[Updated on November 14, 2024.]

I have been buying health insurance on an exchange under the Affordable Care Act (ACA) since 2018. Before the ACA, getting health care coverage was one of the biggest challenges for becoming self-employed. Forget about the cost — just getting a policy was a challenge by itself. ACA changed all that. Now self-employed people and others who don’t get health insurance through their jobs can buy health insurance on the exchange.

Not only are you able to buy health insurance, but the coverage is also made affordable by the premium subsidy in the form of a tax credit. How much tax credit you get is calculated off of your modified adjusted gross income (MAGI) relative to the Federal Poverty Level (FPL) for your household size.

Your MAGI for the purpose of ACA is basically:

- your gross income;

- minus pre-tax deductions from paychecks (401k, FSA, …)

- minus above-the-line deductions, for example:

- pre-tax traditional IRA contributions

- HSA contributions

- 1/2 of self-employment tax

- pre-tax contribution to SEP-IRA, solo 401k, or other retirement plans

- self-employed health insurance deduction

- student loan interest deduction

- plus tax-exempt muni bond interest;

- plus untaxed Social Security benefits

Wages, interest, dividends, capital gains, pension, withdrawals from pre-tax traditional 401k and IRAs, and money you convert from Traditional to Roth accounts all go into MAGI for ACA. Otherwise-not-taxed muni bond interest and Social Security benefits also count in MAGI for ACA.

Side note: There are many different definitions of MAGI for different purposes. These different MAGIs include and exclude different components. We’re only talking about MAGI for ACA here.

400% FPL Cliff Converted To a Slope

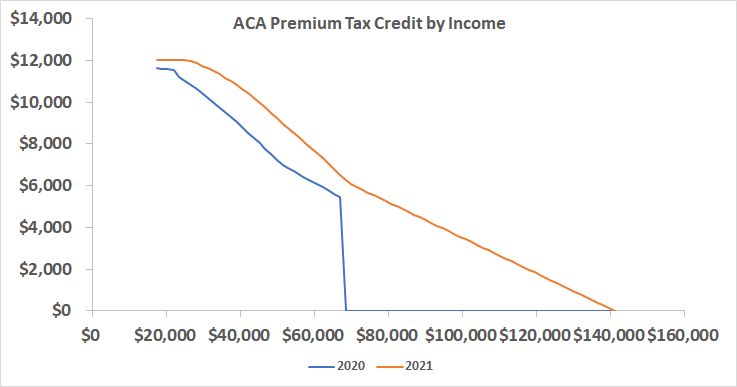

Your tax credit goes down as your income increases. Up through the year 2020, the tax credit drops to zero when your MAGI goes above 400% of FPL. If your MAGI is $1 above 400% FPL, you pay the full premium with zero tax credit. People had to be very careful in tracking their income to make sure it didn’t go over the cliff.

With the American Rescue Plan Act of 2021 and the Inflation Reduction Act of 2022, for five years only — 2021 through 2025 — this cliff becomes a slope. The tax credit will continue to drop as your income increases but it won’t suddenly drop to zero when your income goes $1 over the cliff.

The chart above shows the ACA premium tax credit at different income levels for a household of two people in the lower 48 states where the second lowest cost Silver plan costs $1,000/month. The blue line is for 2020 with the cliff. The orange line is for 2021 with a slope. The gap between the two lines represents the change from a cliff to a slope. The laws also increased the tax credit before the old cliff but the increase was much more significant after that point.

Because health insurance premium is higher for older folks and health insurance costs more in some areas of the country, the tax credit is also higher for someone older with the same MAGI and in areas where health insurance is more expensive.

When the Cliff Comes Back

Not having to watch out for the cliff is a huge relief to people closer to the edge of the old cliff, but the new laws are only effective for five years from 2021 through 2025. The cliff is scheduled to return in 2026.

For a household of a single person in the lower 48 states, that 400% FPL cutoff is expected to be a little over $60,000 in 2026. For a household of two people in the lower 48 states, the cutoff is expected to be close to $84,000 in 2026. See Federal Poverty Levels (FPL) For Affordable Care Act for where the FPL is for your household size.

People will have to manage their income and watch out for the cliff again. The most critical part is to project your income before the end of the year and not realize income willy-nilly before you do the projection. If you find yourself close to the cliff before you realize income, you can still adjust. Many people are caught by surprise only when they do their taxes in the following year. Your options are much more limited after the year is over.

Fortunately, it’s relatively easier to stay under the cliff for those who rely on an investment portfolio for income. When you are before 59-1/2, you’re primarily spending money from your taxable accounts. A large part of the money withdrawn is your own savings; the rest is interest, dividends, and capital gains. Spending your own savings isn’t income. If you withdraw $60k to live on, your MAGI isn’t $60k. It’s probably less than $30k.

