As I’m self-employed and under 65, I buy health insurance through the health insurance marketplace established under the Affordable Care Act (ACA). It’s for people in jobs that don’t offer health insurance, 1099 contractors, part-time employees, freelancers and gig workers, self-employed business owners, retirees under 65, and others who don’t get health insurance through an employer or a government program.

I’ve been doing this for eight years. Nationwide, over 20 million people buy their health insurance this way. It’s still a small percentage relative to the number of people who get health insurance from employers (165 million), Medicare (68 million), or Medicaid and CHIP (78 million).

If you’re among these 20 million people, you may qualify for a Premium Tax Credit (PTC) to buy health insurance. The tax credit is based on your modified adjusted gross income (MAGI) relative to the Federal Poverty Level (FPL) for your household size. In general, the lower your MAGI is, the less you pay for health insurance net of the tax credit.

MAGI for ACA

Your MAGI for ACA is basically:

- Your gross income

- plus tax-exempt muni bond interest

- plus untaxed Social Security benefits

- minus pre-tax deductions from paychecks (401k, FSA, HSA, …)

- minus above-the-line deductions listed on page 2 of Form 1040 Schedule 1, for example:

- Pre-tax traditional IRA contributions

- HSA contributions made outside of payroll

- 1/2 of the self-employment tax

- Pre-tax contributions to SEP-IRA, solo 401k, or other retirement plans

- Self-employed health insurance deduction

- Student loan interest deduction

Wages, 1099 income, rental income, interest, dividends, capital gains, pension, withdrawals from pre-tax traditional 401k and IRAs, and Roth conversions all go into the MAGI for ACA. Muni bond interest and untaxed Social Security benefits also count in the MAGI for ACA.

Tax-free withdrawals from Roth accounts don’t increase your MAGI for ACA.

Side note: There are many different definitions of MAGI for various purposes. These different MAGIs include and exclude different components. We’re only talking about the MAGI for ACA here.

2021-2025: 400% FPL Cliff Changed to a Slope

Your premium tax credit goes down as your MAGI increases. Up through the year 2020, the tax credit dropped to zero when your MAGI went above 400% of the Federal Poverty Level (FPL) for your household size. If your MAGI went $1 above 400% of FPL, you had to pay the full premium for your ACA health insurance with zero tax credit.

Laws changed during COVID. This 400% of FPL cliff became a downward slope for five years, from 2021 to 2025. The tax credit continued to decrease as your MAGI increased, but it didn’t suddenly drop to zero if your income went $1 above 400% of FPL ($81,760 in 2025 for a two-person household in the lower 48 states). The tax credit at income levels below 400% of FPL also became more generous during those five years.

The Cliff Returns in 2026

The new 2025 Trump tax law — One Big Beautiful Bill Act (OBBBA) — didn’t extend the enhanced tax credit after 2025. The 400% of FPL cliff is scheduled to return in 2026. The premium tax credit for incomes below 400% of FPL will also drop back to the pre-COVID levels.

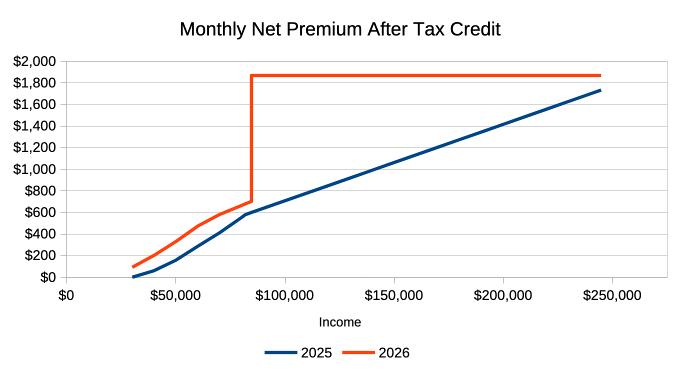

A decrease in the premium tax credit translates into an increase in the monthly premium net of the tax credit. The chart above illustrates the monthly net premium at various income levels for a sample household. The blue line is for 2025, with the enhanced tax credit. The orange line is for 2026, without the enhanced tax credit. The sharp vertical rise shows the cliff’s effect.

Variable Impact

How your net premium after any tax credit will change in 2026 depends on your position in the chart.

If your MAGI is to the left of the vertical cliff in the chart, your premium net of the tax credit will go up slightly in dollar terms. It goes from $158/month to $331/month at a $50,000 income in this example. Although the net health insurance premium more than doubles between 2025 and 2026, a $173/month increase may be manageable if you’re prepared.

Your net premium will increase by a higher amount if your income is to the far right in the chart. At a $200,000 income in this example, the net premium increases from $1,417/month to $1,872/month, up $455/month. No one wants to pay $455 more per month, but at least you have the income to afford it.

The increase is precipitous immediately to the right of the cliff. We’re talking about going from $602/month in 2025 to $1,872/month in 2026 at an income of $85,000. That’s an increase of $1,270 per month or $15,240 for the year. How do you come up with an extra $15,000 for health insurance when your income is $85,000?

Premium Increase Calculator

I created a calculator that shows how much more you can expect to pay in 2026 compared to 2025. This doesn’t include the relative price changes between the plan you choose and the benchmark plan. You’ll pay extra if the price for your plan increases more than the benchmark plan, or less than the amount shown if the price for your plan goes up less than the benchmark plan.

Know Your Cliff

You must know first and foremost where the cliff is for you. The table below shows the 400% of FPL cliff for various household sizes in 2026:

| Household Size | Lower 48 States | Alaska | Hawaii |

|---|---|---|---|

| 1 | $62,600 | $78,200 | $71,960 |

| 2 | $84,600 | $105,720 | $97,280 |

| 3 | $106,600 | $133,240 | $122,600 |

| 4 | $128,600 | $160,760 | $147,920 |

| 5 | $150,600 | $188,280 | $173,240 |

| 6 | $172,600 | $215,800 | $198,560 |

| 7 | $194,600 | $243,320 | $223,880 |

| 8 | $216,600 | $270,840 | $249,200 |

Source: Federal Poverty Levels (FPL) For Affordable Care Act.

Coping Strategy

The chart I used as an example is for a two-person household. A chart for your specific situation will have the same shape but different numbers on the axes.

