I received an email from Vanguard notifying me of upcoming changes to its fee schedule. The one change that stands out for me is that Vanguard may charge $100 effective July 1, 2024, if I transfer an account to another broker unless I have $5 million with Vanguard.

I’ve been investing with Vanguard for over 25 years. I have had the feeling from some changes by Vanguard in recent years that I’m not as valued as before. This latest announcement finally pushed me to the inevitable. I submitted a request to transfer my account to Fidelity before the new fee takes effect.

If you’re thinking along the same lines, you should check a few things before you transfer your accounts out of Vanguard. I’m not suggesting that everyone should leave Vanguard. This guide is only for those who have already decided to transfer. It will make your transfer from Vanguard go more smoothly.

- 1. Do you have a taxable account at Vanguard?

- 2. Cost Basis Method Election in Taxable Account

- 3. Do you have Vanguard mutual funds?

- 4. Do your Vanguard mutual funds have ETF shares?

- 5. Prepare the Receiving Account

- 6. Wait for Everything to Settle

- 7. Save Cost Basis Details of Taxable Accounts

- 8. Save Account Number and Recent Statement

- 9. Request Transfer of Assets at the Receiving Firm

- 10. Verify Cost Basis in Taxable Account

- 11. Residual Sweep

- 12. 1099 Forms Next Year

1. Do you have a taxable account at Vanguard?

Tax-advantaged accounts, such as Traditional and Roth IRAs, can be transferred to another broker without tax consequences. The transfer doesn’t generate a 1099 form. It doesn’t count toward your annual contribution limit. Please skip to Step 3 if you only have tax-advantaged accounts at Vanguard.

Transferring a regular taxable brokerage account needs more careful attention.

2. Cost Basis Method Election in Taxable Account

If you have mutual funds (not stocks, ETFs, bonds, or brokered CDs) in a regular taxable brokerage account, you should first make sure the cost basis method of your holdings is set to Specific Identification (“SpecId”). The default cost basis method for mutual funds is Average Cost. Setting it to SpecId will transfer the cost basis of each tax lot when you transfer your account. It’ll help you minimize taxes when you sell in the future. If the cost basis method is still Average Cost when you transfer, only the average cost will transfer to your receiving broker, and you will lose your purchase history.

This only applies to taxable accounts. You don’t need to do anything with the cost basis method in tax-advantaged accounts.

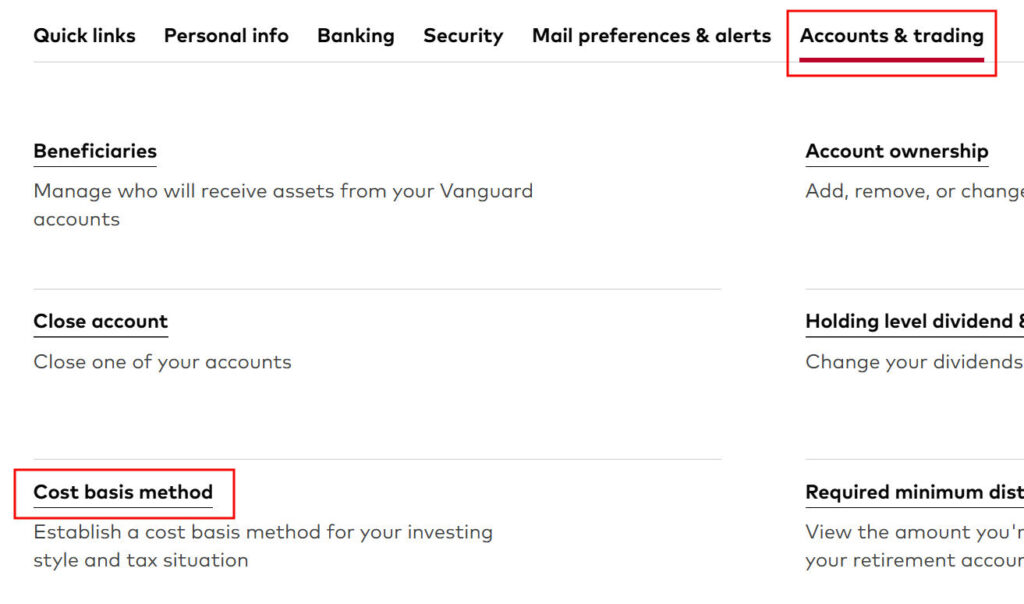

You can see or change your current setting in Profile & settings (the head icon) -> Accounts & trading tab -> Cost basis method.

