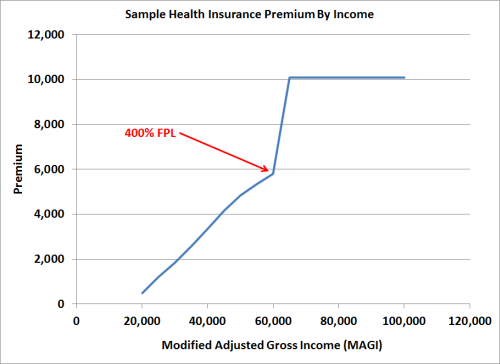

I posted this chart in the previous post Stay Off Obamacare Premium Subsidy Cliff.

It looked at the sudden jump in the net health insurance premium once your income goes above the premium subsidy cliff set at 400% FPL. This time we zoom in and take a closer look at the part of the chart when your income is below 400% FPL.

Suppose a married couple retired early and their modified adjusted gross income (MAGI) is $20k from interest, dividends, and capital gains. Should they convert some pre-tax money in their Traditional IRA to Roth in order to take advantage of their low tax rates?

Long-term capital gains are taxed at 0% for taxpayers in the 10% and 15% tax brackets (AGI up to $94k in 2014 for married filing jointly taking the standard deduction and two personal exemptions). Should they intentionally realize some more long-term capital gains when those gains are taxed at 0%?

They should if they have health insurance elsewhere. Things get more complicated when they buy health insurance on the exchange under Obamacare.

300% FPL bend point

Zooming in shows there is a slight bend in the line at 300% FPL.

This is because the deemed affordable premium as a percentage of income increases until your income reaches 300% FPL. Then it levels off at 9.5% of income between 300% FPL and 400% FPL.

| Income | Affordable Premium |

|---|---|

| up to 133% FPL | 2.0% of MAGI |

| 133-150% FPL | 3.0 – 4.0% of MAGI |

| 150-200% FPL | 4.0 – 6.3% of MAGI |

| 200-250% FPL | 6.3 – 8.05% of MAGI |

| 250-300% FPL | 8.05 – 9.5% of MAGI |

| 300-400% FPL | 9.5% of MAGI |

| above 400% FPL | full cost |

Extra Tax From Losing Tax Credit

Between 300% FPL and 400% FPL, when you add income by converting to Roth or realizing capital gains, your affordable premium increases by 9.5% of the extra income. Losing 9.5% in tax credit is equivalent to adding 9.5% to your marginal tax bracket.

Between 300% FPL and 400% FPL, the money you convert to Roth in the 15% tax bracket becomes taxed at 24.5%. Realized long-term capital gains which normally would be taxed at 0% become taxed at 9.5%.

When your income is below 300% FPL, the loss of tax credit due to extra income is higher, at about 15% of the extra income. The money you convert to Roth in the 10% tax bracket becomes taxed at 25%. The money you convert to Roth in the 15% tax bracket becomes taxed at 30%. Realized long-term capital gains which normally would be taxed at 0% becomes taxed at 15%.

Here’s a 2×2 matrix to summarize the impact:

| MAGI | Convert to Roth | Long-Term Capital Gains |

|---|---|---|

| Below 300% FPL | ~25-30% | ~15% |

| 300% – 400% FPL | 24.5% | 9.5% |

The first $20k or so in income is still tax free. It’s offset by the standard deduction and personal exemptions. It also takes you right up to the point where you become eligible for the premium subsidy (100% or 138% FPL). After that, you pay 25% to 30% tax on Roth conversions and 9.5% to 15% tax on realized long-term capital gains.

There’s an added cost on converting to Roth and harvesting long-term capital gains when you are getting the premium subsidy to buy health insurance under Obamacare. Considering that you are getting a large subsidy though, it’s still not bad.

