How to do the backdoor Roth and how to report it on the tax return are popular topics on this blog. Many people are doing the backdoor Roth pre-planned. They know their income is too high for contributing directly to their Roth IRA. So they do it indirectly through the backdoor. By following the complete how-to, they are able to make it tax-free and really easy to report on their tax return, whether they use TurboTax, H&R Block, or FreeTaxUSA.

Unplanned Backdoor Roth

Many others find themselves doing it unplanned. They contributed to their Roth IRA but they found out their income was too high only when they did their taxes. The tax software or their tax preparer told them they weren’t eligible to contribute to their Roth IRA for the previous year.

Then they learned that they could recharacterize their Roth IRA contribution as a Traditional IRA contribution — or if they haven’t yet contributed, just contribute to the Traditional IRA for the previous year — and then convert it to Roth. So they did. This made it an unplanned backdoor Roth.

As with many things in life, it’s much better to be proactive and do it planned as opposed to being reactive and doing it unplanned. There are some pitfalls in doing the backdoor Roth unplanned.

Pro Rata Rule

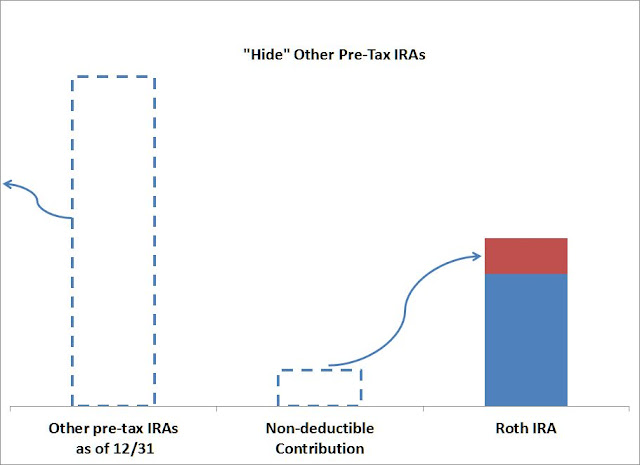

First, there is that pro-rata rule. If you have other traditional, SEP, or SIMPLE IRAs, sometimes coming from a rollover from a previous 401k or 403b, the unplanned backdoor Roth will make you pay taxes at today’s high tax rate as if you converted some pre-tax money unless you “hide” those pre-tax IRAs.

The customer service rep at your IRA provider doesn’t know whether you have other IRAs. You could contribute or recharacterize to traditional and then convert, but it doesn’t necessarily mean you will owe zero taxes from doing so. That’s a big reason for not taking tax advice from customer service reps.

Tax Return Confusion

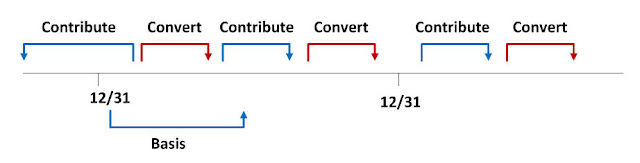

Then there is confusion from contributing *for* one year and converting *during* a different year.

When you are proactive, you can contribute for the current year and convert within the same year. It will make it clean and easy to report on your tax return.

When you are reactive, by the time you realize your income is too high, it’s already after December 31. You end up converting during the following year. Even when the conversion is tax-free because you don’t have other IRAs, you still have to deal with splitting the tax reporting in two different years. All the questions and confusion on how to report backdoor Roth come from this camp.

What should you do if you did an unplanned backdoor Roth?

Hide Pre-Tax IRAs

It would’ve been better to “hide” your other IRAs before you converted, but since you already converted, now it’s time to catch up on moving those pre-tax IRAs out of the way. If you leave the pre-tax IRAs alone to the end of the year in which you converted, you will trigger the pro-rata rule. So don’t wait.

Roll over your other pre-tax Traditional, SEP, and SIMPLE IRAs to a workplace retirement plan. Most employer plans accept incoming rollovers from pre-tax IRAs.

Split Tax Reporting

When you contribute *for* one year and convert *during* a different year, you will have to split the tax reporting into two different years. You report the contribution on the tax return for the first year. You report the basis carried over from the first year and your conversion on the tax return for the second year. You will have to remember. The confusion is your penalty for doing it unplanned.

