“How much can I safely withdraw from my portfolio?” is a frequently asked question among pre-retirees and new retirees. Ben Felix said it was 2.7%. Morningstar said it was 4.0%. Bill Bengen said it was 4.7%. Dave Ramsey said it was 8%. The higher the safe withdrawal rate, the more retirees can spend from their investment portfolios.

Researchers developed methods to raise the safe withdrawal rate. Some suggested using a guardrail system. Some suggested using annuities, whole life insurance, or a reverse mortgage. In any case, the implied message is that it’s desirable to have a higher withdrawal rate.

You also hear that it’s a challenge for new retirees to switch from saving to spending. Some financial advisors say a big part of their role is to encourage clients to spend more money. I also know YouTube and podcast shows that scold people for not living a rich life. A popular book Die With Zero encourages people to spend more money when they’re still young.

No doubt some people want to spend more but irrationally fear that doing so will jeopardize their future. Suggestions for overcoming this irrational fear include buying annuities, building a TIPS ladder, setting aside money in a separate “fun money” account, and creating spending targets and color-coded tracking systems to give oneself “permission to spend.”

However, I would say this emphasis on withdrawals and spending in retirement is misplaced. What matters in retirement is enjoyment and life satisfaction. Spending is a poor proxy for enjoyment and life satisfaction. The best things in life are (nearly) free. It’s OK not to spend more money when you go for enjoyment and life satisfaction.

Spending Requires Time and Attention

Spending always involves choices, which require time and attention to sort through. Retirees don’t need another job in figuring out how to spend their money; they may prefer to direct their time and attention elsewhere.

My wife and I spent several hundred thousand dollars on all sorts of materials and labor when we built our house last year. We’re happy with the final results, but the process of spending all that money took a lot of time and mental energy.

Should we use this 10″ x 2.5″ blue rectangular tile or this 4″ x 4″ white square tile for our kitchen backsplash?

We want to paint the interior walls white. Does that mean White Dove, White Heron, Cloud White, or any other 50 shades of white?

We have hard water here. Do we want a water softener that uses salt pellets or a saltless water filtration and conditioning system?

Some people might say the problem was that we bought things, and it would be better to spend money on experiences. Setting aside whether living in a house in which everything was hand-picked by ourselves is an experience, spending on experiences also requires choices, time, and attention.

Did you say international travel? Where to go? When? For how long? Need visa? Which airline to use? Buy the tickets now or wait? Economy, Premium Economy, or Business Class? Use cash or points? Where to stay? What to see? Sign up for a tour or go on our own?

Low Perceived Value

Observers of retirees not spending as much as they can afford mistakenly think those retirees must be afraid of running out of money. Besides not wanting to waste their precious time and energy on spending, retirees aren’t spending as much because they don’t see value in additional spending.

When we were building our house, I saw some neighbors put in these exposed beams on their ceilings:

I lost interest when I learned they were three-sided empty boxes purely for decoration.

Some other neighbors chose Wolf, Sub-Zero, and Thermador kitchen appliances. I’m sure those high-end appliances have some features that normal appliances don’t have. I wasn’t interested in finding out what those features were, because mainstream appliances had always worked well for me.

A home in the neighborhood was advertised as a furnished rental. It said all their furnishings came from RH. When I mentioned this to my wife, she asked, “What’s RH?“

I’m driving a 2005 Honda Accord. It’s been with me for 20 years. I know how it works. It takes me wherever I want to go. I can afford a new car, but it would still take me to the same places. I don’t see why I should spend time on figuring out whether I should want an EV, a hybrid, or a gas-powered car, which brand, model, trim, and options, or whether they’re still charging thousands over MSRP with a long wait to get a new car.

I’m not depriving myself of decorative faux beams, high-end appliances, upscale home furnishings, or a new car when I’m happy with what I have now. Getting out of my way to get them would be a distraction.

Spending Is a Poor Proxy for Enjoyment

I spent a full month in Switzerland in the summer of 2022. I enjoyed it and wrote a blog post about it. The trip cost well over $10,000 all-in.

A neighbor gave away a 20-year-old cheap bike by the curb last year. Walmart sells a new bike much better than this for under $200 today.

I pumped some air into the tires, and it still worked. I hadn’t ridden a bike since college. I started riding it in the neighborhood, in town, and eventually on a gravel road by a lake, which gave me this view in the spring:

Riding a bike got me to places I hadn’t been. I rode this old, cheap bike over 60 times in a year.

Looking back, I can honestly say that the cheap bike gave me more joy than the $10,000 vacation in Switzerland. I enjoyed both, but it doesn’t mean that expensive international travel (experience!) must be more enjoyable than a cheap bike (things!).

