[Updated on February 3, 2026 with updated screenshots from TurboTax for the 2025 tax year. These steps don’t change much from year to year.]

When mutual funds and/or ETFs that invest in foreign countries receive dividends or interest, they have to pay taxes to those countries. These mutual funds and/or ETFs report to your broker after the end of the year how much they paid in foreign taxes on your behalf.

Form 1116

When you invest in these mutual funds and/or ETFs in a regular taxable brokerage account, your broker will report to you the total foreign taxes you paid through all your funds and/or ETFs. The IRS allows a tax credit for taxes you paid indirectly to foreign countries.

The foreign taxes paid are reported in Box 7 on the 1099-DIV form from your broker. It’s easy to handle when the total foreign taxes paid from all your 1099-DIV forms is no more than a certain amount — $300 for single filers and $600 for married filing jointly. You enter the 1099-DIV forms into your tax software, and the software will automatically put the total on your tax form (Schedule 3, Line 1).

When your total foreign taxes paid from all your 1099-DIV forms exceed the $300/$600 threshold, you’ll need to include Form 1116 in your tax return. It’s a complicated form. I’ll show you how to do this in TurboTax.

If you use H&R Block software, please read:

Use TurboTax Desktop Software

The screenshots below came from TurboTax Deluxe desktop software. The desktop software is both more powerful and less expensive than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax desktop software from Amazon, Costco, Walmart, etc., and switch from TurboTax Online to TurboTax desktop (see instructions for how to make the switch from TurboTax).

I’ll use this simple scenario as an example:

You received a 1099-DIV from your broker. Box 7 “Foreign Tax Paid” on the 1099-DIV shows $700. 100% of this $700 came from a mutual fund or ETF. You only have this one 1099-DIV that has a number in Box 7.

1099-DIV Entries

If you imported your 1099’s, double-check that all the numbers from the import match your downloaded copy.

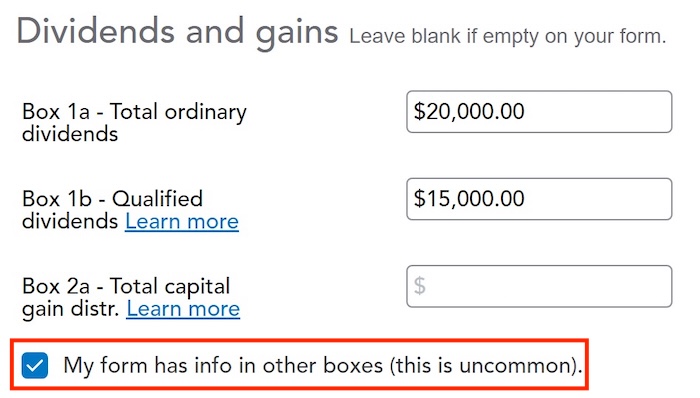

If you’re entering your 1099-DIV manually, you have to check a box on the 1099-DIV entry screen to reveal additional input fields. Then enter the foreign tax paid number into Box 7.

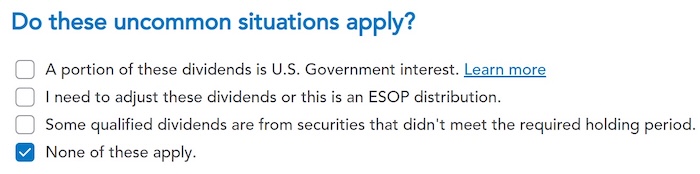

We don’t have any of these uncommon situations.

