I received an email from Vanguard notifying me of upcoming changes to its fee schedule. The one change that stands out for me is that Vanguard may charge $100 effective July 1, 2024, if I transfer an account to another broker unless I have $5 million with Vanguard.

I’ve been investing with Vanguard for over 25 years. I have had the feeling from some changes by Vanguard in recent years that I’m not as valued as before. This latest announcement finally pushed me to the inevitable. I submitted a request to transfer my account to Fidelity before the new fee takes effect.

If you’re thinking along the same lines, you should check a few things before you transfer your accounts out of Vanguard. I’m not suggesting that everyone should leave Vanguard. This guide is only for those who have already decided to transfer. It will make your transfer from Vanguard go more smoothly.

- 1. Do you have a taxable account at Vanguard?

- 2. Cost Basis Method Election in Taxable Account

- 3. Do you have Vanguard mutual funds?

- 4. Do your Vanguard mutual funds have ETF shares?

- 5. Prepare the Receiving Account

- 6. Wait for Everything to Settle

- 7. Save Cost Basis Details of Taxable Accounts

- 8. Save Account Number and Recent Statement

- 9. Request Transfer of Assets at the Receiving Firm

- 10. Verify Cost Basis in Taxable Account

- 11. Residual Sweep

- 12. 1099 Forms Next Year

1. Do you have a taxable account at Vanguard?

Tax-advantaged accounts, such as Traditional and Roth IRAs, can be transferred to another broker without tax consequences. The transfer doesn’t generate a 1099 form. It doesn’t count toward your annual contribution limit. Please skip to Step 3 if you only have tax-advantaged accounts at Vanguard.

Transferring a regular taxable brokerage account needs more careful attention.

2. Cost Basis Method Election in Taxable Account

If you have mutual funds (not stocks, ETFs, bonds, or brokered CDs) in a regular taxable brokerage account, you should first make sure the cost basis method of your holdings is set to Specific Identification (“SpecId”). The default cost basis method for mutual funds is Average Cost. Setting it to SpecId will transfer the cost basis of each tax lot when you transfer your account. It’ll help you minimize taxes when you sell in the future. If the cost basis method is still Average Cost when you transfer, only the average cost will transfer to your receiving broker, and you will lose your purchase history.

This only applies to taxable accounts. You don’t need to do anything with the cost basis method in tax-advantaged accounts.

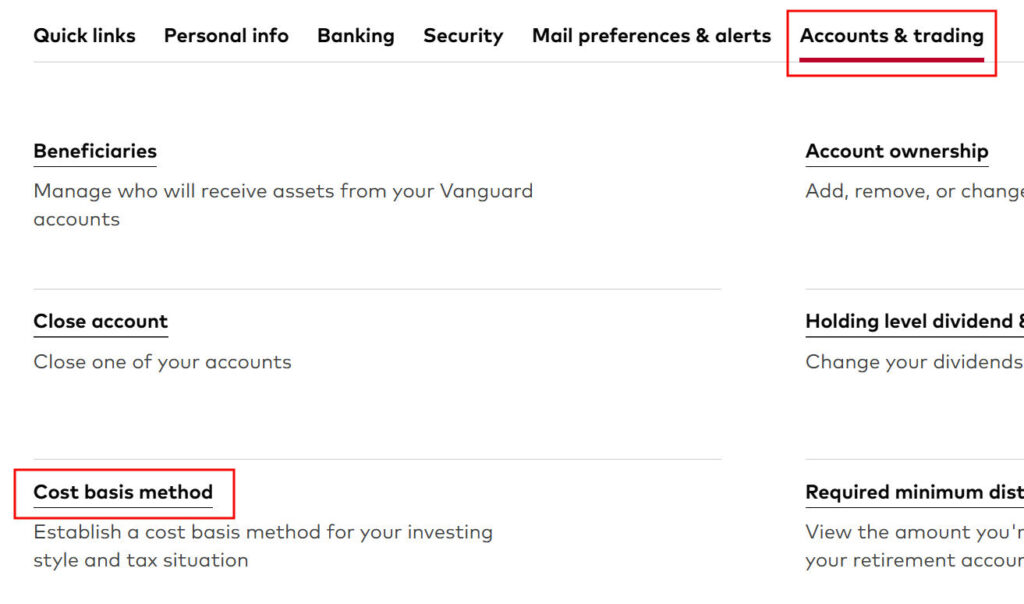

You can see or change your current setting in Profile & settings (the head icon) -> Accounts & trading tab -> Cost basis method.

The change may take a day or two to complete. Wait until it’s done before you continue.

3. Do you have Vanguard mutual funds?

Individual stocks, ETFs, bonds, and brokered CDs are all equally available at another broker. You can transfer these easily to another broker and hold, buy, or sell them at the new broker. Please skip to Step 5 if you only have individual stocks, ETFs, bonds, and brokered CDs in your Vanguard account.