Catch Up

You were already caught by an unplanned backdoor Roth in one year. Don’t let it happen again. If there is any chance that your income may be too high again this year, resolve that you will be proactive and do a planned backdoor Roth from this year forward. When in doubt, do the planned backdoor. Don’t wait until next year.

After you contribute or recharacterize your contribution to the Traditional IRA for the prior year, also contribute to the Traditional IRA for the current year. Convert twice or simply convert both together. This way you break out of the cycle of doing it after the fact. It will be smooth next year.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Steve says

What if you accidentally contributed to a Roth for 2016 already, and you know that you’re income will be too much, and you want to change it to a backdoor-roth.

Can you simply recharacterize it into a traditional IRA, and then roll it back over into the Roth?

It’s all in cash, and there are no other traditional IRA funds. So I believe taxes shouldn’t be complicated by this….?

Thanks!

Harry Sit says

You recharacterize the contribution as a contribution to the traditional IRA and then convert the money into Roth.

Flying says

In the second year you report the basis carried over from the first year and your conversion.

Could you provide more details on how to report the basis etc?

George James says

Hi Harry,

My wife and I made contributions to Roth IRA (2x$5,500=$11,000) in 2014 for the year of 2014, and we made another 2x$5,500=$11,000 Roth IRA contribution at the beginning of 2015 for the year of 2015. But then, right before we filed our 2014 tax return, we found that our AGI for 2014 was high, so we re-characterized all these Roth contributions (about $22,000) to Traditional IRA, and then converted them to Roth IRA.

All these happened in 2015, and my question is: Do I need to amend my 2014 tax return? Thanks a lot.

George

Harry Sit says

If you didn’t file 8606 forms with your 2014 tax return, find the old form on IRS website and file them by themselves now. One copy for each person, just fill out the first few lines, which then flows to line 14.

George James says

For 2014, I did file two 8606 forms (one for me and one for my wife) and reported a traditional IRA contribution of $5,500 for each person, though the re-characterization happened in 2015 (before April 15). So we do not need to amend our 2014 return?

Problem is, this year we received all 1099-R forms related to these transactions, including the re-characterization of our 2014 Roth contributions. Shouldn’t we report all of them?

Thank you so much!

Harry Sit says

2014 is fine. Move on to 2015. If you use software, it will prompt you to include a statement explaining what you did. If you are doing it by hand, read the instructions for what you need to include in your statement.

George James says

Thank you so much!

Noel W says

Hello Harry,

My wife and I contributed the max to our ROTH accounts in 2015. An unforeseen circumstance in 2015 pushed our combined AGI over the limit for ROTH contributions. We realized this during tax prep in 2016.

My finance person sent a bunch of paperwork in March 2016, and in short we did the following transactions:

1 – recharacterized the ROTH to Traditional IRAs

then

2 – converted the Traditional back to ROTH using the backdoor

My financial institution says that we will receive our 1099-R’s in late 2016. Do we report anything on the 2015 taxes in Turbotax, or do we wait for the 1099-R’s and report the moves made for 2014/2015 on the 2016 taxes?

Thank You!

Noel

Harry Sit says

Assuming the contributions were for 2015, you report the contributions, separately for each person, first as Roth, then say you changed your mind, exactly as you did in reality.

Noel W says

Thank you. I originally input the ROTH information and Turbotax got angry at me… I will retry and attempt to express the changes.

Thank you.

Victor says

Harry, great article, as usual. I did exactly that for 2016 and I am all set come April of 2017 (contributed to IRA and converted to Roth IRA in Jan-Feb 2016).

I just filed my tax return for 2015. Unfortunately, my Custodian (ML) sent me my 2015 1099-R with $11,000 – I contributed $5,500 for 2014 in February of 2015 and then converted in May (after the deadline). I contributed another $5,500 for 2015 in May of 2015 and converted in December of 2015.

Assuming I did everything right for prior years – what are my consequences for reporting only $5,500 for 2015 as a basis? I don’t think it’s an audit issue, but rather a mismatch b/n my return and what ML sends to IRS? ML did put a distribution code “2” in box 7.

Do you think I should correct anything or am I ok?

Harry Sit says

What do you mean by “reporting only $5,500 for 2015 as a basis”? You are carrying forward $5,500 basis from 2014. When you add the $5,500 you contributed for 2015 to that, your $11,000 distribution on the 1099-R is fully covered. After the conversion, your basis for 2015 becomes zero.

mitch says

While recharacterization is perfect for traditional IRA accounts, is there any recourse for a 401k to a 401k roth recharacterization? My taxes for 2015 are now too high and I need some means for reducing last years income. Any help is greatly appreciated. Thank you.