When you supplement your income with part-time self-employment, you still have the option to contribute to pre-tax traditional 401k, IRA, and HSA. Those pre-tax contributions lower your MAGI, which helps you stay under the 400% FPL cliff when necessary.

100% and 138% FPL Cliff

There is another cliff on the low side, although that one is easily overcome if you have retirement accounts.

In order to qualify for a premium subsidy for buying health insurance from the exchange, you must have income above 100% FPL. In states that expanded Medicaid to 138% FPL, you must also not qualify for Medicaid, which means you must have MAGI above 138% FPL.

These are checked only at the time of enrollment. Once you get in, you’re not punished if your income unexpectedly ends up below 100% or 138% of FPL. If you see your income next year is at risk of falling below 100% or 138% FPL when you enroll, tell the exchange you’re planning to convert some money from your Traditional 401k or Traditional IRA to Roth. That’ll raise your income.

Say No To Management Fees

If you are paying an advisor a percentage of your assets, you are paying 5-10x too much. Learn how to find an independent advisor, pay for advice, and only the advice.

Sam says

Hi Harry,

On the 2021 ACA application I see a section ( near the end of the app) I did not see in the 2019 application.

Read & agree to these statements: If you disagree you may be asked to provide additional info. If anyone is later found to have qualifying coverage ( like medicare, medicaid or chip, the market place will automatically end their MP coverage.

Harry, Which is the best circle to check? circle 1= I agree to allow the MP to end MP coverage or circle 2= I don’t give the MP permission to end MP coverage in this situation. Very confusing as I don’t know which one to pick.

Harry Sit says

If you will never have outside coverage such as Medicare, Medicaid or CHIP, it doesn’t matter. If you’re afraid they will mistakenly terminate your Marketplace coverage, don’t give them the permission. If there’s a chance you will have outside coverage, you won’t qualify for the premium tax credit. If you don’t terminate the marketplace coverage yourself or let them terminate it for you, you will pay the full price. If you’re willing to pay the full price to have double coverage, don’t give them the permission. If you don’t want to pay the full price for coverage you don’t need, and you’d like to have them terminate it in case you forget, give them the permission.

Joyce says

I will be enrolling in an Obamacare plan for 2021 in Pennsylvania. In Sept 2021, I will qualify for Medicare so I will be on the ACA plan for only 9 months. When I estimate my 2021 income for the ACA, should I estimate for nine months (Jan – Aug), or for the full year? Also will stimulus funds, including one-time payments, or additional stimulus money added to pandemic unemployment, be considered income? ( I understand that unemployment is counted.) Thank you!

Harry Sit says

You need to estimate your income for the full year. The one-time $1,200 per adult plus $500 per child stimulus payment doesn’t count as income. The $600/week enhanced unemployment benefits do count.

Teri says

Hi Harry. I retired at 57 in mid 2019. My income for the year was too high to qualify for the PTC so I stuck with COBRA . in 2020 I sold part of a stock holding to live off of over the next 5 years. Now I am applying for ACA for 2021. My dividends over the next year will have me under the FPL, but as I have learned I can convert some traditional 403b from employer matching to Roth, or sell more stock to bring my income to ~ 150% FPL. I estimated my income to be $20,000 for 2021 on my application. My question today is, I must submit proof of my income. How do I do that? There is a list of documents that can be submitted. Obviously previous tax information is not accurate, I have no paycheck, what will “prove” the low income for the coming year?

Harry Sit says

Just write a letter and state your situation truthfully. Attach your retirement or COBRA paperwork to show you’re no longer employed, and your 403b and brokerage account statements to show where your income will come from. Worst case they don’t accept it and you pay the full premium. You’ll get the premium tax credit when you file your 2021 tax return. You only lose the cost-sharing reductions (lower deductible, co-pays, and out-of-pocket maximum) on Silver plans if they don’t accept your proof of income.

Ron says

Harry, thanks for your response. I didn’t quite understand the last sentence and I’m in a similar situation. My understanding is that you can get the same monetary amount regardless of if you file the paperwork and accept the reductions monthly or if you pay the full price and claim it on your 1040 at the end of the year. Does your statement, “You only lose the cost-sharing reductions (lower deductible, co-pays, and out-of-pocket maximum) on Silver plans if they don’t accept your proof of income” change that? Is there an advantage to getting those things monthly if you can over simply paying it for the year and claiming them on your taxes (aside from the opportunity cost on investing the money you’d be paying out of pocket of course)?

Harry Sit says

If you pay the full premium upfront you will still get the premium tax credit when you file your tax return. I do it that way myself. See ACA Health Insurance: Ask For Premium Assistance Or Not. When your income is at 250% FPL or below, especially 200% FPL or below, which is the case for Teri (but not me), you can qualify for Cost-Sharing Reductions in the form of a lower deductible, lower co-pays, and a lower out-of-pocket maximum. These Cost-Sharing Reductions are only available on Silver plans and only available when you ask for the subsidy upfront by proving your income will be that low. If your income won’t be that low it doesn’t apply to you.

