[Originally written in 2008. Updated in 2022. The case is still valid after all these years.]

To Roth or not to Roth, that is the question.

Many employers offer both a Traditional and a Roth contribution option in their 401(k) plan. If you choose the Traditional option, your contributions go in pre-tax but you pay tax when you withdraw after you retire. If you choose the Roth option, you pay tax first before you contribute but your withdrawals are tax-free after you retire. You can mix and match between Traditional and Roth but your total contributions between the two can’t exceed the annual limit.

| Traditional | Roth | |

|---|---|---|

| Contributions | pre-tax | post-tax |

| Earnings | tax-deferred | tax-free |

| Withdrawals | taxable | tax-free |

This question of whether one is better off with contributing to the Traditional 401k or contributing to the Roth 401k has been the subject of a lot of debate. Although there is no one-size-fits-all answer, I think for most people the majority, if not 100%, of the contribution should go to a Traditional 401(k). I will state my case against the Roth 401(k) in this article.

The basic premise of a Roth 401(k), and to some extent a Roth IRA, is that of prepayment. You are prepaying taxes now so you don’t have to pay tax later. This prepayment concept is not uncommon. For example, buying a season ticket is prepaying for the individual events. Buying a timeshare is prepaying for vacation accommodation.

Whenever we deal with a prepayment scheme, we have to assess whether prepaying is “worth it.” The same paradigm also applies to Traditional versus Roth 401(k). There are several factors that make prepaying the taxes now not worth it.

Fill In Lower Tax Brackets In Retirement

I showed in a previous post The Commutative Law of Multiplication that if the marginal tax rate at retirement is the same as it is now, the Traditional and Roth 401(k)’s are equivalent. If the marginal tax rate is higher now than in retirement, one is better off contributing to a Traditional 401k. If the current marginal tax rate is lower, one is better off contributing to a Roth 401k.

But that applies only to the marginal dollar, which is the last dollar you can shift between Traditional and Roth 401(k). It is not necessarily the case for the entire contribution or the average dollar.

The tax system in the United States is progressive and it will probably stay that way. It means that income is taxed at increasing rates as it goes higher. Even if you think the marginal tax rate in the future will be higher, there will still be lower brackets and these lower brackets should be filled with money from a Traditional 401(k).

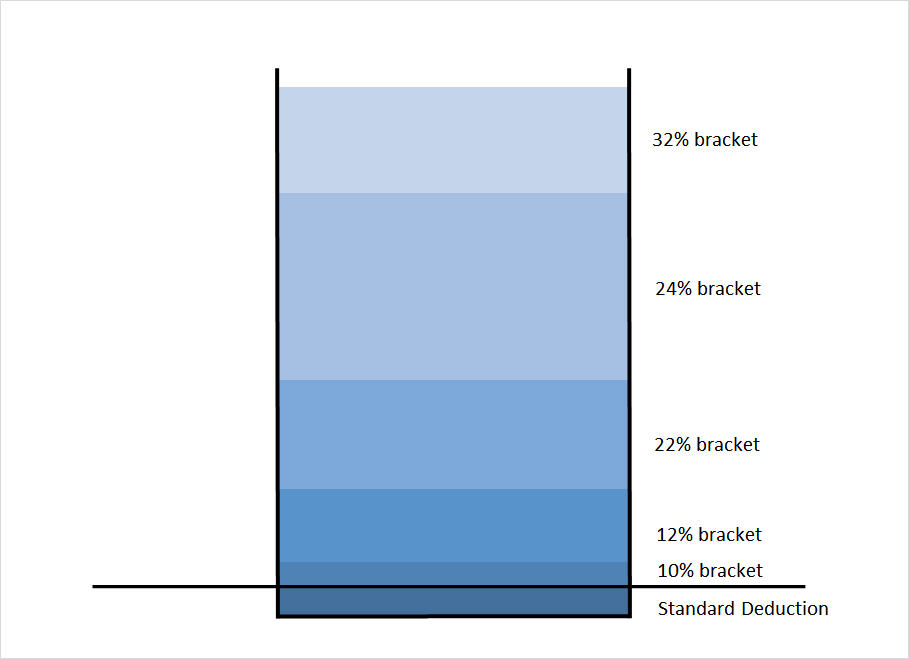

The chart below illustrates how the tax brackets work:

Picture a bucket with markings on the side. As you pour water into the bucket, the water goes up and crosses the marked lines. This represents how your income is taxed. The first chunk of your income absorbed by your tax deduction isn’t taxable. The next chunk of your income is taxed at 10%. The next chunks after that are taxed at 12%, 22%, etc.

When you contribute to a Traditional 401(k), you are scooping up income from the top of this bucket. The dollars you contribute come from the highest tax bracket for your income.