Harry Sit says

No. There is no recharacterization for in-plan Roth rollover, i.e. if you moved money from traditional 401k to Roth 401k within the same plan.

mitch says

Thank you for your reply.

Matt says

Harry,

I found your articles are very useful. But my situation is a little different.

I have two non-deductible contributions T-IRA account (two different brokerage).

The first T-IRA account was opened in 1996, I contributed $2000 in 1996, and $2000 in 1997. Now the account has values up to $25,000 (gained).

The other T-IRA account was opened in 2012. The total contribution from year 2012 to 2015 are $24,000, the account has values up to $22,000 (lost)

My question is:

1) I want to use backdoor ROTH IRA. Can I convert 2015 T-IRA to ROTH IRA? If yes, how to?

2) If I want to use backdoor Roth IRA for 2016, can I just follow your steps ? Can I skip to step 2 or I have to “hide” my TWO non-deductible T-IRA ?

3) Can I only convert my 2nd T-IRA(lost) to Roth IRA and leave the first T-IRA unchanged to avoid tax on the big earning?

Thank you

Harry Sit says

All your traditional, SEP, and SIMPLE IRAs are treated as one giant IRA. If all the contributions you mentioned were non-deductible, you contributed $28,000 and the total value is now $47,000. If you want to pay minimal taxes when you convert to Roth, you will have to “hide” $19,000 worth of money not-yet-taxed. It’s OK to contribute before you “hide” but it’s better to “hide” before you convert.

Matt says

Harry, Thank you for your reply.

From your article, the first step “hide” is for pre-tax contribution. Since my contribution are all non-deductible, how to “hide” these $19,000 money not-yet-taxed? Do I need rollback or convert to other account?

Your help is greatly appreciated.

Harry Sit says

It’s not for pre-tax contribution, but for pre-tax money, including earnings not yet taxed. Just follow the same steps.

Victor says

Harry, did you have any feedback on my question above (#5)? Thank you very much

Personal Finance News says

Great article Harry!

Two years ago I contributed into Roth IRAs for me and my wife, but later I found that my income was over the limit. So I did go through all the steps you just described in “unplanned backdoor roth.”

Last year I wait until the end of the year to see if I need to do a regular or backdoor Roth IRAs. since my income criss-crosses around the limit. Again my income was over the limit so I did the planned backdoor Roth IRAs for me and my wife.

This year I’m not sure if my income will be over the limit since I got the pay cut due to industry downturn. Instead of waiting until the end of the year to confirm, should I go ahead and do the planned backdoor Roth IRAs now? I don’t see any downsize to do backdoor Roth even if income is well under the limit, except more involvement and time.

Harry Sit says

No downside. Just remember to maintain a Roth IRA contributions and withdrawals spreadsheet, which applies to both direct contributions and backdoor.

BILL says

Harry, Great articles, unfortunately I am a bit of a novice and I have a couple of questions to make sure I’m getting this correct.

I have had a Roth for about 8 years, in 2014 I over-contributed to my Roth based on my AGI but was still able to partially contribute. In March, 2015 $515.86 was converted to a traditional IRA then $517.48 was recharacterized back into my Roth, I received a 1099-R for both transactions… do they both get reported on my 2015 return? Also, the traditional IRA had a balance of $0 before and after this process… therefore is my basis $515.86?

Thanks so much… trying to correctly report this in turbo tax online.

Harry Sit says

You got ‘convert’ and ‘recharacterize’ backwards. The $515.86 recharacterized should’ve been reported on 2014 return as a non-deductible contribution, which becomes a basis carried over to 2015. You still enter the 1099-R into TurboTax. It will see the code and tell you what to do.

BILL says

So if I recharacterized $515.86 into a traditional IRA from my roth (and that was all the money that was in the traditional IRA (had a prior balance of 0) and this occurred in 2015, and then a day later I converted $517.48 back into the Roth, is my basis 0 or is it $515.86? Is the $515.86 considered a non-deductible contribution since it was after-tax money that went into my Roth in 2014?