David says

Hi Harry,

I am applying for a marketplace plan and I’m still confused about something. If I understand one of your previous answers correctly, you gave a high estimate of income in order to pay the full price and then claim the PTC on your taxes. However, if during enrollment I choose “no” to the question “Do you want to find out if you can get help paying for health coverage” then can I avoid giving an estimate at all, pay full price, and still be able to claim the PTC on my tax return assuming my income falls within the required range? Thank you.

Harry Sit says

The marketplace for my state doesn’t ask that question. Answering “no” to that question from your marketplace doesn’t forfeit your qualification for the Premium Tax Credit on your tax return.

Zan Rose says

Harry, what do you think? I’m rethinking the value of silver plan, a day too late. I think I over-value the extra cost savings. I’ve picked a silver plan, as I have in the past. This year: household size of two, but spouse has medicare, so just me. Household income is 2.45 timex FPL so we qualify for extra cost savings as well as APTC. But here is my day-too-late thinking. The bronze version of my plan would cost $1800 less in premiums over the course of the year. My typical expenses are 4 generic prescriptions (90-day each, so that’s actually 12 for the year), two pcp visits and two specialist visits. Even though the cost per prescription and per visit are higher, it doesn’t get near the $1800. In an otherwise low-use year, I can save the difference. I think bronze would have made more sense.

Even more so for my adult child who has no regular prescription expenses (age 25, not in my household, no insurance through work, income for 1-person household about 2.3 x FPL).

Oscar says

Harry, regarding the ACA 80/20 rule that health insurance cos. must spend 80% of premiums toward care of the patient and 20% for overhead. In 2020 I received a medical loss ratio (MLR) rebate of $327.00 for 2019 that was applied to one of my invoices in 2020 to reduce that month’s premium. However on the 2020 1095-a form the amount of monthly premiums are the same for each month. No adjustment was made for the one invoice month with the MLR applied to it.

I take the premium tax credit when filing a return.

I can find no where how to handle this or if no action is needed.

Harry Sit says

See IRS FAQs here:

https://www.irs.gov/newsroom/medical-loss-ratio-mlr-faqs

Recalculate your taxes for the previous year based on the reduced premium. If you received a tax benefit, the MLR rebate is taxable in the year you received it. If not, it isn’t taxable. It’s similar to how you do with the state income tax refund.

oscar says

Harry, no tax benefit, no deduction of premiums on 1040. But does anything need to be done regarding the 1095-a and

form 8962 when applying for the premium tax credit in 2020 since the MLR rebate was used to reduce one month’s premium for 2020? I received no check. The insurance company took it off the premium invoice.

Harry Sit says

No. Reducing the premium is just a substitute for sending you a check. Your 2020 premium didn’t change. You want to see whether your 2019 subsidy would have been lower had your 2019 premium been reduced by the rebate. If it would’ve, you benefitted from the overcharge, and therefore the rebate is taxable in 2020.

LZ says

Harry,

I’m self-employed and have had an ACA insurance plan for years. I’ve filed Form 8962 every year and take the Self Employed Health Insurance deduction every year.

In 2024, I received a medical loss ratio check because my insurance company failed to meet the 80% medical services milestone for 2021-2023. The check is only for a couple hundred dollars. From the link you shared and what you said in above comments on this topic, whether I need to do anything depends on whether I received a benefit in the past tax year or years. I’m unsure how to handle this in a few aspects.

1. Since the check is for the company failing to meet the milestone in 2021-2023, is it still a question only of if I received a benefit on my 2023 taxes?

2. At this point, I don’t see an easy way to recalculate my past taxes. They’re done and filed and I don’t think I can go back into the software and open up that past year and start playing with it again. So in that case, what to do?

3. If you do find out you had a benefit in the past year, what exactly would you do on this year’s taxes? Change how you fill out the Form 8962 in some way even though it would then not match your 1095-A for this year?

What would you do in my situation?

Harry Sit says

Because the check is for only a couple hundred dollars, the easiest way to handle it is to treat it as taxable income. You likely did take a higher tax credit or deduction than you would have in those previous years. It isn’t worth the efforts to find out. You don’t change Form 8962 or 1095-A for this year. You just add the check as other income in the tax software, which eventually lands on Schedule 1 Line 8z.

Teri says

Harry, Are all of the line items on 1099 div or 1099 Int tax forms counted towards my AGI? If not which forms of earnings or income are excluded? Specifically, are gains made within mutual funds (that remain within the fund) included as income?

Harry Sit says

The box 1 numbers on 1099-DIV and 1099-INT forms all count. Tax exempt muni interest counts too. Unrealized gains don’t count. Realized gains count even if you reinvest into the same fund or a different fund.

