The tax season is over for most people but if you used TurboTax downloaded software, don’t uninstall it just yet.

I showed in previous posts some unwelcoming features in TurboTax that you may want to opt out of — underpayment penalty and estimated tax payment vouchers. Ironically, TurboTax downloaded software also has a very useful feature hidden deep inside. You have to know how to dig it out.

Project Taxes for Current Year

It’s called the What-If Worksheet. After you’re done with your previous year’s taxes, you use the What-If Worksheet to project your taxes for the current year. It also makes it easy to compare different scenarios.

The idea of the What-If Worksheet is that you can create alternative scenarios and see how your taxes will change.

What if you earn more income?

What if your income drops?

What if you take on a mortgage?

What if you sell some investments and realize capital gains?

What if you convert some IRA money to Roth AND you sell some investments with a capital loss?

The What-If Worksheet is only available in TurboTax downloaded software. It’s not in its online software. It’s another reason to use TurboTax downloaded software, not the online software. As far as I know, only TurboTax has it. H&R Block doesn’t have it. Neither does FreeTaxUSA.

Plan for Roth Conversion

I’ll show you how to plan for Roth conversion with this Work-If Worksheet in TurboTax by the same example I used in the previous post Roth Conversion with Social Security and Medicare IRMAA.

TurboTax shows that this couple with $95,000 of income paid $2,018 in federal income tax. That’s only 2% of their income. They are interested in doing a Roth conversion next year to take advantage of their low tax rate.

Find What-If Worksheet

For some odd reasons, TurboTax doesn’t advertise this vastly useful What-If Worksheet. You’ll have to know that it exists and really look for it.

Click on Forms on the top right in TurboTax downloaded software and then click on the Open Form button.

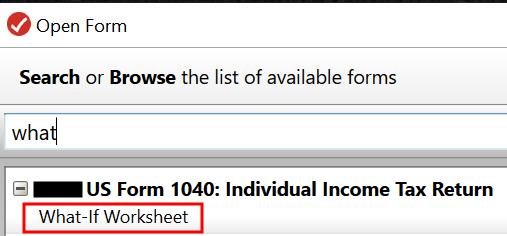

This opens a pop-up window. Type “what” or “what-if” in the search box. Double-click on the “What-If Worksheet” in the search results to open it.