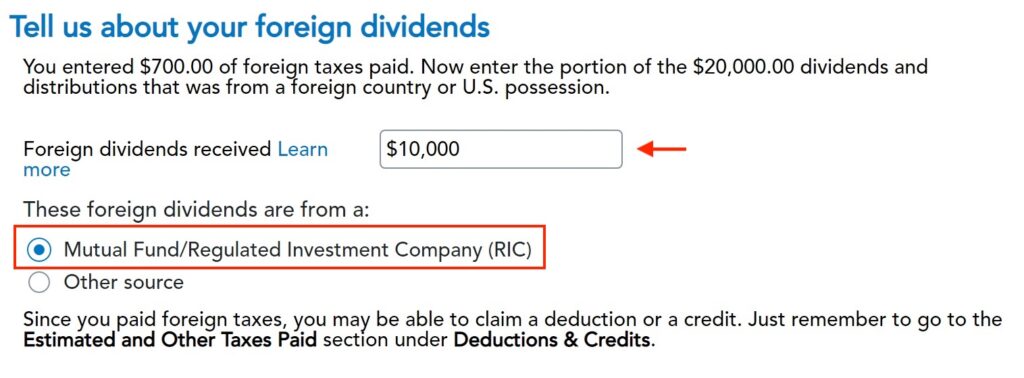

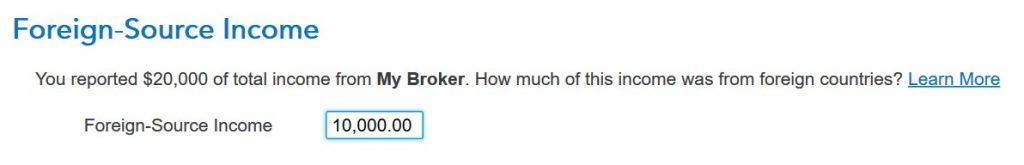

Foreign-Source Income

TurboTax asks you how much of the dividend on your 1099-DIV was from foreign countries. This information isn’t on the 1099-DIV itself. Your broker may have included supplemental information with the 1099-DIV. For instance, Fidelity provides the breakdown of total foreign income in its 1099 package. Tell TurboTax that these foreign dividends were from a mutual fund or ETF.

After you’re done with one 1099-DIV, continue with your other 1099-DIV forms. We only have one 1099-DIV form in our example.

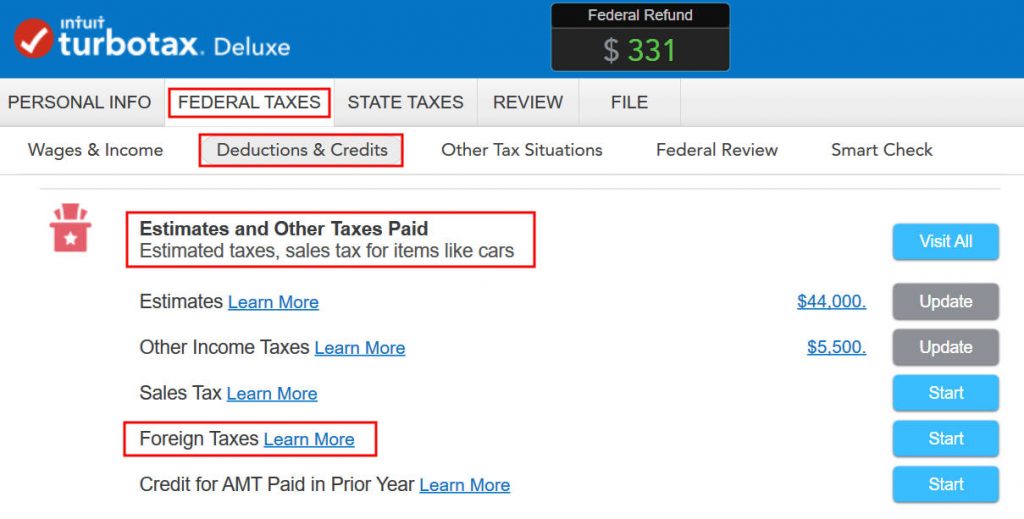

Foreign Taxes

At a much later point, TurboTax will ask you about the foreign tax paid under Deductions & Credits -> Estimates and Other Taxes Paid -> Foreign Taxes.

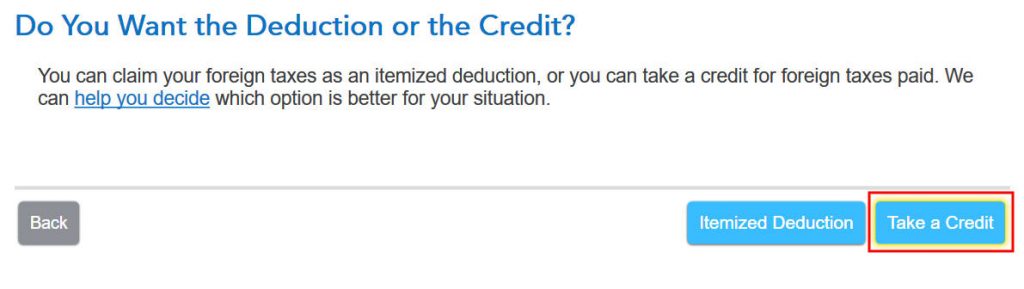

After a brief introduction, the first question is whether you want a tax deduction or a tax credit. The “help you decide” pop-up says that, in general, you’re better off taking the credit. So click on “Take a Credit.”