Charlie says

Under the recently passed Rescue Act/Stimulus Package, it appears one provision is to eliminate any paybacks of PTCs for 2020. If you already filed 2020 tax return and paid back some PTCs, can you amend and get this back?

Reference: https://www.inquirer.com/health/coronavirus/coronavirus-covid-19-stimulus-package-health-insurance-aca-tax-subsidies-cobra-20210313.html

And is the ACA CLIFF gone for 2020 and forward?

Harry Sit says

The law is only a few days old. The IRS needs to update the tax forms to reflect the new calculation. Then the tax software vendors have to update their software. Eventually you will be able to amend and get your money back.

The subsidy cliff still exists in 2020 for people like me who didn’t ask for the advance PTC at open enrollment for 2020. When my income is over the cliff, I pay 100% of the cost. The cliff is gone in 2021 and 2022, but unless the law is extended it’ll come back in 2023 and beyond.

Ron says

This article has been a great reference throughout the past few years. With the ARP (American Rescue Plan) it seems a few things have changed and the strategies discussed here need tweaking.

It seems that the cliff is no more for 2021 and 2022 – although there’s still a fall off, albeit more gradual now. I’d love to understand that more. For example, to get the full benefit your AGI | MAGI must be below [insert formula]; after which the drop off is computed by [insert formula]. I’m just starting my research. Any pointers would be helpful.

In a related note, the Stimulus Payment cliff is discussed here for those who care. It’s an interesting article that describes the three gates used to determine/manage if you qualify for the most recent stimulus payment. It also describes that there’s no clawback…meaning, once you qualify, even if you make over the limit in 2021, the government won’t require you to pay it back.

https://www.kitces.com/blog/the-american-rescue-plan-act-of-2021-tax-credits-stimulus-checks-and-more-that-advisors-need-to-know/

Stimulus Repayment

Ron says

Actually, that article was longer and better than I thought…. I have no connection to it btw … it covers the formula that I was looking for too…it’s just down near the bottom in a chart. I would say that article is a great addendum to this one in that it covers the modifications to what is discussed here based on the ARP.

Charlie says

Some Good News!

If you paid back an Advanced Premium Tax Credit for 2020 on an already-filed tax return, you won’t have to file an amended return and the IRS is going to reimburse you for the repayment you already made.

https://www.irs.gov/newsroom/irs-suspends-requirement-to-repay-excess-advance-payments-of-the-2020-premium-tax-credit-those-claiming-net-premium-tax-credit-must-file-form-8962

Charlie says

Good News Update–

The automatic refunds are going out for those who repaid their APTC on their 2020 tax returns before the change in the law was made.

I received mine today via direct deposit along with a smidge of interest.

Dan A says

Charlie, thank you so much for posting this bit of good news. Had it not been for your 4/13 comment, I would not have known why the IRS direct deposit appeared in my bank account this morning.

MM says

Great article and I’m sick that I did not know any of this for my 2019 return. I ended up having to payback $7k+ for the 2019 PTC for myself (husband was already on medicare), and that was with much effort with my CPA in calculating MAGI. I have read all of the above, my head is spinning. Is there anything I can do at this point to alter the results? I am guessing only an updated return showing a greater business loss? Both my husband and I are retired (and were in 2019), no W2 income, we have a small 25-year business, SS income, IRAs and Roth, tax-free bonds and muni bonds.

From what I read above, I could have simply made a contribution to an IRA as a remedy. Argh.

Harry Sit says

It’s too late for 2019, but I’m surprised your CPA didn’t suggest making a pre-tax contribution to a traditional or SEP-IRA. When the cliff comes back in 2023, watch your income before the end of the year and make necessary adjustments when you still have a chance.

MM says

I appreciate your quick reply. I am, too, and I’m not too happy about it! Will an updated 2019 return showing lower income from the business create an adjustment and a refund to me for the overstated MAGI on the 2019 form 8962?

And I am sending your article to my CPA. And to the insurance broker that never mentioned this when filling out the marketplace policy.

Many thanks.

Harry Sit says

Yes, but only if the original return was wrong. Otherwise someone will wonder why all of sudden you’re showing a lower income from the business more than a year after the books were closed.

Geoff says

A helpful article, thank you. Where can we access the subsidies “on the slope” for 2021?

Harry Sit says

You access the subsidy by buying health insurance on the ACA exchange for your state. Some states run their own exchange. Some states use healthcare.gov. See which is the case for your state here:

https://www.healthcare.gov/marketplace-in-your-state/

john says

Nice article Harry and thanks for doing it.

It’s just sad and typical government stupidity that if you make $1 over the cap your insurance is $1000+ for what amounts to garbage health insurance, keep it under the cap and you pay nothing for the same garbage, makes sense right ?

If the people currently in charge have any sense, and I don’t see much of that on either side, the sliding scale will continue, it actually incentivizes people to make more money which in turn helps everyone, which is probably why they’ll end it after 2022.