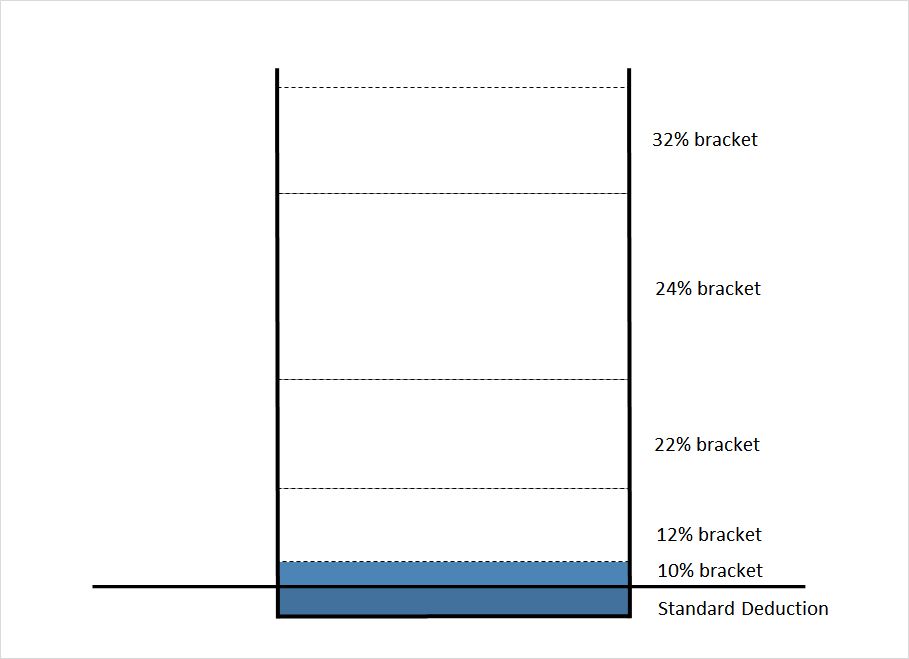

After you retire, you’re staring at an empty or shallow bucket before you pour in money from your 401(k). The money first goes through the lower brackets before it reaches the top.

Even if you assume your marginal tax bracket in retirement will be higher due to tax increases, a large portion of the 401(k) withdrawal may still be taxed at a lower rate than what it was when you contributed the money.

Until you know you can generate from your Traditional 401(k) enough income to fill the lower brackets, it doesn’t make sense to contribute to a Roth 401(k). For people without a pension, it means the majority of the retirement savings should go to a Traditional 401(k), not Roth.

If you have a pension and/or you expect to have a huge balance in Traditional 401(k)/IRA, large enough to fill the lower brackets every year, then contributing some money to Roth makes sense.

Avoid High State Income Tax

Many people work in high-tax states like California and New York today. They work there because there are a lot of good-paying jobs in those states. They won’t necessarily retire there because taxes and the cost of living are high in those states.

States popular with retirees like Florida and Texas have no state income tax. If you’re working in a high-tax state today but there’s a good chance you will retire in a no-tax or low-tax state, contributing to a Traditional 401(k) lets you avoid paying the high state income tax on the contributions. Prepaying the high state income tax now is a dead loss.

Leave the Option Open for Future Roth Conversions

When you leave your employer, you can roll over the Traditional 401(k) to a Traditional IRA, which then can be converted to a Roth IRA at a later time when it is advantageous to you. A Roth 401k or IRA on the other hand can never be converted back to Traditional.

With a Traditional 401k, you hold the option, which has value. If you contribute to a Roth, you give up that valuable option. You can decide to convert and pay the tax whenever you are in a lower tax bracket than where you are now. Good times for conversion include:

- Going back to school for a career change.

- Becoming unemployed due to layoffs or burn-out.

- Starting a business (not as much income in the first few years).

- A two-income couple having one parent stay at home or work part-time for a few years after they have kids.

- A high-income single person marrying a lower-income spouse.

- Taking early retirement.

- Moving from a high-tax state to a no-tax or low-tax state.

Unless you’re sure that your marginal tax bracket will never be lower throughout your lifetime, you should leave the option open by putting money in a Traditional 401(k) and waiting to convert to Roth when an opportunity comes.

Avoid Triggering Phase-outs

Because contributing to a Roth 401k does not reduce your gross income, you appear to have a higher income than if you contributed to a Traditional 401k.

