth 401k to a Traditional 401k, it is the same supposing your tax rate is the same. Supposed you have 25% marginal tax rate. Then you needed to make $13,333 in order to be able to get $10,000 to contribute to your Roth 401k after tax. If you had put that $13,333 into a Traditional IRA, with the same investment choices, it would have grown to $1,333,333. Then if you are taxed at 25% at withdrawal, ultimately you are still left with $1,000,000.

Kevin says

A lot of math flying around here. I’m looking at this simple figure. Let’s say I have $10K to invest this year, and can choose between Roth or a traditional 401k. In my tax bracket, if I choose Roth, I’m paying $1500 in fed tax on that $10K. If I go traditional, I save that $1500, but if that investment grows 5% annually for 30 years, I’ll have roughly $43K and will be paying taxes on that, which will be more than $1500 I’m sure. Therefore Roth wins. Yes or no?

Brandon says

This is a great discussion and I am so glad I stumbled upon it. I want to contribute to it and please comment back with any opinion that you may have. The target audience for a discussion like this is probably geared more towards the more financially responsible people of this world who will actually take the time to read this article, so there may not be many people in my financial situation reading this. But the fact remains that there are many people that make in the $50,000 range that do not plan on making much more than $83,600 by retirement (understanding that the maximum for the 25% tax bracket will surely change well before my retirement, but for the sake of argument). My corporation matches my contribution to my 401(k) up to 6% of my pay. I contribute exactly this amount, 6%, because of the 100% match and because I feel it’s not worth contributing more due to my current financial needs.

For the many people in my situation, living in states like Pennsylvania that are “income tax friendly” that are not planning on moving, wouldn’t the Roth 401(k) be a given? The taxes are paid now on what I contribute (employer’s funds go into a traditional 401(k)) and I will only be contributing my 6% match. The money that I am paying in taxes for my contribution will not be invested into any kind of retirement fund, just coming out of my pocket money and savings account money. So I am paying the state and federal tax, but the money is now earning tax-free interest while in the 401(k) account and again the amount that I paid in taxes on my contribution cannot be invested into the account to gain the same interest yield over the years to pay the taxes that would be owed on the interest if it was in a traditional 401(k).

I thought I would enter in this comment because this entire thread really doesn’t cover the guy/girl that will only be contributing a certain percent until retirement to get the company match and nothing more. So the situation is kind of like Chim’s comment #26 but slightly different; if I contribute $2,000 this year (and am in the 15% tax bracket using his example) and pays the $300 in taxes my earnings from it are tax free at retirement. So if that $2,000 turns into $10,000 at retirement I saved a lot of money investing in the Roth. Since the maximum I could have contributed was $2,000 (due to in this hypothetical situation that my $2,000 investment is 6% of my yearly salary) isn’t the Roth 401(k) the best answer?

The only true factors to consider seem to be today’s tax bracket and state taxes paid now versus tax bracket at retirement and the amount of interest earned over the years. But, if the money taken out of the 401(k) after retirement is kept low enough so that one’s yearly income is under the maximum for the 25% tax bracket (being that my yearly earnings now fall in the 25% tax bracket), the factors are now only state taxes paid now versus interest earned over the years. Unless I was to only take out enough money per year after retirement to keep just under maximum income level for the 15% tax bracket, isn’t the Roth a no brainer for someone in my situation? I’m sorry if this is all a bit confusing, but please let me know what you think. Thank you.

Harry Sit says

@Brandon – If you are going to invest 6% no matter what, I agree with you: Roth 401k is better. But why set that artificial constraint for yourself? If you are going to do 6% Roth 401k, you are going to dig into your savings to supplement your now smaller paycheck. If you are willing to dig into savings, why not do say 8% to traditional 401k? You end up with the same paycheck as 6% to Roth 401k.

Pennsylvania treats traditional 401k and Roth 401k the same. Contributions are taxed. Withdrawals are not.

Brandon says

Thank you for your fast response. Your questions have the insight that I was looking for. After reading through these comments I learned a lot and thought long and hard about my comment above, but I never considered that the 25% federal taxes I would be paying now when contributing to a Roth 401(k) at 6% would give me the same paycheck that contributing 8% to the traditional 401(k) would (being that 25% of my contribution that I pay on my taxes would be exactly 2% more I could invest into the traditional). Without going into a major math equation, the extra 2% into the traditional (earning interest over many years), though not being matched by my employer, would most likely cover my taxes that I would be paying on both of my contributions and my earned interest at retirement to the extent that paying the taxes now when contributing to a Roth isn’t saving me any more money in the end, correct? Also, the state taxes I would be paying to Pennsylvania now would just be an extra “ding” to my total earnings.