Charlie says

Harry, it seems there’s an enhanced opportunity for doing some Roth conversions in 2021 and 2022 while the ACA Cliff has been replaced with the Slope?

Will use that “Case Study Spreadsheet” to model different scenarios. It’s interesting to run these and compare various items such as the amount/% of SS being included in income, regular income tax, and ACA repayment.

With tax rates seemingly headed northward in the future along with the ACA Cliff being gone for 2021 and 2022, it may make sense to do some higher-level Roth conversions than one may have thought to do.

Harry Sit says

Definitely model different scenarios with the case study spreadsheet shown in this post: Tax Calculator With ACA Health Insurance Subsidy. I’ll update that post to the latest spreadsheet shortly.

Carol says

I’m very interested in this (enhanced opportunity for Traditional-to-Roth IRA conversions), as well. Thanks for pointing this out.

Dave says

I’m 64 and received the Advance Payment of Premium tax credit for 2020 with my 2020 MAGI just $200 above the 138% FPL. That was with a $2,000 HSA contribution. And I do not qualify for expanded Medicaid here in NH. I contributed only $2,000 to my HSA for 2020 because that was about my limit to avoid pushing me below 138% FPL. But on reading this, it sounds like I could make another contribution for 2020 (if I do it by 5/17/21) of up to $2,550 and yet not have to pay back any of the subsidy? Is that right?

Harry Sit says

That’s right. The 138% FPL is only checked at the time of enrollment. When you file your tax return, the minimum is 100% FPL, and there are still ways to qualify even when your MAGI goes below 100% FPL. See IRS Form 8962 Instructions, page 2, under “Who Can Take the PTC.”

john hopper says

I’m 64, single filer, and live in New Orleans. Healthcare.gov tells me the max amount of income to be eligible for an Obamacare subsidy in 2021 is $51,520. I called Healthcare.gov, the IRS, and my insurance provider -Blue Cross Blue Shield and none of them had any information as to how I can figure out how much subsidy I will have to pay back when I file my taxes next year if I make more than 51k in income (the slope). Can you tell me where I can access that information?

Harry Sit says

Use the calculator from the Kaiser Family Foundation:

https://www.kff.org/interactive/subsidy-calculator/

First enter your income as $51k and see how much subsidy you qualify for. Next increase your income, say to $61k, and see how much subsidy you qualify for. The difference is the amount you’ll pay back if you estimate that you’ll make $51k but actually make $61k.

Kevin says

Harry,

Does the charitable contribution adjustment for standard-deduction takers (non-itemizers) – that is, the amount that goes on Line 10b of the 2020 Form 1040 – get added back to taxable income (or AGI) to arrive at MAGI for ACA purposes? Thanks!

Thanks for a wonderful article. This was incredibly helpful.

Harry Sit says

No. It reduces AGI and MAGI in 2020 by up to $300. The similar deduction in 2021 doesn’t reduce AGI or MAGI.

Kevin says

Thank you. Very succinctly put. So I can go ahead and max the 2021 above-the-line charitable contribution deduction without worrying about the effect on MAGI (although, thanks to *you*, I know that it is a slope rather than a cliff this year and next). Good!

Dee says

Hello, thank you for your insight. My earned income is a little too low and I need to increase my income to qualify for an ACA subsidy and avoid Medicaid. If I convert an existing IRA into a Roth in 2021, does the full amt. of the current value of the conversion count as income or does only the original IRA deposit amt. count? So if I opened an IRA in 2012 for $5,000 and it is worth $5,500 today, does the full $5,500 count as 2021 income?

Harry Sit says

The full $5,500 counts as income if the original $5,000 was pre-tax.

Dee says

Thank you. What are my options as an age 55+ single mom with a 17 year old dependent in a state with expanded Medicaid? I want to avoid Medicaid for myself so my estate doesn’t owe the State $$ when I die if I use benefits. Can I get single ACA coverage if my son qualifies for Medicaid? Or can he opt for ACA coverage too? Our income is in the $20k to $26k range. I can adjust income up or down slightly by opening an IRA or converting an existing one to a Roth. Suggestions? Thank you.

Harry Sit says

Many states cover children under Medicaid or a Children’s Health Insurance Program (CHIP) at a higher income level when the adult isn’t eligible for Medicaid. If your dependent is eligible for Medicaid or CHIP, you can get single ACA coverage. Medicaid or CHIP is free or close to free when your dependent qualifies. Check where your state’s cutoff is from Kaiser Family Foundation:

https://www.kff.org/health-reform/state-indicator/medicaid-and-chip-income-eligibility-limits-for-children-as-a-percent-of-the-federal-poverty-level/

And of course double-check with your state’s agency for Medicaid or CHIP for the most up-to-date eligibility criteria.

