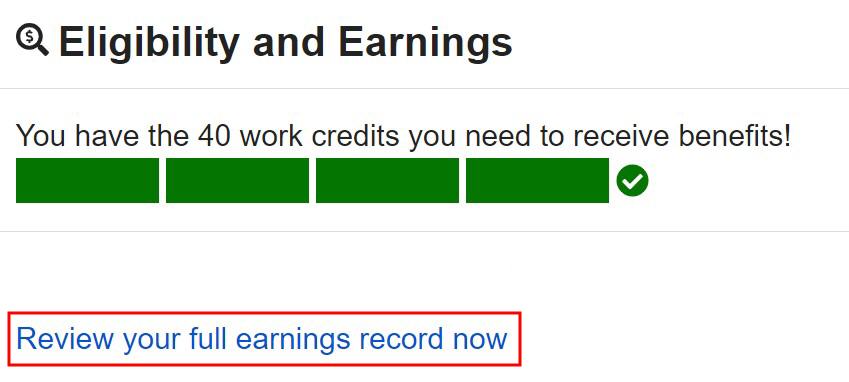

Although I’m many years from being eligible for Social Security, I created a my Social Security online account with the Social Security Administration. I did that as a part of the “plant your flag” strategy to preempt identity thieves.

Social Security Administration used to send paper statements once a year to report your earnings history and your estimated benefit. The benefit estimate on the paper statement assumed that you will work until your full retirement age and you will earn the same each year as you did last year. The full retirement age is 67 for anyone born in 1960 and after. When they moved the statement online, the online account showed the same estimate using the same assumptions.

Neither assumption is necessarily true. You may plan to retire early and not work until 67. You may plan to downshift and earn less for some years before you retire. While the paper statement had to show a single static estimate, doing the same in the online account doesn’t take advantage of the interactive computing capabilities.

ssa.tools

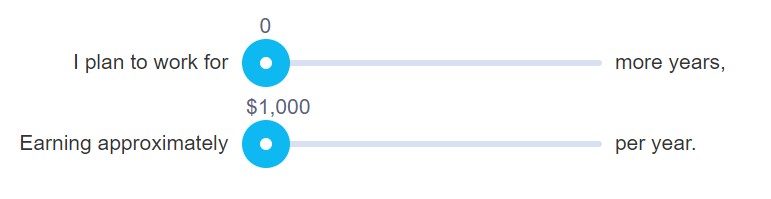

To help address this deficiency, software developer Greg Grothaus created a Social Security calculator at ssa.tools. After you copy and paste your earnings records from the my Social Security online account into ssa.tools, you have two sliders for how many more years you will work and how much you will earn per year.

