Back in March, Congress created two loan programs to help small businesses and the self-employed mitigate the economic impact of the COVID-19 pandemic: the Economic Injury Disaster Loan (EIDL) and the Paycheck Protection Program (PPP). Because we were not sure whether we were able to get either loan, we applied for both (see previous post COVID-19 Loans for Self-Employed: Where to Apply). We ended up getting both loans after a long application process — the EIDL loan directly through the SBA, and the PPP loan through a bank.

Our business stabilized somewhat in recent months. Revenue was down 65% in April compared to April of last year. It was down only 47% in June. It’s still bad but the trend is upward. So we decided to pay off the EIDL loan early.

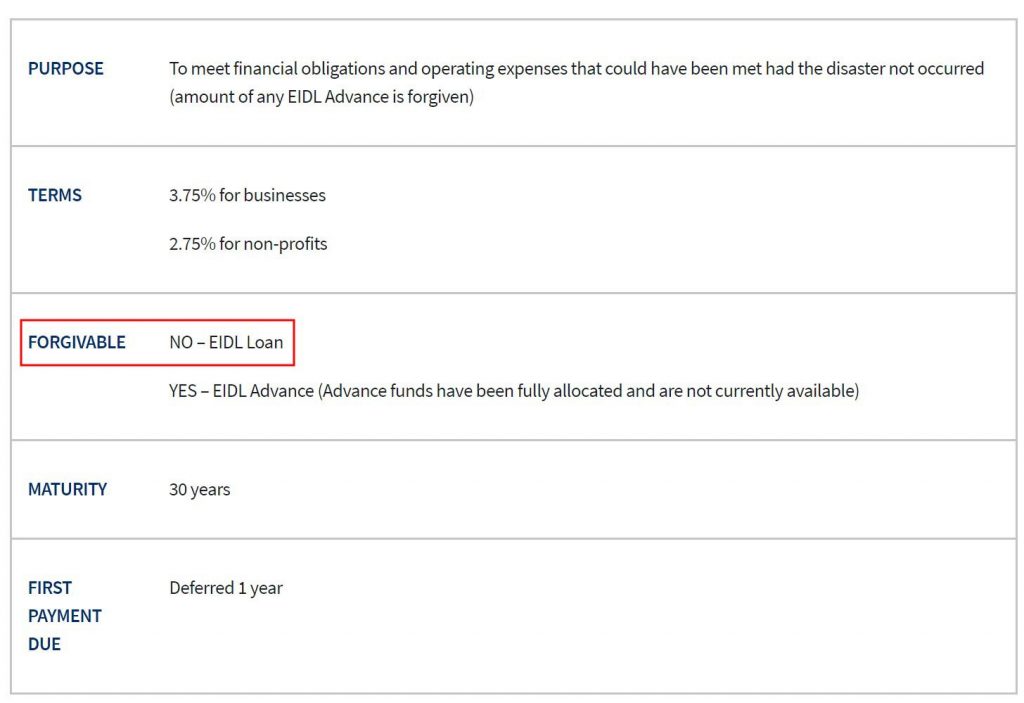

EIDL Loan Is Not Forgivable

The EIDL loan is a 30-year loan at a 3.75% interest rate. No payments are required during the first year but interest still accrues. Except for the EIDL grant ($1,000 per employee up to $10,000), the EIDL loan is not forgivable.

Therefore if you no longer need the cash, it’s better to pay it back early to stop the interest. There’s no prepayment penalty. When no payments are due yet, the SBA isn’t sending any statement or payment stub. If you’d like to pay the loan off, it’s not obvious how much you need to pay or where to send the payment. I’m showing you what to do if you received the EIDL loan and you’d like to pay it off early or pay back a part of the loan to lower your interest charge.

SBA Loan Number

First, you need the SBA loan number for your EIDL loan. This 10-digit number is in the Loan Authorization and Agreement (LA&A) you electronically signed with the SBA. It’s at the beginning of page 2 and also on the upper left of all pages in that document.