Alan Jaffe says

For my family of 3 in Fl. I have to make a minimum of $21,700. Now my income is $55,000 (all from dividends), of which $45,000 of it is non-taxable and $10,000 of it is taxable. So my question is, do they consider the $55,000 as my income or $10,000? If they consider the $10,000, then maybe I don’t qualify. Thx.

Harry Sit says

You qualify. They look at your Modified Adjusted Gross Income (MAGI). Whether your dividends are taxable or not, they’re still part of your gross income.

Angela Caruso says

I found your article and thanks for your research and up to date info.

I left teaching in June of 2021, and was covered until Aug 31 with Employer sponsored Healthcare. I could have opted into COBRA until Oct 31. I applied for coverage, but was given a high price in late October due to the fact COBRA was still offered. I’m currently uninsured.

Should I apply now with my approx 45 year to date income? Or wait until 2022? I will start work abroad with family in Puerto Rico making about minimum wage for the spring, and not sure about the Sumner. My full time residence is NJ. Thanks

Harry Sit says

Enrollment for 2022 is open right now. You should enroll now before open enrollment ends. The relevant income they ask for is your estimated income in 2022. It doesn’t matter what your income was in 2021.

Angela Caruso says

I appreciate your response. Thank you

Davis says

harry,

Florida did not expand medicaid and I do not qualify for medicaid in any case.

Does this mean I must be 100% or 138% above the FPL in 2019,2020,2021?

Harry Sit says

100% of FPL in non-expansion states.

Greg says

In reporting Roth Conversion to IRS for ACA income purposes, what exactly do they want? Simply a brokerage statement that at least shows that line item?

Dave says

You’ll get a 1099-R that reports it.

Greg says

Thanks Dave. I wasn’t clear. I have to submit something to ACA by March 11, 2022 showing proof of income for 2022, or my plan could be cancelled. I guess they just want to see if I’m on a track with the expected income I used in my application. I won’t have any tax documentation for it at this point so I’m trying to find out what would suffice to prove that Roth Conversion. This is my first year using ACA my plan.

Dave says

OK Greg, if I understand correctly you did a conversion from IRA to ROTH in 2022. In that case, I’d say yes, the brokerage statement that shows it would suffice.

Greg says

Yep, that’s correct, and my thinking as well. Thanks Dave.

Charlie says

For those people who are asked for “proof” of next year’s income when your situation is going to be different, just provide them with something reasonable that makes sense.

I went from working to retired and my plan was to take some distributions from IRA to be my income. I sent them a letter explaining these circumstances and provided them with a copy of my IRA brokerage statement. I indicated I was going to take XX Dollars out during the next year. The brokerage statement showed 25 to 30 times that amount as being available. They accepted that and I’ve never been asked again to submit proof of income again. Good Luck.

G says

I did a Roth conversion, taxable income event. They didnt accept, I called and was told to just upload explanation. Thats fine, as that document is not in their list and is in the “Other” category. I did that, fully explained it. They say I didn’t send the requested info and have determined my eligibilty will change July 1. I actually sent everything required, so back to the phone to see what the deal is.

ameridan says

Anyone looking for a method to reduce income to avoid the cliff, consider buying secondary CDs that aren’t new issue, and are have higher coupon rates than current interest rates. You will pay a premium (rather than @ par of $100, might pay $115 per $1000, as an example), and your brokerage will report the amortization of that premium you pay (spreading out that capital loss), as an annual adjustment to the interest earned, which you will then reflect on your Schedule B.

Paul says

Hi Harry,

I jumped into CD’s too early this year and now I can get double or more, but must pay the EWP. Never did this before and being told this will show up in box 2 of 1099int.

If I do go through with it , how will it effect magi for ACA purposes?

Harry Sit says

The early withdrawal penalty is an above-the-line deduction. It reduces your MAGI for ACA purposes.

Peter says

Harry,

I-bond income that is deferred until cashed. Is this annual income included in MAGI for ACA purposes?

Charlie says

Only if you elect to have it reported each year. The default is deferred until the year you cash in. Deferring makes sense in my situation because in a few years, both will be on Medicare and won’t be on ACA.

Dan A says

Amortized Bond Premiums (from buying high interest rate secondary CDs at higher than par values) and early withdrawals can be nice subtractions from MAGA.

G says

I know that if income is projected too low (subsidy is too high), then we simply pay additional taxes when filing tax returns. But what about the deductible side? Say I have a plan with $50 premium and $500 deductible and I had $1500 in healthcare services that year, and it turns out that my income was too high for that plan and the best that would have fit was a $100 premium and $2000 deductible. I will have to pay back the additional $50 premium subsidy, but what about the fact that I actually did not qualify for the low deductible? So I my $1500 in healthcare would have still have been all of mine to pay in the $2000 deductible plan, but in the $500 deductible plan, I only paid a smaller percentage of the $1500 in services. Does the IRS claw that back as well? Or is it only premium subsidies that are the focus?