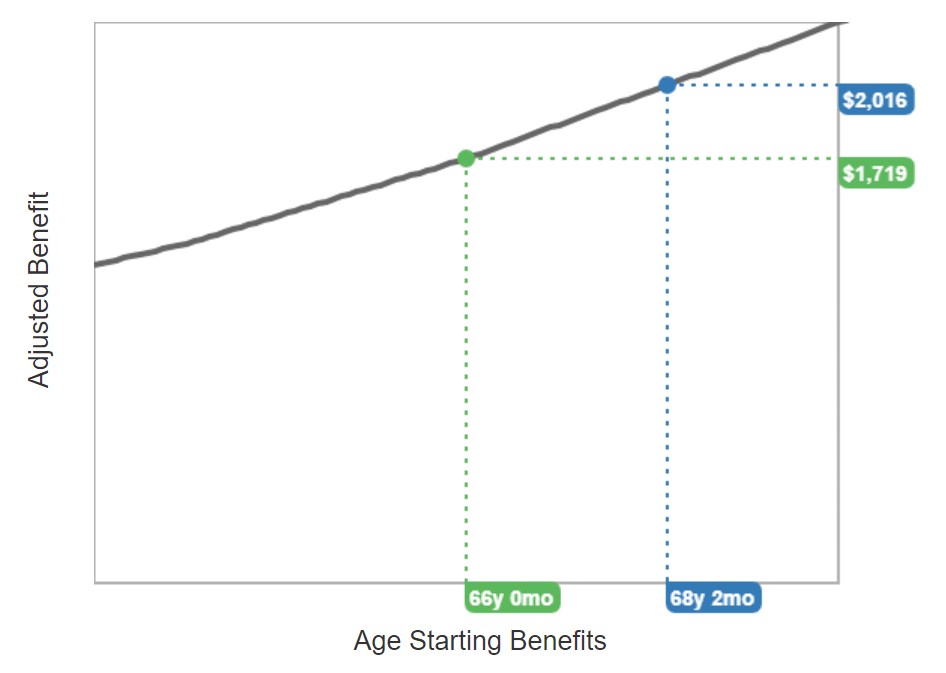

Moving the two sliders produces an interactive chart showing your estimated benefits at different claiming ages.

my Social Security

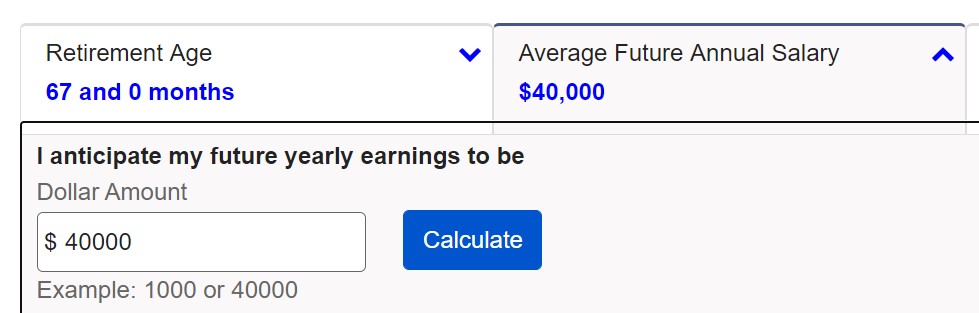

Social Security Administration apparently liked this idea. Now they built an interactive input in the my Social Security online account. This way people who didn’t know about the calculator at ssa.tools can also see how their estimated benefits will change by how much they will earn in the future.

Although the assumed future annual salary still defaults to your earnings from last year, you can change it to a different number.

The chart shows how your Social Security benefit changes by when you will claim your benefit.

Unfortunately, the chart in the my Social Security online account allows only changing the average future annual salary. They still assume you will work and earn that estimated salary each year until your full retirement age. You can’t change how long you will work. The input for “Retirement Age” is only for when you will claim your Social Security benefits. It shows the effect of claiming early for a reduced benefit or claiming late for a higher benefit. When you will stop working and when you will claim your Social Security benefits are two different concepts. They should make it clear and open a separate input for how many more years you will work.

It’s easier to use the my Social Security site because they have all your data, all the rules, and you don’t have to jump out to another tool. It’s a shame the government agency isn’t using that power to the fullest extent. While Social Security Administration also provides a detailed calculator that allows more granular inputs, that detailed calculator is harder to use and not integrated with your earnings history. You’ll have to type in each year’s earnings manually. The Social Security calculator made by Greg Grothaus at ssa.tools does a much better job in showing you how your Social Security benefits will change by how long you will work and how much you will earn.

Why did a government agency with its budget and resources do a poorer job than a side project by an enthusiast software developer and a couple of contributors? That has to be a topic for another day. Until the government agency catches up to the side project, copy your earnings history from the my Social Security online account and use ssa.tools.

You may be surprised to learn that after some years of full-time work, working additional years doesn’t add much to your Social Security benefits. See Retiring Early: Effect On Social Security Benefits.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Pop John says

Thanks Harry, as usual another insightful post. However, I have been using another tool and you are very familiar with it :-).

You wrote an excellent piece on second bend point on social security and attached a spreadsheet to calculate the second bend point. In addition to calculating the second bend point, the spreadsheet also gives a good idea of your benefits based on earnings you input. I use that to calculate my benefits. I just update the inflation numbers from the link you provided. This way I have all my data locally and need not have to input sensitive data anywhere.

Hope that is still accurate! Love to hear your thoughts.

Harry Sit says

After I came to know ssa.tools, I use ssa.tools myself now. The spreadsheet should still work. ssa.tools runs completely locally in the browser. The data don’t go anywhere outside. If you’d like, you can turn off WiFi on your computer before pasting the earnings data. You’ll see it still works.

