As I’m self-employed and under 65, I buy health insurance through the health insurance marketplace established under the Affordable Care Act (ACA). It’s for people in jobs that don’t offer health insurance, 1099 contractors, part-time employees, freelancers and gig workers, self-employed business owners, retirees under 65, and others who don’t get health insurance through an employer or a government program.

I’ve been doing this for eight years. Nationwide, over 20 million people buy their health insurance this way. It’s still a small percentage relative to the number of people who get health insurance from employers (165 million), Medicare (68 million), or Medicaid and CHIP (78 million).

If you’re among these 20 million people, you may qualify for a Premium Tax Credit (PTC) to buy health insurance. The tax credit is based on your modified adjusted gross income (MAGI) relative to the Federal Poverty Level (FPL) for your household size. In general, the lower your MAGI is, the less you pay for health insurance net of the tax credit.

MAGI for ACA

Your MAGI for ACA is basically:

- Your gross income

- plus tax-exempt muni bond interest

- plus untaxed Social Security benefits

- minus pre-tax deductions from paychecks (401k, FSA, HSA, …)

- minus above-the-line deductions listed on page 2 of Form 1040 Schedule 1, for example:

- Pre-tax traditional IRA contributions

- HSA contributions made outside of payroll

- 1/2 of the self-employment tax

- Pre-tax contributions to SEP-IRA, solo 401k, or other retirement plans

- Self-employed health insurance deduction

- Student loan interest deduction

Wages, 1099 income, rental income, interest, dividends, capital gains, pension, withdrawals from pre-tax traditional 401k and IRAs, and Roth conversions all go into the MAGI for ACA. Muni bond interest and untaxed Social Security benefits also count in the MAGI for ACA.

Tax-free withdrawals from Roth accounts don’t increase your MAGI for ACA.

Side note: There are many different definitions of MAGI for various purposes. These different MAGIs include and exclude different components. We’re only talking about the MAGI for ACA here.

2021-2025: 400% FPL Cliff Changed to a Slope

Your premium tax credit goes down as your MAGI increases. Up through the year 2020, the tax credit dropped to zero when your MAGI went above 400% of the Federal Poverty Level (FPL) for your household size. If your MAGI went $1 above 400% of FPL, you had to pay the full premium for your ACA health insurance with zero tax credit.

Laws changed during COVID. This 400% of FPL cliff became a downward slope for five years, from 2021 to 2025. The tax credit continued to decrease as your MAGI increased, but it didn’t suddenly drop to zero if your income went $1 above 400% of FPL ($81,760 in 2025 for a two-person household in the lower 48 states). The tax credit at income levels below 400% of FPL also became more generous during those five years.

The Cliff Returns in 2026

The new 2025 Trump tax law — One Big Beautiful Bill Act (OBBBA) — didn’t extend the enhanced tax credit after 2025. The 400% of FPL cliff is scheduled to return in 2026. The premium tax credit for incomes below 400% of FPL will also drop back to the pre-COVID levels.

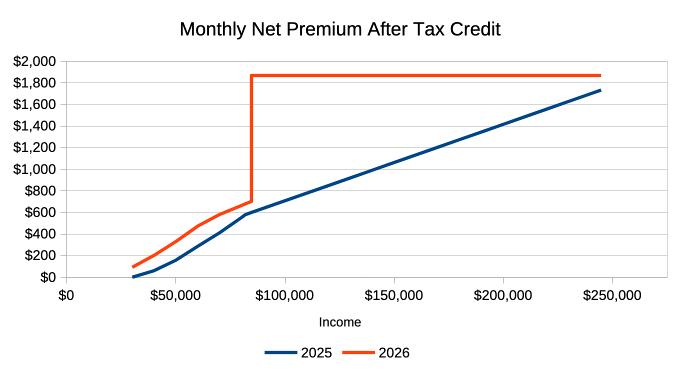

A decrease in the premium tax credit translates into an increase in the monthly premium net of the tax credit. The chart above illustrates the monthly net premium at various income levels for a sample household. The blue line is for 2025, with the enhanced tax credit. The orange line is for 2026, without the enhanced tax credit. The sharp vertical rise shows the cliff’s effect.

Variable Impact

How your net premium after any tax credit will change in 2026 depends on your position in the chart.

If your MAGI is to the left of the vertical cliff in the chart, your premium net of the tax credit will go up slightly in dollar terms. It goes from $158/month to $331/month at a $50,000 income in this example. Although the net health insurance premium more than doubles between 2025 and 2026, a $173/month increase may be manageable if you’re prepared.

Your net premium will increase by a higher amount if your income is to the far right in the chart. At a $200,000 income in this example, the net premium increases from $1,417/month to $1,872/month, up $455/month. No one wants to pay $455 more per month, but at least you have the income to afford it.

The increase is precipitous immediately to the right of the cliff. We’re talking about going from $602/month in 2025 to $1,872/month in 2026 at an income of $85,000. That’s an increase of $1,270 per month or $15,240 for the year. How do you come up with an extra $15,000 for health insurance when your income is $85,000?

Premium Increase Calculator

I created a calculator that shows how much more you can expect to pay in 2026 compared to 2025. This doesn’t include the relative price changes between the plan you choose and the benchmark plan. You’ll pay extra if the price for your plan increases more than the benchmark plan, or less than the amount shown if the price for your plan goes up less than the benchmark plan.

Know Your Cliff

You must know first and foremost where the cliff is for you. The table below shows the 400% of FPL cliff for various household sizes in 2026:

| Household Size | Lower 48 States | Alaska | Hawaii |

|---|---|---|---|

| 1 | $62,600 | $78,200 | $71,960 |

| 2 | $84,600 | $105,720 | $97,280 |

| 3 | $106,600 | $133,240 | $122,600 |

| 4 | $128,600 | $160,760 | $147,920 |

| 5 | $150,600 | $188,280 | $173,240 |

| 6 | $172,600 | $215,800 | $198,560 |

| 7 | $194,600 | $243,320 | $223,880 |

| 8 | $216,600 | $270,840 | $249,200 |

Source: Federal Poverty Levels (FPL) For Affordable Care Act.

Coping Strategy

The chart I used as an example is for a two-person household. A chart for your specific situation will have the same shape but different numbers on the axes.

