Fidelity chooses to give free TurboTax Premier to a random subset of customers every year. If you follow the link in the special offer to TurboTax’s website, the online version of TurboTax Premier is free, and the desktop version costs only $5 (plus tax in some states).

Where to Find the Offer

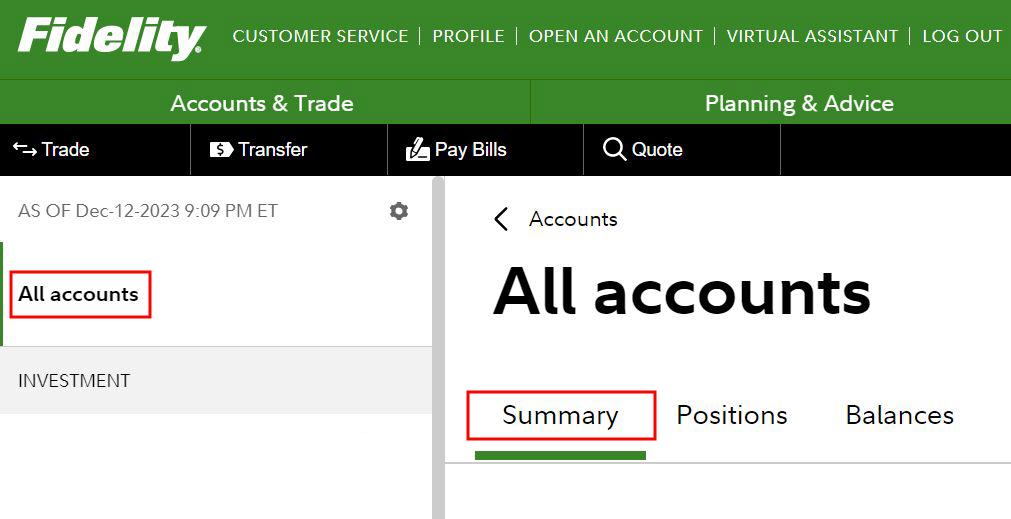

Fidelity doesn’t email or otherwise alert you that you have been selected for this offer. You have to look for it on the All Accounts -> Summary tab after you log in to Fidelity’s website.

The All Accounts -> Summary tab usually displays some informational and marketing “cards” such as this one:

You’ll see a card with the free/$5 TurboTax offer among these other cards on the All Accounts -> Summary tab if Fidelity’s offer targeting algorithm included you for the offer. Be sure to scroll down and look for it. If you don’t see anything there, it means the algorithm hasn’t selected you.

Buy the Desktop Version

Although the offer may only mention TurboTax Online, the same link also lets you buy the desktop version of TurboTax Premier for $5. The $5 desktop version is a better deal than using the online version for free. I explained why in Tax Software: Buy the Download, Not the Online Service.

If you used TurboTax Online last year, you can save last year’s return as a tax data file and import it into the desktop software. See How do I save my TurboTax Online return as a tax data file? from TurboTax Help.

The desktop version also has the useful What-If Worksheet for tax planning, which isn’t available in the online version. See Tax Planning with TurboTax What-If Worksheet: Roth Conversion.

The desktop software charges a fee for state e-file (only the e-file, preparing the state return is free), but you can e-file for free on the state revenue agency’s website in many states. I use the tax forms prepared by TurboTax and file directly with the state every year. See Free E-File State Tax Return Directly on the State’s Website.