Joe says

I applied for disability benefits and the option to estimate future benefits is no longer available from ssa.gov. I guess the next-best option for me would be ssa.tools, so I’ll try that instead.

Scott R says

Harry, I went to set up an account on ssa.gov and it asks for my cell phone #, but it sounds like it’s optional. I’m curious what your opinion is on whether or not I should give it to them or leave that blank.

Harry Sit says

They text a security code to your cell phone when you log in. I had no qualms in giving SSA my cell phone number.

d says

Great website. I built a tool to project the impact of working one more year (by year) until I reach full retirement age. This tool lines up with it almost exactly. Pasting my values in gave me a nice output I could paste into my spreadsheet (updating inflation indexes etc).

This info is really valuable and I will refer back to it from time to time. I copied the link into my spreadsheet. Thanks.

Ed Fogle says

Harry, how about a discussion of the Social Security Fairness Act of 2023. All reporting was that it would be retroactive to January 1, 2024. Not so fast. We found out part of it is only retroactive for 6 months and possibly less. I believe it’s the GPO part. It’s only retroactive for six months prior to applying for the spousal benefit. Since my wife’s spousal benefit was zero due to her pension she never applied. When we found out her new benefit wasn’t increased as we expected she contacted SSA in February which fortunately set the application date and therefore the retroactive date to September. Not quite January 1, eh? So listening to SSA tell everyone they didn’t need to do anything if their contact information was on file was bogus. It could cost dearly.

Harry Sit says

The retroactive restriction affects all Social Security claims. If you’re eligible for benefits, not even subject to WEP or GPO, but you don’t file a claim, you can only go back a set number of months. The automatic adjustment from the repeal only applies to people who already filed but had their benefits reduced. If someone filed in 2024 and chose to have their benefits start in November 2024 without backdating six months, their adjustment will also start in November 2024, not January 1, 2024. The January 1 date is only for people who filed and had their benefits reduced as of that date.

Social Security Administration says this on their FAQ page for the Social Security Fairness Act:

“If you never applied for retirement due to WEP or spouse’s or surviving spouse’s benefits because of GPO:

You may need to file an application. The date of your application might affect when your benefits begin and your benefit amount.”

https://www.ssa.gov/benefits/retirement/social-security-fairness-act.html?tl=5

That page was last updated April 22, 2025. I’m not sure when the quoted part first appeared on the page.

Ed Fogle says

The bureaucrats strike again! The writers of the bill obviously weren’t thinking. All the talk of retroactive to January 2 was bogus because they were on stupid to look at all scenarios. The could have written it to override this six month retroactivity. Infuriating.

Ed Fogle says

Harry,

Here’s the problem. Most people would take the reports at face value. SS said if you have your contact info on file just wait. All reports were that everything was retroactive to January 1, period. Most would not have known to go to the SSA website for more details. Case in point. My wife was subject to both GPO and WEP. Her teacher’s pension benefit precluded SS spousal benefits but she had earnings subject to SS so she receives a reduced benefit due to WEP. When she got her updated benefits letter in February due to the bill she just said “good I got another $300/month”. I thought that had to be wrong and looked at the letter.

Based on my SS benefit she should have gotten about $800/mo more. So I insisted she call SS. She explained this and they set up a call for two months later. Last week we got the call and I was included in it. That’s where I learned, despite all the news reports and statements from the media and SS, the retroactivity wasn’t really true. Further research indicates when applying for SS she probably was determined to not be eligible for any spousal benefits so there was no application for that and therefore no record. But how many people would remember this let alone think to go back and apply once the Fairness Act was passed? Fortunately the first call in February established her application date. A little good luck.

I’m sure many people subject to GPO never applied for any SS benefits so they will sit around waiting for SS to do what they said they’d do, contact them when SS has their new benefit figured out. All the while thinking it will be retroactive to the first of last year when in fact they are losing the benefit month after month.

The writers of the bill should have known about this so why didn’t they override the 6 month retroactivity limitation or clarify to the public the non-application of it for people subject to GPO? Typical bureaucrat stupidity as far as I am concerned.

Neelesh K Vaidya says

Hello Mr. Sit, I am wondering if it’s worthwhile to collect social security earlier – at FRA, rather than waiting until 70. Since the social security will run out of money by 2034.