It’s tax filing time. I’ve been fielding a lot of questions on my articles about the backdoor Roth (if you are not familiar with it please read these first):

- Backdoor Roth: A Complete How-To

- How To Report Backdoor Roth In TurboTax

- How To Report Backdoor Roth In H&R Block Software

- How to Report Backdoor Roth In FreeTaxUSA

One theme quickly emerged. All those who are confused were contributing to the traditional IRA for the previous year and then converting it to Roth. They made it too hard for themselves.

For example, they contributed to the traditional IRA for the previous year between January 1 and April 15 and then converted it to Roth. They are planning to contribute for the current year, again in the following year before April 15, before converting it to Roth. Although it’s OK to do so, it just gets very confusing at tax time when they do it this way.

The tax law requires that you report your traditional IRA contribution *for* that year and your converting to Roth *during* that year.

In the example above, the contribution made *for* year X in year X+1 goes on the tax return for year X. It has to carry over the tax basis to the return for year X+1. The conversion to Roth *during* year X+1 goes on the tax return for year X+1. The contribution *for* X+1 to be made in X+2 again goes on the tax return for year X+1 but the conversion *during* year X+2 must wait for the tax return for year X+2.

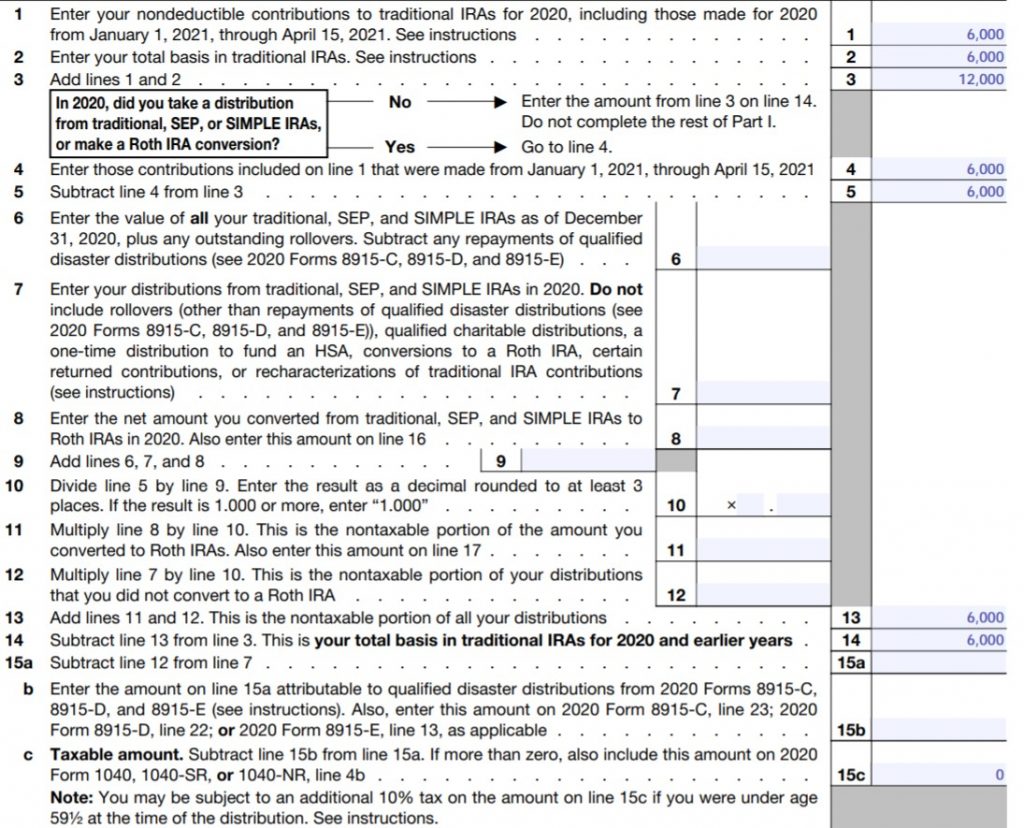

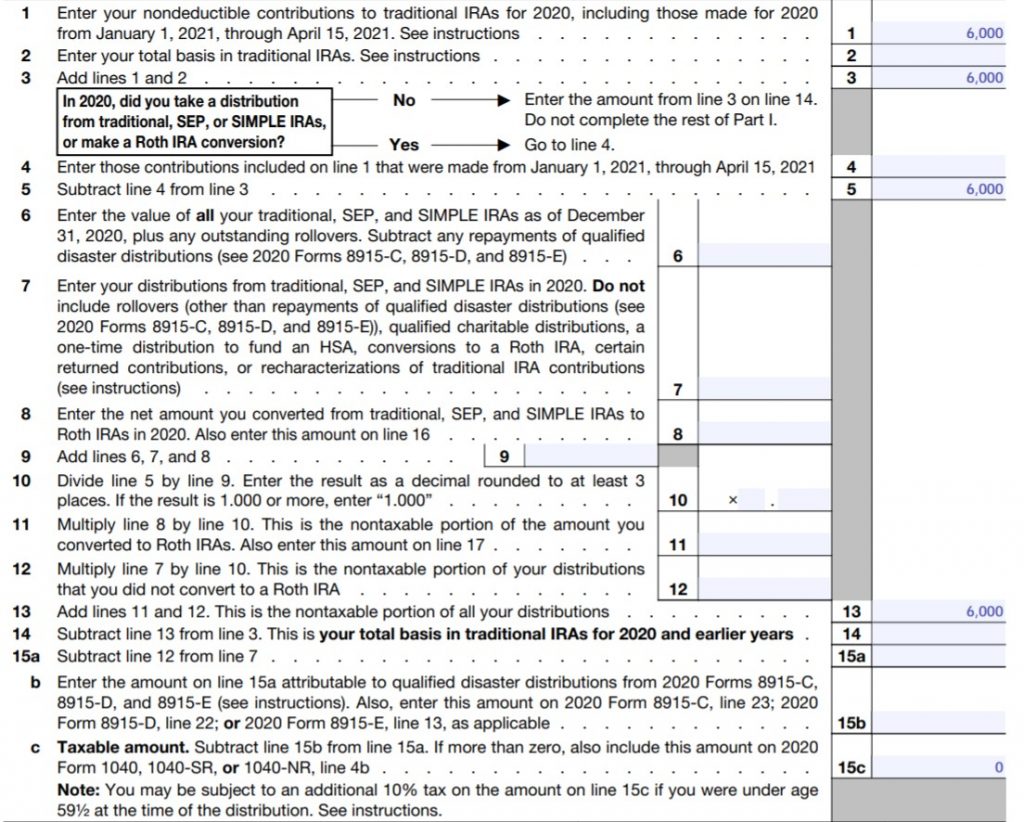

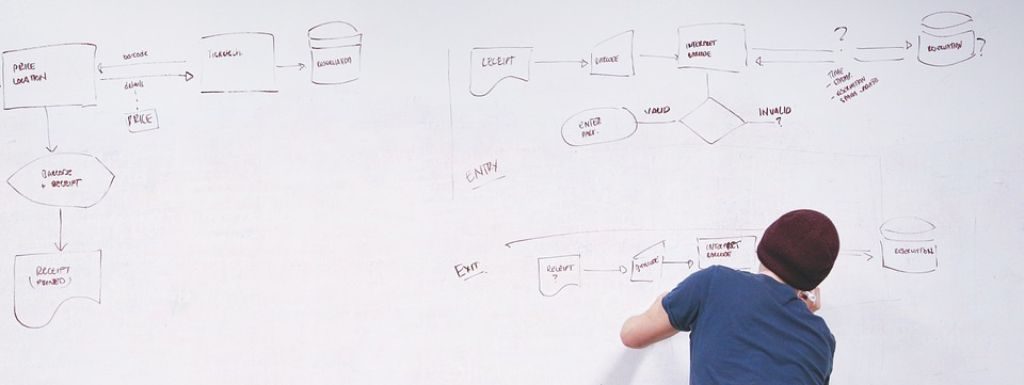

The tax return for the current year ends up having a basis carried over from the previous year, a conversion, a contribution (made in the next year), and a basis carried forward to the next year. The Form 8606 ends up looking like this:

This is very confusing.

The easy way to do it is to contribute for the current year rather than waiting until the following year. Contribute for year X in year X and convert in year X. Contribute for year X+1 in year X+1 and convert in year X+1. This way will be clean and neat. Both the contribution and the conversion go on the same tax return. You don’t carry over anything from one year to the next or wait until the following year to finish it off.

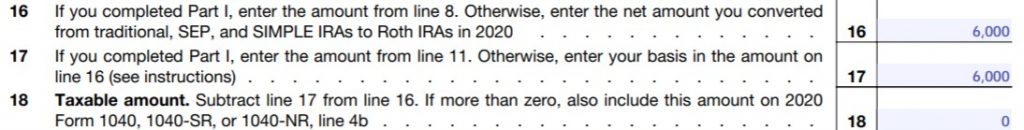

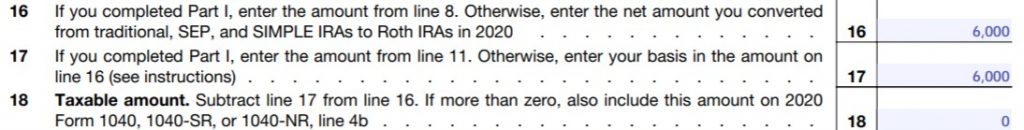

The Form 8606 when you are doing it the easy way looks like this:

That’s very clean.