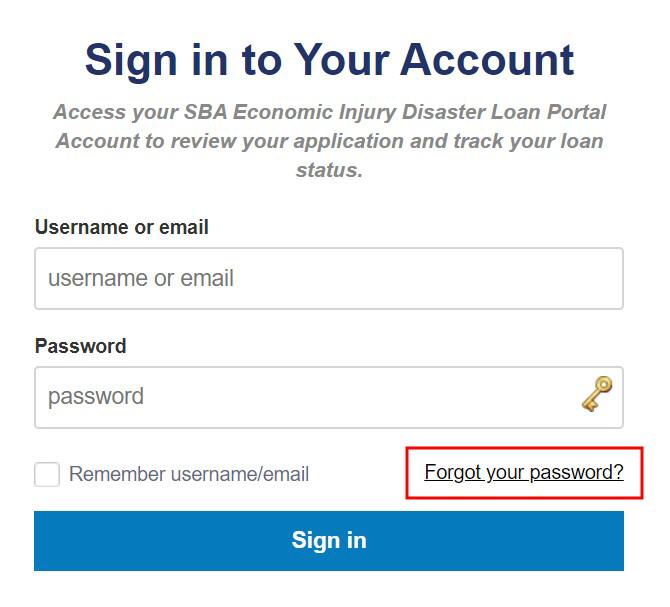

If you didn’t save the document you electronically signed with the SBA, you can go back to the EIDL loan portal at https://covid19relief1.sba.gov and sign in with the email and password you created. If you forgot the password, there’s a “forgot your password” link on the login page.

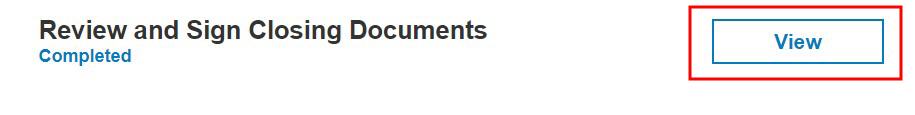

After you log in, you can re-download the signed loan document.

If you still can’t get into the loan portal, please call the SBA EIDL customer service center at 800-659-2955 or email [email protected].

SBA CAFS

Next, you need to register with the SBA’s Capital Access Financial System (CAFS). This is similar to the online banking site when you have a loan with a bank. If you have problems registering for online access, please scroll down for how to contact SBA’s Disaster Loan Servicing Center by phone.

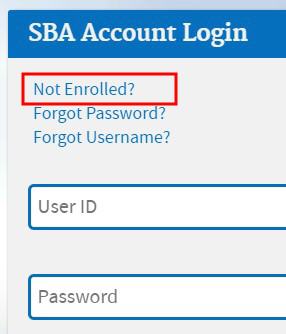

Click on the “Not Enrolled?” link above the login fields.

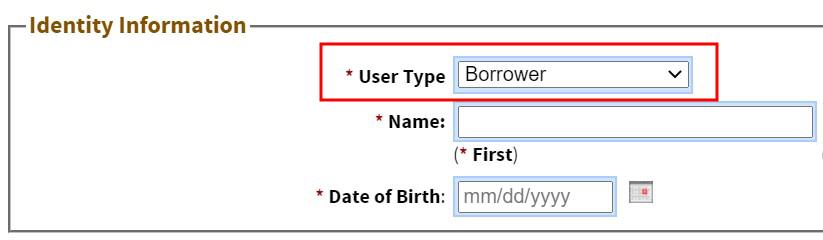

Choose “Borrower” under User Type.

After entering your zip code, click on the Lookup Zip button.

Enter your SBA loan number in the “Financial Commitment ID” field.

Payoff Amount

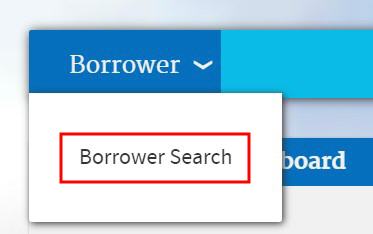

After you successfully register for access, you log in to CAFS with the user ID and password you created. The system will send a one-time PIN to your email address or mobile phone for two-factor authentication. After you get in, at the light blue bar at the top, click on Borrower, and then Borrower Search.