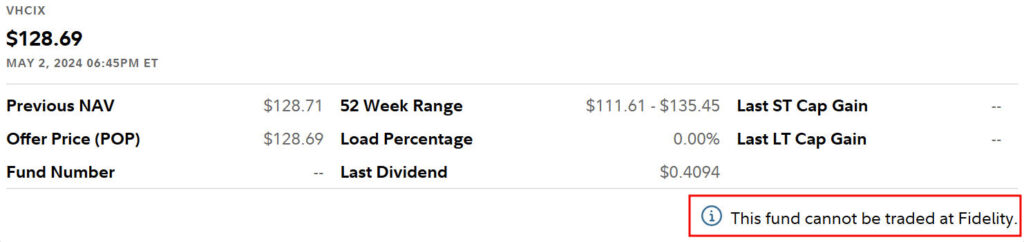

Not all Vanguard mutual funds can be held by all brokers outside of Vanguard. Please check with the receiving broker to see if they can accept your Vanguard mutual funds. For example, if you search for VHCIX (Vanguard Health Care Index Fund Admiral Shares) on Fidelity’s website, you’ll see a small note saying “This fund cannot be traded at Fidelity.”

As Steve noted in comment #34, having this note doesn’t mean that Fidelity can’t accept it in a transfer. One of my funds has this note, and it transferred successfully.

If your receiving broker can accept your Vanguard mutual funds, there’s usually no charge for holding existing shares or automatically reinvesting dividends, but you may have to pay a commission when you buy more shares of those funds. Fidelity and Charles Schwab don’t charge a commission for selling shares of Vanguard mutual funds you already own, but they do charge for buying additional shares outside of automatic dividend reinvestments. Some other brokers charge for both buying and selling.

I have Vanguard mutual funds but I’m not buying new shares in those funds. I will only hold, automatically reinvest dividends, and sell my existing shares over time. I won’t incur any fees when I hold my Vanguard mutual funds at Fidelity.

4. Do your Vanguard mutual funds have ETF shares?

If your receiving broker can’t accept your Vanguard mutual funds or if it can accept them but you want to buy more shares in the future besides automatically reinvesting dividends, see if your funds are also available as an ETF. Look up the fund on Vanguard’s website. If the fund is also available as an ETF, it will say so under the fund’s name.

You can convert most of these mutual funds to the equivalent ETF tax-free without a fee. Here’s how to do it online. After your funds are converted to ETFs, you can transfer the resulting ETFs to another broker and buy more shares of the ETFs at the new broker.

For example, Vanguard Health Care Index Fund Admiral Shares (VHCIX) is also available as Vanguard Health Care ETF (VHT). You can transfer the ETF and buy more shares after you convert VHCIX to VHT.

Converting to ETF is an option, but it isn’t always necessary when you can transfer the fund as-is. You can keep holding the Vanguard mutual funds and only reinvest dividends and sell at Fidelity or Schwab. If you need to buy more shares, buy an ETF or an alternative fund. You’ll have two holdings for the same asset class, but it’s not a big deal.

There’s a small risk that the cost basis will be messed up when you convert your mutual funds to ETFs in a taxable account. It shouldn’t happen, but you never know. I didn’t want to take that chance when I transferred a taxable account from Vanguard. I don’t mind only holding the Vanguard mutual funds, automatically reinvesting dividends, and selling without a commission at Fidelity. I just won’t buy new shares of those mutual funds.

This small risk of messing up the cost basis doesn’t apply to tax-advantaged accounts. I would convert eligible mutual funds to ETFs in a tax-advantaged account before I transfer.

If you decide to convert your mutual funds to ETFs in a regular taxable brokerage account, be sure to complete Step 2 before you start converting. If a mutual fund is still on the Average Cost method when it gets converted, the converted ETF will only have the average cost.

Some Vanguard funds aren’t available as an ETF. Four Vanguard funds have an equivalent ETF but they can’t be converted to the ETF:

- Vanguard Total Bond Market Index Fund (VBTLX)

- Vanguard Short-Term Bond Index Fund (VBIRX)

- Vanguard Intermediate-Term Bond Index Fund (VBILX)

- Vanguard Long-Term Bond Index Fund (VBLAX)

If you transfer your account, buying new shares of these funds will likely incur a commission at the new broker. You’ll have to find an alternative. Some Vanguard funds not available as ETFs are still the best in their class. For example, Vanguard money market funds and muni bond funds consistently have lower expenses and higher yields than similar Fidelity or Schwab funds. Some retirees also like Vanguard Wellington and Wellesley funds. Maybe you should keep your account at Vanguard if you plan to buy additional shares of those funds.

5. Prepare the Receiving Account

If you decide to transfer but you don’t already have an account of the same type at the receiving broker, it’s better to create one ahead of time and configure it to the correct settings. The account type should match (Traditional-to-Traditional, Roth-to-Roth, taxable-to-taxable). The account name should also match (individual-to-individual, joint-to-joint, trust-to-trust). If they don’t match, please fix them on either side first.

Some brokers pay a bonus for incoming transfers. You must sign up specifically for the bonus and have it coded to your account. I won’t transfer to a broker only for the bonus, but I’ll take the bonus if I already want to transfer to that broker and it happens to pay a bonus. Please ask your assigned rep at the receiving broker if you have one.

Dividend reinvestment and cost basis tracking method for your incoming transfer will follow the settings in the receiving account. Take a look and set them to your preference before your investments come in. The cost basis tracking method for mutual funds is set to Average Cost by default in a new account. Change it to Actual Cost, Identified Cost, or something to that effect, for better control over taxes in a taxable account. If you don’t change the setting away from Average Cost, the cost basis of your incoming funds may be recalculated to the average cost.