If you are doing backdoor Roth, please do yourself a big favor and do it the easy way. Contribute for the current year and convert it in the same year. Contribute for year X in year X and convert during year X. Don’t wait until the following year. Otherwise you just confuse yourself at tax time.

If you must get caught up for one year, that’s fine. Contribute for the previous year before April 15, but also contribute for the current year in the current year, and convert both during the current year. You can convert more than once in any year, and there is no limit on the amount you convert. This way you will have a clean slate come next year, which lets you do it the easy way going forward.

Comments are closed because questions are becoming repetitive. Be sure to read existing comments for answers to questions similar to yours.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

indexfundfan says

Maybe I am mistaken, but at one time have you advocated to do a conversion only once every two years to avoid issues with the step transaction doctrine?

Harry says

That still works if you don’t get confused about carrying forward the basis. Otherwise wait some time within the same year will do. I’m only against converting the very next day, which is really unnecessary.

Bob says

Echo the comment above – it only is confusing if you fail to carry forward the basis. I thought it was pretty straight forward – compared to the way they deal with ESOP sales this year. To your point, I did consider just contributing in December and having on less thing (carry forward) to remember. This is my first year using Turbotax in a while, but I believe Turbotax will pick up the carry forward from your last return.

UAPhil says

If your IRA contributions are non-deductible (for example, because your income is too high and you are covered by a retirement plan at work), and if you have other IRA funds, the “back door Roth conversion” is likely to result in a net tax liability on conversion. The reason is that the IRS requires you to prorate the Roth Conversion across all your IRA’s. Caveat emptor!!

Harry says

Only if you didn’t read the complete how-to linked at the beginning of the article.

Eric says

I must filling out this form wrong. I have a 2012 non-deductible contribution of $5000 that I didn’t convert to a Roth. I have a 2013 non-deductible contribution of $5500 and a 2013 conversion of $10,500 to Roth.