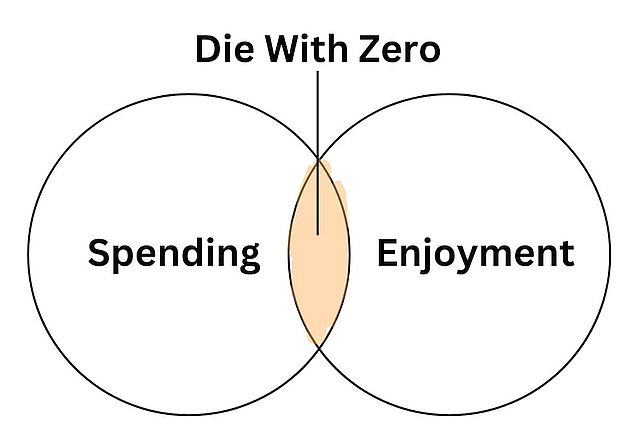

And that’s my biggest problem with the book Die With Zero. It falsely equates spending with enjoyment as if the more you spend, the more you’ll enjoy life. Money not spent is seen as forgone enjoyment. Spending can induce or enhance some enjoyment, but there’s only a thin overlap between the two. Fixating on spending misses the true source of enjoyment.

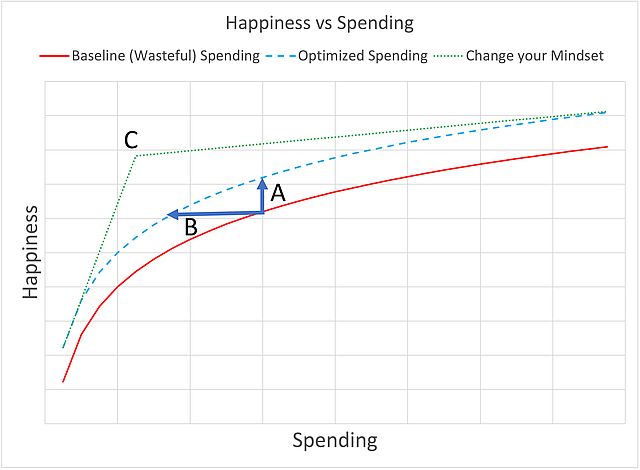

The blogger Frugal Professor included this chart in his blog post The Spending Tradeoff — Opportunity Costs vs Utility. The green dotted line shows the relationship between spending and happiness when you have a different mindset.

He concluded that if you shift your mindset, you unlock a superpower in which your happiness is largely uncorrelated with your spending once you hit a modest point C. Or as reader Eloise said in the comments:

Happiness is really an “inside” job. It is in the mindset. Having the time to reflect on this and discover it, is priceless.

The Best Things in Life Are Free

An advantage of retirement is having more free time. I can’t believe the endless enjoyable activities that cost little to no money.

I do beginner yoga by following videos by Yoga With Adriene on YouTube. It’s free.

I do some bodyweight exercises — pushups, squats, plank, lunges, and bird dogs. You need at most a $20 exercise mat.

I take a book to read on my favorite park bench under a tree by a pond. It’s free.

I learned history when I watched a 6-hour documentary series The U.S. and the Holocaust by Ken Burns. It’s free on Kanopy through the public library. Kanopy also has The Criterion Collection films and educational courses by The Greatest Courses.

I walk up a hill when I’m not riding a bike. It’s free and it’s good for both physical and mental health. This was the view last week (our home is down there in the middle):

We had booked travel to the Dolomites region of Italy this summer.

As the dates drew closer, we asked why we wanted to be tourists in Italy when we were enjoying our activities locally. Our home is more comfortable than a hotel. The food we cook is healthier than restaurant food. We don’t need to deal with potential flight delays, crowds, theft, or getting sick.

So we canceled the trip (experience!) and used the money to buy two new bicycles (things!). We had so much fun learning mountain biking as beginners. Every ride put a big smile on our faces. I rode 19 times for a total of 28 hours since I bought the bike at the end of August. I’m in the back in this compiled video:

I agree with Christine Benz when she said this on X:

“Memory dividends” don’t only come from a once-in-a-lifetime experience, such as flying 50 friends to an island, renting out an entire hotel, and booking your favorite band for a private performance (this was an example in the book Die With Zero). They also come from more frequent simple joys that cost nearly nothing.

OK to Underspend

A rich life isn’t about spending money. The best things in life are free. You won’t worry much about the safe withdrawal rate if you look for enjoyment and life satisfaction in the right places. It isn’t a character flaw if you’re not spending as much as you can afford.