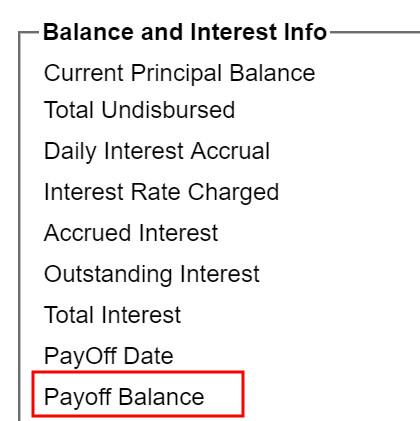

You will see a list of your loans. If you received both the EIDL loan and the PPP loan, you can identify your EIDL loan by the loan number, the loan amount, or the loan type (“DCI”). Click on the EIDL loan. You will see your loan details. If you are trying to pay the loan off, read the Payoff Balance during working hours Monday through Thursday.

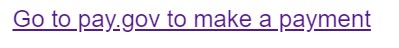

Further down the page, you will see a link that says “Go to pay.gov to make a payment.” So you go there next.

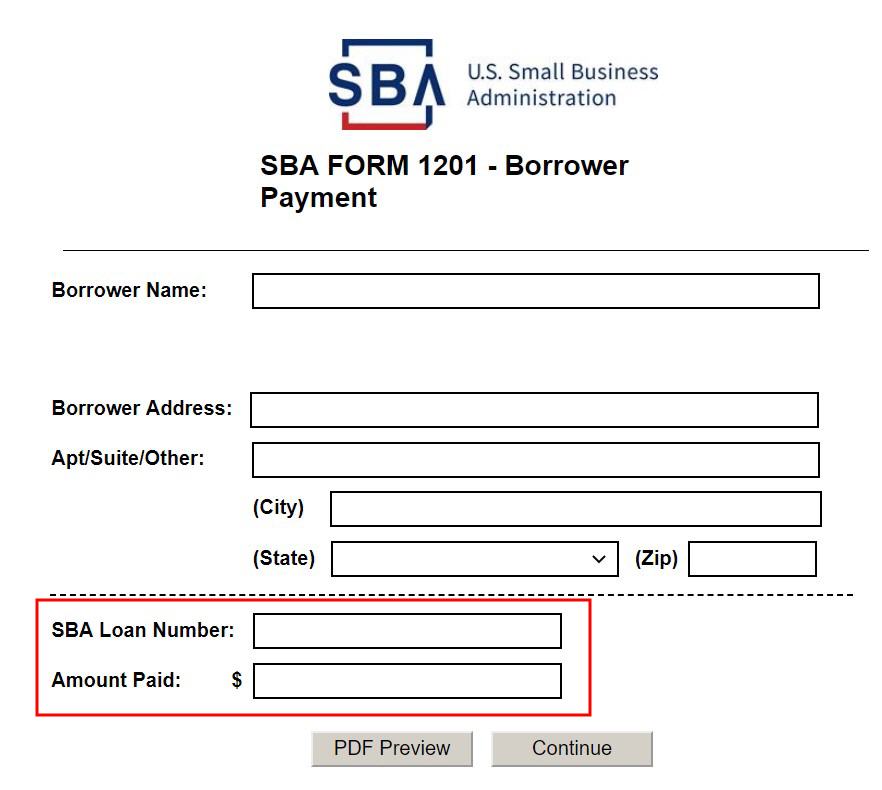

Pay.gov

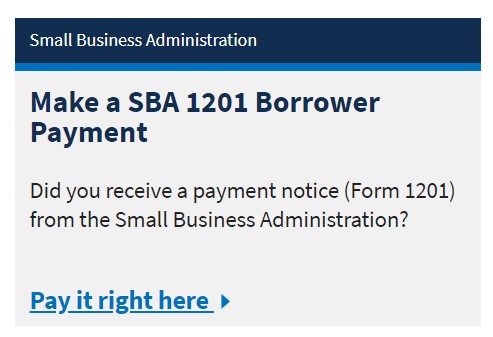

The link just sends you to the home page of pay.gov. This is a multi-purpose website for making many different kinds of payments to the U.S. government. You will see this in the middle of the home page:

You follow that link even though you don’t really have a payment notice (Form 1201) from the SBA. When you follow along, the crucial information you need are your SBA loan number and the payment amount.