If your MAGI is safely to the left of the cliff and there’s no risk of going over, be prepared for an increase in your health insurance premiums in 2026 due to the decrease in the premium tax credit. If it’s far to the left, watch out for a different cliff at the low end, which I’ll explain later in this post.

If your MAGI is too far to the right of the cliff and you have no way to bring it to the left of the cliff, you’ll have to pay 100% of the health insurance premium starting in 2026, which can be well over $20,000 a year.

The tricky part and the opportunities are in the middle. If your MAGI is close to the cliff on each side, you should manage it carefully to keep it from going over the cliff.

Manage Your Income

The most critical part is to project your MAGI throughout the year and not to realize income willy-nilly. You can still adjust if you find your income is about to go over the cliff before you realize income. Many people are caught by surprise only when they do their taxes the following year. Your options are much more limited after the year is over.

If income from working will push your MAGI over the cliff, maybe work a little less to keep it under.

Tax-free withdrawals from Roth accounts don’t count as income.

Take a look at the MAGI definition. Minimize items that raise your MAGI, and maximize everything that lowers your MAGI.

When you have W-2 or self-employment income, you have the option to contribute to a pre-tax traditional 401k and IRA. These pre-tax contributions lower your MAGI, which helps you stay under the 400% of FPL cliff.

Choose a high-deductible plan and contribute the maximum to an HSA. The new 2025 Trump tax law made all Bronze plans from the ACA marketplace automatically eligible for HSA contributions starting in 2026.

On the other hand, Roth conversions, withdrawals from pre-tax accounts, and realizing capital gains increase your MAGI. You should be careful with doing those when you’re trying to stay under the 400% of FPL cliff.

Shifting Income

If you’re at risk of going over the cliff in 2026, consider accelerating some income from 2026 to 2025 when the premium tax credit is still on a slope. If pulling income forward to 2025 helps you stay under the cliff in 2026, you lose much less in premium tax credit from your additional income in 2025 than in 2026.

On the other hand, if you’re going over the cliff in 2026 no matter what, consider postponing some income from 2025 to 2026. Once you’re over the cliff in 2026, you have nothing more to lose, while less income in 2025 will give you more premium tax credit.

Borrowing

If you have a temporary spike in your need for more cash, consider borrowing instead of withdrawing from pre-tax accounts or realizing large capital gains. Spending borrowed money doesn’t count as income.

When you need cash to buy a new car, instead of realizing large capital gains and pushing yourself over the cliff, take a low-APR car loan to stretch it out. HELOC, security-based lending, and selling short box spreads are also good sources for borrowing.

You can repay the loan when you don’t need as much cash or when you no longer use ACA health insurance.

Bunching Income

If you can’t avoid going over the 400% of FPL cliff, consider bunching your income. When you’re already over the cliff, you might as well go over big. Withdraw more from pre-tax accounts or realize more capital gains and bank the money for future years.

Spending the banked money doesn’t count as income. Going over the cliff big time in one year may help you avoid going over again for the next several years.

100% and 138% FPL Cliff

There is another cliff at the low end, although you can easily overcome it if you have pre-tax retirement accounts.

To qualify for a premium tax credit for buying health insurance from the ACA marketplace, your MAGI must be above 100% of FPL. In states that expanded Medicaid, your MAGI must be above 138% of FPL. This map from KFF shows which states expanded Medicaid and which states didn’t.

The marketplace sends you to Medicaid if you don’t meet the minimum income requirement. The new 2025 Trump tax law required reporting work and community engagement in Medicaid. You don’t want to have your income fall below 100% or 138% of FPL and be subject to those new requirements in Medicaid.

If you see your income is at risk of falling below 100% or 138% FPL, convert some money from your Traditional 401k or Traditional IRA to Roth. That’ll raise your income above the minimum income requirement.

Other Changes to ACA

Besides letting the Premium Tax Credit cliff return, the new 2025 Trump law also made these other changes to the ACA:

All Bronze Plans Will Be HSA-eligible

All Bronze plans and catastrophic plans offered through the ACA marketplace will automatically be eligible for HSA contributions starting in 2026.

Before this change, an HSA-eligible plan could be more expensive than a high-deductible plan not eligible for HSA, which negates the benefit of contributing to an HSA (see Downsides of HSA: When It’s Not Worth It to Contribute). Starting in 2026, you can choose a less expensive plan and still contribute to an HSA, which lowers your MAGI and helps you stay off the premium cliff.

Repayment Cap Eliminated

Currently, if you underestimated your income when you enrolled and received more subsidy than your actual income qualifies, you would pay back the difference when you do your taxes, but the repayment has an upper limit. See 2025 Cap on Paying Back ACA Health Insurance Subsidy.

The new 2025 Trump tax law eliminates the repayment cap starting in 2026.

No More Auto-Renewal

Right now, if you don’t actively renew for next year during open enrollment, you will automatically continue with your current plan or a replacement plan selected by the marketplace.

The new 2025 Trump tax law requires re-verification at each renewal, starting in 2028. You may be dropped if you miss the deadline to re-verify. Set up multiple calendar reminders for the open enrollment deadline — don’t miss it!

***

You’ll find more deep dives on recent changes from the 2025 Trump tax law in the full OBBBA series.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

ameridan says

Great writeup! Nice to have a well-thought-out reference. I retired at 52 and did the 72t. Fortunately now that I’m 60 I can decide on how much to withdraw from IRA accounts, because I would have been over the cliff with no means of changing the withdrawal amounts. As you state, I’ll just use taxable savings to supplement my pension for a few years now.

Michael says

You state that money converted from traditional to Roth accounts is part of MAGI.

Later you state that spending your own savings is not income.

Why isn’t money converted to a Roth (saved money on which taxes were paid) treated the same?

Harry says

Sorry if it wasn’t completely clear. As you are converting pre-tax money from Traditional to Roth, that conversion is taxable, and it is in part of your MAGI in the year you convert. After you already converted, withdrawing from Roth accounts after 59-1/2 isn’t taxable and it’s not part of your MAGI when you withdraw. I was referring to the former, not the latter.

bp says

What? An Obamacare article that doesn’t blindly bash or praise, but looks rationally on how it might actually affect people. Good work.