The change may take a day or two to complete. Wait until it’s done before you continue.

3. Do you have Vanguard mutual funds?

Individual stocks, ETFs, bonds, and brokered CDs are all equally available at another broker. You can transfer these easily to another broker and hold, buy, or sell them at the new broker. Please skip to Step 5 if you only have individual stocks, ETFs, bonds, and brokered CDs in your Vanguard account.

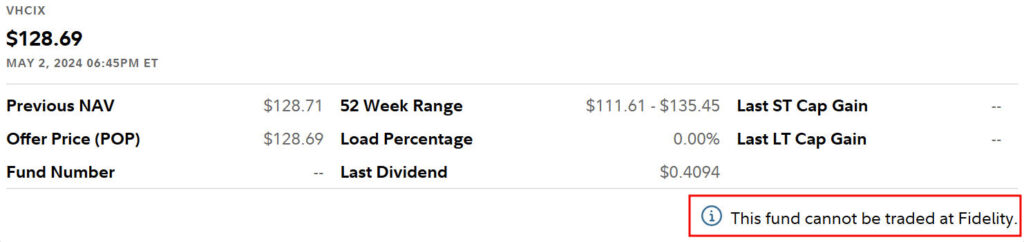

Not all Vanguard mutual funds can be held by all brokers outside of Vanguard. Please check with the receiving broker to see if they can accept your Vanguard mutual funds. For example, if you search for VHCIX (Vanguard Health Care Index Fund Admiral Shares) on Fidelity’s website, you’ll see a small note saying “This fund cannot be traded at Fidelity.”

As Steve noted in comment #34, having this note doesn’t mean that Fidelity can’t accept it in a transfer. One of my funds has this note, and it transferred successfully.

If your receiving broker can accept your Vanguard mutual funds, there’s usually no charge for holding existing shares or automatically reinvesting dividends, but you may have to pay a commission when you buy more shares of those funds. Fidelity and Charles Schwab don’t charge a commission for selling shares of Vanguard mutual funds you already own, but they do charge for buying additional shares outside of automatic dividend reinvestments. Some other brokers charge for both buying and selling.

I have Vanguard mutual funds but I’m not buying new shares in those funds. I will only hold, automatically reinvest dividends, and sell my existing shares over time. I won’t incur any fees when I hold my Vanguard mutual funds at Fidelity.

4. Do your Vanguard mutual funds have ETF shares?

If your receiving broker can’t accept your Vanguard mutual funds or if it can accept them but you want to buy more shares in the future besides automatically reinvesting dividends, see if your funds are also available as an ETF. Look up the fund on Vanguard’s website. If the fund is also available as an ETF, it will say so under the fund’s name.

You can convert most of these mutual funds to the equivalent ETF tax-free without a fee. Here’s how to do it online. After your funds are converted to ETFs, you can transfer the resulting ETFs to another broker and buy more shares of the ETFs at the new broker.

For example, Vanguard Health Care Index Fund Admiral Shares (VHCIX) is also available as Vanguard Health Care ETF (VHT). You can transfer the ETF and buy more shares after you convert VHCIX to VHT.

Converting to ETF is an option, but it isn’t always necessary when you can transfer the fund as-is. You can keep holding the Vanguard mutual funds and only reinvest dividends and sell at Fidelity or Schwab. If you need to buy more shares, buy an ETF or an alternative fund. You’ll have two holdings for the same asset class, but it’s not a big deal.

There’s a small risk that the cost basis will be messed up when you convert your mutual funds to ETFs in a taxable account. It shouldn’t happen, but you never know. I didn’t want to take that chance when I transferred a taxable account from Vanguard. I don’t mind only holding the Vanguard mutual funds, automatically reinvesting dividends, and selling without a commission at Fidelity. I just won’t buy new shares of those mutual funds.

This small risk of messing up the cost basis doesn’t apply to tax-advantaged accounts. I would convert eligible mutual funds to ETFs in a tax-advantaged account before I transfer.

If you decide to convert your mutual funds to ETFs in a regular taxable brokerage account, be sure to complete Step 2 before you start converting. If a mutual fund is still on the Average Cost method when it gets converted, the converted ETF will only have the average cost.