There are all kinds of income-based eligibility cutoffs and phase-outs in the tax code. When you exceed the income threshold, your tax benefits from those programs are either reduced or eliminated. Some of these tax breaks include:

- Child Tax Credit

- Child and Dependent Care Credit

- American Opportunity tax credit

- Lifetime Learning credit

- Eligibility to contribute to a Roth IRA

- Student loan interest tax deduction

Think of the stimulus payments during the COVID pandemic. If a single person earned $80,000 but contributed $10,000 to a Roth 401k, he/she wasn’t eligible for the payment. If he/she contributed $12,000 to a Traditional 401(k) instead, he/she was eligible.

Easier to Get the Full Employer Match

Some people think if you contribute to Roth 401k, the employer’s match will also go there, which will effectively increase your employer match. That’s not true. The employer match always goes to the pre-tax account whether you contribute to the Traditional 401k or the Roth 401k.

When money is tight, it’s easier to qualify for the full employer match when you contribute to the Traditional 401k with pre-tax dollars.

Who Should Use a Roth 401(k)?

With so many disadvantages, then, for whom does a Roth 401(k) make sense?

A Roth 401(k) is good for people in low-paying jobs now but expect to have high-paying jobs later. Doctors in resident programs fit that description very well. They are paid very little while they are in residency but their income is expected to rise substantially higher when they finish the program. Their income will stay high in their career and they will receive a high income after they retire. Prepaying tax now makes sense because they are prepaying at a low rate and they will avoid paying a higher rate later.

College students working part-time jobs or recent graduates working in entry-level jobs are also good examples for taking advantage of a Roth 401(k) while their income (and their tax rate) is low.

A Roth 401(k) is also good for people who are already in the top tax bracket and expect to be there forever. If they don’t see any chance of being in a lower tax bracket, prepaying tax now will lock in the tax rate so they won’t have to worry about future tax increases. On the other hand, people who are in the top tax bracket are in a good position to retire early, with many years of lower tax brackets to fill. So don’t be too sure of staying in the top tax bracket forever.

Tax Diversification?

What about the idea of tax diversification? Some advocate both a Roth 401k and a Traditional 401k because the tax rates in the future are uncertain.

Diversification is good in general but it doesn’t mean automatic 50:50. Just like investing in emerging markets provides diversification, it doesn’t mean you should invest 50% of your money in emerging markets. You still have to decide how much you should allocate your retirement savings between Traditional and Roth just like you allocate a portfolio between developed markets and emerging markets.

Tax diversification also doesn’t mean you have to do it right now if you are in your peak earning years. There might be better times coming up in the future.

As for me, I had contributed 100% to a Traditional 401(k) every year when I worked full-time. Prepaying taxes just wasn’t worth it.

Higher Effective Contributions

Some say the Roth 401(k) is better because you can fool yourself into contributing more when you’re using after-tax money. Contributing 10% of your salary post-tax effectively puts more money into your 401k than contributing 10% of your salary pre-tax. It’s true but you should adjust your contribution to 12% or 15% to equalize the net paycheck when you contribute to a Traditional 401k.

A Roth 401k has a higher effective contribution limit because the annual contribution limit is the same when you max out your 401k. There is some truth to it. See follow-up post, Roth 401(k) for People Who Contribute the Max, which includes an online spreadsheet that calculates the value of having a higher effective contribution limit in a Roth 401k.

What About Roth IRA?

All arguments for and against the Roth 401k also apply to the Roth IRA when you are not yet contributing the maximum to your Traditional 401k. Instead of contributing to the Roth IRA, you can just increase the contribution to your Traditional 401k.

An additional argument in favor of the Roth IRA is that some 401k plans have higher fees. Even then the Traditional 401k can still be better when you don’t expect to work there for many years. You can roll over to your own IRA for lower fees when you change jobs. See Alternatives to a High Cost 401k Or 403b Plan.

If you are already contributing the maximum to your Traditional 401k, you may still be able to take a deduction for contributing to a Traditional IRA. See The Forgotten Deductible Traditional IRA. A Roth IRA is better when you already contribute the maximum to your Traditional 401k and you don’t get a deduction for contributing to a Traditional IRA anyway.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

wx27 says

Nice write-up on the Roth 401(k). I’ve had discussions with co-workers highlighting what I think is a major point missed by a lot of the analysis out there, that being tax saved by going with a traditional 401(k) comes from the top of the progressive tax/income chart while withdrawals fill up from the bottom. For those of us that won’t have pension income, this makes the appropriate rate comparison today’s marginal vs retirement’s average rate. Other factors favorable to traditional include currently earning in a high state/local tax locale and retiring elsewhere and also that some states allow for an exclusion of a certain amount of pension/IRA income in retirement from state/local taxation (ex: NY@20K). This increases the 0% tax base on your chart, driving the average rate on the whole distribution even lower.

Also underappreciated is the option you have to convert to Roth in the future when tax rates are favorable to you due to any of the circumstances you outlined.