I agree; health insurance surely has been one of the more daunting challenges for folks who are looking to retire early. Thanks for clarifying how early retirees can use this policy to their (further) advantage.

Evan says

While the information in this post is accurate, it shows just how ridiculous ObamaCare really is.

I am self-employed and have paid for my own individual Blue Cross policy for over 10 years now. It is a high deductible plan with a HSA option. I am still in my early 40’s and in very good health, so the premiums have been affordable. And I have fortunately never actually used the insurance in the 10+ years I have had it.

With the implementation of ObamaCare next year, my plan is no longer a benefit compliant plan, and the replacement options with Blue Cross will increase my current premiums by about 300%. Therefore, I have looked at the exact scenario Harry outlines above. I can just move to an exchange plan, manipulate my income down to qualify for subsidies, and possibly even pay less than I do now for improved coverage.

Do I want to do that? No, I hate the idea of ever being on the government dole as I have never been in my life. But with the government negating my existing policy and artificially increasing my existing premiums thru ObamaCare, the incentive is obviously there.

If I choose to do this, it will actually increase the liability of my healthcare cost to other taxpayers. Just as Harry, who pretty clearly could afford his own insurance even at age 55-65, will therefore also shift more of his medical cost onto taxpayers.

Wise economically for such individuals, but terrible public policy.

Harry says

“Just as Harry, who pretty clearly could afford his own insurance even at age 55-65, will therefore also shift more of his medical cost onto taxpayers.”

I don’t know about that. Health care is very expensive. I tried adding 10 years to my age. The $4,000 tax credit at the edge of the cliff becomes $10,000, and that’s based on today’s prices. As you know medical costs have been going up faster than inflation. I don’t think I will be able to afford it without the credit. I thank the taxpayers for helping me out. I have been helping other taxpayers (and non-payers) with my fair share all these years.

Evan says

Just saw this this morning. Senator Susan Collins of Maine is pushing for means testing of the ObamaCare subsidies as one condition in a plan to reopen the government. Which would make this entire post no longer relevant.

Will means testing happen? Probably not this year, but I can’t see how it won’t in pretty short order. Anyone that believes and plans on receiving health care insurance subsidies based on lower income, while still maintaining substantial wealth, is likely to be disappointed.

Harry says

The news report I read says “income means testing” which is already in the ACA, not “assets means testing.” I don’t know what exactly Sen. Collins is proposing. Proposals, however, are a dime a dozen in Washington. We will deal with it when something is passed by both houses and signed into law by the President. It will give opportunity for more blog posts!

Michael says

This is a little off-topic, but… Aside from helping out the early-retired, I think an underappreciated aspect of Obamacare might be its effect on stimulating entrepreneurship. Yes, one could argue that requiring employers of 50 or more to provide health insurance coverage could negatively impact small businesses, an alternative view would be that not having to worry about where they’ll get health insurance could prompt more people to go out and start a business vs. sticking with their regular job due to keep their insurance.

harold says

Are you frickin serious???????????????? You seriously think obamacare will stimulate entrepreneurship?????????????????

Did you actually look at that chart? Don’t make more that a little over $60k or you’re screwed – thanks to obamacare. Way to bring down American entrepreneurship.

Seriously! Have ANY of you read any history books?????????????? Socialism/communism does NOT work! Do the frickin math!

Who educated (propagandized) you people? I guarantee you there isn’t a single person who supports obamacare who has EVER lived in a socialist/communist country. Educate yourselves and quit being seduced with this b.s.

Harry says

harold – I don’t know. Lack of a subsidy doesn’t make one worse off than before. I get Evan’s point about certain low-cost bare bones policies are off the market now. Some are forced to spend more to buy something better. Anyway, there are plenty of debates about the merits and the dismerits of Obamacare. This is not the right place for that debate. It’s for looking at the lay of the land and seeing what we make of it.

Elenor says

Michael is apparently not a small business owner! I inherited my husband’s business in 2011. After a very hard and dicey half year trying to get it back up and running (a small manufacturing company; and there were parts I did not know how to make, subcontractors I could not get to perform), I’m now on a path to survivability. (Not safe yet, hoping I see it coming!)

As both the owner and employee of an LLC (operating as an S Corp), the $23,000 I paid myself in 2013 would not come CLOSE to allowing me to pay for Obamacare, and since the company had a profit of $64k — and the govt counts that as “my” income ( except, of course, I can’t withdraw and spend it without killing the company!), I certainly could not describe ObamaCare as having any: “effect on stimulating entrepreneurship”! No subsidy for the $64k; no possibility of affording premiums on $23k… so where’s my entrepreneurial stimulation?! (Unless you count the frantic panic as I tried to figure out what to do: That’s been stimulating, but not in a good way!)

The cheapest bronze plan I could find would have cost nearly $7k in premiums, with a $6k deductible. (I’m 58.) So, for that $11k in 2014 Obamacare coverage — if the kidney stone I had in 2012 had happened this year, I would not have gotten one (very!) red dime in insurance coverage! And the $8k that took nearly a year to pay off ONLY covered diagnosis (a night in the ER, tests, drugs); but NOT any treatment! They referred me to a doctor, but I couldn’t possibly pay for anything more. Thankfully the pain drugs allowed me to live through the excruciating couple of weeks of the *#&@&* stone making its way out… and I was fer shure praying for no complications, because that would have bankrupted both me and the company.

So yeah, you betcha, Michael — CommieCare REEEEALLY helps this entrepreneur!

Thankfully, as it turned out, when I jumped through hoops and pretty much begged, I managed to get admitted into the VA health care system. Seems I “made too much” to be admitted — but since I had served for six years as an officer (back in the 70s-80s), they finally “had” to let me into the system. I can’t actually GET health care from the VA (there are lots of maimed kids and older vets who, rightly, come ahead of me in line for care), but I cling to the hope that if something serious goes wrong, I might be able to get seen… But at least I only have to pay a boatload of taxes for OTHER people’s CommieCare — and not penalties or completely destructive premiums for “my” insurance.

Harry Sit says

Sorry to hear your loss Elenor. Would switching the business to a C Corp help?

Mike Piper says

Nice explanation. 🙂

My understanding is that in addition to the premium subsidy cliffs, there are also cliffs at 150%, 200%, and 250% of FPL with regard to the cost-sharing subsidy.

