It’s tax filing time. I’ve been fielding a lot of questions on my articles about the backdoor Roth (if you are not familiar with it please read these first):

- Backdoor Roth: A Complete How-To

- How To Report Backdoor Roth In TurboTax

- How To Report Backdoor Roth In H&R Block Software

- How to Report Backdoor Roth In FreeTaxUSA

One theme quickly emerged. All those who are confused were contributing to the traditional IRA for the previous year and then converting it to Roth. They made it too hard for themselves.

For example, they contributed to the traditional IRA for the previous year between January 1 and April 15 and then converted it to Roth. They are planning to contribute for the current year, again in the following year before April 15, before converting it to Roth. Although it’s OK to do so, it just gets very confusing at tax time when they do it this way.

The tax law requires that you report your traditional IRA contribution *for* that year and your converting to Roth *during* that year.

In the example above, the contribution made *for* year X in year X+1 goes on the tax return for year X. It has to carry over the tax basis to the return for year X+1. The conversion to Roth *during* year X+1 goes on the tax return for year X+1. The contribution *for* X+1 to be made in X+2 again goes on the tax return for year X+1 but the conversion *during* year X+2 must wait for the tax return for year X+2.

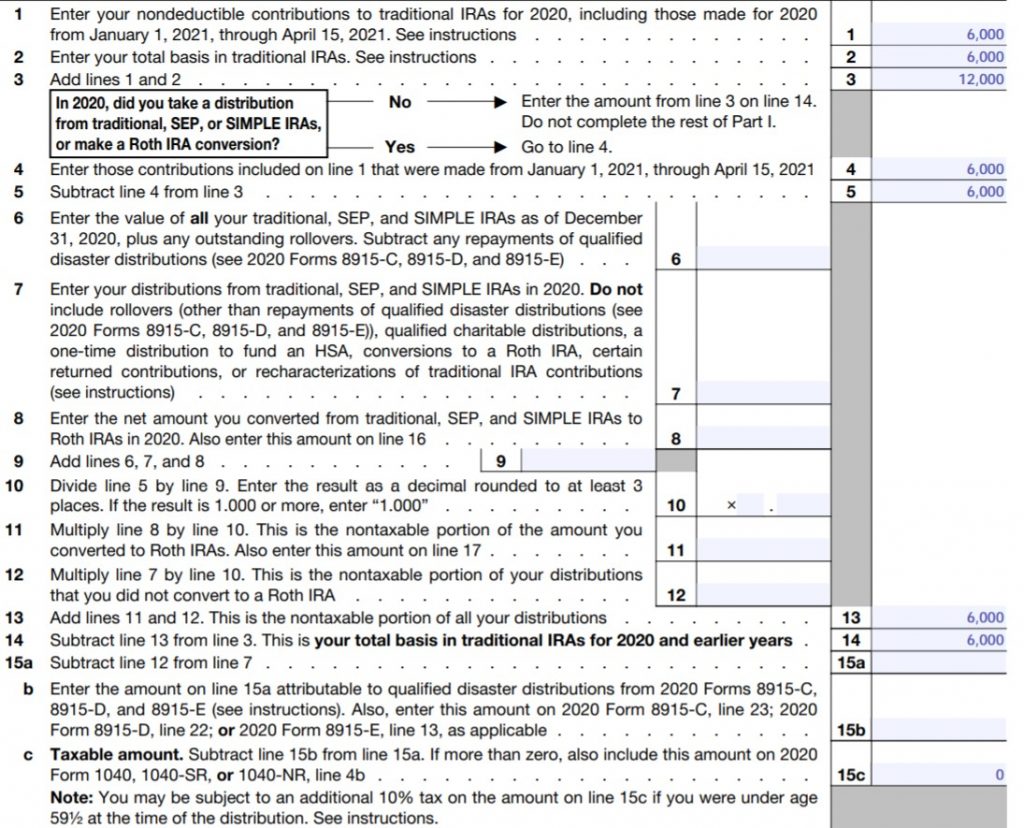

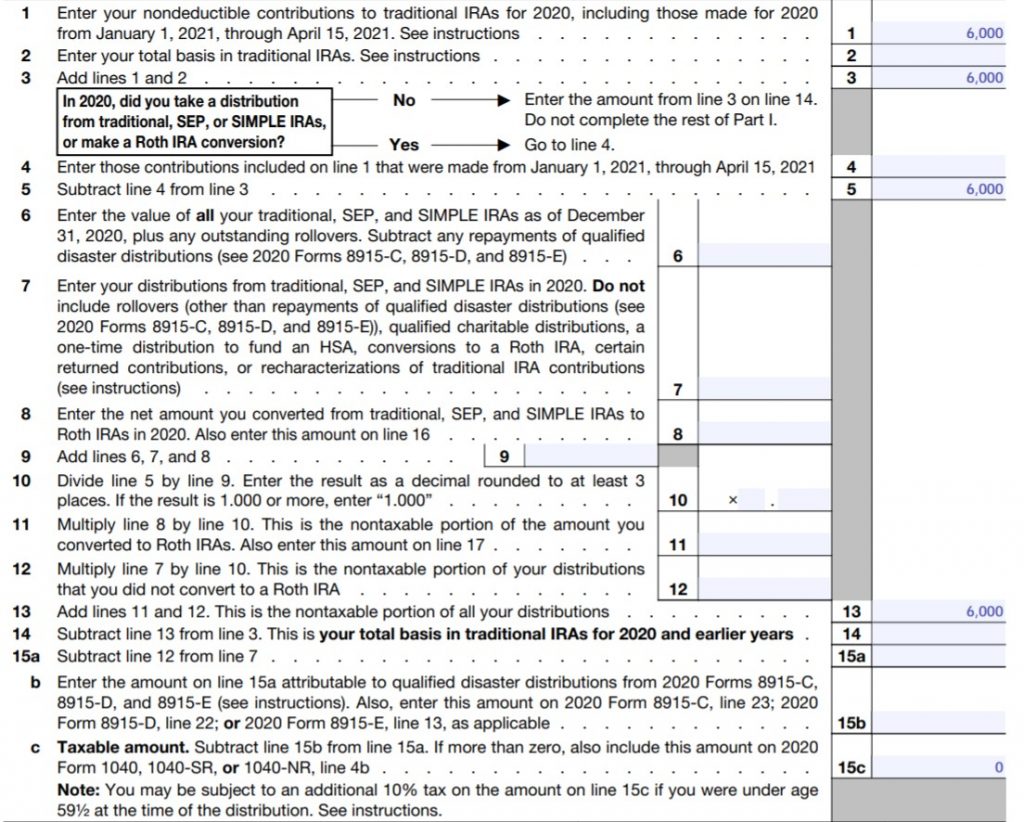

The tax return for the current year ends up having a basis carried over from the previous year, a conversion, a contribution (made in the next year), and a basis carried forward to the next year. The Form 8606 ends up looking like this:

This is very confusing.

