[US Bank updated the terms and conditions for this card. Cards approved on or after April 14, 2025 follow the new terms. Cards approved before April 14, 2025 still fall under the previous terms. This post applies only to cards approved before April 14, 2025.]

Bank of America emailed me last month to tell me it had been 10 years since I joined its Preferred Rewards program. This program offers 2.625% rewards on a credit card when you have $100,000 combined at Bank of America and its affiliated brokerage, Merrill Edge (see Bank of America Travel Rewards Card Pays 2.625% on Everything).

I like the Bank of America credit card with the Preferred Rewards program because it’s simple after a one-time setup. I get good rewards on every purchase, and there is no annual fee, special categories to remember or juggle, or dollar caps.

Bank of America finally got some competition after 10 years. It came from U.S. Bank, the fifth largest bank in the country by total deposits. Recently, U.S. Bank launched a Smartly Visa card with a similar structure. It gives 4% rewards when you have $100,000 combined at U.S. Bank and its affiliated brokerage, U.S. Bancorp Investments. I heard about this new card from the Frugal Professor blog.

I decided to switch because this Smartly card from U.S. Bank offers the same simplicity with higher rewards: no annual fee, no special categories to remember or juggle, and no dollar caps. It satisfies my preference to use one card for everything. I’ll close my Bank of America and Merrill Edge accounts after I fully transition over.

This isn’t a sponsored post. It contains no affiliate links. I have no relationship with any bank or broker except as a customer.

Required Accounts

Here’s what you need to earn 4% rewards on every purchase:

1. U.S. Bank Smartly Visa card. The base reward is 2%. You get higher rewards when you have other accounts with U.S. Bank.

2. U.S. Bank Smartly Checking account. A checking account is technically optional but you’re implicitly expected to have it because most other U.S. Bank customers have a checking account with the bank.

The Smartly checking account is free and requires no minimum balance or direct deposit when you have a U.S. Bank credit card. Having a free checking account also gives you 100 free online stock and ETF trades per year in the brokerage account.

3. U.S. Bank Smartly Savings account. The Smartly savings account is required to earn more than the base 2% rewards on the Smartly credit card. It’s free with no minimum balance when you have a U.S. Bank credit card. You deposit the rewards in the savings account.

4. Investments worth $100,000 or more in a self-directed brokerage account with U.S. Bancorp Investments. The best way to meet the $100,000 requirement is by transferring investments worth $100,000 or more to a self-directed brokerage account with U.S. Bancorp Investments. You don’t have to trade in the brokerage account. Only holding the investments in the account will boost your credit card rewards to 4%.

If you’re married and you want separate card accounts for each spouse (not one person as an authorized user on the other person’s card), a joint taxable brokerage account holding $100,000 in investments makes both of you eligible for 4% rewards on your respective cards. If you must use an IRA, only the IRA owner’s card gets 4% rewards. The IRA owner can add the spouse as an authorized user on his or her card.

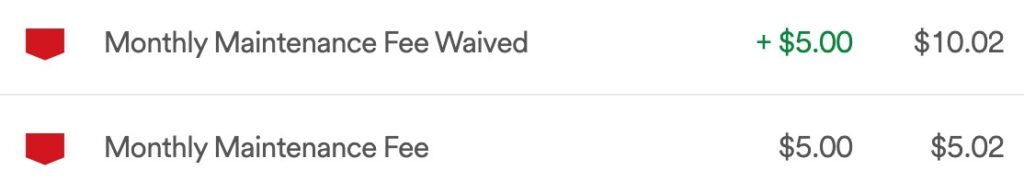

The checking account and the savings account can be joint accounts. I keep $10 in each account. Keeping $10 avoids seeing a negative balance when the account charges a maintenance fee before it immediately credits a fee waiver.

What Works Well

The 4% credit card rewards are the motivation for this whole package. It’s straightforward after a one-time setup. I qualified for the maximum 4% rewards only a few days after a brokerage account transfer brought the combined balances above $100,000. For instance, this $15 transaction earned 4% in reward points:

One reward point is worth $0.01 when you redeem it into the checking or savings account at U.S. Bank (minimum 2,500 points = $25 per redemption). You can transfer the cash to the credit card as a payment.

Nice Card Design

The Smartly Visa card looks and feels premium in the hand because it’s black and metal. It doesn’t matter much though when you use Apple Pay or Google Pay.

Website and Mobile App

The U.S. Bank online banking website and mobile app work well. It was easy to set up paperless statements for all accounts and autopay for the credit card, change the PIN on the cards, and lock the debit cards. The mobile app uses biometrics for login security.