PatentGuy says

echoing wx27, tax planning requires a significant amount of fortune telling.

Scott says

If I contribute to a ROTH IRA, I know I need to file my taxes married jointly, that is why I stopped contributing (this was a painful and expensive mistake).

Is this the same for a ROTH 401K? Can I file my taxes any way I want (preferably married but file seperatly)?

Harry Sit says

Scott – You can file tax any way you want if you contribute to a Roth 401(k).

Mike says

Does anyone actually have a list of companies that offer Roth 401ks? I’m about to graduate with a Civil Engineering degree and would love to know which firms offer them.

ron says

Is there a best Roth convesion calculator. There are so many out there.

Ms Texas says

Finance Buff – what are your thoughts about my post regarding the pros/cons of the Roth when living in a state with no income taxes such as Texas?

Thanks

Harry Sit says

Ms Texas – Living in Texas removes one reason against a Roth 401k (#2 in the post). All the other reasons still apply. The key factors are whether you will have a pension when you retire and whether you will retire early. Nobody can predict the future. You just have to take your best shot and live with it.

Ren says

I think there is another side to the AMT coin and how it impacts the comparison of Traditional and Roth 401k, though I may be mistaken.

If you are already being hit by AMT then it creates a window of income that has a marginal rate of 28% rather than the 33% (or higher) without AMT. In this situation, any extra income that can be shifted to that year is only taxed at 28% — up to the amount which pushes the regular tax due up to the AMT tax due.

Of course, the real trouble with this is that I’ve found it exceedingly difficult to estimate in advance the amount of AMT that will be due, particularly with income levels in the range that trigger the deduction and exemption phase-outs. Additionally, there are often better ways of shifting income from the following year rather than from retirement years.

One final point, unrelated to the rest of my comment and only vaguely related to your post: The newly available ability to convert from traditional to Roth IRAs without income restrictions is a definite boon for those of us without a large existing IRA balance to make non-deductible IRA contributions and then convert them to Roth IRAs. Since the contributions have already been taxed, the tax is only due on the gains.

Harry Sit says

Ren – Unless you are talking about really high income, the 28% rate is actually more likely 35%.

With regard to your final point about Roth conversion, I just did it after rolling over the pre-tax money in the traditional IRA to a 401k plan. See previous post Rollover IRA to Solo 401k.

Ren says

Hmm.. I must have missed the AMT exemption phase-out. I could have sworn that when I did my taxes last year (TurboTax), adding a $100 of income after AMT was triggered only increased my taxes by $28 (as long as AMT still applied). I was certainly mindful of the standard exemption and deduction phase-outs, as I mentioned.

Perhaps the AMT exemption phase-out is obscured by the standard phase-outs that may be occurring at similar income levels.

In any event, I’m glad that I never made the jump to the Roth 401k.

PatentGuy says

Tax rates will be as high as possible as time goes on. We love our entitlements and God-given benefits for free. There will be more old people that do not work but get lots of entitlements and benefits. In their minds, they earned every penny and then some. But, there will be less young people who actually have good paying jobs (high tax payers) to pay for the old people.

This would seem to make the case for converting to Roth now, and paying tax now at the GW Fed rate (2010), sla you are young enough and anticipate accumulating a big amount of “tax free” earnings by the time you are old and ready to tap into said earnings.

BUT, the government of the future can/will simply change the rules and tax you anyway on those earnings. There are many ways to tax you without calling it a direct tax, such as by taxing any other income or SS benefits you may have at an extreme rate. You will be demonized for getting these “tax free” earnings unfairly. if you accumulate wealth, by definition, it was unfair of you to do so. time to “give back to the community” which you have robbed blind by paying taxes to convert your IRA to Roth back in 2010.

It is year 2035. The U.S., top to bottom, is broke. They will need every penny they can get from you. They are not going to cut-off any entitlements just so you can get the benefit of some “loop hole deal for the rich” back in 2010.

Mark my words. (Go ahead, mark them. Use a highlighter pen or something like that).

bud says

very nice article. my company just introduced roth to us as well. As for myself, this is all new to me and maybe someone can advise suggestions to give me a general idea of what is best for me. I’m 25 years old and I plan to attend college in the next 4 months. I plan to stay with the company and hopefully move up as i finish my education, but like i mentioned, all this is new to me and maybe someone can point me in the right direction. Thanks in advance.

Chappy says

Well done analysis which has helped me reconsider my planning. Two questions: 1) Doesn’t the time value of money alter the equation (i.e. isn’t a dollar in taxes saved today worth more than taxes saved later because the latter’s present value will be less (assuming typical inflation, returns, etc.)?