I like this answer to the question Why is determining a withdrawal rate or method so difficult? on the Bogleheads Forum:

For most of us here, the only way to make this difficult is an effort to try to spend as much as you possibly can without running out.

We are not trying to do that, so it’s not difficult for us.

Wanderingwheelz

It’s not difficult for us either. We focus on enjoying the best things in life regardless of whether it requires spending money. If it does, we spend the money (we paid $6,000 total for our two bicycles). Otherwise we don’t concern ourselves with whether we’re “underspending.”

What do you do when the money pile grows and grows?

Giving, whether to family or charities, is completely different from spending. Money given to young people and charities means a lot to them. Seeing the results of your help brings back enjoyment and life satisfaction. Look for ways to give to family and charities. Give early and give often.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Doug says

Great article! I completely agree with you. I think the right spending on “things” can lead to many “experiences”. Like you, I enjoy the comfort of my home. I love to cook. Some spending on an upgraded kitchen (“things”) can lead to countless “experiences” of delicious home cooked meals, often with extended family and friends. Like Ms. Benz, no bucket list for me.

Mark Caspary says

Yes Harry, I think you’ve hit the nail squarely on the head! I don’t need a Bucket List. The simple things are enough for my wife and me. Gardening and maintaining the house are enjoyable to us, with an occasional vacation thrown in for good measure. We also enjoy playing music with friends and free concerts at the local college.

Harry Sit says

Beautiful! You found the true source of enjoyment.

Wade Shanley says

Timely article. I just read Die with Zero. While it was an interesting concept, something just didn’t sit right with me about it. It wasn’t all bad, we are thinking more seriously about gifting some of our investments now vs waiting till we die. That concept i do agree with. But its still a decision that requires mental energy and will be complex as our heirs are our 11 nieces and nephews. Nobody knows this now, but if we gift to them now they will have a good idea. Decisions!

KD says

Having an option to spend money and then not choosing to do is a bit different. But this is an excellent article and very good advice.

Robert says

Harry:

Thank you for this article and for how you are generously contributing to the well-being of your readers. Thoroughly enjoyed this read; sharing it with others.

SUSAN says

Harry, I enjoy reading your opinions which often seem to cut through all the gunk and confusion around doing things. I also appreciate your prioritization of simplicity in order to maximize time that is spent well. Thank you! Susan

Scott Dichter says

The tip off for Kanopy, which you can watch thru your Roku on your TV! Made this item a perfect examply of something free but high value (I get 30 tickets a month, hello Great Courses). THANK YOU VERY MUCH.

Jack Nettleton says

Thanks for another great post. I particularly enjoyed the chart from the Frugal Professor. Reading your internet content is an example of something that adds value and doesn’t cost money. I enjoyed your books as well and the cost benefit was very favorable.

I think those faux beams are kind of ugly anyway

The White Coat Investor says

Lots of fun things are inexpensive (my cheapest hobby, disc golf, is nearly free), but sometimes they’re not. An example:

I was just invited to a big 3 day hockey event in a remote place this Winter and really want to go. Unfortunately, on the morning of day 3 I am supposed to be 2 big states away giving a talk to a bunch of docs, which I also want to do. I could stay the evening of day 2 for the championship game and still make it to the speaking gig the next morning, but only if I fly private, which will cost more than I’m being paid to do the speaking gig and at least 10X what I could fly commercial for. Those sorts of experiences and convenience are what more money buys. I’m fortunate that I even have this decision to make. Swapping thousands for an enjoyable evening seems crazy because there once was a time in my life when I would routinely swap 2 hours and a bunch of my own blood plasma for $15. But you can’t take it with you.

Pd says

The Spend your money on “Experiences” bug hit us too.. We just got back from a long

trip to Japan that was nothing but stress from massively overcrowded tourist spots, language problems, high stress train and subway masses, and long waits for everything, including hotel check ins… a serene bamboo forest with 20,000 jammed tourists packed in like sardines.. an experience all right, and getting covid the last day to make post trip a wonder indeed.

Chris says

I agree except that your old steel bike is probably better than an “bike shaped object” from Walmart.

https://www.vice.com/en/article/mechanics-ask-walmart-major-bike-manufacturers-to-stop-making-and-selling-built-to-fail-bikes/

Erik says

I am male age 53 and retired seven years. i have read everything on this blog since inception. we are told here (this blog) and elsewhere that saving saving saving is quintessential to building a net worth to live on post retirement (i agree). Then, we find out that our frugal habits/nature become so pervasive, that the simple existence we fostered to get to the point of spending lavishly (post retirement) is no longer the “dream”. Giving is now going to be the end result.