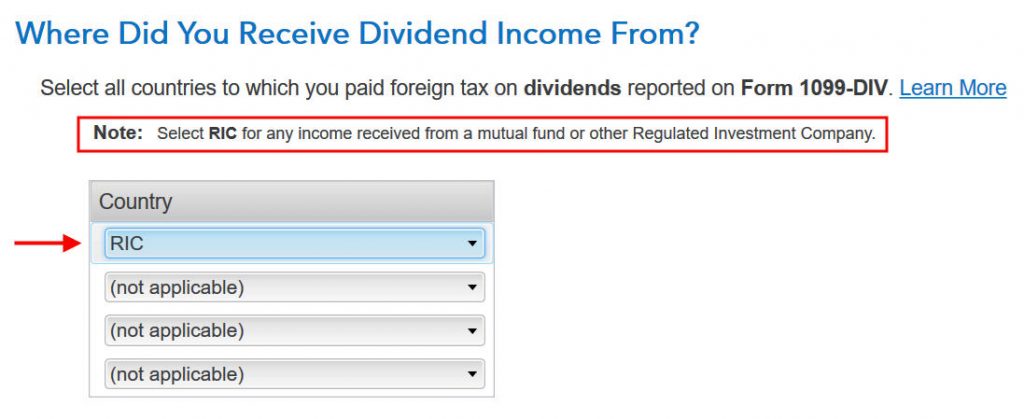

Next, TurboTax asks you which countries you received dividend income from. RIC is pre-selected here because we said in the 1099-DIV entries that the foreign taxes were from mutual funds and/or ETFs.

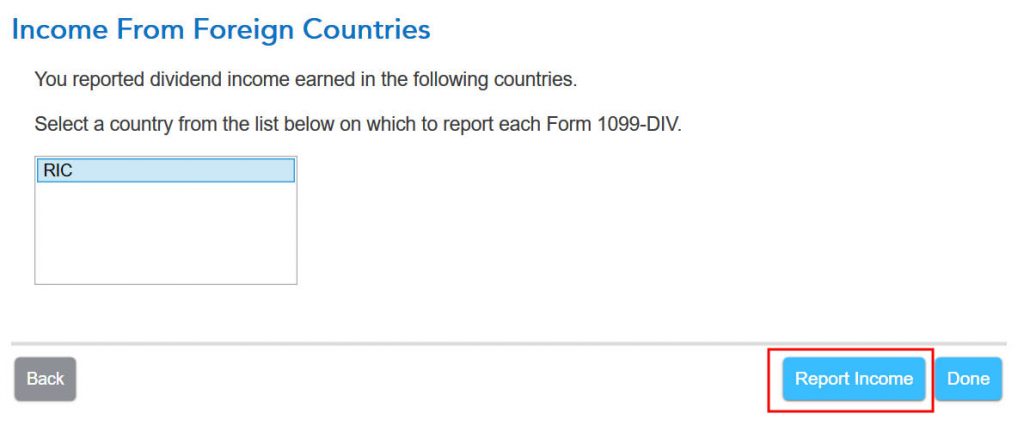

Then you report income received from the country “RIC.” Click on “Report Income.”

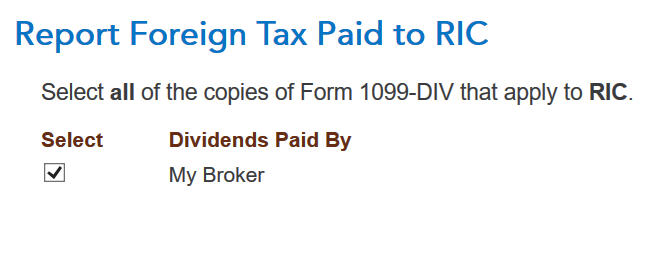

Now you say foreign tax paid from which 1099-DIVs were paid to the country RIC. If all your foreign taxes paid were from mutual funds and/or ETFs, select all your 1099-DIV’s that have a number in Box 7.

TurboTax pre-populates the foreign-source income we gave previously.

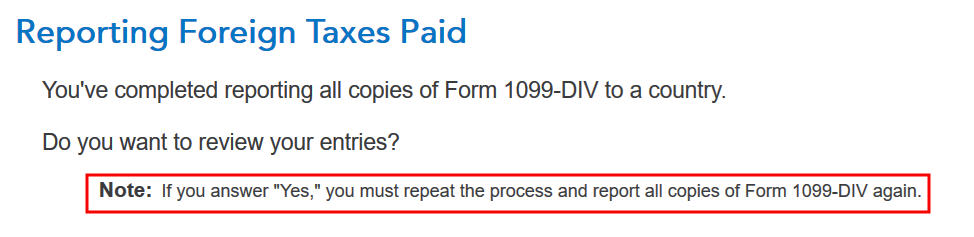

TurboTax asks whether you’d like to review the 1099-DIV forms you entered before. We answer “No” here because we already entered the 1099-DIV forms correctly.