Form 8606:

Box 1: $5500

Box 2: $5000

Box 3: $10,500

Box 5: $10,500

Box 6: $10,500

Box 8: $10,500

Box 9: $21,500

Doesn’t this generate .50 in Box 10 and a taxable amount of $5,250? I was under the impression that since all contributions were non-taxable the entire conversion should be non-taxable.

Harry says

Line 6 should be zero? After you converted you would have nothing left by the end of the year.

Eric says

That’s the ticket. Obviously not paying attention.

Albert says

I contributed $5500 to a non-deductibile IRA in Feb 2014 and converted to Roth IRA the following day. I did not realize that the Roth IRA has to be reported for the 2014 tax season and not 2013. I should have contributed and converted in the 2013 calendar year.

Since my traditional IRA is $0 since I converted and I did not accumulate any gains, do I still need to fill out form 8606?

Harry says

Yes you do if your contribution was for 2013. That’s how your basis is going to carry over to 2014 to offset the conversion in 2014.

HMck says

Hello,

If I am getting caught up for the first time this year, I understand that I contribute for 2013 IRA before Apr 2014(and show it in my 2013 Tax return) along with my 2013 calendar year conversion to Roth in the same 2013 Tax return. How do I contribute for 2014? Do I just open another traditional IRA anytime this year (2014) and convert before Dec 2014 to Roth?

Harry says

That will work. Or you can contribute to the same IRA again for 2014 and convert before 12/31. Usually when you convert, the assets move over to your Roth. The account is still there with a zero balance.

Patrick says

Hi Harry,

I made excess contributions for 2013 and 2014 to my Roth IRA due to exceeding income limits. I would like to recharacterize the excess Roth IRA contributions as non-deductible traditional IRA contributions *then* convert the traditional IRA back to a Roth IRA. From what I understand, I’ll be taxed on the earnings from the contributions while it was in my Roth IRA (which is fine by me). Are there any other consequences/pitfalls to doing this?

BTW, really great articles!

Harry says

Just the same “hiding” other IRAs in a qualified plan, as detailed in the complete how-to article linked at the beginning of this article. Be sure to still report your 2013 Roth IRA contribution and its recharacterization on your 2013 tax return.

Robert says

Regarding the moving of IRA funds to a 457 plan to lower the tax hit on the conversion, I checked with my one of my 457 plan providers and the representative I spoke to said they accept rollovers from a traditional IRA, but that it is listed still as an IRA within the 457 plan. So, if the money is still showing as a rollover IRA within the 457 plan, does that make it part of the pro rata calculation, incurring a higher tax on the conversion? I am planning to do this for 2014 so I have some time to figure this out.

Harry says

As far as I know, there isn’t such a thing as “an IRA within the 457 plan.”

Robert says

I will have to check further with the 457 provider. The individual I spoke to may have meant that the money would be identified separately as a rollover IRA from the deferred compensation $ within my account. I am assuming you mean that once the money is transferred to the 457, it no longer is counted as IRA and does not follow those pro rata rules as far as conversions are concerned. Is that documented anywhere in IRS publications as far as you know?

Harry says

The money is either in an IRA or it’s not. If it’s in a 457 it’s not in an IRA. How the 457 accounts for it is their business. The IRS says count your money in traditional, SEP, and SIMPLE IRAs. That’s already documented.

Robert says

Hi Harry,

Checked with another rep for the 457 plan re: transfer. He said it would be counted as part of my 457 plan but it would be identified separately because it still would be following the traditional IRA rules as far as distributions and penalties for early withdrawal etc.which is different than the 457 rules. But he agreed with what you are saying in that the IRS would not be seeing it as IRA $. Does that 8606 form have a line that accounts for the lowering of the basis as a result of the transfer of the money to the 457 plan another qualifed plan?

Harry Sit says

Robert – Your basis is your total non-deductible contributions. It does not lower when you transfer pre-tax money out. Form 8606 line 6 asks for the total value in your traditional, SEP, and SIMPLE IRAs as of Dec. 31. When the pre-tax money is no longer in those IRAs, the value by definition drops.

Tom says

Great article, thanks Harry! Quick question – I am needing to do a catch-up this year so I am contributing now for the 2013 year and will contribute again later in the year for the 2014 year. As far as the conversion goes, can I do the conversion for the 2013 year now and do it again later in the year for 2014? In other words, during the calendar year 2014 I will have done 2 conversions (one for 2013 and another for 2014). Can I do that or am I limited to 1 conversion for year?

Harry says

Tom – You can convert however many times as you want.

Tom says

Ok, cool. So when I file my 2014 taxes, I will just enter the sum of both my conversions for my Gross Distribution on the 1099-R?

Harry says

Your IRA provider may put it on one 1099-R or two. If you use software and you get two 1099-R’s you just enter each one separately, as you do when you have multiple W-2’s or multiple 1099-INT’s, etc.

bmints says

Hi, If I have no traditional IRAs, and can’t contribute to a ROTH due to income, I can open a fully funded traditional non-deductible IRA and then immediately convert it to a ROTH the next day. Assuming zero gain/loss, do I then need to pay taxes on the $5,500 that comes out of my traditional IRA? I thought the answer was “NO”, but my CPA has added this $5,500 to my taxable income for 2013. This is wrong, right?

Harry says

bmints – You have to tell your CPA about your non-deductible contribution. Otherwise they wouldn’t know. There’s a 1099-R form for the conversion. If they didn’t know you made a non-deductible contribution, the 1099-R form makes it taxable.

Mark says

So when filing online, can I just skip the 1099-R form? What adjustments should I make to adjust for the nondeductible contributions? Can I just do the 8606 form instead?