Fred says

Great article Harry! I read Die with zero and it made me really think about spending more now and in the future. There are some great takeaways from the book. However, I like your point not to associate spending with life satisfaction. As White Coat Investor stated, there are however times spending more is associated with greater life satisfaction. For me, its about spending money on things or experiences that I value.

August West says

Well, I came away with a different impression than many of your other readers. I think you had a good point to make, which I think was that it is OK to just have money without feeling some need to plan out how to spend every last cent. But the way you made your point was with examples that detracted from your point by just making it seem that you are basically lazy. And, some of your examples were contradictory to each other and to your overall point. You celebrate the free bicycle and how it is better than any new bike you would have to pay for. Then, weirdly, you go into how you spent $6,000 for mountain bikes. Obviously, you have a lot of money and so whatever you do with your spending does not matter; most people are not in that situation. But anyway, spending $6,000 on mountain bikes is not at all indicative of having money and feeling like you do not need to spend it all. As Christine Benz has pointed out, things that you buy are used in ways that are experiences. So, you spent a lot of money and use the bikes for experiences. Seems to negate the whole point of your post.

Harry Sit says

I didn’t say the free bicycle was better than any new bike I would have to pay for. It’s not. I only said it was better than the $10,000 vacation to Switzerland. The free bike introduced me to activities I hadn’t thought of before, which ultimately led to buying “real” mountain bikes for more activities we enjoy.

My point isn’t that you should only go for things that are free. It’s a matter of which side you come in first when you have spending on one side and enjoyment on the other side with a thin overlap in between. If you approach from the spending side — “I have money. How do I use it to upgrade my life?” — it’s easy to go for vacation in Switzerland and Dolomites, a new car, faux beams, high-end appliances and furnishings, or flying 50 people to an island. “You can’t take it with you!” If you approach from the enjoyment side, you land on reading books by the pond, bodyweight exercises, watching documentary series, walking up a hill, riding bicycles, and inviting people to dinner. “It doesn’t matter if I’m underspending.” Paying $6,000 for two mountain bikes is the overlap.

robert says

i am 58 y/o in my 4th yr of my early retirement. i read “Die with Zero”. i liked some of the points it made such as if you were going to leave money to children that it may be better to do so at an earlier age rather than when you die and they are at their peak earning yrs or worse old where they don’t get to enjoy experiences money can buy. at the risk of making my son “soft” with finances and imperiling his self reliance, i decided to boost his UTMA taxable brokerage by giving him enough by 21(when he takes control) where he’ll get 2.5M by 60 without added inputs.( this is theoretical- i told him he needs to continue contributing to it as well as retirement plans). this also serves to get him enthused about investing and compounding and after several years it is working.

on the other hand, i very much disliked how “Die with Zero” equates spending as a measure of how you are going to have memory dividends with once in a lifetime experiences etc….you can build memory dividends with experiences that aren’t expensive. i don’t hunt, but bagging your first deer or staying at the deer camp, fishing trips, road trips will yield a lot of memory dividends on the cheap. i had done videos of my mountain biking and put them up on youtube though i am a mediocre mountain biker at best and it is to relive those experiences( i tell my son when he catches me rewatching them on youtube that i am my #1 fan that contributes the most views). my once a year 100 mile bike ride i started doing only after retiring and the pretty participation medals from it i proudly display on my curio cabinet ( i aim to have at least 10 lined up- so far 3) cost just the registration fee. i finally bought a new road bike to upgrade my 18 yr old road bike. amortized over years, the cost of dollars per hour spent on the saddle – that is a cheap buy even with expensive bikes, not to mention the health benefits. the memories of our frequent and relatively expensive trips we used to take in orlando theme parks when my child was young have faded away. my son can’t even remember them. travel for me is stressful as i worry about the house when we are away and how our pets are doing. we did take a 3 week trip through asia 6 months ago and i do know the japanese and singapore legs of that trip will pay big memory dividends but so did a cheaper trip to NYC and eating a NYC hot dog from a street cart or food from Halal brothers. years later my son and i still reminisce about having to walk a long distance in our flip flops to go back to our hotel after checking out some dolphin attraction for free while on vacation rather than paying for the dolphin experience. the walk was the fun part, the dolphins just jumped around.

living below your retirement means also just really give me a sense of security and contentment.

DonnaWanShare says

Great article!