KD says

Those may be especially useful for early retirees assuming that their healthcare needs will increase with age till they reach Medicare eligibility. For example http://www.early-retirement.org/forums/f28/withdrawal-strategies-with-obamacare-68529-3.html#post1361570 (Ref. Harry’s communication)

One has to decide how much such a benefit is worth in dollars terms and lifestyle design. May be Harry or you can quantify this.

Harry says

Mike – That’s true. It’s a big topic. We will have to take one small bite at a time.

KD – The value of low deductible, low co-pay, and low out-of-pocket maximum of course depends on how much you use the insurance. As you said, when you are older and you need more service, the low cost-sharing becomes more valuable. Hopefully you remain healthy and you make it a non-issue. Otherwise directionally I would say if you can live on much less income than 400% FPL now, convert some money to Roth and push toward it. Save the low income years for the future when you need the low cost-sharing.

indexfundfan says

What are the last minute things that you can do to reduce the MAGI for the purpose of ACA subsidy? Say, it is 12/26/14 and you just estimated that your MAGI is hitting the income cliff.

It seems like the place to look at are the “above-the-line” deductions. Are charity donations going to help?

Mike Piper says

Yes, above the line deductions.

So, no, charitable contributions will not help.

Things like HSA contributions, pre-tax 401(k) contributions, and deductible IRA contributions would help.

Harry says

No, charity donations are below the line. Above-the-line deductions include among other things HSA contributions, self-employment retirement contributions (solo 401k, SEP-IRA), deductible traditional IRA contributions, and tuition and fees.

indexfundfan says

Thanks guys.

Most of the above-the-line deductions are hard to generate in the last minute if you are not self-employed.

One interesting item I see is the penalty for early withdrawal from savings, which I guess would include CDs.

Is the income cliff that steep such that paying say $100 in early withdrawal penalty would net you more than $100 increase in subsidy?

Harry says

I think the deductible traditional IRA contribution is a good lever. If someone contributed to Roth because of lower income and lower tax rates, recharacterize to traditional. It’s deductible at that income level. CD early withdrawal penalty is useful only if you are right at the cliff. Low interest rate means low penalty. You’d have to withdraw a lot early in order to generate a meaningful penalty. But if it comes to that, sure. The chart shows if you are $1 over, you lose $4,000 in tax credit (for my age group in my area).

indexfundfan says

If a person has ready cash, I think the person can generate as much penalty as he/she likes — open the CD on day one and break on the next day. You will pay a high penalty if the CD term is long.

However, the person needs to check the terms carefully that the institution will not deny a person from breaking a CD within a certain amount of time.

Obviously if putting money into the deductible IRA is available, paying a CD penalty is much less favorable.

Stuartf says

I see conflicting info on “household income”. Can a married couple (one on Medicare and one not) file married/separately and get the exchange customer under the $46000 MAGI level?

Mike Piper says

You cannot receive the premium subsidy credit if you are married filing separately.

See IRC 36B(c)(1)(C)

http://www.law.cornell.edu/uscode/text/26/36B#c

Richardb says

What are the consequences of under or over estimating your magi when applying?

Harry says

If you under-estimate your income to make it below 100% FPL or 138% FPL in states that expanded Medicaid, you will be denied the premium subsidy advance. Then you will get the subsidy back when you file your taxes. If you under-estimate your income to make it below 400% FPL but your actual income is over 400% FPL, you will have to repay the premium subsidy advance when you file your taxes. If you under-estimate your income but your actual income isn’t over 400% FPL, you will have to repay some, but not necessarily all, of the premium subsidy advance when you file your taxes.

If you over-estimate your income to make it above 100% FPL or 138% FPL but your actual income isn’t, you repay some, but not necessarily all, of the premium subsidy advance when you file your taxes. If your over-estimate your income to make it above 400% FPL, you will be denied the premium subsidy advance. Then you will get the subsidy back when you file your taxes. If you over-estimate your income to a point still below 400% FPL, you will get additional premium subsidy when you file your taxes.

S. B. says

Nice write-up. It does appear to be a “cliff” due to the fact that the credit was not appropriately phased out gradually at the cutoff level. For some people, I’m thinking this will make the marginal tax rate at the cutoff very, very high.

dd says

Yes, a very nice write-up that increases the awareness of the importance of income numbers, even $1.

Dennis says

Hi Harry,

Does a “capital loss” from a state’s tax-exempt municipal bond index fund bring down your MAGI?

Great article!

Thanks!

Harry says

As usual, realized capital loss first offsets realized and distributed capital gains, which reduces gains added to your MAGI. If you have more losses than gains, you can bring down your income by up to $3,000. Any additional losses are carried over to the next year.

sharon says

When you report income for obamacare do you only report when you withdraw from any of your savings like CD`S,Roths, and other investments?

Harry says

You report all your income. Interest earned on your savings is income, whether you withdraw or not. However, withdrawing from your own savings or from Roth accounts (if you meet qualifications) isn’t income.

Jim says

Great article. One quick comment…

It is my understanding that a 401k (whether employer or individual) is deducted before calculating your ACA credit, but an IRA is not. Can someone clarify that?

Harry says

Not exactly. Traditional 401k contributions are excluded from your income; Roth 401k contributions are not. Deductible contributions to a traditional IRA reduce your MAGI; non-deductible contributions and Roth IRA contributions do not.

geoff boston says

Thank you for the article. The only intelligent answer on the net to the question of Obamacare MAGI and tax free municipal bond interest. But I am now more depressed.

sally davidson says

I am confused I see different comments on a regular IRA

On line I have seen that a 401k contribution is not added back to calculate MAGI but a regular self funded IRA is What is true? ??

Harry Sit says

Of course what I say is true. There is no adding back for either. Pre-tax 401k is taken out before your W-2 income. Your deductible IRA contribution is an above-the-line deduction, which comes before your AGI is computed. Only add back non-taxable muni bond interest and Social Security benefits.

Denise says

I am in early retirement and on obamacare healthplan. I also have Nuveen tax free muni bond funds that I earn and take the monthly dividends. They are down in value, essentially losing money. I havent sold any though so no loss on capital gains will show.