With this extra analysis, the traditional seems to be the winner. And if my withdrawals from my 401(k) after retirement could still keep me under the maximum income for the 15% tax bracket (after all, I will be in my 60s and probably not running around spending money like I do now) instead of the 25% bracket that I am in now, then it seems that the traditional 401(k) is a definite winner. Is this correct?

Harry Sit says

@Brandon – You got it!

David says

@Brandon–it might be the winner in this scenario until you reach age 70 1/2 and then start having to take withdrawals from your account. Don’t forget your RMD. Also, don’t forget to add 1/2 of your SS income to the rest of your income. If you are single and exceed $25K then you’ll start being taxed on your SS. If you’re married and you and your spouse’s combined income exceeds $32K, you’ll be taxed on SS. I think those are some of the variables you’d have to account for in your situations. Also, it depends on what your contribution about is in terms of dollars.

But, if your total retirement savings were $83,000, then the traditional 401(k) would probably be the better bet assuming tax rates don’t change and assuming you don’t make much money in retirement.

Tim Lawler says

TFB,

Great post, and extremely informational! I am a military physician, and the govt eqivalent to a 401k, called the Thrift Savings Plan (TSP), is considering giving the option of a Roth 401k in the next year or two. We’ll see if they actually do it, but it will definitely give me something to think about! You are a great resource that I will now refer to in the future. Take care.

Tim

Allen says

TFB,

With respect to your first point, I was wondering whether other income of you and your spouse in retirement (e.g., accumulated pre-2008 non-Roth 401(k) contributions, Social Security benefits, accumulated employer contributions to 401(k), accumulated “profit sharing” contributions, IRA savings, variable annuities, and other outside investments / savings) wouldn’t act to quickly fill in the lower tax brackets in retirement making the Roth 401(k) more attractive? With these various potential sources of post-retirement income, it seems that it might not take very long at all to reach relatively higher marginal rates.

Allen

Doug says

I agree with most of your assessment (and won’t bother arguing whether tax rates are likely to go up or down in the future).

I am curious about one thing though — how have plan sponsors taken to Roth 401ks? They must make passing ADP compliance testing even harder.

They already had to deal with low wage earners who were struggling to make ends meet and don’t feel they can afford to defer any of their income, but now they have to deal with this whole new group of recent college grads just starting out who expect one day to be moving up into a higher tax bracket. Might as well wait until you hit the 25% marginal bracket before contributing to a traditional 401k — in the meantime capitalize on prepaying your taxes at a lower rate by putting money into a Roth 401k (Roth IRAs were bad enough, but now its so much easier when you’re employer has already arranged all the paperwork for you).

Do you happen to know if this has been much of an issue for plan sponsors? I feel like there’s a certain conflict of interest there — they want to give their employees good financial advice, but they also really want the NHCEs to contribute to traditional accounts so they can pass their ADP testing and not have to make forced distributions to all the company execs, or take the costly measures of making safe harbor contributions to everybody’s accounts.

Harry Sit says

@Doug – Roth 401k contributions are added to pre-tax contributions in ADP testing. To the extent employees shift from pre-tax to Roth but contribute less, the employer takes a small hit in ADP testing. However adding Roth 401k also attracts contributions from employees who previously don’t contribute. Overall I don’t think adding Roth 401k has much negative impact on ADP testing.

Doug says

Ah, thanks. I’m was having trouble finding that wording in the official regulations (I’ll just have to keep digging through the IRC…). I took the financial planning CEBS tests back in the late 90s, but I haven’t kept up on changes to the regulations (there have been a lot of them) over the last few years since I’ve been sitting out the labor market (and taking advantage of the opportunity to convert portions of my pretax savings year by year).

I was assuming Roth and Traditional plans would be treated as separate plans and as such, the traditional deferred plans would have to pass ADP testing and the aggregate of the plans would have to pass ACP testing (of course I was also thinking that the combined limit was only subject to higher aggregate section 415 limits).

So I guess the key is that ADP is really a misnomer now — leave it to our lawmakers to redefine the word “deferred”.