It’s better if you are able to convert to Roth or harvest long-term capital gains before you get on the exchange (say when you have a part-time job that provides health insurance), or you do so in a year when you don’t get the premium subsidy anyway, as I wrote in the previous article Income Bunching Under Obamacare.

Related

Please read these related articles in the series about the Affordable Care Act:

- Stay Off the Obamacare ACA Premium Subsidy Cliff

- Marriage Penalty Under Obamacare ACA Premium Subsidy

- Income Bunching Under Obamacare ACA Premium Subsidy

- Effective Tax Rates Under Obamacare ACA Premium Subsidy

- Cost-Sharing Subsidy Under Obamacare ACA

- IRS Guidance On Circular Reference in Obamacare ACA Premium Subsidy and Deduction

[Photo credit: Flickr user SalFalko]

Say No To Management Fees

If you are paying an advisor a percentage of your assets, you are paying 5-10x too much. Learn how to find an independent advisor, pay for advice, and only the advice.

John says

When I retire, I think my new full time job will be managing my taxable income to work within all of these rules! Thanks for laying it out for us. Nice job.

Jay says

I remarried after my first wife died from cancer. A mistake as I am on Medicare and my wife is not for another 5years. She was on Obamacare as an independent contractor paying $400 per month for a high deductible plan of $5,000 that the premiums are close to $5,000. Two years ago she had an accident which her healthcare out of pocket expense exceeded $10,000 for two years. Now being married she pays $800 a month due to our combined household income. We are dropping the insurance and self insure despite the penalty…we are bankrupting ourselves.

Will Eaton says

Are there any tools or calculators that can help with LTCG harvesting and Roth conversion decisions when you are in the 0% tax bracket and have Obamacare/ACA?

Harry Sit says

TurboTax or H&R Block software installed on your computer will do it. Enter different amounts of LTCG or Roth conversion and see what effects they will have. The software you can buy now doesn’t have the new tax law changes for 2018. You will have to wait until maybe late November when the new versions come out if you’d like to see more precise results.

Harry Sit says

I found a spreadsheet that can do this. I did a walk-through in a new post:

2018 Tax Calculator With ACA/Obamacare Health Insurance Subsidy

Nancy says

I retired early and 2018 is my first year, 57 yrs old. I’m on the ACA and am constraining my MAGI taxable income as low as I can manage (single person, $12,600 in 2018) to get the best subsidy I can get. I made a spreadsheet to track and calculate income, quarterly dividends, interest, cap gains, as well as track any “above the line” deductions to taxable income for the year, so I can see at-a-glance a line item for calculated “Convert from IRA to Roth” to stay within that MAGI number for the year.

Constraining my income to this very low level means my conversion from pretax IRA to Roth is very minimal. I calculate I’ll be able to convert around $3K from IRA to Roth by the end of December.

I’m wondering if, starting in 2019, I should allow my taxable income to be a bit higher (say, $15K to $18K)? In other words, am I constraining my taxable income too low and missing out on what might be a better value of converting more $$$ IRA to Roth during these years I’m on the ACA until I reach age 65 in 8 years and go on Medicare? Any thoughts on if it’s better to convert more from IRA to Roth and get a smaller premium tax ACA subsidy?

Harry Sit says

It’s a tradeoff between receiving a smaller subsidy and possibly paying more tax now versus not having to pay taxes on the withdrawals from the Roth IRA in the future. In order to evaluate the tradeoff, you should first estimate what tax rate you will pay on the traditional IRA withdrawals in the future. That will be your savings. Next you find out by converting an additional amount, how much subsidy you will lose and how much additional taxes you will pay due to having a higher income. That’s your cost The spreadsheet tool in the reply to comment #3 will help answer the cost question. If you think you will save 25% in the future but you only pay 15% now, you would go ahead and convert more. If you think you will save 15% in the future but you will pay 25% now, you don’t do it.

Lou says

Nancy, my situation is similar to yours so Harry’s response is extremely useful to me. Thank you both.