2) I heard there’s an option to convert traditional 401k money to Roth 401k in 2010, much like the IRA situation, but I can find nothing to confirm this rumor online. Is it true?

Thanks!!

Chappy says

One more question: On second thought, the above analysis seems to ignore the gains in the account, unless I’m missing something. For the regular 401k, taxes on the income & gains are deferred. In the Roth 401k (after the 5 year period) there’s no tax on withdrawals, so if returns turned out to be fantastically huge (just go with me on this), wouldn’t the Roth come out ahead, since the tax would be zero and the traditional would be large (fantastically huge times any tax rate = large)? Appreciate any thoughts. Thanks!

wx27 says

Hi Chappy,

If you assume your effective tax rate on traditional 401k withdrawals is the same as the effective tax rate you pay now while contributing to the Roth 401k, then the two accounts are worth exactly the same IF you can store the taxes you aren’t paying right now with the trad 401k inside a tax-deferred acount.

Trad starts with $X, grows to X * (1+r), taxes are t * X * (1+r), you are left with X * (1+r) * (1-t) after taxes.

Roth starts with $X * (1-t), grows to X * (1-t) * (1+r), withdrawn with no further taxes.

Now since usually the deferred taxes on the trad 401k can’t all be stored in another tax-deferred account, you end up with some tax slippage on that money over time and the Roth comes out slightly ahead.

Note that all this is assuming effective tax rates are equal across time.

Fred says

Okay.

So I can maximize my 401k and my Roth IRA AND have some for taxable investments.

Should I do Roth 401k or Traditional?

Seems absolutely braindead obvious to do Roth 401k.

Josue says

Hello,

I just finished college and started working a couple weeks ago. I’m single for the momment and my salary is around 70k… I believe that because I just started working full time, Roth might be the way to go. What would you advise me?

CHUCK COURTOT says

I have 145k in a rollover IRA. I am 60 years old, live in Florida and plan to remove the funds in 2 1/2 years. Would I benefit more by moving the monies to a Roth now, MINUS enough to pay the income tax, or leave things where they are?

Thank you

Ron says

How do the taxes work if you leave the country and become a citizen of another country? Everyone talks how bad it may become, but what if you just move to another county (rather than state) and become a citizen? Then you pay taxes at their rate?

How does that change the taxes paid on a 401K or Roth 401K?

Harry Sit says

Ron – If you renounce your citizenship, you are taxed as if you withdrew 100% of your IRAs on the date of the renunciation. No early withdrawal penalty though. From that point onward, if you still leave your assets in the U.S., you are taxed as any other foreign investor. See http://www.taxmeless.com/USCitizenRenounce.htm

Will says

TFB – You know your stuff. Thanks.

I have lots of kids (7) and they use up lots of expenses (college) and I have received plenty of deductions and credits over the years. I have had an effective total federal tax rate of between 0 and 5% over the years. The kids are leaving and taking their deductions with them. The Roth has seemed to make more sense because I am expecting to have more income and less deductions when I retire.

I converted my present and future 401K contributions to a Roth 401K. I asked my employer if I could convert the historic contributions over to a Roth 401k and pay the taxes now. They said the government didn’t allow it. Is that true?

Harry Sit says

Will – It is true. You will have to wait until you change jobs and rollover your traditional 401k to a Roth IRA if it still makes sense to do so at that time.

Frank says

Check this one out from 3 days ago, part 3:

[spam link removed.]

Frank says

How about paying the tax now, putting your money in an Index UL, where you:

1. Have no negative returns(401k & IRA are usually 100% in the market)

2. Lock in your gains every year(this money is never subject to being lost!!) This in itself crushes any Roth. Avg S&P 500 for the last 30 years is something around 8%. Sounds pretty good, but the actual dollar amount your money would have grown in that time is less than 2%. It’s funny the way the 8% number looks good, but real growth is what should be calculated. You’d have been better not worrying about your money and putting it into a CD, unless the bank goes out of business(lol)

3. Money comes out tax free and is passed to heirs tax free. Over 70% of annuities get passed down to heirs fully taxable.

I can’t find anything out there on the market that beats this….and don’t tell me the cost of insurance is an issue since we have no idea how much our 401k’s cost every year.(see 60 minutes video about “401k –The Truth Behind Hidden Fees”)

Just my feedback at what I have found, while trying to research the best way to make sure my retirement will work. It seems that it’s not working for most people in their 70’s and 80’s and I’m 35.

Harry Sit says

Frank – You sound like an insurance agent muddying the water. If you are serious about buying an IUL, go ahead. It’s your money. Do whatever you want. Contribute to your agent’s retirement. Your agent will thank you.