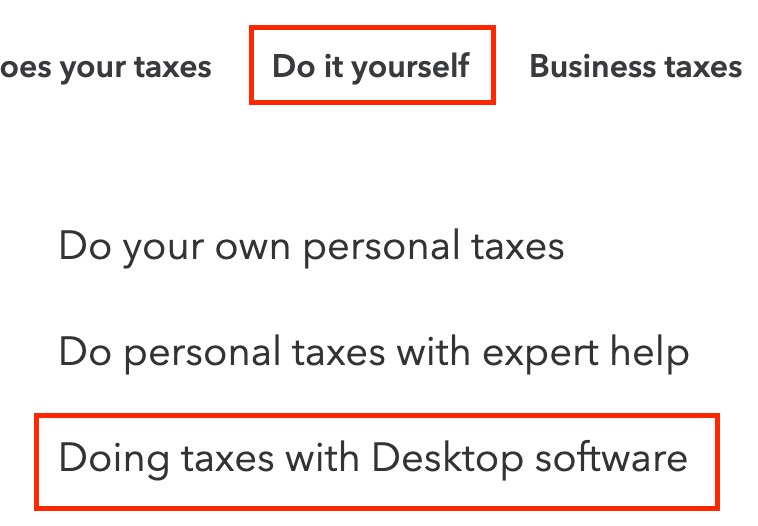

You’ll find the desktop version on TurboTax’s website under “Do it yourself” -> “Doing taxes with Desktop software.”

Selection Criteria

If you don’t see the offer for free/$5 TurboTax on the All Accounts -> Summary tab after you log in to Fidelity’s website, that means Fidelity’s marketing algorithm didn’t choose you. Which customers Fidelity selects to offer the free/$5 TurboTax has a large degree of randomness.

Having large accounts probably helps, but it doesn’t guarantee it. Some people with low 6-figure accounts get the offer, and some people with high 7-figure accounts don’t get it.

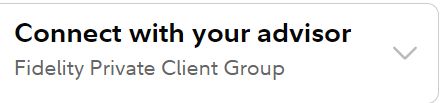

Being in the “Private Client Group” and having an assigned advisor may help, but it doesn’t guarantee it either. Some people receive the offer without an assigned advisor or the Private Client Group status, and some people still don’t get the offer even though they have the Private Client Group status and an assigned advisor.

Having a taxable account isn’t required either. Some people get the offer with only retirement accounts, and some people with a large taxable account still don’t get it.

Active traders have a better chance of getting the offer, but many people still get it when they made only a few trades last year.

My new theory is that trust accounts, non-prototype accounts, solo 401k accounts, and business accounts don’t count for this offer, even though they may count for the Private Client Group status. I had never received the offer when the bulk of my assets at Fidelity were in those accounts. I received the offer this year for the first time only after I transferred an IRA from Vanguard to Fidelity. An IRA is a personal account. It counts.

Accept Randomness

People have a hard time accepting a degree of randomness. There’s a Chinese expression,

It’s not scarcity that people worry about, but inequality.

People are OK with not having free TurboTax from Fidelity if no one gets it — Fidelity didn’t promise it to anyone after all, and other brokers don’t offer it either — but they’re unhappy if someone “less deserving” gets it and they don’t.

It’s easier if you treat these as randomly assigned. Some customers are luckier than others. Your raffle ticket didn’t come up in the drawing. That’s all.

Not Chosen, What to Do?

I have a large taxable account with Fidelity, I’m in the Private Client Group, and I have an assigned advisor, but I never received the free TurboTax offer until this year. If you think you have all the reasons to get the free TurboTax offer but you don’t see it on the All Accounts -> Summary tab, what now?

Check Spouse’s Login

If you’re married and your spouse has a separate login, ask him or her to check under his or her login. Sometimes one spouse has the offer and the other doesn’t.

Wait

Not everyone sees the offer at the same time. Some see it in mid-December, and some see it in January. If you don’t see the offer, it may still show up later.

I didn’t have the offer when other people reported seeing it last December. Then it appeared in January.

Ask Your Advisor

If you have an assigned advisor, your advisor has no control over who gets the free TurboTax offer or when the offer shows up, but he or she may have some discretionary client relationship budget. Some advisors will tell you to buy the software yourself, and they’ll reimburse you when you send them the receipt.

It’s up to you whether you want to pursue this with your advisor. I didn’t bother when I didn’t have the offer in previous years because I don’t beg as a matter of principle.

You know whether you have an assigned advisor by looking at the top right on the All Accounts page after you log in to Fidelity’s website. You have an assigned advisor if you see a photo and a name when you click on the dropdown. You don’t have an assigned advisor if you only see a toll-free number.