Harry Sit says

Your basis is the amount you originally contributed to your Roth IRA in 2014 before you recharacterized in 2015. If $100 turned into $515.86 by the time you recharacterized, your basis is $100. If $500 turned into $515.86, your basis is $500.

Rij says

I am thinking of a back door Roth Conversion and have a quick question. I plan to move my traditional IRA (funded by deductible contributions) into my 401K (the plan accepts this). avoid the IRA aggregation rule. How long does the “rolled over traditional IRA” need to stay in the 401K to avoid the IRA aggregation rule?

Harry Sit says

Forever, until a year you don’t do conversions any more.

Drew says

Hello, hope you can advise. This year going through my taxes I noticed that I over contributed $5500 to my Roth IRA in tax year 2014. Basically I contributed and got married in 2014, but my wife an I filed as married but filing separate, and I did not know that I’m allow to contribute to a Roth IRA if I file married and file separate and have income over 10K. In 2015 I contributed another $5500, again unaware during the year, however now that I noticed it I called my IRA custodian, and asked them to do the backdoor roth for the 2015 contribution, and return my 2014 contribution as the time for anything has expired. What do I have to do with my taxes? Do I have to amend my 2014 taxes stating that I over contributed? Do I need to amend or just file a 2014 5329 by itself? Also what do I do for my 2015 taxes, do I file them without any penalties and then amend it after fixing the 2014 return. Really confused how to fix all this.

Or is it easier, If I don’t do anything, since I have removed all excess contributions should I just wait for a tax bill and the 6% penalty? Thanks,

Harry Sit says

If I were in this situation I would amend my 2014 with a 5329 and attach another 5329 to my 2015 return.

JimB says

Harry Sit – First, thanks for your education and time on this forum, it’s been a Godsend.

I would think our situation would be the most common but I could not find it in reviewing all your posts. My wife and I didn’t contribute during the actual tax year due to late December distributions that might put us over the income limit for Roth contributions (which they did). If you have covered this already, please point me in the right direction.

In March 2015 my wife and I both contributed a non-deductible $6,500 for tax year 2014 to our empty traditional IRAs and then did a “distribution conversion” to our Roth IRAs. The only reporting on our 2014 tax return was on Form 8606 lines 1, 3 and 14 – one form for each of us.

We also did the same thing earlier this month (March 2016) for tax year 2015.

The only other IRA transaction is a small RMD I have to take from an inherited non-spousal IRA which I have been doing for years.

We now, as of 29 January 2016, each have the 2015 Form 1099-R for conversion out of our traditional IRAs and the 2015 Form 5498 for contributing to our Roth IRAs.

Our questions are (using H&R Block Deluxe for our 2014 and 2015 returns):

1. Do we have to amend our 2014 tax return and, if so, how?

2. How do we report on our 2015 tax return, given we have done this for tax years 2014 and 2015?

Harry Sit says

If you read this article, the takeaway should be stop doing it that way. Catch up and make it planned for 2016. Your 2014 is fine. For 2015, follow the same guide in How To Report Backdoor Roth In H&R Block Software. Enter $6,500 in “Your Total Basis In Traditional IRAs”, which is the number on line 14 of your previous year’s 8606 form.

Jeff says

Trouble with entering my situation in turbo tax. I was attempting backdoor Roth, but accidentally directly invested in my existing Roth for $5500 on 2/2/15. I realized mistake and called vanguard to do recharterization on 2/5/16 to traditional IRA for $5500 plus $71 gain. On 2/6/15, the conversion to the Roth IRA was processed for $5508. With turbo tax I am having trouble how to enter? My form 8606 does not seem right? Should it only reflect the $5500 as if the recharacterization never happened? Do I have to record the gain somewhere or the extra $8 in the conversion? Appreciate your forum.

Harry Sit says

Assuming your 2/5/16 meant 2/5/15, just enter the events as you described. Assuming the original contribution was for 2015, start the contribution as Roth. When it asks you if you recharacterized, say yes. In the 1099-R section, enter the 1099-R for $5,571 recharacterization. Then enter the 1099-R for $5,508 conversion. The 8606 should show $8 taxable.

Penguin says

Hi Harry,

I was in a similar situation as bill and tried to fill out the steps you had described.

In early 2015 when I was filing my 2014 taxes, I realized a work bonus made me eligible only for a partial roth ira (did a regular roth ira for the full 5500 in 2014. I ended up re characterizing what amounted to be 1040 of roth ira to a traditional ira and converting it back to roth via the backdoor method and sent in a statement of explanation (I also did a full backdoor roth for my 2015 ira).