Osho says

There is a fundamental gap is all these discussions that is never addressed. Could someone throw light on this please?

If you contribute say $10,000 to a 401k or a Roth 401 for 30 years, your principal contributed will be $300,000. Add gains of say $100,000 over the 30 years.

At withdrawal, you are looking at $400,000 in withdrawals.

Wouldn’t such a high amount put you in the highest tax bracket anyway?

In that case, doesn’t that make Roth the winner?

My point is that, just the act of contributing a decent amount every year increase the likelihood that you will be in a high tax bracket when you withdraw BECAUSE you contributed all these years.

Harry Sit says

Osho – Is there a reason this person wants to withdraw the lifetime savings all at once? Typically a retiree rolls over the 401k plan distribution to an IRA and withdraws only enough to meet income needs once a year.

Osho says

So only the withdrawn $$$ from 401k are taxed right?

Harry Sit says

Osho – Yes. The remainder stays in the IRA, not taxed until withdrawn.

Osho says

Thank You. That makes me change my perception. Traditional 401k wins.

Time will tell of course.

Never try to optimize finances. You can never win all the time.

Jeremy says

Hey I was hoping I could get some help as well. I just started working and am only 22 years old. As per advice of my parents, I believe I’m going to start investing the maximum amount into my 401k, and feel like I’ll be able to just get by with doing so.

So a few points the article lists:

1) I live in California but definitely plan on moving back to Texas later in my life – Traditional check

2) I am an entry level worker and am definitely planning on making a lot more in my future (hopefully around $130k+) – this isn’t as gross an increase as say…a doctor, so I’m not sure if traditional or Roth would be more beneficial.

3) I do plan on contributing the max, or very close to the max starting now…and at 22 years old, I feel Roth is best for this.

Can anyone here possibly give me some advice for this?

Thanks.

Harry Sit says

Jeremy – Two out of three ain’t bad. It seems Roth is better for you now. When you make more, you can start doing Traditional.

Perry says

Great post and very insightful. I’m starting a new job soon and my employer offers both a traditional 401k and a Roth as well. Unfortunately, I’m bad at making concrete decisions despite the information given to me, so I was wondering if you can suggest what might be ideal for me.

I’m 27, single, live in Texas (no state income tax), and currently make just slightly under 50k. I probably won’t get married or have children for another 5 years. I work in a field that has excellent salary growth, and can expect to make close to 100k within 10 years, and max at around 120k late career. These numbers are not adjusted for inflation of course.

I can live frugally if need be (at least for the time being), and hope to max out my 401k contribution every year. My employer matches $2 for every $1 I contribute for the first $250, and then matches $1 for every $1 I contribute up to 5% of my eligible contribution (not totally sure what this even means?).

I plan to stay and retire in Texas.

Should I opt for a traditional or Roth 401k?

Harry Sit says

Perry – “A Roth 401(k) is good for people in low paying jobs now but expect to have high paying jobs later.”

nets1986 says

TFB – I opened a traditional 401k in January 09 and a Roth 401k in January 10. I have about 15k in the traditional and 5k in the roth now. What is your advice about having a roth and traditional 401k at the same time? Does it hurt me at all in the long run to be splitting my money between the two with compounding interest or anything like that?

Thanks!

Joel K. Berry says

Would you please send this article to my E-Mail address. For years I have been trying to explain to people that the Roth does not make sense for most people. I was a financial planner for about 8 years and tried to explain that statistics show that 90% of the population will not save enough for retirement, and they should use a deductable (or regular) IRA or 410K and increase thier contribution with the tax savings. Also current tax laws allow for 2 exemptions at 65 and older, so more of your earnings are pre-tax in retirement. Even for younger workers who THINK thier income will increase in the future, everything doesn’t always work out as planed. Just ask the 1 out of 10 people who are unemployed today. A bird in the hand is worth two in the bush every time!

Harry Sit says

nets1986 – No problem with having both traditional and Roth 401k at the same time.

dupree says

a great article! TFB, appreciate that you take the time to educate us on the subject. i had doubts about roth 401k vs. traditional 401k. my annual taxable gross is >190k. always max out my 401k contributions. my company offered roth 401k. last year. i hv been pondering on whether to split my contributions 1/2 traditional and 1/2 roth. after reading your article in detail and going through all the posts here … for me, at least 100% traditional is the way to go.

dupree says

….. HV A GREAT THANKSGIVING, YA’LL!

Ray says

A good article however you are making a comparison of a tax system now for the ROTH to what you beleive it will be in the future for the Traditional. If you are close to retirement these predictions of the future tax conditions may hold true however for people in there 20’s and 30’s I believe the tax code will change significantly over time and the result will be tremendously higher taxes in the future. There is little chance that tax brackets of today will look anything like the system in 30 plus years. I will take my chances paying taxes today vs having to pay taxes 30 years down the road on a million dollar tax deferred account. Also because social security will likley be eliminated or raised to a much higher age, most will need to live off something. The Roth gives this flexibility.