Don’t bother calling customer service at the call center if you don’t have the offer. They don’t know how the offer targeting algorithm selects customers for the offer. Customer service can’t put an offer in your account.

Ask a Friend or Family

Someone may have the free TurboTax offer from Fidelity, but they don’t use TurboTax because they use an accountant or tax preparer, or they prefer some other software.

If a friend or family member has the offer but they won’t use TurboTax, you can use their link to buy it. After they log in to Fidelity and click on the offer, you use their computer to log in to your TurboTax account to buy it.

Buy It On Sale From Amazon

While it’s a good deal to get TurboTax for $5, it isn’t that expensive when you buy it without the special offer. Amazon typically puts TurboTax on sale when Costco has it on sale. It was between January 18 and February 7 in 2025. The Deluxe + State edition, which is sufficient for most people, usually sells for $35-40 at that time.

When I didn’t have the offer in previous years, I bought the Deluxe (federal-only) edition for under $30 because my state tax is dead simple. I file the state tax directly on the state tax department’s website for free with only three numbers from the federal return.

Buy It With Stacked Discounts

Fidelity and many other financial institutions offer a discount on TurboTax. I call it a fake discount because the discounted price is about the same as the normal price on Amazon. For example, Fidelity offers 25% off TurboTax for people not chosen to receive it for free. The discounted price for TurboTax Deluxe + State on TurboTax’s website is $52.50. Amazon sells it for $56 as the regular price.

However, many credit cards have a cash back deal during the tax season for $20 cash back when you spend $39 or more on TurboTax. Chase, Bank of America, and Citi all have this deal on their cards. The cash back deal must be activated on the card before you make the purchase, and the purchase must be directly from TurboTax. When you combine the cash back deal with the fake discount, you can get TurboTax Deluxe + State for $32.50.

The price after stacked discounts is comparable to the price from Amazon on sale. The advantage of buying with stacked discounts is that you don’t have to wait or check when Amazon has it on sale.

***

I would buy it from Amzon or buy with stacked discounts if I don’t get the offer next year. Fidelity doesn’t owe me a $5 TurboTax. I’ll take a surprise gift if they choose to give it to me, but I’ll just buy it on my own when they don’t.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Bill says

Excellent article, especially checking the spouse account. I’ve always considered myself an expert on this offer and there’s nothing in here which is incorrect (fortunately, I get it every year myself). It’s very strange that you have a rep and are PCG and never get the offer. Not having a rep is usually the gotcha for people who don’t have it.

Richard E Martz says

Agreed. I think it is mainly if you have a rep. A relative has an 8 figure account but no longer gets it for free.

Bill says

They should call and have a rep assigned.

Jim Herbeck says

I used to get it free, but not for the last couple of years – the algorithm is very random.

Thanks for the tip about looking at your spouses account – she’s getting it free this year! Ha!

Steve says

I received the Fidelity TT offer and paid $5 for download version. The only reason I paid attention to it this year was because of thread in Bogleheads forum about it. I normally use Block desktop tax software but have used Turbotax last couple of years due to having to fill out Form 1116.

Nice to know I am one of Fidelity’s select clientele.

Steve says

My wife got the offer from Fidelity, too.

larry says

We have gotten the offer on either my or my wife’s account for the past three years, but as you said I have had to be proactive in searching for it each time.

I find it curious that a firm such as Fidelity doesn’t promote this more, or at least notify all eligible customers that the tax program is available. Why offer a benefit and then not market it? Strange….

Bill says

It is absolutely ridiculous that they do not tell their customers about it. Think about the goodwill they would get if your rep emailed you about it! I met a couple of fellow PCG customers at a Fidelity event a few years ago, and they had no idea that this even existed, but had it when they looked. So now every year when I see it, I send them a text message to let them know to go look. Customers who exclusively use the app or don’t go to the Portfolio page will never see it, never mind that it’s at the very bottom of the page if you DO go to the Portfolio. I always used to email my rep to let her know abut it, but I think she’s still angry with me for moving a bunch of assets out of Fidelity (but kept enough there to still receive TT and have her as my rep since she’s now a VP).