This year while filing my 2015 taxes I received my 1099-r. It has two rows under “contributory ira” one row is for the 5500 backdoor roth i did for the 2015 tax year and the other is for the 1040 that i re-characterized both with distribution code 02 for tax year 2014 (the roth conversion was done in 2015 for this amount).

It also had a third row under “Roth IRA” with the amount I had re-characterized from the roth of 1000 with distribution code r.

However my taxes owed then went up a few hundred dollars after entering the 1040 and 1000 amounts. This didn’t make much sense to me as the taxable amount after the re-characterization was only 40 dollars (basis was 1000 at the time of recharacterization the value went to 1040). Not sure what I am doing incorrectly?

Harry Sit says

You did it correctly. You just haven’t reached the IRA contribution part yet. After you enter your $5,500 contribution plus $1,000 carryover, the tax will come back down. Ignore the interim tax meter. It isn’t final until you go through all the parts.

Penguin says

Thanks for your help 🙂

Sheri T says

Hi Harry,

I have been doing Backdoor Roths since 2015, two years at a time, and always have the Vanguard reps do the transactions. In 2019 for my 2018 & 2019 conversions, they messed it up an did Buys as a direct contribution to a Roth, for which I was not qualified. In Aug 2020, this came to light and since after deadline I had to take a distribution of 2018 for 6500 but they recharacterized the 7000 plus growth (8,492.24) into my traditional ira. It remains there in a low earning fed money market. I haven’t filed my 2020 yet, and would like to convert the Traditional IRA into a Backdoor Roth but not 100% sure I can and how. My CPA thinks I need to take the distribution and has that filled out on the 2020 1040 line 4a. The 1099R for 2020 shows one 6500 distribution and one 8492.24 Recharacterized. The CPA filed a 8606 in 2019 showing contribution of 7,000(my catchup amt). Can I convert now before filing 2020 and would the 8606 need to show a conversion of the full amount 8,492.24? Hope you can help me. Thank you.

Harry Sit says

You can still convert. It’ll be 2021 conversion. You’ll get a 1099-R in January for the actual amount you’re converting now (not the $8,492.24 from your recharacterization). You’ll report it on your 2021 tax return.

Sheri Tomlinson says

Ok, thanks for getting back. I am not clear on the amount to convert if it is not the rechar amt. Can you clarify please?

Harry Sit says

You can choose to convert however little or up to 100% of the value in your traditional, SEP, and SIMPLE IRAs. Your $7,000 basis will be used up by the proportion of your conversion relative to the total value in those IRAs (the “pro rata rule”).

Kelly says

Hi Harry,

I contributed $500 to my Roth IRA for 2022 and afterwards found out that I would receive some unexpected income. I will be in one of the phase out ranges for contributions. My questions are 1. should I, can I, do a backdoor Roth for the remaining $5,500? or 2. contribute the max directly to the Roth IRA based on the phase out limit and then contribute the remaining balance with a backdoor Roth?

Harry Sit says

If your expected income will allow $500 in direct Roth contribution, you can leave the $500 alone and do the rest as backdoor. There’s no lower or upper income limit for doing a planned backdoor Roth. You can still do planned backdoor even if your income ends up below the phaseout range. When in doubt, do the planned backdoor.

Kelly says

Thank you!

Jason says

I asked this question to my CPA and he wasn’t sure of the answer: Roth IRA conversions don’t count towards your MAGI for determining whether or not you can contribute to a Roth IRA (see Pub 590-A, Worksheet 2-1.) How about for In-Plan Roth conversions? Worksheet 2-1, line 2 says:

Enter any income resulting from the conversion of an IRA (other than a

Roth IRA) to a Roth IRA (included on Form 1040, 1040-SR, or 1040-NR,

line 4b) and a rollover from a qualified retirement plan to a Roth IRA

(included on Form 1040, 1040-SR, or 1040-NR, line 5b)

Would an IPRC fall into the rollover “from a qualified retirement plan”, or would that only be if I rolled the 401k into an IRA (instead of keeping it in the 401k)? The spirit of the worksheet seems to suggest that wouldn’t count, but it’s a gray area.