Transactions display nicely in online banking and the mobile app. You can download the credit card transactions in CSV or QFX format to import into personal finance software such as Quicken.

Bank of America shows this for a purchase at a Walmart:

U.S. Bank shows this:

U.S. Bank translated the description “WM SUPERCENTER #4696” into a more recognizable merchant name “Walmart” with a logo. This adds a nice touch. I haven’t seen other banks doing it.

Good Money Market Funds in Brokerage Account

Unlike Merrill Edge, U.S. Bank’s brokerage service doesn’t advertise itself independently. Every brokerage customer is assumed to be a bank customer. You log in to the bank’s website to access the brokerage account. The banking side and the investing side have separate mobile apps though.

The brokerage account is fully functional for how I will use it. I’m holding one ETF worth a little over $100,000, which pays about $500 in dividends per quarter. I’ll transfer the dividends to the credit card as payments.

There’s no fee to buy a money market fund in the brokerage account. I put $100 in Gabelli U.S. Treasury Money Market Fund Class I (GABXX, 0.08% expense ratio) as a test and paid no fee. Other people bought Vanguard Treasury Money Market Fund (VUSXX, 0.09% expense ratio) and paid no fee. The order entry page displays a $25 fee for buying VUSXX but no fee was charged.

The Downsides

This setup with U.S. Bank has some downsides that don’t bother me. It’s not for you if any of these is a deal breaker.

Foreign Transaction Fee

The Smartly Visa card has a 3% foreign transaction fee. You still net 1% after the fee. You can use a different card for foreign transactions but the no-fee card has to pay more than 1% on those purchases to make a difference. If you spend $5,000/year on foreign transactions, using a 2% card with no foreign transaction fee only nets you $50.

I’m inclined to just eat the 3% fee and not bother switching because I don’t spend that much on foreign transactions.

Skimpy Card Benefits

Although the card looks and feels premium physically, it comes with few ancillary benefits. It doesn’t have extended warranty or secondary rental car insurance. My Bank of America card has those benefits but I haven’t had any chance to use them in the last 10 years. If extended warranty or secondary rental car insurance is important to you, you must remember to use a different card on transactions you want to cover.

No FICO Score

Bank of America shows a FICO 8 credit score from TransUnion monthly at no charge if you opt in for it. U.S. Bank also offers a free credit score monthly but it’s based on the VantageScore 3.0 model, which fewer lenders use. Seeing a FICO score is nice but not essential to me.

Only Email or SMS for 2FA

U.S. Bank’s website only uses email or SMS for two-factor authentication. It doesn’t accept a Google Voice number for SMS. You must make sure to secure your email and mobile number. I activated the extra security feature offered by my mobile carrier to protect against unauthorized porting-out requests.

Low ACH Limits

The maximum amount of ACH push I can initiate at U.S. Bank is $1,500 per day and $3,000 per week. Maybe I have these low limits only because my accounts are new. The low limits don’t affect me because I don’t need to transfer any money out. I’ll use the monthly credit card rewards and the quarterly dividends to pay toward the credit card.

Possible $50 Annual Fee

The brokerage account lists a $50 annual fee in the fee schedule. Customer Service reps said verbally that the fee is waived when you have $100,000 in the brokerage account. It’s not a big deal either way. I’m OK with paying the $50 fee in case customer service reps misspoke.

Designating Beneficiaries Requires a Form

Designating beneficiaries for the brokerage account requires mailing a paper form or calling customer service to arrange for e-signing. It doesn’t bother me because it’s only a one-time task.

Changing Dividend Reinvestment Requires Calling

Changing the dividend reinvestment setting in the brokerage account requires calling customer service. The default setting is different between mutual funds and stocks/ETFs.

If you transfer in mutual fund shares, dividend reinvestment is automatically enabled. You need to call customer service if you want it turned off. If you transfer in stocks or ETFs, dividend reinvestment is off by default. You need to call customer service if you want it turned on.

I didn’t have to call because the default behavior matches my preference. I transferred in an ETF and I don’t want to reinvest dividends. I’ll transfer the dividends as a payment to the credit card.

If you’re not fazed by these small downsides, here are some notes that may help you in opening and setting up your accounts.