If your MAGI is safely to the left of the cliff and there’s no risk of going over, be prepared for an increase in your health insurance premiums in 2026 due to the decrease in the premium tax credit. If it’s far to the left, watch out for a different cliff at the low end, which I’ll explain later in this post.

If your MAGI is too far to the right of the cliff and you have no way to bring it to the left of the cliff, you’ll have to pay 100% of the health insurance premium starting in 2026, which can be well over $20,000 a year.

The tricky part and the opportunities are in the middle. If your MAGI is close to the cliff on each side, you should manage it carefully to keep it from going over the cliff.

Manage Your Income

The most critical part is to project your MAGI throughout the year and not to realize income willy-nilly. You can still adjust if you find your income is about to go over the cliff before you realize income. Many people are caught by surprise only when they do their taxes the following year. Your options are much more limited after the year is over.

If income from working will push your MAGI over the cliff, maybe work a little less to keep it under.

Tax-free withdrawals from Roth accounts don’t count as income.

Take a look at the MAGI definition. Minimize items that raise your MAGI, and maximize everything that lowers your MAGI.

When you have W-2 or self-employment income, you have the option to contribute to a pre-tax traditional 401k and IRA. These pre-tax contributions lower your MAGI, which helps you stay under the 400% of FPL cliff.

Choose a high-deductible plan and contribute the maximum to an HSA. The new 2025 Trump tax law made all Bronze plans from the ACA marketplace automatically eligible for HSA contributions starting in 2026.

On the other hand, Roth conversions, withdrawals from pre-tax accounts, and realizing capital gains increase your MAGI. You should be careful with doing those when you’re trying to stay under the 400% of FPL cliff.

Shifting Income

If you’re at risk of going over the cliff in 2026, consider accelerating some income from 2026 to 2025 when the premium tax credit is still on a slope. If pulling income forward to 2025 helps you stay under the cliff in 2026, you lose much less in premium tax credit from your additional income in 2025 than in 2026.

On the other hand, if you’re going over the cliff in 2026 no matter what, consider postponing some income from 2025 to 2026. Once you’re over the cliff in 2026, you have nothing more to lose, while less income in 2025 will give you more premium tax credit.

Borrowing

If you have a temporary spike in your need for more cash, consider borrowing instead of withdrawing from pre-tax accounts or realizing large capital gains. Spending borrowed money doesn’t count as income.

When you need cash to buy a new car, instead of realizing large capital gains and pushing yourself over the cliff, take a low-APR car loan to stretch it out. HELOC, security-based lending, and selling short box spreads are also good sources for borrowing.

You can repay the loan when you don’t need as much cash or when you no longer use ACA health insurance.

Bunching Income

If you can’t avoid going over the 400% of FPL cliff, consider bunching your income. When you’re already over the cliff, you might as well go over big. Withdraw more from pre-tax accounts or realize more capital gains and bank the money for future years.

Spending the banked money doesn’t count as income. Going over the cliff big time in one year may help you avoid going over again for the next several years.

100% and 138% FPL Cliff

There is another cliff at the low end, although you can easily overcome it if you have pre-tax retirement accounts.

To qualify for a premium tax credit for buying health insurance from the ACA marketplace, your MAGI must be above 100% of FPL. In states that expanded Medicaid, your MAGI must be above 138% of FPL. This map from KFF shows which states expanded Medicaid and which states didn’t.

The marketplace sends you to Medicaid if you don’t meet the minimum income requirement. The new 2025 Trump tax law required reporting work and community engagement in Medicaid. You don’t want to have your income fall below 100% or 138% of FPL and be subject to those new requirements in Medicaid.

If you see your income is at risk of falling below 100% or 138% FPL, convert some money from your Traditional 401k or Traditional IRA to Roth. That’ll raise your income above the minimum income requirement.

Other Changes to ACA

Besides letting the Premium Tax Credit cliff return, the new 2025 Trump law also made these other changes to the ACA:

All Bronze Plans Will Be HSA-eligible

All Bronze plans and catastrophic plans offered through the ACA marketplace will automatically be eligible for HSA contributions starting in 2026.

Before this change, an HSA-eligible plan could be more expensive than a high-deductible plan not eligible for HSA, which negates the benefit of contributing to an HSA (see Downsides of HSA: When It’s Not Worth It to Contribute). Starting in 2026, you can choose a less expensive plan and still contribute to an HSA, which lowers your MAGI and helps you stay off the premium cliff.

Repayment Cap Eliminated

Currently, if you underestimated your income when you enrolled and received more subsidy than your actual income qualifies, you would pay back the difference when you do your taxes, but the repayment has an upper limit. See 2025 Cap on Paying Back ACA Health Insurance Subsidy.

The new 2025 Trump tax law eliminates the repayment cap starting in 2026.

No More Auto-Renewal

Right now, if you don’t actively renew for next year during open enrollment, you will automatically continue with your current plan or a replacement plan selected by the marketplace.

The new 2025 Trump tax law requires re-verification at each renewal, starting in 2028. You may be dropped if you miss the deadline to re-verify. Set up multiple calendar reminders for the open enrollment deadline — don’t miss it!

***

You’ll find more deep dives on recent changes from the 2025 Trump tax law in the full OBBBA series.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Rob says

I was receiving indiana HIP (medicaid) till I was approved for disability, then Medicaid said I made to much and going to lose my insurance. I had to take a distribution from my 401 to live off of befor my disability started. Will this distribution count as income on healthcare.com

Denise says

Unfortunately I believe it will. The only income I believe that doesn’t count is SSI and veterans disability. Even your tax free income counts. You can go to healthcare.gov site and it will tell you what income is reportable. I also think you must be disabled for 2 full years before you are eligible for medicare.

Rob says

If I open a health saving account, will it reduce my income for market place insurance? Is there a time line when you can open the account? Does the market place use income after deductions?

Denise says

Yes! You can open a HSA but it will only help if the health plan you are on qualifies. Many on the ACH do not. You have until April 15 th to set up account the previous yr taxes.

It reduces your income and you may use the funds at anytime in the future but not for premiums. Other than this and any capital losses you may are the only deductions tgey allow.

Sid says

Can you use your HSA funds in a year where you do not have a HSA plan?