Harry Sit says

Mark – No you can’t just skip it. Please read the articles listed under the first paragraph.

bmints says

Hi Harry, Thanks for the reply. I just checked our return. Turns out the tax preparer completed Form 8606 (for both my wife and I) and line 25 (taxable amount) says “zero”, yet they still entered $11k ($5,500 for the two of us) on the 1040 line 15b. I think it looks like it was just a mistake?

Harry says

Ask them then. You are paying them. They should explain.

Jim says

Great article! I just want to make sure I’m completing the 8606 form correctly. In 2013, I contributed $5,000 to a traditional IRA for 2012 and converted it to a Roth IRA. In 2014, I contributed $5,500 to a traditional IRA for 2013 and converted it to a Roth. Here’s what I reported on the 8606 for 2013:

Part I:

Line 1: $5,500

Line 2: $5,000

Line 3: $10,500

Line 4: $5,500

Line 5: $5,000

Line 6: 0

Line 7: 0

Line 8: $5,000

Line 9: $5,000

Line 10: 1.00

Line 11: $5,000

Line 12: 0

Line 13: $5,000

Line 14: $5,500

Line 15: 0

Part II:

Line 16: $5,000

Line 17: $5,000

Line 18: 0

Does that look right?

Harry Sit says

Yes it looks right. It will become much simpler once you start doing it the easy way.

Jim says

Thanks!

Harry Sit says

I added your example to the article and a clean Form 8606 for comparison.

Jim says

Great – thanks again!

P.S. It looks like there’s an amount missing on line 9.

Harry Sit says

Thank you for double-checking. Fixed.

Rob says

One thing is confusing me about this. I understand that I need to contribute to my traditional Ira before April 15 2014 for 2013 but does the conversion to Roth also need to take place by April 15?

Harry Sit says

It does not. Because it happens *in* a year, and not tied to any specific contribution, it can take place at any time.

Brian says

In the second (“easy”) way, I’m confused that you only fill in Part 2 (the conversion part) of the 8606.

Don’t you also need to account for the nondeductible contribution in Part 1?

Harry Sit says

My tax software did it that way, based on the reading of the 3rd bullet under the Part I heading:

“You converted part, but not all, of your traditional, SEP, and SIMPLE IRAs to Roth IRAs in 2013 (excluding any portion you recharacterized) and you made nondeductible contributions to a traditional IRA in 2013 or an earlier year.”

It means you don’t have to do Part I if you converted all.

Tom says

So if you do it the easy way your basis on line 14 stays at 0 doesn’t it?

Harry Sit says

It does.

Dave Martin says

Thanks so much for this article. In the “complicated way” outlined above what would Form 8606 look like for 2012, the year when the $5,000 tax basis is carried over?

Harry Sit says

If the “complicated way” for 2012 means a $5,000 contribution made for 2012 in 2013 and converted in 2013 (but no conversion in 2012), it’s just just 5,000 on line 1, 0 on line 2, 5,000 on line 3, and again 5,000 on line 14. That 5,000 gets carried forward to 2013 as shown above.

CM says

I’m not clear on why you don’t have to fill out “part 1” using the easy way. In Turbotax, it asks for the basis (which I assume the IRS wants to track), and your contribution for the year, which is Part 1, line 1. I’m not clear on how you can avoid these questions.

Harry Sit says

See comment #19 and reply above. If TurboTax fills out Part I it’s fine. It will arrive at the same bottom line.

Susan Lindberg says

I did a back door Roth in January of 2014 for both the 2013 and 2014 tax years all at the same time. Because I had already filed my taxes for 2013, I did not report it on that tax return. How do I fix this? Do I need to go back and file an amended return for last year?

Harry Sit says

You can find 2013 Form 8606 and file it by itself. The IRS has an archive of forms for past years.

David says

In the complicated version, could you explain how Pub 590B Worksheet 1-1 fits into this? Pub590B p 14 says “To report your nontaxable distribution and to figure the remaining basis in your traditional IRA after distributions, you *must* [my emphasis] complete Worksheet 1-1 before completing Form 8606.” I don’t understand Worksheet 1-1, nor why I must fill it out. But shifting the example above ahead one year, I assume $5000 contributed in Jan 2014 for 2013, converted in 2014, and $5500 contributed in Jan 2015 for 2014, converted in 2015. For 590B Worksheet 1-1, I then get $0 for line 1, $10500 for lines 2 and 3, $0 for line 4, $5020 for lines 5 and 6, but strangely 1.0 for line 7, and $5020 for line 8, which is all going wrong. Line 2 seems like the culprit, but it specifically says to include contributions made during 2014 ($5000) and during 2015 that were for 2014 ($5500).

Mal says

Mr. Sit,

Thanks for your wonderful series on the Backdoor Roth.

I was hoping to get your thoughts on my situation. I contributed for 2013 and 2014 the max to my Roth IRA ($5,500 each year), but I ran over the limits in 2014 and didn’t find out until after filing my 2013 tax return. I had Fidelity recharacterize the contributions and earnings for 2013 and 2014. I then converted the non-deductible T-IRA amounts to my Roth account. I think I’m tracking on my 8606 for 2013 (and that I have to amend my return for 2013 with an explanation).

But for my 2014 8606, I’m not sure if I’m right:

Line 1: 5,500

Line 2: 5,500

Line 3: 11,000

Line 4: 0

Line 5: 11,000

Line 6: 0

Line 7: 0

Line 8: 12,466.35 (what Fidelity calculated as the earnings and contributions)

Line 9: 12,466.35

Line 10: .882

Line 11: 11,000

Line 12: 0

Line 13: 11,000

Line 14: 0

Line 15: 0

—

Line 16: 12,466.35

Line 17: 11,000

Line 18: 1,466.35

Thanks, Sir!

Harry Sit says

It looks good to me.