Roth fan says

Roth 401k wins because it can be rolled over into a Roth IRA and no RMD are required at 70 1/2. This allows the account to continue to grow, while the traditional account has to be depleted. The forced taking of required distributions deplete the traditional account while the Roth account is allowed to grow, tax free. Thus the Roth account can continue to grow, even after 70 1/2. In addition, if you have qualified income, you can continue to contribute to your Roth account. You can’t do that with a traditional account. Thus, you are able to see your account balance continue to grow, while your traditional counterparts will have to take distributions, pay taxes on the distributions, and potentially have social security benefits taxed more because of the added income. I think without the rmd issue, it would be very difficult to make a compelling argument either way. But the rmd issue seals the deal for me. With that comes the ability to pass it on to my heirs and have a stretch Ira which would pass tax free income on to my children or grandchildren for decades, just from a Roth 401k that I rolled into a Rorh Ira.

KD says

Roth fan, if you play with the spreadsheet, you will get appropriate answer – roth or traditional 401k. Its the tax rate at the marginal dollar that determines the choice. rmd issue is moot as trad. 401k can be converted to a roth ira too, just pay taxes while doing so while roth 401k is contributed after paying taxes. one way or the other, you pay taxes. how much or how little is the all important question and it is answered very well by the spreadsheet.

Roth fan says

KD

I respectfully disagree. A rollover is much different from a conversion, particularly from your own psyche. I much rather pay tax on the small amount going into the Roth 401k, which will ultimately be rolled over into a Roth IRA, rather than paying potentially hundreds of thousands to the IRS trying to convert a traditional 401k to a Roth IRA. My ultimate end game is to be on a Roth IRA for the reasons I stated earlier. So why not avoid the hassle of the conversion. That small deduction you lose pales in comparison. So you may argue that each of the small tax deferred contribution added up and invested over time would equal the amount of the tax paid at conversion, I would not disagree. But why even bother. I’d rather pay my tax on the seed, not on the crop.

Harry Sit says

@Roth fan – Actually each of the small tax deductions added up and invested over time would be more than the amount of the tax paid at conversion, for the reasons listed in the main post. In addition, conversion doesn’t have to be all-or-nothing. Between age 59-1/2 and 70-1/2, you can do spread your conversions over 11 years. Even after 70-1/2, RMDs are very low – 4% to 5% – just enough for your spending money. You can continue to convert for another 10 years if you haven’t converted everything by then.

Roth fan says

@TFB

That’s why i believe knowing your end game should be the determing factor. Ultimately, if my plan is to roll my Roth 401k over to a Roth IRA, then contributing to a traditional 401k when I have the choice to contribute to Roth 401k adds the unnecessary complexity of conversions. Also, the great unknown is tax rates. Most assume they will be in a lower tax bracket at retirement. But that is a great leap of faith. Today’s tax rates are historically low. For most of our tax history, the highest tax bracket has been over 50%. As a result the lower tax brackets have been reduced. But that tax policy can easily change, particularly since our governmental obligations are growing not declining. So even though our retirement income may be less than our current income, it may be taxed at the same rate, or more. But with a Roth, you get that out of the way. I also said earlier about the impact of the rmd’s on social security benefits. But the thing that seals the deal for me is at 70 1/2. The IRS wants it’s money back, whether you want to take rmd, no matter how small a percentage. You have to decrease your balance, whether you want to or not, whether you have additional income or not. Meanwhile the Roth account, if rolled over to a Roth IRA, continues to grow and compound. And you can even continue to make contributions. You know have a tremendous asset that you can leave to your heirs. It is at this stage, that the Roth account clearly surpasses the traditional account. And while you can make the conversion, writing large checks to the IRS is not something I have any desire to do, especially when I can plan to avoid it.

Roth fan says

Finally, with a conversion, you will need money outside of the retirement account to pay the IRS for it to even work, which again is deleting other assets just to get to a place where you could have been at the start.

Ethan says

To use the language of Donald Rumsfeld, I feel that future tax rates and policys are a known unknown. When choosing a Roth, amongst other considerations I felt that I would rather pay a rate that I know rather than a rate that I don’t. As you said, there are so many different scenarios 30 years out and you don’t have enough brain cells to compute. Therefore, take the rate that you know. How low could future tax possibly be in a country that has a giant unfunded social security ponzi scheme. Not to mention the unknown unknowns of how policy might shift.

Matt says

I realize I am responding to an old post, but I just came across it. I agree with everything you said, but I think there is one more class of investor for whom the Roth can be a good choice.