Some Vanguard funds aren’t available as an ETF. Four Vanguard funds have an equivalent ETF but they can’t be converted to the ETF:

- Vanguard Total Bond Market Index Fund (VBTLX)

- Vanguard Short-Term Bond Index Fund (VBIRX)

- Vanguard Intermediate-Term Bond Index Fund (VBILX)

- Vanguard Long-Term Bond Index Fund (VBLAX)

If you transfer your account, buying new shares of these funds will likely incur a commission at the new broker. You’ll have to find an alternative. Some Vanguard funds not available as ETFs are still the best in their class. For example, Vanguard money market funds and muni bond funds consistently have lower expenses and higher yields than similar Fidelity or Schwab funds. Some retirees also like Vanguard Wellington and Wellesley funds. Maybe you should keep your account at Vanguard if you plan to buy additional shares of those funds.

5. Prepare the Receiving Account

If you decide to transfer but you don’t already have an account of the same type at the receiving broker, it’s better to create one ahead of time and configure it to the correct settings. The account type should match (Traditional-to-Traditional, Roth-to-Roth, taxable-to-taxable). The account name should also match (individual-to-individual, joint-to-joint, trust-to-trust). If they don’t match, please fix them on either side first.

Some brokers pay a bonus for incoming transfers. You must sign up specifically for the bonus and have it coded to your account. I won’t transfer to a broker only for the bonus, but I’ll take the bonus if I already want to transfer to that broker and it happens to pay a bonus. Please ask your assigned rep at the receiving broker if you have one.

Dividend reinvestment and cost basis tracking method for your incoming transfer will follow the settings in the receiving account. Take a look and set them to your preference before your investments come in. The cost basis tracking method for mutual funds is set to Average Cost by default in a new account. Change it to Actual Cost, Identified Cost, or something to that effect, for better control over taxes in a taxable account. If you don’t change the setting away from Average Cost, the cost basis of your incoming funds may be recalculated to the average cost.

I automatically reinvest dividends and use the default cost basis method in tax-advantaged accounts. In a taxable account, I automatically send the dividends to the spending account and use Actual Cost for the cost basis and Fidelity’s Tax-Sensitive lot disposal method. Charles Schwab calls them Identified Cost and Tax Lot Optimizer.

Beneficiary settings in your Vanguard account won’t come over with the transfer. Set your beneficiaries in the receiving account before you transfer.

6. Wait for Everything to Settle

If you have recent transactions in your Vanguard account (money in, money out, trades, converting mutual funds to ETFs), you should wait for everything to settle before you transfer your account. It’s easier for everyone if you transfer when nothing is in the air.

Don’t sell your investments to cash before you transfer. Doing so in a taxable account will trigger capital gains and taxes. Selling in a tax-advantaged account will make you miss out on gains if the market happens to surge while you wait for the transfer. Fidelity and Schwab don’t charge for selling Vanguard mutual funds after your transfer is completed.

7. Save Cost Basis Details of Taxable Accounts

It’s important to keep the cost basis records accurate when you transfer a taxable account. You should save or print your cost basis details in your Vanguard account before you transfer. This doesn’t apply to tax-advantaged accounts.

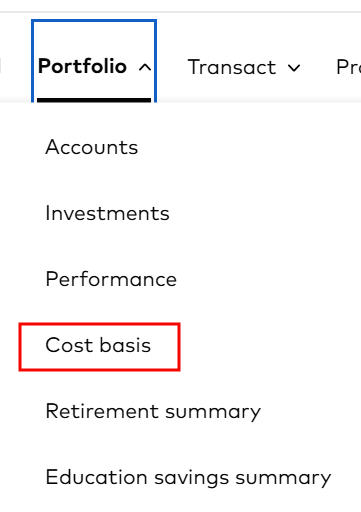

You see these details under Portfolio -> Cost basis.

Expand “Show lot details” under each holding. Save the page to a PDF or print it.

8. Save Account Number and Recent Statement

You’ll need to give your Vanguard account number and a recent statement when you transfer your account. The statements are under Activity -> Statements.

The statement doesn’t show your full account number. You need to copy your account number and save it separately.

9. Request Transfer of Assets at the Receiving Firm

You should initiate the transfer at the receiving firm. The process is usually online. It’s under Accounts & Trade -> Transfers and then “Move an account to Fidelity” in Fidelity. Look for something similar at other brokers.

You’ll be asked where you’re transferring from, the account number at the sending firm, what type of account it is, whether you’d like to transfer everything in the account or only part of it, which account you’re transferring into, and to attach a recent account statement of the source account.