Harry Sit says

You keep the low deductible plan.

Toli says

Hi Harry. I have one minor suggestion for your excellent post, for your thoughtful consideration. There’s the subsidy one is qualified to receive based on their MAGI, household size, etc., and its associated cliffs (low- and high-end) which you cover very well. As you noted in a comment, though, there’s the separate issue of potentially repaying the advance payment of PTC. That repayment has its own cliffs as well. For example, a 4-person household in the lower 48 who expected minimal income (close to 100% FPL) may pay nothing out-of-pocket towards premiums during the year for a reasonable health plan (which is thus fully subsidized through the advance payment of PTC). Then, in December, they receive unexpected income (e.g., a poorly planned Roth IRA conversion, illiquid inheritance) which raises their income (MAGI) above 100% FPL. At tax-time, they may have to repay the advance PTC payment, fully or partly depending on their MAGI. The repayment also has cliff-like characteristics, jumping (for TY 2022) from $650 to $1,650 to $2,800, and then straight to $9,010 (8.5% of MAGI=$106,000=400% of FPL) or more (up to the full advance PTC payment for high enough MAGI). The point is: (a) very small changes in MAGI can lead to disproportionate increases in additional tax-time payments; (b) which may also trigger under-withholding penalties; (c) the new law may turn the subsidy cliff into a slope, but not does not smooth out the repayment cliffs (nor should it); (d) receiving advance PTC payments has some additional pitfalls requiring more careful planning. None of this is unreasonable from a policy design standpoint (the advance PTC payment is a bonus in itself, so its repayment is totally fair game, cliffs or no cliffs), but it can trip up households with liquidity challenges so worth pointing out in your article. Cheers!

Toli says

“Illiquid inheritance” was a bad example since inheritance doesn’t affect the income of the recipient. Better examples of illiquid income are certain lottery winnings (e.g., winning a luxury car in a raffle), or cancelled debt. My bad.

Harry Sit says

The repayment cap is covered in Cap On Paying Back ACA Health Insurance Subsidy Tax Credit. I agree it’s totally reasonable to repay when you have a higher income. The whole repayment cap is a bonus. If you benefit from it, great. If not, that’s the amount you would’ve paid anyway had you estimated your income more accurately upfront.

Toli says

Thank you for the link for the repayment cap post, Harry. I have one more remark (applicable whether or not there’s advance PTC payment) which you may find helpful to share with your readers.

I have heard more than once the following incorrect but reasonable sounding rationale regarding the subsidy: “My contribution (Line 8a of Form 8962 for TY 2022), exceeds my plan premiums (Line 11(a) or 12(a)-23(a)), so I obviously don’t qualify for a subsidy because no premium is left for the government to subsidize after you subtract my contribution, so I won’t bother with Form 8962.” That is dead wrong. As long as your contribution is below the SLCSP premium (Line 11(b) or 12(b)-23(b)), even if your contribution exceeds your plan premiums, you still get a subsidy. In other words, your so-called contribution should not be understood as the portion of the premium you have to pay, despite its name.

More generally, whenever you buy a plan that is cheaper than the SLCSP, as is often the case with HSA-eligible plans, the subsidy is NOT plan premiums minus your contribution; it is higher, at SLCSP premiums minus your contribution (and also capped at the plan premiums, which practically matters only for very low MAGI). That is true at any MAGI, so even at or above 400% FPL, where your contribution is easy to compute as 8.5% of MAGI without completing Form 8962, don’t just compare 8.5% of MAGI to your plan premiums and give up prematurely if the former is higher.

The upshot is: use tax software (no, I don’t work for a software provider), or, if not, complete Form 8962 to the end because your intuition may mislead you to quit early and leave money on the table.

ed_from_vancouver says

Hi Harry,

I’ve been running some “last minute” numbers and it seems I have about $40K of LT capital gains that I can realize at 0%. But, if I do this, it seems (according to the KFF 2022 Health Insurance Marketplace Calculator) that will lose out on $6K of subsidies. I’m left scratching my head as to whether this makes perfect sense or not…

ed_from_vancouver says

meant to write “LT capital gains *harvesting that I can potentially* realize”

Harry Sit says

It’s true that realizing capital gains (taxed at 0% or not) will reduce your premium subsidy. See Roth Conversion and Capital Gains On ACA Health Insurance. Maybe the repayment cap will help. See the link in the reply to comment #136 above.

ed_from_vancouver says

Thanks, Harry. Excellent links, as always. That spreadsheet has given me something to play for the next few hours! 😮

Lou says

I have spent hours reading through this information. I am self-employed and this is the first year I have signed up for ACA. This article and all of the comments show how critical it is to be informed on the rules – my tax person doesn’t seem to know anything about the ACA and how this all works.