For investors that have a mix of low and high risk investments, it makes sense to have both a Roth and a Traditional IRA. If you put your high risk investments in the Roth account and everything goes as planned, in the far future, these investments will have grown substantially and the earnings will all be tax free.

As a silly example, suppose someone’s portfolio is comprised of bond funds and lottery tickets. It makes sense to buy the lottery tickets with Roth dollars and if/when the investor wins the lottery, all earnings are tax free.

Harry Sit says

@Matt – No problem with commenting on an old post, as it is still relevant today. What if it didn’t go as planned? Say the lottery tickets don’t win, you lose all your investments if you buy them in a Roth account. If you buy them in a Traditional account, you at least got the tax deduction. The government in effect subsidizes your loss in those lottery tickets in a Traditional account whereas you are all on your own in Roth.

steve says

The Roth makes sense to me because capital gains within the Roth are ignored. There is no headache of considering short vs long term gains, no complex record-keeping and in the past two years I have saved far more in excluded capital gains taxes than I would have going the 401k route.

Of course if you don’t trade much, or if you aren’t doing well in the market the above is moot.

Mike says

Great article and follow-up comments, they really give you a lot to think about.

Correct me if I’m wrong, though, but doesn’t it make more sense for the Roth if you’re going to contribute a set amount regardless of whether you use a Roth or Traditional 401K? (I think a previous poster brought up the point of contributing a set percentage of salary, which is the same idea.) For example, I’m going to contribute the max (currently 16,500 this year), and hopefully always will, so it’s not like I can contribute a little more to the Traditional if I go that route. And with a Roth, I can pull all of the gains out tax free. If I contributed to a Traditional 401K, I have to pay tax on the gains. So wouldn’t the Roth be better in such a situation?

I guess an argument could be made that you could invest the tax money saved with a Traditional 401K outside of that vehicle where it would be subject to capital gains in retirement. But, if you assume someone had enough to make the same additional investment while investing in a Roth (which some people do), that makes that point moot. Am I missing something here? Thanks!

Jason says

Great article. I had a question regarding my situation that I would like your input.

I am a sole proprietor with no employees.

The Solo 401k plan contribution limits for 2011 are $16,500 for employee contribution plus 20% of net business income for the profit sharing contribution portion (Max $49,000).

My questions are:

1) Would it be possible for me to contribute the $16,500 portion to a Solo Roth 401k, and the profit sharing portion of $32,500 ($49,000 – $16,500) or less to a Traditional Solo 401k?

2) Assuming I am in the same tax bracket in retirement, would I be better off investing all $49,000 into a Traditional 401k or splitting it up into a Traditional and Roth (as described in the previous question)?

Thanks in advance,

Jason

Harry Sit says

@Jason – (1) Yes. (2) I think you are a good candidate for Roth solo 401k for employee contributions and Traditional 401k for employer contributions if you can keep up with contributing the maximum to the traditional part of the plan. See Roth 401(k) for People Who Contribute the Max.

Robert says

I have thoroughly enjoyed reading both your article and all of the contributions to include your timely responses. After reading through all of the posts, I believe I have a better understanding as to what option of the 401k might be more of an advantage depending on circumstances. Clark Howard seems to be a big advocate of the Roth 401K based on the assumption that taxable brackets will be considerably higher than today because of all the unfunded liabilities and for the simplicity of knowing exactly how much income available you will have available regardless of taxes.

For additional clarification, there is mention that someone with a traditional pension plan may benefit more from a Roth 401k than traditional.

Would you mind explaining a bit more in detail on what the salary threshold may be?

I will be retiring from military this year and will soon start a new career with an employer that offers a Roth 401K. Here are some additional details for my initial thoughts of which I would like to hear your take:

• Contribute 10% of total income (new employer) which will be slightly under the max contribution and increase 1% a year thereafter until I reach max contribution to 401k.

• Military pension of roughly $56K during my 27th year of military retirement the same year of which I plan to retire.

• Military pension will increase yearly indexed by inflation (assumption 3% annual inflation rate).

Thanks in advance for your time and consideration.

eric says

TFB is not saying traditional will always trounce Roth 401ks. He’s simply demonstrating scenarios where a traditional will prevail and debunking the myth that the Roth 401k is always better.

I prefer Roth 401ks for myself (my net rental income alone pushes me into the 33% tax rate), but I can clearly see that if someone were in a high marginal tax bracket today and knew that he would have several years of no income (ie, early retirement) that a traditional 401k would squash a Roth 401k. In fact, a traditional 401k can allow one to completely avoid paying income tax on contributions by simply shifting the distributions or rollovers into a Roth IRA in zero income years. The only better tax avoidance scheme out there is the HSA where you get to deduct contributions but withdrawals are tax-free (for qualified medical expenses) regardless of income levels.