I automatically reinvest dividends and use the default cost basis method in tax-advantaged accounts. In a taxable account, I automatically send the dividends to the spending account and use Actual Cost for the cost basis and Fidelity’s Tax-Sensitive lot disposal method. Charles Schwab calls them Identified Cost and Tax Lot Optimizer.

Beneficiary settings in your Vanguard account won’t come over with the transfer. Set your beneficiaries in the receiving account before you transfer.

6. Wait for Everything to Settle

If you have recent transactions in your Vanguard account (money in, money out, trades, converting mutual funds to ETFs), you should wait for everything to settle before you transfer your account. It’s easier for everyone if you transfer when nothing is in the air.

Don’t sell your investments to cash before you transfer. Doing so in a taxable account will trigger capital gains and taxes. Selling in a tax-advantaged account will make you miss out on gains if the market happens to surge while you wait for the transfer. Fidelity and Schwab don’t charge for selling Vanguard mutual funds after your transfer is completed.

7. Save Cost Basis Details of Taxable Accounts

It’s important to keep the cost basis records accurate when you transfer a taxable account. You should save or print your cost basis details in your Vanguard account before you transfer. This doesn’t apply to tax-advantaged accounts.

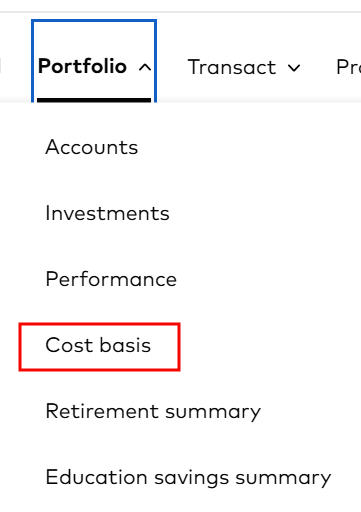

You see these details under Portfolio -> Cost basis.

Expand “Show lot details” under each holding. Save the page to a PDF or print it.

8. Save Account Number and Recent Statement

You’ll need to give your Vanguard account number and a recent statement when you transfer your account. The statements are under Activity -> Statements.

The statement doesn’t show your full account number. You need to copy your account number and save it separately.

9. Request Transfer of Assets at the Receiving Firm

You should initiate the transfer at the receiving firm. The process is usually online. It’s under Accounts & Trade -> Transfers and then “Move an account to Fidelity” in Fidelity. Look for something similar at other brokers.

You’ll be asked where you’re transferring from, the account number at the sending firm, what type of account it is, whether you’d like to transfer everything in the account or only part of it, which account you’re transferring into, and to attach a recent account statement of the source account.

If you’re asked whether you’d like to transfer in-kind or sell and transfer cash, make sure to choose in-kind. In-kind means transferring each holding as-is without any change. Only transferring in-kind won’t trigger taxes in a taxable account.

The transfer usually takes a week or sooner to complete. My transfer completed in four business days.

Many places send an alert when you log in from an “unknown device” these days, but I heard nothing from Vanguard when my entire account went out the door. Vanguard didn’t send any confirmation or alert when they received the transfer request to prevent fraud. Nor did they send any warm-hearted parting message to possibly welcome me back in the future, or any exit survey to ask where they could’ve done better. It shattered all my illusions that I was a valued customer/owner.

10. Verify Cost Basis in Taxable Account

If the transfer is successful, the holdings will come over first without the cost basis details. That’s normal. Vanguard will send the cost basis details in one to two weeks. You should verify the cost basis details against the records you saved in Step 7.

11. Residual Sweep

If you do a full account transfer and your investments pay dividends or interest during or after the transfer, the dividends and interest may still go into your old account. There will be another automatic sweep to transfer any residual amounts. You don’t have to initiate it. It will come over in a few weeks.

12. 1099 Forms Next Year

Your Vanguard login still works after you transfer your account. You’ll still get the 1099 forms next year from Vanguard for any activities that happened before the transfer. Set a calendar reminder to download the 1099 forms from Vanguard next year.

***

Transferring a Vanguard account isn’t difficult, but it requires some planning, especially when you’re transferring a taxable account with mutual funds. Sometimes it’s better not to transfer. The most important parts are not to sell anything and trigger taxes, and to preserve the cost basis records for individual lots in taxable accounts.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

KRB says

Thank you for your post. I transferred out last year and #2 got me. Everything since 2012 was in average cost basis instead of specific. I tried multiple calls etc to change it with no luck (even though I have the transaction statements with actual price). It will cost me thousands of lost dollars in Cap Gains taxes. Read and pay head to the wise advice above.

billy says

Ya, I also didn’t change the cost basis method in the taxable before I transferred out, but in retirement years if my income stays more or less the same, there should not be any value in choosing specific ID, and would simply things when I do my taxes with average cost. I can see if you want to sell during your working years, and plan to have lower income in your retirement years, then I can see the value with specific ID, unless I’m missing something?

Harry Sit says

Choosing specific ID gives you more control over taxes. Whether such control is more or less useful to someone varies from person to person and from year to year for the same person.

Craig says

I had no idea the cost basis setting would influence how cost basis is transferred to another brokerage. I already had everything set to SpecID, but good to know anyway.

I also didn’t realize Fidelity doesn’t charge a fee for selling Vanguard mutual funds, only for new purchases. That certainly makes transferring easier.