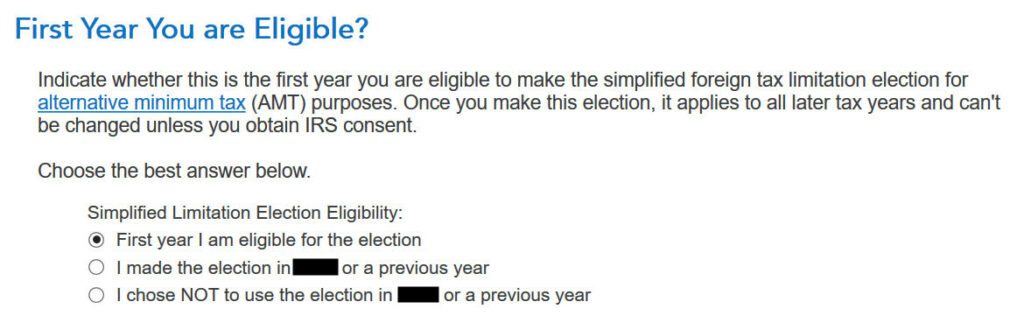

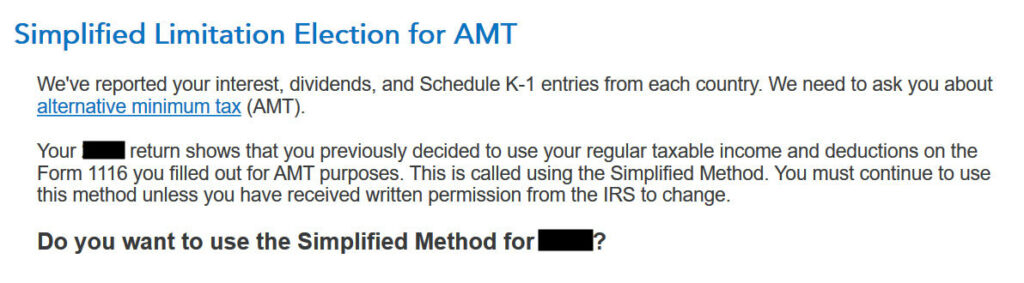

Simplified Limitation for AMT

Now it asks you about a “simplified foreign tax limitation election.” If this is the first year you encounter this, choose the first option.

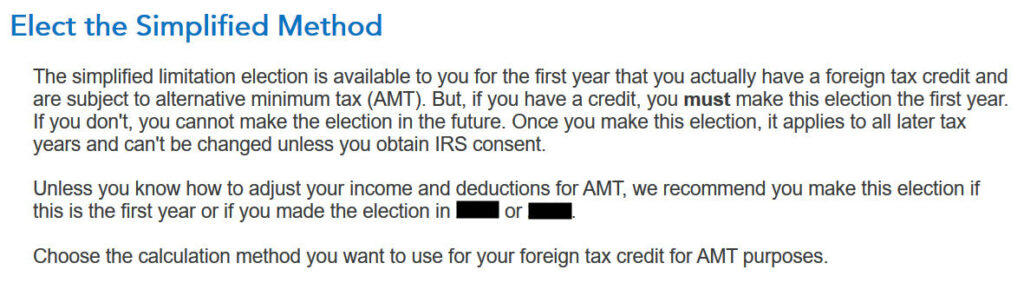

TurboTax suggests you should elect the simplified method. Click on Elect Simplified Calculation.

If you used TurboTax last year and you already elected the simplified method, TurboTax reminds you that you should continue with the simplified method. Answer “Yes” here.