Create a Baseline

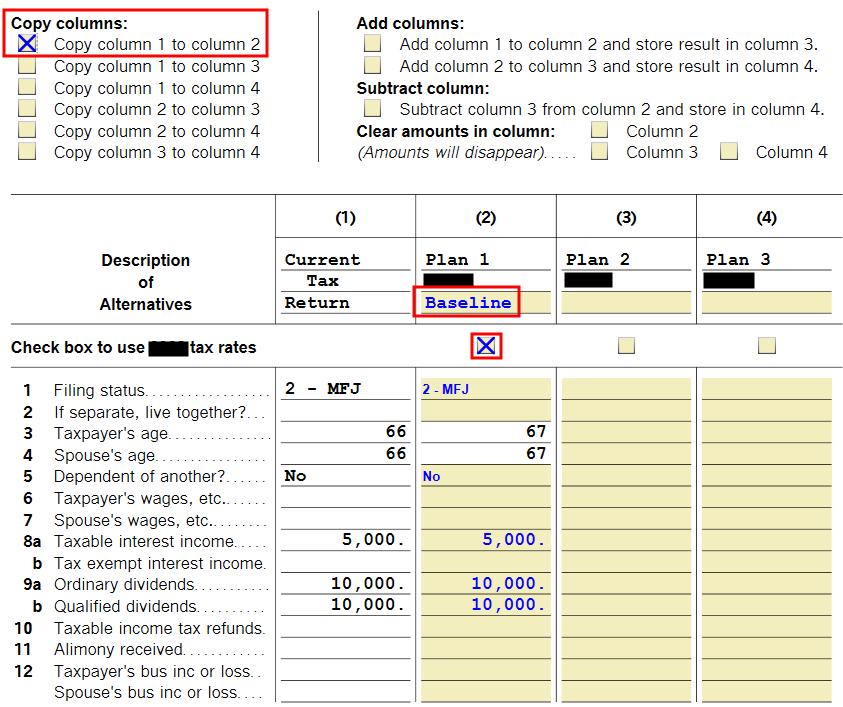

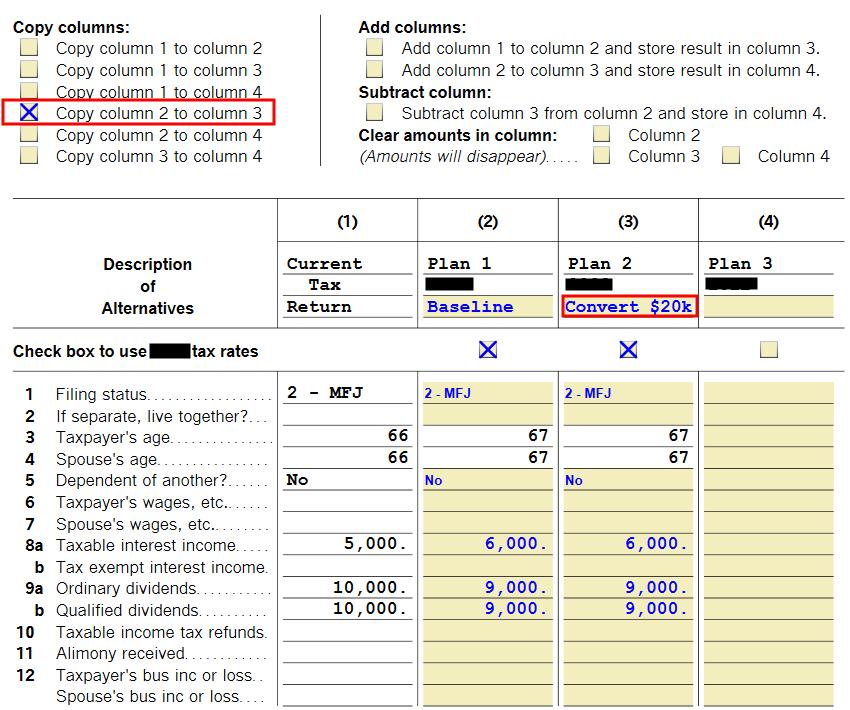

The What-If Worksheet has four columns. Column 1 is auto-populated with data from your tax return. Columns 2 to 4 are used for tax planning.

First, you create a baseline for the current year. Checking the box “Copy column 1 to column 2” under “Copy columns” copies your tax return for last year to Column 2. Checking the box “Check box to use XXXX tax rates” under Column 2 applies the current year’s tax brackets. You can give it a short name such as “Baseline.”

Change the numbers under Column 2 with what you already know will be different this year. For example, you know you will earn more interest because interest rates have gone up, you know you will have less in dividends because you sold some investments last year, your Social Security benefits will go up because of COLA, etc.

Column 2 is your best guess of your current year’s taxes before you take any deliberate actions.

Test Alternatives

After you create a good baseline for the current year, suppose you want to see how converting $20,000 from your Traditional IRA to Roth will affect your taxes.

Copy Column 2 to Column 3 by checking the box under “Copy columns.” Check the box to use the current year’s tax brackets again. Give it a short description such as “Convert $20k.”

Scroll down to the line for taxable IRA distribution and raise the number by $20,000 from the baseline in Column 2 to your alternative scenario in Column 3.

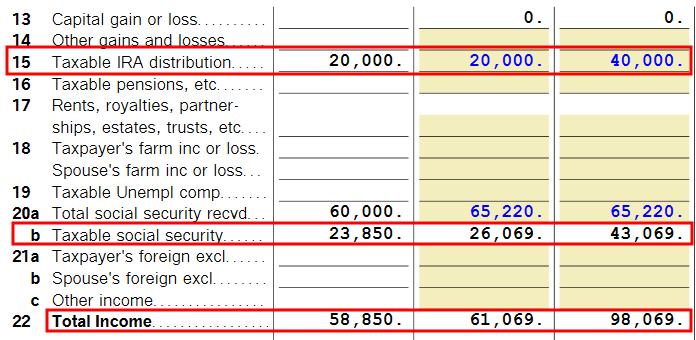

The What-If Worksheet shows this additional income will increase the taxable amount of the Social Security benefits for this couple in the example by $17,000. Together with the $20,000 Roth conversion, the AGI will increase by $37,000.