PatentGuy says

Ray,

What makes you sure that 30 years from now the government won’t confiscate a fat portion of those tax free distributions? Maybe not in the form of “income tax,” but maybe some sort of a wealth tax, or a denial of benefits you would have otherwise received (e.g., medicaid) but for your having the tax free Roth.

David says

Neat analysis. Honestly, I had never really thought about the argument you presented. I’ve generally not been enthusiastic about any type of tax-deferred plan. New capital gains tax laws may change my views now, but it used to be that it was very much worth paying capital gains tax as versus monkeying around with the ordinary income received from a 401k plan.

Still, one thing you don’t mention, and I can understand why, is investment earnings. What’s going to throw a monkey wrench into your argument is the variability of returns. If you’re working in a “lab”, you can assume the same total return in dollars. But, in the real world, it’s not as simple as assuming the same average investment rate. You can take 100 people, all averaging 8 percent (or 5 or 6 or whatever) and they could all end up with different dollar amounts after a set period of time. The longer the investment time horizon, the more varied the results. I also don’t think it’s realistic to assume the same dollar amount earned in both accounts or even a fixed spread between the traditional 401k vs the Roth due to the pretax contributions in the traditional 401k, unless you specify a fixed interest rate, the same time horizon for both investments and the same age for both individuals when they start as well as the same age at retirement. But, if you rely on fixed rates, I think you’ll probably have to contribute more to make up for the lack of return potential with equities and then your argument might not hold water any longer.

The focus on “traditional vs Roth” seems to always focus on taxes, but this is really only one part of the analysis. And, it’s not even a part of the analysis that can be fully understood and worked though. For example, in your other article (http://thefinancebuff.com/commutative-law-of-multiplication.html), you assumed that the Government could change the tax laws to handicap the Roth. That’s true, but why couldn’t they do the same, or worse, with a traditional 401k plan (I’m thinking of a maximum accumulation limit for tax deferred earnings). I realize that you are trying to argue against a Roth and for a traditional 401k plan, but there are assumptions being made which, I think, are arbitrary guesses. Arbitrary because neither you nor I nor anyone else really knows how the issue of taxes will shake out 30 years from now.

As an example of this, if you had told someone 5 years ago that we would have to dramatically increase taxes in 2010+ to pay for a nationalized health care system, most of the nation would laugh at you and try to talk through the tears generated from such laughter. No one’s laughing now.

If you could assume all other things being equal, I think I would agree with your analysis between the two within certain specified limits. Actually, the pre-tax contributions might offset the taxes paid in the future so a Roth conversion might not even be necessary. My argument is simply that you don’t and can’t know that right now.

In other words, I’m convinced that “tax planning” is a contradiction in terms. Once you start on the premise that you can outguess the whim of a yet unelected career politician, I think all of the following math, no matter how objective and concrete, will be wrong, misleading or inaccurate.

Harry Sit says

@David – We are talking about a Roth 401k here. A Roth 401k and a traditional 401k offered in the same plan have the same investment options. I don’t understand your variability of returns has anything to do with it. Whatever you decide to invest in a Roth 401k, you invest in the same in a traditional 401k, and vice versa.

I agree with you on nobody can predict what the tax landscape will be in the future. That said, we still have to make a decision today. Someone has to decide whether to put money in a traditional 401k or a Roth 401k, or split between the two and how. Toss a coin? Automatic 50:50, regardless of one’s current income? You are a financial professional. When someone comes to you with this question, what do you say? Do you say “Do whatever you please. It’s going to be wrong anyway.”?

David says

@TFB:

RE: Variability of returns. What I’m referring to is CAGR vs average rate of return. Yes, the investments are the same in both accounts. What I mean is that when you compare the investment returns of a traditional vs a Roth, you might find out that the Roth provides more income even though the average rate of return assumption was the same (i.e. you don’t know *when* you receive the returns in advance) and you were able to save more in the traditional 401k. You might even be able to take advantage of the progressive nature of our tax system in the traditional 401k, but if your 8% average return in the traditional 401k turned out to be far less than the 8% average you earned in your Roth, it simply doesn’t matter. The Roth still wins. Or, you might find the traditional 401k plan does better than the Roth because the 8% average there was higher. Either way, the tax issue is only one aspect of the total equation.