Mal says

Thanks, Mr. Sit!

Albert says

HI Harry, great article and I wish I had read this earlier before I contributed and converted. I’m still a bit confused on something and hope you can help clear it up for me. I’m catching up a year so I contributed $5500 on Feb 2015 to my 2014 traditional IRA and also contributed $5500 at the same to my current 2015 IRA. Clean start, no other IRA accounts. I converted both 2014 and 2015 IRA to Roth IRA already. Now I’m confused on what to do using turbotax to report the contribution and conversion for both years. Do I just report the 2014 contribution and not the conversion? I will then carry the 2014 $5500 basis to my 2015 return and report the total conversion of $11000 in 2016, am I right? Then come 2016, I should have a simple conversion from there on if the backdoor roth is still open? Thank you very much!

Harry Sit says

That’s correct. 2014: just the contribution. 2015: $5,500 basis carried over + $5,500 new contribution, $11,000 conversion. 2016: clean contribution followed by conversion.

Raji says

Hello Harry, I wish I had read this earlier before I started with backdoor roth. Kindly provide clarification/advice for my 2014 taxes. I do not have other IRA accounts except 401k and started backdoor roth approach only in 2014. I did a back door Roth in Feb of 2014 for both the 2013 and 2014 tax years all at the same time. I converted both 2013 and 2014 IRA to Roth IRA at the same time in 2014 right away. Also there were no gains as I had the money in money-market fund. Unfortunately, I was under the impression that I need to report and submit form 8606 only for the year I did the conversion and I did not report anything in my 2013 taxes. Now what do I do? How many form 8606 should I file now? I believe 2014 will be a clean approach as the contribution and the conversion happened in the same 2014 tax year. But, the 2013 contribution and 2013 conversion in 2014 is confusing. Please guide me in filling the forms if there is more than one. Also, will there be any penalties for not reporting in 2013?

Dennis says

Dear Mr. Sit, I just want to make sure I’m completing the 8606 form correctly. In 2014, I contributed $5,500 to a traditional IRA for 2013 and converted it to a Roth IRA rightaway. In 2014, I also contributed another $5,500 to a traditional IRA for 2014 and converted it to a Roth. I followed the easy way in 2014 and plan to stick with it. But,Here’s what the 8606 should look for the year 2013 and 2014: Can you kindly verify if it looks right?

2013 Part I:

—————–

Line 1: $5,500

Line 2: $0

Line 3: $5,500

Line 4: $5,500

Line 5: $0

Line 6: 0

Line 7: 0

Line 8: $0

Line 9: $0

Line 10: 0.000

Line 11: $0

Line 12: $0

Line 13: $0

Line 14: $5,500

Line 15: $0

No Part II for 2013.

————————————————————–

2014 Part I:

Line 1: $5,500

Line 2: $5,500

Line 3: $11,500

Line 4: $0

Line 5: $11,000

Line 6: 0

Line 7: 0

Line 8: $11,000

Line 9: $11,000

Line 10: 1.000

Line 11: $11,000

Line 12: $0

Line 13: $11,000

Line 14: $0

Line 15: $0

Part II:

Line 16: $11,000

Line 17: $11,000

Line 18: 0

Does this look okay for both the years? I didn’t report in 2013 and plan to file it along with my 2014 taxes.

Harry Sit says

It looks OK, except your 2014 line 3 should be $11,000.

Dennis says

Thanks Mr. Sit, Yup that was a typo and I agree my 2014 line 3 should be 11,000.

Mary says

Hi Harry,

I’ve followed your Backdoor Roth IRA step-by-step for Turbo Tax for my husband (age 62) for our 2014 Taxes.

• He has no other IRA’s (only a 401k plan)

• Made a $6,500 non-deductible Traditional IRA 12-24/14

• Converted $6,500 12/31/14 (no earnings, money was in cash)

If I’m understanding correctly, your 2nd 2013 sample 8606 is the one I should be comparing ours to. The one for “Contribute for 2014 in 2014 and convert in 2014”

That 8606 shows no entries in Part I, entries on Lines 16, 17, 18. Our Turbo Tax produced 8606 has all $0 or blanks except for:

Part I

• Line 1 – $6,500

• Line 3 – $6,500

• Line 5 – $6,500

• Line 13 – $6,500

Part II

• Line 16 – $6500

• Line 17 – $6500

Is this simply a difference in the 2014 Turbo Tax vs the 2013 Turbo Tax? Our IRA Information Worksheet appears to be tracking the contribution correctly. All lines blank except as noted below:

• Part I – Traditional IRA – Lines 1, 2, 3 = $0

• Part II – Roth IRA – Lines 7 & 8 = $6,500

• Part V – Roth IRA Contribution and Conversion Balances – Line $60 = $6,500

I appreciate you taking the time to confirm our 8606 Non-Deductible IRA looks correct based on the above information. Thank you so much!

Mary Mataja

03-08-2015

Harry Sit says

The form I showed was generated by H&R Block software. Yours from TurboTax is also correct. See previous comments 19 and 22.

Mary says

Thank you, Harry! Sorry I missed those 2 comments.

Trevor says

Hi Harry, great article!

I’m stuck in the “catching up” scenario: contributed for 2013 in 2014, before April 15, but also contributed for 2014 in 2014, and converted both in 2014.

Now I’m trying to document all this in TurboTax. When I add each 1099-R it gives the “you don’t need to pay any extra taxes message,” however after adding the second 1099-R taxes due increase significantly and a “IRA Distributions – taxable” of $5,500 shows up.

Does that sound correct? When “catching up” is one of the conversions taxable?