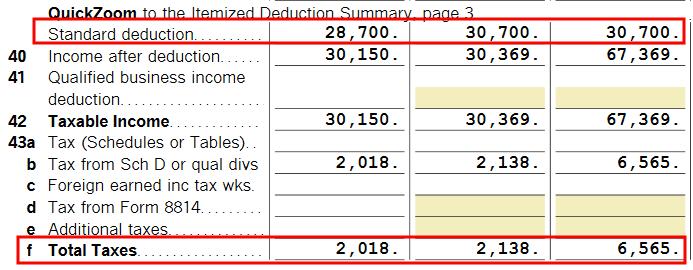

Scroll down further. The What-If Worksheet shows that converting $20,000 to Roth will increase the total tax from $2,138 in the baseline to $6,565. That’s a difference of $4,427, which translates into $4,427 / $20,000 = 22% average marginal tax rate on converting $20k.

Now you can decide whether paying a 22% tax to convert $20,000 is worth it. Do it if you think your future tax rate will be higher than 22%. Don’t do it if you think your future tax rate will be lower than 22%.

If you’d like to test another alternative, such as converting $50k, repeat the above to copy the baseline in Column 2 to Column 4 and increase the IRA withdrawal by $50k in Column 4. Calculate the difference in total tax and the average marginal tax rate when you convert $50k.

Case Study Spreadsheet

The Case Study Spreadsheet in the previous post shows the same effect for converting $20k in this same example.

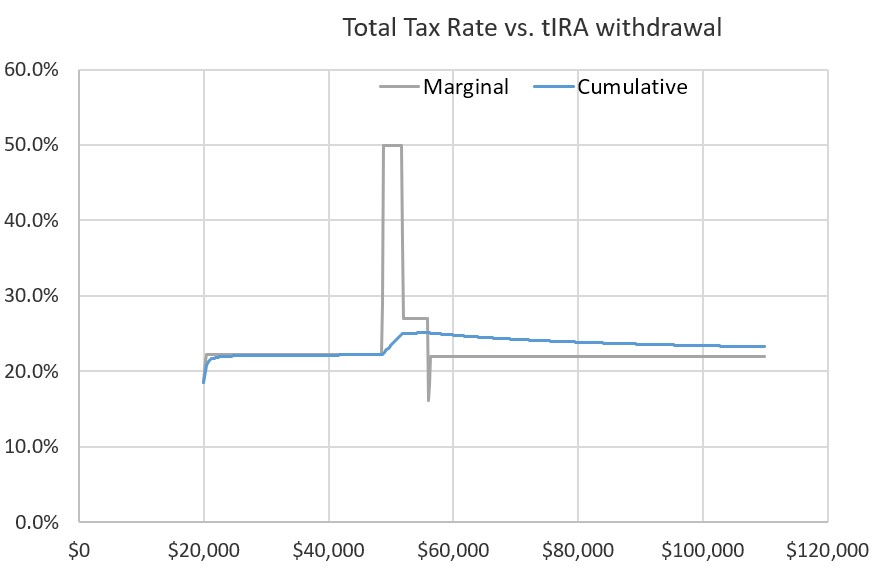

The chart from the Case Study Spreadsheet shows that increasing the IRA withdrawal from $20k to $40k produces a 22% marginal tax rate. It also shows that this same marginal tax rate continues before hitting a spike when the IRA withdrawal reaches $45k (converting $25k to Roth on top of a $20k withdrawal).

The What-If Worksheet in TurboTax doesn’t show the marginal tax rate directly. You have to calculate it yourself by dividing the difference in total tax by the conversion amount. Nor does it show the marginal tax rate for different conversion amounts in a chart. You don’t know where it may hit a spike. You’d have to do trial-and-error with different inputs: $20k is OK, what about $30k; $50k is too high, what about $40k, …

It also only shows the difference in federal income tax. It doesn’t include the effect on state income tax or Medicare IRMAA. The Case Study Worksheet includes both the state income tax and Medicare IRMAA.

The What-If Worksheet in TurboTax is easier to use though. TurboTax already has your tax data. You don’t have to find the right places to enter them in a spreadsheet. You don’t need to learn how to use a spreadsheet if that sounds intimidating.

Professional Software

I’ve heard great praise for a professional tax planning software called Holistiplan. Many financial advisors use it to do tax planning for their clients. I watched a demo of Holistiplan on YouTube:

Holistiplan uses the same technique as the What-If Worksheet in TurboTax.