Harry Sit says

An In-Plan Roth Rollover counts toward the MAGI for Roth IRA contributions. It falls into the “from a qualified retirement plan” part but it doesn’t fall into the “to a Roth IRA” part of the instructions you quoted.

Jason says

One other question – the pro rata rule applies to Mega Backdoor Roth IRA Rollovers, but not to In-Plan Roth 401(k) conversions, correct? And this is because in 401(k) plans the various sources (after-tax, pre-tax, etc.) are accounted for separately, instead of commingled in IRAs? In other words:

After-Tax 401(k) to Roth IRA: Pro-rata conversion rule applies

After-Tax 401(k) to Roth 401(k): Pro-rata conversion rule doesn’t apply

Harry Sit says

The rules are the same whether the money stays in the plan or goes directly to a Roth IRA. Don’t make an interim stop at a Traditional IRA.

Mitko says

Hi Harry,

I am in a bit of a situation. After reading your post above, I think all hope is lost.

I contributed a total of $12k to an existing traditional IRA for 2020 and 2021. I did the same for my wife, so another $12k over these two years. We both had these traditional IRA accounts for several years so there was already pre-tax money there. Our income for 2020 and 2021 grew, so the $24k we contributed became non-tax deductible (essentially post-tax). I was not aware that I had to “hide” the pre-tax fund in the traditional IRA accounts, so all post-tax money is still there.

To make things worse, the 2020 contributions were done in early 2021. The 2021 contributions were done in early 2022.

In 2020 I was not aware that after a certain income, IRA contributions become non-deductable, and when I was filing the 2021 tax returns, I learned about the backdoor Roth conversion, so I decided to convert the $24k to Roth since this was post-tax money.

In 2022, I moved the money from the traditional IRA to the Roth IRA accounts and my wife and I received two 1099-R forms, each for $12k. Now when I do the 2022 tax returns, TurboTax is taxing most, but not all of that $24k. I assume this is because of the pro-rata rule. Is there a way to work around this?

The other odd thing is that our 2021 Forms 8606 show:

Box 1: $6k

Box 2: $6k

Box 3: $12k

Box 14: 12k

There are no other numbers in any other boxes. I am not sure if there is an issue with how the non-deductible contributions were recorded in 2020 and 2021.

What a mess!

Mitko says

To add to the above, I don’t plan to make any IRA contributions for 2022, unless I figure this out. I just want to sort this out, and maybe I will do planned conversions moving forward. What’s the best course of action?

Harry Sit says

The 2021 Form 8606 is correct (you should have a separate copy for each of you). Each of you contributed $12k over two years but didn’t convert by the end of 2021. Therefore $12k is carried forward as basis on Line 14. Taxing most but not all of the $24k conversion in 2022 is also correct. That’s due to the pro-rata rule because you had pre-tax money in the Traditional IRA as of 12/31/2022.

Not all is lost though. The unused post-tax money remains in your Traditional IRA. You still see it as basis on 2022 Form 8606 Line 14. Now in 2023, you can transfer the pre-tax money in your Traditional IRA to a workplace retirement plan and only leave that basis (maybe plus a little bit more) in the Traditional IRA. When you do a planned conversion in 2023, you can convert that remaining amount together with your 2023 contribution. You’ll have an empty Traditional IRA after that, which lets you get on a straightforward planned conversion in 2024 and beyond.

Mitko says

Thanks for confirming that the 8606 is correct. Yes, we have two 8606 forms for 2020 and two forms for 2021. As you said, one form is for me and one for my wife.

I actually moved the $24k from the traditional IRAs to the Roth IRAs, which is why I have the two 1099-R forms for 2022. The amounts from the 1099-R are mostly taxable, so I guess I must pay tax on most of the $24k now because of the pro-rata rule. My understanding is that there is no way around that now, right?

Reading the article, I thought I had to move the pre-tax money that is in the Traditional IRA to my 401(k) before Dec 31, 2022, which I have not done. Are you saying I have until December 2023 to move the pre-tax money? I feel this will only help me clear things up moving forward, but not fix the 2022 taxes I have to pay now due to the pro-rata rule.

Following up on your statement “The unused post-tax money remains in your Traditional IRA…”, which part do you consider “unused post-tax money”?

I have not submitted the 2022 taxes yet, but as of now my Form 8606 now shows:

box 2: $12k

box 3: $12k

box 5: $12k

box 13: $5000 (this is just an example)

box 14: $7000 (this is just an example)

To make sure I understand correctly, I could move the pre-tax money to my 401k, and leave a little over $7k in the traditional IRA (based on box 14)?