Apply In Person

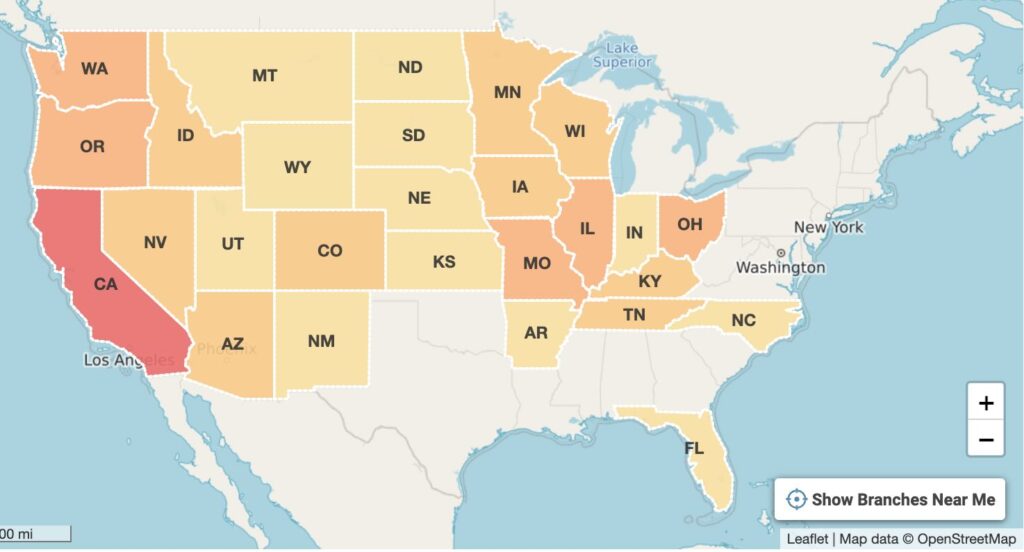

U.S. Bank doesn’t have as many branches as Chase, Wells Fargo, or Bank of America. I read a bit of its history on Wikipedia. A Minnesota bank bought an Oregon bank. An Ohio bank bought a Wisconsin bank. The Ohio-Wisconsin bank bought the Minnesota-Oregon bank and became today’s U.S. Bank. Its branches are in these states according to the website Bank Branch Locator:

If you have a U.S. Bank branch near you, the best way to open the required accounts is to apply in person at a branch. The bank personnel can help you smooth out things in case you encounter issues. You may also help a local person get a small bonus or meet the sales goals.

You can apply for everything online but be prepared to run into small bumps. The blogger Frugal Professor said he tried many times to open a U.S. Bank savings account online but it didn’t work for him even after unfreezing credit and ChexSystems. It only worked when he applied at a branch and the banker called their back office to push it through.

When I applied for a joint savings account online, my part of the application was approved instantly but my wife’s part was declined. I ended up with a savings account in my name only. She received a letter after a week telling her to call the ID Verification department but the phone number always had long wait times. She gave up and applied online again for her own savings account. Her second application received a response “We’ll review it and get back to you.” Fortunately, it was approved the next day.

Apply Online

If you don’t have a U.S. Bank branch near you or if you prefer to do everything online despite the potential bumps, apply for the credit card first. The Smartly Visa card is prominently featured on U.S. Bank’s website. If you don’t get approved for the credit card or if the approved credit limit is too low, you can call to request a manual review. If they still refuse to approve you or increase your credit limit, you won’t have to open the other accounts.

If you have a credit freeze with the 3 major credit bureaus, remember to thaw your credit temporarily before you apply. It’s unpredictable from which bureau the system will pull. I had the pull from TransUnion.

No Google Voice Number

Don’t give a Google Voice number when you apply online. U.S. Bank doesn’t like Google Voice numbers. I’m guessing my wife’s first application for the joint savings account was declined because she gave her Google Voice number in the application.

Checking Account

Apply for the Smartly checking account next. Although a checking account is technically optional in the setup, you’re implicitly expected to have one. When you call customer service on the brokerage side, the phone system asks for a PIN. That PIN is the debit card PIN from your checking account.

The checking account is free and requires no minimum balance or direct deposit when you have a U.S. Bank credit card. It gives you 100 free trades per year in the brokerage account. You may not need those free trades but you might as well have a checking account because most other bank customers have one.

U.S. Bank is offering a $450 bonus right now for opening a new Smartly checking account and making at least two direct deposits for a combined total of $8,000 within 90 days (ACH pushes from Fidelity counted). This bonus promotion ends on April 17, 2025 but it may be renewed. Be sure to use the Apply button on the bonus promotion page when you apply.

If you have a security freeze with ChexSystems, LexisNexis, or Innovis, remember to schedule a temporary thaw before you apply for either the checking account or the savings account. I saw an inquiry on my ChexSystems report from LexisNexis Risk Solutions on behalf of U.S. Bank.