- Copy data from the tax return for the previous year to the current year.

- Make known changes to create a baseline.

- Copy the baseline to an alternative scenario.

- Make changes to the alternative scenario and compare it with the baseline.

It also produces a chart of the marginal tax rate similar to the Case Study Spreadsheet.

If you go to a financial advisor for this type of planning, it may cost you $1,000 or more. You already have the What-If Worksheet in TurboTax downloaded software for tax planning estimates after you use TurboTax to file your taxes. It doesn’t show a chart or include the effect on state tax or Medicare IRMAA but it gets you 80% there. Use the Case Study Spreadsheet if you want to get close to 100%.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Paul says

Carefully examine any tax credits that are automatically populated on the what-if worksheet. They are usually incorrect. Also note that some credits are not available at all if Married Filing Separately.

Lou Petrovsky says

Two questions:

1. Is this feature available also on online TurboTax, or only on purchased TurboTax software?

2. Does the What-if module use updated federal income tax rates? It seems that software purchased before the 2023 tax rates were released would have to use either the 2022 rates or estimates for 2023, based perhaps on the rates provided by the IRS for computing 2023 estimated taxes per its Form 1040-ES instructions. And how about 2023 tax dates for the individual states?

MIKE says

Take a look at dinkytown.net 1040 calculator, it’s free and very easy to use, and is using 2023 rates.

I use’d it to determine my withholding when I worked and now my estimated payments since I retired.

it’s also easy to do what if’s for my roth conversions.

it doesn’t do states, but I found that I can take my federal taxes times 23% and get very close to my state tax.

you can’t use it to file your returns, but its very helpful in tax planning for the year.

Paul says

Lou, it’s not available on the online version of TurboTax. It uses the current filing year’s tax rates (currently 2022) and it doesn’t support state taxes.

Mikes says

Read the article, it has your answers.

Harry Sit says

It’s only available in the purchased software. It doesn’t consider state taxes.

Because the What-If Worksheet uses a completed tax return as the starting point, it only needs to receive the 2023 tax brackets by the time you’re done with 2022 taxes. The IRS announced the tax brackets for 2023 in October or early November 2022. If the software didn’t have the 2023 brackets in the initial release, there’s plenty of time to include the 2023 brackets in one of the weekly software updates.

MikeS says

Awesome write up, I’ve been wanting to check this out for sometime.

Paul says

Correction to my prior reply: There is an option to “Check box to use 2023 tax rates”

HKG says

This is an excellent tool — much better than what I have previously used for this purpose.

One question — when I check the box to use tax rates for 2023, does that also change the cutoff points for the brackets?

Thanks.

Harry Sit says

“Use 2023 tax rates” really means “use 2023 tax brackets” because tax rates themselves don’t change from 2022 to 2023. Only the brackets and the various phaseout limits change. As you see in the screenshot, checking the box changed the standard deduction between 2022 and 2023.

Ann B says

Awesome feature to know about…who knew?? Not me! Thanks!

Tony says

I think some AI blog tried to plagiarize your article.

[link redacted to prevent giving credit to the plagiarizer]

Harry Sit says

Thank you for telling me. I submitted an abuse report to the host of that website.

Richard says

Have you tried the TaxCaster App? Does not seem as sophisticated, but certainly helpful..

Harry Sit says

It works for simple estimates but it can’t be used for forward planning when it’s still on 2022 tax rates and brackets now well into 2023.

Richard says

Thank you.

Sharwin says

Does H&R Block have something similar?

Harry Sit says

Not that I know of.

Randy says

I’ve been working on estimates for 2024 (using TurboTax 2023), and the taxes calculated by the What-If worksheet are higher than I get with my own spreadsheet. I did update my spreadsheet with the 2024 income & capital gains tax brackets. I’m wondering if there’s a bug in TurboTax here. Has anyone else noticed this? In case it makes a difference, the couple of returns I’m forecasting (single and married filing jointly) calculate the tax using the qualified dividends & capital gains worksheet.

Thanks!

Lou Petrovsky says

The 2023 TurboTax (TT) software uses tax brackets not yet indexed for inflation for 2024, so if your spreadsheet includes the IRS’ published brackets for 2024, TT will show more tax. In addition, the 2023 TT program does not use the higher 2024 Taxable Income threshold for applying the 0% rate to long term capital gains and qualifying dividends.