Don G says

The idea that retirement has to be explained or written about with suggestions on what to do what or not do is evidence that the writer seeks confirmation of values. The Yoders were former employees of the Wall Street Journal are the best examples who are always providing excerpts of what they are doing and how profoundly rewarding it might be. It is no accident that there are 330,000 financial planners in the United States. In 2006 a man by the name of Marvin Najerb wrote a rebuttal to Barrons magazine about retiring on a million and how it was possible to do much better with less and how he rejected experts.

Therefore,I can offer NO insights, observations, or recommendations based on MY 16 years in retirement. I am only here on this site for entertainment value.

JB says

I love most of your content but disagree with the take on Die With Zero. For context I think it and your Toolkit book are my two favorite personal finance book recommendations to friends.

Yes the author of Die With Zero has more disposable income than the average reader (or many of his readers combined). But the point isn’t so much about spending on private island parties as it is to spend now to generate memories and value today over potentially spending it later.

The concept of creating memory dividends has really resonated with me, from doing free things with the kids or paid trips with adult friends, knowing that while I will have higher disposable funds in 30 years I won’t be in a position to do it all (eg kids grown!) And unexpected personal health situations within the family have brought this realization into vivid clarity over the last two years too.

In short, don’t just think about it, do it. Having said that, “it” doesn’t have to be expensive, but one is okay to spend some along the way to retirement rather than saving it all to start the fun and consumption after the retirement party. And even if I have oversimplified the approach, I know that through combining smart personal finance management along with being open to creating poignant memories along the way, it will be a truly rich life.

Harry Sit says

I don’t think we disagree. Creating memory dividends is all good but as you say, it doesn’t have to be expensive. The point of doing those free things isn’t to save money. They’re worth doing regardless. Some of them create more powerful memory dividends than the ones created by spending. The book Die With Zero said enough about generating memories by spending but I don’t recall it saying much about generating memories, period, with or without spending. If we only generate memories through spending, we’ll miss a big part of the memory dividends.

Eloise says

Harry,

I’ve been meaning to write a comment when I read this a few days back, but somehow got distracted and didn’t get around to it . :p This is a great post and I agree with a lot of sentiments you mentioned here. Happiness is really an “inside” job. It is in the mindset. Having the time to reflect on this and discover it, is priceless. I really enjoyed this post .

Sam says

Hi Harry! This is a very thoughtful post! I wanted to ask if you thought about normalizing the Zurich experience with the biking adventures based on the time you spent enjoying them. In particular, the Zurich trip must have been just a couple of weeks. Would you say that the enjoyment of biking adventures would still be more than the Zurich trip when restricted to a couple of weeks?

I agree with you that simpler (and possibly) cheaper experiences can bring a lot of enjoyment. However, to me, a diversity of experiences (whether cheaper or more expensive) has the potential to add value/enjoyment in ways we may not anticipate. If you have never traveled, then a trip can bring great rewards. But the marginal utility from every other trip dimnishes. I spent a summer in Japan (for an internship, so it didn’t cost me anything) a decade and a half ago, which significantly impacted me. I took Japanese classes once I returned, and so on. I bike every day, which adds tremendous value to my life. However, I have difficulty quantifying and separating the enjoyment I got from the two activities.

A friend met someone in Alaska who told him about the main highlight of visiting the mainland USA for the first time — he got to see an apple tree.

Balaji Kasal says

Interesting article. Different way bring the prspective.

Regan Blair says

I found your article of interest. We are in our 3rd year of retirement and have a simple lifestyle. Our biggest joy with money is giving it away either to our children, grandchildren or charity. Living in Hawaii and having our kids and grandchildren living on the mainland requires us to travel. Now that we’re retired we prefer to spend extra on 1st class airfare simply due to the long trips. It makes traveling a wee bit more tolerable even though others may think it’s extravagant. But the joy we experience when seeing our grandchildren far exceeds what we spend for airfare. All of us have different ideas about retirement and what we should spend. We take weekly hikes in the mountains which is usually the highlight of our week, but we also enjoy skiing in the winter…which requires us to travel once again. Others may envy us living in Hawaii, but the truth is there are lots of other expenses associated with it such as travel to the mainland to visit family. Without a reasonable nest egg such travel, and the memories that accompany that travel, would be unattainable. We’re grateful for having a surplus.

Harry says

That view with the RR track and snow peaks is absolutely amazing. What a discovery.

Q says

Wholeheartedly agree! We don’t shoot to spend a specific number in retirement. The way I look at it is 4% of the amount at the time of our retirement is our “cap” for expenses. Funny thing is, we don’t even come close to spending our cap. Which is totally fine because we have a wonderfully high quality of life and don’t seem to compromise on buying “things” or having “experiences”. The whole maximum spend thing never resonated with me either….

Cheers!