Brokerage Account Application

The self-directed brokerage account application offers two joint account types: joint tenant with rights of survivorship (JTWROS) and joint tenant in common. I thought I chose the JTWROS option but somehow I got an account as joint tenant in common. Maybe the selection shifted inadvertently when I used the down arrow key on the keyboard or the scroll wheel on the mouse to scroll the page. I had to close that account and open a new one as JTWROS. Be careful to double-check everything before you move to the next page of the application.

I also ran into a bug in the brokerage application. My street address has two repeating digits as in 558 Elm Drive. As soon as I typed the second repeating digit (“55”), the street address field froze and I couldn’t continue. This happened three times before I realized what was causing it. I had to start over, type the non-repeating part first (“58 Elm Drive”), and then move the cursor to the right place to add the repeating digit.

Brokerage Asset Transfer

All brokerage asset transfers must be requested from the receiving side. If you’re transferring assets from a taxable account, take a screenshot of or save to a PDF the cost basis of the shares in the source account before you request a transfer.

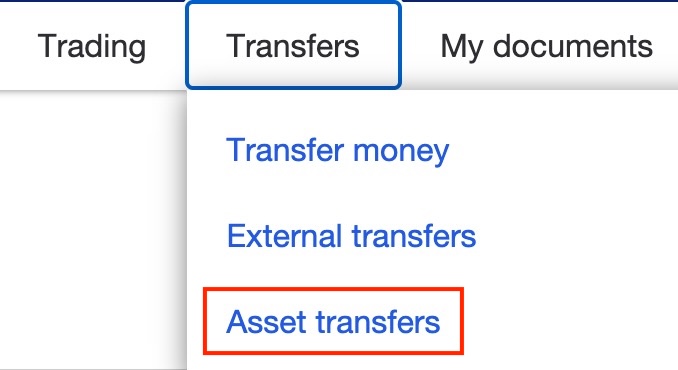

You see an option in the brokerage account to transfer assets in the top menu:

If you click on it right after the account is opened, it gives an error saying the account isn’t eligible to transfer assets. That error only means the account isn’t ready yet. They still need to set up some things on the back end. The error disappears after two or three business days.

The online asset transfer request has a place to attach a statement from the source account. I received an error saying the system wasn’t available when I tried to attach a statement. Other people got the same error. It doesn’t sound like a temporary glitch. Not attaching a statement didn’t prevent the asset transfer though.

I was transferring from Fidelity. Fidelity emailed me the next day saying they received the transfer request but I didn’t see the assets leaving Fidelity. I waited a week before I called Fidelity only to be told that Fidelity had rejected the transfer request from U.S. Bank because it was missing something. I suspect that the transfer request I filled out online had to be re-keyed by someone in U.S. Bank’s back office into the asset transfer system and they keyed something wrong.

I had to resubmit the online asset transfer request. The second attempt succeeded. I received the same notification the next day when Fidelity received the request. I saw the shares leaving Fidelity on that same day and they appeared in the U.S. Bank brokerage account in another two business days.

Confirm Cost Basis

If you transfer assets from a taxable brokerage account, it’s important to confirm that the cost basis of the shares came over correctly. The cost basis records travel separately from the shares. They usually arrive later than the shares. Wait a week or two to check the cost basis records in the new brokerage account.

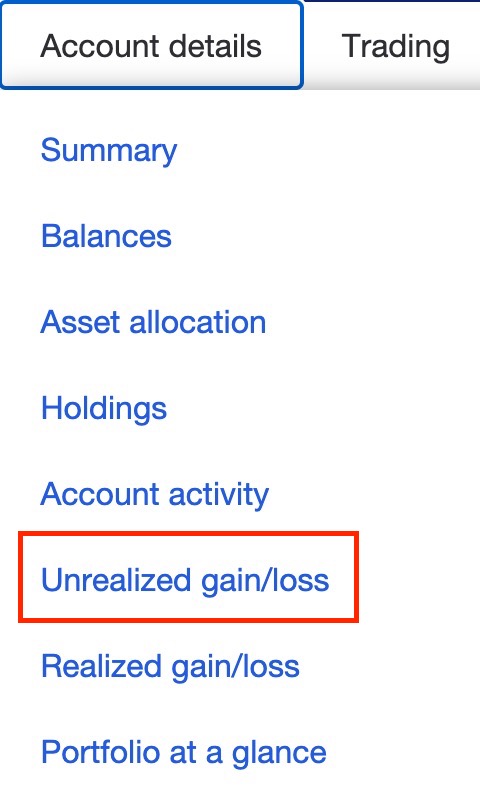

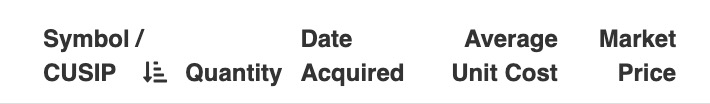

Click on “Account Details” in the top menu and then “Unrealized gain/loss.”