Harry Sit says

It appears it’s using the correct 2024 brackets for regular income but it’s using the old (2023) brackets for qualified dividends and long-term capital gains ($89,250 versus $94,050 for 15%, married filing jointly, 1/2 for single). Subtract $720 from the worksheet number for married filing jointly if the taxable income is over $94,050.

Harry Sit says

Although the absolute tax number may be higher than it should be, the incremental tax between two alternatives is still correct when they’re both higher by the same amount.

CA Academic says

Thank you for this helpful article. I’m considering Roth conversions starting this year or next from my workplace 403b or 457b to either corresponding workplace Roth 403b or 457b, or to one of my Roth IRAs. Not being a TurboTax user, I’ve been researching software tools to aid planning for Roth conversions. I see Fidelity (https://www.fidelity.com/calculators-tools/roth-conversion-calculator/) and Schwab (https://www.schwab.com/ira/ira-calculators/roth-ira-conversion) both have basic calculators to aid in planning for Roth conversions. The Schwab one has a few more input options than the Fidelity one; I also like that it displays the marginal tax rate in its output. What is your opinion of these tools relative to what TurboTax and the Case Study Spreadsheet that you’ve written about offer?

Harry Sit says

The two calculators from Fidelity and Schwab have a different focus and they’re not that useful. They do a quick estimate of your current tax bracket or ask you to give it as an input. Then they ask you what your future tax bracket will be. You don’t really need a calculator if you know those two numbers. If your current tax bracket is 22% and your future tax bracket will be 24%, Roth conversion will win, no doubt about it. However, the estimated 22% number may not be accurate. Your current marginal tax rate may actually be 27% when your income includes long-term capital gains. Roth conversion doesn’t come out ahead in that case. Those two calculators can’t tell whether your current marginal tax rate is really 22% or 27%.

The TurboTax What-If Worksheet and the Case Study Spreadsheet help you calculate your current marginal tax rate by taking into account the composition of your income and phaseouts of tax deductions and tax credits. The calculated tax rate is much more accurate than a quick estimate of your current tax bracket. While the future tax bracket is always unknown, you want to start with an accurate assessment of the present.

CA Academic says

Thanks, Harry, this is super helpful. I’ll check out the Case Study Spreadsheet. Thanks for all you do!

MikeW says

Good article and comments from all. I have been using HRB tax software, and do an iterative process to stay under the 1.4x Standard for Single. This year (2024) I have inherited a traditional IRA (non-spouse), and I also want to do a Roth Conversion of my traditional IRA. Your IRMA Brackets are helpful, because I have relied on the annual letter from Social Security for the IRMAA Brackets, and SS has sent their letter by end of November, but not in 2024 – we’re still waiting.

Michael says

Harry, you say, “After you’re done with your previous year’s taxes, you use the What-If Worksheet to project your taxes for the current year.” So if I’m done using Turbo Tax ’23 for my ’23 taxes, I can then use the “What If” feature for projecting my ’24 taxes including the effects of a 2024 Trad. IRA rollover before year’s end. Am I thinking about this correctly?

Harry Sit says

That’s right. You use the What If Worksheet in TurboTax 2023 to project 2024. Follow the steps in this post. Copy 2023 to one column. Make known changes. Copy the new column again to another column. Now add your what-if’s.

Randy D says

Of course, now you can get TurboTax ’24. I don’t believe they ever fixed the What-If worksheet in ’23 which had the wrong capital gains brackets for 2024 estimates.

Kelly S says

This article was a huge help to me. Using the Turbo “What-If” saved me hours of work figuring out my ROTH conversion amount. Your detailed instructions were great – thanks!

Haseung Kao says

I no longer find this form in 2024 deluxe version. Is it hiding somewhere or did Turbotax remove it?

Randy says

I found it in my Deluxe by searching forms for “What-If” as usual.

Kelly S says

I also found it in my 2024 Deluxe. Forms/Open forms/search for “what-if”. I didn’t run any numbers, but my 2024 final figures were properly populated in the worksheet.

Haseung says

Thank you very much. I was able to find it by searching for it. It used to be listed on the left side under Forms in my return, but I can not see it any more.