If you’re asked whether you’d like to transfer in-kind or sell and transfer cash, make sure to choose in-kind. In-kind means transferring each holding as-is without any change. Only transferring in-kind won’t trigger taxes in a taxable account.

The transfer usually takes a week or sooner to complete. My transfer completed in four business days.

Many places send an alert when you log in from an “unknown device” these days, but I heard nothing from Vanguard when my entire account went out the door. Vanguard didn’t send any confirmation or alert when they received the transfer request to prevent fraud. Nor did they send any warm-hearted parting message to possibly welcome me back in the future, or any exit survey to ask where they could’ve done better. It shattered all my illusions that I was a valued customer/owner.

10. Verify Cost Basis in Taxable Account

If the transfer is successful, the holdings will come over first without the cost basis details. That’s normal. Vanguard will send the cost basis details in one to two weeks. You should verify the cost basis details against the records you saved in Step 7.

11. Residual Sweep

If you do a full account transfer and your investments pay dividends or interest during or after the transfer, the dividends and interest may still go into your old account. There will be another automatic sweep to transfer any residual amounts. You don’t have to initiate it. It will come over in a few weeks.

12. 1099 Forms Next Year

Your Vanguard login still works after you transfer your account. You’ll still get the 1099 forms next year from Vanguard for any activities that happened before the transfer. Set a calendar reminder to download the 1099 forms from Vanguard next year.

***

Transferring a Vanguard account isn’t difficult, but it requires some planning, especially when you’re transferring a taxable account with mutual funds. Sometimes it’s better not to transfer. The most important parts are not to sell anything and trigger taxes, and to preserve the cost basis records for individual lots in taxable accounts.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

June says

Does vanguard list the closing charge on the last statement of the account you transferred and closed?

Harry Sit says

I transferred before Vanguard started charging the fee. I imagine they do list it on the last statement. All activities must be accounted for on the statement.

Sally says

Can I do a partial or percent-of-holdings transfer, in kind, out of Vanguard? For example can I transfer 95% and keep 5 % in Vanguard? This is for a rollover 401K account.

Harry Sit says

You can transfer partially by specifying which positions and how many shares, not by percentage.

Krutar J says

Hi Harry – I followed the steps above last year to do an in-kind asset transfer of IRA and non-IRA brokerage accounts. Everything went well. Thanks.

One question though: Does this transfer trigger a 1099-R from Vanguard? I do not see anything when I log into my old/closed Vanguard accounts. Do I need to call Vanguard to confirm if there was a 1099-R or not?

Thanks!

Harry Sit says

It doesn’t trigger a 1099-R. Money stayed in the same account type. No distribution occurred.

Barry Northrop says

Per a Vanguard FAQ on its Cost Basis page, “any investments still set to SpecID as a preferred cost basis method on August 1, 2025, will be transitioned to the first in, first out (FIFO) method. Open orders won’t be affected. If you’ve selected SpecID as your preferred cost basis method for any investments, we ask that you switch them to another method before August 1, 2025.” Also, a Vanguard rep informed me that converting an OEF to ETF “may lock the basis of any shares converted into the average cost method.” Use of the word “may” does not instill confidence.

Harry Sit says

Wow, if they don’t want to support SpecID anymore, at least transition it to Highest In First Out (HIFO) or Minimum Tax (MinTax). FIFO usually is the worst.

Vincent says

Harry, can I do a partial transfer in-kind to Fidelity and move only a few selected stocks and ETFs rather than close my entire Vanguard Brokerage Account? Could I incur any fees from Vanguard or Fidelity by doing so?

Thanks

Harry Sit says

Yes, you can do partial transfers. I don’t think Vanguard charges for a partial transfer but you should verify with Vanguard. I don’t have an account with Vanguard anymore and they don’t send me policy updates. Fidelity doesn’t charge.

ak says

Hi Harry

I know you are referring to vanguard to fidelity in the above thread, but I was planning to move some funds from an old advisor investment setup at northwest mutual to fidelity. These are mostly american (capital group) mutual funds and one other stinker. I cannot seem to be able to change the cost basis reporting on their site. Are my choices only to request NWM to make that back end change knowing that they will have no interest in helping me given i am moving out funds to fidelity? The advisor wants to have a meeting which i do not care for and now has started talking about SMS investing etc.

Also i plan to save or screenshot all tax lots from their site while I still have an account. Having that can i email fidelity after the transfer to adjust the cost basis or do they expect i would need to do it manually? Thank you for your time!