Denise says

Example: If you open an HSA in 2018 you may fund it and you do not have to use the funds in 2018. In 2019 you may fund the account and again do not have to use any if the funds. At some point you will obviously wish to as they must be used for health care expenses. There are all kinds of banks and financial companies that you can open an HSA with.

I would have liked to have opened and funded and then used the account years later when I would be on medicare D drug plan but unfortunately my ACA plan did not qualify. The healthcare.gov site with all the plans disclose what plans are eligible.

Rachael says

Wondering if anyone else in my situation? I am currently receiving widows benefits and medicaid. I am going to have to replace the roof on my home and the only way is to withdraw funds from retirement account. This is going to make my income to high for medicaid and will not be able to afford purchase on the exchange so I am stuck and don’t know which way to go. How long before I can reapply for medicaid? I hate to take out a loan and pay more in interest than I am earning on my retirement account.

Denise says

Personally, I would do the loan.

Not qualifying for both ACA and Medicaid will be quite costly.

You can always pay off that loan in the future.

The only other options might be accessing a Roth which is not taxable.

Or offsetting gains against investment losses if you own anything outside of 401

Laura says

I know if you work and your health insurance is more than 9.5% of your income you can apply for Obama Care- does that include prescription, dental, and vision along with the health insurance premium you pay?

And that does not include if you put your child on the policy, correct? Is there any cheap premium insurance you can recommend for a young adult under 20.

Denise says

Laura, you can actually go to http://www.healthcare.gov and enter enough information to get a look at actual costs and policies. You dont need to actally apply or give personal info. Just generic.

I was on the ACA with BCBS which included RX but not dental or vision. They may have HMO’s that might offer different things. Personally I want more control over who I see and I travel so HMO not a fit. You are young and healthy though.

Good luck.

Harry Sit says

In order to receive the premium tax credit in 2019, you have to show the employee’s premium for the lowest self-only coverage exceeds 9.86% of your household income (up from 9.56% in 2018). That does not include premiums for dental or vision, or any deductible or co-pay.

https://www.healthcare.gov/glossary/affordable-coverage/

Denise says

I have tax exempt muni bond interest that must be calculated and added into the magi for ACA. Is there anyway to offset this income by selling stock and taking a capital loss? I recieve monthly income from these tax free bonds however the muni funds themselves would be at a loss if I sold. Would that offset the tax free income received?

I am over about $5000 in my income estimate for 2018 and am afraid I will have to pay back funds plus penalty.

Harry Sit says

Not exactly but it can have a similar effect. The loss can only lower your normal income, not your tax free income. Assuming you don’t already have a loss carried forward from previous years, the loss you realize now will first offset any realized or distributed capital gains this year. Then you can use any additional loss to offset ordinary income, up to $3,000. Offsetting your capital capital gains and/or ordinary income will lower your AGI. Then you add your muni interest income on top.

If you don’t have any capital gains, generating a loss only lowers your income by $3,000. You still need to find another $2,000 elsewhere.

Denise says

Ok. Let me try this idea/question.

I have yrly income of approx $7500 from the muni bond tax free.

I have not sold them but I have an “unrealized ” loss on them of about $9000.

If I sold some would that negate anyone of the interest of the $7500? Or does it just get treated same as normal capital gain/loss offset.? (I already did an equal wash of capital gain/loss and have & have a -$3000 carryover loss)

It seems I have been paying myself that monthly income out of my darn principal and now it may also cost me more $ for ACA.

We have purposely complimented our social security income from our savings rather than investments for this reason.

Fortunately as of August we are both on medicare! No more aca! Though i was grateful we had that option.

Thanks for all your help and quick response!

Harry Sit says

When you already have $3,000 or more in capital loss carried over from previous years and you don’t have any capital gains to offset, realizing additional capital loss doesn’t lower your AGI any further. The additional capital loss will be carried forward to future years. Capital loss from muni bonds does not offset the interest from muni bonds.

SSD says

Hey Harry,

I’m 28 and my 2019 income will be more than $150k (filing as individual). I’m healthy overall so would it be best to simply skip out the ACA plans since I won’t get a subsidy and go with a short-term plan that covers medical emergencies?

Thanks

Harry Sit says

You should first find out how much a policy costs. In my area, for one person age 28, the least expensive ACA policy without any subsidy is only $170/month. To a self-employed, it’s also tax deductible. It’s easily affordable with a $150k income.

SSD says

So in my area cheapest ACA is $226/mo with $8k deductible.

I’m looking at short-term health insurance plans and I get one for 12 months for $135 with $5k deductible & max out of pocket and 0% coinsurance.

Are ACA Plans supposed to be better than Short term plans? I’m mainly looking for emergency situations…

Harry Sit says

ACA plans are better. They can’t deny claims as pre-existing conditions. They also don’t have any coverage maximum.

Charlie says

I agree with Harry 100%.

I will tell you what my insurance agent said. Say you get a short term policy for a year and you develop cancer during that year. When that year is up, that insurance company or another might write you a new policy, but cancer will be a pre-existing condition and won’t be covered for one penny. If you are still undergoing treatment or it comes back, you’re screwed. Get an ACA plan and sleep well. And don’t think 28-year-olds can’t get cancer.

Sis says

I am 70 but my spouse is 64, not eligible for Medicare until 66, I planed to farm until then and my spouse was on ACA, which based on income fluctuationed a small amount each year. Due to major disability early this year I could no longer farm so sold equipment to generate income for the rest of our lives. While filing taxes, was told I owed $17,000. For past year for ACA. Wasn’t planning to stop farming until she was 66. Is there any way due to hardship, to not have to pay this much? (As given to me)

Linda says

Well what was your combined income?

Charlie says

Your spouse should be eligible for Medicare at 65 (younger if on disability or has End Stage Renal Disease), you may be confusing this with Social Security when you mentioned 66. No comment on the rest of your question, it seems more details may be needed. Good Luck!

ec says

This is a great thread & a really important topic. I retired in my early 50’s and have been buying insurance on ACA since it was implemented. As a consequence of ZIRP implemented by the Fed post-financial crisis my fixed income investments have been yielding very little but the flip side of that has been to allow me to dial in my MAGI (basically Roth conversions, interest, dividends & capital gains) to maximize my subsidy and minimize the cost of insurance. For 2019 my net cost for a Silver Plan for a family of three is about $550/mo based on $67k MAGI which is reasonable IMO. The messed up thing is the whole 400% MAGI cliff whereby a small increase to around $82K would send my premiums through the roof to over $2100/mo. Whatever the rules are I need to play the game for another 7 years before Medicare, but I still remain stunned that they created a system so patently unfair to so many people. Why was the cliff necessary to create this law? It should be a smooth phase-out as MAGI increases IMO.