If we all had crystal balls and knew future tax rates and our own marginal tax rates, we wouldn’t be having this discussion.

chris says

I appreciate this discussion as it offers real examples and well thought out theories as to what is best.

We have a couple weird circumstances. 1) Our state does not have state income tax. 2) I am a teacher that will receive a pension which is taxed in retirement. 3) My wife earns a high salary that will surely get higher over the years; she is 31 and would like to work a long time.

Her employer offers Roth 401k. Previous contributions, the company’s match, and all bonuses are lumped into the regular 401k. For 3 years, she contributed to regular 401k and we had separate Roth IRAs. Now, our combined income puts us above the limits for Roth IRA contribution. Because we cannot contribute to a Roth IRA anymore, is it safe to assume that the Roth 401k is a good option for us? I have not seen anything on income limits in the discussion. My apologies if I missed it earlier. The more I read, the more confused I get with what applies to our situation.

PS, I do have a small 457 plan as well as a deferred annuity. Our current Roth IRAs amount to a small amount (current balance of $35k) of what we would need in retirement.

chris says

…one other point.

We do NOT contribute the max to the Roth 401k; although we do kick in 6% that will result in a 5% match from the company. Our 6% does not get us to $16,500, but that is mostly because we are not thrilled with the investment options in the plan. Our extra goes to a Fidelity account because we can do so much more with it.

Sally says

Great read. The truth is many of us will NOT be in a higher tax bracket when we retire. I am putting 20% of my income into retirement. I don’t think I’m going to actually make more when I retire. I plan on living on much less as I will pay my house off before then. With no house payments and no saving for retirement, one will not need as much. Also ax rates will not inevitably go up. We can’t predict the future.

Jae says

Hey TFB, first time poster here. Found your blog on the Boglehead forums and love it. I had a question about my girlfriend’s financial situation, she seems to be a tweener.

She works in fashion. Her company offers Roth and Traditional 401k’s.

Factors for Roth:

She makes 35k/year and anticipates her salary moving higher as she ages. It’s my understanding that the last 1k of her salary is taxed at 25%?

Factors against:

CA has a high state tax (6% for 35k I believe). She might move to NYC later, which also has a high state tax though.

Should she go with the Roth or the Traditional? Also, if Roth, would it be wise to invest the first 1k off the top to the Traditional to avoid the 25% rate and send the rest to the Roth 401k?

Thanks for any help.

Harry Sit says

@Jae – The $34k number is taxable income, not gross. If she earns $35k gross, after standard deduction and personal exemption, she’s solidly in the 15% bracket now. State tax certainly complicates things. If her income will soon double or triple, Roth probably makes sense. If she’s just getting a cost-of-living raise, maybe she won’t be in a higher tax bracket when she retires.

David says

Dear TFP,

I am amazed as how you simplify and hit home the most important points. Big thanks for you!! to spend your time to explain to us this is truely appriciated. I am higly litrate but buisness illitrate individual who have little understanding of how the traditional IRA, Roth IRA, Roth 403(b) and all other modes of investment work. in my work I have the advantage of 403(b) which is matched one to one up to 6% and then Roth 403(b) option. I was wondering if I should continue with the 403(b) after matching the 6% or to jump to the Roth 403(b). you have answered most of my questions. after reading your article and the comments, I am now a proud and much more knowledgable individual. Thanks to you.

if I may ask you particular question:

I am a 41 years old married with total house hold income of 150k. this I hope will remain so till around age of mid 55-60. after that it will be part time job earning probably half to 30% of this. considering this and knowing I started saving late to retirment, after maxing the matching, should you still say only 403(b) only? even after reading your article, I was thinking of contributing some to Roth 403(b) incase to either supplement income after 59, or even to transfer to beneficiaries.

of all though, it is a breath to know that the world is full of people like you who truely like to enlighten and help!!

David.

Celtic says

There are a lot of comments here, so if this has been covered, my apologies for the spam.

My annual gross income is too high for a Roth, but this year I’ll have significant real estate investment losses that will push me down into the range where I’m eligible. I was simply investing in a TIRA until I realized this, so wasted $4k in taxable contributions (couldn’t reverse it without converting my entire IRA to a Roth – bummer). However, the remaining $6k for me and my wife’s $5k will all go into the Roth.