Then, say I max out the IRA in 2023 with $6,500. I have to deposit that in 2023 for the tax year 2023 (this way it will be planned), and soon after that I have to transfer the $6,500+$7k from box 14 to Roth, leaving me with a zero balance in the traditional IRA?

I guess, if anyone wants to take advantage of the backdoor Roth IRA conversion mechanism, they should not have any IRA account with pre-tax money under their name, other, otherwise they will end up paying taxes every time they try to convert to Roth.

Thank you again for the responses. Your articles are very helpful!

Harry Sit says

That’s correct – you can’t do anything about the conversion in 2022 now because you didn’t “hide” the pre-tax money before 12/31/2022. Using your numbers for one person, the $12k conversion in 2022 is $7,000 taxable and $5,000 non-taxable due to the pro-rata rule.

Because you had put $12,000 post-money in the Traditional IRA and the conversion only used $5,000 of it (the non-taxable part), you still have $7,000 post-tax money left in the Traditional IRA. When you “hide” the pre-tax money, you leave that $7,000 post-tax money behind in the Traditional IRA. When you add another $6,500 post-tax money for 2023 and convert $6,500 + $7,000 in 2023, the $13,500 conversion isn’t taxable because you’re converting post-tax money.

Looking across all these years, you contributed $18,500 ($12k + $6,500) total post-tax money and you converted $25,500 ($12k + $13,500) total. $7,000 is taxable and $18,500 is non-taxable. You still got 100% of your post-money into Roth untaxed. The only difference between this outcome and the ideal clean planned conversions is that you converted an extra $7,000 pre-tax money to Roth because you didn’t know about the pro-rata rule. That $7,000 is pre-tax money and it’s fair to pay tax on converting it. That isn’t too bad.

Mitko says

Thank you for the explanation. This makes sense now. Here is an example: If I have $50k in the Traditional IRA and $7k of that is post-tax, that means I have to “hide” $43k pre-tax money by rolling it over to my 401k. How does the IRS know that the $43k that I roll over is all pre-tax money? Could there be another pro-rata rule that might kick in because of this roll over?

I find it very limiting that people need to give up having a traditional IRA to do a proper backdoor Roth conversion. If I am to quit my 9-5 job in the future, I may need to roll over the funds from the 401k into a Traditional IRA which would make diminish the benefits of doing this type of conversion (assuming income remains the same).

Thank you again!

Harry Sit says

The law only allows rolling over pre-tax money from an IRA to a 401k plan. If you mistakenly roll over post-tax money to a 401k plan, you’ll have to pay tax again when you withdraw from the 401k. 100% of the money you roll over to a 401k is assumed to be pre-tax. The pro-rata rule doesn’t apply.

The backdoor Roth is an untended consequence of laws passed at different times for different purposes. Being limiting is just the nature of this untended consequence. We should be surprised that it has been allowed to exist for this many years. It almost died last year.

Joe says

Harry,

What is the disadvantage of building up a post-tax basis in a Traditional IRA before doing a backdoor Roth vs. doing a rollover of that basis every year? Is it less work to do a rollover every year than to do one large rollover and one large backdoor Roth conversion every 5-10 years after building up a post-tax basis and pre-tax earnings on that basis?

My understanding is that if you have some accumulated post-tax basis in a Traditional IRA from previous year(s)’ non-deductible contributions (which should be recorded on the last Form 8606), there should be no tax event from a Roth conversion of that basis during the year as long as you roll over the rest of the Traditional IRA funds not including that non-basis portion into a 401(k)/403(b) plan first before you convert the remaining basis into a Roth IRA. In other words, if you make a non-deductible contribution for 2013 and 2014 at the same time on Day 1 into your Traditional IRA, rollover the non-deductible contribution amounts into your 401(k) on Day 2, and finally convert the remaining amount in your Traditional IRA into your Roth IRA on Day 3, there should be no tax event, or at most perhaps a tiny one of there is a few dollars’ pre-tax earnings in the Traditional IRA in between the time of the rollover and the Roth conversion. That might be preferable to having to do the paperwork to do a rollover of the pre-tax amount (which would include earnings on the post-tax basis money) into an employer 401(k) plan every year.

What do you think?