Denise says

I dont mean to be political but I believe if the Democrats get elected in 2020 you will see changes that may be in your favor of your healthcare situation. You may see some positive changes sooner as the mid term election showed healthcare is a major issue for many Americans.

I am now on medicare and so grateful to not be worried any longer though it still costs my husband and I almost $700 a month for medicare and supplemental premiums. When I was on ACA it drove me crazy that my dividends on my tax free muni bonds were not counted towards my own income but were counted towards my magi. Holding those investments caused my magi to increase even though they were down many thousands of $. I did not want to take that kind of hit and sell at a loss.

Might a healthcare savings plan help offset your magi?

puala says

Great column, I have learned alot. To make sure I am straight on this. I recently quit my job and may not meet the minimum threshold for 2019. I can just transfer traditional IRA to a Roth Ira and that could help me get Obamacare subsidies? Would taking a 20k capital gain on a second home sale, also qualify me?

Harry Sit says

Yes converting to Roth will raise your income. At very low income levels it’s probably also tax free. Realizing capital gains will also raise your income. It’s also tax free below a certain threshold.

Betty Hsu says

My filing status is single, and my agi is above 138% of FPL to qulify for silver plan in 2018. As for 2018 tax return, I’m considering to claim my mother as my dependant, this will change my filing status to head of houshold, and household size changed from 1 to 2. I forgot about the obamacare, silver plan eligibility at all.

If I use head of household status file for 2018 return, my income will be below 138% FPL, this will cause the lose of eligible subsidy of silver plan. Do i need to payback the premium credits? Should I just keep the ‘single’ status for 2018, and change it to head of household status for 2019?(increase the agi accordingly to above 138%fpl) Thanks. Betty

Harry Sit says

The 138% FPL (or 100% FPL in some states) minimum income is only looked at the time of enrollment, not at the time when you file your tax return. If your income for the year ended up below the minimum, as long as you made the original estimate in good faith, you are not required to pay back the premium subsidy you already received.

You are required to notify the marketplace when your income and household size change. If your income going forward will be below the minimum for ACA based on your household size, they will switch you to Medicaid.

Gary Gummow says

I fall off the bottom cliff because past investment losses put my AGI to zero, which also kicks me out of Medicaid. Doesn’t matter if work or not — I wouldn’t make enough to get it above zero. Any suggestions? Thanks

Henry C Buzza says

I have considerable investments in Government I-Bonds, am I correct in assuming when I cash them only the interest will be calculated as income for Obama Care

Harry Sit says

That’s correct. If you pay higher education tuition in the year you sell and you meet some other qualifications the interest may be exempt and not count as income.

Thomas says

What about the cost-saving reduction cliff? A person earning $24,980 can have a zero deductible plan while a person earning $24,990 will have a deductible of $3,500. Since cost-saving reduction subsidies do not have to be reconciled why would anyone estimate their income earning at the higher level and end up with a much worst plan that could cost them thousands of dollars more? Another cliff occurs at the estimated income level of $31,225. Your deductible could change from $3,500 to $6,000. By estimating a slightly lower income you may have to reconcile premium subsidies at the end of the year but you will have had the great advantage of a much better health insurance plan. What if your income changes in the middle of the year and for whatever reason you failed to report it to healthcare.gov? Again you may have to reconcile premium subsidies at the end of the year but the cost-sharing reductions may have saved you thousands of dollars. Are there any repercussions that I am missing? Another question I had is in reference to putting money in a traditional IRA to avoid having two pay back premium subsidies at the end of the year. Can you deduct a future contribution into a traditional IRA from your estimated income to keep it low enough for cost-sharing reductions?

Harry Sit says

For what reason will you fail to report your mid-year income change to the exchange? The government can give you a fine of up to $25,000 for “failure to provide correct information … where such failure is attributable to negligence or disregard of any rules or regulations.” They can give you a fine of up to $250,000 for “knowing and willful provision of false or fraudulent information required.”

https://www.law.cornell.edu/cfr/text/45/155.285

If your make an estimate below a cutoff and you can demonstrate that your estimate is reasonable, it’s OK if your actual income goes slightly over, but you are also required to notify the Exchange when you know your income is going higher. If they see you are just trying to game it, you can get into trouble.

Planned deductible Traditional IRA contributions can reduce your estimated income.

Ramesh says

Harry

My wife has ACA for 2019 yr. Our joint income as magi will be $25400 pa. I am 69 yrs drawing social security which is not taxable at the reported income. To generate taxable income at I have converted Roll Over IRA to Roth IRA. This will boost my magi to $42K. This converted Roth IRA is taxable income but we have not

withdrawn Is this conversion will account for magi?

Also you mentioned that withdrawal from Roth IRA is not taxable therefore it will not be added in calculating magi. My understanding is that it is true for the defferred Roth IRA/Roth 401K.

Pls comment

Harry Sit says

The untaxed Social Security counts in MAGI for ACA. The Roth conversion also counts. In trying to stay above the minimum I hope you didn’t put you over the maximum, which for a household of 2 in 2019 is $65,840 in the lower 48 states. After you already did the conversion it’s not possible to undo or reduce the converted amount. If the $25,400 is from your wife’s employment or self-employment, the two of you may be able to make deductible Traditional IRA contributions if it’s necessary to reduce your MAGI to below the maximum.

Michael Skipperky says

Great article, really appreciate it.

My question is does interested/dividends from these types accounts count towards your MAGI?

Normal 401k?

IRA?

HSA?

Roth IRA?

I’m trying to figure out which ones to include to calculator our number as this is the first time we are qualifying. Greatly Appreciate your help

Harry Sit says

Income within those tax advantaged accounts don’t count. Withdrawals from pre-tax 401k or IRA count.