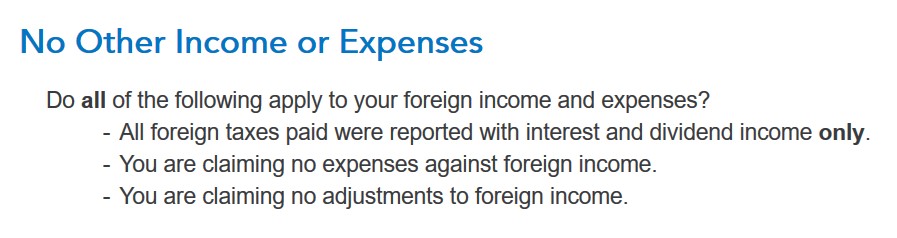

Adjustments

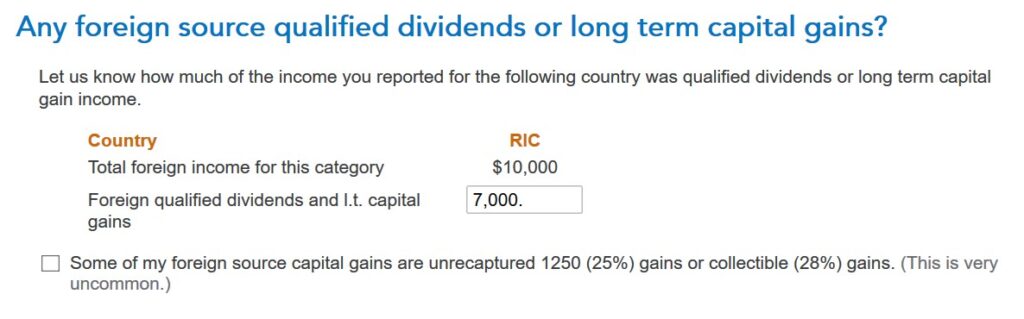

This is important but easy to miss. Click on “No” to trigger more questions. We gave the total foreign-source income in a previous screen, but we didn’t get a chance to say how much of the income is from qualified dividends or long-term capital gains. It makes a difference.

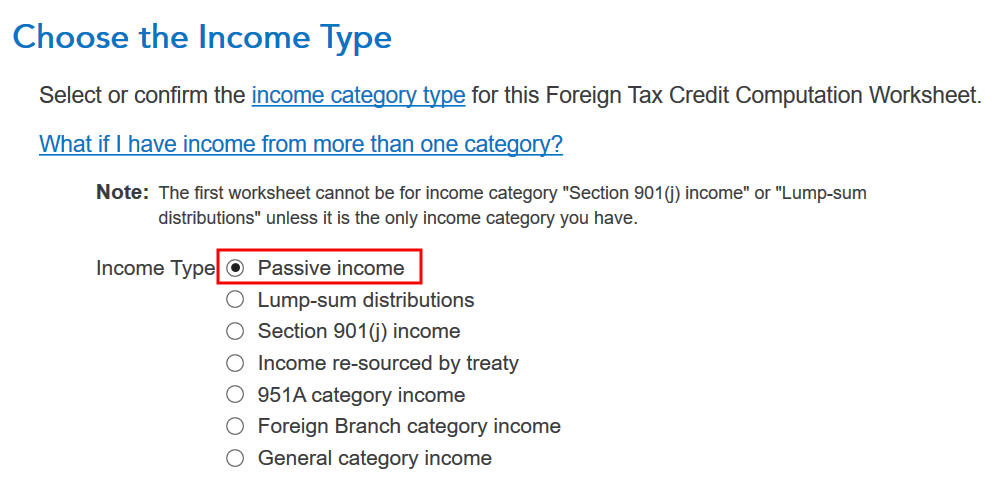

Dividends fall in the Passive Income type.

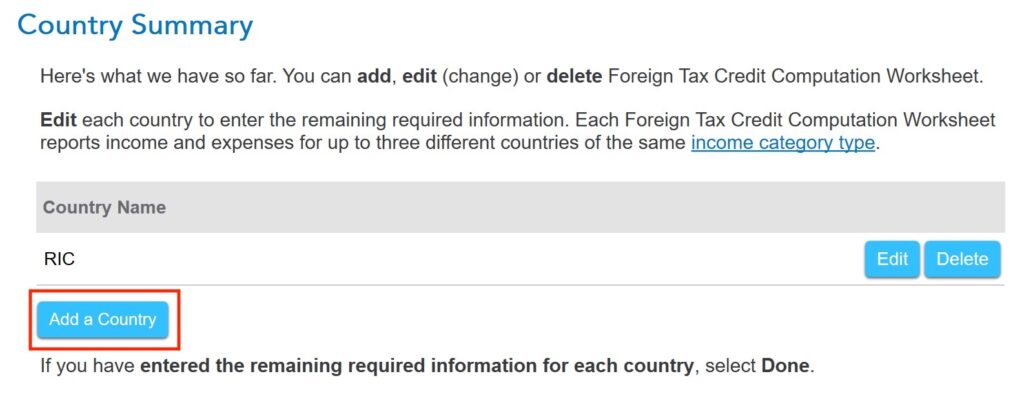

TurboTax displays a country summary for the Passive Income category. If you have foreign income in this category that isn’t from a mutual fund or ETF, click on “Add a Country” to add it and report the foreign income earned and taxes paid in that country.

You find the total foreign-source qualified dividends and long-term capital gains from the 1099 supplemental materials from your broker.

Go with the default “Paid.”