The easy way to do it is to contribute for the current year rather than waiting until the following year. Contribute for year X in year X and convert in year X. Contribute for year X+1 in year X+1 and convert in year X+1. This way will be clean and neat. Both the contribution and the conversion go on the same tax return. You don’t carry over anything from one year to the next or wait until the following year to finish it off.

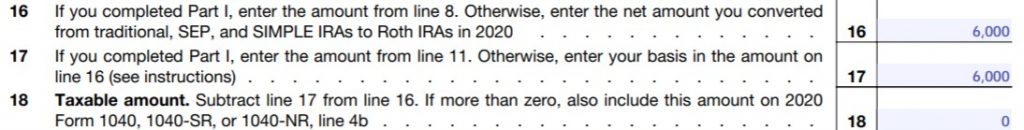

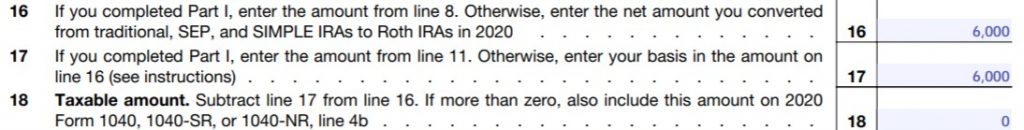

The Form 8606 when you are doing it the easy way looks like this:

That’s very clean.

If you are doing backdoor Roth, please do yourself a big favor and do it the easy way. Contribute for the current year and convert it in the same year. Contribute for year X in year X and convert during year X. Don’t wait until the following year. Otherwise you just confuse yourself at tax time.

If you must get caught up for one year, that’s fine. Contribute for the previous year before April 15, but also contribute for the current year in the current year, and convert both during the current year. You can convert more than once in any year, and there is no limit on the amount you convert. This way you will have a clean slate come next year, which lets you do it the easy way going forward.

Comments are closed because questions are becoming repetitive. Be sure to read existing comments for answers to questions similar to yours.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Steve says

I contributed to a Roth in January 2015 for 2015, but it turned out I was above the income limits for 2015. In January 2016, I recharacterized my 2015 contribution to a nondeductible IRA contribution and the next day converted it back to a Roth. How should I fill out the form?