Jeff says

While it is easy to find the location of the subsidy cliff, how do you find the size? Being youngish and single, I think there will be little subsidy left at 400% FPL, and so the size the cliff is low enough that it doesn’t make sense to plan around it. But how to know for sure? Is there a good way to find the SLCSP (second lowest cost silver plan) for this year before the year is over? healthcare.gov has a tool, but it only works for a year once that year is over, and of course the paper form that tells you is also only mailed once the year is over. For the coming year, I had healthcare.gov show me all the silver plans sorted by cost and wrote down the 2nd lowest, but that is too late for this year. And for next year, given the wobbly interface I have little confidence this is will match the official number anyway once I get it in 2021.

Harry Sit says

The size of the subsidy varies by location, age, and household size. For someone young and single, it can be small or zero, or it can still be substantial. Healthcare.gov and all the state exchanges are showing prices for next year right now during open enrollment. If you shop for a special enrollment for the current year, you will also see the prices for the current year. For planning purposes it will match closely if not exactly to the number on the eventual 1095 form.

Kate says

Thanks for writing this article and putting a name on the ACA “cliff”. My husband and I are still working in December 2019 and don’t want to fall off but are still confused about the maximum MAGI numbers after talking to someone on the Marketplace phone line. For 2 people in SC (a non-expansion state), would our maximum income be $65, 840 or $67,640? Marketplace tells us the latter number. Thanks!

Dan says

“Phaseout levels: For 2019, after earning an income of $100,400 or higher for a family of four, $83,120 for a family of three, $65,840 for a married couple with no kids, and $48,560 for single individuals, you will no longer receive government health care subsidies.”

Charlie says

$67,640 for a couple for 2019.

https://aspe.hhs.gov/poverty-guidelines

The cliff is 400% of the applicable FPL.

Dan says

Well, as Kate stated – how confusing and conflicting, because of poverty thresholds vs. poverty guidelines. Good find Charlie.

Kevin says

There seems to be a conflicting consensus here also.

I found this which is what I have been using:

FPL Numbers

Here are the numbers for coverage in 2018, 2019, and 2020. They increase with inflation every year in January. These are applied with a one-year lag. Your eligibility for a premium subsidy for 2019 is based on the FPL number announced in 2018. The new number announced in 2019 will be used for coverage in 2020.

There are three sets of numbers. FPLs are higher in Alaska and Hawaii than in 48 contiguous states and Washington DC.

48 Contiguous States and Washington DC

Number of persons in household 2018 coverage 2019 coverage 2020 coverage

1 $12,060 $12,140 $12,490

2 $16,240 $16,460 $16,910

3 $20,420 $20,780 $21,330

4 $24,600 $25,100 $25,750

more add $4,180 each add $4,320 each add $4,420 each

It shows for this year to be $65,840. Remember there is a one year lag, what was published in January of 2019 is for 2020 coverage NOT the 2019 coverage which had already started.

Kevin says

For Kate:

When you are looking at or talking to the marketplace be sure to check for what YEAR they are talking about. The current 2019 year or the new 2020 year. Searches in the marketplace will be giving info for the new 2020 year since the marketplace is now open for new plans.

$67,640 will be the cliff edge for the year 2020. $65840 is the cliff edge for 2019.

I know it can be confusing depending on how the particular website you visit words things. But the KEY take away is how they use the word “COVERAGE”. The 2018 poverty level or guideline is what is used to determine 2019 ACA coverage. The 2019 numbers are used to determine 2020 coverage. Do they just state the numbers for the year or do they say “COVERAGE”?

The cliff is @ 400% of the “applicable” Federal Poverty Level used to determine coverage for whatever year you are dealing with. I know I went over that cliff in 2014 and it is a HARD landing. The cliff has grown higher since then.

Kate says

Thanks for all the replies. I am afraid I may be “going over the cliff”! Unfortunately, I have been calculating incorrectly using 2020 numbers ($67,640 instead of $65, 840). It’s gonna be tight, probably $600 over.

Now I am looking at ways to decrease our MAGI for the year. I am still figuring it out, but it looks like contributing to an HSA is our only option. Our current Marketplace plan does not have an HSA option but maybe changing to a different plan for 2020 and contributing before April 15th would do the trick to keep us away from the cliff.

Thanks again, everyone!

Harry Sit says

Kate – That doesn’t work. If your health plan in 2019 isn’t HSA-eligible, you aren’t able to contribute to HSA before April 15 in 2020 and make it count for 2019. The HSA contribution can only reduce your MAGI for 2020.

See if you are able to contribute to a Traditional IRA for 2019. At this income level, the Traditional IRA contribution is deductible.

Charlie says

Kate, since you’re so close, maybe you forgot about that little side business you had (or started today) during the year that lost you money. 😉

Those losses are deductible for tax and ACA purposes. Most would think It a shame to go over the cliff by a relatively minor amount.

Harry’s suggestion is quite valid regarding the IRA.

And thank you to Kevin for correcting the cliff amount I had posted.

Kate says

Oh yes, that pickled pig’s feet business that didn’t take off very well! Thank you 🙏

Sorry I am not very financially savvy- Cue silly question scenario…So far I have only contributed to my Traditional IRA through my employer. But I also have a traditional IRA through Vanguard. Would I be able to contribute to that account to lower my MAGI?

(I forgot about that. That account was a rollover and I have never actively contributed to it before.)

Thanks!

Harry Sit says

The plan you contribute to through your employer is likely a 401k or a 403b, not a Traditional IRA. If you already have a Traditional IRA at Vanguard that came from a rollover, you can also contribute to it. The contribution limit is $6,000 per person for 2019 ($7,000 if age 50 or over). This limit is separate from the limit on 401k/403b contributions through your employer. You can contribute to both a 401k/403b and a Traditional IRA. When you make the Traditional IRA contribution, be sure to say it’s for 2019.

IRS link on IRAs: https://www.irs.gov/taxtopics/tc451

Kate says

Thank you Harry…That is great news! And yes you are correct about my employer plan being a 401k. I will put $6,000 into my Vanguard Traditional IRA as you said. Since those are post-tax dollars, I suppose there will be some details to attend to later but hopefully I will not be “going over the dreaded cliff” as I had previously feared.

Thanks again for the advice!

Michael says

I forgot I had a stop loss on a stock and it sold yesterday. Can I sell a stock for a loss and use the losses to offset the gains for ACA purposes?