If you are trying to pay the loan off, enter the payoff amount you got from SBA CAFS (you can also make a partial payment). The soonest payment date is the next business day. That’s why if you are trying to pay it off, you need the latest payoff amount during the working hours Monday through Thursday. If you get the payoff amount in the evening or on a Friday, by the time the payment arrives, additional interest may have accrued and your payment will be short.

You will give the routing number and account number of a bank account for the payoff. Pay.gov will debit your account and send the payment to the SBA. You can go back to SBA CAFS after a few days to verify the payment and the loan status.

You are done when you see the loan status says “Paid in Full.”

SBA Disaster Loan Servicing Center

If you have problems enrolling in CAFS to view your payoff balance and loan status, you can also try calling SBA’s Disaster Loan Servicing Center. I haven’t called them myself because I was able to get into CAFS. I only found the information on SBA’s website.

SBA has two Disaster Loan Servicing Centers, one in Birmingham, AL, the other in El Paso, TX. Your loan may be assigned to one of the two centers. Or maybe either center will be able to tell you the payoff balance and verify that your loan is paid in full. The Loan Servicing Center also takes payments by phone.

Birmingham Loan Servicing Center

Phone: 800-736-6048

Hours of Operation: Monday – Friday 8:00 a.m. to 4:30 p.m. (CST)

Email: birminghamdlsc at sba dot gov

El Paso Loan Servicing Center

Phone: 800-487-6019

Hours of Operation: Monday – Friday 8:00 a.m. to 4:30 p.m. (MST)

Email: elpasodlsc at sba dot gov

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Marcelo Castro says

Thank you Steve!

Tanya says

So how do I know if the eidl was a grant or needs repaid .. we are a small company and got a little over 4thousand for ppp and 6000 for eidl .

Harry Sit says

You signed an EIDL loan agreement. The amount in the loan agreement was not a grant. It needs to be repaid with interest.

Steve says

At least it appears the PPP forgiveness is not going to be offset from the EIDL loan.

Val says

I qualify for a 2nd PPP draw based on 25% reduction in two quarters last year as opposed to 2019. Business is doing better than I anticipated. So I just returned my EIDL loan (and interest). Do you suggest I get the second draw PPP, just in case, for 2021? I heard that folks who get the PPP are likely to be audited. Don’t want an audit based on a “just in case” business doesn’t pick up.

Harry Sit says

Sorry, I don’t know whether taking the second-draw PPP will get you audited more likely.

Rhonda Burton says

I just got my letter from the SBA re my EIDL loan. How do I know how much my payment amount is? or is it my determination re the amount each time?

Thanks in advance.

Harry Sit says

You’ll probably get another letter from the payment service center. The minimum payment is $48.95 per month per $10,000 borrowed.

KDI says

Pay.gov gives you an option to add a credit card for payment. I’m wondering if there’s any credit score ramifications of routing payments first through a credit card? With my card, I get 1.5% cashback if I pay it early, which means I could save money on the interest in the end… Thoughts?

Harry Sit says

The credit card you add to pay.gov can be used to pay some other government agencies but not the SBA.

KDI says

I haven’t gone through the whole process yet, but it seems that the debit card option auto fills your CC info from your pay.gov account, just asking you for the security code. Can you direct me to a page that specifically says what you’re saying?