Am I correct that I still have to include the dividend interest but cannot deduct any losses unless I sell? I really dont want to even though at this point I feel the interest dividends are being paid out of my own dollar investment. Can you clarify if I am correct?

Harry Sit says

That’s correct: no deduction for loss until you sell. Also, loss is calculated off your original purchase price, not the highest price recently. Specifically to munis, if you sell for a loss within six months of purchase, the tax-free dividends you received become taxable.

Mags says

Can a 30 yr old receiving ACA healthcare subsidies, open and contribute to a Roth IRA or any sort of retirement fund (recommendations?) without losing/reducing the healthcare subsidies? They make very little money (~4-5k per annum). Could I gift them the annual max contribution? Would any future gains in a retirement fund impact the healthcare subsidies? Any tax issues? Thank you

Harry Sit says

Their income has to be above the federal poverty level in order to receive ACA subsidies. They also need to have earned income in order to contribute to a Roth IRA. If they otherwise qualify for both, contributing to a Roth IRA does not reduce or eliminate their ACA subsidies. It’s moot if they can’t do either to begin with.

Dani says

My daughter is 23 and a student this year however her summer job has become a permanent part-time job. i am early retired. Am I right that this year she could make a tax deductible contribution to a traditional IRA instead of her usual Roth contribution in order to lower our family income? I am carrying her as a dependent and deducting her medical expenses(she has type ! diabetes) but her income is higher of course than her typical summer jobs she has had so far. She is on her dads insurance.

Harry Sit says

I would think she still files her own tax return even though she’s claimed as a dependent by you. If that’s the case whether she contributes to traditional or Roth IRA doesn’t affect your income.

ameridan says

I’m pretty sure family income is not affected by your daughter’s income, even if she is a dependent, so she should be fine for three more years regardless what she earns.

Suzanne says

What are some ways to increase one’s earned income to meet the 100% FPL threshold? Situation: a serious injury led to reduced self-employment income this year and I am in danger of making 1 or 2K less than FPL. I am not eligible for Medicaid in my state. I understand I could convert some traditional IRA monies to a Roth IRA and that would add to my income–and of course, at a low income level, taxes should be low anyway. What about selling some profitable mutual funds for capital gains? Any other ideas? [I note the irony of being too sick to make enough money to qualify for healthcare subsidies that pay for insurance coverage I need to get better–that is way more than a donut hole. It’s a pit with snakes in the bottom of it. Makes me want to move to a state that allows single adults on Medicaid.]

Harry Sit says

That works too. At a low income level, long-term capital gains are taxed at 0% federal.

Rick says

I figured this strategy out last year when I got laid off and was forced to buy ACA Insurance. Now I pay the same as when I was working with no deductible, basically it’s catastrophic. So now I don’t go to the doctor unless I really have too. Who’s looking out for you? But to me the worst part of the ACA is that my insurance is not deductible I would draw a lot more out of retirement accounts if it was deductible. The ACA is bad for the economy for this very reason.

If I started a small business could I write off the family ACA insurance?

wij says

Self-employed individuals can take advantage of 1040 line 29 — self-employment health insurance deduction. It’s a way to use some of the net earnings from your business to pay for premiums for a health insurance plan if you are not eligible for a workplace plan.

https://www.irs.gov/uac/Newsroom/Dont-Miss-the-Health-Insurance-Deduction-if-Youre-Self-Employed

NateG01 says

Hi Harry,

My parents own and operate a business that earns $60-70k a year and my mom makes an additional $5-10k a year working odd jobs on the side. The business income puts them out of reach for the health care subsidies. What we are considering is incorporating the business as a C-Corp and paying my dad a small salary of $25k a year. This would put them in reach to qualify for a healthcare plan in our state that would only cost $80 per month.

As a tax professional, what I am concerned about is the reasonableness of the salary. The IRS requires shareholders/employees of a Corp to pay themselves reasonable salaries, and I am concerned that $25k on $60-70k of income is not reasonable. What do you think?

Harry Sit says

I was going to say “check with a tax professional” but you are already a tax professional. Is $60-70k already after maximum contribution to a retirement plan such as a Solo 401k? If not, that’s a good way of lowering AGI without getting into a C-Corp with double taxation and salary reasonableness issues.

Different Rick says

I plan to retire early (and take advantage of ACA subsidies) about the same time my son graduates college. I’m guessing at that time he can no longer be a dependent, but he will probably still need to be on my insurance (under 26 rule). I am looking at ACA costs/subsidies and they are only based on income and number of dependents. If my son is on my ACA plan but is no longer a dependent, is there any change in premium vs. if he is not on my plan? I don’t understand how this works.

Harry Sit says

You son can get coverage on his own, either from work or from the exchange. If you cover an extra person on your policy (a) it may cost you extra in premiums; and (b) you can’t get the premium tax credit.

https://www.healthcare.gov/under-30/#/join-parent-Marketplace-plan-files-taxes

Tim in Virginia says

62 yr old self employed. Does the traditional 401k have to be made in the current tax year or can you still wait until filing taxes April?

Harry Sit says

For the self-employed, traditional 401k contributions come in two parts: the employee contributions up to $18k per year and the employer profit sharing contributions as a percentage of profit. The employee contributions have to be elected in the current year, similar to how it’s done when you are working for someone else (“I choose to contribute ____ from each pay.”). The actual contributions should be made shortly after each pay. The employer profit sharing contributions can be made in the following year before you file your taxes.

Denise says

I am retired at 62 and I am on insurance through the marketplace now. I am thinking of starting a business as an artist which most likely will have little income at first.

Two questions: 1) no matter the income as long as I have an income I can add to my IRA, correct? And 2) To calculate for insurance would the amount of income be based on the net business income as self employed?

Thank you

Harry Sit says

(1) You can’t contribute more than you taxable compensation. For self-employed income that’s your net business profit minus one half of your self-employment tax. (2) It’s based on your “modified adjusted gross income.” Your net business profit is a part of it. It also includes many other items. If your modified adjusted gross income is too low, you won’t qualify for ACA premium tax credit.

Tuna Tom says

Great blog! I am 62, still working (on my employers plan) and planning on retiring when I am 65 so Medicare should work ok for me. But my wife is 12 years younger and not working (small income selling on eBay). She will have to go on ACA to get insurance for 12 years. What is our best option? Should she get the ACA insurance on her own and should we file income taxes separately? Or should we continue to file jointly and then I would need to move a big chunk of my 401K to a Roth 401K so that the MRD’s do not put us over the cliff? Of course this latter move would require paying a lot of taxes up front.