I don’t see any comments for 2023. Is this article is still open for more comments and questions for the 2023 tax year? Once I digest all of the info on the links and the information I have read, my tax person or I am sure to have questions.

Thank you for all this great info !!!! It is greatly appreciated !!!

Harry Sit says

It’s still open for comments and questions.

G says

Be very careful. I was playing with numbers in my first year getting set up and went all the way thru, then cancelled application with income above Medicaid, and one that would have put me on Medicaid. I was just testing things, I would not have had such a low, nor would I want to be on Medicaid. Well, the non-Medicaid one canceled without a problem, but even though I canceled both, her came the Medicaid forms in the mail because they had put me on it. I had to make several calls to get off of it. I have no less than 8 pieces of mail related to it, some before I got removed, and still more after. Didn’t run into the plan year, it was all done in December, but they wasted no time dumping me into it even though I canceled the application.

Harry Sit says

The application is for really applying for insurance. It isn’t for playing or testing. If you only want to see your options in different scenarios, use the “see health plans and prices” part of Healthcare.gov or an equivalent “shop and compare” section on the exchange run by your state.

https://www.healthcare.gov/see-plans/

Lou says

That is great news – thank you Harry!

G says

Long done with that.

Last year (first time renewing) the process asked for December 2022 income. Not knowing what it was going to do with that December entry, I filled it in, expecting more screens letting me know what it was going to do with it. Instead it used Dec income as the 12 month multiplier for 2023 full year income estimate AND submitted with NO confirmation prompt. Had to call and get it removed, then go back and instead put in my own 2023 estimated income. Won’t make that mistake again.

Just an fyi for anyone following this thread. Hopefully they’ve changed it, telling the applicant that it’s going to 12x that December income, and allowing for backing out of that before submitting (or better yet just not use December at all and simply go with an upcoming year total estimate). Haven’t gone thru renewal this year so I don’t yet know if anything is different.

Ed says

Hi Harry,

Today, I have heard about an “adjacent-to-the-ACA” health care option that I had not heard about previously: the “cost sharing subsidy”. I did a search on your website and found a 10-year-old article, but what I want to understand is if it will apply to me (and other readers) and how to see if it can be used and what the benefit will be.

My proposed situation: Just my spouse and me (both under 63 years) and there is the potential to lower our ACA-MAGI to 39,399 (just under the 200% Fed Pov line). How/where (which site) can I test what the cost will be relative to a Gold plan that I’m currently paying for? How does it exactly “boost” (if that’s the word I want) the Silver plan?

I apologize if you have covered this and I missed it. It’s been 5 or more years since I did a deep dive on the ACA and I pretty much just kept renewing without thinking about options.

Harry Sit says

The cost-sharing subsidy still works the same way as that 10-year-old article described. When your income is below 200% of the Federal Poverty Level, you’re eligible to enroll in an enhanced Silver plan that’s better than a Gold plan (87% actuarial value versus 80%). You pay less and you get more. The “boost” comes in the form of a lower deductible and a lower out-of-pocket maximum.

I just tried in my zip code for a household to two people both 63 years old with an income of $39,399. The Silver plan has $0 deductible for medical, $750 deductible for prescriptions, and a $6,000 annual out-of-pocket maximum. A Gold plan from the same insurance company has a $3,000 deductible for medical, $750 deductible for prescriptions, and a $16,000 out-of-pocket maximum. The enhanced Silver plan is better than the Gold plan and it costs $400 less per month than the Gold plan.

You can test/see your options on the ACH marketplace where your normally enroll, under “See Plans & Prices” or “Shop and Compare” or something to that effect.

Ed says

Thanks for the pointer to the ACH Marketplace.

I think I ruined the option for myself (for this year) though. I realized about 40K of capital gains which, with my regular investment income, has us (me and spouse) at a projected 75K for ’23.

I *think* I could potentially bring it down to $39K by doing some tax loss harvesting but…what if I “miss” and only get to $40K. It seems like this is another version (in the shape of steps) of the Obamacare “cliff”. — I wish I could accurately predict what my mutual funds would pass through to me as dividends by year end. I’d hate to just miss it…

Harry Sit says

If you’re enrolling for 2024, it’s based on your estimated 2024 MAGI. Realized capital gains in 2023 don’t affect 2024 health insurance. Just keep your 2024 income low if you enroll in the enhanced Silver plan for 2024.

You’re not punished for barely missing the cutoff due to unexpected income at the end of next year. The cost sharing subsidy doesn’t require a repayment if you miss your estimate.

Ed says

Thanks, Harry!

Your advice was spot on: I went to the (Washington state) site and entered my numbers. From looking at the deductibles and co-pays that the site has listed, it’s not entirely obvious to me that the “Cascade Silver” plan I will have next year is superior to the “Gold” plan I have right now, but everything I’ve heard about on other sites says that this is the way to go. Enhanced Silver >> Gold….who could have guessed that?