Would it have been better if I had recharacterized and converted back to a Roth in December 2015? What about if I had done it in January 2015 right after I had contributed it? Would it have been better if I had initially contributed to a Traditional IRA instead of a Roth IRA?

This is all so freaking confusing and silly. It makes absolutely no sense to have income limits on a Roth IRA contribution. If they want to allow everyone to contribute to a Roth IRA, just remove the limits…don’t make people do annoying and confusing tax maneuvers to contribute to it…

Harry Sit says

For 2015, just your contribution on line 1, zero on line 2, the contribution again on line 3 and line 14.

2016 will be more interesting depending on whether you contribute or recharacterize to nondeductible traditional again, and whether you have other traditional, SEP, or SIMPLE IRAs. If both no, it will be more like the second example except with your 2015 contribution amount on line 2 instead of line 1.

It would’ve been better if you had converted in December or earlier in 2015. Either way you should work on clearing out other traditional, SEP, or SIMPLE IRAs if you have any.

BOB says

Unfortunately you made your reconversion too soon. You needed to wait at least 30 days from the date of your recharacterization. Also, the reconversion must be in the next calendar year following the original conversion, which you fulfilled. What you have is called a “failed reconversion”. The funds are considered distributed to you. Also, the funds deposited into the Roth account are considered as an excess contribution, and must be removed. You can remove the funds from your Roth account now, by telling the custodian that you are withdrawing an excess contribution. Then you can deposit the funds before April 15, 2016 into a traditional IRA as a contribution for 2015. Depending on your income for 2015, and whether you or your spouse are retirement plan members at your employer, the deposit into the traditional IRA might be tax deductible. Note that you are making a traditional IRA contribution for 2015; you are NOT performing a 60-day rollover. Then, after waiting more than 30 days from the date of your recharacterization in 2016, perform a Roth conversion.

You are still free to make your contribution for 2016 as you wish, traditional or Roth, subject to your 2016 income for the Roth contribution.

This may seem a little complex, but you aren’t facing any penalties. Just play the game according to the rules and you can get some great tax advantages.

Harry Sit says

Bob – Steve didn’t have a reconversion. He just recharacterized a *contribution* (not a conversion) and converted once afterwards, which is OK.

BOB says

Yes, thanks,

Lee says

So I’m getting ready to do my roth. I screwed up and didn’t make a contribution in 2015, so now I’m going to have to do it the confusing way to play catch up. I’m doing this through Vanguard, and plan on doing this catch up method once and then doing it all same tax year to get on same page.

My question is: Will I need to specify to Vanguard what year I am contributing to? In other words, if I go open a non-deductible IRA right now, will Vanguard ask me if it’s a contribution for 2015 or 2016? If not, how is it all kept straight? Is it just the form 8606?

Also, on line 3 of 8606, it asks “In 2015, did you…. make a ROTH IRA conversion.” I answer yes to that? Is it because the conversion is being made in 2016, but really is for 2015? Hope that makes sense.

Just found your website and like it a lot! Thanks.

BOB says

When you make your non-deductible traditional IRA contribution at this time if year, they will ask if it is for the current year (2016) or the prior year (2015). When you make the Roth conversion, it doesn’t matter what year you made the contribution. You are merely converting the funds in the traditional IRA. When you file your form 8606 for 2015, put the contribution for 2015 made in early 2016 into lines 1 & 4. But you did not make a 2015 conversion, so don’t fill in the conversion portion of the form following line 4. You will have a non-zero basis for 2015, which will be shown on line 14. You will refer to this line when you do your tax for year 2016, in 2017. You need to get your 2015 contribution completed by April 18, 2016, but don’t wait to the last few days.

You can also make a contribution for 2016 if you like. If you hold off on the conversion until you make your 2016 traditional IRA contribution, you can also do a single conversion of the total amount at once.

Any conversion made in 2016, and the contribution for year 2016, will be reported next year on your tax for 2016.

Harry, do you agree?

Harry Sit says

BOB – I agree, except line 4 should be left blank.

Lee – Vanguard will ask you. Answer ‘no’ on line 3.

Lee says

Harry – So now I’m confused again. I just want to make sure I get this right.

Line 1: $5500

Line 2: $5500… or $0? Do I count my 2015 contribution (made in 2016, which I was just asked about in Line 1) as a part of my basis?

Line 3: $5500 or $11,000, it depends on what I put on Line 2. Then answer ‘no’ and head to line 14….