Harry Sit says

Filing separately won’t help you. It disqualifies you from receiving a subsidy. You will have to project your income in those 12 years. Social Security counts. Pension counts. Dividend and interest count. Muni interest counts. Withdrawing from traditional 401k or IRA counts. Converting from traditional to Roth also counts. If you are not able to stay off every year, go over big time in one year and stay off in other years.

Denise says

My spouse is retired on medicare and is 7 yrs older. I have retired at 62 and I am on the ACA for my 2 nd yr now. My understanding is Income is calculated based on both of you living in same house regardless of how you file. There is very little that you can deduct for the magi and I was surprised that they counted our tax free muni dividends towards the magi. Your wife having her own business may help some with deductions. Also, one area that is not discussed much but also based on income is assistance with Dr and presciption co pays in addition to premiums depending on income. Interesting that if one underestimates income you have to pay back some of the premium but not the co pay assistance. We too are living off savings rather than investments to help with the cliff but regardless of whether we take or reinvest those lovely munis they count!

Tuna Tom says

How about if I convert ALL of my traditional 401K to a Roth 401K before I am 65? Then when I am 65 my MAGI will be under the 400% since withdrawals afterwards from the Roth will not be counted as income. Then I will be entitle to the subsidy. Guess this is called 401K manipulation?

Harry Sit says

It may not be necessary to convert ALL now. That’s why you need to project your income.

Redneck Farmer says

Harry,

In order to ensure that income was “in the zone” in say 2015, would it be possible to re-characterize [some exact part of] a Roth IRA conversion in early 2016 (before tax return filed); i.e., instead of trying to nail the calculation prior to Dec 31, 2015 with a conversion of an exact amount from TIRA to Roth IRA? In other words, after Jan 1, 2016 [while doing taxes], I should have precise numbers for all of my 2015 income and not have to do any guessing.

Do Roth re-characterizations work like that?

Harry Sit says

Redneck Farmer – Yes it’s possible if you find that you overshot it. Be sure to read the follow-up articles listed at the end of this article, especially the ones on converting to Roth and income bunching.

jim says

Is the deferred interest on unredeemed series I savings bonds required to be included in the ACA MAGI?

Harry Sit says

No.

Shri says

Hi – Great blog! I have a question

So my parents (dad age 62, mom age 53) are retired with a decent sized traditional IRA in Florida. They don’t have any active income, just withdrawals from IRA.

So for married filing jointly, they need to withdraw from their IRA at least 100% of federal poverty level for household of 2 right? As shown here http://familiesusa.org/product/federal-poverty-guidelines – $16,020 so they will qualify for maximum ACA subsidy?

Or higher than $16,020 for tax year 2016?

Thank you very much.

Harry Sit says

That’s correct. If they don’t need the money for spending, convert it to Roth, which counts as income. At that income level, they are not going to pay much in taxes anyway.

Shri says

Harry,

Thank you very much for your response. If they convert $16,020 worth of traditional IRA into ROTH for year 2016, all gains accumulating from ROTH will be tax free right?

And second question – my dad has accumulated long term capital losses from past years. So when we talk about $16,020, is it BEFORE or AFTER accounting for the $3,000 annual limit of capital loss carry-forward deduction?

Thanks.

Harry Sit says

Tax free growth in Roth is subject to the usual conditions: 59-1/2, 5 years after first Roth was established etc.

It’s after the capital loss. Don’t cut it too close. Even if they convert $23,000 ($20,000 AGI after deducting the $3,000 capital loss), they will still pay zero federal income tax.

KT says

Hello!

I am self-employed and have a net operating loss from 2015 and can carry over to 2016 as well. I just received notice that I’m being kicked off of my Grandfathered plan (so much for ‘keeping your plan!’). Healthcare.gov states that self-employed individuals estimate their income from their Schedule C, line 31 (Net Profit/Loss). Being that I have a Net Loss, I fear it will push my family and I to Medicaid, which I don’t believe I will qualify for anyway after going through their lengthy application process. Any advise as to 1. if you think I will be eligible for the subsidy or 2. how it is calculated if there is a net operating loss?

Thanks in advance

KT

Harry Sit says

Are you expecting a net loss after the carryover in 2016 as well? Is self-employment your only income? If you need to generate income above the minimum to stay in ACA as opposed to Medicaid, you can convert some traditional 401k or IRA to Roth.

HollyO says

Well, My husband and I just received the nightmare scenario of our 2015 AGI falling just a few hundred dollars over the 400% per FPL Obama care cliff and therefore, financial stab for full premium payback. We would never have been able to afford the 300% rise in our health care per month had we known but now we’ll have to pay thousands and go off insurance indefinitely. I find it sickening how this so-called affordable health care is a boondoggle for the multi-national insurance companies to have an unlimited rise in their percentages while being partially covered for a few by tax payer government subsidies. Meanwhile, middle class people made poorer by the rise of inflation since the 70ties are struggling to pay their mortgages while trying to figure out how to limit their incomes and sneak around their own invested savings accounts just to be able to pay rising helium balloon medical premiums subsidies intact . It seems to be highly questionable these days for the middle class people in this country to be saving anything at all including their lives. I see varying FPL calculations every site I’m on. Who makes those up? I wouldn’t exactly call the system communism but a highly lucrative form of corporate government bundle ( it’s called fascism ) dangled over us slowly boiling frogs in a cruel for profit punishment otherwise known as American healthcare bailouts for the biggest players. The rules of the game were not fully disclosed to us when we innocently signed up for this so cleverly called ‘affordable care’. Learning a lot… a little late, however…interesting blog discussion. My how we’ve been played!

Robert says

Hello HollyO

This happened to us last year…. we learned the hard way about the Cliff…. We had to pay every penny back and hit with four $1500 vouchers we had to pay in the year 2016 to make sure we didn’t under pay this year. If we did not pay them it was a 3% penalty added on top. We are in the process of signing up again this year but our income brings us to the 300% mark so hopefully we will be OK in 2017. It was a hard lesson and we did not have the extra money to give the healthcare industry. Obama lied, looking forward to a new administration but still worried about healthcare….. At 62 I may need it.

