Life isn’t fair. Some people want to do the mega backdoor Roth (see previous article The Elusive Mega Backdoor Roth), and they can afford it, but their 401k/403b plans don’t let them. Some people are in a plan that allows it but if they go full tilt their net paycheck will be too small for their current living expenses. What if you fall into this second scenario?

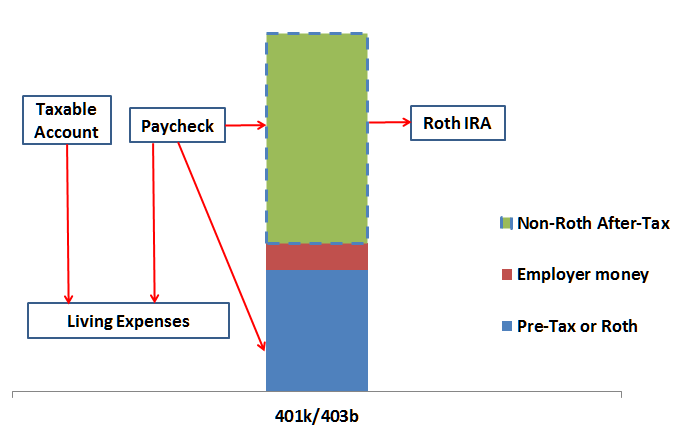

You can still take advantage of the mega backdoor Roth if you have money saved outside retirement accounts. If you were investing money in a regular taxable account before you discovered that you have the mega backdoor Roth available to you, you can effectively move some of that taxable money into a Roth account.

You set up the payroll deduction for non-Roth after-tax contributions to your 401k or 403b plan. If that drops your net paycheck next to nothing, you just sell some of your taxable investments to make your ends meet.

Even if you have to pay capital gains tax when you sell your taxable investments, it’s still worth it. I made a spreadsheet to show it. Here’s an example:

| Assets in taxable account now | $10,000 |

| Cost basis | $4,000 |

| Capital gains tax rate now | 20% |

| Marginal tax rate at time of 401k distribution | 40% |

| Capital gains tax rate at retirement | 20% |

| Tax rate on dividends | 20% |

| Investment return | 8% |

| Dividend distributions in taxable account | 2% |

| Extra cost in 401k | 1% |

| Number of yours in plan until rollover to Roth IRA | 1 |

| Number of years until withdrawal | 30 |

| End value in Roth IRA | $85,436 |

| End value in taxable after paying capital gains taxes | $76,190 |

I included 5% state income tax on dividends, capital gains and 401k distribution. If you sell the $10,000, after paying capitals gains tax you are left with $8,800. You spend this $8,800 while simultaneously contributing $8,800 as non-Roth after-tax to your 401k or 403b plan. After staying in the plan for 1 year, you roll it over to the Roth IRA, paying 40% taxes on the gains during that 1 year. Your Roth IRA will grow to $85,436 tax-free in another 29 years. If you don’t do the mega backdoor Roth, your $10k in taxable investments will grow into $76,190 in 30 years after all taxes are paid. You are better off by 12% with the mega backdoor Roth.

If you don’t have as much unrealized capital gains in your taxable investments, for instance if you have a cost basis of $8,000 instead of $4,000 in your $10,000 investments, doing the mega backdoor Roth would be 21% better.

As usual, you can enter your own assumptions and see how it comes out for your scenario. The online spreadsheet is here:

If you have the mega backdoor Roth available to you, don’t forego the opportunity until you exhaust substantially all your taxable investments.

For more on mega backdoor Roth, please read:

- The Elusive Mega Backdoor Roth

- Mega Backdoor Roth Without In-Service Distribution

- Mega Backdoor Roth and Access To Your Money Before 59-1/2

- Mega Backdoor Roth In Solo 401k: Control Your Own Destiny

[Photo credit: Flickr user yat fai ooi]

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Scott says

Harry – The IRS came out with an FAQ today on Notice 2014-54. Does this effectively limit this opportunity or am I missing something? I have a large regular 401K balance and just started contributing to a Non-Roth after-tax 401K as well. If I can’t roll over just the after-tax amounts I struggle to find the benefit here. Help!

Can I roll over just the after-tax amounts in my account to a Roth IRA and leave the remaining amounts in the plan (i.e., take a partial distribution of just the after-tax amounts)?

No. The guidance provided in Notice 2014-54 does not alter the requirement that each distribution from a plan must include a proportional share of the pretax and after-tax amounts in the account. Accordingly, any partial distribution from the plan must include some of the pretax amounts you have in your account — you cannot take a distribution of only the after-tax amounts and leave the pretax amounts in the plan. In order to roll over all of your after-tax contributions to a Roth IRA, you could take a distribution of the full amount (all pretax and after-tax amounts) in your account, roll over all the pretax amounts in a direct rollover to a traditional IRA or another eligible retirement plan, and roll over all the aftertax amounts in a direct rollover to a Roth IRA.

Harry Sit says

If you are under 59-1/2, still working for the employer, your pre-tax and Roth accounts are prohibited by law for a distribution. Therefore the proportional share is still your after-tax account. If you are already 59-1/2 or if your plan allows in-service distribution of employer money, you take the pre-tax money to a traditional IRA and roll it back into the plan if necessary.

Harry Sit says

P.S. Where do you see this FAQ? I can’t find it on irs.gov. I’d like to see what else they said.

Scott says

I found it here: http://www.kpmg.com/US/en/IssuesAndInsights/ArticlesPublications/taxnewsflash/Documents/irs-dec23-2014.pdf

Harry Sit says

Thank you Scott. I subscribed to that IRS newsletter to monitor future announcements.

Harry Sit says

I read the first question again. If it’s asking whether the earnings on the after-tax contributions can be left in the plan, we know of course that’s not possible. The earnings must be distributed together with the after-tax money. You either pay tax on the earnings when you roll it over to the Roth IRA or you take the earnings to a Traditional IRA. It’s not clear whether the “proportional share” has to go across other money eligible for distribution, such as your pre-tax contributions and earnings when you are already over 59-1/2.

We don’t have to worry as a participant. The plan administrator will tell us how much of a distribution is pre-tax and how much is after-tax. If the pre-tax amount is too high, you take it to a Traditional IRA.