Line 14: Again, either $5500 or $11,000, since I answered ‘no’ on Line 3. I can’t see how it could be $11,000, because I can’t have that much basis in IRA’s…. I’m not sure if I technically have ANY basis in IRA’s…

Line 15: The taxable amount… the form doesn’t tell me how to calculate this if I didn’t fill out Lines 4-13, which I didn’t. Since it says “Subtract line 12 from line 7” and I didn’t fill in those areas, is the answer “0”?

I’m most confused about the questions asking what my total basis in IRA’s is and what I do on Line 15 if I skipped lines 4-13. Does the contribution I make in 2016 (for 2015) count towards my basis? I think that is the real question.

THanks

Harry Sit says

Lee – Line 2 is your basis before the contribution you are reporting. It says see instructions. This year’s line 14 will copy to next year’s line 2. After you answer ‘no’ on line 3 it says go to line 14 and do not complete the rest of Part I. Just follow the instruction.

Lee says

Ok thanks for clearing that up. It says ‘see instructions,’ but I can’t find them anywhere for that particular line. Maybe I’m looking in the wrong place, but I’ve been over the Form 8606 instructions several times and keep missing it.

Appreciate you clearing that up.

Dustin says

Just discovered your blog and I love it. I just wish I had found it sooner.

So I read the steps. Step 1 says to “Hide other IRAs.” I have a 2014 traditional IRA (deductible) with Schwab that has its own specific account number (2222-2222). If I open another traditional IRA (non-deductible) for 2016 with a new account number (3333-3333) and then convert it to a Roth IRA with its new account number (4444-4444) then I don’t have to “hide” the 2014 traditional correct? In other words, there is no need to “Hide other IRAs” in Step 1 as long as you have separate account numbers for each IRA right? So I can still do the backdoor Roth for 2016 and not pay taxes on the 2014 traditional IRA as long as everything as its own account number from the way I interpret it. Thanks a ton for your insight.

Harry Sit says

Not correct. Account numbers don’t matter.

Dustin says

So what you are saying is if I open a traditional IRA (nondeductible) in 2016 (account 3333-3333) and convert to a Roth IRA (account 4444-4444) in 2016 then I will have also have to convert my traditional IRA (deductible) from 2014 (account 2222-2222) into a Roth IRA and pay taxes on the 2014 traditional IRA?

Harry Sit says

No, you have to hide it as you originally read.

Dustin says

So if I don’t hide the traditional IRA (deductible) from 2014 and I want to convert my 2016 traditional IRA (nondeductible) into a Roth IRA in 2016 then I will have to pay taxes on the traditional IRA (deductible) from 2014?

Harry Sit says

Yes, proportionally. Google “pro-rata rule.”

David S says

Hello Harry,

Thank you so much for all the great information. I think I understand from the explanations and examples, but if you don’t mind can I have you check over my information. Here is the situation. My wife and I had an excess contribution from my Roth IRA of $940 that we each had to move into a traditional IRA. We did that however around March 2015. After April 15th, we both converted the total amount with earnings back to a Roth IRA. At that time there was $0 in our traditional IRA at the end of 2015. Conversion amount was $1036. Also, I will probably have to move an excess contribution from my Roth IRA for 2015 to a traditional IRA this year as well, but it will be FOR 2014. Don’t know the exact amount yet, but it will be say ~$2000 and while it is for 2015, it will happen in 2015.

Intuitively, I imagine the $1036-940 = $96 is the taxable portion and I seem to come up with that on the form, but can you double-check my entries please:

Line 1: $2000

Line 2: $940

Line 3: $2940

Line 4: $2000

Line 5: $940

Line 6: $0

Line 7: $0

Line 8: $1036

Line 9: $1036

Line 10: 0.9073

Line 11: $940

Line 12: $0

Line 13: $940

Line 14: $2000

Line 15: $0

Part II:

Line 16: $1036

Line 17: $940

Line 18: $96

So $96 is the taxable portion that I report for 2015, which seems to make sense.

Questions.

1. For line 8 the instructions say something like don’t report amount later re-characterized, which I don’t understand.

2. I plan to re-characterize the $2000 back to a Roth IRA again. Do I need to wait till after April 15th? If I do it before April 15th, I still deal with it on next year’s return, correct?

3. While my wife and I are filing jointly, our excess contributions and re-characterizations are handled independently, so I imagine that we both fill out separate form 8606s.

Thank you very much for taking the time to look at this.

David

Harry Sit says

David – I’m sorry I can’t check it over for everyone individually. Similar questions were already answered in the comments. I would also bring to your attention Traditional and Roth IRA: Recharacterize vs Convert.