The point? Be opportunistic in seizing on Roth situations if your year-to-year taxable situation varies. Good luck to all, and thanks to TFB for all the posts and insights.

dd says

Good reading..

This analysis includes factors that I had not considered.

bill says

If you consider time value of money and depreciating $, paying tax at a later time makes sense (sorry guys, i haven’t read all 142 comments yet)

Steve says

I put $6k into a Roth in 2008, and another $6k in 2009 for a total of $12,000. Since that time my Roth which is at Interactive Brokers has grown to a value of about $25k, (it was as high as $36k several months ago, but I’m not worried). All of the $12k+ is in short term capital gain. The beauty of the Roth for me is I don’t have to pay it! Even better, I don’t even have to track it for IRS purposes. The freedom to do short term investing alone has long since far exceeded the taxes that I paid on the initial $12k to start with. If you enjoy playing with stock, and enjoy buying and selling, being able to do so without having to pay Capital gains is quite wonderful and at least in my case, quite remunerative.

Lovey says

My employer now offers a Roth 401K along with the traditional 401k as well.

I contribute 8% of my salary while my employer contributes 6.5% of my salary as a match. To get the matching contribution, I only need to put in 4% of my salary.

Should I take that 4% above what I need to get the match and redirect it to the Roth 401K?

My husband and I both have Roth IRAs. We were not contributing the max allowed but will be able to starting this year.

His 401k is the gov’t TSP.

We are 21 & 25 years from retirement.

Lovey

John says

I am surprised that the author of this article ignored earnings. I ran a simple modle in which a 25 year old contributed $10,000 per year for 40 years. I assumed a 6% rate of return over those years. His nest egg would be $1,640,477 at 65 years old. During those 40 years, he would have contributed $400,000 and saved $100,000 in taxes for pre-tax or paid $100,000 in taxes for contributing to a Roth (assuming a 25% tax bracket). Withdrawals of the pre-tax account would be taxed at $410,119 (again, assuming a 25% tax bracket). The Roth account would be withdrawn at $0 in taxes. To sum it up:

Traditional: Contributions – $400,000 – Up front Taxes – $0 – Withdrawal Taxes $410,119

Roth: Contributions – $400,000 – Up Front Taxes – $100,000 – Withdrawal taxes $0

I don’t know about you, but I would prefer to pay $100,000 versus $410,119

At a 4% return on investment, the numbers are as follows:

Traditional: Contributions – $400,000 – Up front Taxes – $0 – Withdrawal Taxes $247,066

Roth: Contributions – $400,000 – Up Front Taxes – $100,000 – Withdrawal taxes $0

At an 8% return on investment, the numbers are as follows:

Traditional: Contributions – $400,000 – Up front Taxes – $0 – Withdrawal Taxes $699,453

Roth: Contributions – $400,000 – Up Front Taxes – $100,000 – Withdrawal taxes $0

The majority of your nestegg shold be earnings. It is silly to have this argument without considering earnings.

ogd says

OMG @John and other guys. He’s said this 100 times already…

Really — multiplication is commutative. If you pay tax now, there will be less to invest, less basis for that growth, and a much lower amount to be withdrawn tax-free. How much smaller? Exactly today’s tax rate.

@John: the upfront taxes are paid *before* the investment. That’s why they’re upfront. So instead of 10K, there’s only $7500 left to invest each year. Do the math, and it will be identical to the last digit. It’s a simple identity:

$X * ReturnRateOnEachDollar * (1 – TaxRate) = $X * (1 – TaxRate) * ReturnRateOnEachDollar

Where $X is the amount of disposable income you have to invest. So the differences are, 1) are you bumping against the limits with the $X, or 2) will the TaxRate be different due to various circumstances?

TFB: this is an excellent article, thank you so much. Lots of things to think about. I am in fact bumping againt the contribution limitation, so one option is to hedge (large-ish company match would go to Trad 401k).

Simon Martins says

@ogd: I’m not sure where you got the $7500 value. John is comparing investing $10k in both traditional and Roth, not putting different values into one and the other.

Harry Sit says

@Simon Martins – The money to pay tax has to come from somewhere. If you are able to do $10k in Roth 401k, you have enough money to do $13k in Traditional 401k. That’s an apples-to-apples comparison, not $10k in each.

Tony Foster says

The writer of the article fails to point out the most important point. All the money you earn on those already taxed contributions is TAX FREE.