Harry Sit says

https://pay.gov/public/form/start/3723407

Accepted Payment Methods:

Bank account (ACH)

PayPal account

Debit card

Versus paying a different agency: https://pay.gov/public/form/start/25987221

Accepted Payment Methods:

Bank account (ACH)

Debit or credit card

lety Kester says

What about being able to make advance payments to principal. Is this possible for an EIDL Loan?

Harry Sit says

Yes, you can make partial prepayments by following the same process shown here.

Lindsey says

I cant figure this out either. When I follow the instructions there is no where for “Principle Only”.

Harry Sit says

Just like a car loan, you always have to pay off the accrued interest to date first before any additional amount is applied to the principal. You can’t skip over the interest you already incurred as of today. If you simply make a payment, they’ll automatically calculate how much goes toward the interest you already incurred and how much goes toward the principal.

Jody K. says

Really helpful article – thank you so much!

Power says

Hi, just need some info about SBA loan repayment. Can i start making partial payment instead of waiting for the due date? Will there be any penalty for early payment. Six months now since i received the loan. Now the SBA requested hazard insurance doc from me. The only document is a declaration insurance for the business i stated as a Taxi which i used 100% for my business.

Harry Sit says

There’s no prepayment penalty. Some of us already paid the whole thing off before the first monthly payment is due. If you’re only able to make partial prepayments, that will work too. It won’t lower your monthly payment but it will lower the interest charges.

Heather W. says

Thank you for this post! It was super helpful and informative!!!

Nicole H says

I want to thank you for creating this post!

I paid off the loan amount but couldn’t find where to check my balance.

Today I registered at CAFS and found that I still have a small amount that needs to be paid!

Glad that I caught it!

Fellow SB says

I recieved a generic letter with specific Application and Loan Numbers from the SBA for my EIDL. This letter was not helpful in any other way as to a loan amount $ or montly payment. Your post was perfect. I followed it completely through for my LLC: found the Loan Agreement with the note and monthly payment; then signed up with your posted websites and went in and paid a chunk of money toward the EIDL. Thank you so very much for plain English steps so I can pay this back before its even due in June. Sincerly, a fellow small business.

KM says

If you don’t pay the full amount back but pay back a large amount of it, how do you know it will get applied to principal and not interest payments?

Harry Sit says

As in other loans, any payment will first apply to the unpaid interest, and the remainder will apply to the principal. Suppose you borrowed $20,000 and by the time you make a payment you already accrued $500 in unpaid interest. If you pay $10,000 now, $500 will go to interest and $9,500 will go to principal. Your loan principal balance will come down to $10,500.

TCL says

Thank you so much. This entire process (EIDL only for me) has been a cluster. The hoops I had to go through to register and pay have been so bad. The communications and customer service have been rough – especially in the beginning. Obviously, they weren’t ready for this and were pushed through a website and process that wasn’t ready for prime time. I’ve begun the process of repaying the loan back in full and hopefully we won’t have another pandemic to worry about. Stay safe everyone and thanks again for the post.

Thanks for the post!

Juan E Valadez Jr says

I am trying to create a cafs account but when I put in my phone number it is asking for a country code I thought it was 1 but it is not accepting it

Marty says

Try +1 for US country code

flash reynolds says

Harry Sit. Read your comment. Excellent. Not worth playing with 0% card options. SBA is a good deal. Just keep good records.

Thanks.

mm says

Can I use the EIDL money from the loan to pay back the loan?

The debt being accrued will wipe out my business.

I don’t want the loan – can I give back the money ?

Harry Sit says

Yes, you can pay it back with the unused EIDL money.

Joanne Kjolsen says

Thank you so much for this. I thought I had paid off the loan in full and never knew about registering to CAWEB.SBA.GOV to see my payments and the daily interest accruing. Had I known sooner, I wouldn’t have had to pay $66.42 just now as I truly thought I had paid it in full in February! And, now I realize I will have to login again Tues when my payment posts to see how many more pennies I owe for these couple of days. But it was this article that alerted me to it so thank you very much indeed.