Amy says

Well, I’m very able to accurately guesstimate my income at the beginning of the year, so I don’t fully understand all of the scenarios that might result in this big income boost at the end of the year from which you suffer, so maybe this doesn’t apply to you. But if you are truly very low-income till the end of the year, then you should be eligible for Medicaid. California is a state that expanded Medicaid. Medicaid counts real-time income, so if you are low-income while receiving it it doesn’t matter if you get a windfall at the end of the year. You don’t have to pay back any of your Medicaid benefit. At the time of the windfall, you would have to shift to an ACA plan (subsidy proportionate to your income). However, my understanding is that the windfall only counts for the month it was received, and then you can go back to Medicaid. Might be worth looking into if you will be in this situation again in the coming year. Here in PA for folks under age 64, assets/resources/savings are not considered in determining Medicaid eligibility. It is only based on income.

If you don’t fit in this Medicaid-eligible category because your income is too high, you might want to consider signing up for an HSA plan. If you and your spouse both make the maximum HSA contribution ($3350 or $4350 each depending on age) that can be deducted from your income as well as any traditional IRA/401K contribution. Note that if your income is so low that you qualify not only for a subsidy but also for cost-sharing, then you can’t make an HSA contribution even if you have an HSA-qualified plan.

Good luck.

HollyO says

Thanks for the reply…I am wondering how many people found out about this the hard way and i tend to think it is not all that constitutional. There was no disclosure about the ‘Cliff’ when I signed us up thinking that signing up online was A-OK. It is a hidden tax for the middle class…just barely middle class… to pay for the poor. My husband is not taking it very well emotionally. I do not know what the 1500 voucher you speak of is…but an insurance agent told me that if you have an IRA account that can be written off your gross income and bring down the amount to be taxed by Obamacare. I would love to boycott the exchange at this point but they have made that impossible since all premiums have tripled in rates here in CA. Health insurance is no longer affordable for our income bracket. I would join a class action suit if there is one out there to sue the government and/or insurance companies but ‘fascistic’ conglomerates such as this healthcare scam package between private and public agencies makes for a never ending battle. I will be writing letters out to various points of influence, however voicing my complaint.

Denise says

If you are employed or even your spouse, you can add the maximum to an IRA and that totally changes your income for the ACA calculation.

I am 63 and retired. I own tax free muni bonds but the dividend/interest must be calculated and added to my income even though they are tax free. Regardless of whether you are losing money because they are down. I ended up selling just so I can take a loss on my income calculation. Capital gains or loss effect your calculations.

However, without the ACA I would not have been able to retire. More upside to ACA with required coverage and tests then downside for me. Waiting for the day when I can get on Medicare but now hearing rumors about Republicans making changes there.

HollyO says

Thank you for your comment…I am glad to find out about the IRA idea to adjust income as applicable to ACA. I don’t see how ACA is making it better for your retirement. We had fine insurance that we could afford before the law came into effect. Afterwards it shot directly up…from 230 a month to 980.00. Now insurance is no longer affordable unless one has the subsidy. The medical insurance companies all must have gotten together to adjust their rates at the consumers’ expense. I am also very surprised at the lack of disclosure to the public about the 400% over FPL cliff. We had no way of knowing what our income would be until end of year which put us into a vulnerable category. Obviously the designers knew that a certain segment of the population would fall into this predicament and I would even go so far as to say that the industry-government-IRS were gleefully counting on these exorbitant paybacks to recoup their losses. Helps me to better understand why the government supports dictatorships like Saudi Arabia, Turkey and Israel. Is this why you are worrying about whether the new regime will end Medicare and social security? Well, I wonder…How far we will be forced to let them carry out their privatization schemes with the tax payers money.

Denise says

HollyO, With an IRA you can contribute to a 2016 IRA until April 15 th of 2017 so if one underestimated that can be the safety net. But you have to have income so doesnt help me due to being retired already. I also believe the ACA would have been much better but the fighting and eventual compromising effected the plan. The insurance companies surely took advantage where they could including what I viewed as black mail. The Aetna statment on lucrative Humana merger stated ” It is very likely that we would need to leave the public exchange business entirely and plan for additional business efficiencies should our deal ultimately be blocked.”

The ACA plans also insure much needed regulation of no denial for pre-existing illnesses, free mammograms and cancer screenings. In addition when you actually start to use many of the plans they have a co-pay and the deductible doesn’t even come into play for most testing. Keep in mind if one has several imaging tests at the same time only one co pay is required which was huge for me. One of my biggest peeves is the fact that medicare is not allowed to negotiate drug prices as the Veteran Assoc. can. Why? Wonder how many insurance companies own or have major interest in the drug companies?! Over all I am grateful the ACA passed and that I have it.

Katie says

My husband and I will be about 10K over the 400% line this year due to one time income pop. We do not make enough to contribute that much to a deductible IRA. Our income is usually very near the bottom, close to being too poor for a subsidy (No medicaid expansion) Is there some way to spread out the income? Or bring our MAGI down ? Thanks.

Katie says

Got cut off, sorry. We do have more than 10K in Roths, could we convert that to a deductible IRA without having that much earned income? We already take the HSA deduction. and some self employment health insurance deduction. Otherwise that 10K is going to cost us $24K in premiums.

Harry Sit says

An existing Roth can’t be turned into a traditional IRA and give you a deduction. With your one-time income pop, are you still eligible for a deductible IRA contribution? Check IRS income limits here: https://www.irs.gov/retirement-plans/ira-deduction-limits

If you are eligible, you can contribute as much you have in earned income up to $5,500 per person per year ($6,500 if you are 50 or over). If that’s still not enough to bring your MAGI down below the 400% cutoff, you will have to see if you can reduce your one-time income pop. What’s giving you that pop?

Denise says

Perhaps you can open an HSA. It will lower your magi. Most ACA plans qualify. Funds do not expire but must be used for medical expenses. You can open and fund one for 2017 until April if 2018. I will use my funds for RX once I am on medicare in 2 years.

Katie says

Thanks Denise,

We already take the Max HSA so that’s baked in.