You will see the number of shares, the date acquired, and the cost basis per share when you click on the “+” sign to expand each holding. Your original broker is responsible for sending the cost basis to U.S. Bankcorp Investments. Contact the source broker if you don’t see any cost basis in the new account or if the cost basis records don’t match the screenshot or PDF you saved before the transfer.

***

Opening the accounts and setting them up took some time and effort. It’s all smooth on autopilot now. My activities in all U.S. Bank accounts come down to:

- Use the credit card for all purchases.

- U.S. Bank debits an external account on autopay (monthly).

- Redeem rewards into the savings account (monthly).

- Transfer the rewards deposit from the savings account to the credit card as a payment.

- Receive dividends in the brokerage account (quarterly).

- Transfer the dividends from the brokerage account to the credit card as a payment.

- Deposit paper checks to the checking account (rare).

- Transfer from the checking account to the credit card as a payment.

All money generated in the accounts stays within U.S. Bank. There won’t be any transfers to or from an external account except for autopay.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Eric says

And one more thing. I AM a USBank preferred stock shareholder, so I do not have to imagine being a shareholder. So when you ask if I as a shareholder would want hundreds of thousands of customers like me which are unprofitable ? The answer is no. But the root of the problem is the bank using bait and switch tactics to lure customers the bank knows will be unprofitable, then to change the rules knowing some will stay. Short term profit at the expense of your reputation.

Eric Gold says

Oh ? How many shares do you own ?

US Bank made a mistake taking you on as a customer. As a shareholder, would you have them continue their mistake and continue to lose money, or admit to the mistake and correct it by dumping you ?

Eric says

You are correct. They care about short term profits over their long-term best interest (their reputation).

Eric Gold says

Their reputation is fine. They dump bad customers

Eric says

Their mistake was making promises they knew up front they could not keep.

Eric says

So a bad customer is one who follows the rules THEY set up, only to be victimized by obvious bait and switch tactics ? Do you even know what bait and switch means ?

Eric Gold says

Playing the victim card is only going to appeal to other losers. If all the losers actually never become customers again, US Bank will be overjoyed. The US Bank long-term stockholders will be overjoyed.

You signed a contract that gave you the right to leave anytime you wanted, and it gave US Bank the right to dump you anytime they wanted to. US Bank honored the contract to the letter, and when they decided you were a lousy customer, they pinned your wings.

I have no problem with US Bank. And by the way, even if you were a highly profitable customer (hah!), It is obvious that they kept to the contract terms. I *do* know what ‘bait & switch’ means, and you are not it. Not by a mile.

Eric Gold says

Nonsense. US Bank fulfilled the contract signed with you to the letter. The *entire* contract, not just the 3 sentences you find convenient to remember

Eric says

I never said what they did was illegal.

Eric Gold says

I didn’t say you did (say it was illegal)

I said your characterization of dumping you as a ‘bait & switch’ is BS

I said that your impression that dumping you will negatively effect US Bank’s reputation is silly. If anything, it *improves* US Bank’s reputation.

Harry Sit says

Let’s not worry about whether something is good or bad for the bank. They don’t listen to our assessment anyway. We only decide our own reactions, stay or leave.

If the current v1 terms had been offered in the beginning, with a per cycle cap and category exclusions, I think I still would have applied. As long as it doesn’t deteriorate further, I’m happy I got in before the offer ended.

Eric Gold says

Spot on, Harry

Eric says

As a shareholder I am concerned about what is good or bad for the bank, but you are correct, all we can do is stay or leave.

Dan says

Joint account owners with very similar spending types. User 1 with higher $20k credit limit got bad nerf letter and User 2 with $15k credit limit for good nerf letter. LOL I don’t even know what to say?!

Eric says

Does not surprise me with this company.

Jacob says

My card was approved before April 14th, but I received the bad letter.

Jackie says

Ditto 😕

Lori says

FYI US Bancorp now shows a $25 fee on the order page for purchasing GABXX. Like with VUSXX, the fee doesn’t appear to be charged, but it does mean you need to adjust your purchase amount to account for it.

Pat says

Printed this article a year ago and put off acting. Wanted ev/th joint w/ my husband, but that required he do some things on his end and we were both very preoccupied with a major health issue. Long story short: 2026, a new year – time to take care of this. Well………..no longer offered. Only way to get 4% cash back is to keep at least $100,000 in checking acct. were it would be earning next to nothing. Was told those who applied under the earlier conditions were grandfathered in. Sure wish I’d acted sooner!