Harry Sit says

Trevor – First make sure you reported your contribution for 2013 on your 2013 return. Then you include that carryover basis in the “Let’s Find Your Basis” screen. See How To Report Backdoor Roth In TurboTax.

martin says

Harry, shouldn’t line 4 on Dennis 2013 form 8606 be 0 and not 5500?

Harry Sit says

martin – No, it should be $5,500 because he contributed in 2014 for 2013.

martin says

Harry sorry but just so I am clear because I made my 2013 contributions in 2014 and the converted. So for the 2013 form 8606 above

line 3 states :

In 2013, did you take a distribution

from traditional, SEP, or SIMPLE IRAs,

or make a Roth IRA conversion

If the answer is ” no “, enter line 3 on 14 and do not complete rest of part 1.

since the conversion for 2013 was made in 2014 and no distribution was taken in 2013, doesn’t that mean you leave line #4 blank as it directs

I just want to make sure I did not screw up my 2013 taxes or am I missing something?

Thanks for the response. Appreciate your help and this site

Harry Sit says

martin – You can skip the lines as instructed. They are just making it easy for you when they know those interim lines are not going to make a difference. If you go through the lines anyway they are not going to object either. You end up at the same place. That’s what counts.

Robert says

Hey Harry,

Just found your blog today, good stuff! I wish I had know this all earlier!

So my situation is this:

I contributed $5500 to my Roth IRA in the Tax year 2013, at the time my income was high and I hit the phase out. I ended up with $2,979 in excess contributions. At the time I just ate the 6% penalty and moved on. However, I want to remove the $2,979 in excess contributions this year so I don’t get hit with the 6% penalty again.

I contributed $5500 to my Roth IRA in the Tax year 2014, my income increased again and now I’m fully phased out. I intend to recharacterize the $5500 of Roth IRA contributions to $5500 of Traditional IRA contributions.

Once I’ve recharacterized the $5500 from R-IRA to T-IRA I want to convert the T-IRA back to the R-IRA. Preferably ASAP to keep the taxes low.

So few questions:

1) What do I do about the $2,979 of excess contributions from Tax year 2013?

2) Since I’m converting the T-IRA to an R-IRA in Calendar year 2014, but BEFORE 4/15, would that conversion still fall under Tax year 2014 or would it fall under Tax year 2015?

Thanks for your wonderful blog! I’m reading up on the rest of your great articles.

Harry Sit says

Robert – (1) You waited way too long. See Correcting an Excess Roth IRA Contribution. None of the three options is available to you now to avoid the penalty for 2014. (2) Conversion is tracked in the year it actually happens, which is really the point of this article. See the paragraph in bold.

chy says

Harry I have decided to recharacterize my roth ira contributions for personal reasons. I contributed and converted my tax year 2013 TIRA in 2014. Can I still recharacterized that back to the TIRA since the conversion was done in 2014? Or am I limited in just recharacterizing my tax year 2014 TIRA contributions? I have not yet filled my 2014 taxes yet

Thanks for the reply

Harry Sit says

chy – You can recharacterize the conversion performed in 2014 before the tax filing deadline including extension.

Ad says

Thanks for pulling these together, I used your article to help me figure out turbo tax last year (my first year doing it and very much appreciated!). I had a quick question though because something doesn’t seem to be adding up. For 2013, I made $1,800 contributions between 1/1/13 and 12/31/13 and another $3,700 in April 2014 (for 2013). My 8606 looked like this:

Line 1 -5500

Line 2 – 0

Line 3 – 5500

Line 4 – 3700

Line 5 – 1800

Line 8/9 – 2338

Line 11/12 – 1800

Line 14 – 3700

So now i have this 3,700 that I need to report as basis on 2014 return. In 2014 I made 3,600 in contributions from 1/1/14 to 12/31/14 and am not making a 2014 contribution in 2015 to make my life easier. However the 1099 I received was approximately $3,900. As a result, it does not appear that I received a 1099 that accounted for all of the necessary distributions (the 2014 contribution for 2013 ($3,700) and the 2014 contributions for 2014 ($3,600)). Should I have received two different 1099’s for each of the “periods”? I doubt that those contributions lost that much value by year end (even though markets were a bit rough during that period). Does this seem normal or should I be reaching out to my financial institution?

Harry Sit says

Ad – The 1099-R is about money coming out of the traditional IRA during the year, not money going into it or the value at year-end. If you only converted the $3,700 when it grew to $3,900 and you still have your $3,600 left in the traditional IRA (whatever value it became at year-end) then it makes sense.

Ad says

I think what confuses is me is that these should have been converted already (The 2013 contribution made in 2014 should have been converted right then and there? and the 2014 contributions made for 2014 should have been converted at year end?). This is all done thru my financial advisor. I mean at the end of the day isnt that the point of the back door (To convert traditional to roth)? I am guessing this is what I have to confirm with my advisor?

Thanks for your help with this!!!

Ad says

Hi Harry – I went thru my return and something just doesnt add up. I feel like I should have some sort of gain here. See below for my information:

Contributed $3,900 during 2014 (1/1-12/31/14)

No catch up contribution made after 12/31/14

In 2014, Converted the $3,700 catch up contribution made in April 2014 for 2013.

The carryover basis is $3,700 pursuant to py 8606

1. 3900

2. 3700

3. 7600

4. 0

5. 7600

8. 3995

9. 3995

10. 1.0

11. 3995

12. 0

13. 3995

14. 3605

15. 0

16. 3995

17. 3995

18. 0

Harry Sit says

Ad – You are missing a line 6, the total value of all your traditional, SEP, and SIMPLE IRAs at the end of the year. The subsequent lines will change once you have a number for line 6. Get it from your account statement(s).

Ed says

Great article, the *in* and *for* differentiation is not made clear by the IRS!

I can’t seem to understand why line 8 would be different between the easy and hard way. Either way, aren’t you converting $5,500 to a Roth from a traditional?

