I compared two free calculators for the optimal Social Security claiming strategy with hypothetical test cases. They both do a good job.

Latest Blog Posts

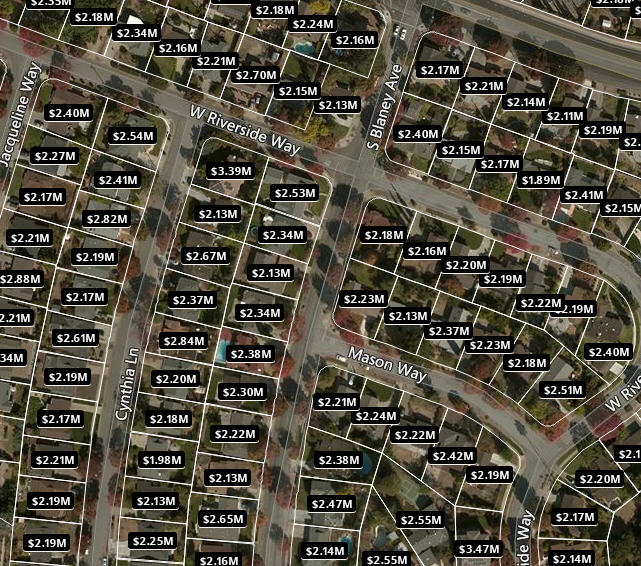

You Can’t Eat Your House. Or Can You?

A paid-off home not only provides you a place to live. It can also fund your retirement.

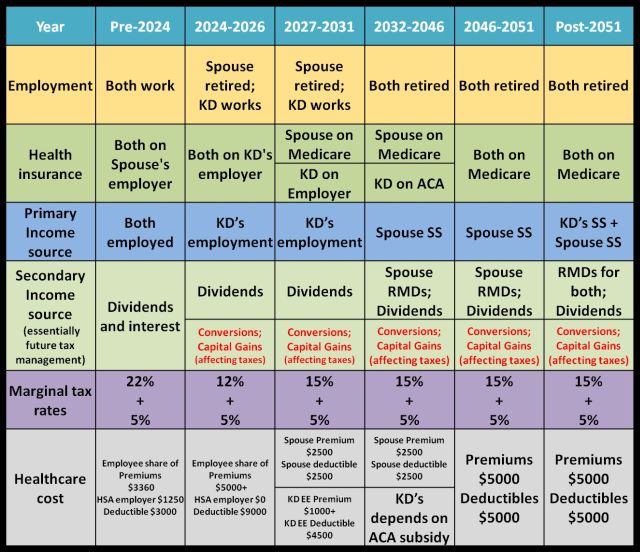

Plan It and Update It

Putting your financial plan into a simple table helps you focus on the major blocks and see where you are.

Self-Employed Health Insurance: COBRA, ACA, Health Sharing Ministry

How I decided my health insurance options after I became 100% self-employed.

From Two Jobs to One, a Second Childhood Begins

Going from two jobs to one, from an employee to self-employed, starts a new journey of a second childhood.

Maintaining and Executing An Estate Plan

Real life experience and learning from maintaining and executing an estate plan.

Switching Brokerage Account Into A Trust: Fidelity, Vanguard, Merrill Edge

Just having a trust document doesn’t do much. You need to put accounts under the trust’s name. I walk you through for how we did it with Fidelity, Vanguard, and Merrill Edge.

Will and Trust Through Employer Legal Plan

Using the legal plan through an employer works for simple estate planning.

Financially Comfortable and Pivot

Pivoting when you are financially comfortable offers a safer and more enjoyable path to a second childhood.

What Having My Car Die in the Middle of the Road Taught Me About Investing

Beware of overconfidence. It can cause great harm.