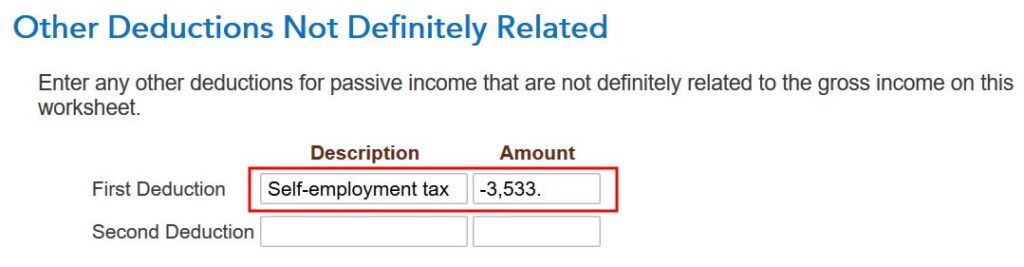

By default, TurboTax treats all above-the-line deductions on your Schedule 1 Part II as “not definitely related” to your foreign income, which means they reduce your U.S. and foreign income proportionally. If you have a deduction on your Schedule 1 Part II that’s only related to your U.S. income and has nothing to do with your foreign income, such as the deductible 1/2 of your self-employment tax when your self-employment is 100% U.S., enter it here as a negative number to back it out. Backing it out makes that deduction only reduce your U.S. income, but not your foreign income.

Continue clicking through and accept the default on many screens after this one.

Foreign Taxes Paid

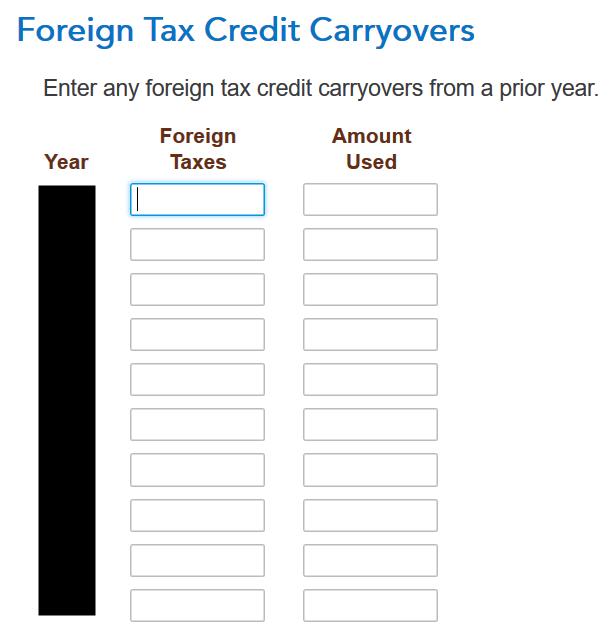

We don’t have any carryover from previous years in our example. A carryover is created when you paid more in foreign tax than the tax credit you’re allowed. Your leftover foreign tax paid is first carried back to the previous year and then carried over to the following year. If you have carryovers from previous years, they’ll show up here. There’s another set of carryovers for AMT.

After going through all these, we’re getting 100% credit for the $700 foreign tax paid. Woo-hoo! You may get less than 100% credit depending on your income composition. If that’s the case, the credit you can’t take this year will carry over to next year.

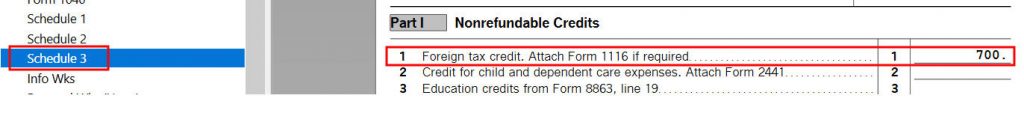

Verify on Schedule 3

You can verify that you’re getting the foreign tax credit by clicking on Forms at the top right. Find Schedule 3 in the left navigation pane and look at the number on Line 1. You can also look at Form 1116. It looks awfully complicated.

Excess Foreign Tax Credit

We received 100% of the foreign taxes paid as a tax credit in our example. If you paid higher foreign taxes on a lower US income, you may not be able to take 100% of the credit. TurboTax will tell you that you’ll have to wait until next year to take a portion of the credit.

Carrying over part of the credit to the following year requires filing a Form 1116 Schedule B. TurboTax will automatically generate Schedule B when you need it.

Summary

TurboTax works when you paid more foreign taxes than the $300/$600 threshold that requires a Form 1116. You’ll have to gather the foreign income from the 1099 supplemental information from your brokers. After it’s all said and done, you’re getting some credits for taxes you paid to foreign countries through your mutual funds and/or ETFs.