Lori says

Same. #4 / Converting MF to their etf equivalent tax free was also new to me and I’ll definitely give Vanguard a call for the MF that qualify.

Ouzel says

Thanks for this. I’m not planning to leave Vanguard yet, but I’ve bookmarked your post to re-read when and if I do.

DK31579 says

Keep in mind that if you transfer out after July 1, you “may” be hit with a $100 transfer out/account closure fee…part of the new fee structure at Vanguard after July 1.

sharon royal says

I wish you had written this article before I transferred my taxable account from Vanguard. Oh, well. I saw the new commission changes from Vanguard, too, and all it did was make me think I need to stop procrastinating and get the IRA account transferred, too. Vanguard’s brokerage service is so awful. I’m surprised I put up with it for decades, but they finally added the straw that broke the camel’s back a few months ago.

Mark says

Although I had a Vanguard account some years ago, I had such problems simply getting into the website recently, I vowed not to go with them again.

S Tx says

I transferred an account from Fidelity to Schwab to allow an advisor to manage it for me. I was charged a fee by Schwab for closing the account. I requested Fidelity reimburse me – they did. I recently moved funds to Schwab from Fidelity and didn’t want to encounter a fee, so transferred assets in kind, but left a small amt of cash – no fee seen.

Harry Sit says

Charles Schwab charges $50 for a full transfer. Fidelity doesn’t charge. You can close your Fidelity account without a fee if you don’t want it lingering.

RobI says

What about moving Vanguard money market funds like VMFXX or VUSXX? Seems like there is always 0.3% lower div rate in Fidelity equivalent funds. Not worth moving in terms of annual income lost if you have more than about $33k in Mmkt funds.

For me at least I’m happy and sticking with Vanguard, but still use Fidelity for cash and credit card.

Harry Sit says

Those funds are still the best in class. Don’t move if you keep a lot of cash in money market funds. Automatically rolling T-Bills is an alternative at Fidelity.

Trooper says

Thanks for this post, Harry; you clearly read Vanguard’s fee letter more closely than I did 🙂

I too have been a long-time VG customer and while this is only a $100 issue, it may be a sign of more bad things to come.

Question: I have a T-Bill ladder at Vanguard, the last rung of which matures in November of this year. It seems like it would be best to wait until then to transfer those funds? Or will T-Bills transfer easily prior to maturity?

Harry Sit says

The T-Bill ladder should transfer just fine if you don’t have T-Bills maturing during the expected 1-week window for the transfer. The bills will still mature on their scheduled dates in the receiving account.

shelly says

My call to Vanguard regarding whether transfers must be initiated or completed prior to July 1st to avoid the fee yielded a nearly 60 minutes on hold. It seems to the front line customers service teams and their management were not given documentation that provided this detail. The “consensus” was that the transfer must be completed by July 1st to avoid fees as that is industry standard.

billy says

I don’t know about industry standard verbiage, seems like a Comcast fee. I would just secure message them in the future when you can by choosing upload documents.

Nikki Stark says

I got so fed up with the terrible customer service and occasional website / bank transfer problems at Vanguard that I moved everything to Fidelity 2 years ago. I wish this excellent and detailed guide would have been available back then, but I did my research and completed most of the steps in this article. I initiated the transfer at Fidelity and everything moved without any problems.

I have been so much happier with Fidelity and am glad I went through the process to move. Fidelity has excellent customer service and I have not encountered any issues with bank transfers or other problems that I had encountered at Vanguard.

I still wanted to use Vanguard’s funds, which are better than anything else in my opinion, but it was easy to convert to the ETFs. So now I have the best of both worlds using Vanguards ETFs on Fidelity’s superior platform. It is true that Vanguard has slightly better yields on their money market funds than Fidelity, but the amount is negligible to me when I consider how frustrated I had gotten with Vanguard and how happy I have been with Fidelity.

If you are thinking about moving, I don’t think you will regret it!

Bob says

I can resonate with your comment regarding your feeling of being less wanted as a customer. My sense is that the value of your holdings isnt as significant with Vanguard as it used to be. That is they want investment management fees!

The web site and ios APP is a disaster! Someobdy must have had glossy 8x10s on someone as what was there before was working fine!

A blog post regarding Vanguard in general might be useful to your followers

Jim says

Thank you for this timely and useful article. Do you know if I need to do anything special to transfer a taxable account that is titled to a revocable trust? Also, do IRA beneficiaries transfer over?

Harry Sit says

You’ll need an account titled to the same revocable trust at the receiving firm. If you don’t have one already, you need to show trust summary documentation to open one.

IRA beneficiaries don’t transfer over. They go by the beneficiary setup in the receiving account. Thank you for bringing this up. I’ll add this good point to the post.

calwatch says

Definitely the $100 looks like the straw that broke the camel’s back which is going to lead to lots of AUM flowing out. Granted, they may still be with Vanguard ETFs or mutual funds, but not being on the Vanguard platform means less availability to sell the Personal Advisor services or other value added products. The $100 is higher than almost all brokers, and above the usual $75 reimbursement that brokers like E*Trade, Fidelity, and SoFi offer.