Thanks, Ed

Harry Sit says

Ed – The tax forms here were generated by TaxACT software. I let the software do its job. There’s an asterisk on line 13 about a worksheet. I read somewhere the worksheet replaces lines 6-12.

Ed says

Ah, ok I see that now. I do not have a worksheet when filling out manually, do you agree the amount on line 8 would be 5,500 without the worksheet?

Harry Sit says

Ed – It would the actual converted amount from the 1099-R. In my example it would be $5,550, including $50 investment gains.

chy says

Thanks for reply Harry.

Since I have now recharacterized, do I just go ahead and file my taxes like the conversion never happened i.e ignoring completely the Form 1099-R I received and only completing part 1 of Form 8606?

thanks for response

Harry Sit says

chy – If you are using software, you should just answer the questions. Enter the 1099-R, say it was converted, then say the conversion was recharacterized. The software will tell you what to do. If you are doing it by hand, see Form 8606 instructions under “reporting recharacterization.”

Steve says

Awesome article! I know you say to do the contribution and conversion all in the same tax year to keep things simple, but I’m afraid I discovered this too late. Should I wait until next year, or should I create a non-deductable IRA for my wife and myself (11,000) for 2014 now that it is too late to do the conversion *in* 2014? I am a little confused if it is still possible to make a contribution *in* 2015 *for* 2014 and then get back on track and make a contribution *in* 2015 *for* 2015 and do BOTH conversions in 2015? In other words, should I just begin this whole process before Dec. 31st 2015 *for* 2015, and do it as you recommend thereafter, or is it still possible to salvage 2014 without making things ridiculously complicated in perpetuity?

Thanks!

Steve

Harry Sit says

Steve – The paragraph at the end starting with “If you must get caught up for one year” addresses your question.

Bob says

Hi Harry: I’m getting some difficulty in performing step 1 of the procedure. The custodian of the target 403b plan hasn’t heard of the special rule (in the new 1/2015 PUB 590-A at the bottom of page 22) and is leery of the possibility of getting a transfer of after-tax funds, which would be the case under the usual pro-rata rule. Therefore, do you know the Treasury Regulation or Tax Code section that lies behind the statement in PUB 590-A? Or any other IRS ruling or revenue procedure. Thanks.

Harry Sit says

Bob – Your question is not directly related to this article. I emailed you the info you were looking for.

Amy says

Hi Harry,

I did my 5.5K contribution for 2013 in 2014 and also conversion in traditional to Roth in 2014. I believe I entered in my 2013 1040 form correctly as line 14=5500 and line 15=0. For the “Let’s Find Your IRA basis-Total Basis as of December 31, 2013” in Turbotax, should I be getting using the 2013 tax form 8606 number ($5500) even though I didn’t make contribution for 2013 till 2014?

Harry Sit says

Yes, as the instruction text says “Look at your most recent Form 8606. Find the box …”

Sharon says

I am really struggling and would appreciate some guidance. I made two $6,500 nondeductible contributions in February of 2014: one for 2013 and one for 2014. The next day both were converted to my Roth IRA. $5,000 was included on my 2013 return as both a contribution and conversion. I have a 2014 1099R that reports a $13,000 distribution. I’m using turbo tax and read your article “How to report back door roth in turbo tax” I can’t seem to get there – it is showing I should be taxed and if I change the contribution to $13k, it shows I’m over the amount I can contribute. Can you please help me. Also, should I somehow be fixing my 2013 return – both the contribution amount to $6,500 and the conversion amount to zero?

Harry Sit says

I hope by now you learned not to confuse yourself again. You will have to fix it starting from 2012 (maybe earlier too).

2012: $5,000 contribution done in 2013; $5,000 basis carried to 2013.

2013: $6,500 contribution done in 2014; $5,000 basis carried over from 2012; $5,000 conversion; $6,500 basis carried over to 2014. This is like the first example in this article.

2014: $6,500 contribution; $6,500 basis carried over from 2013; $13,000 conversion.

Jason York says

Hi Harry,

Excellent breakdown, Harry. I over-contributed to a Roth in the amount of $700 – contributed $2000 in 2014, but was only eligible to contribute $1300.

1) Reclassify the $700 to a non-deductible Traditional IRA (before April 15, 2015)

2) Contribute $3500 to make up the difference between the IRA contribution limit (before April 15, 2015)

I already filed my 2014 return. According to the 8606 instructions, if the recharacterization occurs in 2015, I only need to report the $700 in an attached statement, and not on the 2014/2015 tax return.

Assuming I contribute another $5500 for 2015 to the non-deductible Traditional IRA and convert before Jan 1 2016:

What amount do I file on the 2014 8606?

What amount do I file on the 2015 8606 next year?

Does it matter when I convert back to the Roth in this case?

Thanks!

Harry Sit says

You report non-deductible traditional IRA contribution *for* that year. So do the math: $4,200 and $5,500 respectively. It doesn’t matter when you convert, but it’s better done before the end of 2015 to clear everything out so you don’t have to carry over things to the next year.

Jason York says

Thanks, Harry. Got it, so it would look like so:

2014 Form 8606 (no Roth conversion in 2014)

1. 4200

2. 0

3. 4200

14. 4200

2015 Form 8606 (contribute $5500 in 2015, convert $9700 from T-IRA to R-IRA before Dec 31 2015, assuming no gains)

1. 5500

2. 4200

3. 9700

4. 0

5. 9700

13. 9700

14. 0

15. 0

16. 9700

17. 9700

Harry Sit says

You got it!

Jason York says

Cool. Thanks, Harry.

Do I need to be factoring any gains/losses when it comes to the recharacterization for Form 8606?