Completing Form 1116 is complicated even with TurboTax. You’ll have a further complication in carryovers when you don’t get to use 100% of the credit. I try to avoid this situation by putting mutual funds and ETFs that invest in foreign countries in a tax-advantaged account. See Too Much Hassle in Claiming Foreign Tax Credit on IRS Form 1116.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

CB says

Thanks Harry. To double check myself I filled out form 6251 on my own outside of TT and confirmed that I do not owe any AMT. Since I have not previously had the situation of a needing form 1116 and owing AMT in the same year I am confident your suggestion is accurate and it basically does not matter. As a side note, I did force the TT data to have my Foreign tax paid to be under 600 dollars and TT did not route me through the questions of the simplified approach/form 1116 it just says congrats you are getting a credit when you go through that section. Thanks again for your help !!!

BlackCoffee says

Do you have an opinion about which deductions (in addition to 1/2 SE tax) should be backed out on Line 3b in TurboTax? I’m thinking of things like:

* HSA contributions

* Traditional IRA contributions

* Solo 401(k) contributions

* Educator expenses

Harry Sit says

Think if you don’t have US income whether you would still have the deduction. If you wouldn’t, that deduction is definitely related to the US income and should be backed out.

– HSA contribution: You would still have it because it’s not related to income. You can buy HDHP with 100% foreign income.

– Traditional IRA contribution: If your taxable compensation (“earned income”) is 100% US income, it should be backed out.

– Solo 401k contribution: Same as Traditional IRA contribution.

– Educator expenses: Too small to matter, but if you’re an unpaid voluntary teacher, do you still get to deduct this? If yes, then it isn’t related to income and should be left in.

BlackCoffee says

Thanks for replying, Harry, and I agree with your logic.

Epik Vas says

I am looking on Turbotax 2022 and 2023 (Premium) and it does not ask under 1116 when I add a country regarding LT. Capital Gains or Qualified Dividends.

Just not there.

Is this new for 2024?

Am I missing something?

Harry Sit says

It’s in previous years’ software as well. Answer no to “Do all of the following apply?” (the first screen under the Adjustments heading).

It’s new this year that the software automatically adds the country RIC when you say the dividends are from mutual funds. You had to add the country RIC yourself in previous years’ software.

Jim says

I am extremely frustrated. I am trying to answer this one question on TurboTax:

Tell us about your foreign dividends

You entered $1,003.21 of foreign taxes paid. Now enter the portion of the $99,552.14 dividends and distributions that was from a foreign country or U.S. possession.

Foreign dividends received: _______?_______

All $1,003.21 of my foreign taxes come from a single Vanguard fund.

VNGRD TTL INTL STK ADML (VTIAX)

On my 1099, I can clearly see $16,411.29 for Total Dividends & distributions, and the total and qualified percentages.

FOREIGN SOURCE INCOME PERCENTAGES

Fgn Source Inc Tot 88.66%

Fgn Source Inc Qual 61.15%

From everything I have found on the TurboTax chat questions, I think I am supposed to multiply $16,411.29 x .8866. That means my answer to “Foreign Dividends Received” is $14,550.25. Do you agree?

Thank you,

Jim

Harry Sit says

That’s correct. Further down, when it asks you about your foreign qualified dividends and long term capital gains, it will be $16,411.29 x .6115. Fidelity reports the dollar amounts in its 1099 supplement. Vanguard reports the percentages, which requires an extra step using a calculator.

Jim says

Thank you, Harry. I appreciate the prompt reply. As I clicked through, I did not get the second question about “foreign qualified dividends and long-term capital gains”. Maybe that question comes in the Deductions & Credits section. I am using the online version, not a downloaded version.

I appreciate your assistance.

Jim

Helen says

Thank you for this article! The part about answering “no” to not having any adjustments is key, too bad it’s worded so awkwardly in TurboTax.

I do have a question:

If I have both some foreign stocks that have taxes and some foreign stocks that don’t have taxes, do I include income from all of them when calculating foreign source income or just the stocks with taxes?

Mike M. says

Helen,

You include any foriegn income that is taxed in the US.

“Lines 1a and 1b—Foreign Gross Income”

“Include income in the category checked above Part I that is taxable by the United States and is from sources within the country entered on line i, even if isn’t taxable by that foreign country. ”

https://www.irs.gov/instructions/i1116#en_US_2024_publink11441fd0e4093

KLap says

I’m so glad your article came up in my Google search. When I couldn’t find answers elsewhere your step by step walk through was perfect. Saved me the headache and frustration of trying to tackle form 1116. Much appreciated!