Steve says

It is probably similar to the reason Costco constantly changes the location of products in its stores, without labeling products in aisle. Costco wants you to travel throughout the store on your “treasure hunt”.

Fidelity rewards some of its customers who access their portfolio pages with a gift every now and then. Keep scrolling down your Fidelity portfolio page or you’ll miss out.

Maybe Harry will make it one year!

Bill says

Steve, the location on the Fideelity site does not change. It’s always at the bottom of the Portfolio page. It used to be a challenge to find the download version, butthey made that much easier this year.

TJ says

Sounds like Utah has simpler tax forms than California if you only need to copy 3 numbers. 🙂

Or are your taxes simpler in early retirement than they were while employed, also?

Harry Sit says

The state tax forms are simpler. The only 3 numbers I need from the federal return are federal AGI, federal standard or itemized deductions, and interest from Treasuries (not directly on the federal return but a subset of interest and fund dividends derived from Treasuries). The state’s online system calculates everything else.

Larry says

A good summary of everything known and unknown about the free TT offer. Anyone who truly knows how this works has been sworn to silence.

Fidelity is free to extend or not extend this perk as they see fit, but in 2018 a rep told me (after having given it to me the previous 2 years, and had low 7-figures and 30+ years with them) that “my relationship with Fidelity was insufficient”. Words I will never forget. I even asked him to confirm that those were the words he intended to use. I’m sorry but that crosses a line that no financial firm should ever cross.

A couple phone calls later, I had moved most of my Fidelity assets to Schwab, who gave me a bonus that could pay for TT for the next 100 years.

Christian Walenta says

when I saw your article a few weeks ago I checked my Fidelity account and indeed had an offer for Free TT, this week I went back in to click on it and get the SW, but the offer is nit there anymore. Strange, but could it be that the offer is only temporary or can disappear of not used?

Bill says

They pulled the offer, hopefully only temporarily. My theory is that pulled it because some folks figured out how to hack TT using cookies so that people who did not receive the offer were able to take advantage of it. Hopefully they will fix the problem in the new year and reinstate it. This has happened previously, too.

BTW, this is a good reason why you should always take advantage of the offer when you see it. Either purchase the download version, or go into the online version and skip ahead to the file section and “pay” the $0 fee to lock it in.

Barry N. says

This is the second year in a row I have gotten the offer. I looked after Harry’s article appeared and seized the opportunity (with the $5 download). Why me is a mystery. I don’t have a rep and only have a mid 6-figure account with Fido but I do trade a fair amount. The offer remained on my Summary page after I took it but is gone now. Last year the offer disappeared and then reappeared. Very weird Fidelity behavior.

Bill says

If you are what they consider Active Trader Pro, that is one sure way of getting the offer. Or maybe you just have to sign up to use the program?

As I mentioned in my last comment, my theory on the disappearance is that they realized that people who were not supposed to be getting the offer had figured out how to trick the TT website into thinking that they qualified (there were posts on other sites about using cookies). So it’s been pulled for retooling. At least that’s my theory based on what has happened in the past.

Larry says

This blog does not allow replies to replies but this is for Bill who replied to comment #8.

I guarantee that if you look around the internet, you will find that _no one_ knows how this perk works.

Being an Active Trader? Having a certain amount of funds? A certain number of accounts? Being in the “Private Client Group”? Having an assigned advisor? Those all seem plausible but it has been proven that NONE of them are guarantees.

Bill says

And I can tell you that over the years, I have been one of the main people who have posted about this perk on other sites (I used to be the starter of the thread on a popular consumer site, I’ve slacked in recent years). Yes, there is no 100% guarantee that you will get it. But there are certain things that have shown to increase the likelihood of getting it. My rep has told me that she has nothing to do with who gets it, and I’m the one who always tells her when it’s available. And yes, there are some people who get it and shouldn’t based on the “guidelines”. The description here does a pretty good job of explaining what we know about it.