Meaning, the amount requested to recharacterize is $700, but the amount *actually* transferred from the R-IRA to the T-IRA could be more/less depending on gains/losses.

FROM INSTRUCTIONS:

Reporting recharacterizations. Treat any recharacterized IRA contribution, Roth IRA conversion, or Roth IRA rollover from a qualified retirement plan as though the amount of the contribution, conversion, or rollover was originally contributed to the second IRA, not the first IRA. For the recharacterization, you must transfer the amount of the original contribution, conversion, or rollover plus any related earnings or less any related loss. In most cases, your IRA trustee or custodian figures the amount of the related earnings you must transfer. If you need to figure the related earnings, see How Do You Recharacterize a Contribution? in chapter 1 of Pub. 590-A. Treat any earnings or loss that occurred in the first IRA as having occurred in the second IRA.

You made a contribution to a Roth IRA and later recharacterized part or all of it in a trustee-to-trustee transfer to a traditional IRA. Report the nondeductible traditional IRA portion of the recharacterized contribution, if any, on Form 8606, Part I. Do not report the Roth IRA contribution (whether or not you recharacterized all or part of it) on Form 8606. Attach a statement to your return explaining the recharacterization.

Harry Sit says

As the instructions say, your IRA custodian will calculate how much earnings need to go together with the recharacterized $700 from the Roth IRA to the traditional IRA. You include the total in an attached statement.

Jason York says

Understood to include the total in an attached statement, but what goes on Line 1 of the 8606 in this case? *Just* the $700?

I suppose my question is, from a contribution perspective for the 8606 on Line 1, is it merely the recharacterization portion of the transfer, or the entire transfer amount?

Harry Sit says

Just $700, as part of $4,200 as we resolved earlier.

Jeff says

Harry:

Great page. I’ve been doing backdoor conversions in the same year for a few years now. I don’t think my CPA has yet figured out the right way to file the 8606.

In 2013, I started with $0 balance in the traditional IRA, contributed $5500 non-deductible to the traditional IRA, and rolled/converted the $5500 a few days later into the Roth.

In 2014, again, I started with $0 balance in the traditional IRA, contributed $5500 non-deductible to the traditional IRA, and rolled/converted the $5500 into the Roth a few days later.

At the end of 2014, I had a $0 balance in my traditional IRA.

No one on this thread discussed Part II of form 8606, but based on the instructions, it appears that I need to complete it.

Is this the correct way to complete the 8606?

PART I:

1) 5500

2) 0

3) 5500

4) 0

5) 5500

6) 0

7) 0

8) 5500

9) 5500

10) 1.00

11) 5500

12) 0

13) 5500

14) 0

15) 0

PART II:

16) 5500

17) 5500

18) 0

Harry Sit says

You can see Part II on page 2 if you click on the image. I will add it to the article to save people a click.

Jeff says

Harry:

Thanks so much!

So, based on my scenario, am I filling the form out correctly?

If so, then in your above second example of a completed form, why are lines 8, 9, 10 and 11 blank?

Since the funds are converted, it appears that these lines should be completed. Is that correct?

Jeff

Harry Sit says

See reply to comment #39.

Robert says

Thanks for the great info, Harry. I’ve read that by doing a backdoor Roth and filing Form 8606 you won’t be able to file your taxes electronically, and that you must mail a paper copy. Can you confirm / deny this? Thanks!

Harry Sit says

I don’t e-file anyway so I don’t think it’s a big deal one way or the other. I also don’t think filing the 8606 form causes it. You may be required to attach a statement for your Roth conversion. Some tax software such as TurboTax can do the statement electronically. Some other tax software stop you from e-filing whenever you are required to attach a statement. The solution is to buy software that can e-file with a statement if you want to e-file.

willinsj says

Hi Harry,

The comment link on the original backdoor Roth article is down so I hope you find my question here. I have been doing the backdoor conversions since I first read your article and this year will be my fourth conversion – thanks!

My question (and please forgive me if I missed the answer in the comments sections – I did give them a read through) is that I am going to change jobs at the end of this year. I am going to do my Roth conversion using your steps (deposit after tax into traditional IRA and convert to Roth) for this tax year. Next year I would like to take the money I have in my 401K, roll it over to a traditional IRA, and convert those funds into a Roth (I understand that I will pay taxes on those funds). With the rollover and subsequent conversion of the 401K in mind, can I still put the ‘backdoor’ $5500 into my traditional IRA and covert those funds to a Roth in that same tax year? Step 1 of the article seems to suggest that I can do that – just want to be sure.

Thanks for your assistance and your article!

Harry Sit says

If you don’t mind paying taxes on converting the 401k to Roth, you can roll over the 401k directly to a Roth IRA. Either way it won’t affect backdoor Roth. Doing it directly just makes it easier than the two-step, with no interim stop in a traditional IRA.

johnv says

Hi Harry

thanks for great info. Two quick questions:

1) Given it is end of November now, wondering is it still safe time window to execute this strategy for this current 2015 year? i.e., open account this week and convert in December before 12/31 to follow your guidance of contribute *for* and convert *in* the same year?

2) Can this be done for both self and for my non-working dependent spouse if we are married filing jointly?

Thanks in advance.

Harry Sit says

johnv – 1) It’s your call on how much buffer you put between contribution and conversion. 2) It can be done for both self and spouse if each follows all the steps in the complete how-to article linked at the beginning.

Doug says

Good morning Harry,

Great article!

Quick question

Have made T2015 contributions with immediate conversion to R2015 IRA for both my wife and myself in 2015. Please confirm when filing jointly that can just file on 1 form 8606 and double the values as we both have contributed the 6500 max for over 55 age contributions. Just want to confirm the do not have to file separate 8606 forms. Thanks

Harry Sit says

You need separate 8606 forms, one for each person.