KS says

I have foreign taxes paid ~$640 – all are from a couple of mutual funds, an ETC and three individual stocks (Luxemberg, Netherlands, and Japan). This is the first year where I have had more than $600 in foreign taxes paid and am required to go through form 1116 as well as answer questions about AMT (which I am not sure why). TurboTax says I have to split the 1099-DIV from the brokerage such that there is one entry per country. For testing out 1116, I entered all income under RIC, now TurboTax shows me that I will get credit of $150. This is frustrating because the $40 more in foreign taxes paid is causing me increase my taxes by $450. If I changed the foreign taxes paid from $640 to $600, I get full credit this year. Am I legally allowed to not take foreign tax credit for one of the mutual funds to bring down my foreign taxes credit under $600. If so, how to do it?

Harry Sit says

Form 1116 is meant to give you less than the full credit when you paid more than $600 in foreign taxes. You can’t just settle for $600.

SS says

Thanks very much for the article Harry. I did notice one item that might help someone. We had some educator expenses, which is US income related so we needed to back out in the “Other Income Not Definitely Related” section. This is similar to Harry’s “1/2 SE Tax” example. In my case, I forgot to back this out. This caused TurboTax to request an explanation under Form 1116 due to item 3b have a 300 adjustment (the amount of educator expenses that we entered). It seems like Turbotax should be able just enter this explanation or prepopulate the “Other Income Not Definitely Related” with a -300 in my case! So, moral seems to be, if you get this TurboTax error, just go to Schedule 1, Part II (as Harry mentioned) and figure out which adjustments need to be entered in and rerun the Federal Review and error should disappear.

Anyways, hope it helps someone.

Harry Sit says

I don’t think the educator expenses should be backed out. If you’re an unpaid volunteer teacher, you’re still allowed to deduct the expenses. The deduction isn’t contingent on any income.

SS says

Harry, thanks for your reply. If I don’t back out the 300, then 3b has an extra 300 which needs to have an explanation statement. I took a look at the educator expenses detailed info and I don’t see a requirement for earned income to take that credit as you mentioned. Unsure what to do. Having an “explanation statement” seems less concrete than just have it removed especially since it doesn’t make any difference for foreign tax credit.

Harry Sit says

Having an explanation statement doesn’t cause any issues. It doesn’t prevent e-file. I have an explanation statement for the HSA contribution adjustment that I don’t back out. My explanation statement is simply “Health Savings Account deduction.”

Steve says

I have foreign tax paid reported on two Form 1099-DIVs. The foreign tax on one 1099-DIV is all RIC. The foreign tax on the other 1099-DIV is RIC, Canada, and Sweden.

In the last several years I have not had success with Turbotax step-by-step mode getting the Form 1115 for three countries from two 1099-DIVs properly completed. I switch to TT forms mode and enter info for the three country columns on the Form 1115 worksheet.

I can understand how Turbotax step-by-step mode might work for 1 or 2 1099-DIV if the foreign tax is all RIC, but not if more than one country is involved.

Rob says

I am having the same issue. I have ten foreign countries for foreign dividends and the step by step process keeps taking me around in circles.

Rob says

I have ten foreign countries for dividends and withholding. I never get to the “country summary” screen because TT keeps deleting the countries if I have more than one. I guess that I will try just adding one and go through the entire process to the country summary screen and try adding them there. If that works then it is something that both TurboTax support and the TurboTax community doesn’t know about. Quite frustrating.

Although it doesn’t have to do with foreign dividends, another problem that I will have with TT is HSA distributions. TT automatically assumes that the HSA distribution is for the tax year being prepared when it doesn’t have to be. So if there is an HSA distribution then it automatically deducts this amount from your medical expenses even if the reimbursement was for prior tax years. You can add a fictitious expense to correct for this on your federal taxes but I live in a state which doesn’t allow the HSA deduction. So TT adds the HSA distribution back to my medical expenses for state income tax which is proper but I have already added it back with the fictitious expense on the federal taxes, which results in too high of expenses on my state taxes. I have contacted TT “support” for five years in a row and they still haven’t fixed it.

Steve says

Forget about trying to enter foreign tax credit for more than one country using step-by-step view.

Clear out all Foreign Tax Credit entries in TurboTax.

In step-by-step view, enter the correct info for one country.

Switch to forms view.

Open the Form 1116 Worksheet.

Enter the entries for the remaining countries in separate columns on that worksheet.

–The above assumes that your total foreign tax credit is enough to require you file Form 1116 with your return (more than $600 for MFJ). If you have less credit than Form 1116, total all the info up (credits and foreign source income from all sources) and enter the total as one country and be done with it.

Good luck.

Rob says

I actually just got it to work as described in the article. I entered for one country and went through the process until I got to the “country summary” screen shown in the article. Then I added the countries one by one. I reviewed the forms briefly and they appear correct. I will check them in detail later. Very poor instructions by TurboTax in step by step mode.

Thanks for your input. I am sure that way would have worked also.