Harry Sit says

Yes, up to your realized gains during the year plus $3,000.

Michael says

Thanks for the info Harry

Joyce Williams says

Thank you so much for this info. It’s impossible to get reliable answers from anyone associated with Obamacare or the healthcare exchange. Can you tell me if ALL income in a given year is counted? Or, is it only the income earned while receiving Obamacare? My situation is that I currently have private health insurance, but will be retiring in a few months and working part time as a sole proprieter. At that time, my income will drop significantly — and I will need to pick up an Obamacare plan since I will not be able to afford the high cost of continuing my private plan through COBRA. Will the income I earned while on that private plan be counted towards my total income? Thank you!

Harry Sit says

It will. Your income for the entire year is compared to the federal poverty level, which determines whether/how much you qualify for the premium tax credit.

Jimmy says

Here it is mid-March of 2020 and I am preparing my taxes for 2019. I clearly need to communicate better with my wife (filing jointly) because she went and sold some stock and also had more income and now we are a few thousand dollars over the 2019 400% cliff. She also went and contributed to her Roth IRA for 2019 a year ago. However, I believe we can re-characterize that Roth contribution as a new traditional IRA, knocking our MAGI down $7K and getting us safely away from the cliff.

For planning for next year, this chart is very useful for Californians. https://www.coveredca.com/pdfs/fpl-chart.pdf But it does raise a question. My guess is that in 2019 and earlier, if I went $1 over the cliff, the federal government which had paid to subsidize my Obamacare, would say, too bad you underestimated, you in fact qualify for zero subsidy, we want our money back, in my case about $20K.

Now the chart shows that in 2020 California puts forward a state subsidy covering the 400% to 600% range. So what happens if I underestimate myself at 390%. The feds pay my subsidy. But when I file my taxes for 2020, we all realize I underestimated again and came in at 500%. So now does California reimburse the feds for the $20K the feds want back from me? Going further, what if for 2021 I estimate myself at 500%. Does California provide the subsidy directly right out of the gate that year? And then… what if I end up going a dollar over 600%… is there another cliff there… and now the subsidy gets clawed back from me on the state tax form and not the federal tax form?

Harry Sit says

If you go over 400%, you pay back to the IRS, and you get a tax credit from California. If you estimate 500%, California pays part of the premium to the insurance company. If you go over 600%, you pay California back.

Jimmy says

Mr. Sit I did want to thank you for discussing this important tax hazard. My tax advisor has been clear that, they’ll tell me what is my MAGI if that is my issue, but that they don’t get into how this affects my health insurance and its subsidies.

I don’t know if this 400% -600% band state coverage is only for the 12% of those reading this who live in California, do other states do this. I suppose its an improvement, in 2019 if I fall off the cliff, it costs me $20K. In 2020 in California I at least get, a tax credit from California for the $20K. However, do I have this right, it might take me over 20 years to deplete that credit into my state taxes, and I can only carry the balance forward for 6 years? It just seems like there’s a lack of coordination across the government agencies.

This also applies across the various health care agencies: Medi-Cal, CoveredCA, and C-CHIP. When my income varies, it has often lead to hours on the phone as the implications of this work their way through the various agencies. Start with the county, though my ACA advisor is not allowed to talk to them.

I’m scared to go over the 400%. I guess I could tell CoveredCA before the fact that I guesstimate I’ll be at 500% next year. But how are subsidies shared across IRS and CA, if from IRS point of view, over 400% gets zero subsidy. CoveredCA should anticipate this and pay all the subsidy. I still fret about that 400% boundary as above, I don’t want to end up with tax credits that I ultimately can’t fully spend.

I also don’t yet understand any 600% cliff. It would require a special new graph for your article entitled Sample Premium Tax Credit By Income for California Residents in 2020, that extended out to 600%. I guess its possible the new California law phases down the subsidy rapidly so there is no cliff but just a smooth steeply sloping line that starts picking up all the Federal at 400% then rusn down to zero at 600%.

ameridan says

I inherited an annuity last year that threw my tax planning to heck, and I had to return my 2019 subsidy of 10K, resulting in my having to pay $1265 a month for my spouse’s health insurance (what a ripoff!!!). Now that she’s 65, Medicare is a much more affordable $144 a month.

rj says

Awesome article! Easily the most informative on the internet! I retired early a few years ago and have been on ACA without qualifying for subsidy credits since that time. This year it seems I may be able to manage my income so that I do qualify. Can I personally foot the whole ACA premium bill out of pocket all year and still get the subsidy at the end of the year on my tax return if I manage to avoid the cliff? Also, is the subsidy calculation reconciled somehow by the various online tax software solutions? And finally, is there a helpful site for calculating the credits for a given income level?

Just one clarification. When I read the “Staying Under the Cliff” subheading, right or wrong, it gave me the impression that you need to have earned income (e.g. a part-time job) in order to contribute to an HSA. To be clear, you do not need earned income to contribute to an HSA and receive the tax deduction, you simply need a qualifying high deductible health plan. It’s an important distinction to understand for those looking to manage their income under the cliff.

From what I gather, you can use the following common levers to manage under the cliff based on income type:

Earned Income: 401k and IRA Contributions

Any Income Type (earned or unearned): HSA contributions, Capital gains losses, IRA conversions

ameridan says

IRA conversions, although very helpful in regards to future tax considerations, I don’t think will help to manage staying under the cliff.

rj says

You’re right. An IRA conversion adds to your income which pushes you toward the cliff, while the other items I listed move you away from the cliff. That said, if someone is trying to manage their income to “just under the cliff ” while wanting to do a backdoor IRA conversion because they think taxes are lower now and will increase in the future…. but perhaps that’s better left for a different article.

gardener says

We experienced a different kind of cliff, this one at the low end. We paid full premiums on a Marketplace gold plan in 2018. On enrollment we submitted estimated income over 400% FPL, got no advanced credit, but then lost business and finished the year with a Sch C loss. Both the state Marketplace and the IRS, contacted mid year, advised that we could continue paying the premiums and get the PTC back when we filed for the year: neither asked us if our estimated enrollment income had been more than 400% FPL.

The IRS denied the refund “because you did not receive any advance PTC”.