Craig says

I don’t mind the transfer fee (though $100 seems a little steep), but it’s also described as an account closure fee which bugs me. Someday when I (or my beneficiary) is closing my accounts it annoys me to think of paying $100 on the way out. It also says “may be charged” with no further explanation.

billy says

Ya, $100 account closure fee is a step too far. But this is what I dug up below,

EMAIL

“July 1st account closure and transfer fee: A $100 processing fee may be charged for account closure >>>or<<< transfer of account assets to another firm.

Vanguard Brokerage's ability to close accounts, including low balance accounts with no activity."

VG said in I/M today, "No account closure fee if you close your account yourself online (not ACATS) and If you have less than $1,000,000 it's considered low balance, but won't auto close account."

What there saying and what they just emailed seems contradictory, may be Harry can do some more digging?

Vincent says

Great article, Harry. Thanks for the guidance.

I’ve been with Vanguard for almost 3 decades. They used to have great customer service, dedicated financial planners, free and helpful advice, and many perks for Flagship Members. Unfortunately, Vanguard is less helpful now and seems mostly interested in selling advisor services.

Leaving Vanguard seems like the right move for many reasons but my confidence level in Vanguard to make a seamless transfer is very low.

Perhaps it is best to take my RMD for 2024 before making the switch and then simply move all accounts.

Will covered and non-covered shares of individual stocks in my Taxable Brokerage Account transfer properly?

Don Goldberg says

All this to avoid a $100 fee sometime in the future? I don’t get it.

Trooper says

My wife and I each have a Traditional IRA and a Roth IRA, a jointly held taxable account, she has an inherited IRA and I have a 401(k) rollover IRA with Vanguard. That’s $700.

Harry Sit says

I’m not suggesting that everyone should leave. This guide is only for those who already decided to leave for one reason or another. I’ve had reasons to leave for some time but I kept one account for nostalgia from the Jack Bogle days. This latest announcement only finally brought clarity to me that I should leave. Everyone else should make their own decisions. Many should stay.

Steve says

Great article! All of my taxable investments at Vanguard are in mutual fund accounts that I re-balance as necessary. When re-balancing I will be selling shares from one Vanguard fund and purchasing shares in another Vanguard fund. To avoid paying purchase fees in the future to Fidelity, I will need to convert to ETFs before leaving Vanguard. Are there any down sides to owning the equivalent Vanguard ETF shares? Also, if Vanguard messes up the cost basis during the ETF conversion, will it be difficult it to make the correction? Thank you!

Harry Sit says

Converting to ETF is an option but it isn’t absolutely necessary. You can keep the Vanguard mutual funds and only reinvest dividends and sell. If you need to buy for rebalancing, buy an ETF or a Fidelity index fund. The downside is you’ll have two holdings for the same asset class but I don’t see it as a big deal. I didn’t convert to ETF because I wanted to avoid any chance to mess up the cost basis in my taxable account.

The cost basis shouldn’t be messed up during the ETF conversion but you never know whenever there’s a change. I don’t know how easy or difficult it is to correct the problems. I only didn’t want the extra work in the slightest chance it happened.

Converting to ETF works fine in tax-advantaged accounts. No downside in owning the equivalent Vanguard ETF shares. Vanguard uses ETF shares for many of its advisor clients.

Rick says

Not all Vanguard funds can be transferred (such as the MM funds already discussed). Many (most?) can, but you should verify by searching on Fidelity site using “fund family = Vanguard”. There are over 100 that are supported.

Harry Sit says

That’s a good point. I see it’s quicker by searching for the symbol in the quote box on the top on Fidelity’s website. If a fund can’t be transferred, it has a note saying “This fund cannot be traded at Fidelity.” If a full research page comes up, it means the fund can be transferred.

John says

I think you can change the cost basis when filing tax.

KevG says

The $100 closeout fee is annoying. What I am more concerned with is that there is a charge of 1% for foreign dividends paid in dollars. In my case it is only 40 to 50 bucks a year, but it is also growing. Do I just sell my foreign dividend payers or pay the fee. Tough call.

Jeff Mason says

I’ve heard that Fidelity will reimburse the $100 transfer fee. At Vanguard I’ve got 4 accounts (brokerage, SEP, tIRA and Roth). Would Vanguard charge $100 for EACH of these accounts? If so, would Fidelity reimburse the full amount? If they will, might it be a good idea to hold off on transferring for a while, to allow the dust to settle, and for Vanguard to possibly reverse their decision?

(FYI, we also have accounts at Fidelity [Individual, Roth, SIMPLE, credit card], and have been considering consolidating at some point. This may be the right time.)

Harry Sit says

Yes, the transfer fee is charged per account (per transfer if you do a partial transfer). Fidelity’s transfer fee reimbursement policy isn’t officially published. Anecdotally I heard that the fee reimbursement requires a minimum $25k transfer and there may be a cap of either $50 or $75 per account. There might be an annual cap too. You’ll have to request the reimbursement after the transfer. It isn’t automatically granted.

Mark Caspary says

In the article it was mentioned that some firms pay a bonus if you transfer to them, does anyone know if Fidelity pays this bonus?

Harry Sit says

I heard Fidelity pays a bonus if you transfer a large amount. Please call Fidelity and ask for “Investment Solutions” at the voice prompt if you’re thinking of transferring a large amount. Fidelity doesn’t say publicly how large is large and how much they pay.

Mary says

Again, Thanks you so much.I always find your blogs very useful. I follow you and have my email submitted. 1 question, pls.