Fidelity used to talk about it on the following page. Interestingly, the footnote is still there, but they seem to have deleted the item in the table that it referred to. You can tell that they’re talking about tax software by reading to the end.

https://www.fidelity.com/trading/active-trader-trading-service-levels

Active traders who trade 120+ trades per calendar year and has one or more nonretirement account(s).

Certain covered clients: Private Wealth Management (PWM) client and owns one or more nonretirement account(s) or PCG, Premium, and ATS clients with minimum assets of either: PWI assets of $1,000,000 or more and PI assets of at least $500,000 and own one or more nonretirement account or Nonretirement assets $1,000,000 or more. Applies to Federal returns and one state return only. Cost of additional state returns are the responsibility of the client.

Bill says

Fidelity temporarily pulled the offer just before the end of the year. No official word on why, but I think it’s because people had figured out how to set the browser cookies in a way that made it look like you were eligible for the offer when you got to the TT site (this was discussed on SD and likely other sites). As of yesterday, they’re now showing a box saying that you qualify for the offer and that it will be available by the end of January. So, if you looked for it in the past week or so and did not see it and thought you didn’t qualify, look again.

Rich T says

Thanks so much for this article!

I checked, and found the offer!

Bill says

Just to clairfy, the offer is not currently available, but they put a placeholder on the portfolio page saying that you qualify and that it will be available by the end of the months.

The contents of the thread on the popular consumer thread that talking about setting cookies to fraudulently get the offer when you did not qualify has been removed. First time I’ve ever seen that happen.

JG says

I received the offer for TT Online Premium free, however, when I click “Get started now,” I am directed to a page offering “Save 20% on TurboTax.”

Harry Sit says

Go back and try clicking on “Get started now” again. It usually works on a second try.

IH says

I have the same problem. I saw the offer on the summary page, but when I clicked ” get started now,” the page only directed me to 20%. I contacted Fidelity, and the rep confirmed that I was eligible. She couldn’t understand why clicking on “get started now” only gave me a 20% discount. She instructed me to log out and log in again, and it still did not fix the issue. Frustrating.

Arun says

Excellent article as always. Using the spouse login worked for me after mine did not. Thanks Harry.

Steve says

Any idea when Fidelity is likely to start offering free/discounted Turbo Tax 2024?

Harry Sit says

Usually mid- to late December.

Bill says

Usually around the third Thursday.

RT says

Hi Harry

As it happens shortly after I purchased TurboTax 2024 download from Amazon I got Fidelity offer.

I would like you to have it if you want it. Let me know

Harry Sit says

Thank you for the generous offer! I’ll send you an email.

Larry S says

I have received the TT offer in the past and have it again this year on my summary page but I can’t actually download it yet. It’s making me wait until January to get it which is unusual.

The banner ad states:

“You’re eligible for an exclusive TurboTax® offer! You qualify for this year’s free TurboTax program offered to select Fidelity customers. You’ll see the link here by mid-January. Check back soon”

P says

Still random eligibility. I recently put another big chunk of assets into my taxable account and got denied after getting it in the past. Sent email to my private client team and got a bogus response that I get a 30% off coupon. Been a private client over a decade and even have close to $1M in active Fidelity funds (not the low cost index fund variety) that generate healthy fees for Fidelity (I’m not selling them until I soon retire whereas my marginal tax rate will be much lower). I don’t think anyone has a good idea what their algorithm is.

GaryK says

My link went live yesterday. Account mix at Fidelity is 1/3 taxable revocable Trust, 1/3 traditional rollover IRA, 1/3 ROTH, and am PCG with a dedicated rep, though I seldom speak with him.

I don’t know about previous years re: the TT offer because I’ve been a TaxCut user for over 15 years, bolted from TT when Intuit pulled that stunt (2008/2009?) and demanded $9.95 per return just to print.