In hindsight we should have estimated our income below 400% of FPL, and our history would have justified that. We could have paid any APTC back on filing, with no penalty.

Or in our case we would have qualified for the minimum AGI had we filed (or filed amended now?) with fewer expenses and chosen *not* to take the Self-employed health insurance deduction because that alone reduces the AGI below the Federal Poverty Line and would prevent us qualifying for a refund of Premium Tax Credit.

At our age, the difference is dramatic: a $9000 PTC refund or a ~$2000 tax due (for SE Tax).

Any ideas about this situation?

Harry Sit says

Calculating the PTC and self-employed health insurance deduction is a little complicated. You start with not taking any self-employed health insurance deduction and see how much PTC you’re eligible for. Then you take the difference between your full health insurance expenses and the previously calculated PTC as a deduction and see how much PTC you are eligible for now. Then you take the difference between your full health insurance expenses and the new PTC as a deduction and see how much PTC you are eligible for now. You keep doing this in multiple rounds until your numbers don’t change. See IRS Guidance On Circular Reference in Obamacare Premium Subsidy and Deduction.

If you do the calculation correctly, chances are you are eligible for some PTC.

gardener says

Thanks for the quick reply, but I am not sure that will help.

I am using TurboTax Home & Business 2018 and can watch as the program progressively steps through the ‘circular iteration’ — as long as I plug in sufficient business income (hypothetically) to qualify for PTC in the first place.

Two contrasting examples illustrate this best:

Example 1: With a Sch 1, Line 12 business income of $26,469, TurboTax 2018 calculates (after several iterations):

– 136% FPL household income on Form 8962 L5

– $11,516 PTC brought to Form 1040, Sch 5, L70

– $2517 SE HI deduction (Sch 1 L29 in 2018) and finally

– $7776 federal refund.

Example 2: With a Sch 1, Line 12 business income of $26,369 (just $100 less than example above), and with all other numbers being the same as above, the results now are:

– 99%% FPL household income on Form 8962 L5

– $0 PTC brought to Form 1040 Sch 5 L70

– $8303 SE HI deduction (Sch 1 L29, 2018) and finally

– $3846 federal tax due

If I had more time I could probably find an income level that would flip from refund to tax due on a single dollar difference.

So we are in the zone of the second example, sadly, and have to try and look for exceptions.

In this, our fatal error seems to be that we simultaneously did not qualify for advanced PTC in the year (because of estimated income greater than 400% FPL) AND our final income was negative (or at least less than 100% FPL).

We can’t change the estimated income now, but perhaps could do something about the business income in an amended return.

Finally, I can’t see what abuse the lawmakers are trying to protect from in not allowing anyone who estimated income over 400% FPL to get PTC when actual income disappoints to this degree. This would seem to be just the kind of circumstance that the ACA was designed help with.

Harry Sit says

Tax software does a good job in iterating when you stay within the PTC territory at all times. They fail when your numbers take you into and out of the PTC territory. Try this calculator instead:

https://cims.nyu.edu/~ferguson/Calculator%20SE%20ACA.html

For the third input in the calculator – Federal poverty line for your state and household size for 2018 coverage – look up here:

https://www.federalregister.gov/documents/2017/01/31/2017-02076/annual-update-of-the-hhs-poverty-guidelines

That calculator will show you how much PTC you’re eligible for and how much self-employed health insurance deduction you should claim.

gardener says

Thanks, that Calculator is a great resource to have. I am not sure I have understood how to use this, but I believe these are accurate results in two examples close to the FPL (lower limit for PTC):

2018 Coverage Year

Annual SLCSP: 12223

Annual actual (gold plan): 14410

FPL for state, couple joint: 16240

Example 1, Income: 16240

calculator gives:

Subsidy: 14410

Net HI cost: 0

MAGI: 16240

contribution: 326

your subsidy can exceed neither 14410 or 11897

Example 2, Income: 16239 (one dollar less than above, than FPL), gives

Subsidy: 14411

Net HI cost: -1 (note: -ve number!)

MAGI: 16240

contribution: 326

your subsidy can exceed neither 14410 nor 11897

With a negative amount appearing in Ex 2 for Net HI cost, the Calculator explains: “Finally, if any negative numbers appear above, your income is too low to receive a subsidy”. I interpret this to mean that you are ineligible for any PTC.

So, to my original point, the calculator—like TurboTax—also seems to predict that there is a ‘low income cliff’. This occurs for a taxpayer with actual income below FPL, combined with income-at-enrollment estimated (over-estimated) to be above 400% FPL . The over 400% estimated-income exclusion is because of IRS rules on exceptions, not because of the calculator results.

With the premiums used in this example (our actual 2018 premiums), the drop in actual income of a single dollar below the FPL (=$16,240 in example), results in a loss of PTC comparable with the FPL itself. This is a huge effect for a low income taxpayer, whose most important error seems to be that they have overestimated their income at enrollment.

Harry Sit says

Yes there is a minimum, but if you fell below the minimum only because you took 100% of your premium as the self-employed health insurance deduction, which you said was the case, that calculator will help you find out how much you should take as the deduction and take the rest as PTC.

Note the last input in the calculator, the income, is _before_ self-employment health insurance deduction. In your example 2, if the income after self-employment health insurance deduction was $16,239 (below the FPL) and the health insurance premium was $14,410, you should use $30,649 as Income in the calculator. Then the calculator shows:

“Appropriate subsidy amount: 10913

With this subsidy, your net health insurance cost, to be deducted from Line 29 of your Form 1040, is: 14410 – 10913 = 3497

With this net health insurance cost, your modified adjusted gross income is: 30649 – 3497 = 27152

Your expected contribution is: 1310

Your subsidy can exceed neither 14410 nor 10913”

Then it all makes sense. You take part of the premium as self-employment health insurance deduction. Your MAGI after the deduction is still above FPL, which makes qualify for the PTC. You calculate the expected contribution from the MAGI. Your PTC is the difference between SLCSP and your expected contribution.

gardener says

Thanks, the example above was actually for a modified adjusted gross income of 16240. In other words, had the full premiums been taken as a deduction, AGI would have been 16240-14410=1830.

So, I think I am saying that if your modified AGI is less than 16240, you fall off a cliff, because you suddenly lose any refund of any amount of PTC. If my reading of the Form 8962 Instructions is correct, then perhaps if your *estimated* enrollment income was more than FPL then the IRS might give you an exception, but not if your estimated enrollment income was *also* more than 400% FPL.