No, when someone comes to me, I do not say “choose whatever one you wish”. I think your argument is, in principle, the same as the argument which tries to argue in the other direction. This goes back to the idea that one is inherently better than the other. That would be the intrinsic approach. But, the alternative isn’t “do whatever you want” either, which would be the subjective approach. The choice should be objective. Which means, it depends entirely on one’s purpose, financial goals and a few other factors. It’s pretty involved and my approach is the exact opposite of how it’s normally done. I do not think it could be discussed in one or even several posts.

Harry Sit says

@David – Maybe you need to give an example here. With the same investments, how can the returns be different depending on whether one chooses traditional 401k versus Roth 401k? I would think both the CAGR and average return will be the same. No? The funds don’t know whether the money is in a traditional 401k or a Roth 401k. To the funds, money is money; they will grow the money the same way. If you are saying the investor will choose different investments depending on whether he/she is in a traditional 401k or Roth 401k, why would the investor do that?

It sounds like you have an elaborate approach. If you are willing to share, you are welcome to write guest posts for this blog. We will see what readers say. If not, I certainly understand.

Danny says

You are completely off base with this article. The Roth is almost ALWAYS the best option for anyone. The word “traditional” doesn’t exist in my retirement planing. I don’t know about you, but I plan to be in a much much higher tax bracket when I retire. That’s the whole point in saving for retirement!

The most popular financial example is the person that contributes only $100/month in an avearage mutual fund over 40 years will have $1,000,000. That person only contributed $48,000 of his own money. With the traditionsl 401K, he’ll pay taxes on $1,000,000. With the Roth, he’s already paid his taxes on the $48,000, and he can withdraw the $1,000,000 tax free.

The great thing about the Roth is that you are only taxed on the money you put in, not the growth. When I retire, the vast majority of my 401K and IRAs will be growth, not money that I put in, and I plan to have $5,000,000. If I decide to pay cash for a retirement house, I don’t have to worry about taxes.

David says

@TFB– CAGR is the real rate of return, but averaging is just a blended rate of return with no consideration as to when the investment returns are earned. As a result, it can play with the actual dollar amounts.

Here’s a simple example. I’ve exaggerated the returns a bit since it’s over a short time frame. But, the longer the time frame, the less variation that’s needed in the returns.

I used 12 percent, since lots of people fantasize about 12 percent returns, heh, but any interest rate can be used to illustrate the same phenomenon.

Yr 1 = 20% = $120,000

Yr 2 = 4% = $124,800

Yr 3 = -10% = $112,320

yr 4 = 24% = $139,276

yr 5 = 22% = $169,916

Yr 1 = 12% = $112,000

Yr 2 = 12% = $125,440

Yr 3 = 12% = $140,492

yr 4 = 12% = $157,351

yr 5 = 12% = $176,234

Yr 1 = 25% = $125,000

Yr 2 = 30% = $162,500

Yr 3 = 20% = $195,000

yr 4 = 25% = $243,750

yr 5 = -40% = $146,250

As you can see, after 5 years, you get very different results, even though you’ve averaged the same return in each example. What I’ve basically outlined is the Monte Carlo Method. Usually advisers use this to illustrate hypothetical returns for clients and their probability of running out of money prior to death (a method that I think is flawed for a variety of reasons but that is another topic entirely), but I normally use it to point out that each time the MC software is run, you get a different prediction so if you’re overly focused on saving money on taxes, you’ll miss how the rate of return–and when you earn those returns–affects your retirement account in addition to the tax issue.

The returns don’t need to swing as much over 30 years to create the same phenomenon. So, I guess what I’m trying to say is that taxes are just one factor. You could “plan” for the tax bite, and still end up losing out either way. My point isn’t that one type of account is better than the other. My point is that it’s about more than just tax planning. In other words, I don’t think you can make the argument for a traditional 401k by just focusing on the tax issue, because there are other variables involved.

As I said before, I do not think the solution can be easily presented in one or even several posts. It’s not that it’s complicated or overly elaborate. It’s just that a LOT of pre-requisite knowledge has to be laid down before the solution can be presented and much of that information has little to do with actual investing strategies. And, some things I cannot give away, since it’s how I make my living, though my purpose was not to advertise on your site. I just wanted to point out something I noticed. It does not sound like something you’ve considered (or perhaps you have in other posts?). Either way, I think it’s something worthy of consideration.

David says

I apologize, if it isn’t clear, each 5 year block in the previous comment is a separate example to illustrate $100,000 growing at an average rate of 12 percent per year over 5 years.

Vinod says

One more factor : expense ratios of mutual funds/etfs are on total plan assets. In pretax 401k/iras, you are paying for uncle sam’s assets too. over 30 years, this adds up(magic of compounding on expense ratios). In Roth 401k/ira, you only pay expense ratio for your share(since earnings are tax free)