How do you do your cost basis on a “date acquired, various, non-covered and covered shares”? I want to change to SpecID, but come up to this message:

Important information about changing cost basis methods

For covered shares, that are subsequently sold, Vanguard will maintain cost basis information and report it to you and the IRS.

For noncovered shares of mutual funds that are subsequently sold, we’re only able to provide average cost information because we won’t know which cost basis method you used in the past or which tax lots remain in your account.

Be sure you have accurate cost basis records for your noncovered shares because you’ll be responsible for reporting to the IRS any gains and losses on sales of these shares.

Close

Continue

Harry Sit says

Non-covered shares were shares bought before January 1, 2012. If you have shares going back that long ago, this is the best you can do unless you have kept meticulous records for each purchase and sale. It would be the same if you stay at Vanguard. Vanguard will only report average cost for non-covered shares. By changing to SpecID, at least you’ll have more control over covered shares bought after January 1, 2012.

GMShedd says

Thanks for the alert, Harry. I missed this announcement. Like you, I’ve noted a decline in the customer service side at Vanguard, and it has caused me to move several accounts to Fidelity already. Now may be time to move the remaining accounts, some of which I’ve had for over 30 years. The difference in CS was dramatic. Fidelity had people call me to help make the transition go smoothly, and not just low-level people, but people who actually knew what they were talking about. At Vanguard I had a mixed bag–but even those who were good were unable to cut through any of the processes that Vanguard imposes on them. They are essentially the humans who are the customer interface for inflexible (i.e., poorly-written) software that runs the show. At least that’s my take on the situation. Thanks again.

Kay says

Harry, thank you for this article. Could you clarify one thing, please? If I move my Vanguard taxable acct which had been reinvesting dividends, to Fidelity, will the total amount be transferred? Or only complete shares transferred and partial shares sold? Thanks again!

Harry Sit says

It depends on what you have in your account. Partial shares of mutual funds get transferred intact. Partial shares of individual stocks and ETFs are typically sold and only the whole shares are transferred. For example, If you bought 1.9, 2.8, and 3.4 shares through reinvesting dividends, they add up to 8.1 shares. 8 shares will be transferred and only 0.1 shares will be sold.

Dawl says

“I have had the feeling from some changes by Vanguard in recent years that I’m not as valued as before.”

Hope you don’t mind the follow-up question, but in what other ways did Vanguard recently make you feel that you were not as valued?

Harry Sit says

For one, labeling my account “self-managed” as passive aggressive in-your-face shaming for not signing up for their advisory service. All brokerage account customers should be assumed to be self-managing. They don’t need to be labeled. That’s how Vanguard started, by serving customers who self-managed their investments. Now these customers are seen as second class citizens.

Ouzel says

I agree. I don’t like “self-managed” and every time I login to Vanguard I get an ad for their advisory service. I feel they want to get rid of the DIY investors. I’ve been following the comments here and on bogleheads.org, and I’ve decided to move my tIRA, Roth, and taxable accounts to Fidelity before the end of June.

P.S. I bought your book on Amazon for a young relative. It’s very clear and well organized.

Steve says

In addition to the poor customer service at Vanguard, I am unhappy with its ESG meddling. Vanguard is a major participant in the ESG arena. It uses its significant voting power to force corporations to adhere to standards that depress profits. But, does leaving Vanguard while continuing to invest in Vanguard funds have a meaningful impact on its ESG activity?

Harry Sit says

The proxy votes are done by the funds. Holding the same funds at a different broker doesn’t make any difference. Vanguard started letting fund investors vote on the corporate issues in some of their funds.

https://corporate.vanguard.com/content/corporatesite/us/en/corp/articles/expanding-proxy-voting-choice.html

Kurt Y says

This article is amazing in its detail and how it fits my situation (and others as the comments have shown). I’ve never specified my cost basis method and so Average Cost is my default. I’ve owned these funds individually before I was forced by Vanguard to move them to a brokerage account or incur fees. Each holding’s cost basis defaults to Average Cost (although I haven’t specified any) and only shows one or two lots — covered and noncovered (if it is a fund I’ve held for a long time it has noncovered shares).

1. Are you saying, when I set the cost basis method to Specific Identification, that it will then show all individual buy/sells of the covered lot?

2. If the setting will now show each transaction, but I intend to keep it simple and use Average Cost when I sell later at the other brokerage, would there still be an advantage to setting Specific Identification beyond being able to change my mind later?

3. In one holding, I’ve previously sold shares. For my taxes, I used the Average Cost method. Since I can’t switch methods for tax purposes, would I still set Specific Identification as my cost basis method for this holding?

Thank you for such a thorough article.

Harry Sit says

If a broker has the individual lot history, its computers can always calculate an average if you set your account to Average Cost. If the broker only has the average, it can’t reconstruct the individual lots from the average. Right now Vanguard has your history but it’s only showing the average because you set it that way. If you leave it at Average Cost and transfer, Vanguard will only send the average cost to the receiving broker. The history will be lost. I hope Vanguard didn’t lose your history when you moved from the mutual funds platform to the brokerage platform but you still want to preserve any history that hasn’t been lost yet.

If you already sold shares using Average Cost, the shares bought before the sale stay on Average Cost but you can use individual lots for the shares bought after the sale.