In the example you give, where some PTC can be taken, you need to ‘override’ TurboTax to enter the number $3497 in Line 29, compared to what TurboTax wants to put there.

Harry Sit says

That’s correct. If your income before taking any self-employment health insurance deduction is already below the FPL and you didn’t receive APTC, you aren’t able to get the PTC. If you see you are about to fall into that situation before the end of the year, raise income, by stopping pre-tax 401k contributions, selling investments for capital gains, converting pre-tax accounts to Roth, etc. It’s more difficult after the fact.

The calculator helps when your income before taking any self-employment health insurance deduction is above the FPL but tax software may have difficulty in finding the correct split between the deduction and the PTC.

gardener says

I understand. So we will be cautious in future before submitting an estimated income over 400% FPL at the time of enrollment.

That way, if we go over, we pay back any APTC without penalty. If we go under a little, we can settle by payment or refund on filing. And if we are so unfortunate as to go below 100% FPL we can try pleading for an exemption (see Form 8962 Instructions).

Retroactively, even in a case such as this, and providing that if there is sufficient Sch C income, could we also file with reduced Sch C expenses to keep MAGI above 100% FPL?

Harry Sit says

If you find some expenses were claimed wrong, for instance, they were part personal expenses part business expenses, or you claimed a home office deduction but the home office didn’t really meet all the requirements, you can amend the return and claim the correct amount. However, if the expenses were all legit, you are required to claim all of them. See the link below from the IRS on claiming less in self-employment expenses. It relates to the EITC but it’s not limited to the EITC.

https://www.eitc.irs.gov/tax-preparer-toolkit/frequently-asked-questions/earned-income-self-employment-income-and-business

gardener says

Thanks, that is good to know. I presume the same principle prohibits the self employed from not claiming the Self Employed Health Insurance premium when income is low.

robert says

Hello Harry,

At enrollment there is a section that reads : Do you want to find out if you can get help paying for health coverage? Can you check the box “no” and not estimate if you don’t know what your income will be, pay full price for the premium and if you find at the end of the year you are within 100% – 400% take the ptc when filing your return?

Harry Sit says

You can certainly wait to get your PTC when you file your taxes. Just make sure your income doesn’t fall through the lower end. See discussion in comments 90-94. I chose to give a high estimate for our income and pay the full premium for 2019 because I didn’t want to bother submitting documents to justify a lower estimate. I received the PTC when we filed the tax return. We were better off financially with paying the full premium anyway. See previous blog post:

ACA Health Insurance: Ask For Premium Assistance Or Not

Lindy says

Regarding the above question about whether it is ok to not estimate your income and wait til taxtime to get your credit, note that if your income is hovering near the low end, you would miss out on cost sharing with a silver plan. This means a lower deductible, lower out of pocket, and lower copays, at two different tiers in the high $10,000s and low $20,000s. It’s thousands of dollars in savings in money, if you actually use your insurance and would benefit from, say, a $500 deductible instead of $2000 or more. (At least, this is how it works out in my state.)

Paul says

Harry, I understand that an early withdrawal penalty (EWP) from savings (CD) will reduce MAGI. But does a 10% IRS penalty from a Trad. IRA (before 59 1/2) distribution (withdrawal) have an effect on MAGI relating to the ACA?

Harry Sit says

No, because the 10% penalty is a tax. It doesn’t affect your income.

john says

Hi,my question may be Off Topic,as I do not receive Obamacare,but instead(Healthfirst) which is actually Medicaid.I am unemployed and make less than $16,000(Gross income) so for a couple of years now I have been on this Healthfirst(Medicaid) insurance.The question I have is,due to Coronavirus,the Stock market crashed,I panicked and sold a Stock I had,this will give me a Capitol Gain for this year (2020) and go way over my normal($16,000) yearly Gross income.I will report this(Large) Cap Gain on my 2021 Taxes.Do I need to call Healthfist and tell them I sold my stock,I did re-invest the Cap Gain into another Stock.Obviously,I am now no longer qualified for Medicaid when my (Large)Cap Gain gets reported to the IRS.I have not been going to any doctors for fear of the unknown,due to this Capitol Gain.Thanks.

Harry Sit says

You should contact Healthfirst. If they say you’re OK, you can shed your worries and go to the doctors as needed. If they say you should enroll in ACA insurance now, you still have time. If they only find out next year, you may be subject to a clawback, and the window to enroll in a different plan already passed.

Green says

I recently qualified for coverage through my employer but it’s around 7% of wages. Not really affordable to me even though it’s under the affordability percentage. I’m assuming they’re using this rate to meet the affordability safe harbor to avoid the ESRP penalty.

Since affordability is based on modified AGI and the employee required contribution, contributing an appropriate amount to a pre-tax 401(k) would cause the employer-sponsored coverage to exceed the affordability percentage and also keep the employee under the subsidy cliff for marketplace coverage. The employee would qualify for marketplace coverage with tax credit because of the lowered MAGI even if their employer offers coverage that meets minimum value and is considered affordable by the safe harbor.

I would be close to maxing out the 401(k) for 2021 in order to have the premium exceed the affordability percentage.

Am I missing anything or getting something wrong? How would the IRS reconcile this between the employer and employee since the employee required contribution for the premium on form 1095-C isn’t used when preparing an income tax return?

Harry Sit says

If you want the Advance Premium Tax Credit when you enroll in a marketplace plan, you need to have someone at your employer fill out this form (or its equivalent for a state-run exchange):

https://marketplace.cms.gov/applications-and-forms/employer-coverage-tool.pdf

If you’re willing to pay the full price at the time of enrollment and then claim the premium tax credit on your tax return, you will have to justify it based on the 1095-C and your MAGI. See IRS Publication 974 (page 11). The employer also sends the 1095-C data to the IRS. If the IRS sees that your employer coverage is affordable, they can deny your premium tax credit.

mp says

AGI/Tax question:

If i deposit 7k into our HSA (family)… do i have to put this on my taxes? it lowers my AGI and possibly too low. i’m guessing since it’s a deduction i don’t really have to claim it.

our income only comes from dividends/interest

thanks