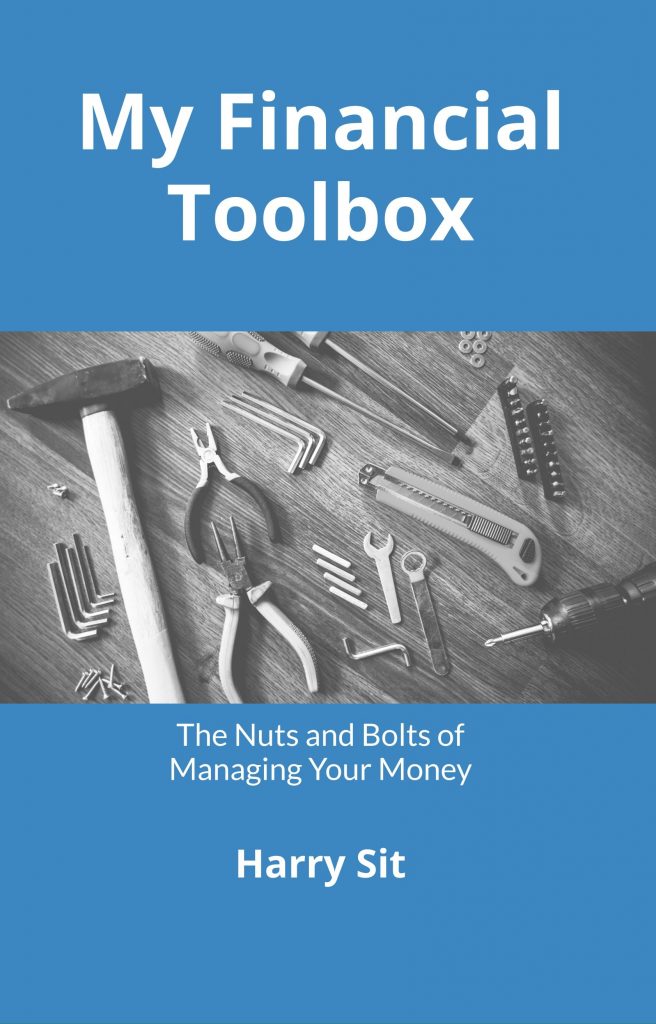

Hi, I’m Harry. I’ll show you the nuts and bolts of managing your money.

401k, IRA, investing, insurance, taxes, … I lived, breathed, and wrote about these for so many years. No fluff, just concrete first-hand learning and sharing.

Explore Topics

Recent Posts

Is It Worth Moving to Lower Cost of Living After You Retire?

Use this calculator to quantify the higher cost of housing in a very high cost of living area to decide if it’s worth it to stay put after you retire.

2024 2025 HSA Contribution Limits and HDHP Qualification

2024 and 2025 HSA contribution limits and HDHP qualifications for individual and family coverage. Big changes in 2024 due to high inflation.

Split-Year Backdoor Roth IRA in FreeTaxUSA, 2nd Year

Follow this detailed walkthrough of how to report in FreeTaxUSA recharacterizing and converting backdoor Roth contributions from the previous year.

Split-Year Backdoor Roth IRA in FreeTaxUSA, 1st Year

Follow this detailed walkthrough of how to report in FreeTaxUSA the backdoor Roth contribution made or recharacterized for the previous year.

Backdoor Roth in H&R Block: Recharacterized in the Same Year

Follow this detailed walkthrough of how to report in H&R Block recharacterizing a Roth IRA contribution in the same year and converting to Roth again.

Split-Year Backdoor Roth IRA in H&R Block, 2nd Year

Follow this detailed walkthrough of how to report in H&R Block tax software converting recharacterized backdoor Roth contributions from the previous year.