Jess says

Thanks, Harry, for this helpful post. I’m deciding whether to move. Is it risky to have just one custodian for all the combined accounts? Should we be concerned about the potential consequences of relying on a sole custodian for the entirety of all investment accounts? Thank you in advance.

Harry Sit says

I’m not concerned about using only one broker for all investment accounts. You can use more than one if you don’t mind managing them.

Steve says

I just discovered that not all Vanguard mutual funds can be converted to their equivalent ETF. For example, the ETF equivalent for the Vanguard Total Bond Market Index mutual fund (VBTLX) is BND. But, a Vanguard specialist told me that differences in the way that the two funds operate prevent the conversion. There are several other Vanguard mutual funds that also cannot be converted for the same reason.

Craig says

You are absolutely correct. I have been trying to convert several Vanguard Funds to ETF’s without success for two years. These funds are the kingpins of their fund catalog. There is no way you can liquidate the funds to ETF’s without capital gains. Vanguard has you locked in by their language of their fund investment. I went fund by fund in my portfolio with a Vanguard advisor attempting to convert. Vanguard does not have near the ETF’s that they have funds. I have been contemplating leaving Vanguard for nearly a year.

John G. says

Harry, thank so much for this well-written post, made all the more impressive by how quickly it was available after the new fees were announced, and the generous answers you have given in the comments. It was exactly what I needed to guide me through the transfer application process. As a data point, I did ask Fidelity about a bonus and was told the minimum would be $1M for that. They probed a bit about my intention with the incoming funds and I’m clearly a DIY investor with them; maybe the threshold would be lower if they expected the new funds to go under active management. That’s purely my speculation though, based on how the conversation went.

Ouzel says

I’ve been wondering about a bonus also. I’m transferring my three accounts from Vanguard to Fidelity one at a time. My Roth is in progress now. I’m also DIY.

Steve says

I am in my 70s and I want to leave Vanguard before July 1, but I also want to keep my portfolio as simple as possible. I can convert all of my funds to equivalent ETFs with the exception of the Vanguard Total Bond Market Index fund (VBTLX), which as stated in a previous comment, cannot be converted to the ETF, BND.

To end up with all ETF shares in my portfolio, I could sell my VBTLX at a loss in my taxable account. Thirty-one days later, I can purchase BND in my taxable account to avoid a wash sale situation. Since I also have a large IRA investment in VBTLX, on day 31 after the sale of VBTLX in my taxable account could I sell all of my IRA VBTLX shares and then immediately reinvest that money in BND in my IRA account without any wash sale consequences? Are there any other negative consequences?

Thank you for your help with this!

Harry Sit says

I wouldn’t go through this much trouble to move into BND. Just transfer VBTLX as-is. Reinvest dividends or take dividends in cash for spending as you prefer. If you need to buy for rebalancing, buy BND or Fidelity’s fund FXNAX. You’ll have one extra fund in your account but it will be small and it will be gone first whenever you need to sell.

Steve says

Section 3 of the article refers to Vanguard mutual funds that cannot be held by outside brokers. I conducted searches for all of my Vanguard funds on Fidelity’s website and found that three of them include the notation that, “This fund cannot be traded at Fidelity.” I spoke with a Fidelity telephone representative who said that the notation for the three funds is incorrect. The explanation was unclear and the representative transferred me to a broker consultant. The broker consultant told me that the notation is not well stated, and that it will be changed. He said that all three of the funds with the notation will be accepted by Fidelity. The shares in those funds can be sold free of any fees, but new share purchases are disallowed due to a mismatch in Fidelity’s infrastructure.

Harry Sit says

Thank you for this information. I edited the post. One of my funds has the note saying “This fund cannot be traded at Fidelity” but it transferred successfully.

Ouzel says

I wonder if the same thing is true of VTCLX and VTMSX? I have these funds in my taxable account and because of the “cannot be traded at Fidelity” notation, I assumed I’d have to keep my taxable account open at Vanguard. Calling Fidelity never occurred to me.

Steve says

VTMSX is one of the funds I asked about, and the brokerage consultant confirmed that Fidelity will accept it, but it will be restricted to sell only transactions with the exception of dividends and capital gains that can be reinvested automatically. My impression is that most, if not all of the Vanguard funds with the “cannot be traded at Fidelity” notation will be accepted with the above restriction.

Ouzel says

Thank you so much, Steve!

Mark says

I talked to a Fidelity Rep yesterday about transferring my Vanguard account. It was a pleasant experience compared to vanguards customer service as of late. He told me they have been getting quite a few inquires from Vanguard customers. He also gave me his direct phone number at Fidelity and said he would personally monitor my transfer as soon as I let him know I have started it. I asked about the bonus he told me it was $1000 per million.

Alex says

Harry, if I recall correctly Vanguard introduced Admiral shares around year 2000 and the limits were pretty high then. However, when you reached it, the share class converted, I cant recall if it was automatic or you had to request it. The problem was, I think, that NAVs for the same fund but different class were different. I think that the only thing you have to figure out the correct cost basis for non-covered shares prior to admiral conversion is the transaction history, which is still available on the Vanguard website. Unfortunately, it is one page at a time and cannot be downloaded into anything but PDF. I think its important to spend the time and have that back up if you do move.

RayK says

Hi Harry,

I am considering moving my Merrill Edge rollover IRA to a Fidelity ira account and am new to there website.