I’m wondering now if we could move some money from our Roths to a Deductible IRA and take that deduction Above the Line. Can you move more from the Roth into a Regular than you make in a year? Do you have to have done a more normal “conversion” (regular to Roth) previously? Other restrictions?

Thanks Again for your prompt reply

Mike Thompson says

Hi,

Appreciate the insights.

Can you clarify the following:

In order to qualify for premium subsidy for buying insurance from the exchange, you must have income above 100% FPL. In states that expanded Medicaid to 138% FPL, you must also not qualify for Medicaid, which means you must have MAGI above 138% FPL.

Q. Why is going on Medicaid not beneficial?

THANKS!

M

Harry Sit says

Some doctors don’t accept Medicaid. If you are happy with Medicaid, no problem.

Mike Conrad says

Going on Medicaid can be a disaster if you’re between the age of 55 and 65 and own a house. They’ll charge every penny of medical expenses (at the highest retail rates) against your house with a lien which takes precedence over all other claims. Look up “Medicaid Estate Recovery” for more. If you were hoping home equity might be an aid in retirement, this can ruin your life.

Several websites mistakenly claim that this ‘estate recovery’ applies only upon your death, but that is wrong. It applies if you should ever want or need to sell your house. Essentially, you no longer own it.

The foregoing doesn’t even address the fact that Medicaid providers are the worst out there, bar none. State legislatures do what they do for the ‘optics’ and for how issues are played (or ignored) in the mass media. The devil is in the details, as this page details in other ways as well.

SD says

Hi Harry – what is the income range (for 2017 tax return) that a COUPLE (married filing jointly with no dependents) needs in order to get the max Obamacare subsidiary?

Harry Sit says

Just above 100% FPL in states that didn’t expand Medicaid, just above 138% FPL in states that did. See 2016 2017 2018 Federal Poverty Levels (FPL) For Affordable Care Act.

HollyO says

According to my understanding, it still is any dollar over 400% above the National Poverty line figure which is different state to state and year to year. You can find out exact figures on the IRS website…the covered Ca people seem to be instructed not to tell you so that you may get a big surprise like we did in 2016. I found out from the IRS website. This cliff is the crucial edge where one must pay all subsidies back. ACA does wonders for the middle class…NOT! Only an IRA account investment will allow you to subtract from your gross income in order to bring this income amount down so that you are not over the edge.

Kim says

Thank you for your really helpful article! I have been unemployed/under employed for all of 2017, earning a grand total of $18,208 for the year. In addition to that, I received $5,395 in ACA subsidies for 2017 (per my 1095A form). I also decided to roll my 401k IRA over into a Roth IRA in 2017 because I saw that I’d be in the lowest tax bracket and wanted the taxes due to be as low as possible. That rollover amount was $28,244. After the rollover, I took and early disbursement ( I am only 54) in the amount of $17,930. In preparing my own taxes for 2017, the rollover amount of $28,244 is showing as income and incorrectly inflating my AGI, which is triggering a total repayment of all of the ACA subsidy. Per your article, my MAGI number is based on $47,520 ($11,880 x 400%), right? And currently, the 1040 form that I’m working on shows my AGI as $46,472. What do recommend I do, so that I am able to keep my ACA subsidy (because I truly had a low income year) and also properly include the rollover amount (which is taxable because it went from a tax deferred IRA to a taxable Roth IRA)? Any help you can offer would be much appreciated!

calwatch says

It’s possible that you had premiums less than what is needed for the subsidy. This is common in low cost states and for younger premium. Your income is based on the $48,000 or so, because conversions count as income.

Denise says

I would certainly hope that the rollover would not count towards the ACA calculations!

Definitely worth it to pay a tax accountant on this one.

Are you eligible to open a health savings account before April 15? That may lower your income and funds are used for future medical.

I earn tax exempt i terest on muni bonds but also pay an advisor fees on that account.

I am trying to see if that can offset my income because I am on ACA also.

Lynda says

Do I have to include IRA or IRA CD interest earned for the year but not taken out of my accounts in my calculation of income? For a MAGI estimate it says to include non-taxable Social Security which I understand what that is but then it says to include “tax-exempt interest” which is what? What does “tax-exempt interest” include. Also if I have the insurance but find that my income on my taxes in that year have gone under the MAGI amount required what happens. Thank you!

Denise says

No, your interest earned in your Ira and not taken out is exempt. Doesn’t count.

What they are referring to are generally tax free municipal bonds. This would be in investment accounts but not in IRAs or 401 k. You earn interest and are paid that interest, usually on a monthly basis. The income is tax free but for some reason the ACA says it must be included in your income calculation for qualifying for ACA healthcare subsidy however you do not pay federal income tax on the interest.

Lynda says

Wow, thank you for your answer. Do you happen to know what happens if my taxes turn out to be under the MAGI threshold (I think it is around 12,000) and I am already in the Marketplace for the year. Do I just get dropped off the Marketplace, do I have some sort of penalty or payback? Can’t seem to find that info. Thank you!

Lynda says

Upon further research it looks like I would be dropped from the Marketplace but not have to pay anything further, no penalty, etc. But also I could not get any refund on my premiums if I overestimated my income. Where as if my income was still over the minimum but not to the higher level of the MAGI I estimated I may be able to file a form for a refund. I don’t think this will be an issue for me but sometimes you can have losses on your taxes you don’t expect… Thank you!

Denise says

I am not totally sure if I understand your question, however my Magi income was a bit less than what i put on my ACA application for 2016. I recieved a credit on my income taxes and the amount that I overpaid was in my refund check. Of course, that just went to my acct for filing my return:)

I think as I do my taxes this year I may have underestimated my income. Oh well, guess I will have to either repay the diff or get back less depending on the amount.

Fyi. Any losses on investments are minused on income calculation for ACA!

Kevin says

I fell off the cliff HARD in 2014..

.

.

.

I had to repay $10,000 in advance premium credits. I took too much money from my IRA to pay medical bills and health insurance premiums.

Now I pay attention to the small cliff @ 300% and the HUGE one @ 400%.

If I had only delayed paying some of those medical bills a few months till I got into 2015 I could have saved close to $6,000.

Now I wish they would stabilize things so a person can plan ahead instead of stumble from one year to the next with this healthcare stuff.

SD says

@Kevin: Wow, that’s tragic.