However, $5 for the local installed version of Premier is pretty sweet, especially since I haven’t yet seen TaxCut at Amazon for the 1/2 off price. I do like what I’ve seen thus far with TT, putting in enough info to confirm the safe harbor amount I need to pay for estimated to avoid a penalty. My taxes this year are heavily skewed to Q4 because that’s when I did sizable Roth conversions, and generally use the annualization method in this situation. TT’s entry of the quarterly income and estimated payments is far less painful than TaxCut’s has been.

GaryK says

One other thing comes to mind which may have factored into receiving the offer — we did move significant assets to Fidelity in 3 chunks last year, increasing the total account (self, spouse, and kids) by about $1M.

Bill says

After getting this offer for many years (I’ve always considered myself one of the experts on this offer), I do not have it this year. I moved a bunch of my assets out of Fidelity in early 2023, but am still comfortably in Private Client range. One thing that did change from last December is that I got a new Fidelity rep, and although he does show up on their website, I have not set up a meeting with him (he did suggest that I do it when he called to introduce himself). My previous rep always claimed that she didn’t have anything to do with it showing up, so I don’t see how my not having a real relationship with him could affect my getting it. I do have a 30% off offer, which brings Deluxe down to $49 and in theory would qualify for the $20 back offer on several of my credit cards. I kept hoping it would show up, as others often say it does later on, but I’m not holding out hope at the moment. I guess I could email my Fidelity rep.

Mark says

I think Fidelity does itself more harm than good with the “random” nature of this benefit. If I go to the effort of looking in my account (perhaps multiple times) to see whether I’ve received the benefit (which includes finding an article like this online for instructions on exactly where I’m supposed to look and how it works), I’m going to be particularly annoyed with Fidelity if I DON’T receive the benefit.

I know I’m posting well after tax season, and I did look in 2024 & 2025 for this benefit during the first 1/3 of the calendar year; I just never got around to making this post.

What has resulted from this failed quest has been my impression that Fidelity doesn’t respect me or my time. When a company creates a negative impression in customers, it can take a lot of effort to undo that negative impression. Fidelity needs to re-think this approach. I won’t be searching again for this so-called benefit – they’ll have to put a big banner on my account announcing I’ve received it.

Bill says

I may have already written this here, but Fidelity does a very poor job with this offer. They don’t generate the goodwill they would if they sent out an email to the folks who get it saying “we’re pleased to offer you this small gift as thanks for your continued business” and signing it from their FA. I wonder what percentage of customers whip get the offer actually find it and redeem it. So much wasted opportunity, and instead they get angry PCG customers who don’t get it but think they should have.

GaryK says

Posting to bump this thread. I’m seeing an offer for 25% off TT, shows up before I even log in on the homepage. Logging in and clicking through, not clear if it’s online only, or includes the desktop version (though I suspect the former).

Anyone seeing anything different, or have more info?

Harry Sit says

I had the %-off offer last December when some other people reported having the free offer. Then the free offer showed up in January. I expect the same will happen this year. Right now I only have the 25% off. I’ll check back in mid-January.

The offer always worked for both online and desktop in the past. I expect it’ll be the same this year. Free offer gives online for free and the desktop costs $5.

Bill says

The 25% off definitely works on the desktop version. You have to navigate through the usual menus to get to the desktop/download version and the discount shows up applied.

Steve says

I see the same message. At the moment Amazon is offering TurboTax 2025 Deluxe Federal & State software for 30% off.

GaryK says

Sam’s Club and Costco have similar pricing for members at $55.99 for Deluxe Federal & State. On Intuit’s site they’ve also cut the price, so it’s $70 (not the 79.99 Amazon is using to calculate the “30%” discount).

Bill says

Check your credit cards for TurboTax cashback offers. Most of mine have $20 back, which would make buying direct from TurboTax with a discount like the 25% mentioned here a better deal than buying from a store.

Bill says

Also Deluxe with state is $52.50 and Premier is $78.75 on turbotax.com with the 25% off. That would make Deluxe $32.50 if you have the $20 off (which I have on my Amex card). Chase and Citi have 30% off up to $20, so it would be less than the max discount for Deluxe.

larry s says

I have gotten the free offer for the past five or six years. I don’t recall ever getting a 25% offer in December, but the free one has always arrived sometime in January.

