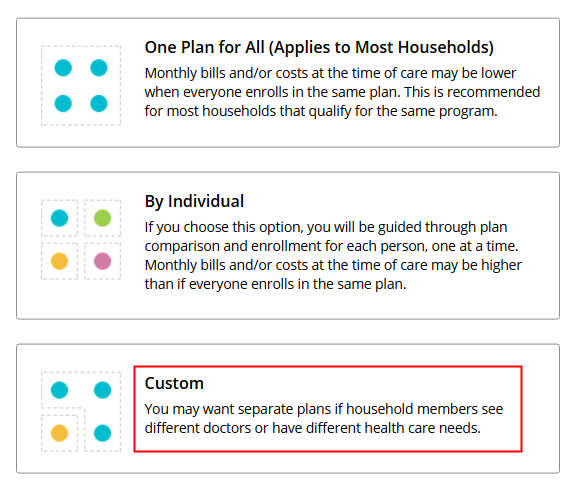

When you get health insurance from ACA, you can enroll different family members with different healthcare needs into different insurance plans.

Latest Blog Posts

When ACA Insurance Does Not Include Your Doctor

If your doctor is only covered by a more expensive health insurance plan, you can save money on insurance and still keep your doctor.

Easy Early Retirement Portfolio Withdrawals

A portfolio withdrawal setup is not complicated. Many parts are already familiar. The variable percentage withdrawal method automatically adapts.

Where To Get Vaccine Shots For International Travel

Health insurance often doesn’t cover vaccines for international travel. I got my vaccine shots at an unusual place.

What To Do With A Maturing CD

You have several good options for your maturing CD. All have their own merits. You can’t go too wrong.

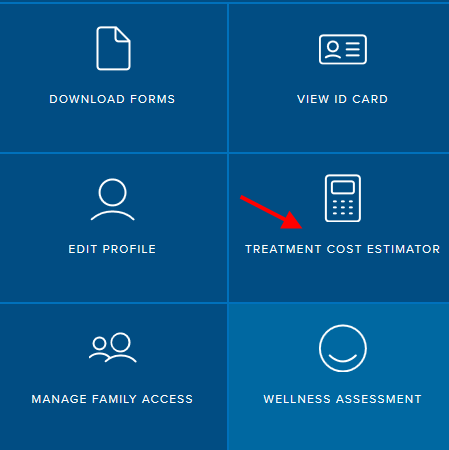

Shop for Healthcare Cost When You Have High Deductible Insurance

When you have high deductible health insurance, you must shop around for expensive services. The savings are substantial.

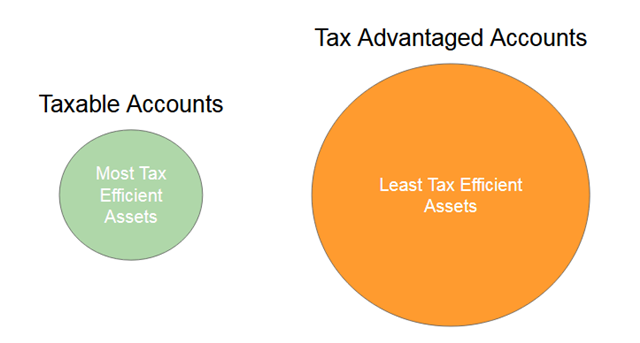

When Tax Efficient Asset Placement Doesn’t Make Much Difference

Tax efficient asset placement is directionally correct but the relative sizes of your accounts can put a serious limit on its effectiveness.

Know Your Edge

Your success comes from leveraging your edge. We should all know what’s our edge.

Extra Mortgage Payment: Do Dates Matter?

If you are paying extra toward your mortgage, does it matter which day you make the extra principal payment within a month?

Using a 529 Plan From Another State Or Your Home State?

Residents in many states can use a 529 plan from another state without losing any tax benefits.