Viktor K says

Hi Harry,

I asked the SBA today about early payment and this is what they emailed back to me:

… The terms & conditions are for the life of the loan. Lump sum payments or paying down the loan will not change them…

Does it sound the same as you explained about paying $20,000 back earlier?

https://thefinancebuff.com/pay-off-sba-eidl-loan-early.html#comment-26834

So to me, this lump sum mention sounds like whenever you pay your loan back, you’ll still have to pay the 30-year calculated interest. Please, correct me.

Harry Sit says

Terms and conditions refer to the interest rate and the required monthly payments. It’s true if you pay $10,000 toward a $20,000 loan, your interest rate and the required monthly payments don’t change. However, the amount of interest is always calculated on the outstanding principal. When your outstanding principal is lower, your amount of interest next month is lower. More of your monthly payments go toward principal and you pay less in total interest.

Lynn W says

Does anyone know if the lien release/official letter is sent when the total amount is pre-payed off? Or do I have to specifically request this from the Loan Servicing Center?

Fred says

I paid in full the eidl loan of 13k before the due date which is summer of next year , and it says paid in full and also I got an email from sba saying was paid in full. My question is I just got an email asking me to sign and complete a sba resolution/certificate of my llc, and I sent one of this last year, but I think this is a general request for everyone, any idea??? Do I still need to send this even if I don’t have a loan anymore? Like send it every year? Any advice Thanks

Harry Sit says

You still need to send it.

kim says

I received 51k SBA EIDL loan, its been two months in my account and I don’t need it. Will there be interest accured even if it hasn’t been 24 months.

Harry Sit says

Interest starts accruing immediately.

Nicole says

If we pay the amount on the monthly statement, will the loan be paid off in full after the 30 years? Or will there be some kind of balloon payment due at the end for the extra interest we accrued during the year it was deferred. I only ask bc my monthly payment amount seems to be the same as it was.

Harry Sit says

No balloon payment at the end. The accrued interest is already taken into account in calculating the monthly payment for the remaining years.

Capener says

Does anyone know If you paid back the loan because you didn’t need it at the time, are you able to pull out those funds again? Or is it closed once you pay it back?

Harry Sit says

I don’t think you can redraw the loan. It’s not a line of credit.

Amy says

This is a great resource, thanks so much. I’m ready to pay off completely, but it’s 4:45pm on a Friday. Recommend I wait until Monday to get the right payoff amount?

Harry Sit says

Yes, it’s better to get your payoff balance during working hours on Monday.

sunny says

I made a large payment on pay.gov to try and pay it off, but a large chunk was allocated to interest instead of the principal. I want to make one more payment to pay it off completely, but how do I make sure that it goes to principal?

Harry Sit says

Nothing special. Just make the payment. It didn’t matter a large part of your previous payment was applied to interest. If it didn’t go toward interest, the unpaid interest would generate more interest in the same way as your principal. Ultimately you’re paying off all principal and accrued interest.

Sylvia says

Thank you! This was very helpful 🙂 I wish they didn’t make it so darn complicated! I feel bad for older folks that are not tech savvy!

Best Regards 🙏🏼

Carey Barfield says

I am currently on deferral with interest accruing on my EIDL loan. I have not made a payment and dont have to until Nov 22. If I pay back over 60 percent of the loan BEFORE the loan deferment period ends, will my payment amount be adjusted accordingly for the claculated payments or will my payment amount remain the same and just the term of the loan shorten?

Harry Sit says

My understanding is that the monthly payment amount won’t be adjusted but the allocation between principal and interest will change after you make a partial lump-sum payment. This will make you pay less interest over time and pay off the loan faster. Please confirm with one of the loan service centers.

Victor E Taurizano says

I have paid off my SBA Loan, I see now it says “paid in full”. Now how I get the UCC lien release?

Harry Sit says

See comment #21.

SanFu says

I have some questions about my company EDIL loan?

– Can I pay off my loan earlier, instead of a 30-year term? If I can, how to calculate the amount, plus the interest…

– Can I change the guarantor of my loan to myself ?( previous guarantor was my manager, one of my family)