Bill says

The 25% off is for everyone and actually advertised right on fidelity.com. I’ve never seen it that prominent before. I also found it on my Portfolio page where the free offer would normally be. But the free offer typically doesn’t show up until the 3rd week of December, so it will be interesting to see if people get it later this week.

Harry Sit says

Some people already reported seeing the “coming soon” free offer now. Not having it now doesn’t mean you won’t get it in January.

GaryK says

So far, still no change, just the ‘25% Off’ offer. Also, I may be reading this wrong, but when I go to Intuit via the link, I don’t see anything about the desktop version being part of the offer, and there’s this:

“Discount applies to TurboTax federal products only (no state products). Savings in addition to early-season discount. Offer cannot be combined with any other TurboTax offers.

Actual prices are determined at the time of print or e-file and are subject to change without notice.”

Seems to me that this is a significant reduction from the products offered via the promotion in years past.

Also, I’ve just learned that the PC desktop version of TurboTax requires Windows 11, which may be an issue for some. Meanwhile, the H&R Block Deluxe + State software is now $36.99 at Amazon (and runs on both Windows 10 & 11).

Harry Sit says

It’s still only “25% off” for me as well, unlike last year. Maybe it will still change later (I don’t remember when it changed last year), but I’m buying it on Amazon today. Amazon has the Deluxe federal-only version plus a $10 gift card combo for $37 (net $27), and the Deluxe with State version plus a $10 gift card combo for $45 (net $35). These combos are listed separately from the standalone products. You’ll have to search for “TurboTax with gift card” specifically.

If you go with the “25% off” plus a stacked cash-back deal from a credit card, the 25% off applies equally to desktop products, despite the wording that may imply otherwise. Follow the same steps outlined in this post. Look for the menu at the top to find the desktop products.

GaryK says

Thanks Harry. The search you provided did not work for me, but on the “Today’s Deals” page, I can see both the software only at $44.95 and gift card combo also $44.95 for TT Deluxe + State. The combo deals are indicating expiration in about 16 hours (10 AM CST as I write this), whereas the software alone just says ‘Limited time deal’. Who knows what tomorrow will bring.

Steve says

Interesting. I cannot find 2025 Turbotax deluxe with state plus $10 gift card using Amazon search.

In a past year I bought that year’s TT with a gift card, but in looking at my previous Amazon orders, there is no mention of the gift card in my Amazon orders history.

Bill says

Search for B0GH2XRDQT. I’d include the link, but I’m not sure if they’re allowed here so I’ll put it in a reply.

Bill says

https://www.amazon.com/Intuit-TurboTax-Desktop-Federal-Download/dp/B0GH2XRDQT

Bill says

Link went to moderation. You can also search on Slickdeals for “Intuit TurboTax 2025 Tax Software + $10 Amazon Gift Card: Deluxe (Federal+State)” and there is a thread with all the product links.

Steve says

Maybe Harry gets special deals from Amazon????

Steve says

Per GaryK, I do see the TT with state and card in Amazon’s “Today’s Deals”, expiring in 15 hours.

Steve says

Again per GaryK, search on Amazon for ‘TurboTax with gift card’ displays 25 TT federal and state with card.

Writes note for next year….

Bill says

BTW, I spoke to my Fidelity rep’s client services person last week to review my information (they reached out to me to set up the call), and I mentioned the TurboTax issue. I said that I was disappointed that I didn’t get it free again (and also that I only got 25% instead of 30%) but wasn’t going to contact my FA about it since last year he told me it was only for managed clients and I cancelled the follow-up I had with him to discuss that. The rep told me that he would speak to him anyway and that they would see if they could do anything to reimburse me like they did last year. I’m not holding my breath.

He did tell me that they DO know who gets it for free and sometimes reach out to clients to tell them that they have it. I’ve never heard that before, and I know when I did get it, I was the one telling my FA that it was available. Has anyone ever been notified by your Fidelity rep that you have the offer available to you?