I am also considering their cash management account (I see 3 CMA choices) and would like your opinion on which CMA account I might choose for basic banking needs?

Thanks in advance

Harry Sit says

There’s only one CMA account. If you’re referring to 3 Ways to Use Fidelity as a Bank Account, it’s just different ways to use the same account. Please add your question there to keep this one focused on transferring from Vanguard.

RayK says

Harry,

Will do as you suggest and thank you for awesome guidance.

RayK says

Hi Harry,

Can you help me understand the cost basis difference in a brokerage account between FIFO versus selecting Specific Identification (“SpecId”)?

Thank you much!

Harry Sit says

Vanguard provides an overview with links to each method. I like this old help article from Fidelity with examples. Dates are old but examples are helpful.

Penny says

I am transferring out and all funds are in the MM sweep account. Do I have to liquidate to cash to transfer? The statement doesnt show that its VFMXX anywhere.

Also, new brokerage advisor’s office is having hard time finding an overnight address for forms. Any clue? I want to do this fast and they said it is still being worked on due to this.

Harry Sit says

Money market funds transfer as cash. You don’t need to liquidate. The new broker should enter the transfer in their electronic system if you want to do it fast. It’s slower to send paper forms. If you must send forms, contact Vanguard for the address.

Penny says

Thanks. Not sending paper. Just that broker’s forms want an elusive overnight address. I think they finally found one.

Michael says

Thanks Harry. This was a very detailed guide which made the transfer easy. I love your guides and your book. My initial ACAT transfers went through 1-2 weeks ago and the residual sweeps finished today. Should I close my Vanguard accounts this weekend/next week? I think the answer is yes but wanted to make sure before we get to July 1. I also don’t want to close prematurely and have a hassle getting my 1099 next year.

Harry Sit says

Vanguard will close the account automatically if you did a full transfer. You’ll get a letter in the mail in 2-3 weeks.

BN says

This was a timely article as I moved my Vanguard account to Fidelity. Thank you !

The transfer took a week and I was able to transfer VWIUX and VTIAX in kind.

VWIUX can’t be traded and VTIAX will incur a $100 (Increase from Aug 1) fee if bought at Fidelity. VTIAX won’t incur fees for DRIP.

On a side note, I still have a couple of 529’s with Vanguard.

Will vanguard still automatically close my individual account in 2 weeks ?

Harry Sit says

Vanguard will send you a letter in 2-3 weeks to tell you that your account is closed. It doesn’t matter whether you still have 529’s with Vanguard.

BN says

You were right Harry. Vanguard closed my Indvidual account after 14 days and left just the 529’s.

Allan says

Kind of a side note, but why doesn’t Vanguard allow a beneficiary to be named on a taxable Vanguard mutual fund account??? All other companies allow beneficiaries on taxable accounts.

Penny says

Might be a state specific thing. Done states don’t allow TOD accounts.

RobI says

This link lists some accounts that cannot have beneficiaries. Joint accounts are one surprising category as assumption is made about surviving spouse being the person inheriting.

https://investor.vanguard.com/investor-resources-education/beneficiaries

Marg says

Does this mean even transferring like 20K cash from my Vang. taxable account to external bank acct (Marcus) I will be charged $100.00? Thanks.

Harry Sit says

No, transferring cash to a bank account doesn’t incur a fee.

Daniel says

Was there a reason why you didn’t recommended using the export function and saving the lot level cost basis details to an Excel file (instead of opening lot level details under the cost basis tab and saving them as either a PDF or printing them)?

Harry Sit says

I didn’t see the export function. 🙂 In case there’s a discrepancy and you need to convince Vanguard that they sent the wrong basis to the new broker, I would think the PDF is a better proof than a freely-editable Excel file.

Vincent says

Is it true that Vanguard will automatically close your account if they determine that you call too frequently for assistance?

Harry Sit says

The amendment to the account agreement didn’t say they will “automatically” close your account.

“4. You understand that excessive reliance on Our phone associates for tasks

that can be accomplished online may negatively impact Your customer service

experience, including but not limited to delayed response times, additional

fees, and possible Account termination.

5. As set forth in Section 8(f) of this Agreement, VBS reserves the right to

resolve Non-Trade Inquiries exclusively on its website or other available

channels as opposed to providing such information by phone. Furthermore,

at its discretion, consistent with Section 8(c) of this Agreement, VBS reserves

the right to close Your Account, or terminate any feature or service at any

time, for any reason, and without prior notice, inclusive of not meeting Our

Digital Interaction Expectations.”

https://personal1.vanguard.com/pdf/vbaamd.pdf

Steve says

I completed my transfer of assets from Vanguard to Fidelity four weeks ago. Before doing so, I asked about the account closure policy and was told that if I left any amount of money (even a penny) in my account, it would not be closed. I left $0.89 in my settlement fund and the account remains open.

My account is a living trust account, and I prefer to leave it in place in the event that I decide to use it in the future. Re-establishing a trust account at Vanguard is not a simple process.

Rona says

How does Vanguard pay itself the account closure fee? Does it actually create a taxable event to do so?

Harry Sit says

That should be a question for Vanguard. If you don’t have enough cash in the account to pay the fee, they can hold your transfer request and ask you to sell investments or deposit cash. Or they can transfer a negative cash balance to your new broker. Your new broker can choose to reimburse you fully or partially or chase after you for the negative cash balance.